Baggage Scanners Market Report Scope & Overview:

Get More Information on Baggage Scanners Market - Request Sample Report

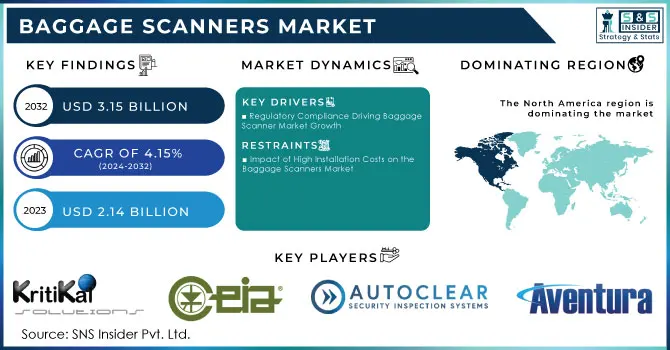

The Baggage Scanners Market Size was valued at USD 2.14 Billion in 2023 and is expected to reach USD 3.15 Billion by 2032 and grow at a CAGR of 4.15% over the forecast period 2024-2032.

The baggage scanner market is growing significantly and shall be continuing in the same trend for few more years. Rising illegal and terrorist activities worldwide and growth in security awareness in public places are the major factors driving the market.

Different colors on the screen are employed by the baggage scanner to ascertain whether or not any dangerous object exists in it. Its applications are employed in security for end-users such as railway stations, border checkpoints, airports, educational institutes, and commercial facilities. Development and upgrading of railway stations and airports along with the proper implementation of government policies and regulations related to public safety at railway stations, airports, security checkpoints, and state borders are expected to provide promising opportunities for the growth of the baggage scanner market. At present, the market share of 87.7% is accounted for by baggage handling systems, whereas an increase in the baggage management system, including reconciliation, tracking, tracing, and messages is expected to occur at a higher pace as airports and airlines pay more attention to minimizing baggage mishandling.

Baggage Scanners Market Dynamics

Key Drivers:

-

Regulatory Compliance Driving Baggage Scanner Market Growth

Strong regulations by the government and stronger safety measures on baggage screening have affected the market of baggage scanners in terms of demand from facilities around the world that seek leading scanning technologies. Governments and international agencies introduced stricter rules, such as the United States Transportation Security Administration (TSA) and the European Union Aviation Safety Agency (EASA), and introduced strict regulations to induct more security provisions at airports, railway stations, and other transportation centres. For instance, the presence of explosives detection systems and advanced imaging technology in checking each piece of baggage ensures that checked baggage is screened. Transportation security which received USD 7.4 billion in 2024 is an example. Although the methodology in this work is based on discrete statistics, sequential testing methods have encompassed continuous models. Sequential testing to quantify the limit of detection (LOD) of trace detection systems is standardized in ASTM E2677-2018. The testing standard explicitly cautions that proprietary signal processing can affect the Gaussian analysis of the LOD, and notes the security and classification issues that attend the LOD of explosives. The ASTM procedure requires the preparation of exploratory measurement samples to bracket the LOD for systematic statistical testing, with an optimum testing sample set of 4 × 12 samples, so potentially it has a greater experimental burden than a binary test. The binary testing of the instrument based on the methodology of this paper is viable for evaluating the suitability of a system for explosives screening, as appropriate or convenient.

Restrain:

-

Impact of High Installation Costs on the Baggage Scanners Market

The high costs of installation of baggage scanning systems make it economically unviable for low-profile operations in regional airports and transit stations. Some advanced scanning technology will attract an initial investment of at least USD 50,000 and upwards of USD 150,000. This potential cost may discourage prospective buyers from embracing these new security measures that are required to meet the high demands of the government. For instance, the Transportation Security Administration has allocated billions of dollars annually to enhance security systems at airports, with a strong push towards the use of state-of-the-art scanning technologies. Small operators, on the other hand, may find it difficult to justify such costs against budget constraints, leaving outdated systems that do not meet today's needs for security requirements. By the Numbers; it's been the busiest in TSA history. We've seen pretty busy spring and summer travel seasons, and this year we are on track to screen over 800 million passengers and crew, plus all their checked and carry-on bags. That's compared to 771 million passengers and crew screened last year. But we're not just working harder-we're working smarter and more strategically. In the spring we published the TSA strategy, and facilities that cannot afford these investments will grow more slowly and be more vulnerable to security threats. This process, in turn, leads to lower growth of the overall market since advanced baggage scanning technology must be broadly adopted for an improvement in safety over public transportation sectors.

Baggage Scanners Market Segmentation Overview

By System Type

X-ray scanners Are the fastest-growing market with the highest CAGR of 5.72% in the forecasted period 2024-2032. because of the unmatched Efficiency of Threat Detection and baggage scanning. Phishing remains a significant threat since most technological efforts to warn users of potential threats have proven futile. A recent phishing cost study projected that for a large business, the annual expenditure would be 3.7 million dollars. Research reveals that there is a huge market of personal data in which fresh credit card data fetches between 20 and 45 dollars per card. The overall number of phishing attacks in 2016 was 1,220,523 representing a 65% increase over 2023. Their ability to produce detailed, multi-dimensional images of contents in luggage ensures much better scrutiny meeting very stringent security demands. This is further solidified by the continued technological advancement for X-ray scanning, such as adding AI and high-resolution capabilities.

RFID is dominating the market share with 56% in the forecasted period. scanning segment in the baggage scanner market is gaining traction due to its efficiency in tracking and managing luggage. RFID technology enables real-time monitoring of bags throughout their journey, significantly reducing the chances of loss or misplacement. This system enhances operational efficiency and improves the passenger experience by providing accurate data on bag locations. As the demand for seamless travel experiences rises, the RFID segment is projected to grow, complementing traditional X-ray scanning methods.

By End User Type

The Transit Stations projected dominance, which captured a massive 18.00% of market share in the baggage scanner market up to 2023, shall be a result of persistent global travel and urbanization. Transit hubs are critical nodes where large volumes of baggage require efficient and thorough scanning, underlining the need for innovative technology. Their strategic position in securing mass transit requires sustained investments, stringent security measures, and ongoing innovations in technology so that safety for passengers can be ensured along with the process of baggage handling, making them indispensable in the long run in the market.

The Airport segment holds the maximum growth rate of CAGR of 6.34% in the market for baggage scanners during the forecast period 2024-2032. because air travel volumes are likely to increase to 4.5 billion passengers by 2025, and airports are investing in leading-edge security technologies to improve the safety of passengers and smooth out their processes impacting the cash flow of airlines and airports. The majority of the projects have been delayed, and only a few were terminated. The market for baggage handling systems is expected to witness a trough phase in 2020. Similarly, in the marine industry, cruise ships were not allowed to disembark at various ports of Southeast Asian countries as there was a threat of importing the virus by passengers and crew with the infection.

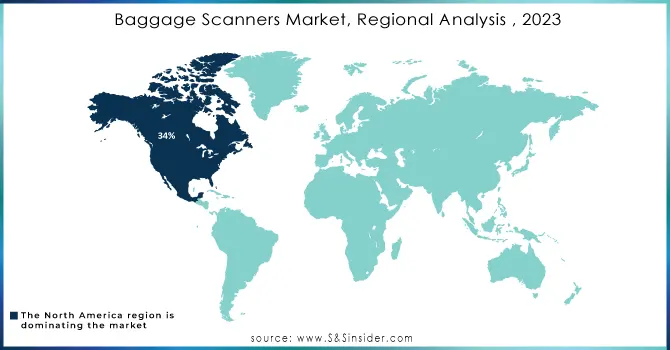

Baggage Scanners Market Regional Analysis

North America and Europe have been the foremost regional markets owing to stringent legislation regarding public safety. The Asia Pacific market would increasingly rise in terms of the adoption of baggage scanners due to the increase in terrorist attacks. The North American market would garner around 34% market share in the year 2023 due to its prominent number of airports. For instance, the 9/11 attack in 2001 made it inevitable to deploy airport scanners at all international and domestic airports in the United States. The Asia Pacific market would exhibit a major CAGR of 6.34% during the predicted period of 2024-2030.

In The Asia Pacific region, the Construction of many airports has taken place in countries such as China and Japan, mainly due to increasing globalization. In India, there are over 400 airports and airstrips, out of which 135 operate. More than 376 million passengers utilize airports across India, with international passengers approximating 69.6 million numbers, all in a single financial year of 2024. Passenger traffic exceeds the record of the previous year, 2019, and increased by 15 percent from last year, 2023. Along with several multinational companies establishing their bases in the region, demand for business travel by the employees in the company is increasing and might also increase the count of passengers in airports.

Need Any Customization Research On Baggage Scanners Market - Inquiry Now

Key Players in Baggage Scanners Market

Some of the major players in the Baggage Scanners Market are:

-

KritiKal Securescan (X-ray Inspection Systems, Explosive Trace Detection Systems)

-

Protective Technologies (X-ray Inspection Systems, Explosive Trace Detection Systems)

-

C.E.I.A. (X-ray Inspection Systems, Metal Detection Systems)

-

Autoclear (X-ray Inspection Systems, Explosive Trace Detection Systems)

-

Aventura Technologies (X-ray Inspection Systems, Metal Detection Systems)

-

Braun International (X-ray Inspection Systems, Metal Detection Systems)

-

Gilardoni (X-ray Inspection Systems, Explosive Trace Detection Systems)

-

Pony (X-ray Inspection Systems, Metal Detection Systems)

-

Vidisco (X-ray Inspection Systems, Explosive Trace Detection Systems)

-

Hamamatsu (X-ray Inspection Systems, Explosive Trace Detection Systems)

-

MB Telecom (X-ray Inspection Systems, Metal Detection Systems)

-

RAPISCAN SYSTEMS LTD (X-ray Inspection Systems, Explosive Trace Detection Systems)

-

SAFRAN MORPHO (Biometric Identification Systems, Access Control Systems)

-

SMITH DETECTION (X-ray Inspection Systems, Explosive Trace Detection Systems)

-

Suresca (X-ray Inspection Systems, Metal Detection Systems)

-

Crisplant (Conveyor Systems, Baggage Handling Systems)

-

Astrophysics Inc. (X-ray Inspection Systems, Explosive Trace Detection Systems)

-

Glidepath (Conveyor Systems, Baggage Handling Systems)

-

G&S Airport Conveyor (Conveyor Systems, Baggage Handling Systems)

-

GE Security (Inspection Systems, Explosive Trace Detection Systems)

Recent Trends

-

In February 2023, Smiths Detection, a global leader in threat detection and security screening, unveiled the HI-SCAN 6040 CTiX Model S. It is a more compact variant of the widely acclaimed Computed Tomography (CT) checkpoint scanner designed to improve passenger security screenings. The model maintains all the advanced imaging capabilities of its predecessor; in fact, it is much more efficient for security operators but in a more space-saving format.

-

In September 2024, Micro-X unveiled its next-generation baggage scanner at a global airport security event. The company is now trailing new scanning technologies to efficiently improve baggage checking and enhance threat detection in airports across the globe. The presentation underlined the scanner's ability to successfully meet current and growing demands for aviation security worldwide.

-

In September 2023, Smiths Detection said it would deploy 3D cabin bag scanners at Indian airports by the end of 2023. Passengers would be allowed to leave electronic devices and liquids in their bags, helping minimize security processing time at airports.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.14 Billion |

| Market Size by 2032 | US$ 3.15 Billion |

| CAGR | CAGR of 4.5 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By End Users Type (Transit Stations, Airports, Border Checkpoints, Commercial Facilities, Others) • By System Type (RFID Baggage Scanners, X-Ray Baggage Scanners) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | KritiKal Securescan, Braun International, Protective Technologies, C.E.I.A., Autoclear, Aventura Technologies, Braun International, Gilardoni, Pony, Vidisco, Hamamatsu, MB Telecom, RAPISCAN SYSTEMS LTD, SAFRAN MORPHO, SMITH DETECTION, Suresca, Crisplant, Astrophysics Inc., Glidepath, G&S Airport Conveyor |

| Key Drivers | • Regulatory Compliance Driving Baggage Scanner Market Growth |

| Restraints | • Impact of High Installation Costs on the Baggage Scanners Market |