Bamboo Cosmetic Packaging Market Report Scope & Overview:

The Bamboo Cosmetic Packaging Market Size was valued at USD 0.34 billion in 2023 and is projected to reach USD 0.62 billion by 2032 and grow at a CAGR of 6.85% over the forecast periods 2024 -2032. The bamboo cosmetic packaging market is flourishing due to a convergence of environmental and economic factors. Growing consumer awareness and a desire for sustainable solutions are driving demand for eco-friendly packaging like bamboo. This trend aligns perfectly with the rise of natural cosmetics and social media's influence on consumer preferences. Governments are taking a tough stance on plastic pollution with stricter regulations on packaging materials. This puts pressure on cosmetic companies to find eco-friendly alternatives. Bamboo packaging offers a compliant solution due to its biodegradability and compostability. As regulations tighten, consumer awareness and support for sustainable options like bamboo will likely increase.

Get More Information on Bamboo Cosmetic Packaging Market - Request Sample Report

Additionally, bamboo's rapid growth and versatility offer a cost-effective alternative for various industries, creating a lucrative opportunity for market players. However, volatile raw material prices and the persistent effects of pandemic on the cosmetics industry pose potential challenges to future growth.

MARKET DYNAMICS

KEY DRIVERS:

-

Consumers' growing environmental awareness is a key driver of the bamboo cosmetic packaging market's expansion.

The bamboo cosmetic packaging market is flourishing due to a confluence of trends. Consumers seeking convenience are embracing travel-sized packaging, while manufacturers are responding with eco-friendly options like push-up tubes and bamboo jars. This aligns perfectly with the rise of sustainable fashion and natural cosmetics, which prioritize environmentally responsible practices. Additionally, the growing need to reduce packaging's environmental footprint and the influence of social media promoting sustainable products are further accelerating market growth.

-

Urbanization, rising disposable incomes, and a growing focus on appearance are all fueling the bamboo cosmetic packaging market.

RESTRAINTS:

-

Production and processing can be more expensive compared to traditional materials like plastic.

Bamboo, a natural material, requires specific treatment processes like drying, curing, and shaping to ensure consistent quality and prevent cracking or warping. These additional steps add to the overall production cost compared to readily available and pre-treated plastic options.

-

The availability of bamboo can be impacted by seasonal factors, potentially leading to fluctuations in supply

OPPORTUNITY:

-

A growing trend in the packaging industry is the increasing demand for customized solutions.

Customization allows brands to tailor packaging to specific demographics or marketing campaigns. This can be particularly effective for seasonal promotions, limited edition products, or targeted advertising efforts.

-

The growing desire for eco-friendly, recyclable packaging presents a lucrative opportunity for companies in this market.

CHALLENGES:

-

The market's expansion could be hampered by the volatility of raw material prices.

-

Intricate or customized bamboo packaging designs might require specialized labor and equipment.

While plastic production can be highly automated, working with bamboo often requires more manual labor and specialized skills, particularly for intricate designs or finishes. This translates to higher labor costs for manufacturers.

IMPACT OF RUSSIA UKRAINE WAR

The war in Ukraine is disrupting the global packaging sector, causing disruptions that will likely reverberate for some time. Rising raw material prices and company shutdowns in Ukraine and Russia are creating ripple effects. Major cosmetic companies have halted operations in Russia, leading to a 14% market shrinkage and an 80% plunge in imports. While some brands remain available through parallel imports or local ownership changes, consumers face higher prices and potentially limited product selection. These disruptions are likely to have indirect consequences for the bamboo cosmetic packaging market, as the beauty industry adjusts its sourcing and production strategies in response to the war's ongoing impact.

IMPACT OF ECONOMIC SLOWDOWN

An economic slowdown can adversely affect the bamboo cosmetic packaging market in a few ways. As consumers become more cost-conscious, they might prioritize essential goods over beauty products, potentially reducing demand for bamboo packaging. Additionally, manufacturers facing pressure to cut costs might explore alternative packaging materials or simpler designs to reduce expenses. This could lead to a shift away from premium bamboo options. However, some consumers might still seek value in sustainable choices, potentially creating an opportunity for bamboo packaging that emphasizes affordability alongside its eco-friendly qualities.

KEY MARKET SEGMENTS

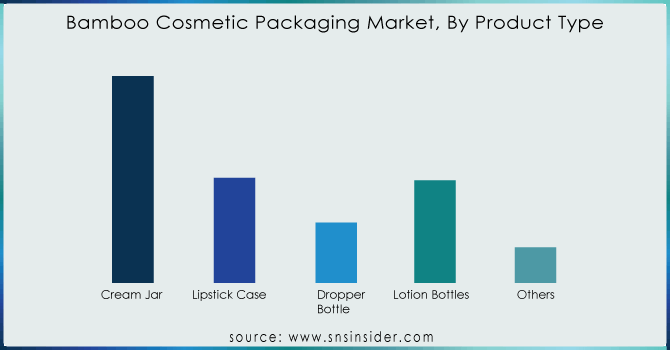

By Product Type

-

Cream Jar

-

Lipstick Case

-

Dropper Bottle

-

Lotion Bottles

-

Others

Lotion bottles dominating in the bamboo cosmetic packaging market, capturing a commanding 57.5% of market revenue. This dominance stems from the beauty industry's growing embrace of sustainable solutions. Bamboo, a more eco-friendly alternative to traditional plastics, aligns perfectly with this commitment to environmental responsibility. Consumers, increasingly prioritizing products that reflect their values, are driving the demand for eco-conscious options. Bamboo lotion bottles cater directly to this trend by offering a natural and sustainable alternative to conventional plastic bottles.

Need any customization research on bamboo cosmetic packaging market - Enquiry Now

By Application

-

Skincare

-

Makeup

-

Haircare

-

Other

Skincare products packaged in bamboo dominate the bamboo cosmetic packaging market, claiming a significant 56% share. This dominance reflects a confluence of factors. Firstly, rising disposable income empowers consumers to invest in self-care, leading to a surge in demand for high-quality skincare products. Secondly, this growing awareness of self-care extends to the packaging itself. Consumers are no longer satisfied with just functionality, they seek packaging that complements the premium quality of the product and elevates its visual appeal. Bamboo, with its natural aesthetic and sustainable qualities, perfectly aligns with these preferences, making it a popular choice for organic skincare products.

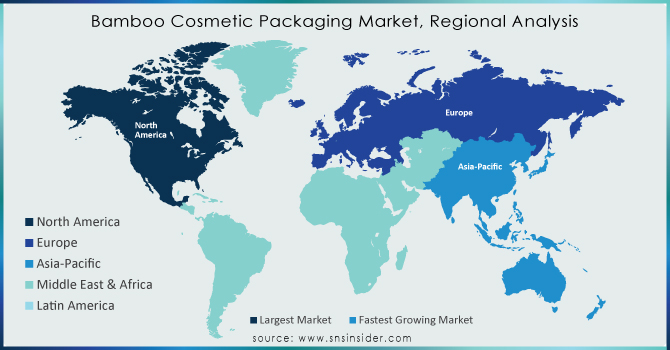

REGIONAL ANALYSIS

North America is poised for significant growth in the bamboo cosmetic packaging market, fueled by several key factors. The U.S., a major player in cosmetics and cosmetic packaging production, exports its products to various regions. American consumers are also significant contributors, with annual beauty product spending reaching a staggering $89.7 billion. Leading brands like L'Oreal, Unilever, and Estee Lauder showcase the industry's strength. Manufacturers in the region are increasingly recognizing the value of environmentally friendly packaging solutions. This aligns perfectly with the growing demand for natural products in the cosmetics industry.

Europe is a leader in the bamboo cosmetic packaging market, ranking second globally. Consumers are increasingly ditching single-use plastics and prioritizing eco-friendly options, mirroring the "Attenborough effect" on plastic awareness. This has spurred cosmetics companies to embrace PCR plastics where possible. Interestingly, Germany holds the largest market share within Europe, while the UK witnesses the fastest growth, showcasing regional variations in consumer preferences. The Asia-Pacific region is projected to lead the bamboo cosmetic packaging market growth. Social media influencers effectively reach this demographic, promoting eco-friendly choices. Growing environmental awareness among young Asians fuels the adoption of sustainable packaging like bamboo, paper, and glass. China leads the market share, while India experiences the fastest growth, reflecting regional variations in market dynamics.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key players

Some the major players in Bamboo Cosmetic Packaging Market are Amcor plc, Mondi, BALL CORPORATION, Tetra Pak, WestRock Company, Smurfit Kappa, Huhtamaki, Evergreen Packaging LLC, Berry Inc, Sealed Air, Crown, BASF SE, WINPAK LTD, Elopak, Bloom Eco Packaging, Sonoco Products Company And Others Players.

Amcor plc-Company Financial Analysis

RECENT DEVELOPMENT

-

BeGreen Packaging significantly expanded its capabilities in March 2022. This included adopting direct print-to-fiber technology and introducing a wider variety of geometric designs. These advancements are expected to optimize packaging efficiency and create visually striking options for their customers.

-

Huhtamäki Oyj acquired Jiangsu Hihio-Art Packaging Co. Ltd. in April 2021. This acquisition is expected to bolster Huhtamäki's presence in the Asian market and potentially expand its product portfolio in the region.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 0.34 Bn |

| Market Size by 2032 | US$ 0.62 Bn |

| CAGR | CAGR of 6.85% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Cream Jar, Lipstick Case, Dropper Bottle, Lotion Bottles, Others) • By Application (Skincare, Makeup, Haircare, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Mondi, Amcor plc, BALL CORPORATION, Tetra Pak, WestRock Company, Smurfit Kappa, Huhtamaki, Evergreen Packaging LLC, Berry Inc, Sealed Air, Crown, BASF SE, WINPAK LTD, Sonoco Products Company, Elopak, Bloom Eco Packaging |

| Key Drivers | • Consumers' growing environmental awareness is a key driver of the bamboo cosmetic packaging market's expansion. • Urbanization, rising disposable incomes, and a growing focus on appearance are all fueling the bamboo cosmetic packaging market. |

| Key Restraints | • Production and processing can be more expensive compared to traditional materials like plastic. • The availability of bamboo can be impacted by seasonal factors, potentially leading to fluctuations in supply |