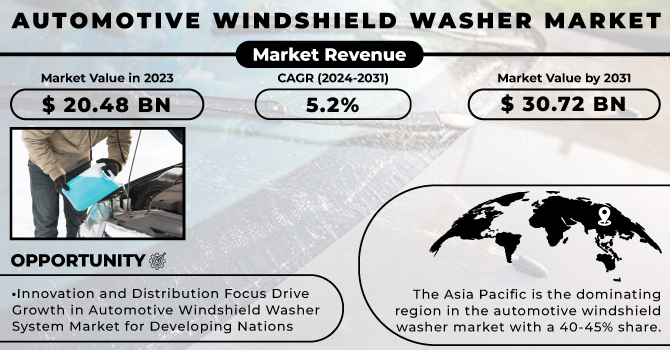

The Automotive Windshield Washer Market Size was valued at USD 20.48 billion in 2023 and is expected to reach USD 30.72 billion by 2031 and grow at a CAGR of 5.2% over the forecast period 2024-2031.

Essential for secure driving, windshield washer fluid plays a vital part in keeping up clear visibility through all climate conditions. This extraordinarily defined fluid, often containing a mix of denatured alcohol, detergents, colorants, and even fragrances, acts in conjunction with the windshield wiper system to effectively remove dirt, dust, and even snow.

Get More Information on Automotive Windshield Washer Market - Request Sample Report

The market for this vital fluid is balanced for significant growth in the coming a long time, fueled by two the components like the increasing demand for its use in vehicles and a growing consumer focus on maintaining their cars, particularly the windshields. This development is assist supported by the availability of various washer fluid formulations, each catering to particular needs and climate conditions. The washer fluid system itself is a well-coordinated network comprising of a reservoir, pump, hoses, and nozzles, working consistently to provide the liquid onto the windshield for ideal cleaning, ensuring a safe and clear driving experience.

KEY DRIVERS:

Surging Commercial Vehicle Sales Drive Growth in Automotive Windshield Washer System Market

The recent surge in commercial vehicle sales has created demand for windshield washer systems. This drift is anticipated to move the development of the car windshield washer system market, as more commercial vehicles require these systems for keeping up clean windshields and ensuring optimal visibility on the road. This development is fueled by the expanded dependence on commercial vehicles for transportation, driving to a more prominent require for their upkeep and maintenance.

High-Performance Vehicles and Consumer Desire for Enhanced Visibility Drive Automotive Windshield Washer System Market Growth.

RESTRAINTS:

High Production Costs Limit Market Growth for Automotive Windshield Washer Fluids

OPPORTUNITIES:

Innovation and Distribution Focus Drive Growth in Automotive Windshield Washer System Market for Developing Nations

Manufacturers in the automotive windshield washer system market are actively innovating to cater to diverse consumer needs. This includes developing application-specific products that address various driving conditions and preferences. Additionally, a strong focus on improving distribution networks ensures wider availability and accessibility of these systems. This combined effort is particularly relevant for developing nations where a growing population and expanding economies are driving the demand for automobiles, leading to a heightened need for efficient windshield washer systems.

Rain-Sensing Wiper Systems Gain Traction in Mid-Sized Cars, Powered by IoT and Collaboration with Automakers

CHALLENGES

High Setup Costs and Short Lifespan of Systems Potentially Hinder Automotive Windshield Washer System Market Growth.

The ongoing conflict between Russia and Ukraine has disrupted the automotive windshield washer system market by causing a 5-7% decline in its growth trajectory. Factory closures and production halts due to parts shortages and supply chain disruptions, particularly in Europe, have directly impacted the demand for new windshield washer systems installed in vehicles. The war has triggered a significant price surge in nickel, a key component for stainless steel used in washer system components. This translates to higher production costs for manufacturers, potentially leading to increased consumer prices and dampening demand. Thus, the economic fallout from the war has shifted consumer spending priorities. With rising inflation and uncertainty, individuals are likely to prioritize essential expenses over non-critical car maintenance like replacing windshield washer fluid or upgrading the system, further hindering market growth.

The economic downturn leads cause to the automotive windshield washer system market at 3-5% decline in the market growth. This slowdown primarily stems from reduced new car sales. As consumers limit their budgets and prioritize essential spending, discretionary purchases like new vehicles take a backseat. This directly translates to a diminished demand for pre-installed windshield washer systems in new cars. The economic uncertainty often leads individuals to postpone non-critical car maintenance, including replacing windshield washer fluid or upgrading the system. This shift in consumer spending behaviour results in a temporary decrease in demand for aftermarket washer fluid and system components. The declining disposable income levels during economic slowdowns impact consumer purchasing power. This can lead individuals to seek cheaper alternatives for windshield washer fluid or even delay purchases altogether. However, it's crucial to remember that the windshield washer system holds a unique position within the automotive industry.

By Fluid Type:

Bug-Repellent

Water-Repellent

Anti-Freeze

Others

Water-Repellent Windshield Washer Fluid is the dominating sub-segment in the Automotive Windshield Washer Market by fluid type holding about 60-65% of market share. Water-repellent washer fluid offers superior visibility during rain and snow by creating a water-beading effect on the windshield, improving safety and driving experience. This makes it the most popular choice for consumers.

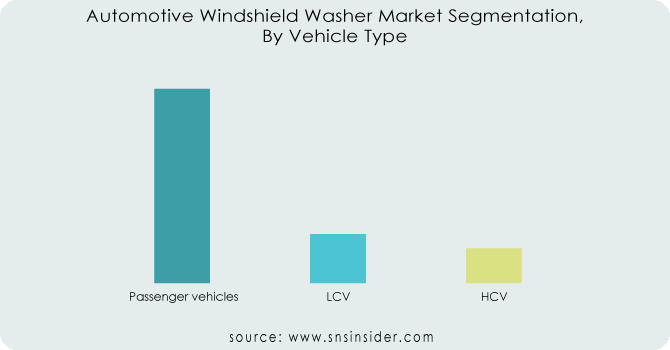

By Vehicle Type:

Passenger vehicles

LCV

HCV

Passenger Vehicles is the dominating sub-segment in the Automotive Windshield Washer Market by vehicle type holding about 70-75% of market share. Passenger vehicles constitute the vast majority of vehicles on the road, leading to a higher demand for windshield washer systems

Get Customized Report as per your Business Requirement - Request For Customized Report

By Application:

OEM

Aftermarket

Aftermarket is the dominating sub-segment in the Automotive Windshield Washer Market by application holding about 65-70% of market share. The aftermarket segment caters to existing vehicles, encompassing replacement washer fluid purchases, system repairs, and upgrades. This segment benefits from the large installed base of vehicles and the need for regular maintenance and fluid refills.

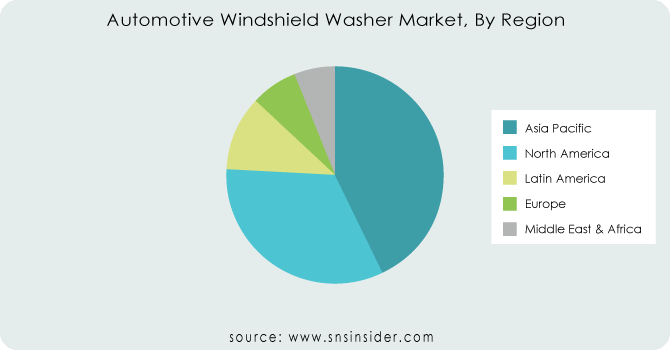

The Asia Pacific is the dominating region in the automotive windshield washer market with a 40-45% share. This dominance stems from its booming automotive industry, particularly in China and India, leading to a massive number of vehicles on the road and a high demand for both washer systems and fluids. Additionally, the region boasts a flourishing aftermarket sector catering to the existing vehicle base, further solidifying its leadership position. North America is the second highest region in the market with a 30-35% share, its well-established automotive industry, strong aftermarket presence, and high consumer awareness regarding car care contribute significantly to its market size.

REGIONAL COVERAGE

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

The major key players are General Motors, Lincoln Aviator, 3M (U.S.), ITW Global Brands (U.S.), Guangzhou Botny Chemical Co., Ltd. (China), Sonax GmbH (Germany), Qwix Mix (U.S.), Total (France), Recochem Inc. (Canada), ACDelco (U.S.), Prestone Products Corporation (U.S.), Soft99 Corporation (Japan), Japan Chemical Industries (Japan) and other key players.

In March 2022 - StradVision and ZF partnered to boost automated driving software offerings. StradVision's SVNet software tackles object detection in challenging conditions and optimizes sensor integration for shuttles and vehicle electrical systems. This collaboration expands both companies' automated driving perception technology portfolios.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.48 Billion |

| Market Size by 2031 | US$ 3.72 Billion |

| CAGR | CAGR of 5.2% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Fluid Type (Bug-Repellent, Water-Repellent, Anti-Freeze, Others) • by Vehicle Type (Passenger vehicles, LCV, HCV) • by Application (OEM, Aftermarket) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America |

| Company Profiles | General Motors, Lincoln Aviator, 3M (U.S.), ITW Global Brands (U.S.), Guangzhou Botny Chemical Co., Ltd. (China), Sonax GmbH (Germany), Qwix Mix (U.S.), Total (France), Recochem Inc. (Canada), ACDelco (U.S.), Prestone Products Corporation (U.S.), Soft99 Corporation (Japan), and Japan Chemical Industries (Japan) |

| Key Drivers | •Glass technology advancements, as well as light flow control, might have an impact on the market. •Larger windshield screens in electric and hybrid automobiles could help accelerate industry growth. |

| RESTRAINTS | •The high costs of windshield washer formulae may prevent the market from growing. •Companies' premiumization of windshield cleaning fluid in order to appeal to all demographics.+D25 |

The Automotive Windshield Washer Market Size was valued at USD 20.48 billion in 2023.

The Automotive Windshield Washer Market grow at a CAGR of 5.2% over the forecast period 2024-2031.

Forecast period of Automotive Windshield Washer Market is 2024-2031.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Impact Analysis

5.1 Impact of Russia-Ukraine Crisis

5.2 Impact of Economic Slowdown on Major Countries

5.2.1 Introduction

5.2.2 United States

5.2.3 Canada

5.2.4 Germany

5.2.5 France

5.2.6 UK

5.2.7 China

5.2.8 Japan

5.2.9 South Korea

5.2.10 India

6. Value Chain Analysis

7. Porter’s 5 Forces Model

8. Pest Analysis

9. Automotive Windshield Washer Market Segmentation, By Fluid Type

9.1 Introduction

9.2 Trend Analysis

9.3 Bug-Repellent

9.4 Water-Repellent

9.5 Anti-Freeze

9.6 Others

10. Automotive Windshield Washer Market Segmentation, By Vehicle Type

10.1 Introduction

10.2 Trend Analysis

10.3 Passenger vehicles

10.4 LCV

10.5 HCV

11. Automotive Windshield Washer Market Segmentation, By Application

11.1 Introduction

11.2Trend Analysis

11.3 OEM

11.4 Aftermarket

12. Regional Analysis

12.1 Introduction

12.2 North America

12.2.1 Trend Analysis

12.2.2 North America Automotive Windshield Washer Market Segmentation, By Country

12.2.3 North America Automotive Windshield Washer Market Segmentation, By Fluid Type

12.2.4 North America Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.2.5 North America Automotive Windshield Washer Market Segmentation, By Application

12.2.6 USA

12.2.6.1 USA Automotive Windshield Washer Market Segmentation, By Fluid Type

12.2.6.2 USA Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.2.6.3 USA Automotive Windshield Washer Market Segmentation, By Application

12.2.7 Canada

12.2.7.1 Canada Automotive Windshield Washer Market Segmentation, By Fluid Type

12.2.7.2 Canada Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.2.7.3 Canada Automotive Windshield Washer Market Segmentation, By Application

12.2.8 Mexico

12.2.8.1 Mexico Automotive Windshield Washer Market Segmentation, By Fluid Type

12.2.8.2 Mexico Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.2.8.3 Mexico Automotive Windshield Washer Market Segmentation, By Application

12.3 Europe

12.3.1 Trend Analysis

12.3.2 Eastern Europe

12.3.2.1 Eastern Europe Automotive Windshield Washer Market Segmentation, by Country

12.3.2.2 Eastern Europe Automotive Windshield Washer Market Segmentation, By Fluid Type

12.3.2.3 Eastern Europe Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.3.2.4 Eastern Europe Automotive Windshield Washer Market Segmentation, By Application

12.3.2.5 Poland

12.3.2.5.1 Poland Automotive Windshield Washer Market Segmentation, By Fluid Type

12.3.2.5.2 Poland Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.3.2.5.3 Poland Automotive Windshield Washer Market Segmentation, By Application

12.3.2.6 Romania

12.3.2.6.1 Romania Automotive Windshield Washer Market Segmentation, By Fluid Type

12.3.2.6.2 Romania Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.3.2.6.4 Romania Automotive Windshield Washer Market Segmentation, By Application

12.3.2.7 Hungary

12.3.2.7.1 Hungary Automotive Windshield Washer Market Segmentation, By Fluid Type

12.3.2.7.2 Hungary Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.3.2.7.3 Hungary Automotive Windshield Washer Market Segmentation, By Application

12.3.2.8 Turkey

12.3.2.8.1 Turkey Automotive Windshield Washer Market Segmentation, By Fluid Type

12.3.2.8.2 Turkey Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.3.2.8.3 Turkey Automotive Windshield Washer Market Segmentation, By Application

12.3.2.9 Rest of Eastern Europe

12.3.2.9.1 Rest of Eastern Europe Automotive Windshield Washer Market Segmentation, By Fluid Type

12.3.2.9.2 Rest of Eastern Europe Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.3.2.9.3 Rest of Eastern Europe Automotive Windshield Washer Market Segmentation, By Application

12.3.3 Western Europe

12.3.3.1 Western Europe Automotive Windshield Washer Market Segmentation, by Country

12.3.3.2 Western Europe Automotive Windshield Washer Market Segmentation, By Fluid Type

12.3.3.3 Western Europe Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.3.3.4 Western Europe Automotive Windshield Washer Market Segmentation, By Application

12.3.3.5 Germany

12.3.3.5.1 Germany Automotive Windshield Washer Market Segmentation, By Fluid Type

12.3.3.5.2 Germany Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.3.3.5.3 Germany Automotive Windshield Washer Market Segmentation, By Application

12.3.3.6 France

12.3.3.6.1 France Automotive Windshield Washer Market Segmentation, By Fluid Type

12.3.3.6.2 France Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.3.3.6.3 France Automotive Windshield Washer Market Segmentation, By Application

12.3.3.7 UK

12.3.3.7.1 UK Automotive Windshield Washer Market Segmentation, By Fluid Type

12.3.3.7.2 UK Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.3.3.7.3 UK Automotive Windshield Washer Market Segmentation, By Application

12.3.3.8 Italy

12.3.3.8.1 Italy Automotive Windshield Washer Market Segmentation, By Fluid Type

12.3.3.8.2 Italy Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.3.3.8.3 Italy Automotive Windshield Washer Market Segmentation, By Application

12.3.3.9 Spain

12.3.3.9.1 Spain Automotive Windshield Washer Market Segmentation, By Fluid Type

12.3.3.9.2 Spain Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.3.3.9.3 Spain Automotive Windshield Washer Market Segmentation, By Application

12.3.3.10 Netherlands

12.3.3.10.1 Netherlands Automotive Windshield Washer Market Segmentation, By Fluid Type

12.3.3.10.2 Netherlands Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.3.3.10.3 Netherlands Automotive Windshield Washer Market Segmentation, By Application

12.3.3.11 Switzerland

12.3.3.11.1 Switzerland Automotive Windshield Washer Market Segmentation, By Fluid Type

12.3.3.11.2 Switzerland Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.3.3.11.3 Switzerland Automotive Windshield Washer Market Segmentation, By Application

12.3.3.1.12 Austria

12.3.3.12.1 Austria Automotive Windshield Washer Market Segmentation, By Fluid Type

12.3.3.12.2 Austria Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.3.3.12.3 Austria Automotive Windshield Washer Market Segmentation, By Application

12.3.3.13 Rest of Western Europe

12.3.3.13.1 Rest of Western Europe Automotive Windshield Washer Market Segmentation, By Fluid Type

12.3.3.13.2 Rest of Western Europe Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.3.3.13.3 Rest of Western Europe Automotive Windshield Washer Market Segmentation, By Application

12.4 Asia-Pacific

12.4.1 Trend Analysis

12.4.2 Asia-Pacific Automotive Windshield Washer Market Segmentation, by Country

12.4.3 Asia-Pacific Automotive Windshield Washer Market Segmentation, By Fluid Type

12.4.4 Asia-Pacific Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.4.5 Asia-Pacific Automotive Windshield Washer Market Segmentation, By Application

12.4.6 China

12.4.6.1 China Automotive Windshield Washer Market Segmentation, By Fluid Type

12.4.6.2 China Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.4.6.3 China Automotive Windshield Washer Market Segmentation, By Application

12.4.7 India

12.4.7.1 India Automotive Windshield Washer Market Segmentation, By Fluid Type

12.4.7.2 India Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.4.7.3 India Automotive Windshield Washer Market Segmentation, By Application

12.4.8 Japan

12.4.8.1 Japan Automotive Windshield Washer Market Segmentation, By Fluid Type

12.4.8.2 Japan Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.4.8.3 Japan Automotive Windshield Washer Market Segmentation, By Application

12.4.9 South Korea

12.4.9.1 South Korea Automotive Windshield Washer Market Segmentation, By Fluid Type

12.4.9.2 South Korea Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.4.9.3 South Korea Automotive Windshield Washer Market Segmentation, By Application

12.4.10 Vietnam

12.4.10.1 Vietnam Automotive Windshield Washer Market Segmentation, By Fluid Type

12.4.10.2 Vietnam Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.4.10.3 Vietnam Automotive Windshield Washer Market Segmentation, By Application

12.4.11 Singapore

12.4.11.1 Singapore Automotive Windshield Washer Market Segmentation, By Fluid Type

12.4.11.2 Singapore Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.4.11.3 Singapore Automotive Windshield Washer Market Segmentation, By Application

12.4.12 Australia

12.4.12.1 Australia Automotive Windshield Washer Market Segmentation, By Fluid Type

12.4.12.2 Australia Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.4.12.3 Australia Automotive Windshield Washer Market Segmentation, By Application

12.4.13 Rest of Asia-Pacific

12.4.13.1 Rest of Asia-Pacific Automotive Windshield Washer Market Segmentation, By Fluid Type

12.4.13.2 Rest of Asia-Pacific Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.4.13.3 Rest of Asia-Pacific Automotive Windshield Washer Market Segmentation, By Application

12.5 Middle East & Africa

12.5.1 Trend Analysis

12.5.2 Middle East

12.5.2.1 Middle East Automotive Windshield Washer Market Segmentation, by Country

12.5.2.2 Middle East Automotive Windshield Washer Market Segmentation, By Fluid Type

12.5.2.3 Middle East Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.5.2.4 Middle East Automotive Windshield Washer Market Segmentation, By Application

12.5.2.5 UAE

12.5.2.5.1 UAE Automotive Windshield Washer Market Segmentation, By Fluid Type

12.5.2.5.2 UAE Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.5.2.5.3 UAE Automotive Windshield Washer Market Segmentation, By Application

12.5.2.6 Egypt

12.5.2.6.1 Egypt Automotive Windshield Washer Market Segmentation, By Fluid Type

12.5.2.6.2 Egypt Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.5.2.6.3 Egypt Automotive Windshield Washer Market Segmentation, By Application

12.5.2.7 Saudi Arabia

12.5.2.7.1 Saudi Arabia Automotive Windshield Washer Market Segmentation, By Fluid Type

12.5.2.7.2 Saudi Arabia Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.5.2.7.3 Saudi Arabia Automotive Windshield Washer Market Segmentation, By Application

12.5.2.8 Qatar

12.5.2.8.1 Qatar Automotive Windshield Washer Market Segmentation, By Fluid Type

12.5.2.8.2 Qatar Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.5.2.8.3 Qatar Automotive Windshield Washer Market Segmentation, By Application

12.5.2.9 Rest of Middle East

12.5.2.9.1 Rest of Middle East Automotive Windshield Washer Market Segmentation, By Fluid Type

12.5.2.9.2 Rest of Middle East Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.5.2.9.3 Rest of Middle East Automotive Windshield Washer Market Segmentation, By Application

12.5.3 Africa

12.5.3.1 Africa Automotive Windshield Washer Market Segmentation, by Country

12.5.3.2 Africa Automotive Windshield Washer Market Segmentation, By Fluid Type

12.5.3.3 Africa Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.5.3.4 Africa Automotive Windshield Washer Market Segmentation, By Application

12.5.3.5 Nigeria

12.5.3.5.1 Nigeria Automotive Windshield Washer Market Segmentation, By Fluid Type

12.5.3.5.2 Nigeria Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.5.3.5.3 Nigeria Automotive Windshield Washer Market Segmentation, By Application

12.5.3.6 South Africa

12.5.3.6.1 South Africa Automotive Windshield Washer Market Segmentation, By Fluid Type

12.5.3.6.2 South Africa Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.5.3.6.3 South Africa Automotive Windshield Washer Market Segmentation, By Application

12.5.3.7 Rest of Africa

12.5.3.7.1 Rest of Africa Automotive Windshield Washer Market Segmentation, By Fluid Type

12.5.3.7.2 Rest of Africa Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.5.3.7.3 Rest of Africa Automotive Windshield Washer Market Segmentation, By Application

12.6 Latin America

12.6.1 Trend Analysis

12.6.2 Latin America Automotive Windshield Washer Market Segmentation, by country

12.6.3 Latin America Automotive Windshield Washer Market Segmentation, By Fluid Type

12.6.4 Latin America Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.6.5 Latin America Automotive Windshield Washer Market Segmentation, By Application

12.6.6 Brazil

12.6.6.1 Brazil Automotive Windshield Washer Market Segmentation, By Fluid Type

12.6.6.2 Brazil Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.6.6.3 Brazil Automotive Windshield Washer Market Segmentation, By Application

12.6.7 Argentina

12.6.7.1 Argentina Automotive Windshield Washer Market Segmentation, By Fluid Type

12.6.7.2 Argentina Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.6.7.3 Argentina Automotive Windshield Washer Market Segmentation, By Application

12.6.8 Colombia

12.6.8.1 Colombia Automotive Windshield Washer Market Segmentation, By Fluid Type

12.6.8.2 Colombia Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.6.8.3 Colombia Automotive Windshield Washer Market Segmentation, By Application

12.6.9 Rest of Latin America

12.6.9.1 Rest of Latin America Automotive Windshield Washer Market Segmentation, By Fluid Type

12.6.9.2 Rest of Latin America Automotive Windshield Washer Market Segmentation, By Vehicle Type

12.6.9.3 Rest of Latin America Automotive Windshield Washer Market Segmentation, By Application

13. Company Profiles

13.1 General Motors

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services Offered

13.1.4 SWOT Analysis

13.1.5 The SNS View

13.2 Lincoln Aviator

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services Offered

13.2.4 SWOT Analysis

13.2.5 The SNS View

13.3 3M (U.S.)

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Products/ Services Offered

13.3.4 SWOT Analysis

13.3.5 The SNS View

13.4 ITW Global Brands (U.S.)

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Products/ Services Offered

13.4.4 SWOT Analysis

13.4.5 The SNS View

13.5 Guangzhou Botny Chemical Co., Ltd. (China)

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Products/ Services Offered

13.5.4 SWOT Analysis

13.5.5 The SNS View

13.6 Sonax GmbH (Germany)

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Products/ Services Offered

13.6.4 SWOT Analysis

13.6.5 The SNS View

13.7 Qwix Mix (U.S.)

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Products/ Services Offered

13.7.4 SWOT Analysis

13.7.5 The SNS View

13.8 Total (France)

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Products/ Services Offered

13.8.4 SWOT Analysis

13.8.5 The SNS View

13.9 Recochem Inc. (Canada)

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Products/ Services Offered

13.9.4 SWOT Analysis

13.9.5 The SNS View

13.10 ACDelco (U.S.)

13.10.1 Company Overview

13.10.2 Financial

13.10.3 Products/ Services Offered

13.10.4 SWOT Analysis

13.10.5 The SNS View

13.11 Prestone Products Corporation (U.S.)

13.11.1 Company Overview

13.11.2 Financial

13.11.3 Products/ Services Offered

13.11.4 SWOT Analysis

13.11.5 The SNS View

13.12 Soft99 Corporation (Japan)

13.12.1 Company Overview

13.12.2 Financial

13.12.3 Products/ Services Offered

13.12.4 SWOT Analysis

13.12.5 The SNS View

13.13 Japan Chemical Industries (Japan)

13.13.1 Company Overview

13.13.2 Financial

13.13.3 Products/ Services Offered

13.13.4 SWOT Analysis

13.13.5 The SNS View

14. Competitive Landscape

14.1 Competitive Benchmarking

14.2 Market Share Analysis

14.3 Recent Developments

14.3.1 Industry News

14.3.2 Company News

14.3.3 Mergers & Acquisitions

15. Use Case and Best Practices

16. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Automotive Ignition Coil Market size was valued at USD 6.91 billion in 2023 and is expected to reach USD 10.44 billion by 2032 and grow at a CAGR of 4.7% over the forecast period 2024-2032.

The E-Scooter Sharing Market Size was valued at USD 1.29 billion in 2023 and will reach USD 6.17 billion by 2032 and grow at a CAGR of 19% by 2024-2032

The Automotive DC-DC Converters Market Size was valued at US$ 813.143 million in 2023 expected to reach USD 8253.129 million by 2031 and grow at a CAGR of 33.6% over the forecast period 2024-2031.

The Public Transportation Market Size was valued at $231.44 billion in 2023 and will reach $440 billion by 2032 and grow at a CAGR of 7.4% by 2024-2032

The Freezing Fishing Vessels Market Size was USD 1.65 Billion in 2023 & is expected to reach USD 2.75 Bn by 2032 & grow at a CAGR of 5.85% by 2024-2032.

The Automotive Leaf Spring Market Size was valued at USD 5.5 billion in 2023 and is expected to reach USD 7.50 billion by 2032 and grow at a CAGR of 3.5% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone