Behavioral Biometrics Market Size & Trends

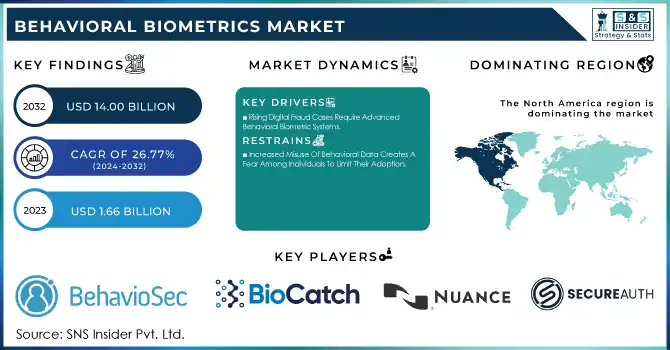

The Behavioral Biometrics Market Size was valued at USD 1.66 Billion in 2023 and is expected to reach USD 14.00 Billion by 2032 and grow at a CAGR of 26.77% over the forecast period 2024-2032. The Behavioral Biometrics Market has recently experienced rapid growth due to the increasing demands from diverse industries. It analyzes behavioral patterns, which include keystroke dynamics, gait analysis, signature analysis, and voice recognition, to verify identities and thwart cyber-attacks and fraud attempts.

Get more information on Behavioral Biometrics Market - Request Sample Report

In the year 2023-2024, leaders in behavioral biometrics are Japan, China, USA, France, Germany, and India. In European countries like France and Germany, they are now integrating behavioral biometrics for reinforcement of strict data regulation and security in online transactions. In the USA, data breaches are increased and will implement such technologies into cybersecurity solutions. China and Japan are leveraging these technologies to safeguard their rapidly growing e-commerce platforms and digital payment systems across Asia. In India, where the digital economy is rapidly expanding, there is a notable rise in adoption within the banking and financial industries.

Government policies across the globe are also acting as a growth stimulant for the Behavioral Biometrics Market. For example, the European Union's General Data Protection Regulation (GDPR) focuses on data protection and is forcing organizations to spend on advanced authentication techniques such as behavioral biometrics. Asian governments are also forming frameworks to better cybersecurity, which drives the growth of the Behavioral Biometrics Market in turn. In the United States, the California Consumer Privacy Act (CCPA) is also forcing companies to spend on security measures to protect consumer data.

Technological advancements have significantly improved the capabilities of behavioral biometrics. AI and ML support real-time evaluation and continuous authentication, which improves accuracy and user experience. Cloud-based solutions are scalable and cost-effective, making them accessible to a wide range of companies. Another trend is the integration of behavioral biometrics with IoT security to meet the need for secure connected devices.

The latest product releases in 2023 and 2024 have showcased innovation within the industry. Biometric firms are introducing products that integrate various biometric modalities, like facial recognition alongside behavioral analysis, offering enhanced security features. These advancements serve industries such as banking, healthcare, and e-commerce where secure and smooth user authentication is essential.

Behavioral Biometrics Market Dynamics

Key Drivers:

-

Rising Digital Fraud Cases Require Advanced Behavioral Biometric Systems.

Cybercrime incidents increase annually, prompting organizations to adopt behavioral biometrics to enhance digital security. Behavioral biometrics offer a non-invasive but highly efficient security layer by examining user interactions, such as typing habits, mouse activities, and device utilization. According to the FBI's Internet Crime Report 2023, the agency received 880,418 complaints concerning cyber-crimes from the public, indicating a 10 percent increase from 2022. The potential total loss increased to USD 12.5 billion in 2023, up from USD 10.3 billion in 2022, highlighting the necessity for strong solutions.

These systems consistently observe user actions, providing instantaneous fraud identification and reducing risks in areas like banking and e-commerce. Additionally, the smooth user experience offered by these solutions encourages widespread use, establishing them as a fundamental element of future cybersecurity plans.

-

Increased Online Services Require Secure And Seamless Authentication Solutions.

The World Economic Forum states that over 85% of organizations view increased adoption of new technologies and wider digital access as crucial elements for facilitating transformation. This has escalated the need for behavioral biometrics, providing safe, seamless authentication methods that are essential for upholding user confidence.

Sectors like healthcare and finance are adopting these solutions to safeguard sensitive information while maintaining adherence to regulations. Government programs in India, like AADHAAR-based biometric verification, are compelling both public and private sectors to adopt it. Behavioral biometrics can combine security with user convenience, making it an integral component of the digital economy.

Restrain:

-

Increased Misuse Of Behavioral Data Creates A Fear Among Individuals To Limit Their Adoption.

The improvement in security through behavioral biometrics has raised major concerns about privacy. The gathering and examination of individual behavior data may result in misuse or unauthorized entry, thereby eroding user confidence. According to reports from Germany's Federal Data Protection Authority, 48% of consumers in 2023 showed hesitation in using biometrics because of privacy issues. As stated in The Identity Theft Research Center (ITRC) Annual Data Breach Report, the year 2023 saw a record high of data breaches in the U.S. in just one year. This is 72 percentage points greater than the previous record number of compromises established in 2021. A minimum of 353 million people were impacted.

Moreover, adhering to data protection regulations such as GDPR in Europe and CCPA in the U.S. presents difficulties for market participants. These rules mandate stringent data storage and processing protocols, which elevate operational complexity. Despite technological progress, addressing data encryption and ethical concerns is essential for broad acceptance. Educating users about the safety protocols in place and promoting transparent data practices are crucial to overcoming this limitation.

Behavioral Biometrics Market Key Segments

by Deployment

In the On-Premise segment, firms captured a 64% market share in 2023. On-premise solutions are favored because they provide complete control over an organization's data, making them essential for sectors related to governance and defense. Another value that On-Premise solutions provide is customization. On-premises systems can be designed according to particular security issues pertinent to the business organization.

However, the Cloud-Based segment is projected to grow at the highest CAGR of 27.25% from 2024 to 2032. The expansion would be driven by the adoption of SaaS models and the scalability of cloud-based solutions that address the changing needs of organizations. Companies in developing markets such as India and China are rapidly transitioning to cloud solutions to reduce infrastructure expenses while benefiting from enhanced analytics features. The integration of AI with cloud solutions is increasing its attractiveness by offering real-time insights and improved fraud detection features.

by Organization Size

In 2023, the Large Enterprises segment dominated with 73% of the market share because of having sufficient budgets and a higher requirement for advanced cybersecurity solutions. Large enterprises, especially in finance and telecommunication, are using behavioral biometrics to protect their sensitive data and comply with strict regulatory requirements.

The SMEs segment is expected to grow with the highest CAGR of 27.56% from 2024 to 2032. This growth indicates the increased awareness and availability of low-cost, cloud-based behavioral biometrics solutions since SMEs are essential to the global economy, accounting for as much as 70% of employment and GDP. SMEs in countries like Japan and Germany are using these technologies to protect digital transactions and win the trust of customers. Government incentives such as subsidies and grants to upgrade cybersecurity are also driving adoption among SMEs.

by Type

Voice recognition segment accounted for 38% of the market share in 2023, driven by applications in call centers, banking, and virtual assistants. Its growth is driven by further innovation in natural language processing and AI, which provide the possibility of more accurate voice authentication.

Meanwhile, the Keystroke Dynamics segment is expected to grow with the fastest CAGR of 28.02% from 2024 to 2032. The rising adoption of keystroke dynamics in multi-factor authentication systems for enhanced security without compromising on user experience is a primary driver. Industries such as e-commerce and education are now increasingly using keystroke analysis for identity verification, especially in remote transactions. The flexibility and affordability of keystroke dynamics, along with their compatibility with existing security protocols, are significant growth contributors in this segment.

Behavioral Biometrics Market Regional Outlook

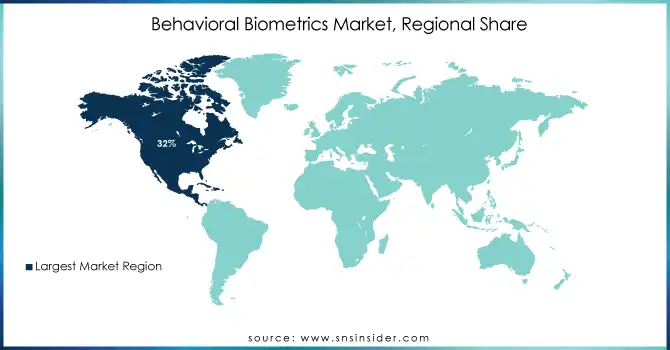

In 2023, the North America region led with a 32% market share, primarily because of the early embrace of advanced security technologies and strong infrastructure in the U.S. and Canada. Government programs, like those from the U.S. Cybersecurity and Infrastructure Security Agency, additionally strengthen regional development.

The Asia Pacific area is expected to expand rapidly, achieving a CAGR of 27.55% between 2024 and 2032. This swift expansion is fueled by growing digitalization, escalating cyber threats, and favorable government policies in countries such as China, Japan, and India. For example, China's cybersecurity legislation emphasizes sophisticated biometric technologies, while the rapidly growing e-commerce and fintech industries in the area present opportunities for market participants. Collaborations between local governments and tech firms in the Asia Pacific are speeding up innovation and adoption, making it a hub for behavioral biometrics development.

Need any customization research on Behavioral Biometrics Market - Enquiry Now

Key Players

Some of the major players in the Behavioral Biometrics Market are

-

BehavioSec (Behavioral Biometrics Platform, Continuous Authentication Solutions)

-

BioCatch (Behavioral Biometrics for Fraud Detection, Account Takeover Protection)

-

Nuance Communications (Voice Biometrics, Security Suite)

-

SecureAuth Corporation (Adaptive Authentication, Identity Security Solutions)

-

UnifyID (Implicit Authentication, Behavioral Biometric SDK)

-

Plurilock Security Solutions (DEFEND Continuous Authentication, ADAPT Multi-Factor Authentication)

-

Mastercard Incorporated (NuData Security Behavioral Analytics, Identity Check™)

-

Fair Isaac Corporation (FICO) (Falcon Fraud Manager, Behavioral Analytics)

-

NEC Corporation (Bio-IDiom, NeoFace Watch)

-

Samsung Electronics (Samsung Pass, Knox Security)

-

IBM Corporation (IBM Security Access Manager, Trusteer Pinpoint Detect)

-

Daon (IdentityX Platform, VeriFLY)

-

Affectiva (Emotion AI, Automotive AI)

-

iProov (Face Authentication, Palm Verifier)

-

TypingDNA (Typing Biometrics Authentication, TypingDNA Verify)

-

Veridas (Voice Biometrics, Face Biometrics)

-

AimBrain (AimBrain Authenticate, AimBrain Verify)

-

Acceptto (Continuous Behavioral Authentication, eGuardian®)

-

autonomous_ID (Bio_Sole™, Identity Management Solutions)

-

Alluxa, Inc (Optical Filters, Optical Coatings)

Major Suppliers (Components, Technologies)

-

Alluxa, Inc. (Optical Filters, Optical Coatings)

-

OmniVision Technologies (Image Sensors, Camera Modules)

-

Ambarella Inc. (Image Processing SoCs, AI Vision Processors)

-

Intel Corporation (Processors, AI Accelerators)

-

Qualcomm Technologies, Inc. (Snapdragon Processors, AI Solutions)

-

Sony Semiconductor Solutions (Image Sensors, Camera Modules)

-

STMicroelectronics (Microcontrollers, Sensors)

-

Texas Instruments (Processors, Analog Components)

-

LG Innotek (Camera Modules, Optical Components)

-

Himax Technologies (Display Drivers, Imaging Processing ICs)

Recent Trends

-

July 2024: The U.S. Department of Veterans Affairs announced plans to grant firm fixed-price contracts to Abridge AI and Nuance Communications for the purpose of testing and assessing commercial, cloud-based ambient scribe software in actual VA settings.

-

November 2024: Australia's major banks have joined forces with BioCatch to pilot launch an anti-scam initiative aimed at reducing fraud in banking payments. To further combat fraudulent activities across Australia's financial sector, major banks across the region opted for BioCatch, a digital fraud detection startup from Israel, to implement BioCatch Trust Australia-a pilot of an inter-bank, behavior and device-based fraud and scams intelligence-sharing network.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.66 Billion |

| Market Size by 2032 | USD 14.00 Billion |

| CAGR | CAGR of 26.77% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Service) • By Type (Voice Recognition, Keystroke Dynamics, Gait Analysis, Signature Analysis, Others) • By Deployment (On-Premise, Cloud-Based) • By Application (Risk & Compliance Management, Identity Proofing, Continuous Authentication, Fraud Detection & Prevention) • By Organization Size (Large Enterprises, SMEs) • By Industry (Retail & E-Commerce, Healthcare, BFSI, Government & Defense, IT & Telecom, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BehavioSec, BioCatch, Nuance Communications, SecureAuth Corporation, UnifyID, Plurilock Security Solutions, Mastercard Incorporated, Fair Isaac Corporation (FICO), NEC Corporation, Samsung Electronics, IBM Corporation, Daon, Affectiva, iProov, TypingDNA, Veridas, AimBrain, Acceptto, autonomous_ID, Alluxa, Inc. |

| Key Drivers | • Rising Digital Fraud Cases Require Advanced Behavioral Biometric Systems. • Increased Online Services Require Secure And Seamless Authentication Solutions. |

| Restraints | • Increased Misuse Of Behavioral Data Creates A Fear Among Individuals To Limit Their Adoption. |