To get more information on Battery-as-a-Service Market - Request Sample Report

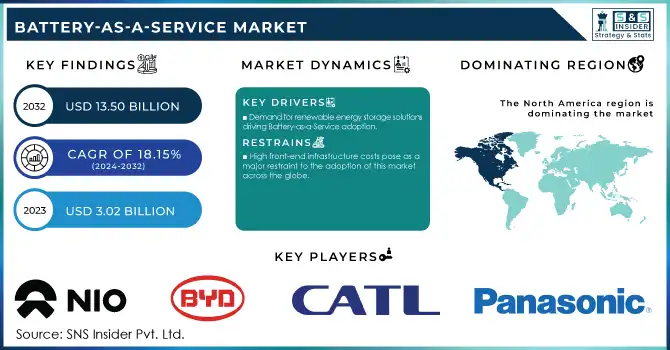

The Battery-as-a-Service Market Size was valued at USD 3.02 Billion in 2023 and is expected to reach USD 13.50 Billion by 2032 and grow at a CAGR of 18.15% over the forecast period 2024-2032.

Battery-as-a-Service Market is gaining significant traction as industries seek to innovate in addressing the challenges of energy storage, sustainability, and mobility. Users are now renting batteries instead of buying them outright; this offers flexibility and decreases upfront costs, which is most popular in automotive and transport, energy, and industrial applications where demand for effective and sustainable energy solutions is rising.

In countries such as the United States, China, and Europe, governments are implementing policies which support electric vehicles and renewable energy sources directly aligned to the growth of Battery-as-a-Service. The US Administration's incentivizing EVs and infrastructure investment is another key driver for this sector. In the U.S. Tax incentives and subsidies in the pursuit of increased EV adoption created fertile ground for growth in the Battery-as-a-Service service provider sector, particularly in the automotive segment. China is another key market that has established an aggressive EV policy framework, with mandated battery swapping standards and incentives to manufacturers who adapt to Battery-as-a-Service models, making it a global leader in battery-as-a-service.

Recent developments in battery technology are also driving the Battery-as-a-Service market. Improvement in Battery Lifecycle Management and Swapping Technology ensures faster, more efficient battery replacement with higher customer convenience levels. Companies are now developing modular batteries that can easily swap out in EVs, so the vehicle is always operational for most of the time. Time down is minimized, and the overall efficiency of the vehicle increases. New innovations such as Solid-State Batteries and Fast-Charging Technology in the energy storage sector play a huge role in extending the life of the battery while improving energy density that can make Battery-as-a-Service viable across industries.

There is much potential for Battery-as-a-Service unlocking very significant opportunities within the near future, especially for Renewable Energy and Grid Storage. Decarbonization is gaining rapid attention all over the world, and thus the need for scalable energy solutions going to grow exponentially. Scalable energy solutions can be managed by the energy providers and industrial users efficiently through Battery-as-a-Service. This flexibility can then also be transferred to new industrialization processes that may not have even been considered before, like the residential energy storage sector. For example, here, leasing batteries can help reduce the burden the family would have with regard to the installation of such solar energy-generating systems.

KEY DRIVERS:

Increasing adoption of EVs necessitates flexible battery leasing models.

A surge in sales of electric vehicles leads to a surge in demand for efficient and cost-effective battery solutions. Battery-as-a-Service customers can lease the batteries instead of buying them, thereby saving the upfront cost for the purchase of Electric Vehicles. According to official government sources, in 2022, EVs accounted for 7.2% of new car sales worldwide, and their number will balloon considerably with growing official incentives for the adoption of EVs, starting with tax credits and subsidies in key markets such as the U.S., China, and Europe. The EV market is likely to experience a 35%-40% EV sales due to EV policies, thereby unlocking huge potential for battery leasing services as companies like Tesla and NIO expand their battery-swapping and leasing models.

Demand for renewable energy storage solutions driving Battery-as-a-Service adoption

Renewable energy sources, such as solar and wind, are increasingly being embraced, requiring large-scale, flexible, and scalable battery storage solutions. For energy companies and grid operators, battery-as-a-service will help to manage energy storage without big capital investments. For example, the trend on increasing renewable energy adoption is seen in policies like the European Green Deal and the U.S. Infrastructure Bill that provides billions for renewable energy infrastructure, including battery storage. The US government data shows that in 2023, renewable energy accounted for more than 21% of electricity generation in the country, and this percentage will rise. As a result, more battery leasing solutions will be in demand. Battery-as-a-Service advantages energy storage companies with more flexibility in renting storage capacity rather than buying an expensive battery system at the frontline. This makes it much easier to introduce renewables into the energy grid.

RESTRAIN:

High front-end infrastructure costs pose a major restraint to the adoption of this market across the globe.

One of the main barriers to entry for the Battery-as-a-Service market is the substantial upfront investment to establish battery-swapping stations and supporting infrastructure. Establishing a Battery-as-a-Service network, especially in the automobile domain, requires quite significant investments in technologies, physical infrastructures, and battery supply chains. Companies that would want to provide the service of leasing batteries need to establish or captivate battery swapping stations and ensure a steady supply of high-performance batteries. These costs are prohibitively high in hinterland regions, where penetration for EVs is still low. According to government data, setting up a single battery-swapping station for EVs would cost anywhere from USD 500,000 to USD 1 million, which varies with the region and capacity of the station. Logistics of maintaining, charging, and distributing batteries also entail heavy operational expenditures. For that reason, such small and medium-sized companies in developing economies may not be able to enter this market.

BY SERVICE

Stationary Equipment led the market in 2023, with a 57% market share. Stationary batteries are primarily used in renewable energy grid energy storage solutions, industrial uses, and backup power systems. Growing deployments of renewable energy sources, especially solar and wind energy, enhance large-scale stationary battery storage solutions demand. Stationary Battery-as-a-Service allows energy companies and industries to lease battery storage instead of purchasing expensive battery systems much-needed solution to achieve equilibrium in the supply and demand curves for renewable energy grids.

On the other hand, Mobile Equipment, which includes EV batteries and other mobile applications, will register the highest CAGR of 18.70% during the forecast period of 2024-2032. There is therefore fast growth that has been supported by the adoption of EVs in most parts of the world and the need for efficient replacement of EV batteries. In economies such as China, mobile Battery-as-a-Service models have almost completely come into effect, whereby the drivers of EVs replace the spent battery with a full one at charging stations. The mobile Battery-as-a-Service market is likely to boom exponentially with the growing adoption rate of EVs, especially in the U.S. and Europe.

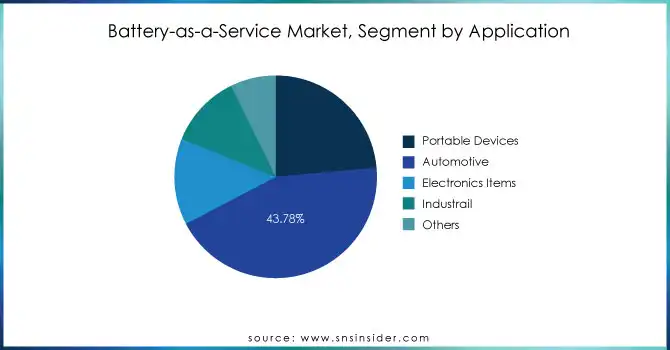

BY APPLICATION

In 2023, Automotive and Transport will lead the market with a majority share of 51%. The general automotive sector, especially electric vehicles, is the major application for Battery-as-a-Service. OEMs as well as service providers are increasingly offering battery leasing options as a part of their EV offers, thereby reducing the financial burden on consumers. The growth in the adoption of EVs across the globe, backed by government initiatives and incentives, is driving growth in Battery-as-a-Service for this segment.

More insightful information can be obtained in this report, where the Automotive and Transport sector is anticipated to advance with the fastest CAGR of 18.61% during the forecast period of 2024–2032. Growth is mainly ascribed to growing consumer demand for EVs and the expansion of battery-swapping networks. Battery leasing in the segment is essential to overcome such challenges regarding high battery costs and a long time consumed in recharging, considered major hurdles in the adoption of EVs.

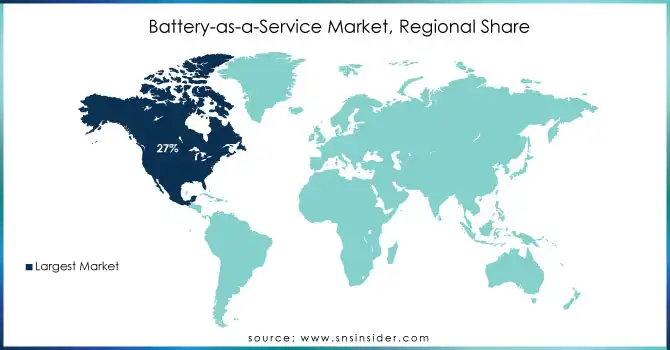

In terms of the regional analysis, North America held the highest market share of 27% in the Battery-as-a-Service market in 2023. The main reason behind the above is that the U.S. leads the region's automotive industry, with increasing adoption of electric vehicles and due support from their government toward renewable energies. The infrastructure bill by the U.S. government that allocates funds for electric vehicle infrastructure and energy storage solutions has spurred the adoption of Battery-as-a-Service across both automotive and energy sectors. Major operators in North America are now contracting with battery producers to expand their battery-swapping and leasing.

However, Asia Pacific is expected to grow at the highest CAGR of 19.23% during the forecast period of 2024 to 2032. China is a world leader in Battery-as-a-Service, through a mature battery-swapping structure, and with the government having proactive policies supporting adoption of EVs and battery leasing models. India and Japan are emerging markets for Battery-as-a-Service and are driven by increasing investment into renewables and automotive sectors.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the major players in the Battery-as-a-Service Market are

NIO (Battery swapping, EVs)

Tesla (Energy storage solutions, EV batteries)

BYD (Energy storage systems, EV batteries)

CATL (Battery systems, energy solutions)

Panasonic (EV batteries, energy storage)

LG Energy Solution (Battery systems, EV batteries)

Northvolt (Energy storage solutions, battery cells)

Envision AESC (EV batteries, energy storage)

Gotion High-Tech (Battery systems, EV solutions)

A123 Systems (Battery technology, energy storage)

CBAK Energy Technology (EV batteries, energy storage)

Amperex Technology Limited (Battery systems, mobile equipment)

EnerSys (Battery solutions, energy storage)

Enevate (Battery technology, fast-charging solutions)

Samsung SDI (Battery systems, EV batteries)

Leclanché (Energy storage solutions, battery systems)

Kion Group (Battery systems, industrial applications)

Hitachi Chemical (Battery components, energy solutions)

Mitsubishi Electric (Energy storage, industrial batteries)

ABB (Energy storage, EV charging solutions)

Charge Zone

Ford

General Motors

BMW

Audi

Daimler

Volkswagen

Rivian

Lucid Motors

Nissan

Toyota

October 2024: India-based EV charging network ChargeZone recently launched its new Battery Passport System, an online platform that generates a comprehensive life cycle record of any battery. It collects detailed information for every stage, thereby helping to move from a linear to a circular economy by providing transparent information in the lifetime of the battery. With this transparency, all stakeholders in the EV battery ecosystem would be facilitated, from buyers of EVs to manufacturers, recyclers, and other economic operators.

October 2024: In an effort to strengthen its market leadership in battery electric vehicles, Tata Motors is exploring the feasibility of a Battery-as-a-Service model for a few of its products, sources privy to the development said. The battery rental option for consumers would help reduce the ex-showroom prices of its BEVs by 25-30 per cent, and the BaaS model is likely to be offered for the electric variant of Tiago, Punch, Tigor, Nexon, and others.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.02 Billion |

| Market Size by 2032 | US$ 13.50 Billion |

| CAGR | CAGR of 18.15 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Battery Ownership Models (Battery Purchase, Battery Lease, Battery Subscription), • By Energy Storage Capacity (Less than 50 kWh, 50-100 kWh, Over 100 kWh), • By Application (Automotive and Transport, Energy, Industrial, and Others) • By Service (Stationary Equipment, Mobile Equipment) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | NIO, Tesla, BYD, CATL, Panasonic, LG Energy Solution, Northvolt, Envision AESC, Gotion High-Tech, A123 Systems, CBAK Energy Technology, Amperex Technology Limited, EnerSys, Enevate, Samsung SDI, Leclanché, Kion Group, Hitachi Chemical, Mitsubishi Electric, ABB. |

| Key Drivers | • Increasing adoption of EV necessitates flexible battery leasing models. • Demand for renewable energy storage solutions driving Battery-as-a-Service adoption. |

| Restraints | • High front-end infrastructure costs pose as a major restraint to the adoption of this market across the globe. |

Ans: The Battery-as-a-Service Market is expected to grow at a CAGR of 18.15% during 2024-2032.

ns: Battery-as-a-Service Market size was USD 3.02 Billion in 2023 and is expected to Reach USD 13.50 Billion by 2032.

Ans: The major growth factors of the Battery-as-a-Service Market are Increasing adoption of EV and Demand for renewable energy storage solutions.

Ans: The Stationary Equipment segment dominated the Battery-as-a-Service Market.

Ans: North America dominated the Battery-as-a-Service Market in 2023.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Vehicle Production and Sales Volumes, 2020-2032, by Region

5.2 Emission Standards Compliance, by Region

5.3 Vehicle Technology Adoption, by Region

5.4 Consumer Preferences, by Region

5.5 Aftermarket Trends (Data on vehicle maintenance, parts, and services)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Battery-as-a-Service Market Segmentation, By Battery Ownership Models

7.1 Chapter Overview

7.2 Battery Purchase

7.2.1 Battery Purchase Market Trends Analysis (2020-2032)

7.2.2 Battery Purchase Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Battery Lease

7.3.1 Battery Lease Market Trends Analysis (2020-2032)

7.3.2 Battery Lease Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Battery Subscription

7.4.1 Battery Subscription Market Trends Analysis (2020-2032)

7.4.2 Battery Subscription Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Battery-as-a-Service Market Segmentation, by Application

8.1 Chapter Overview

8.2 Automotive and Transport

8.2.1 Automotive and Transport Market Trends Analysis (2020-2032)

8.2.2 Automotive and Transport Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Energy

8.3.1 Energy Market Trends Analysis (2020-2032)

8.3.2 Energy Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Industrial

8.4.1 Industrial Market Trends Analysis (2020-2032)

8.4.2 Industrial Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Others

8.5.1 Others Market Trends Analysis (2020-2032)

8.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Battery-as-a-Service Market Segmentation, By Energy Storage Capacity

9.1 Chapter Overview

9.2 Less than 50 kWh

9.2.1 Less than 50 kWh Market Trends Analysis (2020-2032)

9.2.2 Less than 50 kWh Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 50-100 kWh

9.3.1 50-100 kWh Market Trends Analysis (2020-2032)

9.3.2 50-100 kWh Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Over 100 kWh

9.4.1 Over 100 kWh Market Trends Analysis (2020-2032)

9.4.2 Over 100 kWh Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Battery-as-a-Service Market Segmentation, By Service

10.1 Chapter Overview

10.2 Stationary Equipment

10.2.1 Stationary Equipment Market Trends Analysis (2020-2032)

10.2.2 Stationary Equipment Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Mobile Equipment

10.3.1 Mobile Equipment Market Trends Analysis (2020-2032)

10.3.2 Mobile Equipment Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Battery-as-a-Service Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.2.4 North America Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.5 North America Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.2.6 North America Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.2.7.2 USA Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.7.3 USA Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.2.7.4 USA Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.2.8.2 Canada Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.8.3 Canada Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.2.8.4 Canada Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.2.9.2 Mexico Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.9.3 Mexico Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.2.9.4 Mexico Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Battery-as-a-Service Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.3.1.7.2 Poland Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.7.3 Poland Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.3.1.7.4 Poland Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.3.1.8.2 Romania Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.8.3 Romania Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.3.1.8.4 Romania Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Battery-as-a-Service Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.3.2.4 Western Europe Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.5 Western Europe Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.3.2.6 Western Europe Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.3.2.7.2 Germany Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.7.3 Germany Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.3.2.7.4 Germany Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.3.2.8.2 France Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.8.3 France Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.3.2.8.4 France Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.3.2.9.2 UK Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.9.3 UK Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.3.2.9.4 UK Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.3.2.10.2 Italy Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.10.3 Italy Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.3.2.10.4 Italy Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.3.2.11.2 Spain Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.11.3 Spain Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.3.2.11.4 Spain Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.3.2.14.2 Austria Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.14.3 Austria Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.3.2.14.4 Austria Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Battery-as-a-Service Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.4.4 Asia Pacific Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.5 Asia Pacific Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.4.6 Asia Pacific Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.4.7.2 China Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.7.3 China Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.4.7.4 China Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.4.8.2 India Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.8.3 India Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.4.8.4 India Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.4.9.2 Japan Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.9.3 Japan Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.4.9.4 Japan Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.4.10.2 South Korea Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.10.3 South Korea Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.4.10.4 South Korea Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.4.11.2 Vietnam Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.11.3 Vietnam Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.4.11.4 Vietnam Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.4.12.2 Singapore Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.12.3 Singapore Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.4.12.4 Singapore Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.4.13.2 Australia Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.13.3 Australia Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.4.13.4 Australia Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Battery-as-a-Service Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.5.1.4 Middle East Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.5 Middle East Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.5.1.6 Middle East Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.5.1.7.2 UAE Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.7.3 UAE Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.5.1.7.4 UAE Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Battery-as-a-Service Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.5.2.4 Africa Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.5 Africa Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.5.2.6 Africa Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Battery-as-a-Service Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.6.4 Latin America Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.5 Latin America Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.6.6 Latin America Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.6.7.2 Brazil Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.7.3 Brazil Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.6.7.4 Brazil Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.6.8.2 Argentina Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.8.3 Argentina Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.6.8.4 Argentina Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.6.9.2 Colombia Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.9.3 Colombia Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.6.9.4 Colombia Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Battery-as-a-Service Market Estimates and Forecasts, By Battery Ownership Models (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Battery-as-a-Service Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Battery-as-a-Service Market Estimates and Forecasts, By Energy Storage Capacity (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Battery-as-a-Service Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12. Company Profiles

12.1 NIO

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Tesla

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 BYD

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 CATL

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Panasonic

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 LG Energy Solution

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Northvolt

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 Envision AESC

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Gotion High-Tech

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 A123 Systems

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

KEY MARKET SEGMENTATION

BY BATTERY OWNERSHIP MODELS

• Battery Purchase

• Battery Lease

• Battery Subscription

BY ENERGY STORAGE CAPACITY

• Less than 50 kWh

• 50 - 100 kWh

• Over 100 kWh

BY APPLICATION

• Automotive and Transport

• Energy

• Industrial

• Others

BY SERVICE

• Stationary Equipment

• Mobile Equipment

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Diesel Particulate Filter Market size is expected to reach USD 24.91 billion by 2031 and grow at a CAGR of 7% by 2024-2031

The Terminal Tractor Market is expected to reach USD 2.20 Billion by 2032 and was valued at $1.24 billion in 2023 and growing at a CAGR 5.89% by 2024-2032

The Minivans Market Size was valued at USD 104.68 Billion in 2023 & is expected to reach USD 137.59 Billion by 2032 & grow at a CAGR of 3.09% by 2024-2032.

The Electric Vehicle Connector Market Size was recorded at USD 2.08 billion in 2023 and is expected to reach USD 17.8 billion by 2032, growing at a CAGR of 27% over the forecast period 2024-2032.

Automotive Fasteners Market size was valued at USD 24.13 billion in 2023 and is expected to reach USD 32.41 billion by 2031 and grow at a CAGR of 3.74% over the forecast period 2024-2031.

The Automatic High Beam Control Market Size was valued at USD 10.68 billion in 2023 and is expected to reach USD 18.82 billion by 2032 and grow at a CAGR of 6.5% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone