Automotive Wiring Harness Market Size:

Get More Information on Automotive Wiring Harness Market - Request Sample Report

The Automotive Wiring Harness Market size is projected to reach USD 72.03 billion by 2032 and was valued at USD 51.05 billion in 2023. The estimated CAGR for 2024-2032 is 3.9%.

The key growth driver for the automotive wiring harness market is the increasing penetration of advanced driver-assistance systems (ADAS) and electric vehicles (EVs). Considering this increased concern for passenger safety, as many as about 65% of all the vehicles produced globally are expected to have some type of ADAS installed by 2025. It will spur the demand for advanced harnesses that would support such networks of sensors and electronic control units. This recent wave of automobile production of electrical vehicles is, therefore, another very demanding driver as electric vehicles contain up to 40% more wiring than a conventional internal combustion engine, which is also the major cause of an alarming rise in wiring harness requirements. The efforts of accelerating electrification of the automotive industry along with cutting down on carbon emissions were further encouraged for the adoption of EVs. Around 2030, it was expected to reach 30% of total vehicles sold across the globe. Use of lightweight material in wiring harnesses helps in reducing up to 15% vehicle's weight and encourages an overall vehicle efficiency further in line with strict fuel efficiency standards. The other significant factor pushing for the increasing integration of infotainment and connectivity systems is that about 75% of new vehicles are expected to come equipped with smart infotainment solutions, thereby requiring an extensive wiring network. The movement towards autonomous vehicle technologies, where an additional increase in functionality necessitates a 20-30% increase in complexity, also drives demand. Thus, important traction is being faced in the market due to a technology change, consumer preference shift, and regulatory directives that are skewed toward more improved safety and sustainability of vehicles.

Not only this, but modular and standardized harnesses are also gaining much importance, and they can bring about a reduction of almost 15% in the cost of manufacturing and much better design options. Other developments, including the use of multiplex wiring systems, have brought about a 20% reduction in total wiring length from one vehicle to another. Savings on cost and weight are therefore achieved. More connectivity, autonomous driving, and electrification will take the automotive sector further with a more complex vehicle; the wiring harness market will reform itself to enable it to manufacture smarter materials and even more refined configurations that can cope with these additional complexities.

Drivers:

All the increased electric vehicle adoption, rising ADAS integration, regulatory safety requirements, and demand for connected vehicles will take the automotive wiring harness market forward.

Increased Technology Advancements and Changing Regulatory Requirements Lead to a Rise in Demand for Specialized Wiring Solutions, Opportunity in the Automotive Wiring Harness Market. The driving force from increased demand for high voltage wiring harnesses within the assemblies, due to growing penetration of electric vehicles, is driving the market. Global EV sales are up 60% in 2023. Added to this is growing interest in lightweight harness materials for better vehicle efficiency; some 25% of automotive OEMs have now adopted lightweight aluminum wiring over the more traditional copper in the latest models.

The other opportunity lies in the advancement of ADAS, which requires higher-level wiring harnesses to connect the sensors and control units. Market estimates suggest that 58 percent of new vehicles sold in 2024 are expected to come equipped with Level 2 or more ADAS capabilities, increasing the demand for advanced electrical systems. Government safety norms are also witnessing the development of a demand for reliable wiring solutions. Here, more than 70% of the vehicles meet highly stringent safety compliance through reliable electrical systems, thus providing a very huge opportunity for wiring harness manufacturers to produce enhanced safety features.

Challenges:

The growth in automotive wiring harness market is hindered by increased complexity of EV and ADAS wiring, increasing raw material costs and labor shortages.

Automotive Wiring Harness Market faces challenges due to the increased complexity of wiring systems in latest advanced technology as used in vehicles. The high-voltage wiring requirements results in a much more complex supply chain when compared with electric vehicle customers due to the tough performance standards set for wiring, which must withstand big voltages and thus leads to more complexity in development and manufacturing at cost. About 35% of suppliers face difficulties in meeting such specialized requirements on EV wiring, thereby affecting the production timelines. This makes the wiring harness design more complex because the higher rate of data transmission coupled with increased reliability in data transmission demands more sophisticated engineering-some 40% of manufacturers of wiring harnesses report issues in optimization of weight, space and cost for vehicles with ADAS.

The other challenge is the rise in the raw materials price such as that of copper, which is approximately 60% of the normal composition of a wiring harness. Due to growing global copper prices, manufacturing costs increase by 15% on average. Apart from the historically mentioned labor shortages in the field, availability of skilled technicians is also one of the main challenges for manufacturers since wiring harness assembly is still substantially a labor-intensive activity; today, as much as 48% of the manufacturers claim difficulties in finding enough skilled labor.

Segment Analysis:

By Component

The Automotive Wiring Harness Market can be mainly bifurcated into its sub-components like electric wires, connectors, terminals, and others. Electric wires take the major share in the market, approximately 45%. Increased adoption of electric and hybrid vehicles opens avenues for growth opportunities for manufacturers through the demand for high-quality wires that can bear a higher voltage. Another significant portion is connectors that guarantee the secure connection between different vehicle systems. This is approximately 25% of the market. With the increasing amount of wiring going inside the vehicle, to accommodate more and more advanced infotainment systems and ADAS, the demand for special connectors rises continually. Terminals are 15% of the segment and play a very critical role in guaranteeing secure electrical connection, especially in high-stress environments. Recently, terminals of new material designs are perceived as gaining traction due to light weight and energy-efficient automotive designs. Other category holds approximately 15 percent of the market share with protective coverings, relays and fuses. These components are essential for any system to have protection and reliability-more so as wiring harnesses tend to become increasingly complex.

By Electric Vehicle

In this market, the traditional BEV segment holds a majority market share of around 65%, primarily because of increasing consumer demand for zero-emission vehicles and support from various governments towards being sustainable. The requirement for high-voltage wiring harnesses for that size of a battery and electrical systems application puts a call for innovation with regard to lighter and more efficient materials from manufacturers. PHEVs, with around a 35% market share, are also significant because of the ability that they offer to switch between their primary electric and backup conventional power sources. Since PHEVs require wiring harnesses to connect all the electric and internal combustion engine components, there is increased complexity both in design and manufacturing. Again, due to governmental incentives for hybrid technology as an intermediate step towards full electrification, PHEVs are also one of the important market drivers.

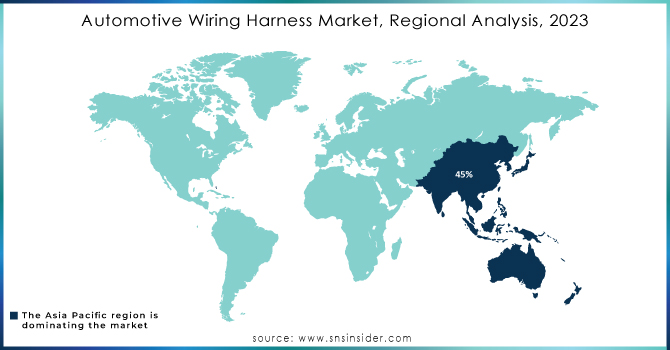

Regional Analysis:

The Automotive Wiring Harness Market has significant regional dynamics with Asia Pacific regions leading by a market share of about 45%. This is because most of the major automotive manufacturers are located in countries in China, Japan, and South Korea; meanwhile, this region accounts for the fastest growth of electric vehicles. High-performance wiring harnesses become the need of the hour with growing production of regular and electric vehicles, new technologies in vehicles, and a high trend towards innovation in engineering and improving safety standards. It also has a good representation of renowned automotive OEMs and Tier 1 suppliers besides the strong focus on innovation in engineering, ensuring a well-placed 25% share of North America.

Europe takes up about 20 percent of the market share, wherein this region's concern about reducing carbon emissions and promoting eco-friendly mobility is another driver factor. Advanced driver assistance systems and electric vehicles have been very early adopting countries in Europe, which in turn, propels the demand for sophisticated wiring harnesses.

Recent Developments:

Leoni AG: Up 21% so far for this year as of June 2024. Leoni has increased its capacity in the production lines of high-voltage wiring harnesses and rising support to electric vehicles. The company issued a press release on opening up its new manufacturing facility in Eastern Europe for lightweight and flexible wiring solutions designed specifically for electric and hybrid vehicles.

Marelli April 2024: Marelli has developed a modular wiring harness system aimed at maximizing connectivity within the minimum overall weight. The modular wiring harness system is here to further efficiency in the assembly phase and decrease installation complexity for automotive manufacturers mainly on electric and connected vehicles.

Sumitomo Electric Industries: Launches New Series of Connectors for High Voltage Applications in Electric Vehicles New Connections from Sumitomo Electric Can Face Extreme Temperatures and Hostile Environments, Improving Reliability and Safety in EV Applications.

Need Any Customization Research On Automotive Wiring Harness Market - Inquiry Now

Key Players:

Leoni AG: (High-Voltage Wiring Harnesses, Modular Wiring Systems)

Yazaki Corporation: (Automotive Wiring Harnesses, Eco-Friendly Wiring Solutions)

Sumitomo Electric Industries: (High-Voltage Connectors, Automotive Wiring Harnesses)

Denso Corporation: (Wiring Harnesses for Autonomous Vehicles, High-Speed Data Transmission Systems)

Marelli: (Modular Wiring Harness Systems, Lightweight Wiring Solutions)

Kromberg & Schubert: (Custom Wiring Harnesses, Smart Wiring Solutions)

Aptiv PLC: (Connected Vehicle Wiring Systems, ADAS Wiring Harnesses)

Lear Corporation: (Electrical Distribution Systems, High-Performance Wiring Harnesses)

Furukawa Electric Co., Ltd.: (High-Voltage Wiring Harnesses, Standard Automotive Wiring Harnesses)

TE Connectivity: (Automotive Connectors, Custom Wiring Harness Solutions)

Belden Inc.: (High-Speed Data Cables, Specialty Wiring Harnesses)

Eaton Corporation: (Electrical Distribution Systems, Automotive Wiring Solutions)

Wiring Harness Manufacturer’s Association (WHMA): (Manufacturing Standards, Certification Programs)

AVX Corporation: (Automotive Capacitors, High-Frequency Wiring Solutions)

Molex LLC: (High-Speed Automotive Connectors, Wiring Harness Solutions for Electric Vehicles)

Amphenol Corporation: (Automotive Interconnect Systems, Custom Wiring Harnesses)

Nexans: (Wiring Harnesses for Electric Vehicles, Specialty Automotive Cables)

SABIC: (Engineering Thermoplastics, Lightweight Wiring Insulation Materials)

Aisin Seiki Co., Ltd.: (Electrical Systems for Vehicles, Wiring Harnesses for Hybrid Vehicles)

Corning Incorporated: (Fiber Optic Cables, Advanced Electrical Materials)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 51.05 Billion |

| Market Size by 2032 | USD 72.03 Billion |

| CAGR | CAGR of 3.9% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component: (Electric Wires, Connectors. Terminals, Others) • By Application: (Body Harness, Chassis Harness, Engine Harness, HVAC Harness, Sensors Harness) • By Electric Vehicle: (Battery Electric Vehicle (BEV), Plug-in Hybrid Electric Vehicle (PHEV)) • By Vehicle: (Light Vehicle, Heavy Vehicle) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Leoni AG, Yazaki Corporatio, Sumitomo Electric Industries, Denso Corporation, Marelli, Kromberg & Schubert, Aptiv PLC , Lear Corporation and others |

| Key Drivers | • All the increased electric vehicle adoption, rising ADAS integration, regulatory safety requirements, and demand for connected vehicles will take the automotive wiring harness market forward. |

| RESTRAINTS | • The growth in automotive wiring harness market is hindered by increased complexity of EV and ADAS wiring, increasing raw material costs and labor shortages |

Ans: The Automotive Wiring Harness Market size is projected to reach USD 72.03 billion by 2032

Ans: The estimated Automotive Wiring Harness Market CAGR for 2024-2032 is 3.9%.

Ans: All the increased electric vehicle adoption, rising ADAS integration, regulatory safety requirements, and demand for connected vehicles will take the automotive wiring harness market forward.

Ans: Asia Pacific regions will be dominating with market share of about 45%.

Ans: Traditional BEV segment holds a majority market share of around 65%.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Vehicle Production and Sales Volumes, 2020-2032, by Region

5.2 Emission Standards Compliance, by Region

5.3 Vehicle Technology Adoption, by Region

5.4 Consumer Preferences, by Region

5.5 Aftermarket Trends (Data on vehicle maintenance, parts, and services)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Automotive Wiring Harness Market Segmentation, By Component

7.1 Chapter Overview

7.2 Electric Wires

7.2.1 Electric Wires Market Trends Analysis (2020-2032)

7.2.2 Electric Wires Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Connectors

7.3.1 Connectors Market Trends Analysis (2020-2032)

7.3.2 Connectors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Terminals

7.4.1 Terminals Market Trends Analysis (2020-2032)

7.4.2 Terminals Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Others

7.5.1 Others Market Trends Analysis (2020-2032)

7.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Automotive Wiring Harness Market Segmentation, By Application

8.1 Chapter Overview

8.2 Body Harness

8.2.1 Body Harness Market Trends Analysis (2020-2032)

8.2.2 Body Harness Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Chassis Harness

8.3.1 Chassis Harness Market Trends Analysis (2020-2032)

8.3.2 Chassis Harness Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Engine Harness

8.4.1 Engine Harness Market Trends Analysis (2020-2032)

8.4.2 Engine Harness Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 HVAC Harness

8.5.1 HVAC Harness Market Trends Analysis (2020-2032)

8.5.2 HVAC Harness Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Sensors Harness

8.6.1 Sensors Harness Market Trends Analysis (2020-2032)

8.6.2 Sensors Harness Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Automotive Wiring Harness Market Segmentation, by Electric Vehicle

9.1 Chapter Overview

9.2 Battery Electric Vehicle (BEV)

9.2.1 Battery Electric Vehicle (BEV) Market Trends Analysis (2020-2032)

9.2.2 Battery Electric Vehicle (BEV) Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Plug-in Hybrid Electric Vehicle (PHEV)

9.3.1 Plug-in Hybrid Electric Vehicle (PHEV) Market Trends Analysis (2020-2032)

9.3.2 Plug-in Hybrid Electric Vehicle (PHEV) Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Automotive Wiring Harness Market Segmentation, By Vehicle

10.1 Chapter Overview

10.2 Light Vehicle

10.2.1 Light Vehicle Market Trends Analysis (2020-2032)

10.2.2 Light Vehicle Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Heavy Vehicle

10.3.1 Heavy Vehicle Market Trends Analysis (2020-2032)

10.3.2 Heavy Vehicle Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Automotive Wiring Harness Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.4 North America Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.2.5 North America Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.2.6 North America Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.7.2 USA Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.2.7.3 USA Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.2.7.4 USA Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.2.7 Canada

11.2.7.1 Canada Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.7.2 Canada Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.2.7.3 Canada Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.2.7.3 Canada Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.2.8 Mexico

11.2.8.1 Mexico Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.8.2 Mexico Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.2.8.3 Mexico Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.2.8.3 Mexico Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Automotive Wiring Harness Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.3.1.6 Poland

11.3.1.6.1 Poland Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.6.2 Poland Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.6.3 Poland Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.3.1.6.3 Poland Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.3.1.7 Romania

11.3.1.7.1 Romania Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.7.2 Romania Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.7.3 Romania Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.3.1.7.3 Romania Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.3.1.8 Hungary

11.3.1.8.1 Hungary Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.8.2 Hungary Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.8.3 Hungary Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.3.1.8.3 Hungary Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.3.1.9 Turkey

11.3.1.9.1 Turkey Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.9.2 Turkey Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.9.3 Turkey Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.3.1.9.3 Turkey Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Automotive Wiring Harness Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.4 Western Europe Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.5 Western Europe Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.3.2.5 Western Europe Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.3.2.6 Germany

11.3.2.6.1 Germany Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.6.2 Germany Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.6.3 Germany Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.3.2.6.3 Germany Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.3.2.7 France

11.3.2.7.1 France Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.7.2 France Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.7.3 France Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.3.2.7.3 France Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.3.2.8 UK

11.3.2.8.1 UK Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.8.2 UK Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.8.3 UK Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.3.2.8.3 UK Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.3.2.9 Italy

11.3.2.9.1 Italy Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.9.2 Italy Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.9.3 Italy Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.3.2.9.3 Italy Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.11.2 Spain Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.11.3 Spain Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.3.2.11.3 Spain Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.3.2.11 Netherlands

11.3.2.11.1 Netherlands Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.11.2 Netherlands Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.11.3 Netherlands Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.3.2.11.3 Netherlands Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.3.2.12 Switzerland

11.3.2.12.1 Switzerland Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.12.2 Switzerland Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.12.3 Switzerland Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.3.2.12.3 Switzerland Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.3.2.13 Austria

11.3.2.13.1 Austria Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.13.2 Austria Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.13.3 Austria Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.3.2.13.3 Austria Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.3.2.14 Rest of Western Europe

11.3.2.14.1 Rest of Western Europe Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.14.2 Rest of Western Europe Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.14.3 Rest of Western Europe Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.3.2.14.3 Rest of Western Europe Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Automotive Wiring Harness Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.4 Asia Pacific Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.5 Asia Pacific Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.4.5 Asia Pacific Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.4.6 China

11.4.6.1 China Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.6.2 China Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.6.3 China Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.4.6.3 China Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.4.7 India

11.4.7.1 India Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.7.2 India Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.7.3 India Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.4.7.3 India Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.4.8 Japan

11.4.8.1 Japan Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.8.2 Japan Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.8.3 Japan Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.4.8.3 Japan Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.4.9 South Korea

11.4.9.1 South Korea Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.9.2 South Korea Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.9.3 South Korea Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.4.9.3 South Korea Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.11.2 Vietnam Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.11.3 Vietnam Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.4.11.3 Vietnam Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.4.11 Singapore

11.4.11.1 Singapore Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.11.2 Singapore Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.11.3 Singapore Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.4.11.3 Singapore Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.4.12 Australia

11.4.12.1 Australia Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.12.2 Australia Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.12.3 Australia Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.4.12.3 Australia Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.4.13 Rest of Asia Pacific

11.4.13.1 Rest of Asia Pacific Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.13.2 Rest of Asia Pacific Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.13.3 Rest of Asia Pacific Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.4.13.3 Rest of Asia Pacific Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Automotive Wiring Harness Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.4 Middle East Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.5 Middle East Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.5.1.5 Middle East Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.5.1.6 UAE

11.5.1.6.1 UAE Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.6.2 UAE Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.6.3 UAE Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.5.1.6.3 UAE Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.5.1.7 Egypt

11.5.1.7.1 Egypt Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.7.2 Egypt Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.7.3 Egypt Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.5.1.7.3 Egypt Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.5.1.8 Saudi Arabia

11.5.1.8.1 Saudi Arabia Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.8.2 Saudi Arabia Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.8.3 Saudi Arabia Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.5.1.8.3 Saudi Arabia Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.5.1.9 Qatar

11.5.1.9.1 Qatar Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.9.2 Qatar Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.9.3 Qatar Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.5.1.9.3 Qatar Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Automotive Wiring Harness Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.4 Africa Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.2.5 Africa Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.5.2.8.3 Africa Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.5.2.6 South Africa

11.5.2.6.1 South Africa Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.6.2 South Africa Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.2.6.3 South Africa Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.5.2.8.3 South Africa Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.5.2.7 Nigeria

11.5.2.7.1 Nigeria Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.7.2 Nigeria Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.2.7.3 Nigeria Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.5.2.8 Rest of Africa

11.5.2.8.1 Rest of Africa Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.8.2 Rest of Africa Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.2.8.3 Rest of Africa Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.5.2.8.3 Rest of Africa Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Automotive Wiring Harness Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.4 Latin America Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.5 Latin America Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.6.5 Latin America Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.6.6 Brazil

11.6.6.1 Brazil Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.6.2 Brazil Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.6.3 Brazil Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.6.6.3 Brazil Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.6.7 Argentina

11.6.7.1 Argentina Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.7.2 Argentina Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.7.3 Argentina Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.6.7.3 Argentina Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.6.8 Colombia

11.6.8.1 Colombia Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.8.2 Colombia Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.8.3 Colombia Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.6.8.3 Colombia Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

11.6.9 Rest of Latin America

11.6.9.1 Rest of Latin America Automotive Wiring Harness Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.9.2 Rest of Latin America Automotive Wiring Harness Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.9.3 Rest of Latin America Automotive Wiring Harness Market Estimates and Forecasts, by Electric Vehicle (2020-2032) (USD Billion)

11.6.9.3 Rest of Latin America Automotive Wiring Harness Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

12. Company Profiles

12.1 Leoni AG

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Yazaki Corporation

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Sumitomo Electric Industries

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Denso Corporation

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Marelli

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Kromberg & Schubert

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Aptiv PLC

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 Lear Corporation

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Furukawa Electric Co., Ltd.

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Others

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Component

Electric Wires

Connectors

Terminals

Others

By Application

Body Harness

Chassis Harness

Engine Harness

HVAC Harness

Sensors Harness

By Electric Vehicle

Battery Electric Vehicle (BEV)

Plug-in Hybrid Electric Vehicle (PHEV)

By Vehicle

Light Vehicle

Heavy Vehicle

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Shared Mobility Market size was valued at USD 255.96 Billion in 2023 and is expected to reach USD 1167.54 Billion by 2032 and grow at a CAGR of 17.3% over the forecast period 2024-2032.

The Automotive Brake Linings Market Size was valued at USD 25.67 billion in 2023 and is expected to reach USD 49.70 billion by 2031 and grow at a CAGR of 8.92% over the forecast period 2024-2031.

The Automotive Emission Test Equipment Market Size was valued at USD 772.33 Million in 2023 and is expected to reach USD 1185.07 Million by 2032 and grow at a CAGR of 4.89% over the forecast period 2024-2032.

The V2X Cybersecurity Market Size was valued at USD 2.6 billion in 2023 and is expected to reach USD 12.0 billion by 2032, growing at a CAGR of 18.5% over the forecast period 2024-2032.

The Automotive Battery Management System Market Size was valued at USD 5.27 Billion in 2023 and is expected to reach USD 21.24 Billion by 2032 growing at a CAGR of 16.78% over the forecast period 2024-2032.

The Connected Motorcycle Market Size was USD 160.28 Million in 2023 and will reach USD 3953.17 Million by 2032 and grow at a CAGR of 42.83% by 2024-2032.

Hi! Click one of our member below to chat on Phone