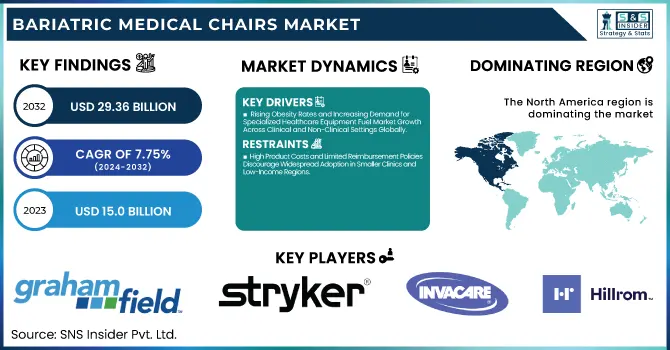

The Bariatric Medical Chairs Market Size was valued at USD 15 Billion in 2023 and is expected to reach USD 29.36 billion by 2032, growing at a CAGR of 7.75% over the forecast period 2024-2032.

To Get more information on Bariatric Medical Chairs Market - Request Free Sample Report

This report presents an in-depth statistical overview and market trends in the Bariatric Medical Chairs market. It includes the incidence and prevalence of obesity-related conditions driving demand, regional healthcare spending patterns, and projected device volume trends. The report includes an analysis of adoption across categories of healthcare settings and user segments, emphasizing clinicians and caregivers. It also delves into trending features, with an emphasis on high-end features like motorized support and hygiene-oriented design. The impact of regulatory compliance and regional safety standards on procurement and product development is also assessed. These insights provide a transparent indication of market dynamics, changing consumer needs, and opportunities for innovations in the bariatric medical chair segment. The growing prevalence of obesity and the rising geriatric population are among the key factors driving the expansion of the bariatric medical chair market. According on recent government statistics, good obesity is a worldwide matter concerning a significant share of humanity; right in 2022 round 650 million adults are obese, and this is expected to rise (around) 167 million by 2025.

The U.S. held a significant portion of the global market in 2023 due to its advanced healthcare infrastructure. The growth of the market is also driven by government initiatives that aim to improve access to healthcare and tackle obesity-related health issues. The US bariatric medical chairs market has been exhibiting steady growth from USD 143.21 Million in 2023 to USD 266.64 Million by 2032. This signifies a notable CAGR of 7.16%, across the observed timeframe. driven by increasing obesity prevalence, rising healthcare spending, and expanding demand for specialized patient support equipment across clinical and home settings. The trend underscores the U.S. as a leading contributor to global market expansion in this segment.

Drivers

Rising Obesity Rates and Increasing Demand for Specialized Healthcare Equipment Fuel Market Growth Across Clinical and Non-Clinical Settings Globally.

The increasing incidence of obesity across the globe is considerably driving the growth of bariatric medical chairs in clinical and non-clinical settings in healthcare. Obesity is at an all-time high with nearly tripled global obesity rates since 1975 and steadily continuing to rise, healthcare facilities can no longer ignore their urgent need for specialized seating solutions suitable for overweight and obese patients. These chairs provide a more reinforced structure, enhanced weight-bearing, larger sizing, and overall improved comfort and safety for higher body mass index (BMI) patients, allowing healthcare professionals to continue to provide care that's efficient and dignified. Moreover, bariatric chairs help reduce the risk of injury to both patients and caregivers during medical procedures or daily activities. With rising public awareness and government initiatives aimed at reducing obesity, healthcare infrastructure is adapting to facilitate supportive equipment such as bariatric chairs. They are also helping hospitals, outpatient clinics, rehabilitation centers, and even long-term care facilities to invest in these chairs to enhance accessibility, ensure compliance with safety regulations, and improve patient satisfaction. Moreover, insurance providers in specific geographies are starting to acknowledge the importance of bariatric care and even introduced reimbursement that will further help grow the market. Overall, this trend towards a more patient-centered approach to obesity management and improved medical environments makes the demand for bariatric medical chairs a critical and growing category of the medical furniture market.

Restraint

High Product Costs and Limited Reimbursement Policies Discourage Widespread Adoption in Smaller Clinics and Low-Income Regions.

The relatively high cost of bariatric medical chairs, especially those with advanced features, continues to be a major barrier for many healthcare providers. These chairs generally employ premium materials, motorized systems, and reinforced structural components to safely support heavier patients, and they command much higher prices than standard medical chairs. This price point is prohibitive for smaller clinics, outpatient centers, and private caregivers in many geographic regions, especially in low- and middle-income countries, limiting adoption. In addition, insurance reimbursement policies are not equally supportive in all markets. Patients and facilities in many places must pay full price out of pocket, despite some developed nation's technology offering partial coverage for bariatric medical equipment. The absence of reimbursement creates disincentives for investment in bariatric infrastructure when there is a clear clinical need. Moreover, limitations in public healthcare budgets limit opportunities for new or expanded bariatric care options. These economic issues, along with low awareness in the medical administration space about the value of prevention in both cost reductions and health improvements, lead to sluggish market penetration. Currently, a lack of flexibility in pricing models and insufficient insurance coverage could create barriers to the adoption of bariatric medical chairs, tilting adoption toward larger hospitals and wealthier regions, thus restraining overall market growth.

Opportunity

Integration of Smart Technology and Customization Capabilities Presents Lucrative Opportunities for Next-Generation Bariatric Chair Manufacturers.

Trends in personalized and technology-led healthcare provision creates new opportunities in the bariatric medical chairs market. The patients today demand new devices that not only serve their physical needs, but also provide additional functionality, data storage, and UI features. Manufacturers integrating features like biometric sensors, IoT-enabled monitoring, automated posture adjustments, and mobile app connectivity into bariatric chairs are gaining a competitive edge. These intelligent features allow for real-time patient data collection and early risk detection, (e.g., pressure ulcers) as well as better clinical oversight. Although it would be necessary to also incorporate even bigger seats and allow reclinations, it is possible to make chairs that can adapt by setting different mobilizing systems to adjust the chairs according to either hospital or home patient needs. It is this precise interweaving of utility with personalization that enrichens the user experience and promotes adherence to care plans over time. In addition, since hospitals and top care facilities are gravitating towards tech infrastructures, bariatric chairs with digital compatibility perfectly fit the ecosystem. With the future of healthcare being driven by smart health (AI, telehealth, smartwatches) technology, bariatric chair makers that focus on innovation, both technical and aesthetic, will have the ability to build new revenue streams and customer loyalty. This shift elevates the role of bariatric chairs from static furniture to dynamic healthcare solutions.

Challenge

Limited Clinical Training and Handling Awareness Among Healthcare Workers Pose Operational Challenges in Utilizing Bariatric Medical Chairs Effectively

Despite the growing availability of bariatric medical chairs, many healthcare workers lack the proper training to operate, adjust, and maintain them effectively. This challenge is particularly pronounced in busy or understaffed clinical settings where time constraints and workload pressure prevent thorough education on specialized equipment. Improper use can lead to safety incidents, including injuries to both patients and caregivers. For example, transferring a bariatric patient without properly engaging lift-assist features or neglecting to secure chair positioning mechanisms can result in falls or strain. Moreover, bariatric patients often require unique care protocols, and staff unfamiliarity can compromise patient dignity and comfort. Without institutional policies emphasizing hands-on training, equipment misuse continues to pose risks. In addition, hospital procurement teams may underutilize or misallocate bariatric chairs simply due to an inadequate understanding of their value, further limiting their impact. Healthcare organizations must invest in structured onboarding, periodic refresher sessions, and user-friendly operation manuals to bridge this gap. Equipment manufacturers can also support by offering virtual demos, tutorials, and on-site assistance. Until clinical education catches up with technological advancements, the true potential of bariatric chairs in enhancing care outcomes will remain constrained.

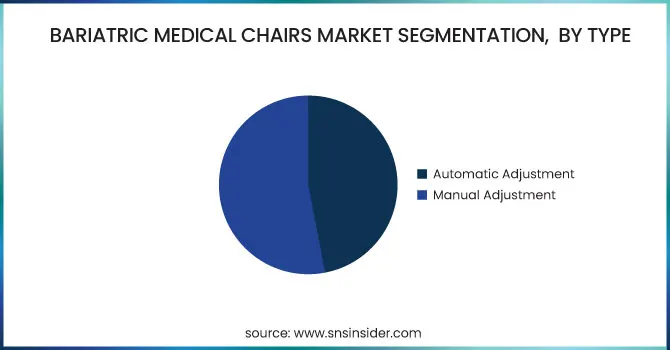

By Type

In 2023, the manual adjustment segment held the largest share of revenue, representing 51% of the global bariatric medical chairs market. Many chair manufacturers produce these chairs, and several reasons, including low price, high capacity, as well as maximal comfort offered by these chairs leading to such dominance. The growing number of obesity cases is the reason for using bariatric medical chairs in hospitals as pointed out by government statistics. As an example, the U.S. has been reported to have an extremely high obesity prevalence according to the Centers for Disease Control and Prevention (CDC), necessitating specific healthcare devices such as manual adjustment bariatric chairs. Furthermore, manual adjustment chairs have a much lower cost compared to automatic adjustment chairs, which is an extra benefit leading to a preference for manual adjustment chairs among many healthcare facilities. This cost-effective nature is of critical importance in parts of the world where healthcare budgets are more limited, and thus cost is often a more pivotal component of the purchasing decision.

The manual adjustment segment's market share can also be linked to the high demand for bariatric medical equipment due to the rising number of bariatric surgeries and obesity-related chronic conditions. Chair innovations, including the application of reinforced frames and wider seat dimensions, improve both usability and patient comfort and add to the segment's dominance. Additionally, government efforts to enhance healthcare infrastructure and expand access to specialized medical devices are further driving the growth of this segment. Investment in healthcare infrastructure in developing countries is anticipated to result in increased demand for manual adjustment bariatric chairs as these nations look to expand healthcare services to meet increasing patient pressures.

By End-use

In 2023, the hospital segment dominated the bariatric medical chairs market, capturing over 44% of the market share. This is largely attributed to the wide range of medical services available at hospitals, including routine exams, advanced surgical procedures, and specialized treatment for bariatric patients. These patients have clinical needs that require numerous specialized equipment in hospitals, including bariatric chairs. Bariatric chairs play an important role in meeting the requirements of patient safety and comfort during a variety of medical procedures. Hospital admission data from the government shows an increasing number of patients worldwide, which increases the demand for specialized healthcare equipment like bariatric medical chairs in hospitals.

Hospitals are subject to stringent regulatory standards and compliance requirements, making it essential for them to invest in compliant and specialized equipment. Another reason for the high demand for bariatric chairs in hospitals is the rising prevalence of obesity and related health issues, according to the reports published by government health agencies. For example, an increase in the geriatric population requiring additional healthcare services is driving the demand for bariatric medical chairs, especially in hospital settings. Furthermore, the investments in the healthcare infrastructure by government support to hospitals drive adoption of specialized equipment such as bariatric chairs, all of which contribute to the segment's leading position in the market.

North America held the largest share of the bariatric medical chairs industry in 2023, owing to its established healthcare infrastructure and favourable reimbursement environment. North America dominated the revenue share at 39%. Lifestyle-associated disorders, including obesity, are becoming more widespread, driving market expansion. Moreover, the increasing number of ENT, dental, and ophthalmic clinics in the countries of the U.S. and Canada also contributed towards the demand for bariatric medical chairs. The U.S. alone accounted for a significant share of the global market in 2023, highlighting its substantial influence within North America. Government spending on healthcare infrastructure and the increasing aged population were among the factors driving the region's growth and establishing a solid basis for market expansion in the future.

Asia Pacific is set to be the fastest-growing market from 2024 to 2032. Hence, the reasons for this quick growth include the growing awareness of healthcare, the large patient hub, growing government funds for the R&D sector, and the upcoming projects in research. Moreover, socioeconomic pressure and demand for specialty healthcare equipment resulting from the growing older adult population in this region contribute to the high regional growth. Countries like India, China, and Japan, are investing massively in healthcare infrastructure and R&D. Further, increasing disposable income and positive accessibility to healthcare in the region will drive the market for bariatric medical chairs. Government initiatives in these regions, such as investments in healthcare infrastructure and support for hospitals, play a crucial role in fostering market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Graham-Field Health Products, Inc. (Everest & Jennings Bariatric Recliner, Lumex Clinical Care Recliner)

Stryker Corporation (Prime TC Transport Chair, Stryker Medical Recliner)

Invacare Corporation (Invacare Bariatric Recliner, Invacare IVC Bariatric Wheelchair)

Hillrom (Baxter International Inc.) (Hillrom Bariatric Treatment Chair, Procedural Recliner P8000)

Medline Industries, LP (Medline Clinical Bariatric Recliner, Medline Extra-Wide Heavy Duty Transport Chair)

Winco Mfg., LLC (Winco Bariatric Recliner 6940, Winco Convalescent Recliner)

Joerns Healthcare LLC (Joerns Bariatric Elite Chair, Joerns Hoyer Presence Lift Chair)

Sizewise (Bariatric Geri Chair, Sizewise Bedside Chair)

Gendron Inc. (Gendron Bariatric Transport Chair, Gendron Recliner 5748)

Promotal (part of Arjo Group) (Promotal Elineo Bariatric Chair, Promotal Midmark Examination Chair)

Key Users

Mayo Clinic

Cleveland Clinic

Johns Hopkins Hospital

HCA Healthcare

Kaiser Permanente

Bupa Health Clinics (UK)

Apollo Hospitals (India)

Mount Sinai Health System

Veterans Affairs (VA) Hospitals (U.S.)

Spire Healthcare Group (UK)

Stryker’s Xpedition powered stair chair received two prestigious International Design Excellence Awards (IDEA) in January 2025, a Bronze in the Medical & Health category, as well as the People’s Choice award. The chair was acknowledged for improving safety, efficiency, and user experience in emergency medical scenarios.

In June 2023, Joerns Healthcare formed a strategic partnership with Winncare to bring the Mangar Lifting Cushion portfolio to the U.S. These lift cushions bring patients from the floor back to seated or bed height in a manner meant to reduce caregiver injuries and improve patient care.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 15 Billion |

| Market Size by 2032 | USD 29.36 Billion |

| CAGR | CAGR of 7.75% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Automatic Adjustment, Manual Adjustment) • By End-use (Clinics, Hospitals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Graham-Field Health Products, Inc., Stryker Corporation, Invacare Corporation, Hillrom (Baxter International Inc.), Medline Industries, LP, Winco Mfg., LLC, Joerns Healthcare LLC, Sizewise, Gendron Inc., Promotal (part of Arjo Group) |

Ans. The projected market size for the Bariatric Medical Chairs Market is USD 958.8 million by 2032.

Ans: The North American region dominated the Bariatric Medical Chairs Market in 2023.

Ans. The CAGR of the Bariatric Medical Chairs Market is 7.28% during the forecast period of 2024-2032.

Ans: Limited Clinical Training and Handling Awareness Among Healthcare Workers Pose Operational Challenges in Utilizing Bariatric Medical Chairs Effectively.

Ans: The hospital segment dominated the Bariatric Medical Chairs Market.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence of Obesity-Related Conditions (2023)

5.2 Device Volume and Installation Trends (2020–2023, Forecast to 2032)

5.3 Feature Usage and Innovation Analysis (2023)

5.4 Regulatory and Safety Compliance by Region (2023)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Bariatric Medical Chairs Market Segmentation, By Type

7.1 Chapter Overview

7.2 Automatic Adjustment

7.2.1 Automatic Adjustment Market Trends Analysis (2020-2032)

7.2.2 Automatic Adjustment Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Manual Adjustment

7.3.1 Manual Adjustment Market Trends Analysis (2020-2032)

7.3.2 Manual Adjustment Market Size Estimates and Forecasts to 2032 (USD Million)

8. Bariatric Medical Chairs Market Segmentation, By End-use

8.1 Chapter Overview

8.2 Hospitals

8.2.1 Hospitals Market Trends Analysis (2020-2032)

8.2.2 Hospitals Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Clinics

8.3.1 Clinics Market Trends Analysis (2020-2032)

8.3.2 Clinics Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 Others

8.4.1 Others Market Trends Analysis (2020-2032)

8.4.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Bariatric Medical Chairs Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.2.3 North America Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.2.4 North America Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.2.5 USA

9.2.5.1 USA Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.2.5.2 USA Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.2.6 Canada

9.2.6.1 Canada Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.2.6.2 Canada Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.2.7 Mexico

9.2.7.1 Mexico Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.2.7.2 Mexico Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Bariatric Medical Chairs Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.3.1.3 Eastern Europe Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.3.1.4 Eastern Europe Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.3.1.5 Poland

9.3.1.5.1 Poland Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.3.1.5.2 Poland Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.3.1.6 Romania

9.3.1.6.1 Romania Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.3.1.6.2 Romania Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.3.1.7.2 Hungary Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.3.1.8.2 Turkey Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.3.1.9.2 Rest of Eastern Europe Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Bariatric Medical Chairs Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.3.2.3 Western Europe Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.3.2.4 Western Europe Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.3.2.5 Germany

9.3.2.5.1 Germany Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.3.2.5.2 Germany Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.3.2.6 France

9.3.2.6.1 France Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.3.2.6.2 France Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.3.2.7 UK

9.3.2.7.1 UK Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.3.2.7.2 UK Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.3.2.8 Italy

9.3.2.8.1 Italy Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.3.2.8.2 Italy Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.3.2.9 Spain

9.3.2.9.1 Spain Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.3.2.9.2 Spain Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.3.2.10.2 Netherlands Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.3.2.11.2 Switzerland Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.3.2.12 Austria

9.3.2.12.1 Austria Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.3.2.12.2 Austria Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.3.2.13.2 Rest of Western Europe Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Bariatric Medical Chairs Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.4.3 Asia Pacific Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.4.4 Asia Pacific Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.4.5 China

9.4.5.1 China Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.4.5.2 China Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.4.6 India

9.4.5.1 India Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.4.5.2 India Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.4.5 Japan

9.4.5.1 Japan Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.4.5.2 Japan Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.4.6 South Korea

9.4.6.1 South Korea Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.4.6.2 South Korea Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.4.7 Vietnam

9.4.7.1 Vietnam Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.2.7.2 Vietnam Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.4.8 Singapore

9.4.8.1 Singapore Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.4.8.2 Singapore Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.4.9 Australia

9.4.9.1 Australia Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.4.9.2 Australia Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.4.10.2 Rest of Asia Pacific Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Bariatric Medical Chairs Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.5.1.3 Middle East Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.5.1.4 Middle East Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.5.1.5 UAE

9.5.1.5.1 UAE Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.5.1.5.2 UAE Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.5.1.6.2 Egypt Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.5.1.7.2 Saudi Arabia Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.5.1.8.2 Qatar Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.5.1.9.2 Rest of Middle East Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Bariatric Medical Chairs Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.5.2.3 Africa Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.5.2.4 Africa Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.5.2.5.2 South Africa Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.5.2.6.2 Nigeria Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.5.2.7.2 Rest of Africa Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Bariatric Medical Chairs Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.6.3 Latin America Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.6.4 Latin America Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.6.5 Brazil

9.6.5.1 Brazil Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.6.5.2 Brazil Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.6.6 Argentina

9.6.6.1 Argentina Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.6.6.2 Argentina Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.6.7 Colombia

9.6.7.1 Colombia Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.6.7.2 Colombia Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Bariatric Medical Chairs Market Estimates and Forecasts, By Type (2020-2032) (USD Million)

9.6.8.2 Rest of Latin America Bariatric Medical Chairs Market Estimates and Forecasts, By End-use (2020-2032) (USD Million)

10. Company Profiles

10.1 Graham-Field Health Products, Inc.

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 Stryker Corporation

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Invacare Corporation

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Hillrom (Baxter International Inc.)

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Medline Industries, LP

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Winco Mfg., LLC

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Joerns Healthcare LLC

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Sizewise

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Gendron Inc.

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Promotal (part of Arjo Group)

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Automatic Adjustment

Manual Adjustment

By End-use

Clinics

Hospitals

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Probe Reprocessing Market was valued at USD 752.42 million in 2023 and is expected to reach USD 1985.18 million by 2032, growing at a CAGR of 11.27% from 2024 to 2032.

Natural Language Processing (NLP) in Healthcare and Life Sciences Market was valued at USD 4.94 billion in 2023 and is expected to reach USD 62.7 billion by 2032, growing at a CAGR of 32.6% over the forecast period 2024-2032.

Procedure Trays Market Size was valued at USD 18.6 Billion in 2023 and is expected to reach USD 47.45 billion by 2032, growing at a CAGR of 11% over the forecast period 2024-2032.

Overactive Bladder Treatment Market was valued at USD 3.63 billion in 2023 and is expected to reach USD 5.45 billion by 2032, growing at a CAGR of 4.64% over the forecast period 2024-2032.

Neovaginal Surgery Market was valued at USD 1.33 billion in 2023 and is expected to reach USD 2.11 billion by 2032, growing at a CAGR of 5.31% from 2024-2032.

The Digestive Health Supplements Market Size was valued at USD 51.65 Billion in 2023 and is expected to reach USD 111.96 Billion by 2032 and grow at a CAGR of 9.42% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone