Bacterial & Viral Specimen Collection Market Size Analysis

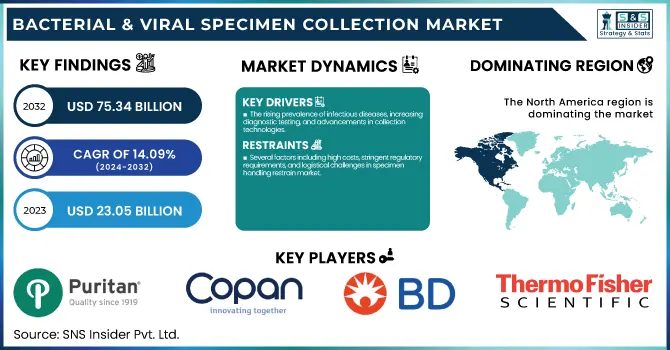

The Bacterial & Viral Specimen Collection Market size was estimated at USD 23.05 Billion in 2023 and is projected to reach USD 75.34 Billion by 2032 and grow at a CAGR of 14.09% over the forecast period 2024-2032.

This report emphasizes the growing prevalence and incidence of bacterial and viral infections as key drivers of demand for sophisticated specimen collection kits. The research identifies regional trends in the use of specimen collection kits and volume distribution, illustrating differences in adoption rates across various markets.

To Get more information on Bacterial & Viral Specimen Collection Market - Request Free Sample Report

It also discusses healthcare expenditure on specimen collection, breaking down contributions from government, commercial, private, and out-of-pocket spending. The report also evaluates R&D investment and innovation patterns with a focus on developments in collection technologies, automation, and the creation of more efficient and precise diagnostic solutions.

Bacterial & Viral Specimen Collection Market Dynamics

Drivers

-

The rising prevalence of infectious diseases, increasing diagnostic testing, and advancements in collection technologies.

The increasing incidence of bacterial infections like tuberculosis, pneumonia, and sepsis, as well as viral infections like influenza, COVID-19, RSV, and HIV, is heavily driving the demand for specimen collection. For example, 10.6 million people worldwide were affected by tuberculosis in 2022, necessitating widespread bacterial specimen collection for diagnosis. Moreover, the increased use of molecular diagnostics, PCR testing, and point-of-care testing (POCT) has also boosted the demand for high-quality specimen collection kits. Innovations like flocked swabs and viral inactivation feature transport media have increased market growth further. Increased adoption of home-testing solution for viral infections, such as at-home COVID-19 and flu testing kits, has further propelled market growth. Disease surveillance and preparation initiatives by the government, such as the CDC's investment in early detection initiatives, are also major drivers. In addition, the growing trend of antimicrobial resistance (AMR) has initiated more bacterial culture and sensitivity testing, which has increased demand for innovative specimen collection solutions. With ongoing innovation in technology and rising awareness regarding infectious disease testing, the market will experience steady growth during the forecast period.

Restraints

-

Several factors including high costs, stringent regulatory requirements, and logistical challenges in specimen handling restrain market.

The price of advanced specimen collection kits, e.g., molecular transport media and specialty swabs, can be exorbitantly high, especially in low-resource and developing areas. New specimen collection devices undergo rigorous regulatory clearance, with regulatory bodies like the FDA and WHO having strict testing requirements for product validation, safety, and performance. Meeting such standards raises R&D costs and delays product introductions. Further, inappropriate specimen collection, contamination risks, and mishandling cause false negatives or misleading results, decreasing testing reliability and hindering adoption. A non-standardization of specimen collection protocols among laboratories also affects consistency in results. Disruptions to supply chains, such as occurred with the COVID-19 pandemic, also deter market growth by resulting in shortages of critical components such as swabs and viral transport media. Furthermore, the presence of alternative diagnostic platforms, including direct pathogen detection through rapid molecular tests, will decrease the reliance on conventional specimen collection. Such factors pose limitations to broad utilization, especially within resource-constrained environments where the need for low-cost solutions becomes paramount.

Opportunities

-

Technological advancements, increasing investment in infectious disease research, and the rising demand for home-based testing solutions.

The introduction of self-collection kits for bacterial and viral infections, including at-home saliva-based COVID-19 and HPV testing, provides patient convenience and accessibility without overburdening healthcare facilities. Advances in transport media with pathogen inactivation features, including PrimeStore MTM, improve biosafety and sample stability and are well suited for use in global disease surveillance. The growing interest in pandemic preparedness has resulted in higher government investment and subsidies in diagnostic facilities, where a need for sophisticated collection solutions is created. Opportunities are also seen in emerging markets, as there is growing investment by developing nations in the monitoring of diseases and diagnostic testing. The use of artificial intelligence (AI) and automation in sample handling is further optimizing laboratory processes, making them more efficient and accurate. Firms are also concentrating on biodegradable and sustainable specimen collection products to meet worldwide environmental regulations. Partnerships between public health organizations and diagnostic firms to create rapid response collection solutions for new outbreaks will also drive market growth. The growing interest in personalized medicine and microbiome research is also opening up new opportunities for specimen collection technologies.

Challenges

-

Market faces several challenges, including supply chain disruptions, biohazard risks, and limited access to testing in low-resource settings.

The pandemic of COVID-19 revealed vulnerabilities in the international supply chain, with swab, collection tube, and transport media shortages affecting diagnosis. Maintaining a consistent supply of good-quality specimen collection materials continues to be a significant challenge, particularly amid unexpected outbreaks. Furthermore, biosafety hazards for handling contaminated specimens need robust protocols and specialized containment procedures, raising the complexity of operations. Temperature control during storage and transport is essential, with temperature changes capable of breaching sample integrity and producing unreliable test results. Restricted access in rural and underserved areas further limits market penetration, with infrastructure shortcomings in laboratory facilities and trained staff for handling specimens prevailing in many regions. Further, patient adherence to self-collection protocols may affect sample quality, resulting in unreliability of test accuracy. The problem of differentiating bacterial and viral infections by mere specimen collection further hampers diagnostic decision-making. All these problems must be addressed with investments in effective supply chain management, improved biosafety practices, and better access to high-quality specimen collection products worldwide in all healthcare settings.

Bacterial & Viral Specimen Collection Market Segmentation Analysis

By Product

The bacterial specimen collection segment was the leader in the bacterial and viral specimen collection market in 2023, with a 68.5% revenue share. This is due to the huge global burden of bacterial infections, such as tuberculosis, pneumonia, and sepsis, that need widespread diagnostic testing. Moreover, the increased focus on antimicrobial resistance (AMR) has fueled greater bacterial specimen collection for surveillance and research.

Meanwhile, viral specimen collection is the most rapidly expanding segment, stimulated by growing need for respiratory virus testing solutions such as influenza, RSV, and novel forms of COVID-19. Increasing popularity of point-of-care and home-based viral testing has further propelled market growth.

By Application

The diagnostic applications segment had the highest market share in 2023 and generated 78.4% of overall revenue. The widespread demand for viral and bacterial diagnostic testing, especially in diagnostic labs and hospit als, has driven market leadership. The rise in government programs for infectious disease screening and public health monitoring has further increased the segment's leadership.

The segment of research applications is growing at the fastest rate, because increasing investments in research on infectious diseases and vaccine development are fueling demand for high-quality specimen collection. Increasing emphasis on genomic studies as well as research on drug resistance is also propelling market growth in this segment.

By End-use

The hospitals and clinics segment captured the highest revenue share in 2023, at 62.2% of the overall market. Hospitals and clinics continue to be the main infectious disease diagnosis centers, with a growing number of patient visits for bacterial and viral tests. The inclusion of sophisticated laboratory infrastructure and government-sponsored screening programs also helped to drive the segment's dominance.

The home testing segment is the most rapidly growing, fueled by growing demand for self-collection kits and remote diagnosis. Growth of telemedicine, together with the demand among consumers for easy-to-use, in-home diagnostic options for viral and bacterial infections, has considerably pushed the growth of this segment.

Bacterial & Viral Specimen Collection Market Regional Insights

In 2023, North America was leading the bacterial and viral specimen collection market, contributing 49.8% revenue share. Its leadership is most influenced by its well-established health infrastructure, favorable diagnostic test rate, and aggressive government initiatives on infectious disease monitoring. The United States, in turn, saw a huge demand for viral and bacterial specimen collection because of the widespread incidence of respiratory infections, sexually transmitted infections (STDs), and antimicrobial-resistant bacterial strains. Also, the large-scale implementation of molecular diagnostics, combined with supportive reimbursement policies, has further strengthened North America's leadership in the market. The dominance of major industry players and ongoing investments in research and development further support the region's grip.

While the market is dominated by North America, the fastest-growing segment is the Asia Pacific region due to growing awareness of healthcare, infectious disease incidence, and developing diagnostic capabilities. China, India, and Japan are witnessing heightened demand for collection of bacterial and viral specimens based on government-funded disease surveillance schemes and increased investment in diagnostic infrastructure. The growth in home-based testing solutions and growing affordability and availability of specimen collection kits has further fast-forwarded market growth in the region. Furthermore, pandemic preparedness efforts and the rise in private diagnostic laboratories have given impetus to the swift market growth in Asia Pacific.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Bacterial & Viral Specimen Collection Market

-

Puritan Medical Products – PurFlock Ultra, HydraFlock Swabs, Opti-Swab

-

COPAN Diagnostics – FLOQSwabs, UTM (Universal Transport Medium), eSwab

-

Becton, Dickinson and Company (BD) – BD ESwab, BD Universal Viral Transport System (UVT), BD Vacutainer

-

Thermo Fisher Scientific, Inc. – MicroTest Swabs, Remel Transport Media, Nalgene Sample Collection Bottles

-

Quidel Corporation – Lyra Direct SARS-CoV-2 Assay, QuickVue At-Home OTC COVID-19 Test

-

Longhorn Vaccines and Diagnostics, LLC – PrimeStore MTM, PrimeStore ATM

-

Pretium Packaging – Diagnostic Sample Collection Containers, Transport Media Bottles

-

Trinity Biotech – Uni-Gold HIV, TrinScreen HIV, Auto4FLOK Swabs

-

Medical Wire & Equipment – Transwab, Sigma Virocult, Sigma Swab

-

HiMedia Laboratories – Transport Swabs, Viral Transport Medium (VTM), Bacterial Culture Media

-

Hardy Diagnostics – HardySwab, HardyVal Transport Systems, Transport Tubes

-

Nest Scientific – Cryogenic Vials, Sample Collection Tubes

-

VIRCELL S.L. – AmpliRun DNA/RNA Controls, VirClia Monotest

-

DiaSorin – Simplexa COVID-19 Direct, LIAISON MDX Viral Detection Kits

-

Titan Biotech – Viral Transport Medium (VTM), Microbial Culture Media

Recent Developments in the Bacterial & Viral Specimen Collection Market

In July 2024, Longhorn Vaccines and Diagnostics expanded the use of PrimeStore MTM for H5N1 testing in dairy cows in collaboration with the USDA. The company is advancing its universal influenza vaccine (LHNVD-110) with IND-enabling studies ahead of a Phase 1 clinical trial in Q1 2025. Additionally, late-stage preclinical development continues for LHNVD-302, an anti-sepsis vaccine with extended half-life antibodies.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 23.05 billion |

| Market Size by 2032 | USD 75.34 billion |

| CAGR | CAGR of 14.09% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [Bacterial Specimen Collection (Swabs, Bacterial Transport Media, Blood Collection Kits, Other Consumables), Viral Specimen Collection (Swabs, Viral Transport Media, Blood Collection Kits, Other Consumables)] By Application [Diagnostics, Research] By End-use [Hospitals & Clinics, Home Testing, Research Laboratories] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Puritan Medical Products, COPAN Diagnostics, Becton, Dickinson and Company (BD), Thermo Fisher Scientific, Inc., Quidel Corporation, Longhorn Vaccines and Diagnostics, LLC, Pretium Packaging, Trinity Biotech, Medical Wire & Equipment, HiMedia Laboratories, Hardy Diagnostics, Nest Scientific, VIRCELL S.L., DiaSorin, Titan Biotech. |