Big Data Market Report Scope & Overview:

The Big Data Market was valued at USD 325.4 Billion in 2023 and is expected to reach USD 1035.2 Billion by 2032, growing at a CAGR of 13.74% from 2024-2032.

To get more information on Big Data Market - Request Free Sample Report

The Big Data Market is experiencing exciting growth due to the rapid increase in data generation and the need for data-driven decision-making in multiple industries. Global data creation is set to surpass 138 zettabytes by 2024, showcasing the sheer quantity of information produced by IoT devices, social media, and enterprise systems. The explosion of this data is causing to acquisition of insights that can be actioned by the organization to ensure an efficient way of operations pushing organizations towards using analytics and Big Data technologies.

The rising share of unstructured data is one of the most prominent drivers impacting the market. This type of data has overtaken structured data as most of the business data generated in the world today which is more than 80%. As a result, this gradually leads to new tools and platforms specifically aimed at processing and analyzing unstructured datasets. Big data is being used by industries like healthcare, retail, and financial services to optimize operations, enhance customer services, and predict trends. As one example, predictive analytics in health care has shown the ability to reduce patient readmission rates by up to 30%, highlighting the power of Big Data applications.

Another important growth factor is the cloud-based Big Data platforms for enterprises, where more than 60% of enterprises are already adopting cloud solutions to fulfill their Big Data needs. Such platforms provide scalability, cost-effectiveness, and improved interaction functionality. Furthermore, real-time analytics is in high demand since businesses want to use their solution in such a way that they will process and get the required details immediately without any delay. This is especially observed in domains such as e-commerce and logistics, wherein real-time insights are vital to staying competitive.

Big Data has also seen its workforce add numbers rapidly, with job postings for data science and analytics growing annually by greater than 25%. This highlights the demand for high-end professionals to manage huge datasets and interpret them. Investments in Big Data infrastructure and technologies are booming, indicating vigorous market growth in the coming years. The Big Data market is characterized by fast-paced technology developments, widespread industry adoption, and increasing emphasis on real-time and unstructured data analytics, affirming its importance in business innovation and the future.

Market Dynamics

Drivers

-

Sectors such as healthcare, retail, and finance are leveraging Big Data to enhance operations, predict trends, and improve customer experiences.

Whether it is healthcare, retail, or any other field, Big Data is fast changing the ways of doing business, predicting trends, and improving customer experience. However, Big Data analytics also improves health care as a whole, with predictive models that assess risk factors to reduce hospital readmissions and encourage preventative care. Remote patient monitoring enables immediate use of patient data which allows early interventions and better patient outcomes, as well as improved allocation of critical healthcare resources. In addition, Big Data uses big datasets from clinical trials and genetic research to speed drug development and help make personalized medicine possible.

Big data is transforming customer engagement and operational strategy in retail. Retailers make sense of consumer habits, preferences, and buying patterns with the help of analytics. This facilitates personalized marketing, effective inventory management, and dynamic pricing strategies. As an example, by merging point-of-sale data and online shopping behaviors, retailers can identify demand flows, optimize the supply chain, drive down costs, and improve customer experience.

Big Data in the finance field has a key role in reducing risks, detecting fraud, and improving customer service. Financial institutions employ Advanced analytics for transaction monitoring systems to identify anomalies in transactions and regulatory compliance. By analyzing customer data, AI creates customized financial products, and personalized investment advice, and caters to a better user experience. Besides that, the credit risk assessment gets better as well through Big Data because, with its help, borrowers can be evaluated accurately when it comes to their creditworthiness. Big Data has paved its way in these industries as a foundation that is responsible for innovation and informed decision-making, providing more value to customers as well as the opportunity to optimize processes and cost of operations.

Restraints

-

Combining Big Data solutions with existing legacy systems is complex and time-consuming.

For organizations, integrating Big data solutions into legacy systems remains one of the biggest challenges because the transition can be so complex and time-consuming. Built on old technologies, legacy systems are too rigid, too limited in their scale, and cannot process and handle the huge volumes and varieties of data generated today. Such systems are often not well-suited for real-time data processing and advanced analytics, which are a standard part of a modern big data platform. As a result, organizations also face challenges in seamlessly integrating their current infrastructure into the specific needs of big data technologies. The primary challenge is that legacy systems store data in outdated formats, which are incompatible with newer platforms that use more advanced data structures. Transferring such large data from legacy systems to big data platforms involves significant resources and needs specialized tools and expertise to maintain its consistency and integrity. Further, the process of integration can wreak havoc in day-to-day operations since most legacy systems are key to business functions. This requires thorough planning and execution so that minimum downtime and disruption take place. Hence, organizations must focus on reskilling the workforce to run the consolidated systems. However, this is a big challenge, and to unlock the maximum value of the data, organizations must aim to combine the Big Data with their old systems. Overcoming these hurdles allows organizations to leverage advanced analytics, improve decision-making, and outperform the competition in the age of data.

Segment Analysis

By Product

The storage segment dominated the market and represented a significant revenue share of more than 53% in 2023. Hard disk drive (HDD) is a low-cost big data storage appliance. But compared to hard disk drives, flash storage applications like memory cards, USB, smartphones, and tablets are getting more prevalent since costs are declining and it is possible to get quick access to data stored on flash devices. One of the key reasons that is making the storage segment grow is that it is not capacity-dependent and the volume of storage can be extended to terabyte or petabyte levels.

The network equipment segment is anticipated to grow with the fastest CAGR during the forecast period. Network-attached storage equipment includes solid-state memory, cloud storage, hybrid cloud storage, backup appliances, etc. This type of equipment does not require constant power to retain data and can be classified as a non-volatile storage medium. Moreover, cloud storage is virtual data storage, and data can be accessed from anywhere. These innovations are contributing to the growth of the market.

By Service

The consulting services segment dominated the market in 2023 and accounted for revenue share of mmore than 49%. With data evaluation and audits, consultants can identify what needs to improve, what risks are lurking, and the most effective way forward for data modernization, analytics, and more. Big data help in the process or as data management of an organization data version to accelerate the analysis process. Testing and personalisation services from data analytics firms are carried out through experiments to improve strategies, content and user experiences. Predictive modeling is used for consultancy services and one of its application in big data is prediction of future events by analyzing the patterns in a given sample dataset. The market growth in consultancy services is often ascribed to different applications.

The training & development segment is anticipated to register the fastest CAGR during the forecast period. Advanced analytics, for instance, machine learning algorithms, allows Human Resource professionals to determine where there are skill gaps for employees, understand future talent needs, and become architects for bespoke training programs that can fill those gaps. Identifying and filling skill gaps is essential for optimizing employee performance, streamlining operational processes, and enabling business growth. Using big data, organizations can connect employee and training performance — ensuring training is effective. The growth of big data market is driven due to these big data applications in training & development.

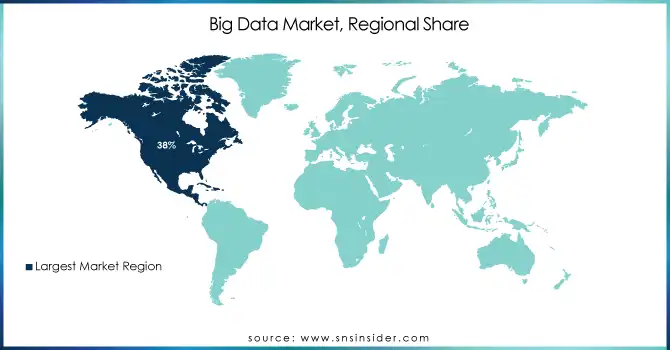

Regional Analysis

The North American big data market held a dominant share in 2023, accounting for 38% of total revenue. The growing utilization of big data solutions by several major companies in various sectors across this region has propelled the expansion of this regional industry over the past few years. Additionally, the increase in investment made by various organizations in research and development activities to increase efficiency and improve operational processes increases the growth of the market. As it has several organizations providing services, solutions, and technology support related to big data such factors further accelerate the North American big data market.

The Asia-Pacific region is expected to register the fastest CAGR during the forecast period. The entry of several businesses from multiple domains of industries in the region, a large population of consumers, unmatched growth in digital transactions, and increasing access to the availability of very large datasets drive this market. Proximity to several information & technology organizations and SMEs focusing on innovation and delivery of competitive big data solutions to its customers in the region. Such solutions are coupled with distributed processing, storage & management, analytics & visualization, data quality, etc.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major players are IBM, Microsoft, Oracle, SAP, Amazon Web Services (AWS), Google, Cloudera, Teradata, Hadoop, Splunk, SAS, Snowflake, and others in the final report.

Recent Development

In January 2024, Microsoft announced plans to invest approximately $80 billion in fiscal 2025 to develop data centers for training AI models and deploying AI and cloud-based applications.

In January 2024, Palantir Technologies was recognized as one of the top-performing stocks, benefiting from its AI offerings and strong earnings, contributing to a 375% increase for the year.

|

Report Attributes |

Details |

|

Market Size in 2023 |

USD 325.4 Billion |

|

Market Size by 2032 |

USD 1035.2 Billion |

|

CAGR |

CAGR of 13.74% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Product (Storage, Server, Network Equipment) |

|

Regional Analysis/Coverage |

North America (USA, Canada, Mexico), Europe |

|

Company Profiles |

IBM, Microsoft, Oracle, SAP, Amazon Web Services (AWS), Google, Cloudera, Teradata, Hadoop, Splunk, SAS, Snowflake |

|

Key Driver |

• Sectors such as healthcare, retail, and finance are leveraging Big Data to enhance operations, predict trends, and improve customer experiences. |

|

Restraint |

• Combining Big Data solutions with existing legacy systems is complex and time-consuming. |