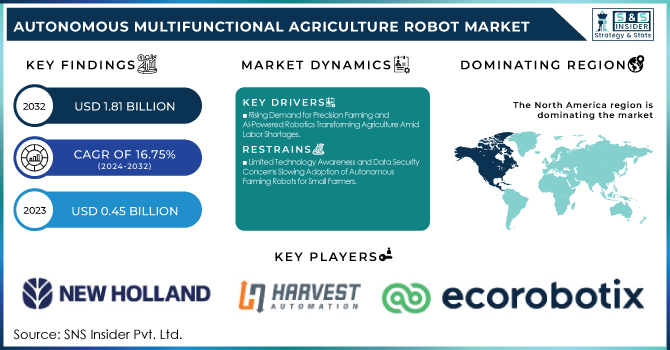

The Autonomous Multifunctional Agriculture Robot Market was valued at USD 0.45 billion in 2023 and is expected to reach USD 1.81 billion by 2032, growing at a CAGR of 16.75% over the forecast period 2024-2032. The Autonomous Multipurpose Agriculture Robot Market is progressing rapidly, attributed to the rising adaptation of AI-driven automation to enable better farming. Deployment is expanding on small and large farms, and advancements in precision navigation, real-time crop monitoring, and autonomous harvesting are enhancing performance. Some, like manufacturing, are grappling with their dependence on the supply chain, the ongoing shortage of semiconductors, and the infusion of higher-level sensors and AI modules. Moreover, the increasing demand for automation is transforming the agricultural employment landscape, necessitating the need for new skills to operate and maintain robots as well as analyze data to improve yields, which means there are very little to no requirements for manual labor and makes agricultural robots undoubtedly a fundamental solution for modern-day sustainable agriculture practices.

Get More Information on Autonomous Multifunctional Agriculture Robot Market - Request Sample Report

Key Drivers:

Rising Demand for Precision Farming and AI-Powered Robotics Transforming Agriculture Amid Labor Shortages

The demand for precision farming is increasing along with labor shortages in the agricultural sector, driving the growth of the autonomous multifunctional agriculture robot market. Agricultural automation adoption is growing worldwide and helps farmers by enhancing crop yield, minimizing costs, and using resources efficiently. For decades the rising cost of farm labor, as well as the shrinking availability of it, has been driving an increase in the use of robotics, especially among farms in North America and Europe. The development of AI, IoT, and machine learning also has contributed significantly to the increase of efficiency of agricultural robots by allowing the machines to collect data in real-time, make automated decisions, and perform predictive maintenance.

Restrain:

Limited Technology Awareness and Data Security Concerns Slowing Adoption of Autonomous Farming Robots for Small Farmers

The key factor hampering the growth of the Autonomous Multifunctional Agriculture Robot Market is the lack of technology awareness and adoption entry barrier, especially for small to medium-sized farmers. Large commercial farms may be quickly adopting robotics, but smallholders in developing countries have trouble grasping and accessing the latest automation. Barriers to adoption come from a lack of technical know-how, unwillingness to change, and the necessity of training labor to operate and maintain autonomous farm robots. Moreover, with the farmers being hesitant to share their confidential agricultural data over cloud-based platforms, the data privacy and cyber security risks associated with AI-driven robotics systems pose challenges for the robotic systems market.

Opportunity:

AI Robotics Cloud Computing and Automation Driving Growth Opportunities in Global Agriculture Technology Market

One of the big opportunities in this market is the combined power of autonomous robotics, analytics, and cloud computing. The vast agricultural data that we can collect and analyze for predictive insights creates opportunities for AI-powered solutions for farm management systems. Moreover, the increasing adoption of drones, robotic harvesters, and autonomous tractors in developing countries, particularly in the Asia-Pacific and Latin America regions, is poised to create lucrative growth opportunities in the market in the coming years. Businesses that offer low-cost, scalable, and tailor-made robotic solutions will find themselves in a position of power, providing services for both extensive industrial farms and farmers who want to automate and increase their productivity at small-holder scales.

Challenges:

Poor Rural Connectivity and Regulatory Barriers Hindering Widespread Adoption of Autonomous Agricultural Robotics

Ensuring rural agricultural areas are properly connected and have adequate infrastructure presents a major challenge in this market. Most precision farming technologies, even autonomous robots, depend on high-speed internet, GPS, and cloud computing to function smoothly. Still, many rural areas around the world–especially in Africa, Latin America, and parts of Asia suffer from sub-par network infrastructure that could prevent autonomous systems from reaching their full potential. Besides this, government policies on the use of autonomous machinery infrastructure, safety regulations, environmental impact, etc are also not linear which creates major regulatory hurdles for mass deployment. Tackling these challenges takes high commitment towards rural digital infrastructure and unified regulatory standards to inspire more adoption of agricultural robotics.

By Component

Hardware dominated the autonomous multifunctional agriculture robot market, with a total market share of 63.7% in 2023. The need for robotic arms, sensors, LiDAR, GPS modules, autonomous tractors, and UAVs (drones) combined, was a major driver for this dominance as these products are essential for automating agricultural activities such as planting, harvesting, spraying, and monitoring. This has led to continuous innovations in hardware in the form of higher adoption of AI-enabled robotics integrated with advanced robotics, IoT, and machine vision, thereby extending the hardware segment. Furthermore, the growing demand for precision agriculture that depends on advanced machines for efficient resource use has boosted investments in agricultural automation. High labor costs and government incentives promoting the adoption of smart farming technologies have driven this growth in North America and Europe, which have been the major regional markets in this respect.

The Software sector is expected to attain the highest CAGR from 2024-2032. The rise in demand for precision farming software solutions is driven by a growing penetration of integrated AI-powered analytics, cloud-based farm management platforms, and machine learning algorithms. Real-time data processing, predictive analytics, automated decision-making, and the ability to monitor, all help farmers optimize yield and reduce operational costs with these solutions. This is expected to propel swift adoption as agriculture trends in SMARTER, connected farming ecosystems where robotics work hand in hand with AI-powered Software. In addition, developments in autonomous navigation software, fleet management systems, and digital twin technologies will fuel growth in the market, especially in the Asia-Pacific and Latin America regions, where digital agriculture is increasing.

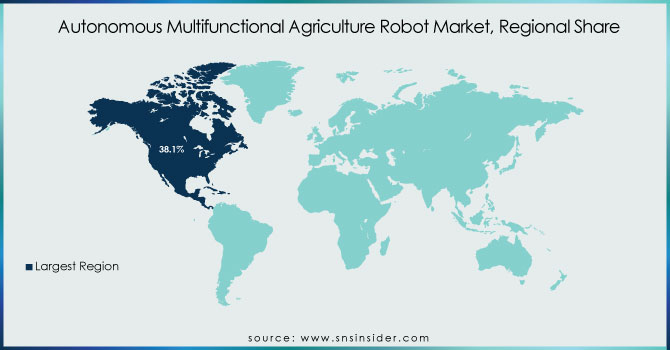

North America held the largest share of the Autonomous Multifunctional Agriculture Robot Market in 2023, accounting for 38.1% of the market, while the region is also anticipated to register the highest growth rate for the period 2024 to 2032. The high labor costs, greater adoption of precision farming, and high investments in agri-tech innovations are boosting this growth. Both the U.S. and Canada belong to the top countries leading the advancements in agricultural technology including, AI features, machine learning, and robotics for increasing the efficiency and sustainability of the agricultural or agri-food industry. Programs like the USDA’s Precision Agriculture Initiative and other agri-tech funding programs are also giving SMP a boost as they look to further popularize smart farming solutions for the agriculture industry. Here are some companies that are changing the way agriculture is done in North America with robotics. For instance, John Deere has created autonomous tractors and See & Spray technology powered by artificial intelligence to reduce the use of herbicides and minimize waste. Carbon Robotics has launched an autonomous laser welding system that destroys weeds without chemical herbicides, making it a more environmentally preferable choice. Additionally, Agtonomy and Bear Flag Robotics have been working on self-driving tractors and fleet automation, allowing farmers to run a tractor and do fieldwork with little to no human presence. And a new wave of high-tech farms is implementing drones, automated irrigation systems, and AI-powered analytics in California's Central Valley and the Midwest Corn Belt.

Need any customization research on Autonomous Multifunctional Agriculture Robot Market - Enquiry Now

Some of the major players in the Autonomous Multifunctional Agriculture Robot Market are:

John Deere (Autonomous Field Tractor, Autonomous Orchard Tractor)

SwarmFarm Robotics ('Robbie' Autonomous Robot, 'Bottomley Potts' Autonomous Robot)

FarmWise Labs, Inc. (Titan FT-35 Automated Weeding Robot)

Solinftec (Solix Ag Robotics)

Lely Industries N.V. (Lely Astronaut A5 Milking Robot, Lely Vector Feeding System)

Naio Technologies (Naio OZ Autonomous Weeding Robot, Naio TED Vineyard Robot)

Monarch Tractor (Monarch MK-V Electric Smart Tractor)

Muddy Machines (Sprout Harvesting Robot, Squirrel Transport Robot)

Niqo Robotics (RoboSpray Precision Spraying Robot, RoboThinner Lettuce Thinning Robot)

Robotics Plus (ProSpray Autonomous Spraying System)

SwarmFarm Robotics (SwarmBot Autonomous Platform)

SAMI AgTech (SAMI Robot for Crop Monitoring)

Bonsai Robotics (Autonomous Tree Shaker, Autonomous Sprayer)

Rotor Technologies (Sprayhawk Autonomous Helicopter)

Smart Apply (Intelligent Spray Control System)

In January 2025, John Deere introduced advanced autonomous tractors, an AI-powered dump truck, and a battery-electric mower, enhancing efficiency and addressing labor shortages in agriculture and construction.

In November 2024, Solinftec's Solix Ag Robotics, an autonomous AI-driven robot, monitors crop health, detects pests, and reduces herbicide use by up to 98%, enhancing farm efficiency and sustainability.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 0.45 Billion |

| Market Size by 2032 | USD 1.81 Billion |

| CAGR | CAGR of 16.75% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | John Deere, SwarmFarm Robotics, FarmWise Labs, Inc., Solinftec, Lely Industries N.V., Naio Technologies, Monarch Tractor, Muddy Machines, Niqo Robotics, Robotics Plus, SwarmFarm Robotics, SAMI AgTech, Bonsai Robotics, Rotor Technologies, Smart Apply. |

Ans: The Autonomous Multifunctional Agriculture Robot Market is expected to grow at a CAGR of 16.75% during 2024-2032.

Ans: Autonomous Multifunctional Agriculture Robot Market size was USD 0.45 billion in 2023 and is expected to Reach USD 1.81 billion by 2032.

Ans: The major growth factor of the Autonomous Multifunctional Agriculture Robot Market is the rising demand for precision farming to improve crop yield, reduce labor dependency, and enhance agricultural efficiency through AI and automation.

Ans: The Hardware segment dominated the Autonomous Multifunctional Agriculture Robot Market in 2023.

Ans: North America dominated the Autonomous Multifunctional Agriculture Robot Market in 2023.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption and Deployment Metrics

5.2 Technological & Performance Metrics

5.3 Supply Chain & Manufacturing Metrics

5.4 Workforce & Skill-Related Metrics

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Autonomous Multifunctional Agriculture Robot Market Segmentation, By Component

7.2 Hardware

7.2.1 Hardware Market Trends Analysis (2020-2032)

7.2.2 Hardware Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Software

7.3.1 Software Market Trends Analysis (2020-2032)

7.3.2 Software Market Size Estimates and Forecasts to 2032 (USD Million)

7.4 Services

7.4.1 Services Market Trends Analysis (2020-2032)

7.4.2 Services Market Size Estimates and Forecasts to 2032 (USD Million)

8. Regional Analysis

8.1 Chapter Overview

8.2 North America

8.2.1 Trends Analysis

8.2.2 North America Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

8.2.3 North America Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.2.2 USA

8.2.2.1 USA Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.2.3 Canada

8.2.3.1 Canada Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.2.4 Mexico

8.2.4.1 Mexico Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3 Europe

8.3.1 Eastern Europe

8.3.1.1 Trends Analysis

8.3.1.2 Eastern Europe Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

8.3.1.3 Eastern Europe Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.1.4 Poland

8.3.1.4.1 Poland Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.1.5 Romania

8.3.1.5.1 Romania Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.1.6 Hungary

10.3.1.8.1 Hungary Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.1.7 Turkey

8.3.1.7.1 Turkey Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.1.8 Rest of Eastern Europe

8.3.1.8.1 Rest of Eastern Europe Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.2 Western Europe

8.3.2.1 Trends Analysis

8.3.2.2 Western Europe Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

8.3.2.3 Western Europe Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.2.4 Germany

8.3.2.4.1 Germany Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.2.5 France

8.3.2.5.1 France Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.2.6 UK

8.3.2.6.1 UK Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.2.7 Italy

8.3.2.7.1 Italy Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.2.8 Spain

8.3.2.8.1 Spain Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.2.9 Netherlands

8.3.2.9.1 Netherlands Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.2.10 Switzerland

8.3.2.10.1 Switzerland Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.2.11 Austria

8.3.2.11.1 Austria Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.3.2.12 Rest of Western Europe

8.3.2.12.1 Rest of Western Europe Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.4 Asia-Pacific

8.4.1 Trends Analysis

8.4.2 Asia-Pacific Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

8.4.3 Asia-Pacific Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.4.4 China

8.4.4.1 China Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.4.5 India

8.4.5.1 India Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.4.6 Japan

8.4.6.1 Japan Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.4.7 South Korea

8.4.7.1 South Korea Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.4.8 Vietnam

8.4.8.1 Vietnam Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.4.9 Singapore

8.4.9.1 Singapore Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.4.10 Australia

8.4.10.1 Australia Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.4.11 Rest of Asia-Pacific

8.4.11.1 Rest of Asia-Pacific Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.5 Middle East and Africa

8.5.1 Middle East

8.5.1.1 Trends Analysis

8.5.1.2 Middle East Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.1.3 Middle East Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.5.1.4 UAE

8.5.1.4.1 UAE Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.5.1.5 Egypt

8.5.1.5.1 Egypt Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.5.1.6 Saudi Arabia

8.5.1.6.1 Saudi Arabia Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.5.1.7 Qatar

8.5.1.7.1 Qatar Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.5.1.8 Rest of Middle East

8.5.1.8.1 Rest of Middle East Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.5.2 Africa

8.5.2.1 Trends Analysis

8.5.2.2 Africa Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

8.5.2.3 Africa Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.5.2.4 South Africa

8.5.2.4.1 South Africa Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.5.2.5 Nigeria

8.5.2.5.1 Nigeria Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.5.2.6 Rest of Africa

8.5.2.6.1 Rest of Africa Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.6 Latin America

8.6.1 Trends Analysis

8.6.2 Latin America Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

8.6.3 Latin America Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.6.4 Brazil

8.6.4.1 Brazil Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.6.5 Argentina

8.6.5.1 Argentina Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.6.6 Colombia

8.6.6.1 Colombia Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

8.6.7 Rest of Latin America

8.6.7.1 Rest of Latin America Autonomous Multifunctional Agriculture Robot Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

9. Company Profiles

9.1 John Deere

9.1.1 Company Overview

9.1.2 Financial

9.1.3 Products/ Services Offered

9.1.4 SWOT Analysis

9.2 SwarmFarm Robotics.

9.2.1 Company Overview

9.2.2 Financial

9.2.3 Products/ Services Offered

9.2.4 SWOT Analysis

9.3 FarmWise Labs, Inc.

9.3.1 Company Overview

9.3.2 Financial

9.3.3 Products/ Services Offered

9.3.4 SWOT Analysis

9.4 Solinftec

9.4.1 Company Overview

9.4.2 Financial

9.4.3 Products/ Services Offered

9.4.4 SWOT Analysis

9.5 Lely Industries N.V

9.5.1 Company Overview

9.5.2 Financial

9.5.3 Products/ Services Offered

9.5.4 SWOT Analysis

9.6 Naio Technologies

9.6.1 Company Overview

9.6.2 Financial

9.6.3 Products/ Services Offered

9.6.4 SWOT Analysis

9.7 Monarch Tractor

9.7.1 Company Overview

9.7.2 Financial

9.7.3 Products/ Services Offered

9.7.4 SWOT Analysis

9.8 Muddy Machines

9.8.1 Company Overview

9.8.2 Financial

9.8.3 Products/ Services Offered

9.8.4 SWOT Analysis

9.9 Niqo Robotics

9.9.1 Company Overview

9.9.2 Financial

9.9.3 Products/ Services Offered

9.9.4 SWOT Analysis

9.10 Robotics Plus

9.10.1 Company Overview

9.10.2 Financial

9.10.3 Products/ Services Offered

9.10.4 SWOT Analysis

10. Use Cases and Best Practices

11. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Component

Hardware

Software

Services

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Semiconductor Timing IC Market Size was valued at USD 8.08 Billion in 2023 and is expected to reach USD 15.74 Billion, at a CAGR of 7.71% by 2032

The Instrument Transformer Market Size was valued at USD 7.21 Billion in 2023 and is expected to grow at a CAGR of 5.94% to reach USD 12.08 Billion by 2032.

The Hybrid Printing Market Size was valued at USD 5.18 Billion in 2023 and is expected to grow at a CAGR of 13.20% to reach USD 15.81 Billion by 2032.

The Restaurant Delivery Robot Market was valued at USD 13.9 Billion in 2023 and is expected to reach USD 95.0 Billion by 2032, growing at a CAGR of 23.84% from 2024-2032.

The Ambient Lighting Market size was valued at USD 70.26 billion in 2023 and is expected to reach USD 155.11 billion by 2032 and grow at a CAGR of 9.20% over the forecast period 2024-2032.

The Interactive Projector Market was valued at USD 3.11 billion in 2023 and is expected to grow at a CAGR of 16.43% to reach USD 12.19 billion by 2032.

Hi! Click one of our member below to chat on Phone