Get More Information on Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market - Request Sample Report

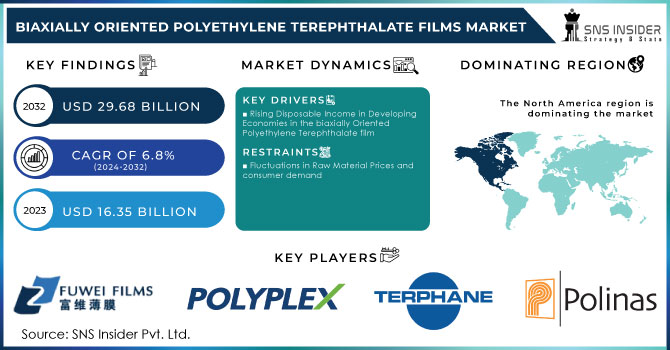

The Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market size was valued at USD 16.7 billion in 2023 and is expected to reach USD 28.4 billion by 2032 and grow at a CAGR of 6.1% over the forecast period of 2024-2032.

The Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market is characterized by dynamic factors such as increasing demand for lightweight, durable, and recyclable materials across diverse applications like food packaging, electronics, and industrial sectors. Recent advancements in film technologies and a growing preference for high-performance materials drive innovation in the market. Companies are focusing on expanding their production capacities and launching specialized products to meet evolving consumer demands. For instance, in January 2025, Polyplex Corporation announced an investment of Rs 558 crore for a new BOPET film manufacturing plant, showcasing its commitment to catering to rising global demand. Similarly, SRF Limited in November 2020 announced plans to set up a second BOPP film production line with an investment of Rs 424 crore, highlighting the trend of capacity expansion to strengthen market presence.

Manufacturers are also emphasizing the development of value-added and environmentally friendly film solutions. Uflex, in February 2024, emphasized its growing portfolio of value-added BOPET films in its quarterly update, underlining the importance of innovation for market differentiation. In October 2023, a new production plant for biaxially oriented plastic films was inaugurated in Binh Duong, Vietnam, further reflecting the industry's focus on regional expansion and technological advancements. Additionally, efforts to develop unique product offerings were evident in April 2018, when Uflex's Flex Films division introduced a soft-touch BOPET film, catering to niche applications requiring a tactile appeal. These developments demonstrate how companies are leveraging innovation, capacity expansion, and regional diversification to address the increasing demand and enhance their market competitiveness.

Drivers:

Growing Preference for Lightweight, Durable, and Versatile Packaging Materials Fuels the Demand for BOPET Films Across Industries

Biaxially Oriented Polyethylene Terephthalate (BOPET) films are gaining significant attention due to their lightweight, durable, and versatile nature, which makes them ideal for various industries. In particular, packaging industries are leveraging BOPET films because of their excellent tensile strength, high tear resistance, and flexibility. The packaging of food and beverages, personal care products, and electronics has increasingly adopted BOPET films due to their ability to protect products while extending shelf life. BOPET films also provide excellent barrier properties, making them resistant to moisture, oxygen, and UV radiation, which is a critical feature for preserving product integrity. With the increasing need for packaging that not only protects products but also offers a premium appearance, BOPET films have found an expanded application range, including flexible packaging and pouches. Their transparent and glossy finish makes them an attractive option for retailers aiming to showcase products. As industries worldwide seek solutions that offer both strength and aesthetics in packaging, BOPET films are expected to continue driving demand, particularly as the trend toward premium packaging in the food, beverage, and electronics sectors intensifies.

Increasing Demand for Sustainable and Recyclable Packaging Solutions Drives the Growth of BOPET Films

Expansion of End-User Industries, Particularly in Emerging Economies, Drives the BOPET Films Market's Growth

Restraint:

High Production Costs and Technological Barriers Limit the Widespread Adoption of BOPET Films in Cost-Sensitive Industries

BOPET films face a key restraint in high production costs, which can make them less appealing for cost-sensitive industries. The production involves complex technologies, including biaxial orientation, requiring specialized machinery and expertise. Post-production processes like metallization, coating, and lamination also add to the cost. For industries focused on low-cost packaging, such as budget consumer goods, BOPET films may not be the preferred choice due to their higher costs. While they offer performance and sustainability benefits, their cost remains a barrier to widespread adoption. Manufacturers are working on process optimization and economies of scale to reduce costs, but this remains a challenge.

Opportunity:

Rising Demand for Value-Added and Customizable BOPET Films Presents New Growth Avenues in Packaging

Growing Demand for Electronic and Industrial Applications Presents Significant Expansion Potential for BOPET Films

While BOPET films have traditionally been used in the packaging industry, there is an increasing opportunity for their application in electronics and industrial sectors. In the electronics industry, BOPET films are used in capacitors, touchscreens, and other flexible electronic components due to their excellent dielectric properties, heat resistance, and mechanical strength. The rise of wearable electronics, flexible displays, and renewable energy technologies like solar panels has opened new growth avenues for BOPET films. As these industries evolve and demand high-performance materials, BOPET films, with their superior electrical and mechanical properties, are poised to capture a larger share of these expanding markets. Additionally, BOPET films' ability to withstand extreme temperatures and environmental conditions makes them an ideal choice for industrial applications, such as insulation materials and protective coatings. The expansion of these industries presents significant growth opportunities for BOPET film manufacturers, providing a path to diversify and enter new markets.

Challenge:

Challenges in Addressing the Environmental Impact of BOPET Films Amid Growing Demand for Sustainability

The environmental impact of BOPET film production presents a significant challenge. While recyclable, their manufacturing is energy-intensive and relies on petrochemicals, contributing to a high carbon footprint. As demand for greener alternatives increases, manufacturers must focus on reducing energy use, improving recycling rates, and developing more sustainable options. Educating consumers on recyclability and enhancing recycling systems are essential to meet growing sustainability expectations.

Sustainability Initiatives and Environmental Impact in the BOPET Films Market

| Company/Initiative | Sustainability Focus | Environmental Impact | Key Actions |

|---|---|---|---|

| Polyplex Corporation Ltd. | Development of eco-friendly BOPET films | Reduced carbon footprint and energy usage in production | Investment in energy-efficient production processes |

| Uflex Ltd. | Introduction of recyclable BOPET films | Reduction of non-recyclable waste and increased recyclability | Launch of recyclable BOPET films for packaging |

| Mitsubishi Polyester Film, Inc. | Focus on reducing waste and energy consumption | Lower emissions and reduced environmental pollution | Implementing advanced recycling techniques for BOPET films |

| Garware Polyester Ltd. | Sustainable film production and packaging solutions | Reduction in plastic waste and enhanced recyclability | Use of renewable energy sources in manufacturing plants |

| Fuwei Films (Holdings) Co., Ltd. | Production of biodegradable and recyclable BOPET films | Decrease in environmental footprint through better recyclability | Development of BOPET films with recycled PET content |

The BOPET films market is increasingly focused on sustainability initiatives aimed at reducing the environmental impact of production and disposal. Companies are adopting measures like introducing recyclable films, improving energy efficiency in production, and developing biodegradable alternatives. For example, Polyplex Corporation Ltd. has invested in energy-efficient production processes, while Uflex Ltd. has launched recyclable BOPET films to reduce plastic waste. Mitsubishi Polyester Film, Inc. and Garware Polyester Ltd. are both enhancing recycling capabilities and using renewable energy in their operations. Fuwei Films (Holdings) Co., Ltd. is focusing on creating biodegradable and recyclable BOPET films, aligning with global sustainability efforts. These initiatives aim to lower the carbon footprint, enhance recyclability, and contribute to a circular economy.

By Product Type

In 2023, Thin Films dominated the Biaxially Oriented Polyethylene Terephthalate (BOPET) films market, capturing approximately 70% of the market share. The preference for thin films can be attributed to their exceptional mechanical properties, including flexibility, strength, and lightweight characteristics, making them ideal for a variety of applications, particularly in flexible packaging. These films are widely utilized in food packaging, labels, and electronic applications due to their excellent barrier properties against moisture, oxygen, and light. The rising demand for sustainable and efficient packaging solutions has further propelled the use of thin BOPET films, as they allow for reduced material usage while maintaining durability and performance. Moreover, advancements in printing technologies have enhanced the aesthetic appeal of thin films, making them increasingly popular for branded packaging. Leading manufacturers are investing in innovations to produce thinner films that meet specific requirements for various applications, ensuring that the thin films segment continues to thrive in response to market needs. Overall, the advantages of thin films, combined with evolving consumer preferences, have solidified their position as the frontrunner in the BOPET films market.

By Thickness

The Below 15 Micron segment dominated the BOPET films market in 2023, capturing 37.2% of the market share, driven by its extensive application in lightweight packaging solutions. Films within this thickness range are particularly favored in industries requiring efficient and cost-effective packaging materials. Their lightweight nature not only reduces shipping costs but also enhances consumer convenience, making them ideal for various applications such as food packaging, labels, and wraps. The growing emphasis on sustainability has led manufacturers to seek materials that provide excellent barrier properties without excessive weight. Additionally, below 15-micron BOPET films offer superior mechanical strength, durability, and clarity, making them suitable for high-quality print applications. This thickness range aligns well with the global trend toward reducing packaging waste and improving recyclability. With increasing consumer demand for eco-friendly and innovative packaging solutions, manufacturers are focusing on optimizing the production processes of below 15-micron BOPET films to enhance performance while minimizing environmental impact. As a result, this segment's prominence is expected to continue, reflecting the broader industry shift toward lightweight and sustainable packaging options.

By Application

In 2023, the Labels segment dominated the Biaxially Oriented Polyethylene Terephthalate (BOPET) films, holding 31% of the market share, reflecting a growing demand for high-performance labeling solutions. BOPET films are widely recognized for their exceptional printability, durability, and resistance to various environmental factors, making them ideal for use in a wide range of labeling applications. The segment's growth is driven by the increasing demand for innovative packaging and labeling solutions across diverse industries, including food and beverages, cosmetics, and electronics. Brands are increasingly adopting BOPET films for labels due to their ability to withstand moisture and UV exposure while maintaining visual appeal. Moreover, the trend towards personalization and customization in product packaging has further fueled the demand for versatile BOPET films in labels, as they can be easily printed with vibrant colors and intricate designs. With the rise of e-commerce and online shopping, the need for attractive and informative labels has become even more crucial. As companies prioritize branding and customer engagement, the labels segment is expected to continue to thrive, reinforcing the significant role of BOPET films in modern packaging solutions.

By End Use Industry

The Food and Beverages industry dominated the Biaxially Oriented Polyethylene Terephthalate (BOPET) films market in 2023, accounting for 42% of the market share, underscoring the critical role of these films in modern food packaging solutions. BOPET films are highly valued in this sector for their excellent barrier properties, which protect food products from moisture, oxygen, and light, ultimately extending shelf life and maintaining product quality. As consumer preferences shift toward convenient, ready-to-eat, and packaged food products, the demand for effective and reliable packaging solutions has surged. BOPET films are increasingly being used for applications such as snack packaging, microwaveable meals, and flexible pouches, where durability and protection are paramount. Additionally, the industry is witnessing a growing emphasis on sustainability, prompting manufacturers to develop recyclable and eco-friendly BOPET films that align with environmental standards. The food and beverages sector also benefits from technological advancements in printing and packaging, which enhance the visual appeal and functionality of BOPET films. As the global demand for packaged food continues to rise, the prominence of the food and beverages industry in the BOPET films market is expected to strengthen further, driven by innovation and evolving consumer trends.

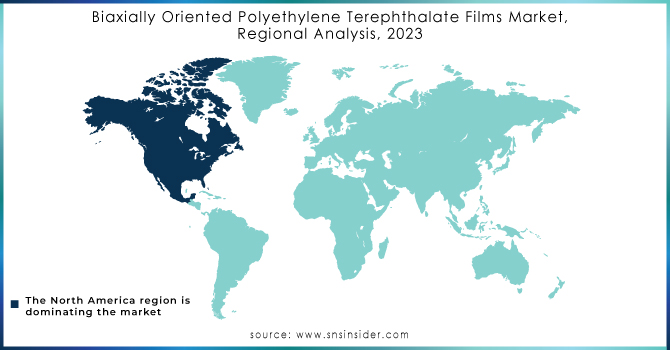

In 2023, the Asia-Pacific region dominated the Biaxially Oriented Polyethylene Terephthalate (BOPET) films market, accounting for approximately 38.3% of the market share. The region's growth can be attributed to the rapid expansion of the packaging industry, especially in countries like China, India, and Japan. China, as the largest producer and consumer of BOPET films, has seen a significant increase in demand for flexible packaging solutions driven by the booming e-commerce sector and consumer goods market. The country’s advancements in manufacturing technology and infrastructure have also bolstered its position as a leading exporter of BOPET films. India has emerged as a prominent player in the region, with a rising middle-class population and increasing urbanization contributing to greater demand for packaged food and beverages. The implementation of initiatives aimed at promoting sustainable packaging solutions further fuels market growth, as manufacturers are investing in BOPET films that offer excellent barrier properties while being recyclable. Japan, known for its high-quality packaging standards, continues to adopt BOPET films for various applications, including electronics and pharmaceuticals, thereby reinforcing the region's dominance in the global market. Additionally, increasing environmental regulations are prompting industries in these countries to shift towards sustainable packaging solutions, thus enhancing the adoption of BOPET films across various sectors.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

DuPont Teijin Films U.S. Limited (Mylar, Melinex, Kaladex)

Ester Industries Limited (BOPET Films, Specialty Polyester Films, Metalized Films)

Fatra A.S. (BOPET Packaging Films, Technical BOPET Films, Metallized Films)

Fuwei Films (Holdings) Co., Ltd. (High Gloss Films, Heat Sealable Films, Matte Films)

Garware Polyester Ltd (Garfilm, Suncontrol Films, Laminating Films)

Jiangsu Xingye Polytech Co., Ltd. (Packaging Films, Electrical Insulation Films, Optical Films)

Jindal Poly Films Ltd. (BOPET Films, Metallized Films, Coated Films)

Kolon Industries, Inc. (SHINYLITE, KOLON Films, Clear Films)

Mitsubishi Polyester Film, Inc. (Hostaphan, Diafoil, Lumirror)

POLİNAS Plastik Sanayi ve Ticaret A.S. (Polinas BOPET Films, Metallized Films, Barrier Films)

Polyplex Corporation Ltd. (Sarafil, Saracote, Saralam)

RETAL Industries Ltd. (RETAL BOPET Films, RETAL Metallized Films, RETAL Barrier Films)

SRF Limited (PET Films, Lumirror, Electrical Insulation Films)

Sumilon Industries Ltd. (Sumilon BOPET Films, Metallized Films, Coated Films)

Terphane LLC (Terphane Films, Sealphane, Barrier Films)

Toray Plastics (America), Inc. (Lumirror, Torayfan, Barrialox)

Uflex Ltd. (Flexpet, Flexmetpro, Flexfresh)

Futamura Chemical Co. Ltd. (OPET Films, Matte Films, Barrier Films)

TOYOBO CO. LTD. (Cosmolight, Toyobo BOPET Films, Clear Films)

Recent Developments

January 2025: Polyplex Corporation announced a ₹558 crore investment to build a new BOPET film manufacturing plant, aiming to meet the growing global demand for BOPET films.

February 2024: Uflex reported strong demand for its value-added BOPET films, highlighting the company's focus on innovation to maintain its market position amid a positive outlook for the packaging industry.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 16.7 Billion |

| Market Size by 2032 | US$ 28.4 Billion |

| CAGR | CAGR of 6.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Type (Thin Films, Thick Films) •By Thickness (Below 15 Micron, 15-30 Micron, 30-50 Micron, Above 50 Micron) •By Application (Labels, Tapes, Wraps, Bags & Pouches, Laminates, Others) •By End Use Industry (Food and Beverages, Cosmetics & Personal Care, Electrical & Electronics, Pharmaceuticals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Fuwei Films (Holdings) Co., Ltd., Polyplex, Mitsubishi Polyester Film, Inc., Terphane, POLİNAS, Fatra, A.S., Sumilon Industries Ltd., Jiangsu Xingye Polytech Co., Ltd., Polyplex, Jindal Poly Films Ltd., Garware Polyester Ltd., SRF Limited, DuPont Teijin Films U.S. and other key players |

| Key Drivers | •Increasing Demand for Sustainable and Recyclable Packaging Solutions Drives the Growth of BOPET Films •Expansion of End-User Industries, Particularly in Emerging Economies, Drives the BOPET Films Market's Growth |

| Restraints | •High Production Costs and Technological Barriers Limit the Widespread Adoption of BOPET Films in Cost-Sensitive Industries |

Ans: The Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market is expected to grow at a CAGR of 6.1%

Ans: The Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market size was valued at USD 16.7 billion in 2023 and is expected to reach USD 28.4 billion by 2032.

Ans: The rising demand for customizable BOPET films in packaging, along with growth in electronic, industrial applications, and recycling advancements, offers significant expansion potential for manufacturers.

Ans: The environmental impact of BOPET films' production, including energy consumption and reliance on petrochemicals, presents a significant challenge amid the growing demand for sustainability and greener alternatives.

Ans: Asia-Pacific (APAC) dominated the BOPET films market with 48% market share, driven by strong demand in packaging, electronics, and food and beverage industries, with key contributions from China, India, and Japan.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, 2023

5.2 Supply Chain Analysis, 2023

5.3 Regulatory Impact, by Country, by Region, 2023

5.4 Sustainability Initiatives and Environmental Impact, 2023

5.5 Innovation and R&D, by Region, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Segmentation, by Product Type

7.1 Chapter Overview

7.2 Thin Films

7.2.1 Thin Films Market Trends Analysis (2020-2032)

7.2.2 Thin Films Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Thick Films

7.3.1 Thick Films Market Trends Analysis (2020-2032)

7.3.2 Thick Films Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Segmentation, by Thickness

8.1 Chapter Overview

8.2 Below 15 Micron

8.2.1 Below 15 Micron Market Trends Analysis (2020-2032)

8.2.2 Below 15 Micron Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 15-30 Micron

8.3.1 15-30 Micron Market Trends Analysis (2020-2032)

8.3.2 15-30 Micron Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 30-50 Micron

8.4.1 30-50 Micron Market Trends Analysis (2020-2032)

8.4.2 30-50 Micron Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Above 50 Micron

8.5.1 Above 50 Micron Market Trends Analysis (2020-2032)

8.5.2 Above 50 Micron Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Segmentation, by Application

9.1 Chapter Overview

9.2 Labels

9.2.1 Labels Market Trends Analysis (2020-2032)

9.2.2 Labels Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Tapes

9.3.1 Tapes Market Trends Analysis (2020-2032)

9.3.2 Tapes Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Wraps

9.4.1 Wraps Market Trends Analysis (2020-2032)

9.4.2 Wraps Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Bags & Pouches

9.5.1 Bags & Pouches Market Trends Analysis (2020-2032)

9.5.2 Bags & Pouches Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Laminates

9.6.1 Laminates Market Trends Analysis (2020-2032)

9.6.2 Laminates Market Size Estimates and Forecasts to 2032 (USD Billion)

9.7 Others

9.7.1 Others Market Trends Analysis (2020-2032)

9.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Segmentation, by End Use Industry

10.1 Chapter Overview

10.2 Food and Beverages

10.2.1 Food and Beverages Market Trends Analysis (2020-2032)

10.2.2 Food and Beverages Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Cosmetics & Personal Care

10.3.1 Cosmetics & Personal Care Market Trends Analysis (2020-2032)

10.3.2 Cosmetics & Personal Care Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Electrical & Electronics

10.4.1 Electrical & Electronics Market Trends Analysis (2020-2032)

10.4.2 Electrical & Electronics Market Size Estimates and Forecasts to 2032 (USD Billion)

10.5 Pharmaceuticals

10.5.1 Pharmaceuticals Market Trends Analysis (2020-2032)

10.5.2 Pharmaceuticals Market Size Estimates and Forecasts to 2032 (USD Billion)

10.6 Others

10.6.1 Others Market Trends Analysis (2020-2032)

10.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.2.4 North America Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.2.5 North America Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.6 North America Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.2.7.2 USA Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.2.7.3 USA Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.7.4 USA Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.2.8.2 Canada Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.2.8.3 Canada Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.8.4 Canada Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.2.9.2 Mexico Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.2.9.3 Mexico Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.9.4 Mexico Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.1.7.2 Poland Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.3.1.7.3 Poland Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.7.4 Poland Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.1.8.2 Romania Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.3.1.8.3 Romania Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.8.4 Romania Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.2.4 Western Europe Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.3.2.5 Western Europe Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.6 Western Europe Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.2.7.2 Germany Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.3.2.7.3 Germany Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.7.4 Germany Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.2.8.2 France Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.3.2.8.3 France Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.8.4 France Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.2.9.2 UK Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.3.2.9.3 UK Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.9.4 UK Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.2.10.2 Italy Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.3.2.10.3 Italy Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.10.4 Italy Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.2.11.2 Spain Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.3.2.11.3 Spain Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.11.4 Spain Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.2.14.2 Austria Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.3.2.14.3 Austria Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.14.4 Austria Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.4.4 Asia Pacific Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.4.5 Asia Pacific Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.6 Asia Pacific Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.4.7.2 China Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.4.7.3 China Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.7.4 China Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.4.8.2 India Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.4.8.3 India Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.8.4 India Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.4.9.2 Japan Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.4.9.3 Japan Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.9.4 Japan Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.4.10.2 South Korea Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.4.10.3 South Korea Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.10.4 South Korea Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.4.11.2 Vietnam Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.4.11.3 Vietnam Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.11.4 Vietnam Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.4.12.2 Singapore Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.4.12.3 Singapore Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.12.4 Singapore Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.4.13.2 Australia Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.4.13.3 Australia Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.13.4 Australia Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.5.1.4 Middle East Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.5.1.5 Middle East Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.6 Middle East Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.5.1.7.2 UAE Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.5.1.7.3 UAE Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.7.4 UAE Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.5.2.4 Africa Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.5.2.5 Africa Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.6 Africa Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.6.4 Latin America Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.6.5 Latin America Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.6 Latin America Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.6.7.2 Brazil Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.6.7.3 Brazil Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.7.4 Brazil Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.6.8.2 Argentina Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.6.8.3 Argentina Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.8.4 Argentina Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.6.9.2 Colombia Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.6.9.3 Colombia Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.9.4 Colombia Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Thickness (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Estimates and Forecasts, by End Use Industry (2020-2032) (USD Billion)

12. Company Profiles

12.1 Fuwei Films (Holdings) Co., Ltd.

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Polyplex

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Mitsubishi Polyester Film, Inc.

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Terphane

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 POLİNAS

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Sumilon Industries Ltd.

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Jiangsu Xingye Polytech Co., Ltd.

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 Jindal Poly Films Ltd.

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Garware Polyester Ltd

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 SRF Limited

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Product Type

Thin Films

Thick Films

By Thickness

Below 15 Micron

15-30 Micron

30-50 Micron

Above 50 Micron

By Application

Labels

Tapes

Wraps

Bags & Pouches

Laminates

Others

By End Use Industry

Food and Beverages

Cosmetics & Personal Care

Electrical & Electronics

Pharmaceuticals

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Discover trends, growth drivers, and challenges in the global Medium Chain Triglycerides (MCT) market, including applications, key players, and forecast insights.

Green Building Materials Market was USD 371.25 billion in 2023 and is expected to Reach USD 1020.53 billion by 2032, growing at a CAGR of 11.89% by 2024-2032.

The Antimicrobial Textile Market size was USD 12.28 billion in 2023. It is expected to reach USD 21.27 Bn by 2032 and grow at a CAGR of 6.3% by 2024-2032.

The Biorationals Market size was USD 1.24 Billion in 2023 and is expected to reach USD 2.67 Billion by 2032, growing at a CAGR of 8.90 % from 2024 to 2032.

The Thermoplastic Polyolefin (TPO) Market Size was valued at USD 6.7 billion in 2023 and is expected to reach USD 12.4 billion by 2032 and grow at a CAGR of 7.4% over the forecast period 2024-2032

The Nanochemicals Market was worth USD 6.26 billion in 2023 and is expected to grow to USD 10.99 billion by 2032, with a CAGR of 6.45% % in the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone