Autonomous Driving Software Market Report Scope & Overview:

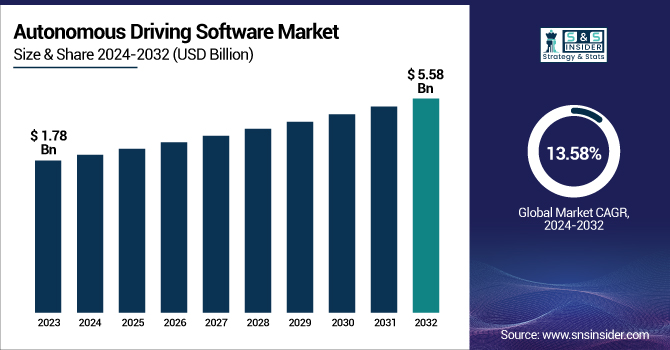

The Autonomous Driving Software Market was valued at USD 1.78 billion in 2023 and is expected to reach USD 5.58 billion by 2032, growing at a CAGR of 13.58% from 2024-2032.

To Get more information on Autonomous Driving Software Market - Request Free Sample Report

This report includes key insights into software performance metrics, global testing locations, cost reductions, and investment trends. As the market expands, technological advancements and the increasing demand for autonomous driving solutions drive growth. Software performance metrics play a crucial role in ensuring the efficiency and safety of autonomous vehicles. Global testing locations are becoming more diverse, enabling better real-world validation. Cost reductions due to advancements in software and hardware integration are expected to further fuel market growth. Additionally, the influx of investments in autonomous driving technologies highlights the sector's potential for innovation and mass adoption in the coming years.

U.S. Autonomous Driving Software Market was valued at USD 0.50 billion in 2023 and is expected to reach USD 1.55 billion by 2032, growing at a CAGR of 13.47% from 2024-2032.

The growth of the U.S. Autonomous Driving Software Market can be attributed to several factors, including advancements in artificial intelligence, machine learning, and sensor technologies, which are critical for the development of autonomous driving solutions. Increasing investments from both automotive and tech companies are accelerating the innovation and deployment of autonomous vehicles. Additionally, government regulations and safety standards are becoming more favorable, boosting confidence in autonomous technology. The rising demand for safer, more efficient transportation solutions and the growing interest in electric vehicles further contribute to the market's expansion in the U.S. during the forecast period.

Autonomous Driving Software Market Dynamics

Drivers

-

Rising Consumer Demand for Safer and More Efficient Transportation Drives Autonomous Vehicle Software Growth

The growing demand for safer and more efficient transportation systems is a key factor propelling the adoption of autonomous vehicles. As consumers seek enhanced safety, autonomous driving technologies promise to significantly reduce traffic accidents by minimizing human error. The convenience of automated vehicles, which can optimize traffic flow, improve fuel efficiency, and provide a more comfortable driving experience, also contributes to their appeal. These advancements are crucial for addressing the increasing challenges of road safety and urban congestion. As a result, the demand for autonomous driving software, capable of offering these benefits, continues to rise, driving the market's expansion across the globe. Consumers' pursuit of enhanced transport experiences is thus a powerful force behind the evolution of autonomous driving technology.

Restraints

-

High Development Costs of Autonomous Driving Software Limit Innovation and Slow Market Adoption, Especially for Smaller Manufacturers.

The significant investment required for research and development in autonomous driving software poses a major challenge to the market. Developing sophisticated systems that integrate advanced AI, sensors, and real-time decision-making capabilities demands substantial financial resources. This includes the costs associated with hardware integration, extensive testing, and the validation of safety protocols. Smaller manufacturers and startups may find it particularly difficult to compete due to their limited budgets, potentially slowing down innovation and adoption. Moreover, the long-term nature of autonomous vehicle development means that companies must secure continuous funding to reach full-scale production and implementation. These high costs create a barrier to entry for new players in the market and can delay the broader availability of affordable autonomous driving technologies.

Opportunities

-

Integration of Autonomous Driving Software with Electric Vehicles Presents Significant Market Growth Opportunities for Developers.

As electric vehicle (EV) adoption accelerates, the integration of autonomous driving software into EVs presents a considerable market opportunity. With the increasing demand for EVs driven by environmental concerns and governmental incentives, manufacturers are seeking ways to enhance the driving experience and improve vehicle efficiency. Autonomous driving technology aligns well with the need for smarter, more energy-efficient vehicles, offering a seamless connection between sustainability and automation. Software developers can capitalize on this synergy by creating solutions that not only enable autonomous driving but also optimize the energy consumption of electric vehicles. This convergence of autonomous and electric technologies promises to open new avenues for software development and application, allowing the autonomous driving software market to expand rapidly alongside the growing EV industry.

Challenges

-

Ethical and Moral Dilemmas in Autonomous Vehicle Decision-Making Raise Concerns Over Algorithmic Bias and Public Trust.

Autonomous vehicles are designed to make real-time decisions, especially in critical situations such as avoiding accidents. However, these decisions often present ethical and moral dilemmas that raise concerns about the implications of algorithmic choices. In life-threatening scenarios, how an autonomous vehicle prioritizes actions—such as protecting passengers over pedestrians—can lead to difficult questions regarding fairness and accountability. The potential for algorithmic bias is another concern, as the software's decision-making process could unintentionally favor certain outcomes over others based on programming or data limitations. These dilemmas challenge the development and deployment of autonomous driving systems, as manufacturers, regulators, and society must navigate these complex moral issues. Ensuring that these systems can make unbiased, ethical decisions is crucial for gaining public trust and fostering wider adoption.

Autonomous Driving Software Market Segment Analysis

By Propulsion

The ICE segment dominated the Autonomous Driving Software Market with the highest revenue share of about 64% in 2023 due to the continued dominance of internal combustion engine vehicles in global transportation. Despite the rise of electric vehicles, ICE vehicles still make up the largest portion of the global vehicle fleet. Additionally, significant investments are still being directed toward integrating autonomous driving technology into ICE vehicles, further cementing their market position in the short to medium term.

The Electric Vehicles (EVs) segment is expected to grow at the fastest CAGR of about 14.65% from 2024-2032 due to the increasing adoption of EVs driven by environmental concerns, government incentives, and the shift towards sustainable transportation. As electric vehicles gain market share, the demand for autonomous driving software integrated with these vehicles also rises. This growth is further fueled by the growing interest in optimizing EV performance through automation and the development of smart, connected infrastructure for EVs.

By Vehicle Type

The Passenger Vehicles segment dominated the Autonomous Driving Software Market with the highest revenue share of about 72% in 2023, as passenger vehicles make up the majority of the global vehicle fleet. The growing demand for advanced safety features, enhanced driving experiences, and the shift toward more convenient, autonomous mobility solutions contribute significantly to the dominance of this segment. Manufacturers are increasingly integrating autonomous technology into passenger vehicles to meet consumer demand for safer, smarter, and more efficient personal transportation.

The Commercial Vehicles segment is expected to grow at the fastest CAGR of about 14.78% from 2024-2032 due to the increasing demand for automation in freight and logistics operations. Autonomous driving software can reduce operational costs, improve fuel efficiency, and enhance safety by minimizing human error. Additionally, the rise of autonomous trucks and delivery vehicles in e-commerce and supply chain sectors is fueling this growth, as businesses seek greater efficiency and operational scalability in commercial transportation.

By Level of Autonomy

The L2 segment dominated the Autonomous Driving Software Market with the highest revenue share of about 42% in 2023, as Level 2 autonomy represents the most common form of automation currently available in production vehicles. This level offers significant driver assistance, such as adaptive cruise control and lane-keeping, while still requiring driver intervention. It is highly appealing to consumers as it enhances convenience and safety without the high cost and regulatory hurdles associated with higher levels of automation, making it widely adopted.

The L4 & L5 segment is expected to grow at the fastest CAGR of about 15.55% from 2024-2032, driven by technological advancements and the push towards fully autonomous vehicles. As the demand for self-driving cars increases, manufacturers and tech companies are accelerating development of Level 4 and 5 vehicles, which promise full autonomy with minimal or no human intervention. These levels are poised to revolutionize mobility in urban environments and commercial applications, driving rapid market expansion.

By Software Type

The Perception & Planning Software segment dominated the Autonomous Driving Software Market with the highest revenue share of about 43% in 2023, as this software plays a critical role in enabling vehicles to understand and interact with their environment. Perception software processes data from sensors such as cameras and LiDAR to detect obstacles, while planning software makes real-time decisions on vehicle movement. Together, these technologies are essential for the safe and efficient operation of autonomous vehicles, making them a core component in the market.

The Interior Sensing Software segment is expected to grow at the fastest CAGR of about 15.22% from 2024-2032, driven by the increasing focus on enhancing in-car experiences and safety. As autonomous vehicles transition to higher levels of autonomy, interior sensing software is crucial for monitoring driver and passenger behavior, ensuring safety, and providing personalized experiences. Additionally, this software supports features like driver monitoring, gesture control, and enhanced comfort, which are becoming increasingly important in autonomous vehicles.

Regional Analysis

North America dominated the Autonomous Driving Software Market with the highest revenue share of about 39% in 2023 due to the strong presence of leading technology companies, automotive manufacturers, and substantial investment in R&D for autonomous driving technologies. The region also benefits from favorable government regulations and safety standards promoting the development and deployment of autonomous vehicles. With high consumer demand for advanced automotive technologies, North America remains at the forefront of autonomous vehicle adoption and innovation, driving market dominance.

Asia Pacific is expected to grow at the fastest CAGR of about 15.73% from 2024-2032, driven by rapid advancements in autonomous vehicle technology and the region's strong automotive manufacturing base. Countries like China, Japan, and South Korea are investing heavily in autonomous driving research, while government support for smart city initiatives and infrastructure development plays a key role. Additionally, the rising demand for electric vehicles and smart transportation solutions in urban areas is propelling the market growth in this region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Aptiv (Aptiv Autonomous Driving Platform, Smart Vehicle Architecture)

-

Aurora Innovation Inc. (Aurora Driver, Aurora Horizon)

-

Baidu, Inc. (Apollo Autonomous Driving Platform, Apollo Go Robotaxi)

-

Continental AG (ContiConnect, Continental Autonomous Driving System)

-

Huawei Technologies Co., Ltd. (Huawei Autonomous Driving Platform, HiCar)

-

Mobileye (EyeQ5, Mobileye Roadbook)

-

Nvidia Corporation (NVIDIA Drive Platform, NVIDIA DRIVE Sim)

-

Pony.ai (PonyPilot, PonyOS)

-

Qualcomm Technologies, Inc. (Qualcomm Autonomous Driving Platform, Snapdragon Ride)

-

Robert Bosch GmbH (Bosch Autonomous Driving Solutions, Bosch ADAS Radar)

-

Waymo (Waymo Driver, Waymo One)

-

Uber ATG (Uber Advanced Technologies Group, Uber ATG Self-Driving System)

-

Tesla, Inc. (Full Self-Driving (FSD), Autopilot)

-

Apple Inc. (Apple Car Project, Apple Autonomous Driving Platform)

-

Zoox (Zoox Autonomous Vehicle, Zoox Self-Driving System)

-

Velodyne Lidar (Velodyne Alpha Puck, Velodyne VLS-128 Lidar)

-

Autoliv (Autoliv Autonomous Driving Safety, Autoliv Vision System)

-

LeddarTech (LeddarPixell, LeddarVision)

-

Daimler AG (Mercedes-Benz Autonomous Driving System, Drive Pilot)

Recent Developments:

-

In 2025, Aptiv will feature an open ADAS platform with hands-off urban assist, ML-based predictive technology, and next-gen in-cabin experiences, highlighting scalability and flexibility in autonomous tech.

-

In 2024, Uber and WeRide partnered with Dubai’s RTA to deploy autonomous vehicles, aligning with the city’s goal of 25% self-driving trips by 2030. The initiative includes pilot programs and aims to enhance mobility and sustainability in Dubai’s transport sector.

-

In 2024, Qualcomm introduced the Snapdragon Cockpit Elite and Snapdragon Ride Elite platforms, advancing software-defined vehicles with AI-driven automation, enhanced in-cabin experiences, and scalable ADAS solutions, accelerating the evolution of connected and autonomous driving technologies.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.78 Billion |

| Market Size by 2032 | US$ 5.58 Billion |

| CAGR | CAGR of 13.58% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Level of Autonomy (L1, L2, L3, L4 & L5) • By Propulsion (ICE, Electric Vehicles) • By Vehicle Type (Passenger Vehicles, Commercial Vehicles) • By Software Type (Perception & Planning Software, Chauffeur Software, Interior Sensing Software, Supervision/Monitoring Software) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Aptiv, Aurora Innovation Inc., Baidu, Inc., Continental AG, Huawei Technologies Co., Ltd., Mobileye, Nvidia Corporation, Pony.ai, Qualcomm Technologies, Inc., Robert Bosch GmbH, Waymo, Uber ATG, Tesla, Inc., Apple Inc., Zoox, Velodyne Lidar, Autoliv, LeddarTech, Daimler AG |