Beverage Packaging Market Report Scope & Overview:

Get More Information on Beverage Packaging Market - Request Sample Report

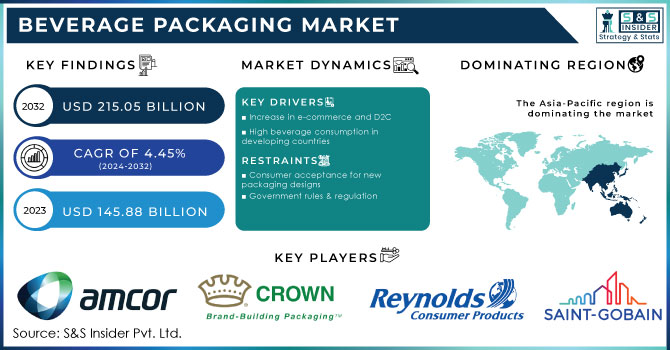

The Beverage Packaging Market Size was valued USD 144.23 billion in 2023, is anticipated to reach USD 226.64 billion by 2032, growing at a CAGR of 5.16% during the forecast period.

The demand for various types of beverages, including carbonated drinks, sports drinks, and fruit juices, has fueled the beverage packaging market. The higher demand for these beverages boosts the need for packaging materials in various sizes and types. Packaging is not just essential to protect the product but also influences consumer choices. Innovative packaging solutions are being used more and more to attract customers, which impacts sales and market growth directly.

Increasing demand for functional and healthy beverages is a major driver in the beverage packaging market. The trend of low-calorie, low-sugar, and fortified beverages demands that the packaging preserve the nutritional integrity of the product. For instance, Energy drinks are at the top with 32% of total sales, accounting for 16 billion dollars, Sports drinks earn 12.2 billion dollars, Sports protein RTDs and meal replacements have 12.8% of sales worth 6.4 billion dollars. Functional RTD coffees and teas (1.8 billion dollars), carbonates (1.7 billion), and yogurt beverages earn 1.2 billion dollars indicating the trend toward healthier choice beverages. Beverages enriched with vitamins, minerals, and probiotics require packaging that can provide superior barrier properties against oxidation, moisture absorption, and light exposure, which degrade the product. This demand has generated the development of packaging technologies that guarantee freshness and extend shelf life.

Another factor that comes into play is the ease of use. Consumers are finding their lives busier; thus, the demand for single-serve, ready-to-go packaging has also increased. Cans, pouches, and bottles that are smaller, portable, and easy to dispose of become more popular. This trend continues to drive innovation in beverage packaging to be lightweight yet sustainable, such as with recyclable PET, paper-based cartons, and aluminum. Apart from this, the emerging requirement of eco-friendly and earth-sensitive consumers is pushing back manufacturers to opt for alternatives like sustainable packaging solutions in materials that reduce environmental effects.

Beverage Packaging Market Dynamics

Drivers:

-

Technological Innovations Driving Sustainability in Beverage Packaging Market

Technological advances, such as smart packaging and the use of lightweight materials, have become major drivers for growth in the beverage packaging market. These technologies improve the functionality of packaging by enabling freshness monitoring, better consumer interaction, and optimization of supply chains. Integrating features related to smart packaging such as sensors or QR codes gives better rapport with consumers.

Building on top of these technological advancements, sustainability-focused innovations are increasingly forming the beverage packaging market. For example, brands like Wise Wolf by Banrock Station used advanced material science to inject sustainability into the design. Their use of 91% recycled glass bottles, use of sugarcane-based labels, and lightweight, recycled aluminum caps showcase how technology may drive eco-friendly solutions but not at the cost of quality or functionality. For example, features such as QR codes on packaging provide a clearer view of the environmental characteristics of the product. The innovation reduces cost and negative impact on the environment; however, it further fortifies consumer trust and unlocks other avenues for expansion.

-

Increased Demand for Single-Serve and Convenience Packaging driving the Beverage Packaging Market

Restrains:

-

Fluctuations in Raw Material Prices Impacting the Beverage Packaging Market

Fluctuations in raw material prices are impacting the beverage packaging market. The prices of key materials like plastic, aluminum, and paperboard are highly volatile and influenced by factors such as raw material availability, production costs, and global supply chain challenges. For example, the price of plastic is highly influenced by the fluctuation in oil prices since plastic is a petroleum-based product. The U.S. Producer Price Index (PPI) graph for plastic material and resin manufacturing shows a high level of increase. In September 2024, the PPI increased by 4.21% from the previous month and 2.25% over the year, which is indicative of the rising production cost of the plastics industry due to causes such as disruptions in the supply chain, higher energy prices, and greater demand for plastic materials. Such cost increase in production is going to shift packaging costs upwards, mainly within those industries reliant on plastic materials.

Similarly, an increase in the energy or mining cost raises aluminum prices whereas paperboard prices are quite sensitive to wood pulp increase and demand for recycled materials; these price changes can have a piling effect on beverage packaging prices. When these material prices tend to rise, the production cost that packaging manufacturers have to endure may lead to a price increase imposed on the end consumer. For instance, when energy prices increase, aluminum demand tends to be higher; therefore, the cost of aluminum packaging goes up significantly, impacting manufacturing processes in beverage and canned food production. This is an essential factor in the beverage packaging market, where cost fluctuations tend to impact manufacturers' bottom lines and consumer prices alike.

-

Supply Chain Disruptions Impacting the Beverage Packaging Market

Beverage Packaging Market Segment Analysis

By Material:

In 2023, the Glass segment dominated the market and accounted for more than 40% of the total market share because of its premium appeal, preservation qualities, and recyclability. It is preferred enormously in the alcoholic beverage, soft drink, and premium juice markets due to its non-reactive nature, which helps preserve the flavor, taste, and integrity of the beverages. It is also entirely recyclable, making it environmentally friendly in light of the ever-increasing consumer and regulatory focus on sustainability. This has ensured glass remains the material of choice for premium products and eco-conscious brands. Further, the governments of the world are now encouraging the use of sustainable materials such as glass, which helps this material continue to maintain a leading position in beverage packaging.

In contrast, plastic packaging appears to exhibit a higher rate of growth (CAGR) due to its lightweight, easy-to-mass-manufactured, and cost-effective nature. Plastic bottles are mostly used for soft drinks and juices or bottled water, as demand for "on the go" beverage use increases. Its increasing adoption is supported further by innovative recyclable material in plastic and efforts focused on lowering the environmental degradation of plastics.

By Product Type:

In 2023, the Bottles segment dominated the market and accounted for 57% of the total market share due to its multifunctionality, robustness, and suitability for different types of drinks, such as water, soft drinks, alcoholic beverages, and dairy products. The bottles offer a greater advantage in terms of mobility, recyclability, and re-closure, while they provide an excellent ground for designing and branding to maximize appeal for consumer convenience and marketing campaigns. In addition, regulations related to recyclable and reusable bottles in several countries have increased demand. For example, glass bottles are widely accepted for their premium appeal and recyclability, but plastic bottles meet the demand for lightweight, on-the-go packaging.

Cartons are growing more rapidly in terms of CAGR as it has an environmentally friendly appeal. Cartons, which essentially consist of renewable materials like paperboard, cater to these eco-conscious consumers and increasingly gain ground in markets driven by sustainability.

By Application:

In 2023, the Alcoholic beverages segment dominated the market and accounted for 47% of the total market share. The alcoholic beverages segment has led the beverage packaging market through several factors, including increased demand for premium alcoholic products, and increased consumption in emerging markets such as China and India. Moreover, the demand for sophisticated solutions such as glass for wine and beer has increased, but sustainability trends are pushing consumers toward more eco-friendly options. Innovations in this category include customized packaging, tailored to consumers' preferences for craft beers and premium liquors.

On the other hand, the non-alcoholic beverages segment is growing with a higher CAGR. The factors driving growth in this area include a shift by consumers toward healthier, low-calorie options, as well as ready-to-drink product growth. In non-alcoholic beverages, demand for sustainable and functional packaging is also on the rise.

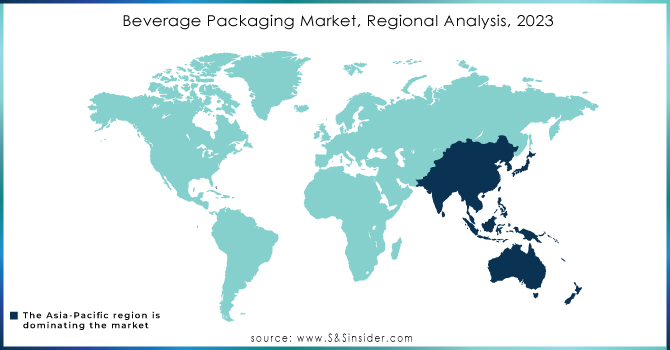

Beverage Packaging Market Regional Overview

In 2023, the Asia Pacific region dominated the market and accounted for 40% of the total market share. The region is rapidly industrializing, and urbanization is on the rise along with a growing middle class that has higher disposable incomes. These factors drive the demand for alcoholic and non-alcoholic beverages, further increasing the demand for beverage packaging solutions. Asia Pacific is another large market for packaging manufacturers since its production is cost-effective, and innovation is very impressive, hence the region remains dominant in the beverage packaging market.

North America is the fastest-growing region for the beverage packaging market, where growth is high due to an increasing focus on sustainable packaging solutions with more investments in technological enhancement. Strong growth has also been experienced in the US and Canada regarding the consumption of non-alcoholic beverages- carbonated beverages and more health-conscious beverages that need packaging innovation. More and more people switching to sustainable as well as environment-friendly type of packaging material also facilitates the market's beverage packaging market growth.

Get Customised Report as per Your Business Requirement - Enquiry Now

Key Players in Beverage Packaging Market

-

Bemis Company, Inc.

-

Sonoco Products Company

-

Scholle IPN

-

Mondi

-

Amcor plc

-

Reynolds Group Ltd.

-

Crown

-

Stora Enso

-

Tetra Laval International S.A.

-

Ball Corporation

-

WestRock Company

-

Graham Packaging

-

Pulpoloco Sangrias

-

Berry Global Inc.

-

Amber Packaging

-

RPC Group

-

Saint-Gobain S.A.

-

Ardagh Group S.A.

-

Gunna Drinks

-

Tetra Laval International

Recent Development

Gunna Drinks: In July 2023, Gunna Drinks unveiled aluminum soda bottles as part of its initiative to reduce plastic usage. The step is expected to eliminate over 1.2 million plastic bottles annually, as part of the company's efforts to go green. The new aluminum bottles are fully recyclable and provide a more environmentally friendly alternative to traditional plastic packaging, as consumers increasingly demand greener packaging solutions.

Pulpoloco Sangrias: In April 2024, Pulpoloco Sangrias introduced the new CartoCan packaging. CartoCan package is an innovative 250-mL aseptic paper can, cutting material usage by 30% compared to traditional cans in aluminum or PET. It is composed of 60% Forest Stewardship Council-certified paper, and it is intended to reduce CO2 emissions by 20-60% compared to alternative packaging. It has a preservative-free 12-month shelf life and is a fully recyclable product for consumers who care much about going green. To date, this type of eco-friendly packaging will give in to the growing demand by consumers regarding sustainable products available in the beverage industry.

|

Report Attributes |

Details |

|

Market Size in 2023 |

US$ 144.23 Billion |

|

Market Size by 2032 |

US$ 226.64 Billion |

|

CAGR |

CAGR of 5.16% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Raw Material (Plastic, Metal, Glass, Paper & Paperboard) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Saint-Gobain S.A, Reynolds Group Holdings Limited, Crown Holdings Inc, Ball Corporation, Orora Packaging Australia Pty Ltd, Berry Global Inc, Intrapac International Corporation, Amcor Limited, Owens-Illinois Inc, BA Glass Germany GmbH, and other players |

|

Key Drivers |

• Increase in e-commerce and D2C |

|

Market Opportunities |

• Market Expansion in emerging economies. |