BFSI Security Market Report Scope & Overview:

Get more information on BFSI Security Market - Request Free Sample Report

The BFSI Security Market size was valued at USD 59.71 billion in 2023 and is expected to reach USD 180.79 billion by 2032, growing at a CAGR of 13.13% Over the forecast period of 2024-2032.

The BFSI Security Market, which covers security solutions for the banking, financial services, and insurance sectors, is growing due to the rising frequency of cyber-attacks, increasing data breaches, and stricter government data protection regulations. The growing popularity of digital banking, combined with cloud computing and mobile technologies, has intensified the need for robust security to safeguard sensitive financial data. The BFSI sector is particularly vulnerable because of its high data value, pushing institutions to strengthen their cybersecurity infrastructure.

Increased spending on advanced security technologies like Artificial Intelligence (AI), machine learning (ML), and blockchain, along with a strong focus on compliance further drives the market growth. By 2025, AI-driven cybersecurity spending in the BFSI sector is expected to exceed $20 billion, reflecting the growing need for adaptive, intelligent security systems. Blockchain in financial services is projected to reach $17.5 billion by 2026, with a rising number of institutions relying on it for transaction security, fraud prevention, and greater transparency. Additionally, compliance-related costs in the financial sector globally are expected to exceed $270 billion annually by 2025, underscoring the impact of regulatory standards on security investments. AI-powered threat detection systems are increasingly used in banking for real-time monitoring of suspicious activities, while blockchain enhances transaction security.

The rising use of digital wallets, contactless payments, and Internet banking has driven demand for security solutions to address new vulnerabilities. The adoption of managed security services (MSS) is also increasing as financial institutions seek specialized skills to boost security without adding to in-house expenses. Leading companies like IBM, Cisco Systems, Inc., and Trend Micro Inc. offer customized cybersecurity solutions tailored to the financial industry. Compliance requirements, such as GDPR in Europe and CCPA in California, further prompt financial institutions to implement advanced security measures for data privacy and protection, enhancing market growth. The demand for both physical and digital security, particularly in North America and Europe with highly digitized financial ecosystems, continues to drive the expansion of the BFSI Security Market.

Market Dynamics

Drivers

- An increase in incidents of cyber-attacks targeting financial institutions pushes demand for robust security solutions.

- Growth in digital banking, cloud computing, and mobile services requires enhanced cybersecurity.

- Growing use of AI, ML, and blockchain to improve threat detection, fraud prevention, and transaction security.

Financial institutions use AI and ML to better detect and respond to threats. Specifically, AI is employed to a large volume of data. Therefore, it is capable of warning about the suspicious activity before it turns into a threat. At the same time, ML is continuously learning, which allows the systems to keep up with the changes and be able to identify more sophisticated threats. In addition, BFSI evaluates transaction safety controls to ensure the security of transactions. The organizations use blockchain to prevent unauthorized access to the information and fraudulent manipulation of the data. Therefore, by implementing blockchain, financial institutions create immutable records of transactions, which results in higher levels of trust and transparency in combination with the reduced risk of fraud. Thus, AI, ML, and blockchain are essential for the BFSI as they help to address various security challenges and facilitate a safer digital environment for both banking service providers and customers.

The BFSI Security Market is witnessing an increase in demand due to the rapid expansion of digital banking, cloud computing services, and mobile services. As customers choose to do online banking or through mobile applications, various types of data are transacted and stored. But on the other hand, it opens the way for different types of cyber threats. Phishing, malware, and account takeovers, among other cyberattacks, are prevalent in digital banking. For instance, many clients use cloud computing because it provides high scalability in storing or accessing information. BFSI organizations store this information off-site. therefore, organizations are forced to implement strong security structures to protect the integrity and confidentiality of their data. Cloud computing offers a scalable solution for BFSIs to store data and acquire services without necessarily making internal investments in infrastructure.

Restraints

- Integrating new security systems with existing infrastructure can be challenging and time-consuming, leading to potential operational disruptions.

- Rapidly changing cyber threats and tactics can outpace existing security measures, necessitating continuous updates and adaptations.

- The lack of cybersecurity professionals with the necessary expertise can hinder the effective implementation and management of security solutions.

The most substantial problem in the BFSI Security Market is the lack of skilled cybersecurity professionals. Financial institutions employ cutting-edge technologies to address the growing number of cyber threats, creating a need for qualified personnel in the cybersecurity domain. However, the available talent is not always proficient in the required competencies, resulting in the risk for the banking sector as the security processes can be incorrectly implemented.

In addition, the distinct competencies needed for working in the sector make it hard for security officers to be recruited. Moreover, the process is relatively costly due to existing competition. As a result, financial institutions tend to manage with a limited amount of security professionals, which cannot always ensure cutting-edge security technology implementation. Overall, issues created by the cybersecurity talent shortage undermine the BFSI Security Market. It reduces the sector’s capability to use advanced technologies and compromises valuable data protection. In such conditions, stable bank-customer relationships are at risk as well. It is essential to equip the sector with talented individuals by utilizing training and development and cooperating with educational institutions in this respect.

Segment Analysis

By Type

The information security segment dominated the market and represented over 71.2% in 2023. The frequent use of cloud storage, digital banking, online transactions, and a growing reliance on data-driven decision-making has made the BFSI sector vulnerable to cyber-attacks. The major financial implications of data breaches, which include reputation damage, legal fees, and operational disruptions, have made BFSI organizations invest in advanced information security technologies and solutions. This vulnerability drives demand for the services on the market.

The physical security segment is projected to experience the highest CAGR during the forecast period. The increasing complexity of financial operations and the expansion of bank branch networks into rural areas have been supporting the need for comprehensive physical security. These trends, when combined with the rising numbers of physical security breaches and unauthorized access to bank facilities, will account for a noticeable share of the given segment in the global BFSI security market.

By Enterprise Size

The large enterprise segment dominated the market and represented over 61.2% in 2023. These organizations manage considerably larger volumes of sensitive financial data, customer information, and intellectual property than smaller financial institutions. Consequently, protecting these vital assets necessitates a robust security infrastructure and advanced solutions, resulting in heightened security expenditures. Moreover, stringent regulatory frameworks set by central banks across various countries regarding data privacy, security, and fraud prevention impose considerable compliance obligations on larger BFSI institutions, which further boosts their market share.

Small and medium-sized enterprises (SMEs) are projected to achieve the fastest CAGR of 14.6% during the forecast period. Small businesses are increasingly becoming targets for cybercriminals due to their perceived inadequate security measures. As a result, the growing awareness of the financial and reputational risks linked to cyberattacks has driven these smaller enterprises to prioritize investments in cybersecurity and risk mitigation strategies. These factors are expected to significantly contribute to the expansion of the BFSI security market.

By End-Use

The banking sector held the highest revenue share of 41.3% in 2023. This sector deals with significant financial resources and sensitive customer data, making it an attractive target for cybercriminals and fraudsters. For example, according to IBM’s 2023 Cost of a Data Breach Report, organizations across the globe are bound to face the cost of USD 4.45 million as an average for a data breach. Moreover, the banking sector, in particular, is becoming more vulnerable to both IT attacks on services and security breaches of facilities. Furthermore, organizations also invest in surveillance systems, development and analysis of incident response plans, enhancement of threat detection and response mechanisms, and employee training. Cumulatively, these measures result in enormous costs contributing to the expansion of the respective market’s share.

The financial services sector is anticipated to grow at the highest CAGR of 14.6% during the forecast period. The adoption of digital and IT-based services has provided a significant number of opportunities for cyber attackers to breach the systems. Cybercriminals continue to target customers in the industry through phishing schemes, fraudulent emails, and deceptive phone calls to steal money from their accounts. For example, Truecaller reported that around 70 million U.S. citizens lost nearly USD 40 billion due to fraudulent phone calls in 2022. The investment in the market to make the customer’s data is increasing the operation resilience of the financial institutions.

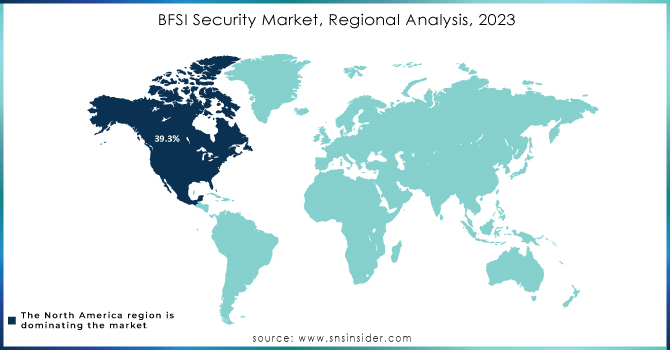

Regional Analysis

North America led the BFSI security market and accounted for more than 39.3% of the total revenue share. Strong demand for advanced security solutions exists in the analyzed location due to the presence of major global financial institutions. These entities operate massive amounts of financial data and require a sophisticated security system to protect their critical assets and customer information. Moreover, due to the high concentration of wealth and financial resources, North American BFSI institutions are among the most targeted by cybercriminals, which explains their rapid pace of security enhancement adoption.

Asia Pacific is expected to register the highest compound annual growth rate of 14.7% during the forecast period. The rapidly changing economic landscape of the region and increasing adoption of IT-based solutions to facilitate quick and efficient transactions have made the region more prone to cyber-attacks. A cyber risk report by Check Point Software Technologies Ltd. revealed that there was a significant increase in global cyber-attack cases during the second quarter of 2024, accounting for 16% of cyber-attacks in the Asia Pacific, particularly in the financial services sector. This is expected to drive the market of the region from 2024 to 2030, as economic activities continue to thrive the need for a robust security infrastructure to support the functions is enhanced.

Need any customization research on BFSI Security Market - Enquiry Now

Key Players

The major key players are

- IBM -(IBM QRadar, IBM Security Guardium)

- Cisco Systems, Inc. - (Cisco Umbrella, Cisco SecureX)

- Palo Alto Networks - (Cortex XDR, Prisma Cloud)

- McAfee - (McAfee Total Protection, McAfee MVISION Cloud)

- Symantec (Broadcom) - (Symantec Endpoint Protection, Symantec Web Security Service)

- Check Point Software Technologies - (Check Point Infinity Architecture, Check Point CloudGuard)

- Trend Micro - (Trend Micro Deep Security, Trend Micro Cloud One)

- Fortinet - (FortiGate Firewall, FortiAnalyzer)

- RSA Security - (RSA SecurID, RSA Archer)

- FireEye (Trellix) - (FireEye Helix, FireEye Threat Intelligence)

- CrowdStrike - (CrowdStrike Falcon, CrowdStrike OverWatch)

- NortonLifeLock - (Norton 360, LifeLock Identity Theft Protection)

- Splunk - (Splunk Enterprise Security, Splunk Cloud)

- Gemalto (Thales) - (Thales CipherTrust Data Security Platform, Thales SafeNet Trusted Access)

- Zscaler - (Zscaler Internet Access, Zscaler Private Access)

- Akamai Technologies - (Akamai Kona Site Defender, Akamai Bot Manager)

- F5 Networks -(F5 Advanced WAF, F5 Distributed Cloud)

- Forcepoint - (Forcepoint Web Security, Forcepoint Data Loss Prevention)

- Bitdefender - (Bitdefender GravityZone, Bitdefender Box)

- CyberArk - (CyberArk Privileged Access Security, CyberArk Endpoint Privilege Manager)

Recent Developments

In July 2024, Check Point Software Technologies Ltd. and Logix InfoSecurity Pvt Ltd announced a Managed Security Service Provider agreement aimed at enhancing email security technology solutions. This partnership is anticipated to combat advanced threats such as email phishing, account hacking, and malware scams across critical sectors, including BFSI.

In May 2024, IBM Corporation and Palo Alto Networks revealed their collaboration to deliver AI-powered cybersecurity solutions to their clients. This strategic alliance is expected to address the rising instances of cyber threats affecting various industries, particularly the BFSI sector.

| Report Attributes | Details |

| Market Size in 2023 | US$ 59.71 Bn |

| Market Size by 2032 | US$ 180.79 Bn |

| CAGR | CAGR of 13.13% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Physical Security and Information Security) • By Enterprise Size (Large Enterprises and Small and Medium Enterprises (SMEs)) • By End-use (Banking, Insurance, and Financial Services) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | IBM, Cisco Systems, Inc., Palo Alto Networks, McAfee, Symantec (Broadcom), Check Point Software Technologies, Trend Micro, Fortinet, RSA Security, FireEye (Trellix), CrowdStrike, NortonLifeLock, Splunk, Gemalto (Thales), Zscaler, Akamai Technologies, F5 Networks, Forcepoint, Bitdefender, CyberArk & Other Players |

| Key Drivers | • An increase in incidents of cyber-attacks targeting financial institutions pushes demand for robust security solutions. • Growth in digital banking, cloud computing, and mobile services requires enhanced cybersecurity. |

| Market Restraints | • Integrating new security systems with existing infrastructure can be challenging and time-consuming, leading to potential operational disruptions. • Rapidly changing cyber threats and tactics can outpace existing security measures, necessitating continuous updates and adaptations. |