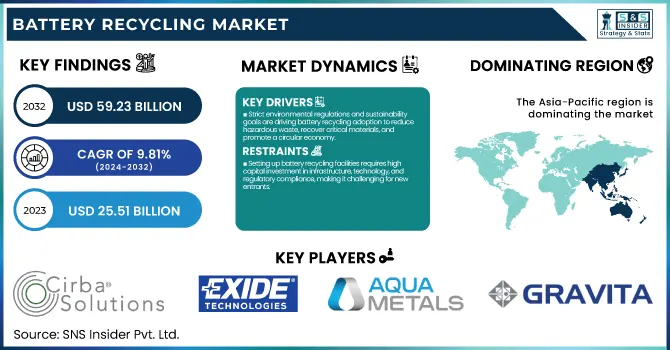

The Battery Recycling Market was valued at USD 25.51 billion in 2023 and is expected to reach USD 59.23 billion by 2032, with a growing CAGR of 9.81% over the forecast period 2024-2032. This report offers a unique perspective on the operational efficiency and technological advancements in battery recycling. It explores utilization rates and maintenance trends of recycling facilities, providing insights into plant reliability. The study examines technological adoption, highlighting automation and innovation in recycling processes. Additionally, it presents global trade patterns of recycled battery materials, shedding light on supply chain dependencies. The report also covers regulatory compliance trends and secondary raw material recovery efficiency to enhance insights, ensuring a comprehensive view of sustainability and circular economy practices.

To Get more information on Battery Recycling Market - Request Free Sample Report

Drivers

Strict environmental regulations and sustainability goals are driving battery recycling adoption to reduce hazardous waste, recover critical materials, and promote a circular economy.

Strict environmental regulations and sustainability goals are significantly driving the growth of the battery recycling market. Globally, governments are implementing strict policies to reduce hazardous waste, limit carbon emissions, and encourage resource efficiency. Laws like the EU Battery Regulation and Extended Producer Responsibility (EPR) policies ensure that batteries are properly disposed of and recycled at the end of their lives, providing a strong incentive for companies to invest in advanced recycling technologies. The move to a circular economy is also pushing manufacturers to reclaim precious metals, including lithium, cobalt, and nickel, to lower the reliance on mining. Further, the increasing concern for landfill waste and improper disposal is expected to drive the adoption of closed-loop recycling systems. Market growth is being further augmented by trends including AI-based sorting, hydrometallurgical recycling, and second-life applications. As electric vehicles (EVs) and energy storage systems become more common, demand for efficient recycling solutions will grow and create a more sustainable battery ecosystem.

Restraint

Setting up battery recycling facilities requires high capital investment in infrastructure, technology, and regulatory compliance, making it challenging for new entrants.

Setting up a battery recycling facility demands substantial capital investment due to the need for specialized equipment, advanced processing technologies, and strict environmental compliance measures. Newcomers face significant financial barriers due to the high costs associated with infrastructure, ranging from shredders to hydrometallurgical and pyrometallurgical processing facilities and waste management systems. And, waste management, labor, use of energy, and safety measures all amount to a high operational cost. Regulatory approvals and permitting processes increase up-front expenses, as companies need to satisfy strict environmental and safety requirements. This complexity when processing several battery chemistries (like lithium-ion and lead-acid) requires continuous efforts toward research and development to improve the recovery rate. The next challenge is scaling up operations to the point of commercial viability, as profitability will rely on a consistent supply of lithium-ion battery feedstock and efficient logistics. This means that only well-established players, or those with government incentives and partnerships, have the potential to profitably operate over the long term in this event.

Opportunities

Strategic partnerships in battery recycling are driving innovation, optimizing material recovery, and fostering a sustainable, closed-loop ecosystem for electric mobility.

Strategic partnerships and collaborations are playing a vital role in accelerating innovation and expanding recycling capabilities in the battery recycling market. Battery manufacturers, recyclers, and automotive companies have come together to establish more efficient, closed-loop systems that capture as much material as possible and help to lessen dependence on raw material extraction. These partnerships progress research into innovative recycling techniques, optimize collection and logistics, and allow the smooth reintegration of recycled materials into new battery manufacturing. As an example, automakers partner with recyclers to manage end-of-life EV batteries, reusing working parts and recovering valuable materials including lithium, cobalt, and nickel. These alliances not only reduce costs and increase sustainability but also help companies comply with evolving regulatory standards. Such partnerships are also fostering a more resilient and sustainable battery ecosystem, ultimately aiding the global move toward clean energy and electric mobility by leveraging shared capabilities, infrastructure, and resource availability.

Challenges

Battery recycling faces efficiency and scalability challenges due to material losses, high energy consumption, complex chemistries, and limited automation, requiring advanced innovations for sustainability.

Battery recycling technologies, while advancing, still face efficiency and scalability limitations that hinder the full recovery of valuable materials like lithium, cobalt, and nickel. However, pyrometallurgical and hydrometallurgical processes pose material losses, high energy costs, and environmental issues. These are not conventional lithium-ion batteries, which can be recycled using current methods (with some limitations) These batteries can be used for research but they have a different chemistry from the common Lithium-Ion batteries. Direct recycling, which holds promise as an alternative, seeks to preserve the cathode structure of the battery, but is still in early-stage development and isn’t commercially scalable. Additionally, battery disassembly is not yet automated, rendering it labor-intensive and expensive. Further, existing recycling plants aren't equipped to handle the surge in battery volume, which means we need innovation in sorting using AI, maximizing yield during the separation of materials, and closed-loop recycling to make processes cheaper, and greener. Addressing these barriers is key to enabling a circular battery economy.

By Chemistry

The Lead Acid segment dominated with a market share of over 82% in 2023, the Lead Acid portion of the market, and these batteries are primarily utilized in automobiles, industrial equipment, and backup power systems, ensuring a steady demand for recycling. Moreover, stringent environmental regulations in various areas require the collection and recycling of lead-acid batteries to prevent hazardous waste generation and environmental pollution. Battery disposal is strictly regulated by various governments and regulatory bodies, giving an extra boost to the recycling market. The high economic viability of lead recovery itself motivates recycling in large numbers keeping the segment stronger in the market. As a result, lead acid batteries remain growth drivers for the battery recycling market.

By Application

The Transportation segment dominated with a market share of over 70% in 2023, primarily because of the fast adoption of electric vehicles (EVs) and the rising requirement to recycle lithium-ion batteries from decommissioned vehicle batteries. With EV production rising globally, has a resource need for EV battery disposal and recycling solutions. As a result, governments of several regions are introducing aggressive regulations and providing incentives to establish sustainable battery management, thereby supporting the growth of this segment. It also recycles precious materials like lithium, cobalt, and nickel, decreasing our dependence on the mining of raw materials and therefore, the environmental impact. The general movement toward the circular economy, as well as growing awareness of sustainable practices among both automakers and consumers, further adds to the dominance of the transportation sector in the battery recycling market.

By Material

The Metals segment dominated with a market share of over 62% in 2023, due to the high economic value and recoverability of key materials such as lithium, cobalt, nickel, and lead. These metals are necessary for making new batteries, especially in electric vehicles (EVs), consumer electronics and energy storage systems. Economics and sustainability have driven the need in recent years, with the demand for new batteries only growing and recycling processes being more efficient than ever before. And recovering these metals leads to less mining, conservation of natural resources, and lower environmental impact. Advanced recycling technologies that can extract high-purity metals and are being pursued by governments and industry players also bolster the segment’s dominance. As battery consumption increases, metal recycling promotes a sustainable supply chain, helping to deliver on circular economy and sustainability objectives.

Asia-Pacific region dominated with a market share of over 42% in 2023, primarily driven by the region's increased battery consumption level, advanced manufacturing capabilities, and rigorous government regulations that promote sustainable recycling practices. Countries such as China, Japan, and South Korea are at the forefront of the region's battery production hubs coupled with a stand of growing demand from EVs, consumer electronics, as well as industrial batteries. China specifically has very harsh environmental regulations and a robust battery supply chain that is fueling the recycling market. Moreover, government programs as well as investments in efficient recycling technologies are also contributing to the growth. Asia-Pacific is the region with the largest share of global batteries recycling, driven by the presence of primary battery manufacturers and recyclers in the region. Its supremacy is reinforced by increasing attentiveness to sustainability and circular economy principles.

Europe is the fastest-growing region in the battery recycling market, driven by stringent environmental regulations aimed at reducing battery waste and promoting a circular economy. The rapid proliferation of electric vehicles (EVs) has driven up public demand for efficient recycling solutions to slice through the end-of-life lithium-ion battery stack. Furthermore, much of both recycling and recovery and infrastructure is currently being set up through investment by both governments and private enterprises. Further growth is sped up by the European Union's stringent policies like the Battery Regulation, which requires greater recycling efficiency and the incorporation of recycled materials into new batteries. With increasing realization and technological support, Europe is poised to be a vibrant player in the segment of battery recycling, guaranteeing environmental safety and conserving resources for the future.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the major key players in the Battery Recycling Market

Cirba Solutions (U.S.) – (Lithium-ion & Lead-acid Battery Recycling)

Exide Technologies (U.S.) – (Lead-acid Battery Recycling)

Aqua Metals (U.S.) – (AquaRefining Lead Battery Recycling)

Gravita India Ltd. (India) – (Lead & Lithium-ion Battery Recycling)

Call2Recycle (U.S.) – (Consumer Battery Recycling Program)

East Penn Manufacturing Co. (U.S.) – (Lead-acid Battery Recycling)

Glencore (Switzerland) – (Battery Metal Recycling - Cobalt, Nickel)

American Battery Technology Company (U.S.) – (Lithium-ion Battery Recycling)

Gopher Resource (U.S.) – (Lead Battery Recycling & Smelting)

Redwood Materials (U.S.) – (EV Battery & E-waste Recycling)

Umicore (Belgium) – (Lithium-ion & Precious Metal Recycling)

Retriev Technologies (U.S.) – (Lithium-ion & Ni-Cd Battery Recycling)

TES (Singapore) – (EV Battery & E-waste Recycling)

Li-Cycle (Canada) – (Lithium-ion Battery Recycling)

Neometals Ltd. (Australia) – (Battery Metal Recovery - Nickel, Cobalt)

Fortum (Finland) – (Sustainable Battery Recycling Solutions)

Battery Solutions (U.S.) – (Single-use & Rechargeable Battery Recycling)

EcoBat (U.K.) – (Lead Battery Recycling & Secondary Lead Production)

Duesenfeld (Germany) – (Lithium-ion Battery Recycling & Low-Emission Process)

SungEel HiTech (South Korea) – (Hydrometallurgical Battery Recycling)

Suppliers for (Closed-loop battery recycling, sustainable EV battery materials) on Battery Recycling Market

Umicore

Redwood Materials

Li-Cycle Holdings Corp.

Exide Industries Ltd.

Glencore plc

Attero Recycling Pvt. Ltd.

SNAM S.A.S.

Tata Chemicals Limited

Gopher Resource LLC

Battery Solutions

RECENT DEVELOPMENT

In January 2023: Aqua Metals, Inc., a leader in clean lithium-ion battery recycling, announced the completion of due diligence for a property in Tahoe-Reno. The company plans to develop a five-acre recycling campus in phases, aiming to process over 20 million pounds of lithium-ion battery material annually using its innovative Li AquaRefining technology.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 25.51 Billion |

|

Market Size by 2032 |

USD 59.23 Billion |

|

CAGR |

CAGR of 9.81% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Chemistry (Lithium-ion, Lead Acid, Nickel, Others) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Cirba Solutions, Exide Technologies, Aqua Metals, Gravita India Ltd., Call2Recycle, East Penn Manufacturing Co., Glencore, American Battery Technology Company, Gopher Resource, Redwood Materials, Umicore, Retriev Technologies, TES, Li-Cycle, Neometals Ltd., Fortum, Battery Solutions, EcoBat, Duesenfeld, SungEel HiTech. |

Ans: The Battery Recycling Market is expected to grow at a CAGR of 9.81% during 2024-2032.

Ans: The Battery Recycling Market was USD 25.51 billion in 2023 and is expected to Reach USD 59.23 billion by 2032.

Ans: Strict environmental regulations and sustainability goals are driving battery recycling adoption to reduce hazardous waste, recover critical materials, and promote a circular economy.

Ans: The “Lead Acid” segment dominated the Battery Recycling Market.

Ans: Asia-Pacific dominated the Battery Recycling Market in 2023.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Battery Recycling Output, by Region (2020-2023)

5.2 Utilization Rates of Recycling Facilities, by Region (2020-2023)

5.3 Downtime and Maintenance Metrics for Recycling Plants

5.4 Technological Adoption Rates in Battery Recycling, by Region

5.5 Export/Import Data of Recycled Battery Materials, by Region (2023)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Battery Recycling Market Segmentation, By Chemistry

7.1 Chapter Overview

7.2 Lithium-ion

7.2.1 Lithium-ion Market Trends Analysis (2020-2032)

7.2.2 Lithium-ion Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Lead Acid

7.3.1 Lead Acid Market Trends Analysis (2020-2032)

7.3.2 Lead Acid Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Nickel

7.4.1 Nickel Market Trends Analysis (2020-2032)

7.4.2 Nickel Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Others

7.5.1 Others Market Trends Analysis (2020-2032)

7.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Battery Recycling Market Segmentation, By Application

8.1 Chapter Overview

8.2 Transportation

8.2.1 Transportation Market Trends Analysis (2020-2032)

8.2.2 Transportation Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Consumer electronics

8.3.1 Consumer electronics Market Trends Analysis (2020-2032)

8.3.2 Consumer electronics Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Industrial

8.4.1 Industrial Market Trends Analysis (2020-2032)

8.4.2 Industrial Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Battery Recycling Market Segmentation, By Material

9.2 Metals

9.2.1 Metals Market Trends Analysis (2020-2032)

9.2.2 Metals Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Electrolyte

9.3.1 Electrolyte Market Trends Analysis (2020-2032)

9.3.2 Electrolyte Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Plastics

9.4.1 Plastics Market Trends Analysis (2020-2032)

9.4.2 Plastics Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Other Components

9.5.1 Other Components Market Trends Analysis (2020-2032)

9.5.2 Other Components Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Battery Recycling Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.2.4 North America Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.5 North America Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.2.6.2 USA Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.6.3 USA Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.2.7.2 Canada Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.7.3 Canada Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.2.8.2 Mexico Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.8.3 Mexico Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Battery Recycling Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.3.1.6.2 Poland Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.6.3 Poland Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.3.1.7.2 Romania Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.7.3 Romania Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Battery Recycling Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.3.2.4 Western Europe Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.5 Western Europe Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.3.2.6.2 Germany Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.6.3 Germany Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.3.2.7.2 France Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.7.3 France Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.3.2.8.2 UK Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.8.3 UK Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.3.2.9.2 Italy Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.9.3 Italy Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.3.2.10.2 Spain Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.10.3 Spain Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.3.2.13.2 Austria Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.13.3 Austria Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.4 Asia-Pacific

10.4.1 Trends Analysis

10.4.2 Asia-Pacific Battery Recycling Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia-Pacific Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.4.4 Asia-Pacific Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.5 Asia-Pacific Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.4.6.2 China Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.6.3 China Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.4.7.2 India Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.7.3 India Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.4.8.2 Japan Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.8.3 Japan Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.4.9.2 South Korea Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.9.3 South Korea Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.4.10.2 Vietnam Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.10.3 Vietnam Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.4.11.2 Singapore Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.11.3 Singapore Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.4.12.2 Australia Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.12.3 Australia Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia-Pacific Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia-Pacific Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Battery Recycling Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.5.1.4 Middle East Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.5 Middle East Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.5.1.6.2 UAE Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.6.3 UAE Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Battery Recycling Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.5.2.4 Africa Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.5 Africa Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Battery Recycling Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.6.4 Latin America Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.5 Latin America Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.6.6.2 Brazil Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.6.3 Brazil Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.6.7.2 Argentina Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.7.3 Argentina Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.6.8.2 Colombia Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.8.3 Colombia Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Battery Recycling Market Estimates and Forecasts, By Chemistry (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Battery Recycling Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Battery Recycling Market Estimates and Forecasts, By Material (2020-2032) (USD Billion)

11. Company Profiles

11.1 Cirba Solutions

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Exide Technologies

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Aqua Metals

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Gravita India Ltd.

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Call2Recycle

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 East Penn Manufacturing Co.

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Glencore

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 American Battery Technology Company

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Gopher Resource

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Redwood Materials

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments

By Chemistry

Lithium-ion

Lead Acid

Nickel

Others

By Application

Transportation

Consumer electronics

Industrial

By Material

Metals

Electrolyte

Plastics

Other Components

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Coiled Tubing Market size was valued at USD 3.78 Billion in 2023. It is expected to grow to USD 6.50 Billion by 2032 and grow at a CAGR of 5.58% over the forecast period of 2024-2032.

The Compressor Control System Market was estimated at USD 5.56 billion in 2023 and is expected to reach USD 8.46 billion by 2032, with a growing CAGR of 4.78% over the forecast period 2024-2032.

The Injection Molding Machine Market size was estimated at USD 15.95 billion in 2023 and is expected to reach USD 24.53 billion by 2032 at a CAGR of 4.9% during the forecast period of 2024-2032.

The Immersion Cooling Market was estimated at USD 287.25 Million in 2023 and is expected to reach USD 1566.59 Million by 2032, with a growing CAGR of 20.74% over the forecast period 2024-2032

The Electrical Equipment Market was valued at USD 276.89 Billion in 2023, and it is expected to reach USD 312.40 Billion by 2032, registering a CAGR 1.35% of from 2024 to 2032.

The Automated Material Handling (AMH) Equipment Market Size was esteemed at USD 25.88 billion in 2023 and is supposed to arrive at USD 57.94 billion by 2031 and develop at a CAGR of 10.6% over the forecast period 2024-2031.

Hi! Click one of our member below to chat on Phone