Battery Sensor Market Size:

Get More Information on Battery Sensor Market - Request Sample Report

Battery Sensor Market Overview:

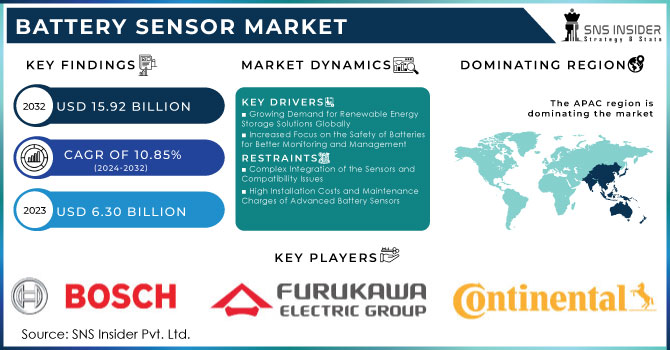

The Battery Sensor Market size was valued at USD 6.30 billion in 2023 and is expected to reach USD 15.92 billion by 2032 and grow at a CAGR of 10.85% over the forecast period 2024-2032.

The battery sensor market has a significant growth driven by the increase in demand for battery management systems (BMS) in electric vehicles, renewable energy storage, and portable electronic devices. Modern battery management systems are essential for the operation of current battery packs, ensuring their safety, efficiency, and long service life. Advanced BMS software can save automakers USD 18 billion in 2030, from USD 76 billion in 2024. For example, Tesla, a leader in the electric vehicle industry, utilizes advanced battery sensors to monitor and optimize the performance of its lithium-ion battery packs in the Battery Management System. Such sensors allow the manufacturers to ensure the safety, reliability, and efficiency of their EVs.

Electric vehicles have been increasingly adopted by governments and customers due to growing concerns about the environment and the prevention of CO2 emissions. For example, the European Union has a 2025 and 2030 mandatory CO2 emission targets which caused automotive producers to increase their electric car production plans. There were 3.5 million more electric cars sold in 2023 than in 2022, which indicates that the sales of electric cars increased by 35% in 2023. Battery sensors actively manage and facilitate the best use of the ecosystem in the electric vehicle, enhancing their efficiency, safety, and life duration. With the increasing lifespan of batteries and the expansion of the driving range of electric vehicle producers, the demand for these solutions has exponentially increased.

Market Dynamics

Drivers

-

Growing Demand for Renewable Energy Storage Solutions Globally

The renewable energy drive which has seen an increasing dependence on solar and wind-based power solutions, has a critical need for effective energy storage solutions. Battery storage systems have vital applications in managing the generation of power resources. At the core of these battery systems are battery sensors that feed real-time data on the battery’s health and performance, allowing for the effective implementation of optimal charge and discharge cycles which ensures the enhancement of the battery’s lifespan and the system’s operational reliability. Governments and organizations around the world have invested great financial capital in renewable energy. For Instance, the UAE-based International Renewable Energy Agency (IRENA) has recorded phenomenal investments in solar and wind-based energy infrastructure the world over. With the trend to continue, investments in humongous battery storage devices are expected to spike the resultant expansion in battery sensors for these large-scale battery storages.

-

Increased Focus on the Safety of Batteries for Better Monitoring and Management

Safety concerns about batteries, particularly the lithium-ion battery variant, have triggered increased attention to battery monitoring and management. Many high-profile battery fires and explosions in electric cars, consumer electronics, and energy storage devices have raised concerns and awareness of various battery safety issues. The regulatory bodies and industry standards have made many strict guidelines for battery storage systems which drives the need for advanced battery sensors. For example, in Switzerland, according to the International Electrotechnical Commission 61508 and the ISO 26262 mandate, battery system designers are instructed to use high-precision sensors to allow reliable battery monitoring and management systems in the overall design.

For increased cycle life and safety, energy storage technology is shifting its focus toward the all-solid-state battery. However, sensor monitors are not available, and therefore development operations are stuck in the pilot phase. The market has a growing potential for advanced battery sensors for use in monitoring and control operations for utilization in the anticipated increased demand for solid-state battery technologies for various applications.

Restraints

-

Complex Integration of the Sensors and Compatibility Issues

Integrating advanced battery sensors with existing systems is a complex and challenging task. This system may not be compatible with new technology, communication protocols may differ, and software interfaces may be proprietary. This is compounded by the need to integrate the devices over the lifecycle of a product designed to run this technology. Such complexity adds time and cost to development and execution while providing few benefits. The integration of new battery sensors into existing electric vehicle platforms is one example of its complexity. It may require substantial changes to the battery management systems, software updates, and removal throughout the entire system. Fixing them would involve RND expenses and may convince manufacturers of the expense of investigating the new battery sensors. There are also questions about how compatible such sensors would be with various battery systems. It is a fact that developing the battery sensor to work with other battery types would add extra development costs for discovered types, which is still a challenge, and integrating with various battery units would add another layer of complexity.

-

High Installation Costs and Maintenance Charges of Advanced Battery Sensors

While the battery sensor market is developing rapidly, one of the major challenges to bar such progress is the fact that the main costs of advanced battery sensors are currently high. Basic sensors monitoring voltage might cost as little as $20 (US) per unit, while Intelligent Battery Sensors (IBS) with advanced features like temperature and current monitoring can range from $50 to $100. Indeed, the more precise and advanced sensors are, the more they cost. For example, sensors that are capable of real-time monitoring of changes in battery condition, wireless connection with other components of the system, and even artificial intelligence approaches are more expensive than their simpler counterparts. Overall, the process of developing and manufacturing any sensor requires considerable financial investment in obtaining new data, manufacturing precise items from high-quality materials, obtaining the appropriate equipment, and so on. At the same time, they become affordable for other components and devices to use. Apart from that, the implementation of advanced sensors in existing systems can require substantial modifications in both the sensor and other components. For example, to introduce a novel sensor, a new battery management system will likely be needed. However, in some subsets of the market, the costs still present a significant obstacle to advancement.

Market Segmentation

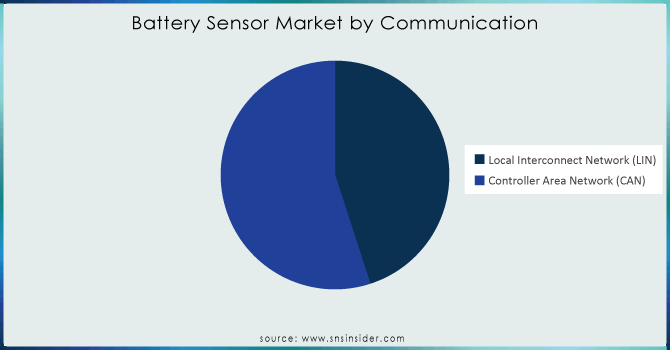

By Communication

The controller area network segment (CAN) is the dominating market and accounted for a market share of 55% in 2023. The sensor measures the voltage of the battery cells, current, temperature, remaining capacity, and other parameters necessary for optimal battery operation. In electric vehicles, the CAN battery sensor constantly monitors battery condition and sends data to the battery management system that regulates the battery charging/discharging in an optimal way, preventing it from overheating and depleting fully. As a result, the lifespan of the vehicle battery is extended and safety is ensured.

The local interconnect network segment is expected to have faster growth with a CAGR of 10.59% from 2024 and 2032. This technology is less expensive, and the growth can be attributed to the vehicle industry’s transition to manufacturing vehicles with a lower premium targeting the less fortunate. They generate low heat, which makes them appropriate for less demanding communication tasks. LIN-based batteries facilitate secondary battery monitoring of peripherals in EVs.

Need any customization research on Battery Sensor Market - Enquiry Now

By Voltage

The 12V segment led the market based on voltage and accounted for over 46.18% market share in 2023 and is expected to continue to dominate over the forecast period. The 12V battery sensors are low in cost and are also an essential part of the regenerative systems and start/stop systems. The 12 V car batteries have a capacity of 400-1000 amps which is constantly needed in vehicle production so that the vehicles can carry out advanced technologies.

The 24V segment is expected to see significant growth of more than 10.75% from 2024 to 2032. Electric commercial vehicles, buses, trucks, and even military trucks are equipped with a 24-volt power supply as they require more power to carry heavy equipment. For example, a 24V battery sensor in a UPS system ensures that the backup battery is healthy. If it senses the voltage is too low, it sends an alert to replace the battery long before a critical power outage, which can damage vital equipment and cause data loss.

By Category

The passenger car segment was the largest market with a share of 45.19% in 2023. Battery sensors are essential in driving passenger cars, maintaining efficient power output and appropriate battery performance levels. The passenger cars market is expected to reach USD 2,076.0 billion in 2024 and become USD 2,099.0 billion in 2028. The largest market within this area will be that of SUVs, with a projected market size of USD 867.9 billion in 2024. The start/stop system is one major application that the battery sensors do which automatically turns off the engine when in place instead of idle, and it restarts without any delay or sounds.

The light commercial vehicle segment is anticipated to witness the highest CAGR from 2024 to 2032. The use of light commercial vehicles extends to various applications in urban delivery fleets, small-scale logistics, school transport, and others. Battery sensors are used in light commercial vehicles to manage availability and optimize energy output for these vehicles. Market players are focusing on developing scalable sensor solutions that come with flexible integration support for light commercial vehicles.

By Type

The BEV held a market share of 53.17% in 2023, dominating the segment. Battery Electric Vehicles, also known as BEVs, use a system of sensors that monitor a car’s battery pack. Though they do not compare to infotainment and climate control displays, these sensors are necessary for tracking voltage, current, temperature, and other parameters to ensure battery performance and safety. BEV gauges send critical data to the battery management system, or BMS, to oversee the charge, prevent overheating, and extend battery life. For instance, while in fast charging, BEV sensors observe rising temperature that makes the BMS either lower the charge rate or begin cooling to avoid battery damage and ensure that the charge is efficient and safe.

The HEV segment is growing fast with a CAGR of 11.16% between 2024-2032. HEV vehicles require qualified battery sensors to help manage energy crops between the engine and the battery, as well as the electric machine. Vehicles employing both internal combustion engines and electric forces have more segments in the automotive industry market, which is why automotive makers need to make stronger and improved hybrid technology and cartridges to make increased use of advanced sensory capable of ensuring that hybrid systems work effectively and efficiently.

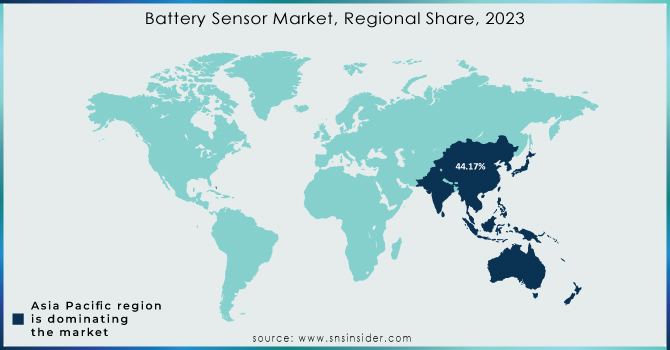

Regional Analysis

The APAC battery sensor market has been the leading in the global market, holding the highest share of 44.17% in 2023. The regional market growth is due to an increase in the production of electric vehicles and the supply of maintainable mobility solutions. In addition, an essential factor of market growth is the high number of electric vehicle manufacturers in the region. In China, the total number of electric cars registered was 8.1 million in 2023, constituting an increase of 35% as compared to 2022. Thus, electric car sales were consistently the foundation of the overall car market’s growth in China. The total car market contracted by an 8% negative change for conventional, or internal combustion engine cars in 2023, and it increased by 5% in totality. In both cases, electric car sales continued to perform as the market was maturing. They actively create new battery sensor technologies suitable for transportation, funding automotive companies, and partnerships with start-ups. At the same time, the governments of the Asia-Pacific countries are increasing pressure on manufacturers by introducing more strict rules for preventing CO2 release and air pollution.

North America's battery sensor market is poised for steady growth of 10.90% from 2024 to 2032. The North American battery sensor market is expanding due to increasing investments in electric vehicle (EV) charging infrastructure and stringent emission regulations. According to Kelly Blue Book numbers, the EV share of the total U.S. vehicle market was 7.6% in 2023. With the U.S. and Canada at the forefront, the region sees rising demand for advanced battery sensors to support EV adoption. The battery sensor market in Europe is also witnessing substantial growth propelled by ambitious CO2 reduction targets. Countries such as Germany, France, and Norway lead in EV adoption, creating a strong demand for high-performance battery sensors in the region.

Key Players

The major market players are Continental AG, Furukawa Electric, Bosch, Vishay Technologies, NXP Semiconductors, Texas Instruments, Inomatic, Hella, TE Connectivity, Denso Corporation, AMS AG, Autotec Components, Renesas Corporation, Insplorion AB, and others.

Recent Development

-

November 2023: United Safety & Survivability Corporation launched a Lithium-Ion Battery Failure Detection Sensor, enhancing safety in electric vehicles.

-

February 2024: Tekscan introduced a pressure mapping sensor specifically designed for battery R&D and manufacturing, aiding in identifying potential battery design issues.

-

May 2022: Continental launched the Current Sensor Module and Battery Impact Detection system, focusing on battery protection and parameter retention in electric vehicles.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 6.30 billion |

| Market Size by 2032 | USD 15.92 Billion |

| CAGR | CAGR of 10.85% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Communication (CAN, LIN) • By Voltage (12V, 24V, 48V) • By Type (BEV, HEV, PHEV) • By Category (Passenger Car, Light Commercial Vehicle, Heavy Commercial Vehicle) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Continental AG, Furukawa Electric, Bosch, Vishay Technologies, NXP Semiconductors, Texas Instruments, Inomatic, Hella, TE Connectivity, Denso Corporation, AMS AG, Autotec Components, Renesas Corporation, Insplorion AB |

| Key Drivers | • Growing Demand for Renewable Energy Storage Solutions Globally • Increased Focus on the Safety of Batteries for Better Monitoring and Management |

| RESTRAINTS | • Complex Integration of the Sensors and Compatibility Issues • High Installation Costs and Maintenance Charges of Advanced Battery Sensors |