Get More Information on Big Data as a Service (BDaaS) Market - Request Sample Report

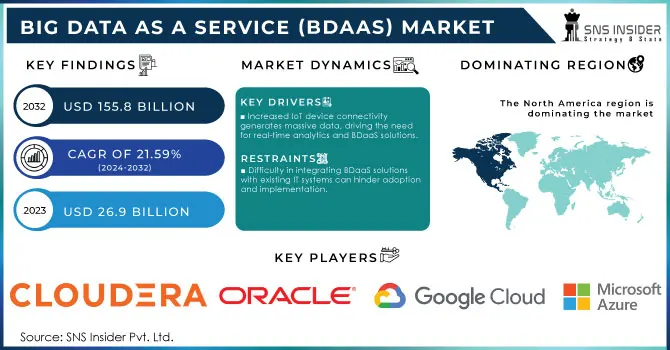

Big Data as a Service (BDaaS) Market was valued at USD 26.9 billion in 2023 and is expected to reach USD 155.8 Billion by 2032, growing at a CAGR of 21.59% from 2024-2032.

The Big Data as a Service (BDaaS) market is expanding rapidly due to the increasing demand for data-driven decision-making and digital transformation across industries. BDaaS offers flexible cloud-based solutions that allow organizations to handle and analyze large data sets without requiring expensive infrastructure. Companies use these services to gain actionable insights, improve efficiency, and develop new strategies. BDaaS providers deliver a variety of solutions, such as Hadoop-as-a-Service and Data Analytics-as-a-Service, enabling businesses to simplify data management. The market’s growth is primarily driven by the rising adoption of cloud computing, increased IoT connectivity, and the growing reliance on advanced analytics for gaining a competitive advantage. As data generation continues to surge, businesses need real-time analytics, which in turn boosts the demand for BDaaS. Additionally, stricter regulatory and compliance requirements, especially in sectors like finance and healthcare, are encouraging companies to adopt BDaaS to securely and efficiently manage their data.

For example, Amazon Web Services (AWS) offers BDaaS solutions such as Amazon Redshift and Amazon EMR (Elastic MapReduce), which provide flexible data processing and analysis capabilities. In 2023, AWS reported a significant increase in demand for these services, with customers like Airbnb using BDaaS to process vast amounts of data in real-time, enhancing both customer experience and operational efficiency. The increasing use of AI, machine learning, and predictive analytics will drive further adoption of BDaaS across sectors like retail, manufacturing, and healthcare, where real-time data insights are essential for innovation and competitiveness. For instance, According to a 2023 report, 50% of organizations have adopted AI in at least one business function, up from 40% in 2022, indicating a strong trend toward integrating AI technologies.

In summary, the BDaaS market is on track for sustained growth, fueled by expanding data volumes, rising cloud adoption, and the demand for real-time insights, positioning it as a key enabler of modern business strategies.

Drivers

The shift to cloud-based infrastructure enables scalable and cost-effective data management solutions.

Increased IoT device connectivity generates massive data, driving the need for real-time analytics and BDaaS solutions.

BDaaS reduces the need for expensive in-house infrastructure, attracting businesses looking to optimize costs.

One of the advantages of Big Data as a Service (BDaaS) in the BDaaS market is that it saves money on expensive equipment and infrastructure at home. In the past, handling and processing large volumes of data demanded significant investments in servers, storage, advanced analytics tools, together with ongoing maintenance and specialized IT personnel.

As a cloud-based solution, BDaaS lifts this financial weight by enabling companies to leverage scalable, on-demand data management and analytics resources. If a company needs storage or processing power, it need only purchase the resources that they require and nothing more; thus, reducing capital and operational expenses.

Providing an example, companies can rapidly access large data sets without increasing physical infrastructure, lowering hardware costs and minimizing downtime. Other benefits of BDaaS include flexibility, since organizations can adjust the scale of their data operations whenever necessary to not invest in infrastructure that they do not need. This economical approach is useful especially for small and medium scale enterprises (SMEs) who have budget constraints, while larger organisations can utilize the power of data without worrying about managing hardware. To sum up, BDaaS is cost-effective for businesses as it reduces the expense of managing and maintaining in-house infrastructure by delivering a cloud-native, scalable data service that scales as per business needs.

The growing requirement of real-time analytics is fueled by the new business use cases emerging from billions of connected Internet of Things (IoT) devices, with rapidly increasing demand for Big Data as a Service (BDaaS). With the advent of an increasing number of connected devices, such as sensors, smart home gadgets, industrial appliances and more, we find ourselves in the middle of a continuous data generation storm. Such data includes everything from operational metrics to customer behaviors and environmental conditions, all of which need real-time analysis for businesses to make fast decisions, streamline processes and provide better customer experience. These intimidatingly large and complex datasets can be efficiently managed and analyzed with BDaaS — scalable, cloud-based tools that free organizations from investing in expensive on-premises infrastructure. With BDaaS they can process IoT data faster, which means that real-time analytics will be powered so companies get actionable insights promptly and respond proactively. For example, in industries such as manufacturing and logistics, real-time IoT analytics can help keep tabs on equipment health and performance, conducting predictive maintenance to avoid costly downtimes.

In the real time data analysis of IoT, some industries like retail and healthcare also gets advantage. This allows retailers to spy on the different behaviors of customers, better manage supplies, and send specific requests for offers to customers, while also allowing health care providers to monitor patients from any distance and provide essential services. To summarize, IoT devices are becoming significantly more connected, creating a massive amount of data that needs real-time processing. This is where BDaaS solutions come to the rescue making the advent of IoT a major market driver for BDaaS growth.

Restraints

Difficulty in integrating BDaaS solutions with existing IT systems can hinder adoption and implementation.

A shortage of skilled data analysts and IT professionals can limit organizations' ability to leverage BDaaS effectively.

Inconsistent or poor-quality data can undermine the effectiveness of BDaaS solutions, leading to unreliable insights.

The data processing is the most important part to achieve effective analytics and insights from the Big Data as a Service (BDaaS) market. Weak data or variable quality can immediately diminish the benefit gained from BDaaS solutions. When organizations use BDaaS to analyze data, they expect insights to be accurate, reliable and meaningful enough to support their strategic decisions. But when the real data is erroneous resulting from being wrong, incomplete or inconsistent then misleading results can be obtained.

In critical areas of health and finance, for instance, bad data can cause improper patient diagnoses or financial imbalances. These errors then also endanger operational efficiency but even more seriously compliance and regulatory functions. While under a BDaaS umbrella, organizations often combine data across disparate sources like IoT devices, social media, and transactional systems. If any of these sources give inaccurate information, it will bias the analytics and cause decisions to be based on wrong data.

Also, dependency on BDaaS may exacerbate poor data quality. With organizations depending on these services for real-time insights and decision-making, the impact of imperfect data become magnified. Corporates may adopt BDaaS solutions without resolving the fundamental causes of poor data quality, thus losing out on improvement opportunities and wasting monetary resources.

Implementing BDaaS is only going to increase the risks associated with data governance and quality if enterprises do not sort their processes prior to on-boarding a BDaaS solution. The importance of accuracy, completeness and consistency is paramount if BDaaS is to provide value to an organization with dependable insights when pivoting strategy based on the desire for growth in a competitive environment.

By Deployment

The public cloud segment dominated the market in 2023, capturing a revenue share of 62.8%. Public cloud platforms utilize a pay-as-you-go pricing model, which enables organizations to bypass the significant capital expenditures tied to on-premises infrastructure. This approach is especially advantageous for small and medium-sized enterprises that require big data analytics capabilities without the financial burden of expensive hardware. Additionally, public cloud services offer scalability, allowing businesses to modify their data storage and processing capabilities based on demand, which helps maximize resource utilization and effectively manage costs.

Conversely, the hybrid cloud segment is expected to register the highest compound annual growth rate (CAGR) throughout the forecast period. Hybrid cloud solutions allow organizations to allocate resources dynamically between public and private clouds in response to real-time demands and workload needs. This adaptability is particularly beneficial for companies encountering varying data volumes or sudden spikes in data processing requirements. By combining the public cloud's scalability with the private cloud's control, businesses can efficiently manage their big data workloads, achieving both high performance and cost-effectiveness. Their unique flexibility and scalability features fuel the increasing demand for hybrid cloud deployments.

By Solution

In 2023, the data analytics-as-a-service (DAaaS) segment dominated the market and accounted for the largest revenue share in the market as different industry organizations are realizing that deriving business insights from data will thus play a key role amid rapid changes and disruptions. The DAaaS market has been primarily fueled by this trend. DAaaS solutions allow businesses to analyze large data volumes quickly and effectively while also delivering actionable insights that drive strategic decisions. Demand for these solutions is particularly robust among industries such as retail, finance, healthcare, and manufacturing in which data insights enhance customer experiences, streamline operations, and boost competitive advantages. One of the reasons for DAaaS's increasing adoption is its own ability to carry out real-time, data-driven insights.

However, Hadoop-as-a-Service (HaaS) segment anticipated to grow at fastest compound annual growth rate (CAGR) during the forecast period. HaaS provides a solution that makes it easier to manage the complexities of Hadoop infrastructure by providing a managed service responsible for technical aspects like setup, configuration and maintenance. With this intuitive model enterprise no more requires an IT team to deploy Hadoop based big data solution. HaaS minimizes the technical challenges associated with Hadoop, thus making big data analytics available to a larger set of companies, including those who might not have substantial in-house expertise.

By End-Use

In 2023, the BFSI segment held the largest revenue share in the market. Hence, it is vital to stress upon groomed risk solutions and fraud detection in this industry. The rise in transaction complexities along with a fast increase in cyberattacks demands complex data analytics too. With fast and accurate tools for real-time big data analysis, BDaaS helps BFSI organizations identify any irregular patterns, predict trends-for risk management, and a quicker identification of fraud. The proactive ability to mitigate risks and enhance security is one of the leading factors for BDaaS adoption in the BFSI sector.

However, manufacturing segment is anticipated to grow at the largest Compound Annual Growth Rate (CAGR) during the forecast period. In order to meet customer expectations and adhere to industry standards, it is imperative that manufacturers uphold high product quality as well as performance. BDaaS platforms make it easier for manufacturers to analyse quality control data, production metrics, and customer feedback that enables them to track and improve product quality. With the help of big data analytics, manufacturers can easily locate the problems and make necessary corrections on time besides improving their production processes continuously. This effort to manufacture superior quality products and eliminate defects are driving the growth of this BDaaS solutions that provide necessary tools for efficient quality management.

Regional Analysis

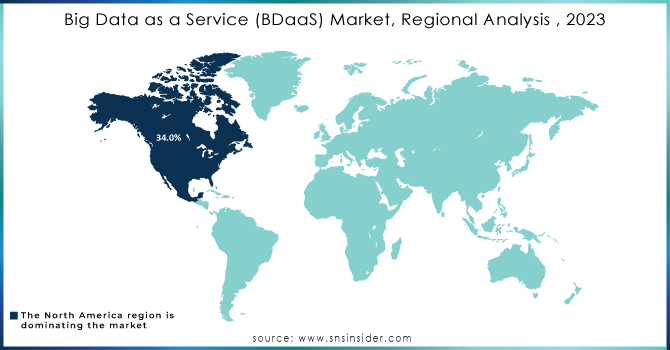

The North America dominated the market and represented revenue share of more than 36.1%, in 2023. Cloud computing has been widely adopted across the region with several businesses already leveraging different services on the cloud. This existing infrastructure and the natural progression toward cloud has made it easy for BDaaS to take advantage of being a cloud-based solution. Organizations in North America are gradually adopting the cloud for their data workloads due to its scalability, flexibility and cost-efficiency. This robust cloud attitude propels the rise of BDaaS because organizations Are looking to turn out to be greater aligned with region solutions big data that suits their infrastructures, and their cloud strategy.

During the forecast period, Asia Pacific BDaaS market is expected to grow at the highest compound annual growth rate (CAGR). The increased adoption of cloud computing throughout the region is driven by an increased need for flexible, scalable, and affordable IT solutions. BDaaS is a cloud-based service that takes an advantage of this trend by giving local businesses the ability to use sophisticated data analytics tools without major capital investment in infrastructure. BDaaS is also witnessing an increase in the Asia Pacific due to a growing acceptance of cloud technologies and a shift towards cloud-based solutions. And companies are leveraging BDaaS to take advantage of cloud computing and enhance data analytics.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

The major key players with their Services

Amazon Web Services (AWS) - Amazon Redshift

Microsoft Azure - Azure Synapse Analytics

Google Cloud Platform (GCP) - BigQuery

IBM - IBM Cloud Pak for Data

Oracle - Oracle Big Data Service

Cloudera - Cloudera Data Platform

Hortonworks - Hortonworks Data Platform

SAP - SAP Data Intelligence

Teradata - Teradata Vantage

Snowflake - Snowflake Data Cloud

Domo - Domo Business Cloud

Qlik - Qlik Sense

Sisense - Sisense for Cloud Data Teams

Tableau (Salesforce) - Tableau Cloud

Hewlett Packard Enterprise (HPE) - HPE Ezmeral Data Fabric

Alteryx - Alteryx Designer

Palantir Technologies - Palantir Foundry

Apache Cassandra - Apache Cassandra as a Service

Splunk - Splunk Cloud

Zoho - Zoho Analytics

B2B User

Netflix

Spotify

Vodafone

Zoom

Mastercard

PayPal

Siemens

Coca-Cola

Instacart

eBay

American Express

Nasdaq

Charles Schwab

Boeing

Unilever

JP Morgan Chase

Verizon

Recent Developments

In June 2024, China introduced Ocean Cloud, its inaugural open marine big data service platform, at an event in Xiamen held in conjunction with World Oceans Day. The platform is designed to enhance the integration and accessibility of marine data, facilitating improved information exchange on both national and global scales through a global ocean three-dimensional observation network.

In December 2023, DxVx entered into a partnership with LG CNS to jointly develop a bio-healthcare big data platform that incorporates artificial intelligence (AI). This collaboration aims to strengthen DxVx's capabilities in personalized precision medicine by utilizing AI for advanced data analysis and enhancing healthcare solutions.

| Report Attributes | Details |

| Market Size in 2023 | USD 26.9 billion |

| Market Size by 2032 | USD 155.8 Billion |

| CAGR | CAGR of 21.59 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment (Public Cloud, Private Cloud, And Hybrid Cloud) • By Component {Solution (Hadoop-As-A-Service, Data-As-A-Service, And Data Analytics-As-A-Service), Services}, • By Enterprise Size (Small and Medium-Sized Business, And Large Enterprises) • By End-Use (BFSI, Manufacturing, Retail, Media & Entertainment, Healthcare, IT & Telecommunication, Government, And Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Accenture, Amazon Web Services, inc., Google LLC, Hewlett Packard Enterprise Development lp, International Business Machines Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, SAS Institute Inc., GoodData, Hitachi Vantara, Teradata |

| Key Drivers | •The shift to cloud-based infrastructure enables scalable and cost-effective data management solutions. •Increased IoT device connectivity generates massive data, driving the need for real-time analytics and BDaaS solutions. •BDaaS reduces the need for expensive in-house infrastructure, attracting businesses looking to optimize costs. |

| Market Opportunities | •Difficulty in integrating BDaaS solutions with existing IT systems can hinder adoption and implementation •A shortage of skilled data analysts and IT professionals can limit organizations' ability to leverage BDaaS effectively •Inconsistent or poor-quality data can undermine the effectiveness of BDaaS solutions, leading to unreliable insights. |

Ans- Challenges in Big Data as a Service (BDaaS) market are

Ans- one main growth factor for the Big Data as a Service (BDaaS) market is

Ans- In 2023, The North America dominated the market and held the significant revenue share of 36.1% in 2023.

Ans- the CAGR of Big Data as a Service (BDaaS) market during the forecast period is of 21.59% from 2024-2032.

Ans- Big Data as a Service (BDaaS) market was valued at USD 26.9 billion in 2023 and is expected to reach USD 155.8 Billion by 2032, growing at a CAGR of 21.59% from 2024-2032.

TABLE OF CONTENT

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Network Infrastructure Expansion, by Region

5.3 Cybersecurity Incidents, by Region (2020-2023)

5.4 Cloud Services Usage, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Big Data as a Service (BDaaS) Market Segmentation, by Deployment

7.1 Chapter Overview

7.2 Public Cloud

7.2.1 Public Cloud Market Trends Analysis (2020-2032)

7.2.2 Public Cloud Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3Private Cloud

7.3.1Private Cloud Market Trends Analysis (2020-2032)

7.3.2Private Cloud Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3Hybrid Cloud

7.3.1Hybrid Cloud Market Trends Analysis (2020-2032)

7.3.2Hybrid Cloud Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Big Data as a Service (BDaaS) Market Segmentation, by Solution

8.1 Chapter Overview

8.2 Hadoop-as-a-Service

8.2.1 Hadoop-as-a-Service Market Trends Analysis (2020-2032)

8.2.2 Hadoop-as-a-Service Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Data-as-a-Service

8.3.1 Data-as-a-Service Market Trends Analysis (2020-2032)

8.3.2 Data-as-a-Service Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Data Analytics-as-a-Service

8.4.1 Data Analytics-as-a-Service Market Trends Analysis (2020-2032)

8.4.2 Data Analytics-as-a-Service Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Big Data as a Service (BDaaS) Market Segmentation, by Organization Size

9.1 Chapter Overview

9.2 Small and Medium-Sized Businesses

9.2.1 Small and Medium-Sized Businesses Market Trends Analysis (2020-2032)

9.2.2 Small and Medium-Sized Businesses Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Large Enterprises

9.3.1 Large Enterprises Market Trends Analysis (2020-2032)

9.3.2 Large Enterprises Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Big Data as a Service (BDaaS) Market Segmentation, by End-Use

10.1 Chapter Overview

10.2 IT & Telecommunication

10.2.1 IT & Telecommunication Market Trends Analysis (2020-2032)

10.2.2 IT & Telecommunication Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Media and Entertainment

10.3.1 Media and Entertainment Market Trends Analysis (2020-2032)

10.3.2 Media and Entertainment Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 BFSI

10.4.1 BFSI Market Trends Analysis (2020-2032)

10.4.2 BFSI Market Size Estimates and Forecasts to 2032 (USD Billion)

10.5 Manufacturing

10.5.1 Manufacturing Market Trends Analysis (2020-2032)

10.5.2 Manufacturing Market Size Estimates and Forecasts to 2032 (USD Billion)

10.5 Healthcare

10.5.1 Healthcare Market Trends Analysis (2020-2032)

10.5.2 Healthcare Market Size Estimates and Forecasts to 2032 (USD Billion)

10.6 Retail

10.6.1 Retail Market Trends Analysis (2020-2032)

10.6.2 Retail Market Size Estimates and Forecasts to 2032 (USD Billion)

10.7 Government

10.7.1 Government Market Trends Analysis (2020-2032)

10.7.2 Government Market Size Estimates and Forecasts to 2032 (USD Billion)

10.8 Others

10.8.1 Others Market Trends Analysis (2020-2032)

10.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.2.4 North America Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.2.5 North America Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.2.6 North America Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.2.7.2 USA Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.2.7.3 USA Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.2.7.4 USA Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.2.8.2 Canada Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.2.8.3 Canada Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.2.8.4 Canada Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.2.9.2 Mexico Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.2.9.3 Mexico Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.2.9.4 Mexico Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.1.7.2 Poland Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.3.1.7.3 Poland Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.1.7.4 Poland Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.1.8.2 Romania Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.3.1.8.3 Romania Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.1.8.4 Romania Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.2.4 Western Europe Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.3.2.5 Western Europe Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.2.6 Western Europe Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.2.7.2 Germany Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.3.2.7.3 Germany Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.2.7.4 Germany Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.2.8.2 France Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.3.2.8.3 France Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.2.8.4 France Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.2.9.2 UK Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.3.2.9.3 UK Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.2.9.4 UK Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.2.10.2 Italy Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.3.2.10.3 Italy Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.2.10.4 Italy Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.2.11.2 Spain Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.3.2.11.3 Spain Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.2.11.4 Spain Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.2.14.2 Austria Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.3.2.14.3 Austria Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.2.14.4 Austria Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.4.4 Asia Pacific Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.4.5 Asia Pacific Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.4.6 Asia Pacific Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.4.7.2 China Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.4.7.3 China Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.4.7.4 China Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.4.8.2 India Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.4.8.3 India Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.4.8.4 India Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.4.9.2 Japan Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.4.9.3 Japan Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.4.9.4 Japan Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.4.10.2 South Korea Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.4.10.3 South Korea Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.4.10.4 South Korea Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.4.11.2 Vietnam Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.4.11.3 Vietnam Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.4.11.4 Vietnam Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.4.12.2 Singapore Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.4.12.3 Singapore Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.4.12.4 Singapore Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.4.13.2 Australia Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.4.13.3 Australia Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.4.13.4 Australia Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.5.1.4 Middle East Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.5.1.5 Middle East Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.5.1.6 Middle East Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.5.1.7.2 UAE Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.5.1.7.3 UAE Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.5.1.7.4 UAE Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.5.2.4 Africa Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.5.2.5 Africa Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.5.2.6 Africa Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.6.4 Latin America Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.6.5 Latin America Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.6.6 Latin America Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.6.7.2 Brazil Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.6.7.3 Brazil Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.6.7.4 Brazil Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.6.8.2 Argentina Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.6.8.3 Argentina Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.6.8.4 Argentina Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.6.9.2 Colombia Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.6.9.3 Colombia Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.6.9.4 Colombia Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Big Data as a Service (BDaaS) Market Estimates and Forecasts, by Organization Size (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Big Data as a Service (BDaaS) Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

12. Company Profiles

12.1 Amazon Web Services (AWS)

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Microsoft Azure

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Google Cloud Platform (GCP)

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 IBM

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Oracle

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Cloudera

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Hortonworks

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 SAP

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Teradata

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Snowflake

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Deployment

Public Cloud

Private Cloud

Hybrid Cloud

By Solution

Hadoop-as-a-Service

Data-as-a-Service

Data Analytics-as-a-Service

By Organization Size

Large Enterprises

Small & Medium Enterprises

By End-Use

BFSI

Manufacturing

Retail

Media & Entertainment

Healthcare

IT & Telecommunication

Government

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Network Slicing Market size was valued at USD 756 Million in 2023. It is expected to Reach USD 24231 Million by 2032 and grow at a CAGR of 47% over the forecast period of 2024-2032.

The Vendor Risk Management Market was valued at USD 8.6 billion in 2023 and is expected to reach USD 30.3 billion by 2032, growing at a CAGR of 14.98% from 2024-2032.

The Virtual Classroom Market was valued at USD 18.23 billion in 2023 and is expected to reach USD 60.85 billion by 2032, growing at a CAGR of 14.35% over the forecast period 2025-2032.

The Virtual Reality in Healthcare Market Size was USD 3.20 billion in 2023 and will reach USD 46.40 Bn by 2032, growing at a CAGR of 33.30% from 2024-2032.

The Enterprise Resource Planning Software Market was valued at USD 62.49 billion in 2023 and is expected to reach USD 175.63 billion by 2032 & CAGR of 12.23% by 2032.

The AI In Fintech Market was valued at USD 12.2 Billion in 2023 and is expected to reach USD 61.6 Billion by 2032, growing at a CAGR of 19.72% by 2032.

Hi! Click one of our member below to chat on Phone