Big Data in Flight Operations Market Report Scope & Overview:

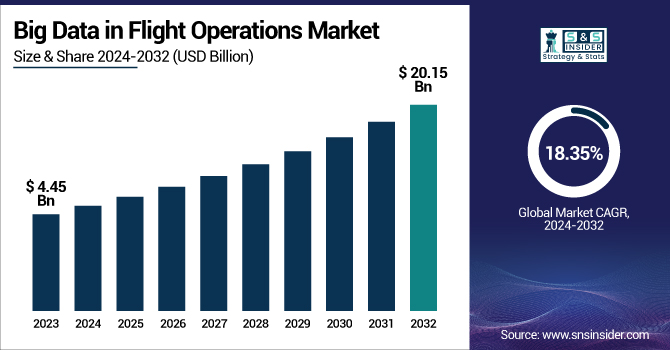

The Big Data in Flight Operations Market was valued at USD 4.45 billion in 2023 and is expected to reach USD 20.15 billion by 2032, growing at a CAGR of 18.35% from 2024-2032.

To Get more information on Big Data in Flight Operations Market - Request Free Sample Report

This report highlights market trends, key drivers and many other growth opportunities in the field of aviation industry, particularly defining the key components of big data flight plan optimization. This discusses the evolution around data-related aspects such as data size and growth, flight operation automation, predictive accuracy enhancement, minimizing aircraft downtime, and passenger traffic prediction. The report also explores the potential of AI and machine learning and discusses how real-time monitoring can improve operational efficiency. An understanding of these risk factors reiterates how the use of big data has become an invaluable tool to improve aviation performance, safety and customer satisfaction.

U.S. Big Data in Flight Operations Market was valued at USD 1.21 billion in 2023 and is expected to reach USD 5.47 billion by 2032, growing at a CAGR of 18.25% from 2024-2032.

Demand for operational efficiency, cost reduction, and enhanced flight safety is fuelling this growth in commercial and defense aviation. Airlines are using data-based technologies to automate flight planning, predict aircraft maintenance and increase aircraft availability. Moreover, with the increase in air traffic volume and passengers demanding for hassle-free travel, carriers are turning towards real-time data analytics. AI and machine learning have been incorporated in flight operations, thus not increasing predictive accuracy and decision-making further, but also making substantial contributions to market growth.

In support of this trajectory, the 2024 FAA forecast projects U.S. carrier domestic passenger growth to average 2.5 percent annually over the next 20 years. Simultaneously, the general aviation segment remains robust, with the U.S. fleet comprising approximately 204,000 active aircraft in 2023 the largest and most diverse GA fleet in the world.

Big Data in Flight Operations Market Dynamics

Drivers

-

Rising demand for real-time analytics to enhance flight efficiency and operational decision-making across global airline fleets

The aviation industry is focusing on real-time data analytics as a means of creating precision when it comes to flight planning, fuel usage, and route optimization. Airlines are under the ever-increasing pressure to minimize operational costs while also ensuring both systems of enhanced on-time performance and safety margins. Operators can synthesize telemetry with weather and engine performance data in real-time to make decisions more accurately and quickly with big data.

In April 2025, Honeywell showcased its Surface Alert (SURF-A) and Smart-X systems during a test flight aboard a Boeing 757. These systems provide pilots with real-time aural and visual alerts, helping prevent runway collisions and taxiway misidentifications.

Moreover, real-time insights enable dynamic scheduling, maintenance management, and predictive analysis, all of which help in minimizing delays and disruption. With global fleets increasing in size and data complexity growing, airlines are increasingly turning to platforms that can handle large datasets in real-time. This evolution in turn is even reshaping the management of flight operations in line with the broader digitalization wave affecting aviation and establishing a new highpoint of operational excellence and competitiveness.

Restraints

-

Data privacy regulations and cybersecurity risks restrict full-scale data utilization and sharing across global airline networks

The aviation industry has stringent data governance and cybersecurity practices, which makes executing Big Data solutions across borders so difficult. Regulations such as GDPR in Europe or FAA mandates in the U.S require compliance that restricts how flight and passenger data can be collected, stored, and SHARED. Airlines have to tread a delicate line between more aggressive analytics and the limits imposed by both the law and the reputational risks in the case of data breaches. Aviation systems are also popular targets for cyberattacks, meaning they require costly and complex encryption and other national defense mechanisms. Such limitations have resulted in delayed integration of Big Data and increased silos between carriers and technology providers this in turn limits their ability to achieve the full benefits of data-driven innovation.

Opportunities

-

Adoption of AI and machine learning to enhance decision automation in complex flight operations scenarios across airline networks

The intersection of Big Data with AI offers a revolutionary potential in flight operations, where the most frequent decisions need to be made within milliseconds. Machine learning algorithms based on huge datasets have the potential to streamline everything from gate and crew assignments to weather-driven rerouting and passenger rebooking.

Google Cloud's partnership with Air France-KLM in December 2024 exemplifies this, as they implement generative AI on the airline group's extensive data to enhance operational efficiency.

Through passenger preference analysis, forecasting aircraft maintenance requirements, and optimizing flight and airport operations, these technologies allow for more precise forecasting and adaptive systems that get better with more data input. Airlines using AI can react more quickly to disruptions, minimize human error, and enhance customer satisfaction. With the aviation industry adopting intelligent solutions, AI-driven Big Data platforms provide competitive edge, operational continuity, and better passenger experiences in an uncertain air travel environment.

Challenges

-

Shortage of aviation-specific data science talent limits the ability to build, deploy, and scale advanced analytics applications effectively

Its proper application in flight operations requires competence that combines both aviation domain knowledge and specialized data science skills. But this hybrid talent is hard to come by, which is limiting airlines' ability to exploit all the value in their data assets. Flight data has a lot of context and nuance (e.g., flight metrics, regulatory requirements, or aircraft systems) which generalist data scientists may not appreciate, which can create models that do not translate to operational relevance or trust. In addition, it becomes tougher to hold on to talent when tech firms and consultancies are throwing around bigger payout packages. Even financially strong airlines can only achieve a certain level of analytics maturity without the right people in place, after which innovation plateaus and one has to deal with unpredictable bottlenecks in digital transformation initiatives.

Big Data in Flight Operations Market Segment Analysis

By Components

The Software segment accounted for the largest revenue share of approximately 65% in 2023 due to of its key position in supporting real-time analytics, automation, and integration in flight operations. Airlines more and more depend on advanced software platforms to help them sort huge amounts of operational and aircraft data for optimizing routes, crew management, and fuel efficiency. Such systems provide scalability, flexibility, and innovative features that are essential to handling sophisticated air traffic environments, making them a prerequisite for contemporary aviation operations.

The Services segment is expected to grow at the fastest CAGR of around 19.52% from 2024 to 2032, driven by the increasing adoption of managed services, consulting, system integration, and real time support. As airlines and aviation stakeholders further deploy sophisticated Big Data systems, they require specialized expertise to implement, maintain, and optimize these platforms, spurring the expansion of professional services and outsourced analytics support.

By Applications

The Flight Operations Optimization segment held the largest revenue share of approximately 35% in 2023, propelled by the increasing focus on fuel efficiency, turnaround time reduction, and aircraft utilization. Airlines are investing in optimization tools that provide comprehensive visibility across scheduling, routing, and load planning. Such capabilities flow directly to reduced costs and operational flexibility, thus presenting this segment as a strategic focus area as competition intensifies, and fuel prices rise and fall.

The Predictive Maintenance segment is expected to expand at the fastest CAGR of approximately 20.07% from 2024 to 2032, due to its ability to transform unplanned downtime and improve asset life. Using real-time sensor data on the aircraft and historical maintenance records, airlines and MROs can proactively predict failure before it ever occurs. It not only augments safety and slashes operational downtime but also trims maintenance expense the very three factors responsible for a surge in predictive maintenance services market share.

By End-User

The Airlines segment dominated the market in 2023, capturing about 51% of the revenue share, driven by the necessity to enhance fuel efficiency, minimize turnaround time, and optimize aircraft utilization. Airlines are making investment in optimization solutions that provide end-to-end visibility within scheduling, routing, and load planning. Such capabilities immediately translate into cost reductions and operational responsiveness, thus being a strategic priority in the face of increased competition and volatile fuel prices.

Maintenance, Repair, and Overhaul (MRO) Providers are projected to grow at the fastest CAGR of about 20.64% from 2024 to 2032, due to growing adoption of data-driven insights and the transition from reactive to predictive maintenance models. They face increasing pressure to reduce aircraft downtime, and a big driver for this is reducing maintenance turn-around, so MROs are using Big Data tools to analyze component health and repair cycle between overhauls. The move to digitalization is quickly escalating, a must-do to be able to provide business aviation MRO customers with value-added and analytics-driven services.

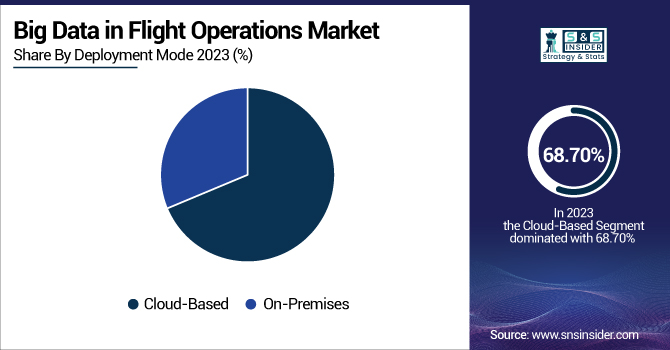

By Deployment Mode

The Cloud-Based segment led the Big Data in Flight Operations Market with a dominant revenue share of around 69% in 2023, owing to greater scalability, lower upfront cost, and real-time access. To optimize processes, ensure collaboration between geographically-dispersed teams, and have the data from various sources readily accessible, airline and aviation service organizations are progressively moving to cloud infrastructures. Cloud-based solutions facilitate the fast deployment of analytics applications, allow for easy integration with incumbent systems as well as provide the powerful computing capabilities required to process enormous data from both aircraft sensors and ground systems. Then, going cloud brings faster updates, better data security, and elasticity, all critical, facilitating risks of flight operations in a more dynamic, more distributed world.

Regional Analysis

In 2023, North America led the Big Data in Flight Operations market, capturing approximately 38% of the total revenue share. This dominance is attributed to the region's mature aviation infrastructure, early adoption of advanced analytics technologies, and the presence of major airlines and tech providers. In 2024, U.S. commercial air carriers transported over 39 billion revenue ton-miles (RTMs) of cargo, according to the FAA Aerospace Forecast, underscoring the growing complexity and scale of operations driven by e-commerce and global logistics. These dynamics have accelerated demand for data-driven solutions to optimize fuel use, enable predictive maintenance, and enhance operational efficiency across the U.S. and Canada.

Asia Pacific is projected to experience the fastest growth in the Big Data in Flight Operations market, with a compound annual growth rate of around 20.63% from 2024 to 2032. This boost is driven by high growth in flying, increased investments in air transport infrastructure, and rising emphasis on digitalization across developing economies such as India, China, and Southeast Asia. Regional carriers are adopting big data to enhance route efficiency, minimize operational expenses, and address growing passenger demand, with governments encouraging smarter, technology-integrated airport environments.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

IBM Corporation [Watson, Cloud Pak for Data]

-

Microsoft Corporation [Azure Synapse Analytics, Power BI]

-

Oracle Corporation [Big Data Service, Cloud Infrastructure Data Science]

-

Amazon Web Services (AWS) [Redshift, Glue]

-

Google LLC [BigQuery, Cloud Dataflow]

-

Honeywell International Inc. [Forge for Airlines, Flight Efficiency]

-

SAP SE [HANA, BusinessObjects BI]

-

Thales Group [FlytX, Aviobook]

-

Airbus SE [Skywise, AirSense]

-

Teradata Corporation [Vantage, IntelliCloud]

-

Informatica [PowerCenter, Intelligent Data Management Cloud]

-

Splunk [Enterprise, Observability Cloud]

-

Tableau Software [Desktop, Server]

-

Hortonworks [Data Platform, DataFlow]

-

SAS Institute [Visual Analytics, Data Management]

-

Qlik [Sense, Data Integration]

-

EMC Corporation [Isilon, Elastic Cloud Storage]

-

Cloudera [Data Platform, DataFlow]

-

MicroStrategy [Analytics, HyperIntelligence]

-

Tibco Software [Spotfire, Data Virtualization]

Recent Developments:

-

In January 2025, Honeywell and NXP Semiconductors expanded their partnership to develop AI-driven aviation technologies. They aim to enhance flight planning and management by integrating Honeywell's Anthem avionics with NXP's computing architecture, focusing on autonomous flying advancements.

-

In November 2024, Menzies Aviation adopted SAP SuccessFactors HCM to enhance its global HR operations. This cloud-based platform improves employee experience, learning, and career development across 53 countries, supporting over 55,000 staff at more than 295 airports worldwide.

-

In October 2024, Microsoft introduced an industry reference architecture tailored for airlines and airports. This framework leverages generative AI to enhance traveler experiences, streamline airline operations, and optimize airport functions, aiming to transform the aviation industry through AI-driven solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 4.45 Billion |

| Market Size by 2032 | US$ 20.15 Billion |

| CAGR | CAGR of 18.35% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services) • By Deployment Mode (Cloud-Based, On-Premises) • By Application (Flight Operations Optimization, Predictive Maintenance, Air Traffic Management, Passenger Experience Management, Others) • By End-User (Airlines, Airports, Maintenance Repair and Overhaul (MRO) Providers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IBM Corporation, Microsoft Corporation, Oracle Corporation, Amazon Web Services (AWS), Google LLC, Honeywell International Inc., SAP SE, Thales Group, Airbus SE, Teradata Corporation, Informatica, Splunk, Tableau Software, Hortonworks, SAS Institute, Qlik, EMC Corporation, Cloudera, MicroStrategy, Tibco Software |