Get more information on Bio-Based Construction Polymer Market - Request Free Sample Report

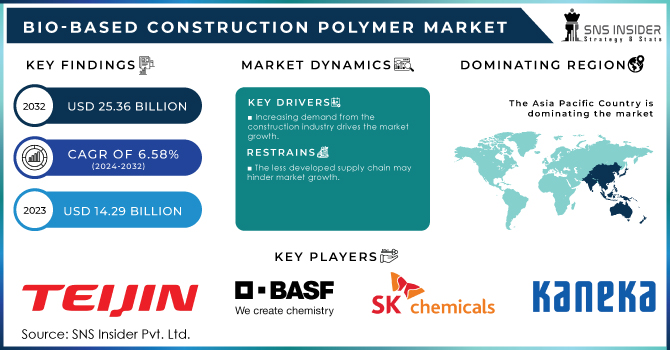

The Bio-Based Construction Polymer Market Size was valued at USD 14.29 billion in 2023 and is expected to reach USD 25.36 billion by 2032 and grow at a CAGR of 6.58% over the forecast period 2024-2032.

The rising awareness of the usage of petrochemical goods combined with the use of renewable resources is anticipated to drive the bio-based construction polymer market. One of the main causes of greenhouse gas emissions in many industrial operating facilities is the use of fossil fuels. Growing industry pressure to switch to bio-based products is the result of growing concerns about the carbon dioxide footprint of large-scale production facilities.

Moreover, the expansion of the bio-based construction polymers market is anticipated to be positively impacted by the advantageous regulatory environment in a number of nations and initiatives by regional governments in support of biopolymers. Government policies that support the use of bio-based raw materials for polymer manufacture include the lead market initiative UK and Bio Preferred U.S. To produce these polymers, large manufacturers are reorienting their attention to the development of sustainable technologies and are joining forces with multiple independent bio-based technology companies. The U.S. gross domestic product the value of all goods and services produced in the country USD 26,500 billion at a seasonally adjusted annual rate in the 1st quarter of 2023 and construction contributed USD 1,100 billion almost 4.0%. increase construction sector increase the demand of bio-based construction polymer market.

In August 2023, SCGC and Braskem partnered for bio-ethylene production for Green Polymer. It is one of the essential strategies of SCGC to expand its green business. It satisfies the demand for environmentally friendly plastic which has a robust growth rate, especially in Europe

Moreover, the construction sector is using more bio-based polymers as a result of expanded R&D efforts to create sustainable, environmentally friendly goods. High manufacturing costs and underdeveloped global supply chains, may hinder to impede the expansion.

Drivers

Increasing demand from the construction industry drives the market growth.

The construction industry is a expanding giant, constantly demanding more materials to keep pace with urban expansion and ever-growing infrastructure needs. Traditionally, these materials have been heavily reliant on fossil fuel derivatives. Market growth for bio-based construction polymers is anticipated as a result of growing awareness of the usage of petrochemical goods and the growing use of renewable materials.

Moreover, fuelled by urbanization and booming infrastructure development, the construction industry's unwavering growth is a major driver for the bio-based construction polymer market. As megacities sprawl and governments prioritize infrastructure projects, the demand for construction materials skyrockets. This ever-expanding market presents a golden opportunity for bio-based polymer manufacturers, as the industry increasingly embraces sustainable alternatives to traditional materials.

Growing in prominence are bio-based building polymers made from sustainable materials such as cellulose and plant-based starches. And constructing buildings with eco-friendly components like insulation panels, doors, and even structural beams all made from bio-based polymers. These ingenious materials not only reduce the construction industry's dependence on fossil fuels but can also match the performance and durability of traditional materials. In some cases, bio-based polymers can even be lighter and more manageable to work with, translating to faster construction times and potentially lower labor costs. This winning combination of environmental responsibility and practical advantages is driving a surge in demand from the construction industry, propelling the bio-based construction polymers market to new heights.

Rising initiatives by government agencies toward the development of green buildings are driving market growth.

Governmental organizations push for eco-conscious materials like bio-based polymers to provide tax percentages rebates or sliding grants toward those builders and developers who opt to go down the polymer path. The United States Department of Agriculture Program, places biobased products at the top of the federal shopping list ensuring a steady demand for bio-based polymers and coaxing manufacturers to pump resources into their growth. Likewise, the European Union Circular Economy Action Plan revolves around promoting sustainable circles while minimizing waste and maximizing resources. China has a Green Building Material Labeling Program. The program is managed by the Ministry of Ecology and Environment in China and gives out labels to those construction materials that satisfy certain environmental standards. When buildings use these green materials with a label, they can be eligible for tax deductions and other rewards. This program promotes the use of bio-based construction polymers an initiative towards encouraging the development and adoption of such materials as green material labels.

Restraint

The less developed supply chain may hinder market growth

The constraints in the supply chain of bio-based construction polymers are going to limit their widespread use. Yet as technology evolves and the demand grows, efforts are being made to overcome these challenges. Establishment of specialized production centers, expansion of distributor network, and development of transportation protocols: these are all measures that contribute to improving the situation. In overcoming these logistical challenges, bio-based construction polymers will be able to actualize their full potential and ultimately transform the construction industry into an environmentally sustainable one.

Opportunities

Development of new technologies in Bio-based polymers and plastics.

Increasing material versatility in applications for bio-based construction polymers is constantly expanding.

By Product

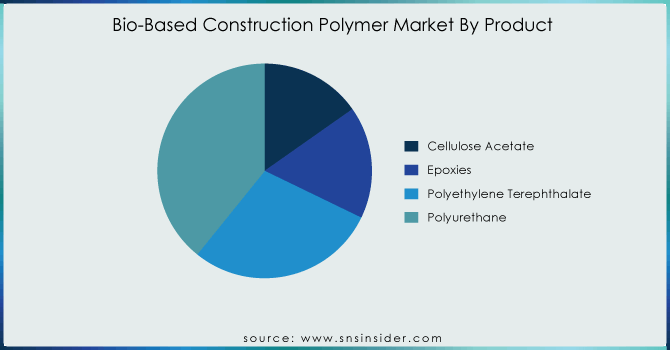

In 2023, polyurethane dominated the global demand and held a market share of more than 39.19% in the bio-based construction polymer industry. The market has a lot of potential due to the use of bio-based polyurethanes as insulation in the building and construction sector, especially in the United States and Europe.

In addition, the U.S. Environmental Protection Agency has commended improvements in sustainability made by polyurethanes as a hydrocarbon-based source of raw materials for polymers. A new report published by the EPA, Green Building Standards and Certification Systems for Low-Emitting Materials: Bio-based Polyurethane Products, highlights substantial environmental benefits from the use of bio-based polyurethanes products like those being developed through Cargill's Integrity joint venture.

PLA is anticipated to increase at the quickest rate over the projected period because of its growing popularity and many benefits over alternative goods. In the building business, it is a bio-derived monomer that is utilized as a foam, binder pore-forming agent, suspending agent, and coating adhesive.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Application

Based on the application pipe segment held the largest market share of around 38% in 2023. The building trade usage of plastics for everything from keeping the heat to joining pipes. Plastic mixtures are catching on big time for pipes and fittings. They're cheap to make, and don't rust, and won't weigh down. Builders often pick eco-friendly polymers for window frames, door parts, drains, gutters, floors, glass, wall panels, insulation, glues, cement, and roofs. These green options packs increase the demand in the market.

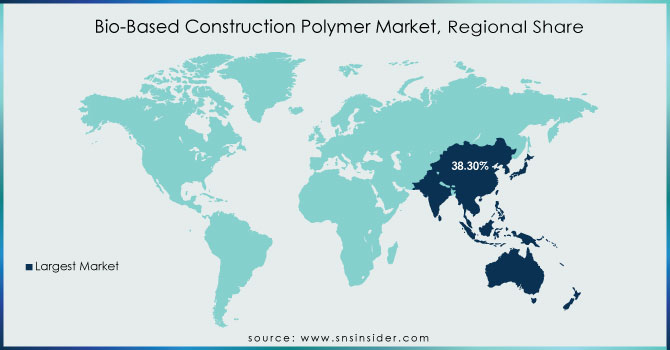

Asia Pacific dominated the bio-based construction polymer market in 2023 with the highest marker share around 38.30%. Market expansion will be aided by the start of new building projects, quick economic expansion, and the introduction of new goods. Paints and other materials to make building work easier are in high demand due to ongoing infrastructure improvement activities, especially in China, Japan, India, and Indonesia. The need for bio-based products will grow in the region due to the pleasant climate and the increase in public construction projects, especially in developing nations.

The need for bio-based polymers in the construction industry will rise in Europe as a result of government laws about carbon emissions during petroleum-based polymer manufacture. The bio-based construction polymers market will expand due to an increase in building and construction activity in North America. The growing desire to use bio-based polymers is expected to fuel the expansion of the bio-based building polymers market in Latin America, the Middle East, and Africa.

Teijin Plastics, BASF SE, SK Chemicals, Kaneka Corporation, PolyOne, Covestro, Bio-On, Toyobo Co., Ltd. Mitsubishi Gas Chemical Company, Nature Works LLC, Evonik Industries, and Others.

In August 2023, a value chain was created by Neste, LyondellBasell, Biofibre, and Naftex to integrate natural fiber with bio-based polymers to create building components. This combination of natural fiber and polymers with detectable biobased content in building components contributes to the creation of carbon storage to fight climate change.

In March 2023, BASF started producing Sovermol, Its first bio-based polyol, in India. This product meets the rapidly expanding need for environmentally friendly goods in Asia Pacific for use in New Energy Vehicles and protective industrial coatings.

In March 2023, Kolon Industries agreed to a joint development agreement with Stora Enso to develop and industrialize bio-based polyesters and applications. This joint venture helped the company to increase its expansion in the market.

| Report Attributes | Details |

| Market Size in 2023 | US$ 14.29 Billion |

| Market Size by 2032 | US$ 25.36 Billion |

| CAGR | CAGR of 6.58% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Chitosan Market, Epoxies, Polyethylene Terephthalate, Polyurethane) • By Application (Insulation, Pipe, Profile, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Alterra Energy, Neste, Plastic2oil, BRADAM Group, LLC, Agilyx Inc., Covestro AG, TEIJIN LIMITED, Mitsubishi Chemical Corp, SABIC, Palram Industries Ltd., Avient Corporation, Teysa Technology Limited, Roquette, Trinseo, Asahi Kasei Corporation, and others. |

| Key Drivers | • Rising initiatives by government agencies toward the development of green buildings are driving market growth. |

| RESTRAINTS | •The less developed supply chain may hinder market growth |

Ans: The expected CAGR of the global Bio-Based Construction Polymer Market during the forecast period is 6.58%.

Ans: The Pipes will grow rapidly in the Bio-Based Construction Polymer Market from 2024-2032.

Ans: Factors such as lack of consumer awareness, and technology limitations, can restrict the growth of the bio-based construction polymer market.

Ans: Increasing material versatility in applications for bio-based construction polymers is constantly expanding.

Ans: The U.S. led the largest share in the North American region with the highest revenue share in 2023.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Bio-Based Construction Polymer Market Segmentation, By Product

7.1 Introduction

7.2 Cellulose Acetate

7.3 Epoxies

7.4 Polyethylene Terephthalate

7.5 Polyurethane

8. Bio-Based Construction Polymer Market Segmentation, By Application

8.1 Introduction

8.2 Insulation

8.3 Pipe

8.4 Profile

8.5 Others

9. Regional Analysis

9.1 Introduction

9.2 North America

9.2.1 Trend Analysis

9.2.2 North America Bio-Based Construction Polymer Market by Country

9.2.3 North America Bio-Based Construction Polymer Market by Product

9.2.4 North America Bio-Based Construction Polymer Market by Application

9.2.5 USA

9.2.5.1 USA Bio-Based Construction Polymer Market by Product

9.2.5.2 USA Bio-Based Construction Polymer Market by Application

9.2.6 Canada

9.2.6.1 Canada Bio-Based Construction Polymer Market by Product

9.2.6.2 Canada Bio-Based Construction Polymer Market by Application

9.2.7 Mexico

9.2.7.1 Mexico Bio-Based Construction Polymer Market by Product

9.2.7.2 Mexico Bio-Based Construction Polymer Market by Application

9.3 Europe

9.3.1 Trend Analysis

9.3.2 Eastern Europe

9.3.2.1 Eastern Europe Bio-Based Construction Polymer Market by Country

9.3.2.2 Eastern Europe Bio-Based Construction Polymer Market by Product

9.3.2.3 Eastern Europe Bio-Based Construction Polymer Market by Application

9.3.2.4 Poland

9.3.2.4.1 Poland Bio-Based Construction Polymer Market by Product

9.3.2.4.2 Poland Bio-Based Construction Polymer Market by Application

9.3.2.5 Romania

9.3.2.5.1 Romania Bio-Based Construction Polymer Market by Product

9.3.2.5.2 Romania Bio-Based Construction Polymer Market by Application

9.3.2.6 Hungary

9.3.2.6.1 Hungary Bio-Based Construction Polymer Market by Product

9.3.2.6.2 Hungary Bio-Based Construction Polymer Market by Application

9.3.2.7 Turkey

9.3.2.7.1 Turkey Bio-Based Construction Polymer Market by Product

9.3.2.7.2 Turkey Bio-Based Construction Polymer Market by Application

9.3.2.8 Rest of Eastern Europe

9.3.2.8.1 Rest of Eastern Europe Bio-Based Construction Polymer Market by Product

9.3.2.8.2 Rest of Eastern Europe Bio-Based Construction Polymer Market by Application

9.3.3 Western Europe

9.3.3.1 Western Europe Bio-Based Construction Polymer Market by Country

9.3.3.2 Western Europe Bio-Based Construction Polymer Market by Product

9.3.3.3 Western Europe Bio-Based Construction Polymer Market by Application

9.3.3.4 Germany

9.3.3.4.1 Germany Bio-Based Construction Polymer Market by Product

9.3.3.4.2 Germany Bio-Based Construction Polymer Market by Application

9.3.3.5 France

9.3.3.5.1 France Bio-Based Construction Polymer Market by Product

9.3.3.5.2 France Bio-Based Construction Polymer Market by Application

9.3.3.6 UK

9.3.3.6.1 UK Bio-Based Construction Polymer Market by Product

9.3.3.6.2 UK Bio-Based Construction Polymer Market by Application

9.3.3.7 Italy

9.3.3.7.1 Italy Bio-Based Construction Polymer Market by Product

9.3.3.7.2 Italy Bio-Based Construction Polymer Market by Application

9.3.3.8 Spain

9.3.3.8.1 Spain Bio-Based Construction Polymer Market by Product

9.3.3.8.2 Spain Bio-Based Construction Polymer Market by Application

9.3.3.9 Netherlands

9.3.3.9.1 Netherlands Bio-Based Construction Polymer Market by Product

9.3.3.9.2 Netherlands Bio-Based Construction Polymer Market by Application

9.3.3.10 Switzerland

9.3.3.10.1 Switzerland Bio-Based Construction Polymer Market by Product

9.3.3.10.2 Switzerland Bio-Based Construction Polymer Market by Application

9.3.3.11 Austria

9.3.3.11.1 Austria Bio-Based Construction Polymer Market by Product

9.3.3.11.2 Austria Bio-Based Construction Polymer Market by Application

9.3.3.12 Rest of Western Europe

9.3.3.12.1 Rest of Western Europe Bio-Based Construction Polymer Market by Product

9.3.2.12.2 Rest of Western Europe Bio-Based Construction Polymer Market by Application

9.4 Asia-Pacific

9.4.1 Trend Analysis

9.4.2 Asia Pacific Bio-Based Construction Polymer Market by Country

9.4.3 Asia Pacific Bio-Based Construction Polymer Market by Product

9.4.4 Asia Pacific Bio-Based Construction Polymer Market by Application

9.4.5 China

9.4.5.1 China Bio-Based Construction Polymer Market by Product

9.4.5.2 China Bio-Based Construction Polymer Market by Application

9.4.6 India

9.4.6.1 India Bio-Based Construction Polymer Market by Product

9.4.6.2 India Bio-Based Construction Polymer Market by Application

9.4.7 Japan

9.4.7.1 Japan Bio-Based Construction Polymer Market by Product

9.4.7.2 Japan Bio-Based Construction Polymer Market by Application

9.4.8 South Korea

9.4.8.1 South Korea Bio-Based Construction Polymer Market by Product

9.4.8.2 South Korea Bio-Based Construction Polymer Market by Application

9.4.9 Vietnam

9.4.9.1 Vietnam Bio-Based Construction Polymer Market by Product

9.4.9.2 Vietnam Bio-Based Construction Polymer Market by Application

9.4.10 Singapore

9.4.10.1 Singapore Bio-Based Construction Polymer Market by Product

9.4.10.2 Singapore Bio-Based Construction Polymer Market by Application

9.4.11 Australia

9.4.11.1 Australia Bio-Based Construction Polymer Market by Product

9.4.11.2 Australia Bio-Based Construction Polymer Market by Application

9.4.12 Rest of Asia-Pacific

9.4.12.1 Rest of Asia-Pacific Bio-Based Construction Polymer Market by Product

9.4.12.2 Rest of Asia-Pacific Bio-Based Construction Polymer Market by Application

9.5 Middle East & Africa

9.5.1 Trend Analysis

9.5.2 Middle East

9.5.2.1 Middle East Bio-Based Construction Polymer Market by Country

9.5.2.2 Middle East Bio-Based Construction Polymer Market by Product

9.5.2.3 Middle East Bio-Based Construction Polymer Market by Application

9.5.2.4 UAE

9.5.2.4.1 UAE Bio-Based Construction Polymer Market by Product

9.5.2.4.2 UAE Bio-Based Construction Polymer Market by Application

9.5.2.5 Egypt

9.5.2.5.1 Egypt Bio-Based Construction Polymer Market by Product

9.5.2.5.2 Egypt Bio-Based Construction Polymer Market by Application

9.5.2.6 Saudi Arabia

9.5.2.6.1 Saudi Arabia Bio-Based Construction Polymer Market by Product

9.5.2.6.2 Saudi Arabia Bio-Based Construction Polymer Market by Application

9.5.2.7 Qatar

9.5.2.7.1 Qatar Bio-Based Construction Polymer Market by Product

9.5.2.7.2 Qatar Bio-Based Construction Polymer Market by Application

9.5.2.8 Rest of Middle East

9.5.2.8.1 Rest of Middle East Bio-Based Construction Polymer Market by Product

9.5.2.8.2 Rest of Middle East Bio-Based Construction Polymer Market by Application

9.5.3 Africa

9.5.3.1 Africa Bio-Based Construction Polymer Market by Country

9.5.3.2 Africa Bio-Based Construction Polymer Market by Product

9.5.3.3 Africa Bio-Based Construction Polymer Market by Application

9.5.2.4 Nigeria

9.5.2.4.1 Nigeria Bio-Based Construction Polymer Market by Product

9.5.2.4.2 Nigeria Bio-Based Construction Polymer Market by Application

9.5.2.5 South Africa

9.5.2.5.1 South Africa Bio-Based Construction Polymer Market by Product

9.5.2.5.2 South Africa Bio-Based Construction Polymer Market by Application

9.5.2.6 Rest of Africa

9.5.2.6.1 Rest of Africa Bio-Based Construction Polymer Market by Product

9.5.2.6.2 Rest of Africa Bio-Based Construction Polymer Market by Application

9.6 Latin America

9.6.1 Trend Analysis

9.6.2 Latin America Bio-Based Construction Polymer Market by Country

9.6.3 Latin America Bio-Based Construction Polymer Market by Product

9.6.4 Latin America Bio-Based Construction Polymer Market by Application

9.6.5 Brazil

9.6.5.1 Brazil Bio-Based Construction Polymer Market by Product

9.6.5.2 Brazil Bio-Based Construction Polymer Market by Application

9.6.6 Argentina

9.6.6.1 Argentina Bio-Based Construction Polymer Market by Product

9.6.6.2 Argentina Bio-Based Construction Polymer Market by Application

9.6.7 Colombia

9.6.7.1 Colombia Bio-Based Construction Polymer Market by Product

9.6.7.2 Colombia Bio-Based Construction Polymer Market by Application

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Bio-Based Construction Polymer Market by Product

9.6.8.2 Rest of Latin America Bio-Based Construction Polymer Market by Application

10. Company Profiles

10.1 Teijin Plastics

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

10.1.4 The SNS View

10.2 BASF SE

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 The SNS View

10.3 SK Chemicals

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 The SNS View

10.4 Kaneka Corporation

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 The SNS View

10.5 PolyOne

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 The SNS View

10.6 Covestro

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 The SNS View

10.7 Bio-On

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 The SNS View

10.8 Nature Works LLC

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 The SNS View

10.9 Evonik Industries

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 The SNS View

10.10 Mitsubishi Gas Chemical Company

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Products/ Services Offered

10.10.4 The SNS View

11. Competitive Landscape

11.1 Competitive Benchmarking

11.2 Market Share Analysis

11.3 Recent Developments

11.3.1 Industry News

11.3.2 Company News

11.3.3 Mergers & Acquisitions

12. USE Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Product

Cellulose Acetate

Epoxies

Polyethylene Terephthalate

Polyurethane

By Application

Insulation

Pipe

Profile

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Water Treatment Chemicals Market was valued at USD 46.7 billion in 2023, and is expected to reach USD 94.2 billion by 2032, at a CAGR of 8.1% by 2024-2032.

Furandicarboxylic Acid Market was valued at USD 3.7 Billion in 2023 and is expected to reach USD 50.6 Billion by 2032, at a CAGR of 34.0% from 2024-2032.

Floor Adhesive Market was valued at USD 6.08 Billion in 2023 and is expected to reach USD 13.12 Billion by 2032, growing at a CAGR of 8.92% from 2024 to 2032.

Industrial Gases Market was USD 105.47 Billion in 2023 and is expected to reach USD 174.13 Billion by 2032, growing at a CAGR of 5.73 % from 2024 to 2032.

Plain Bearing Market size was estimated at USD 12.88 billion in 2023 and is expected to reach USD 20.33 billion by 2032 at a CAGR of 5.20% from 2024 to 2032.

The high-performance plastics market size was valued at USD 27.75 billion in 2023 and is expected to reach USD 61.72 billion by 2032, growing at a CAGR of 9.29% over the forecast period of 2024-2032

Hi! Click one of our member below to chat on Phone