Bio-Based Polymers Market Report Scope & Overview:

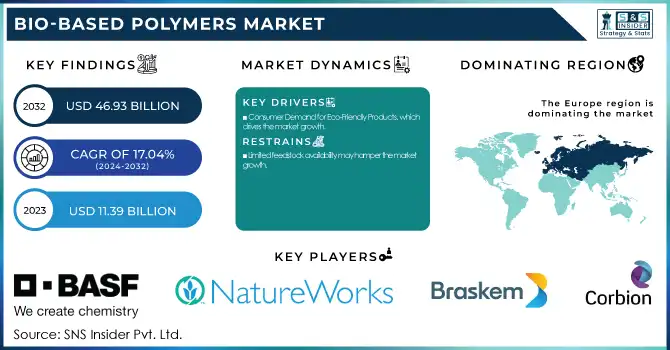

The Bio-Based Polymers Market size was USD 11.39 Billion in 2023 and is expected to reach USD 46.93 Billion by 2032 and grow at a CAGR of 17.04% over the forecast period of 2024-2032. This report delivers comprehensive statistical insights into the bio-based polymer market by analyzing production capacity and utilization by country and polymer type for 2023. It examines feedstock price trends and supply chain dynamics, highlighting regional variations that impact production economics. The report also assesses the regulatory landscape, exploring policy developments that promote sustainable manufacturing and market growth. Additionally, environmental metrics such as emissions data and waste management practices are detailed alongside emerging sustainability initiatives. Finally, innovation trends in R&D and adoption rates across key regions provide a clear picture of market penetration and future potential.

To get more information on Bio-Based Polymers Market - Request Free Sample Report

Bio-Based Polymers Market Dynamics

Drivers

-

Consumer Demand for Eco-Friendly Products, which drives the market growth.

One of the major factors driving the demand for bio-based polymers is the increasing consumer preference for green products. Consumers today are becoming more conscious of the impact of their purchases on the environment and are seeking out products that use sustainable materials and reduce waste. As consumers become more environmentally aware, companies across all sectors of packaging, automotive, consumer goods, etc. have turned to bio-based polymers as a more sustainable alternative to traditional plastics. With growing awareness and demand for sustainable products, businesses are spending on eco-friendly products to boost their brand value and satisfy market needs. Apart from catalyzing the antagonistic development process, this consumer-driven trend is also triggering innovation across the product development lifecycle of the bio-based polymers industry.

Restraint

-

Limited feedstock availability may hamper the market growth.

The unavailability of feedstock may limit the growth of the bio-based polymers market by causing slow-moving supply bottlenecks that restrict the scale of production. In contrast, bio-based polymers depend on renewable feedstocks like corn, sugarcane, and other agricultural by-products, which may be influenced by seasonal changes, climate, and their other applications in food and energy. Not only does this contextualize consistency in production but it also causes volatility in pricing due to the difficulty for manufacturers to maintain competitive pricing. Insufficient or unreliable feedstock supply can stifle a mature supply chain, limiting market entry and investment in new production technologies. Consequently, maintaining a reliable and sustainable feedstock supply is still one of the most formidable hurdles for the sector.

Opportunity

Advancements in Feedstock Utilization create market opportunities.

Feedstock conversion technologies Populations of bio-based polymers are emerging with great promise through improvements in the efficient processing of renewable raw materials to fermentable sugars and then into high-value polymers. This holistic approach includes innovations to processing technologies, as well as the utilization of advanced design approaches and machine learning to allow processors to optimize yields and purity on the biopolymer while minimizing waste during enzymatic treatment and fermentation. These advancements not only reduce the cost of production but also allow for the use of a wider variety of agricultural residues and non-food biomass, relieving the strain on conventional feedstocks. As a result, these technology developments are accelerating the scalability and sustainability of bio-based polymers toward becoming a cost-competitive substitute for conventional fossil-based plastics.

Challenges

Infrastructure and recycling issues may create a challenge for the market.

The infrastructure and recycling issues that bio-based polymers face are major impediments to their widespread adoption and effective utilization. Although these materials are intended to be biodegradable, compostable, or recyclable, their environmental benefits are frequently outweighed because of the lack of appropriate infrastructure to dispose of or process to fully leverage their capabilities. Plastic waste management systems are mostly suited to conventional plastics in many areas, while biopolymers encounter little in recycling or composting facilities. As a result, bio-based polymers can end up in a landfill rather than in a compost facility or biodegradation environment, or they may be mixed with traditional plastics, contaminating their recycling streams and preventing the long-term saving of feedstock for potential reuse

Bio-Based Polymers Market Segmentation

By Type

Poly Latic Acid (PLA) held the largest market share around 32% in 2023. It is due to its versatile properties and wide range of application base. The outstanding transparency, biodegradability, and mechanical performance of PLA render it especially attractive in packaging, disposable products, and consumer-goods markets that largely are being transformed by sustainability trends. Development of cost-effective manufacturing processes. The manufacturing processes have improved to a great extent, and details of largest-scale production have decreased the PLA's production costs, making PLA-type polymers a less-expensive alternative to common plastics. Furthermore, the rising consumer inclination towards green materials along with the favorable regulatory scenario across the globe has fueled the growth of market. All these factors together make PLA the leader of bio-based polymers market.

By Application

Packaging held the largest market share around 28% in 2023. It is owing to the converging forces of demand from end-users for sustainable products, regulatory pressures, and the properties of the material which fulfill the packaging need perfectly. Growing environmental consciousness among consumers as well as industries has diverted interest towards green, biodegradable alternatives to traditional single-use items and packaging for food which in turn has resulted in an increase in demand for bio-based polymers, including PLA. Ideal for packaging applications, they are easily processed into high transparent materials with minimal thickness, while being more durable and with a significantly lower carbon footprint than standard plastics. Additionally, strong regulations to minimize plastic waste and boost recycling have also catalyzed the transition to bio-based packaging.

Bio-Based Polymers Market Regional Analysis

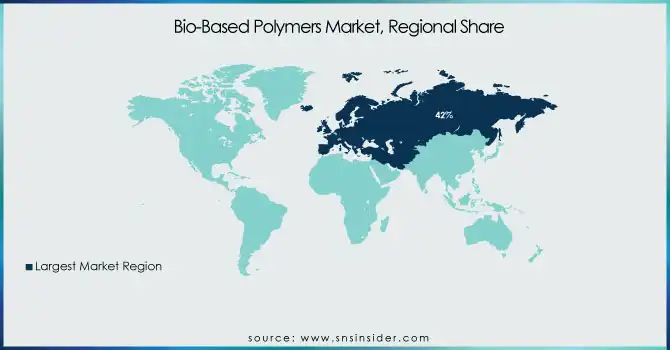

Europe held the largest market share around 42% in 2023. Due to its commitment towards sustainability and strict environmental regulations, Europe dominated the bio-based polymers market. Due to stringent regulations in the region along with increasing awareness among consumers regarding the ill-effects of the petrochemical-based plastics, the market for biodegradable plastics has witnessed significant deployment of materials (biodegradable plastics) such as PLA, PHA and starch-based biodegradables in the packaging sector. The R&D infrastructure is also quite strong in this regard and Government incentives have also fueled this journey of making new technologies and processes available at lower costs. At the same time, the mature recycling systems and high level of waste management in Europe ensure a circular economy, better enabling the bio-based polymers' lifetime cycle.

Asia-Pacific more had a majority share in the bio-based polymers market. Bamboo is being widely used for packaging and consumer goods in the region due to the rising consumer demand for sustainable products. In addition, you have policy support and incentives, and investments supported through policy as well as through incentives for advanced R&D and advanced production technologies that increase cost-competitiveness and scalability. Asia-Pacific has emerged as a key contributor to the global bio-based polymer production, especially due to a strong manufacturing base and steady improvements in feedstock conversion.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

BASF SE - Ecovio, Ultramid

-

NatureWorks LLC - Ingeo, Ingeo Biopolymer for 3D printing

-

Braskem - Green PE, I'm green EVA

-

Corbion NV - Luminy, PURASORB

-

TotalEnergies Corbion - Luminy PLA, High-heat PLA

-

Novamont S.p.A. - Mater-Bi, Origo-Bi

-

Arkema - Rilsan, Pebax Rnew

-

DuPont de Nemours, Inc. - Sorona, Biomax PTT

-

Mitsubishi Chemical Corporation - BioPBS, Durabio

-

Teijin Limited - Biofront, Ecodear

-

Danimer Scientific - Nodax, Rinnovo

-

Plantic Technologies Ltd. - Plantic, Eco Plastic

-

Futerro - PLA, Lactide

-

Biome Technologies plc - Biome Bioplastics, Biopol

-

Toray Industries, Inc. - Ecodear, PLA-based fibers

-

Evonik Industries AG - VESTAMID Terra, RESOMER

-

Rodenburg Biopolymers - Solanyl, Biopolymer compounds

-

FKuR Kunststoff GmbH - Bio-Flex, Terralene

-

Kaneka Corporation - PHBH, Green Planet

-

Bio-On S.p.A. - Minerv PHA, PHA-based bioplastics

Recent Development:

-

In 2023, BASF SE introduced a new grade of its Ecovio bioplastic, specifically designed for flexible packaging applications. This innovative material offers improved biodegradability, making it an eco-friendly solution for single-use packaging while maintaining high performance.

-

In 2023, NatureWorks LLC expanded its production capacity for Ingeo PLA (polylactic acid) biopolymers at its facility in Thailand. This expansion was aimed at addressing the growing global demand for sustainable materials in packaging, textiles, and 3D printing.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 11.39 Billion |

| Market Size by 2032 | USD 46.93 Billion |

| CAGR | CAGR of 17.04% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Starch-based Plastics, Poly Lactic Acid (PLA), Polyesters (PBS, PBAT, PCL), PolyHydroxy Alkanoates (PHA), Polyesters (PBS, PBAT, PCL)) • By Application(Packaging, Textile, Automotive & Transportation, Electronics, Consumer Goods, Agriculture, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, NatureWorks LLC, Braskem, Corbion NV, TotalEnergies Corbion, Novamont S.p.A., Arkema, DuPont de Nemours, Inc., Mitsubishi Chemical Corporation, Teijin Limited, Danimer Scientific, Plantic Technologies Ltd., Futerro, Biome Technologies plc, Toray Industries, Inc., Evonik Industries AG, Rodenburg Biopolymers, FKuR Kunststoff GmbH, Kaneka Corporation, Bio-On S.p.A. |