Autonomous Mobile Robots for Logistics and Warehousing Market Size

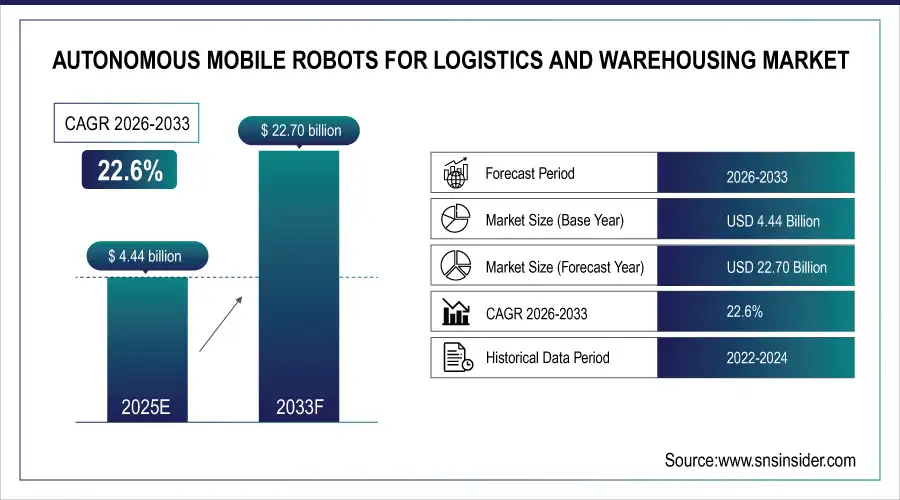

The Autonomous Mobile Robots for Logistics and Warehousing Market was valued at USD 4.44 billion in 2025E and is expecting to grow to USD 22.70 billion at 22.6% CAGR by 2026-2033

The Autonomous Mobile Robots (AMR) for Logistics and Warehousing Market is experiencing significant growth, driven by the increasing demand for automation in supply chain operations. AMRs are self-navigating robots that efficiently handle tasks such as picking, sorting, transporting, and inventory management, enhancing operational efficiency and reducing labor costs. This market expansion is fueled by the rising adoption of e-commerce, which necessitates faster and more accurate fulfillment processes. Technological advancements in AI, machine learning, and sensor technology have further propelled the capabilities of AMRs, enabling them to operate autonomously in dynamic environments without human intervention. The logistics sector, in particular, has embraced these robots to address the challenges of labor shortages and increased consumer expectations for speedy deliveries.

Market Size and Forecast: 2025E

- Market Size in 2025E USD 4.44 Billion

- Market Size by 2033 USD 22.70 Billion

- CAGR of 22.6% From 2026 to 2033

- Base Year 2025E

- Forecast Period 2026-2033

- Historical Data 2021-2024

Get E-PDF Sample Report on Autonomous Mobile Robots for Logistics and Warehousing Market - Request Sample Report

Autonomous Mobile Robots for Logistics and Warehousing Market Trends:

• Rapid adoption of AMRs to address persistent labor shortages and rising warehouse labor costs

• Integration of AMRs with WMS and AI driven software for real time inventory visibility

• Growing use of flexible automation enabling robots to perform multiple picking and material handling tasks

• Strong demand from e commerce driven fulfillment centers requiring faster accurate order processing

• Increased government and industry investment supporting robotics adoption across logistics infrastructure

Autonomous Mobile Robots for Logistics and Warehousing Market Growth Drivers:

-

Primary factors propelling the expansion of Autonomous Mobile Robots (AMRs) in the warehouse and logistics sector.

Several key factors, such as labor shortages, increasing e-commerce needs, and improvements in robotics technology, are fueling the rapid growth of the Autonomous Mobile Robots (AMRs) market in warehouse and logistics operations. One major factor is the growing shortage of warehouse workers worldwide, leading to a 5.6% rise in labor expenses in the warehousing industry in 2023, as forecasted by the U.S. Bureau of Labor Statistics. This is pushing companies to seek automation options to tackle operational inefficiencies. Moreover, the rapid expansion of online shopping has generated a need for quicker, more precise order processing, leading businesses to implement AMRs to satisfy customer demands. The International Federation of Robotics (IFR) predicts that there will be a 31% yearly growth in robot shipments to warehouses until 2025, demonstrating the steady rise in market acceptance. The U.S. Department of Commerce has emphasized the importance of advanced automation in global supply chains for remaining competitive.

Autonomous Mobile Robots for Logistics and Warehousing Market Restraints:

-

Challenges Facing the Autonomous Mobile Robots Market in Logistics and Warehousing

Despite the promising growth of Autonomous Mobile Robots (AMRs) in logistics and warehousing, several market restraints hinder their widespread adoption. One significant barrier is the high initial investment required for AMR technology, which can be prohibitive for smaller enterprises. This upfront cost includes not only the robots themselves but also necessary infrastructure upgrades and integration with existing systems, such as Warehouse Management Systems (WMS). Additionally, the complexity of implementing AMRs can lead to operational disruptions during the transition phase, causing resistance from employees who may fear job displacement or lack familiarity with the new technology. Furthermore, while AMRs can enhance efficiency, their effectiveness is often contingent on a well-structured operational environment; poorly organized warehouses can limit the robots' functionality and ROI.

Autonomous Mobile Robots for Logistics and Warehousing Market Segment Analysis:

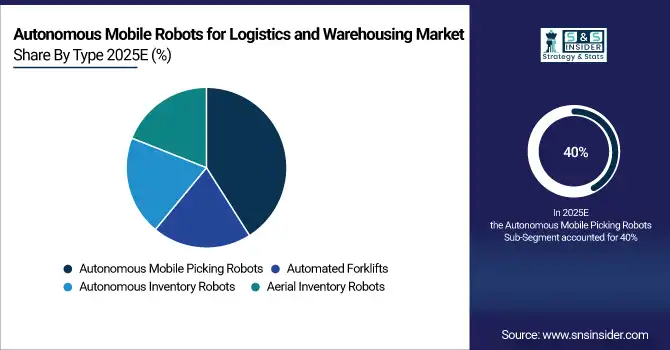

By Type

In the Autonomous Mobile Robots (AMR) for logistics and warehousing Market, Automated Forklifts captured the largest revenue share, accounting for 40% in 2025E. This segment’s dominance is primarily attributed to the increasing need for efficient material handling in warehouses, where speed and precision are critical. Automated forklifts enhance operational efficiency by automating the transportation of goods within warehouses, thereby minimizing human error and optimizing labor resources.

By Application

In the Autonomous Mobile Robots (AMR) market for logistics and warehousing market, the Retail & eCommerce sector dominated with a substantial revenue share of 36% in 2025E. This significant market presence is driven by the rapid growth of online shopping, which has intensified the need for efficient and scalable logistics solutions. Retailers are increasingly turning to AMRs to streamline order fulfillment, enhance inventory management, and reduce operational costs. The flexibility of AMRs allows them to handle a variety of tasks, from picking and packing to transporting goods within warehouses. Recent developments in this segment include the launch of Amazon Robotics' new line of mobile fulfillment robots designed to work alongside human staff, optimizing picking processes and reducing delivery times.

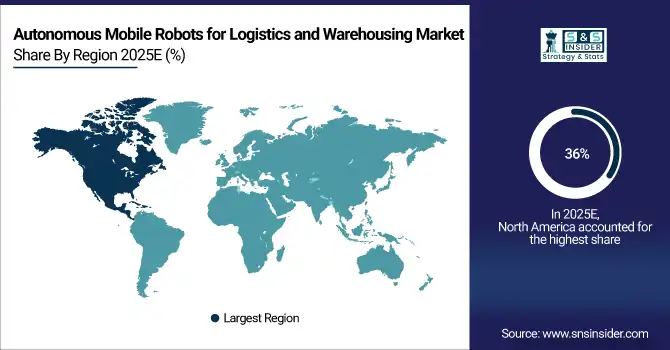

Autonomous Mobile Robots for Logistics and Warehousing Market Regional Analysis:

North America Autonomous Mobile Robots for Logistics and Warehousing Market Insights

In 2025E, North America dominated the Autonomous Mobile Robots (AMR) for logistics and warehousing market, capturing a significant revenue share of 36%. This dominance is fueled by a robust e-commerce landscape, substantial investments in automation technologies, and a growing emphasis on operational efficiency across various industries. The region’s advanced infrastructure and a strong presence of key players contribute to its leading position in the global market. Noteworthy product launches in North America include Amazon Robotics' innovative Kiva robots, which have been instrumental in enhancing warehouse operations by improving picking accuracy and speed. Additionally, Vecna Robotics has introduced its Autonomous Mobile Robot, designed for material handling in warehouses and distribution centers, showcasing advanced navigation and integration capabilities.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Autonomous Mobile Robots for Logistics and Warehousing Market Insights

In 2025E, the Asia-Pacific region emerged as the second fastest-growing region for Autonomous Mobile Robots (AMR) in logistics and warehousing market , driven by rapid industrialization, increasing urbanization, and a burgeoning e-commerce sector. Countries like China, Japan, and Australia are leading the charge in adopting AMR technologies to enhance operational efficiency and meet the demands of a dynamic supply chain environment. Fanuc, a prominent robotics manufacturer in Japan, launched its new line of AMRs specifically designed for seamless integration into existing warehouse infrastructures, showcasing advanced navigation systems and high payload capacities.

Europe Autonomous Mobile Robots for Logistics and Warehousing Market Insights

Europe’s AMR market for logistics and warehousing is driven by labor shortages, high operational costs, and strong Industry 4.0 adoption. Countries such as Germany, the UK, and France lead deployment across e-commerce fulfillment, automotive, and retail warehouses. Stringent efficiency standards, sustainability goals, and government support for automation are accelerating AMR integration, particularly in smart warehouses and cross-border logistics hubs.

Latin America (LATAM) and Middle East & Africa (MEA) Autonomous Mobile Robots for Logistics and Warehousing Market Insights

The LATAM and MEA AMR market is emerging steadily, supported by expanding e-commerce, retail modernization, and logistics infrastructure development. Brazil, Mexico, the UAE, and Saudi Arabia are key adopters, focusing on automation to improve productivity and reduce reliance on manual labor. Although adoption remains lower than mature markets, increasing investments, smart warehouse initiatives, and supply chain digitization are driving long-term growth potential.

Autonomous Mobile Robots for Logistics and Warehousing Market Key Players:

Some of the Autonomous Mobile Robots for Logistics and Warehousing Market Companies are:

-

IAM Robotics (Swift and Locus)

-

Geekplus Technology Co., Ltd. (GPlus and GTP Series)

-

Clearpath Robotics Inc. (Husky and Otto)

-

Boston Dynamics (Stretch and Handle)

-

Conveyo Technologies (Conveyo AMR and Mobile Robot Systems)

-

KUKA AG (KMP 1500 and KMP 600)

-

Fortna Inc. (FortnaFlex and FortnaOS)

-

Locus Robotics (LocusBot and Locus 2)

-

Teradyne Inc. (MiR600 and MiR200)

-

OMRON Corporation (LD Series and HD-1500)

-

Fetch Robotics (Freight Series and RoboShelf)

-

GreyOrange (Butler and GreyMatter)

-

InVia Robotics (InVia Fetch and InVia Logic)

-

6 River Systems (Chucks and Collaborative Robots)

-

Savioke (Relay and TUG)

-

Robotnik Automation (RB-KAIROS and RB-1 Base)

-

DHL Supply Chain (DHL Robotics Solutions and Automated Guided Vehicles)

-

SoftBank Robotics (Pepper and Whiz)

-

Adept Technology (Adept Mobile Robot and Adept Lynx)

-

Seegrid (Seegrid GT10 and Seegrid Palion)

Recent Development

Locus Robotics is a leading provider of Autonomous Mobile Robots for logistics and warehousing, specializing in collaborative, AI-driven AMRs that enhance order fulfillment productivity. Its LocusBots are widely deployed across e-commerce, retail, and third-party logistics facilities to support picking, sorting, and material transport. The company focuses on scalable automation, seamless WMS integration, and rapid deployment, enabling warehouses to improve efficiency, accuracy, and workforce utilization.

-

On June 4, 2024, Locus Robotics was awarded the 2024 Fortress Cybersecurity Award in the Compliance category, recognizing its commitment to adhering to the highest cybersecurity standards and safeguarding customer data.

Boston Dynamics is a prominent robotics company offering advanced Autonomous Mobile Robots for logistics and warehousing, notably through its Stretch robot designed for case handling and palletizing. The company leverages cutting-edge AI, computer vision, and mobility technologies to automate repetitive warehouse tasks. Its solutions help logistics operators improve throughput, reduce labor dependency, and enhance safety in high-volume distribution and fulfillment environments.

-

On August 26, 2024, Boston Dynamics announced the launch of its second commercial product aimed at autonomous warehouse robotics, designed to handle physically challenging tasks within warehouse environments. This expansion into autonomous solutions highlights Boston Dynamics' commitment to enhancing efficiency and safety in logistics operations.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 4.44 Billion |

| Market Size by 2033 | USD 22.70 Billion |

| CAGR | CAGR of 22.6% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2021-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

|

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | IAM Robotics ,Geekplus Technology Co., Ltd. ,Clearpath Robotics Inc. ,Boston Dynamics ,Conveyo Technologies ,KUKA AG ,Fortna Inc. ,Locus Robotics ,Teradyne Inc. ,OMRON Corporation ,Fetch Robotics ,GreyOrange ,InVia Robotics ,6 River Systems ,Savioke ,Robotnik Automation ,DHL Supply Chain ,SoftBank Robotics ,Adept Technology Seegrid and others |