Get more information on Backscatter X-ray Devices Market - Request Sample Report

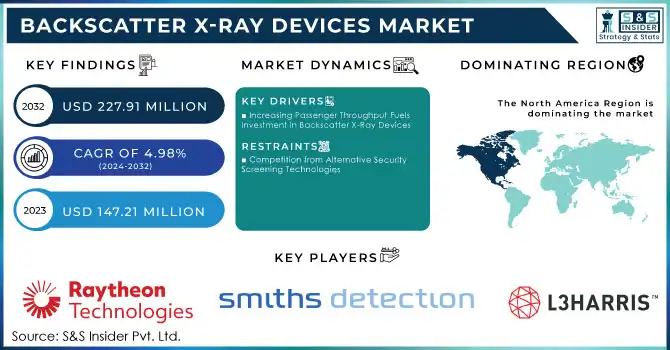

The Backscatter X-ray Devices Market Size was valued at USD 147.21 Million in 2023 and is expected to reach USD 227.91 Million by 2032 and grow at a CAGR of 4.98% over the forecast period 2024-2032.

The Backscatter X-Ray Devices market is evolving rapidly, primarily driven by the integration of artificial intelligence (AI) and machine learning technologies, which significantly enhance threat detection accuracy, making backscatter systems more appealing to various end-users, including security agencies and airport authorities. As security concerns escalate globally, the demand for efficient, non-intrusive scanning solutions in customs and border protection, airport security, and military applications continues to rise. Moreover, the proliferation of smart technologies across different sectors facilitates the deployment of backscatter systems in mixed-use properties and critical infrastructure. Innovative solutions, such as low-power Bluetooth backscatter communications, are also being developed to optimize energy efficiency in these devices. The market is witnessing increased investments in advanced imaging technologies that improve operational efficiency while adhering to stringent regulatory requirements. Key players in the industry are focusing on enhancing product capabilities through technological integration, which is expected to propel market growth significantly in the coming years. With applications expanding into areas like IoT communications and smart homes, the Backscatter X-Ray Devices market stands poised for substantial growth, addressing the urgent need for enhanced security measures worldwide.

The Backscatter X-Ray Devices market is poised for significant growth, primarily driven by the recovery of international travel and the increasing volume of global trade. As countries reopen their borders and international travel resumes, the demand for enhanced security screening solutions at airports and customs facilities is becoming paramount. Airports are investing heavily in advanced technologies to streamline security processes, improve passenger throughput, and enhance safety measures against evolving threats. Backscatter X-ray systems offer non-intrusive scanning capabilities, which are essential for detecting contraband, explosives, and other security risks without compromising the flow of travelers. Global trade dynamics, influenced by shifting supply chains and geopolitical tensions, are pushing customs facilities to adopt more sophisticated screening solutions to ensure compliance with safety regulations. Recent studies found that a 10% increase in immigrants from a particular country residing in one of the 38 Organization for Economic Cooperation and Development member states leads to a 2.08% increase in the value added from their home country embedded in their host country’s exports to the world. This effect is strongest in the services sector, followed closely by agriculture and manufacturing.

Moreover, the cost to apply or renew Global Entry, NEXUS, and SENTRI increased for the first time in over 15 years, reflecting the growing importance of efficient travel and security measures. As the fee for NEXUS rose by 140% from USD 50 to USD 120, and the cost for Global Entry increased by 20%, from USD 100 to USD 120, travelers seeking expedited entry will expect enhanced screening technologies at airports. This increase in travel demand, coupled with the rising emphasis on security, positions backscatter X-ray devices as essential in facilitating safe and efficient global travel and commerce.

Drivers

Increasing Passenger Throughput Fuels Investment in Backscatter X-Ray Devices

As airports work to improve the passenger experience, reducing wait times has emerged as a key motivator for investing in security technologies, particularly backscatter X-ray devices. This surge in travelers highlights the pressing need for efficient screening methods to effectively manage the growing influx of passengers. The implementation of backscatter X-ray devices plays a vital role in enhancing airport security by enabling rapid and precise detection of concealed threats. Their capability to deliver high-resolution images allows security personnel to quickly identify potential risks, ensuring a smoother and safer boarding process. Additionally, experts have noted a rise in passenger flow at the Ukraine-Poland border, underscoring the necessity of effective security solutions in high-traffic environments. This increased passenger throughput aligns with broader efforts to modernize airport infrastructure and enhance operational efficiency. Recent statistics reveal that Emirates has introduced new measures to address the rising passenger numbers, reflecting a global trend towards improved security systems. As airports strive to accommodate growing traveler volumes, the strategic deployment of backscatter X-ray systems becomes crucial. Furthermore, the growing emphasis on technological advancements within the aviation sector has led to innovative upgrades in screening methods, reinforcing the importance of advanced solutions like backscatter X-ray devices. As the TSA anticipates a busy travel season with an expected nearly 6% increase in passengers from the previous year, the role of effective security technology will be essential in meeting heightened passenger expectations. Ultimately, the drive for increased passenger throughput serves as a significant market driver for the backscatter X-ray device industry, emphasizing the need for ongoing advancements in security technology to address evolving demands.

Restraints

Competition from Alternative Security Screening Technologies

The security screening market is undergoing significant transformation, with various alternative technologies emerging as formidable competitors to backscatter X-ray devices. One prominent option, millimeter-wave scanners, utilizes non-ionizing radiation to efficiently detect concealed threats, such as weapons and explosives, while avoiding the health risks associated with ionizing radiation. Their capability to generate high-resolution images makes them particularly attractive to airports, improving both safety and public trust. Furthermore, advanced imaging technologies, including computed tomography (CT) scanners and dual-energy X-ray systems, offer enhanced imaging that boosts the accuracy of threat detection. CT scanners, for instance, produce three-dimensional images that minimize false positives and optimize the screening process in high-traffic areas. Many of these alternative technologies are characterized by lower operational costs, requiring less maintenance compared to backscatter X-ray systems. This cost-effectiveness appeal to budget-conscious airports and security agencies striving to uphold rigorous security standards. Finally, increasing awareness of the health risks associated with ionizing radiation has led to greater traveler concerns, fostering a preference for non-invasive technologies. Collectively, these factors pose significant challenges to the growth and adoption of backscatter X-ray devices, compelling stakeholders to innovate continuously to remain competitive in the market.

by Type

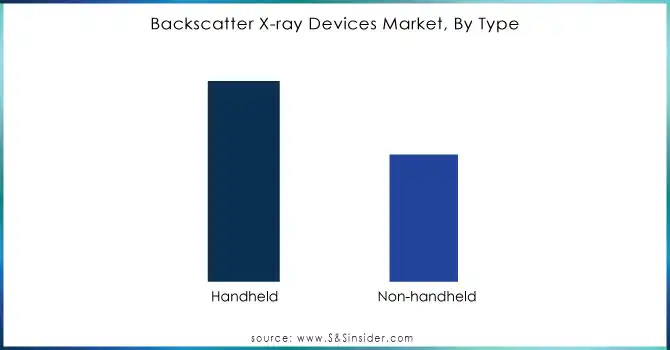

Based on Type, Non-handheld backscatter X-ray devices dominate the market, accounting for approximately 60% of total revenue in 2023. This significant share is due to their numerous advantages in various security applications. Primarily deployed in fixed locations like airports and government buildings, these systems allow for the comprehensive scanning of large volumes of passengers and luggage, ensuring rapid throughput and accuracy. Equipped with advanced imaging technology, non-handheld devices deliver high-resolution images that enable security personnel to quickly identify concealed threats, reducing false positives and enhancing safety. Their fixed installation facilitates higher passenger throughput compared to handheld alternatives, crucial for busy environments. Additionally, non-handheld systems can seamlessly integrate into existing security infrastructures, allowing for upgrades without the need for extensive overhauls, making them cost-effective. They also comply with regulatory mandates for advanced screening technologies in high-risk areas. The growing demand for reliable screening solutions, driven by rising security concerns and technological advancements, is propelling market growth. Key product launches in 2023, such as Smiths Detection's HI-SCAN 6040aTiX and L3Harris's Z Backscatter Van, further emphasize the innovation and ongoing expansion of non-handheld backscatter X-ray systems in the security landscape.

Get Customized Report as per your Business Requirement - Request For Customized Report

by Application

In the backscatter X-ray devices market, the Customs and Border Protection (CBP) segment has emerged as a significant player, capturing around 39% of total revenue in 2023. This prominence is driven by the urgent need for robust security measures at borders and customs checkpoints, where threats like smuggling and trafficking are prevalent.

Several factors are fueling the growth of this segment. Firstly, the increasing global security threats necessitate advanced screening technologies, with backscatter X-ray devices playing a crucial role in detecting concealed weapons, explosives, and illegal goods, thereby enhancing national safety. Additionally, these systems provide rapid screening capabilities, allowing for the quick inspection of vehicles and cargo without sacrificing thoroughness—essential in high-traffic border situations. Continuous technological advancements in imaging and data analysis have further improved their effectiveness in identifying hidden threats. Compliance with stricter regulatory requirements across nations has also driven the deployment of these devices. Recent innovations by key industry players have strengthened CBP operations.

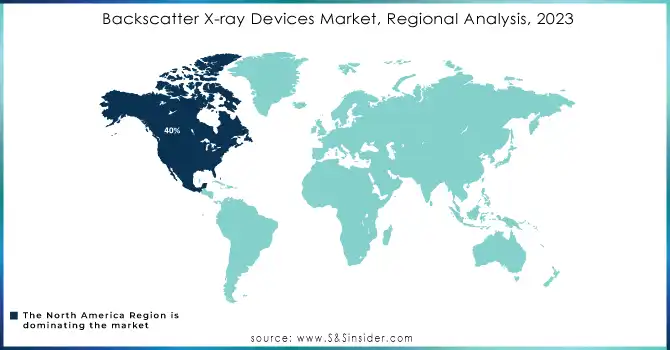

In 2023, North America emerged as the leading region in the backscatter X-ray devices market, capturing around 40% of total revenue. This dominance is attributed to several critical factors underscoring the region's commitment to enhancing security across various sectors. The United States serves as the main contributor, benefiting from substantial investments in border security and airport screening technologies. Canada and Mexico also play significant roles, with both countries increasing border security measures and improving customs operations to strengthen regional safety. For example, Canadian airports are progressively adopting advanced screening technologies, while Mexico is enhancing customs inspections to combat smuggling effectively. Stringent security standards in North America necessitate the widespread use of advanced screening technologies in airports and customs facilities, enabling the effective detection of concealed threats such as weapons and explosives. Continuous investments in modernizing airport and border security infrastructure further drive market growth, as expanding transportation networks require the integration of state-of-the-art security solutions. Rapid advancements in imaging technology and data analysis are enhancing the capabilities of backscatter X-ray devices. Strict regulatory frameworks at both federal and state levels mandate the use of such technologies, propelling demand as organizations seek compliance with legal requirements.

In 2023, the Asia Pacific region emerged as the fastest-growing market for backscatter X-ray devices, driven by an increasing emphasis on security and infrastructure development. Countries like China, India, Japan, and Australia are making significant investments to modernize their security frameworks. For example, China is rapidly expanding its airport facilities and enhancing border security to manage rising traveler numbers. Similarly, India is upgrading airport security and customs operations to combat smuggling and ensure passenger safety, while Japan is reinforcing security measures in preparation for major international events. Heightened security threats, including terrorism and smuggling, have prompted governments in the region to adopt stringent measures. Backscatter X-ray systems play a crucial role in detecting concealed threats, enhancing the safety of both travelers and goods. The region is also witnessing rapid technological advancements, with local manufacturers investing in research and development to create more efficient backscatter X-ray systems that align with global standards. Furthermore, supportive regulatory frameworks are driving demand for these advanced screening technologies as organizations work to meet evolving security requirements. Overall, the Asia Pacific market is positioned for robust growth, reflecting a strong commitment to enhancing security and operational efficiency.

Key Players

Some the Key Players in Backscatter X-Ray Devices Market with product:

Smiths Detection (HI-SCAN 6040aTiX, HI-SCAN 1000)

L3Harris Technologies (Z Backscatter Van, ZBV)

Raytheon Technologies (RTS-24 Backscatter System, HVI 6000)

Analogic Corporation (SecureView 1000, SecureView 4000)

Nuctech Company Limited (Nuctech CTX 9800, Nuctech P800)

Astrophysics Inc. (Eagle P40, Eagle P60)

Zensors, Inc. (Zensors Backscatter X-Ray Systems)

Savi Technology, Inc. (Savi X-Ray Inspection Systems)

Varec, Inc. (Varec Backscatter Systems)

Bionyx Corporation (Bionyx Backscatter X-Ray Solutions)

Fujifilm Holdings Corporation (Fujifilm X-ray Imaging Systems)

General Electric (GE) (GE Backscatter X-Ray Systems)

Varian Medical Systems (Varian X-Ray Inspection Systems)

Teledyne Technologies (Teledyne Backscatter Systems)

Toshiba Corporation (Toshiba Backscatter X-Ray Devices)

HITACHI (HITACHI X-Ray Inspection Systems)

Eagle Technology, Inc. (Eagle X-Ray Solutions)

Datalogic S.p.A. (Datalogic X-Ray Detection Systems)

Varec, Inc. (Varec Security X-Ray Systems)

IMEDCO AG (IMEDCO X-Ray Solutions)

List of Third-party suppliers and manufacturers that provide components or services for backscatter X-ray devices:

HITACHI

Luminus Devices, Inc.

Teledyne DALSA

Toshiba

GE Healthcare

Hamamatsu Photonics

North Star Imaging

RevolutionX

Nikon Metrology

RadiaBeam Technologies

Recent Development

On May 23, 2024, Micro-X announced the expansion of its carbon nanotube X-ray technology into the defense and security sectors, focusing on detecting explosives, weapons, and contraband.

In August 2023, Smiths Detection introduced the SDX 100100 DV series, featuring two dual-view X-ray scanners. The SDX 100100 DV HC is tailored for high-security environments like airports and customs, while the SDX 100100 DV LC is designed for screening oversized baggage and freight up to 100 x 100 cm.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 147.21 Million |

| Market Size by 2032 | USD 227.91 Million |

| CAGR | CAGR of 4.98% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Handheld, Non-handheld) • By Application (Customs And Border Protection, Airport/Aviation, Law Enforcement, Military And Defense, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Smiths Detection, L3Harris Technologies, Raytheon Technologies, Analogic Corporation, Nuctech Company Limited, Astrophysics Inc., Zensors, Inc., Savi Technology, Inc., Varec, Inc., Bionyx Corporation, Fujifilm Holdings Corporation, General Electric (GE), Varian Medical Systems, Teledyne Technologies, Toshiba Corporation, HITACHI, Eagle Technology, Inc., Datalogic S.p.A., and IMEDCO AG. |

| Key Drivers | • Increasing Passenger Throughput Fuels Investment in Backscatter X-Ray Devices |

| RESTRAINTS | • Competition from Alternative Security Screening Technologies |

Ans: The Backscatter X-Ray Devices Marketis expected to grow at a CAGR of 4.98%.

Ans: The Backscatter X-ray Devices Market Size was valued at USD 147.21 million in 2023 and is expected to reach USD 227.91 million by 2032.

Ans: The major growth drivers of the Backscatter X-Ray Devices Market include increased global security concerns, advancements in imaging technology, regulatory compliance mandates, and the rising demand for efficient screening solutions in customs and border protection.

Ans: North America dominating the Backscatter X-Ray Devices Market in 2023.

Ans: Non-handheld dominating the Backscatter X-Ray Devices Market in 2023.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production and Sales Volumes, 2020-2032, by Region

5.2 Regulatory Compliance, by Region

5.3 Regulatory Compliance, by Region

5.4 Consumer Preferences, by Region

5.5 Aftermarket Trends (Data on maintenance, parts, and services)

6. Competitive Landscape

6.1 List of Major Companies, by Region

6.2 Market Share Analysis, by Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Backscatter X-Ray Devices Market Segmentation, by Type

7.1 Chapter Overview

7.2 Handheld

7.2.1 Handheld Market Trends Analysis (2020-2032)

7.2.2 Handheld Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Non-handheld

7.3.1 Non-handheld Market Trends Analysis (2020-2032)

7.3.2 Non-handheld Market Size Estimates and Forecasts to 2032 (USD Million)

8. Backscatter X-Ray Devices Market Segmentation, by Application

8.1 Chapter Overview

8.2 Customs and Border Protection

8.2.1 Customs and Border Protection Market Trends Analysis (2020-2032)

8.2.2 Customs and Border Protection Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Airport/Aviation

8.3.1 Airport/Aviation Market Trends Analysis (2020-2032)

8.3.2 Airport/Aviation Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 Law Enforcement

8.4.1 Law Enforcement Market Trends Analysis (2020-2032)

8.4.2 Law Enforcement Market Size Estimates and Forecasts to 2032 (USD Million)

8.5 Military and Defense

8.5.1 Military and Defense Market Trends Analysis (2020-2032)

8.5.2 Military and Defense Market Size Estimates and Forecasts to 2032 (USD Million)

8.5 Others

8.5.1 Others Market Trends Analysis (2020-2032)

8.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Backscatter X-Ray Devices Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.2.3 North America Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.2.4 North America Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.2.5 USA

9.2.5.1 USA Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.2.5.2 USA Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.2.6 Canada

9.2.6.1 Canada Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.2.6.2 Canada Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.2.7 Mexico

9.2.7.1 Mexico Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.2.7.2 Mexico Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Backscatter X-Ray Devices Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.3.1.3 Eastern Europe Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.1.4 Eastern Europe Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.5 Poland

9.3.1.5.1 Poland Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.1.5.2 Poland Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.6 Romania

9.3.1.6.1 Romania Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.1.6.2 Romania Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.1.7.2 Hungary Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.1.8.2 Turkey Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.1.9.2 Rest of Eastern Europe Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Backscatter X-Ray Devices Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.3.2.3 Western Europe Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.2.4 Western Europe Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.5 Germany

9.3.2.5.1 Germany Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.2.5.2 Germany Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.6 France

9.3.2.6.1 France Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.2.6.2 France Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.7 UK

9.3.2.7.1 UK Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.2.7.2 UK Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.8 Italy

9.3.2.8.1 Italy Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.2.8.2 Italy Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.9 Spain

9.3.2.9.1 Spain Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.2.9.2 Spain Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.2.10.2 Netherlands Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.2.11.2 Switzerland Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.12 Austria

9.3.2.12.1 Austria Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.2.12.2 Austria Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.3.2.13.2 Rest of Western Europe Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Backscatter X-Ray Devices Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.4.3 Asia Pacific Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.4.4 Asia Pacific Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.5 China

9.4.5.1 China Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.4.5.2 China Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.6 India

9.4.5.1 India Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.4.5.2 India Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.5 Japan

9.4.5.1 Japan Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.4.5.2 Japan Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.6 South Korea

9.4.6.1 South Korea Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.4.6.2 South Korea Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.7 Vietnam

9.4.7.1 Vietnam Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.2.7.2 Vietnam Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.8 Singapore

9.4.8.1 Singapore Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.4.8.2 Singapore Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.9 Australia

9.4.9.1 Australia Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.4.9.2 Australia Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.4.10.2 Rest of Asia Pacific Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Backscatter X-Ray Devices Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.5.1.3 Middle East Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.5.1.4 Middle East Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.5 UAE

9.5.1.5.1 UAE Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.5.1.5.2 UAE Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.5.1.6.2 Egypt Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.5.1.7.2 Saudi Arabia Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.5.1.8.2 Qatar Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.5.1.9.2 Rest of Middle East Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Backscatter X-Ray Devices Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.5.2.3 Africa Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.5.2.4 Africa Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.5.2.5.2 South Africa Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.5.2.6.2 Nigeria Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.5.2.7.2 Rest of Africa Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Backscatter X-Ray Devices Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

9.6.3 Latin America Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.6.4 Latin America Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6.5 Brazil

9.6.5.1 Brazil Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.6.5.2 Brazil Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6.6 Argentina

9.6.6.1 Argentina Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.6.6.2 Argentina Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6.7 Colombia

9.6.7.1 Colombia Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.6.7.2 Colombia Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Backscatter X-Ray Devices Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

9.6.8.2 Rest of Latin America Backscatter X-Ray Devices Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10. Company Profiles

10.1 Smiths Detection

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 L3Harris Technologies

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Raytheon Technologies

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Analogic Corporation

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Nuctech Company Limited

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Astrophysics Inc.

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Zensors, Inc.

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Savi Technology, Inc.

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Varec, Inc.

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Bionyx Corporation

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Products/ Services Offered

10.10.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Type

Handheld

Non-handheld

By Application

Customs And Border Protection

Airport/Aviation

Law Enforcement

Military And Defense

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Supercapacitors Market Size was valued at USD 2.36 Billion in 2023 and expected to grow at a CAGR of 16.05% to reach USD 9.01 Billion by 2032.

The Autonomous Underwater Vehicle (AUV) Market Size was valued at USD 3.12 Billion in 2023 and is expecting to grow at a CAGR 16.64% by Forecast 2024-2032.

The Commercial Security System Market was valued at USD 218.41 billion in 2023 and is expected to reach USD 419.23 billion by 2032, growing at a CAGR of 7.55% over the forecast period 2024-2032.

The Surface Mount Technology Market was valued at USD 5.6 Billion in 2023 and is expected to reach USD 10.2 Billion by 2032, growing at a CAGR of 6.83% from 2024-2032.

The Near-Eye Display Market Size was valued at USD 2.31 Billion in 2023 and is expected to grow at a CAGR of 24.90% to reach USD 17.08 Billion by 2032.

The IoT in Smart Cities Market Size was valued at USD 195.18 Billion in 2023 and is expected to grow at a CAGR of 19.3% to reach USD 952.69 Billion by 2032.

Hi! Click one of our member below to chat on Phone