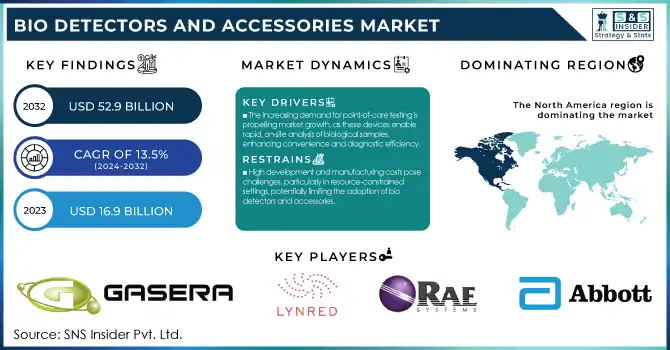

The Bio Detectors and Accessories Market was valued at USD 16.9 Billion in 2023 and is projected to hit USD 52.9 Billion by 2032, growing at a CAGR of 13.5% over the forecast period 2024-2032.

To get more information on Bio Detectors and Accessories Market - Request Free Sample Report

The Bio Detectors and Accessories Market Report examines comprehensive statistical data and trends, including significant industry progress. It points to incidence and prevalence rates to understand disease burden and the need for bio-detection solutions. Moreover, it delves into regulatory approvals and compliance trends, identifying the changes in guidelines that affect finding a foothold in the market. The analysis considers R&D investments and advanced technologies, with a specific focus on AI-enabled bio-detection methods and nanotechnology nanomaterials and their applications. In addition, the report offers the most recognizable way of healthcare expenditure based on bio-detection solutions, covering expenditure from governments, private medical physicians, and end-users. It evaluates regional habits and deployment trends, monitoring the introduction of bio detectors in hospitals, laboratories, defense, and societal health industries. The worldwide Bio Detectors and Accessories Market is growing proportionally, due to increasing issues, biosecurity threats, and growing incidence of infectious diseases. In 2023, globally there were more than 10 million new tuberculosis (TB) cases, as per the World Health Organization (WHO), which emphasizes the pressing need for rapid and accurate tools for diagnosis.

Drivers

The increasing demand for point-of-care testing is propelling market growth, as these devices enable rapid, on-site analysis of biological samples, enhancing convenience and diagnostic efficiency.

One of the major drivers of the bio detectors and accessories market is the increasing demand for point-of-care testing (POCT). This growth is mainly driven by the rising incidence of chronic diseases and the need for point-of-care diagnostics. One prominent area where POCT has made a significant impact is in the management of infectious diseases. In Australia, the introduction of at-home tests for sexually transmitted infections (STIs) like chlamydia and gonorrhea aims to address rising infection rates of 26% and 157% increases respectively over the past decade. These tests have a 99% accuracy rate and give people the ability to perform these tests at home privately.

Additionally, the convenience of home health tests is gaining popularity. Products such as PocDoc Healthy Heart Check provide cholesterol readings and heart risk assessments in just seven minutes and should relieve pressure on healthcare systems. Advances have also been made in POCT through technological developments. Miniaturized and portable diagnostic devices will allow for laboratory-quality results to be obtained outside of a traditional healthcare setting, allowing for real-time, accurate testing.

Restraint

High development and manufacturing costs pose challenges, particularly in resource-constrained settings, potentially limiting the adoption of bio detectors and accessories.

Due to the complexity of research and production processes in the production and manufacture of bio-detectors and accessories, they require significant investments. In addition, many advanced bio-detectors utilize state-of-the-art technologies like AI, molecular sensors, and real-time data analysis platforms as part of their operation, further increasing the development costs. As an example, high-performance bio-detectors that are outfitted with these integrated technologies are costly to research and produce, leaving consumers and businesses with a high price point. Furthermore, the complex fabrication pathways and the need for specialized equipment increase the cost of manufacture. This financial barrier can deter adoption, especially in resource-constrained settings, limiting the widespread use of bio-detectors and accessories. To mitigate this restraint, it is essential to focus on reducing production costs through technological innovations and streamlined manufacturing processes, thereby enhancing the accessibility and affordability of these critical diagnostic tools.

Opportunity

Advancements in biosensor technology, including the development of genetically encoded or synthetic fluorescent biosensors, offer significant potential for innovation and expansion within the market.

Emerging biosensor technology is rapidly expanding the Bio Detectors and Accessories Market and offers robust potential for future applications. Recent advancements in this area have resulted in the miniaturization of biosensors, rendering them portable and wearable. This allows for continuous, real-time measurement of vital health signs like heart rate, glucose, and oxygen levels. Printable biosensor solutions in terms of their cost, flexibility, and customization prospects have come out to be the game-changing solution for the biosensing platform. The collaboration between a biosensor with Artificial Intelligence (AI) and the Internet of Things (IoT) enhances their capabilities by providing early disease detection, predictive analytics, and personalized treatment recommendations. These advancements are already in practical applications, evidenced by recent innovations. A recent example, engineers at the University of California San Diego created an electronic finger wrap that track health biomarkers through sweat. The lightweight device is capable of measuring glucose, vitamins, and drugs, allowing for instant real-time tracking of health while going about daily routines. In a similar vein, tool-sporting Monash University (MU) engineers unveiled a smart, palm-sized sensor that can detect early-stage Alzheimer's disease with a simple finger-prick blood test. This device detects ultra-low concentrations of beta-amyloid and tau proteins, providing a less invasive and more economical diagnostic method.

Challenge

Data privacy and security concerns, especially regarding the handling of sensitive biological information, present significant challenges that may hinder the adoption of bio detectors and accessories

The increased use of bio-detectors and accessories across sectors has elevated concerns about the privacy and safety of data. One of the biggest concerns is the risk of sensitive biometric information falling into the wrong hands. In 2024, the government of New South Wales, Australia, announced plans to roll out facial recognition technology in major stadiums in Sydney, raising concerns as to whether fans might be scanned without their express consent, as well as whether their data could be subject to illicit hacking and identity theft.

Similarly, India's rapid expansion of facial recognition systems in airports has raised alarms about data handling and the potential for government surveillance. As of mid-2024, the Digi Yatra has been implemented in 28 airports accounting for around 90% of India's air travel. Critics say policies on how data will be treated are unclear and may enable the government to access some personal data. Additionally, it has raised the red flag in GMO misuse of genetic data. In late 2024, reports emerged that 'race scientists' had reportedly gained access to data from the UK Biobank, which contains people's genetic material and medical histories for more than 500,000 people. This incident highlights the importance of access protocols, as they protect the public trust and prevent such sensitive genetic information from being used inappropriately.

By Product

The instruments segment was the dominant segment of the market with a 36% share in 2023. This growth can be attributed to the rising adoption of advanced, high-throughput bio-detection systems in numerous applications. This trend has largely been driven by government initiatives. The U.S. Department of Homeland Security's Science and Technology Directorate, for example, distributed USD 8.6 million in 2023 to improve bio-detection capabilities, which included the development of next-generation instruments. The effort was on the premise that the European Commission had made USD 94.6 billion available for research and innovation under its Horizon Europe program, and that a large part of that would be spent on developing new bio-detection processes. These investments have resulted in the development of ever more sensitive, rapid, and versatile instruments with the potential to detect multiple pathogens simultaneously. Advanced molecular diagnostic instruments cut foodborne pathogen detection time by 50%, according to the CDC, greatly improving outbreak response times. The WHO's Global Antimicrobial Resistance and Use Surveillance System (GLASS) promotes the adoption of advanced bio-detection devices in 127 countries and also contributes to the segment growth. In addition, the segment's dominance is attributed to an increasing adoption of portable and point-of-care bio-detection instruments. It highlights the gradual shift toward diagnostic point-of-care testing, as the U.S. Food and Drug Administration (FDA) granted approval to 15 new point-of-care diagnostic devices in 2023. This trend has especially been transformative in resource-constrained settings and during public health emergencies, with on-site rapid detection being critical.

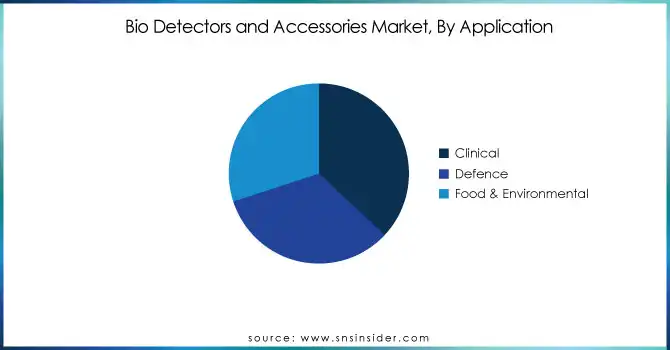

By Application

In 2023, the clinical segment held the largest revenue share of 37% during the forecast period. The large market share is majorly driven by the increasing prevalence of infectious diseases and the rising demand for rapid, accurate diagnostic tools in healthcare settings. According to reports from WHO, there were an estimated 228 Million cases of malaria worldwide in 2023, underlining the need for fast and reliable diagnostic methods. This was further supplemented by the initiative from the government to enhance healthcare diagnostics leading to the clinical application of bio detectors. For example, the U.S. National Institutes of Health (NIH) dedicated USD 1.5 billion in 2023 to the Rapid Acceleration of Diagnostics (RADx) initiative to expedite the development and commercial adoption of novel testing technologies. Similarly, in Europe, the European Medicines Agency (EMA) passed new rules in 2017 regarding in vitro diagnostic medical devices to fast-track the approval of IVDMDs, enabling these advanced bio-detection technologies to be adopted more quickly in the clinical environment. Another key factor contributing to the largest share of the clinical segment is the increasing incidence of hospital-acquired infections (HAIs). About 1 in 31 hospital patients has at least one HAI on any given day, according to the CDC, frothing the wait for pathogens to be detected in healthcare facilities. These infections can be easily managed with the help of biodetectors for early diagnosis and prevention. Additionally, the growing emphasis on personalized medicine has supported the need for advanced bio-detection systems in clinical settings. In the U.S., the annual USD 215 million Precision Medicine Initiative has also spurred investments in this area, resulting in more next-generation and personalized diagnostics.

By End Use

In 2023, Point of Care Testing (POCT) accounted for the highest revenue share of 38% in the market. This market leads to the growing need for rapid point-of-care diagnostics in numerous healthcare sectors. Government policies as well as public health needs have created a strong push toward decentralized testing. For example, POCT use in US primary care settings increased by 18% year-on-year in 2023 according to U.S. Centers for Medicare & Medicaid Services (CMS) data. That's because the EU In Vitro Diagnostic Regulation (IVDRtrue), first fully implemented in 2022, has succeeded in streamlining approval for such devices, including those used in POCT, contributing to the market growth. By the end of 2023, according to the WHO, more than 3 billion rapid diagnostic tests had been distributed worldwide, highlighting the importance of point-of-care testing (POCT) in addressing public health emergencies. Additionally, in 2023 the U.S. Department of Health and Human Services invested USD 650 million to further enhance POCT capabilities in underserved communities to address healthcare disparity and availability of rapid diagnostics. The rise in the incidence of chronic diseases also fuels the growth of POCT. According to the International Diabetes Federation, as of 2023, 537 million adults are living with diabetes which highlights the need for frequent, simple, low-cost monitoring tools. POCT devices for glucose monitoring, HbA1c testing, and other chronic disease markers have seen widespread adoption, supported by government initiatives promoting self-management of chronic conditions.

In 2023, North America had the largest market share, accounting for 40% of the Bio Detectors and Accessories Market. This is attributed to the growing healthcare system the R&D investment in the region and the strict regulatory framework. In 2023, the U.S. National Institutes of Health (NIH) budget for basic biomedical research was USD 41.7 billion, a percentage of this funding would go on supporting advancements in bio-detection technologies. In 2023, 35 new in vitro diagnostic devices were approved by the U.S. Food and Drug Administration (FDA), showcasing the region's innovation and commercialization activity for bio-detection products.

Asia Pacific is estimated to witness the highest CAGR during the forecast period, and had a segment share of 25% in 2023. This growth is attributed to increasing healthcare expenditure, growing awareness about early disease detection coupled with government initiatives for improvement in healthcare infrastructure. In 2023, the National Medical Products Administration (NMPA) of China approved 50 new medical devices for infectious disease diagnostics, showcasing the region's attention to improving bio-detection. In 2023, India's Department of Biotechnology initiated a USD 100 million program to facilitate indigenous development of biosensors and diagnostic tools, which would further accelerate the regional market growth. The WHO reported that the Western Pacific Region, which includes many Asian countries, accounted for 35% of global tuberculosis cases in 2023, highlighting the urgent need for advanced bio-detection solutions in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Key Service Providers/Manufacturers

Gasera Ltd. (GASERA ONE, Photoacoustic Accessories)

Lynred (MCT IR Detectors, Thermal Infrared Cameras)

RAE Systems (AreaRAE Wireless Monitoring System, ProRAE Guardian)

Dräger Safety GmbH (Colorimetric Gas Detector Tubes, Alcohol Screening Kits)

Abbott Laboratories (Libre Sense Glucose Sport Biosensor, FreeStyle Libre System)

DuPont (Screen Printed Biosensor Inks, Silver/Silver Chloride Compositions)

Bio-Rad Laboratories (ProteOn XPR36 Protein Interaction Array System, Bio-Plex Multiplex Immunoassay System)

Masimo Corporation (TFA-1 Single-Patient-Use Forehead Sensor, Radius-7 Wearable Pulse CO-Oximeter)

Molecular Devices Corp. (SpectraMax iD3 Multi-Mode Microplate Reader, ImageXpress Micro Confocal High-Content Imaging System)

Meridian Bioscience, Inc. (Illumigene Molecular Diagnostic Platform, ImmunoCard STAT! Rapid Assays)

Biosensors International (BioMatrix Alpha Drug-Eluting Stent System, BioFreedom Drug-Coated Stent)

Nix Biosensors (Hydration Biosensor Patch, Sweat-Based Biometric Sensors)

Pinnacle Technology (Wireless Rat Biosensor Systems, Glutamate Biosensors)

Aryballe (NeOse Pro Digital Olfaction Sensor, Universal Odor Sensor)

Ion Science Ltd. (Tiger VOC Detector, GasCheck G Leak Detector)

Mine Safety Appliances (MSA) (Altair 4X Multigas Detector, Sirius Multigas Detector)

Industrial Scientific Corporation (Ventis Pro5 Multi-Gas Monitor, Radius BZ1 Area Monitor)

Sensidyne, LP (Gilian Personal Air Sampling Pumps, SensAlert ASI Fixed Gas Detection System)

WatchGas (PDM+ Single Gas Detector, QGM Multigas Detector)

Honeywell Analytics (BW Clip Single Gas Detector, GasAlertMicro 5 Multi-Gas Detector)

Recent Developments

In November 2024, the European Commission launched a €200 million initiative to establish a network of bio-surveillance labs across EU member states to improve biological threat detection and response.

In April 2024, Bio-Rad Laboratories, Inc. introduced the ddPLEX ESR1 Mutation Detection Kit, an ultrasensitive digital PCR assay designed to enhance oncology research, disease monitoring, and therapy selection.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 16.9 Billion |

| Market Size by 2032 | USD 52.9 Billion |

| CAGR | CAGR of 13.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Instruments, Reagents and Media, Accessories and Consumables) • By Application (Clinical, Defence, Food & Environmental) • By End-Use (Point Of Care Testing, Research Laboratories, Diagnostics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Gasera Ltd., Lynred, RAE Systems, Dräger Safety GmbH, Abbott Laboratories, DuPont, Bio-Rad Laboratories, Masimo Corporation, Molecular Devices Corp., Meridian Bioscience, Inc., Biosensors International, Nix Biosensors, Pinnacle Technology, Aryballe, Ion Science Ltd., Mine Safety Appliances (MSA), Industrial Scientific Corporation, Sensidyne, LP, WatchGas, Honeywell Analytics |

Ans. The projected market size for the Bio Detectors and Accessories Market is USD 52.9 Billion by 2032.

Ans: The North American region dominated the Bio Detectors and Accessories Market in 2023.

Ans. The Clinical Application segment dominated the Bio Detectors and Accessories Market.

Ans: The major key players in the market are Gasera Ltd., Lynred, RAE Systems, Dräger Safety GmbH, Abbott Laboratories, DuPont, Bio-Rad Laboratories, Masimo Corporation, Molecular Devices Corp., Meridian Bioscience, Inc., Biosensors International, Nix Biosensors, Pinnacle Technology, Aryballe, Ion Science Ltd., Mine Safety Appliances (MSA), Industrial Scientific Corporation, Sensidyne, LP, WatchGas, Honeywell Analytics.

Ans: Data privacy and security concerns, especially regarding the handling of sensitive biological information, present significant challenges that may hinder the adoption of biodetectors and accessories

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence Rates (2023)

5.2 Global Market Volume and Demand Growth (2020-2032)

5.3 Regulatory Approvals and Compliance (2023-2024)

5.4 R&D Investment and Technological Advancements

5.5 Healthcare Spending on Bio Detection Solutions (2023)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Bio Detectors and Accessories Market Segmentation, By Product

7.1 Chapter Overview

7.2 Instruments

7.2.1 Instruments Market Trends Analysis (2020-2032)

7.2.2 Instruments Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Reagents and Media

7.3.1 Reagents and Media Market Trends Analysis (2020-2032)

7.3.2 Reagents and Media Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Accessories and Consumables

7.4.1 Accessories and Consumables Market Trends Analysis (2020-2032)

7.4.2 Accessories and Consumables Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Bio Detectors and Accessories Market Segmentation, By Application

8.1 Chapter Overview

8.2 Clinical

8.2.1 Clinical Market Trends Analysis (2020-2032)

8.2.2 Clinical Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Defence

8.3.1 Defence Market Trends Analysis (2020-2032)

8.3.2 Defence Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Food & Environmental

8.4.1 Food & Environmental Market Trends Analysis (2020-2032)

8.4.2 Food & Environmental Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Bio Detectors and Accessories Market Segmentation, By End-Use

9.1 Chapter Overview

9.2 Point Of Care Testing

9.2.1 Point Of Care Testing Market Trends Analysis (2020-2032)

9.2.2 Point Of Care Testing Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Research Laboratories

9.3.1 Research Laboratories Market Trends Analysis (2020-2032)

9.3.2 Research Laboratories Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Diagnostics

9.4.1 Diagnostics Market Trends Analysis (2020-2032)

9.4.2 Diagnostics Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Others

9.5.1 Others Market Trends Analysis (2020-2032)

9.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Bio Detectors and Accessories Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.2.4 North America Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.5 North America Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.2.6.2 USA Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.6.3 USA Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.2.7.2 Canada Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.7.3 Canada Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.2.8.2 Mexico Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.8.3 Mexico Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Bio Detectors and Accessories Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.1.6.2 Poland Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.6.3 Poland Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.1.7.2 Romania Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.7.3 Romania Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Bio Detectors and Accessories Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.4 Western Europe Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.5 Western Europe Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.6.2 Germany Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.6.3 Germany Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.7.2 France Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.7.3 France Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.8.2 UK Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.8.3 UK Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.9.2 Italy Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.9.3 Italy Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.10.2 Spain Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.10.3 Spain Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.13.2 Austria Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.13.3 Austria Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Bio Detectors and Accessories Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.4 Asia Pacific Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.5 Asia Pacific Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.6.2 China Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.6.3 China Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.7.2 India Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.7.3 India Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.8.2 Japan Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.8.3 Japan Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.9.2 South Korea Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.9.3 South Korea Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.10.2 Vietnam Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.10.3 Vietnam Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.11.2 Singapore Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.11.3 Singapore Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.12.2 Australia Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.12.3 Australia Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Bio Detectors and Accessories Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.1.4 Middle East Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.5 Middle East Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.1.6.2 UAE Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.6.3 UAE Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Bio Detectors and Accessories Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.2.4 Africa Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.5 Africa Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Bio Detectors and Accessories Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.6.4 Latin America Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.5 Latin America Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.6.6.2 Brazil Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.6.3 Brazil Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.6.7.2 Argentina Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.7.3 Argentina Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.6.8.2 Colombia Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.8.3 Colombia Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Bio Detectors and Accessories Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Bio Detectors and Accessories Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Bio Detectors and Accessories Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11. Company Profiles

11.1 Gasera Ltd.

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Lynred

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 RAE Systems

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Dräger Safety GmbH

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Abbott Laboratories

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 DuPont

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Bio-Rad Laboratories

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Masimo Corporation

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Molecular Devices Corp.

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Meridian Bioscience, Inc.

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Product

Instruments

Reagents and Media

Accessories and Consumables

By Application

Clinical

Defence

Food & Environmental

By End-Use

Point Of Care Testing

Research Laboratories

Diagnostics

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Photoacoustic Imaging Market was valued at USD 85.1 million in 2023, expected to reach USD 137.9 million by 2032, at a CAGR of 5.4% from 2024-2032.

The Fluoroscopy Imaging Systems Market Size was valued at USD 1.99 billion in 2023 and is expected to reach USD 2.45 billion by 2032 and grow at a CAGR of 2.37% over the forecast period 2024-2032.

The On-Body Injectors Market was valued at USD 4.83 billion in 2023 and is expected to reach USD 16.89 billion by 2032, growing at a CAGR of 14.94% over the forecast period of 2024-2032.

The Genome Editing Market size valued at USD 7.99 billion in 2023 and is expected to reach USD 32.72 billion by 2032 with a growing CAGR of 16.98% during the forecast period of 2024-2032.

The Ureteroscope Market Size was valued at USD 1,056.2 Million in 2023 and is expected to reach USD 1,685.14 Million by 2032 and grow at a CAGR of 5.54% over the forecast period 2024-2032.

The Nuclear Imaging Equipment Market was valued at USD 3.78 billion in 2023, and it is expected to reach USD 5.32 billion by 2032, registering a CAGR of 3.87% from 2024 to 2032.

Hi! Click one of our member below to chat on Phone