Automotive Wiper System Market Report Scope & Overview:

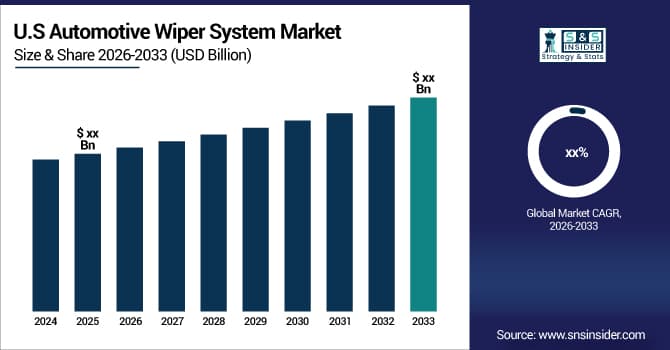

The Automotive Wiper System Market Size was USD 5.25 billion in 2025E and is expected to hit USD 7.02 billion by 2033 and grow at a CAGR of 3.69% by 2026-2033

Automotive wipers are crucial for ensuring clear vision while driving. These essential components consist of a metal arm with a rubber blade that sweeps back and forth across the windshield, removing water, dust, and debris.

To Get More Information On Automotive Wiper System Market - Request Free Sample Report

Powered by electricity or pneumatics, the driver controls their speed. The demand for wipers extends beyond just windshields. Rear wipers are increasingly common in various vehicles, driven by safety concerns and changing consumer preferences. Manufacturers are developing "smart wipers" with rain sensors and other particle detection features, automatically activating for optimal visibility. Additionally, washer wipers that spray cleaning liquid are gaining traction, further enhancing performance. High-end cars even boast headlight wipers for extreme conditions. The growth of the automotive wiper market is fueled by rising urbanization, improved living standards, and increasing purchasing power are leading to a surge in car ownership globally, which directly translates to a higher demand for wipers.

Market Size and Forecast:

-

Market Size in 2025E USD 5.25 Billion

-

Market Size by 2033 USD 7.02 Billion

-

CAGR of 3.69% From 2026 to 2033

-

Base Year 2024

-

Forecast Period 2026-2033

-

Historical Data 2021-2024

Automotive Wiper System Market Trends:

• Integration of smart wipers with rain sensors for automatic operation, enhancing driving convenience and safety.

• Development of washer wipers that spray cleaning fluid directly onto the blade for improved dirt removal and visibility.

• Adoption of advanced, user-friendly features that provide a more sophisticated driving experience.

• Growing focus on eco-friendly wiper blades made from recycled materials to meet consumer demand for sustainability.

• Reduction of water consumption and reliance on virgin materials in wiper production to minimize environmental impact.

Automotive Wiper System Market Growth Drivers:

-

Consumer preference for safety features like rear wipers in various vehicles is boosting market growth.

-

Innovation in smart wipers with rain sensors and washer wipers enhances performance and market appeal.

Technological advancements are revolutionizing the automotive wiper system market, with features like smart wipers equipped with rain sensors taking centre stage. These sensors automatically detect moisture on the windshield, triggering the wipers only when necessary, improving driving convenience and safety. Additionally, washer wipers that spray cleaning fluid directly onto the blade further enhance performance by removing dirt more effectively, leading to a cleaner and clearer view for the driver. These innovative features not only offer superior functionality but also elevate the market's appeal by providing a more sophisticated and user-friendly driving experience.

Automotive Wiper System Market Restraints:

-

Advanced features like smart wipers and washer wipers often come at a premium price, potentially deterring cost-conscious consumers.

-

Integrating advanced wiper systems can require modifications to vehicle design, potentially adding complexity and cost to the manufacturing process.

The automotive wiper system market faces challenges as advanced features like smart and washer wipers increase vehicle costs, potentially deterring price-sensitive consumers. Additionally, integrating these systems may require design modifications, adding complexity and manufacturing expenses, which can slow adoption despite the enhanced functionality and safety benefits offered by such technologies.

Automotive Wiper System Market Opportunities:

-

Development of eco-friendly wiper blades made from recycled materials or with reduced water consumption can attract environmentally conscious consumers.

The rise of eco-conscious consumers presents a significant opportunity for the automotive wiper system market. By developing wiper blades made from recycled materials or with reduced water consumption, manufacturers can tap into this growing segment. These eco-friendly options offer a sustainable alternative to traditional blades, attracting environmentally responsible drivers. This shift towards sustainability can be achieved through utilizing recycled plastic or natural rubber in wiper blade production, reducing the reliance on virgin materials and minimizing waste generation.

Automotive Wiper System Market Segment Analysis:

By Type:

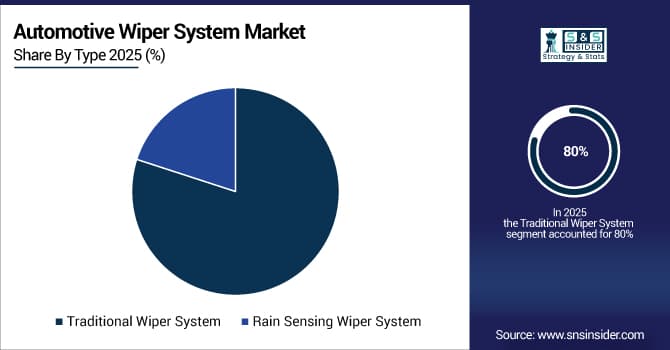

Traditional Wiper System is the dominating sub-segment in the Automotive Wiper System Market by type holding around 70-80% of market share due to its affordability and widespread presence in different vehicle models. The simple design and promptly accessible substitution blades make it the most cost-effective alternative for a large portion of consumers.

By Sales Channel:

OEM is the dominating sub-segment in the Automotive Wiper System Market by sales channel holding around 60% of market share due to the inclusion of wiper systems in new vehicle sales. Car manufacturers typically install traditional wiper systems, although rain-sensing wipers are becoming increasingly common in higher-end models.

By Vehicle Type:

Passenger Cars is the dominating sub-segment in the Automotive Wiper System Market by vehicle type holding above 70% of market share due to the sheer volume of passenger car production and sales globally. The widespread use of passenger cars in various demographics and regions contributes significantly to the demand for wiper systems.

Automotive Wiper System Market Regional Analysis:

Asia Pacific Automotive Wiper System Market Insights

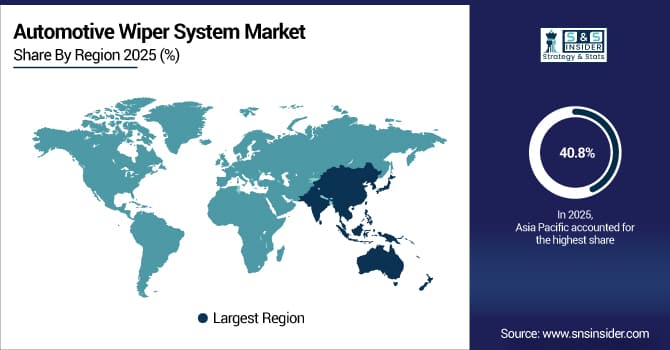

The Asia-Pacific region dominates the automotive wiper system market, holding around 40.8% of market share. This dominance stems from the booming automotive sector in countries like China, India, Japan, and South Korea, leading to a surge in car production and demand for wiper systems. Additionally, the region's emphasis on safety features like advanced wiper technology and its diverse weather patterns requiring optimal visibility further fuel market growth.

Get Customized Report as Per Your Business Requirement - Enquiry Now

North America Automotive Wiper System Market Insights

The North America automotive wiper system market is driven by growing demand for advanced driver-assistance features and enhanced vehicle safety. Increased adoption of smart wipers, rain sensors, and eco-friendly solutions is boosting market growth, supported by well-established automotive manufacturing, rising consumer awareness, and a focus on innovative, high-performance wiper technologies.

Europe Automotive Wiper System Market Insights

Europe is the second highest region in the market with a 25-30% share, its established automotive industry and focus on technological advancements contribute significantly.

Latin America (LATAM) and Middle East & Africa (MEA) Automotive Wiper System Market Insights

The Middle East and Africa are the fastest growing regions in the market. Rising disposable income, government initiatives promoting the automotive industry, and improved infrastructure development in these regions are paving the way for a significant increase in car ownership and the demand for wiper systems.

Automotive Wiper System Market Key Players:

The major key players are DENSO CORPORATION, Mitsuba Corp. (Japan), Acdelco, Robert Bosch Gmbh, Valeo SA, Newport Wipers, Pilot Automotive (US), CARDONE Industries, Sanauto Engineers India Pvt. Ltd., ROCA Industry AB, WAI Global, DOGA, PSV Wipers Limited and other key players.

Acdelco-Company Financial Analysis

Competitive Landscape for Automotive Wiper System Market:

Robert Bosch GmbH is a global leader in automotive components and systems, offering advanced wiper solutions that enhance vehicle safety and driver convenience. The company specializes in smart wipers, rain-sensing technology, and high-performance blades, leveraging innovation and quality to strengthen its presence in the automotive wiper system market worldwide.

- In September 2024, Bosch rolled out a cloud‑based road hazard service that uses anonymized data (including wiper activity) from fleet vehicles to warn drivers of slippery, rainy, or dangerous road conditions in real time.

Schaeffler is a leading automotive supplier known for precision components and systems that improve vehicle performance and safety. In the automotive wiper system market, the company focuses on durable, high-quality wiper mechanisms and integrated solutions, supporting efficient operation, reliability, and enhanced driver visibility in various vehicle applications.

- In August 2024, Schaeffler India launched a digital campaign for its TruPower Wiper Blades, highlighting their high-quality rubber, aerodynamic design, and long life.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 5.25 Billion |

| Market Size by 2033 | USD 7.02 Billion |

| CAGR | CAGR of 3.69% From 2026 to 2033 |

| Base Year | 2024 |

| Forecast Period | 2026-2033 |

| Historical Data | 2021-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Type (Traditional Wiper System, Rain-Sensing Wiper System) • by Sales Channel (OEM, Aftermarket) • by Vehicle Type (Passenger cars, Commercial vehicles) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | DENSO Corporation, Mitsuba Corporation, ACDelco, Robert Bosch GmbH, Valeo SA, Newport Wipers, Pilot Automotive, CARDONE Industries, Sanauto Engineers India Pvt. Ltd., ROCA Industry AB, WAI Global, DOGA, PSV Wipers Limited, Trico Products Corporation, HELLA GmbH & Co. KGaA, Federal-Mogul, Magneti Marelli S.p.A., Nippon Wiper Blade Co. Ltd., Mitsubishi Electric Corporation, ASMO Co., Ltd. |