Get More Information on Automotive Virtual Exterior Mirror Market - Request Sample Report

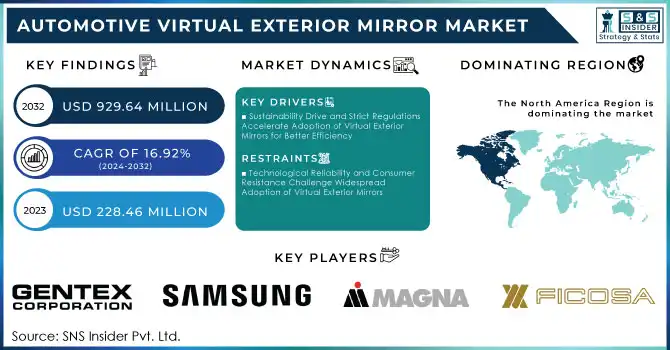

The Automotive Virtual Exterior Mirror Market Size was valued at USD 228.46 Million in 2023 and is expected to reach USD 929.64 Million by 2032 and grow at a CAGR of 16.92% over the forecast period 2024-2032.

The automotive virtual exterior mirror market is anticipated to record an increase in the adoption rate, owing to rising demand from advanced driver assistance systems (ADAS) and biomimetic approaches for improving safety and increasing efficiency. Virtual mirrors replace traditional side mirrors with cameras and digital displays, decreasing blind spots, and providing better visibility under low light and heavy rain conditions. This bump ties in with strict safety regulations and crash-test standards in areas like Europe and North America, as carmakers are being urged to incorporate new tech to lessen blind spots and enhance driver awareness. 70% of new cars in Europe and North America were included with ADAS in 2023, such as camera-based virtual mirrors. Camera-based systems are set to be the standard for advanced safety vehicles across these regions by 2024. The market of virtual mirrors in Asia-Pacific, mainly China, was more than 35% in 2023 due to an increase in the number of electric vehicles (EVs) and consumers for ADAS. These mirrors are proven to reduce 3% aerodynamic drag, improving fuel efficiency. Advancements in technology played a large part too, with Bosch and Magna claiming 20-30% improvements in camera resolution and weather performance from 2022-2023. With the advancement of technology, virtual mirrors are expected to grow quickly in China, with an adoption growth of 17% by 2024.

The Increasing Adoption Of Electric And Autonomous Vehicles Is Also Bolstering This Market

Virtual mirrors are a perfect evolution because self-driving vehicles also utilize advanced imaging and sensor technologies. At the same time, consumer preferences are gravitating toward high-tech, long-luxury with increased safety appeal factor to help push automakers to offer virtual exterior mirrors as an expensive piece of equipment, or as a standard piece of equipment in higher-end models, Tesla for one. This continued evolution is driven by capabilities in camera systems, software, and cloud connectivity that make cameras ever more functional and marketable across vehicle segments. Virtual mirrors were incorporated into 25% of new EVs worldwide in 2023, enhancing vehicle efficiency by 6%. For luxury cars in Europe and Japan, 85% of all new models complied with regulations on camera-based systems while the number is 40% in premium cars for North America. The upgrades in camera tech improved weather performance by 30% and display clarity by 20%. Moreover, virtual mirrors were used on 70% of cars with ADAS to improve safety via blind spot removal.

Key Drivers:

Sustainability Drive and Strict Regulations Accelerate Adoption of Virtual Exterior Mirrors for Better Efficiency

The drive for sustainability across the globe and the rising enforcement of tighter environmental regulations have complemented the uptake of virtual exterior mirrors. This reduces the drag coefficient by eliminating the traditional protrusion caused by side mirrors and, in turn, optimizes vehicle aerodynamics. Reduced drag results in better fuel economy for internal combustion engine (ICE) vehicles and better range for electric vehicles (EVs). In regions such as the European Union and Japan, governments and regulatory bodies are now requiring or at least encouraging the use of energy-efficient information technology. Virtual mirrors are one solution that helps reduce emissions, which is an integral part of environmental goals, increasing their presence in the market. In 2023, virtual mirrors helped vehicles cut drag by as much as 6%, boosting fuel economy and EV range. The 95g/km CO2 limit was applied by the EU, creating an impetus as compliance with the requirement pushed widespread adoption and Japan recorded a 12%, report on fuel economy standards and virtual mirrors' equivalent in electric vehicles and hybrids. The e-Tron tested by Audi showed a 30% visibility bettering in bad weather, and the U.S. reports suggested a 3% annual emission reduction by virtual mirror systems in cities.

Government Support and Technological Advancements Drive Growing Demand for Virtual Exterior Mirrors in Vehicles

New virtual exterior mirrors combine more advanced features, such as blind-spot detection, lane-departure warning systems, and real-time image processing. Those systems also provide a connection to cloud platforms, allowing over-the-air updates and more features that many tech-savvy consumers expect. Also, a growing trend toward self-driving cars that utilize a complex network of sensors and high-accuracy cameras has increased the demand for digital mirrors. With the growing consumer need for functionality as well as design, virtual mirrors are rapidly becoming a desired level of feature in premium and mid-range segments. By 2023, more than 90% of premium vehicles in this market will be equipped with virtual mirrors, to achieve EU safety and emission targets of a 50% CO2 reduction by 2030 as a global trend. Supported by gasoline-beating energy-efficiency incentives these technologies became widely adopted, with 15% of new hybrid and EV models in Japan. Korean vehicle technology exports increased by 35% and 40% Of global consumers from around the world preferred vehicles with vehicle safety systems such as virtual mirrors.

Restrain:

Technological Reliability and Consumer Resistance Challenge Widespread Adoption of Virtual Exterior Mirrors

In heavy rain, fog, or snow when visibility may be poor, cameras and digital displays may struggle to maintain good performance. In addition, they are prone to dirt, scratches, damage, or any other physical obstruction that can affect their entire functionality. Features like image processing and anti-glare require more innovations to make them more consistent. Mirrorless cars are advantageous, but some drivers might just be too used to conventional mirrors; this could mean they'll be less receptive to digital features because they are worried that they may lessen usability, hence confusing safer, especially if a system failure resulting in digital receiver off-one is being made. This is most obvious in areas where knowledge of digital automotive technologies is less developed. To address this skepticism, consumer education and proven practical evidence of the systems being safe and efficient will have to overthrow it.

By Component

The hardware segment accounted for a market share of 63% in 2023, since hardware components are critical for any virtual mirror system to function properly. At their core, these systems consist of hardware like cameras, sensors, and display units that serve in place of conventional side mirrors. As a result of the increasing utilization of technologies based on cameras, as well as the fast growth of sensor technologies (temp, humidity, light, etc.) the hardware has become irreplaceable. This segment is expected to remain dominant due to the increasing penetration of advanced driver assistance systems (ADAS) and safety features in vehicles, which in turn is fuelling the need for high-performance hardware for safety and reliability. Moreover, hardware is a big chunk of the market, partly due to the push towards electric and autonomous vehicles which require amazing camera systems to productively manage movies and safety.

Services is anticipated to achieve the highest CAGR between 2024 and 2032. Specifically, the growth in the market can be attributed to the rising demand for the maintenance, software up-gradation as well as calibration of the virtual mirror systems. The more advanced these systems become, the greater the need for frequent updates that add functionality, bolster safety systems, and correct software bugs. To make the technology more accessible, cloud connectivity and real-time diagnostics are starting to play a larger role in automotive systems, offering manufacturers the ability to instantly update cars and software, which goes a long way toward creating a better customer experience. This move to connected, upgradable systems is driving service demand.

By Deployment Mode

On-premises deployment segment of the automotive virtual exterior mirror market accounted for the largest market share of 62% in 2023. Manufacturers prefer on-prem, as this solution is perceived to be more reliable and secure. With virtual mirrors being a safety or functional component of a vehicle, various OEMs may elect to mount virtual mirrors on the vehicle's onboard systems to help reduce the risks posed by connectivity, data, or system failure. In addition, it allows for seamless integration over to existing vehicle infrastructure, ensuring that manufacturers can continue to manage hardware and software integration processes on behalf of the vehicle manufacturer. This has been especially important in traditional and luxury vehicles where real-time performance and durability are critical.

The cloud deployment model is anticipated to register the fastest compound annual growth rate during the forecast period, owing to the growing adoption of connected vehicle technologies. As automotive systems become more complex and connected, over-the-air (OTA) software updates, diagnostics, and maintenance will become very important, all of which can be facilitated by cloud solutions. A cloud-based virtual mirror system can have greater scalability and flexibility as well as the potential for remote management, enabling manufacturers and service providers to conveniently deliver over-the-air (OTA) updates and upgrades. This coincides with the rising trend towards smart and self-driving vehicles, where the cloud is essential for processing huge amounts of information from sensors, cameras, and other vehicle components.

By Installation Type

The fixed installation type accounted for the largest market share of 58% in 2023. The reason for this monopoly is essentially its reliability and low cost, which makes it the most preferred option for mass-market vehicles. Since fixed systems only need limited modifications to the actual vehicle design, they are easier to integrate into current vehicle types. These mirrors are typically installed in mass-production vehicles and have basic functionalities that do not need to be too complex and have less customization than other types installed with a permanent installation. Additionally, entry-level and mid-range vehicles were always cost-sensitive, demanding easy and cost-effective were always in priority, so fixed mirrors have stormed the market. In less-customizable vehicle applications, the simple and inexpensive nature of fixed systems will likely continue to bolster their majority market share.

The freestyle installation type is predicted to grow the fastest CAGR from 2024-2032. Customizable vehicle features, as well as the adoption of premium vehicles that may also have distinctive features as per customer requirements. With Freestyle installations manufacturers are enabled to create beauty and unique mirror placement. For example, the push toward luxury and self-driving vehicles, which tend to emphasize highly personalized and technologically advanced features, is driving the need for new installation options that are flexible and innovative. These freestyle installations are gaining traction as consumers prefer tailored solutions with the rise in customization trends in the premium vehicle market.

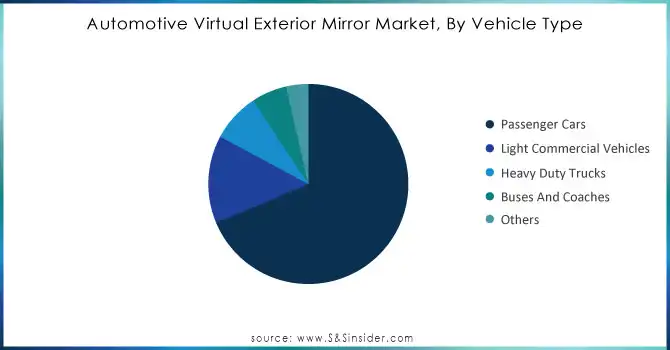

By Vehicle Type

In 2023, the passenger car segment held the largest market share with 68% in the automotive virtual exterior mirror market. This dominance is fueled by the significant use of advanced driver assistance systems (ADAS) in passenger vehicles which can provide improved safety, visibility, and aerodynamic advantages for the vehicle with virtual mirrors. As such, passenger cars are increasingly being outfitted with technology to minimize blind spots and hence growing driver awareness on the road, especially in North America, Europe, and Asia Pacific. Moreover, due to fuel efficiency and demand for aerodynamic design in vehicles, particularly electric vehicles, the boost for virtual exterior mirrors has been essential in reducing drag. Consequently, automotive manufacturers are increasingly integrating these systems into mass production and premium passenger car models as consumers become more concerned regarding safety, performance, and convenient technology assimilation.

Light commercial vehicles (LCVs) are growing at the fastest CAGR over the forecast period 2024-2032. The demand for delivery and vehicles has surged for e-commerce and logistics, most of which are adopting advanced technologies for operational efficiency. The adoption of virtual mirrors provides LCVs with crucial benefits, including increased driver visibility, decreased blind spots, and lower fuel consumption, all of which are important factors for the logistics industry. Moreover, with efficiency and safety regulations getting more stringent in parts of the world such as Europe, LCV manufacturers are also adopting virtual mirrors at a larger level. The continuing evolution of fleet management systems, accompanied by higher penetration of electric light commercial vehicles, is further expected to fuel the LCV-space demand for this technology.

Need Any Customization Research On Automotive Virtual Exterior Mirror Market - Inquiry Now

By Distribution Channel

The OEM (Original Equipment Manufacturer) segment led the automotive virtual exterior mirror market with 64% of the market share in 2023, due to the increasing application of virtual mirrors in new cars and the incorporation of advanced driver assistance system (ADAS) technology. This enables OEMs to control the production and integration variability of the vehicle and include virtual mirrors as standard or premium equipment in mass-market or luxury vehicles. Thus, the growing trends of vehicle safety and eco-friendliness drive OEMs to adopt virtual mirrors more actively on their vehicles thanks to regulations in vehicle emission and crash safety areas in Europe, North America, and so on. Finally, these technologies have been added into cars by automakers to keep up with their competitors, with the electric vehicle (EV) space being a major one seeing consumer demand as such/drivers of EVs were said to be ideal users in this aspect due to the aerodynamic benefits virtual mirrors have.

The aftermarket segment is anticipated to reach this sector with the fastest compound annual growth rate from 2024 to 2032. The market for virtual exterior mirrors is growing because more consumers are looking at retrofitting and upgrading their vehicles but no new ones have many new technologies with the goal of enhancing their driving experience and vehicle safety. The aftermarket, on the other hand, provides convenience allowing vehicle owners to opt for customization of their existing models with high-tech features which was lacking when the vehicle was manufactured. Strong growth in the aftermarket segment is driven by the rising availability of economical retrofitting kits and the increasing trend of vehicle personalization. Furthermore, increased usage of virtual mirrors in the fleet management sector which includes both commercial vehicles and logistics companies is also fuelling the demand for the aftermarket as business establishments are aiming for operational efficiencies alongside rising safety regulations.

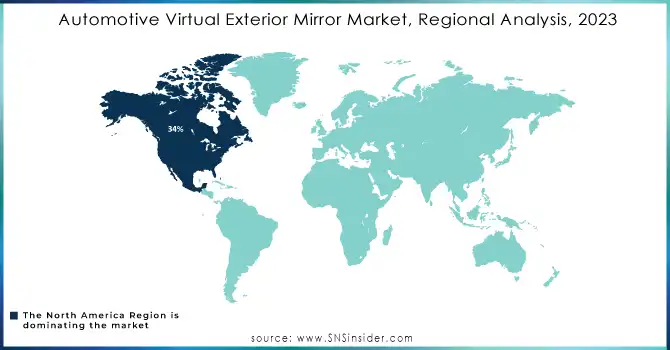

North America accounted for a majority market share of 34% in 2023, owing to increased adoption of vehicles equipped with advanced safety and technology features by consumers. One important case is General Motors (GM), which has been placing virtual mirrors in its upper-end products, for instance, the Cadillac CT6. Instead of mirrors, the vehicle employs side-view cameras to help enhance safety while also smoothing aerodynamics. Tesla, for example, also led the charge with a camera-based system for its vehicles which includes the upcoming Cybertruck that will also adopt digital mirrors in a bid to increase vehicle autonomy and offer a more streamlined vehicle profile. Electric vehicles (EVs) are on the rise in the U.S., and automakers are determined to integrate digital technologies (virtual mirrors) to provide customers with improved fuel economy and safety. Moreover, it pushes more auto-makers to adopt these technologies due to regulatory pressures and new initiatives for sustainability and safety standards.

Asia Pacific will grow at the fastest rate (CAGR) between 2024–2032, owing to growing automotive production & technical advancements in countries such as Japan, China, and South Korea. This region is slowly but steadily adopting virtual mirrors in vehicles with Honda and Toyota being major players. Such as Honda, for example, when it launched the Honda E, the car came with an electric car digital side mirror system that has better visibility while also reducing the drag on the car. As the automotive landscape in China adopts electric and autonomous driving technology, companies like BYD and NIO are incorporating camera-based systems into their vehicle design to better align with innovation while addressing uncertainties around regulations. Virtual mirrors are essential technology for enhancing the aerodynamic performance of EVs, as China is among the world's biggest EV markets.

Some of the major players in the Automotive virtual exterior mirror Market are:

Gentex Corporation (Smart Beam, Digital Rearview Mirrors)

Samsung Electronics (Samsung Virtual Mirror System, Digital Cockpit)

Magna International (Camera-Based Mirror Systems, Vision Systems)

Ficosa International (e-Mirror System, Mirror Camera System)

Valeo SA (Valeo Vision Systems, Blind-Spot Detection Systems)

Continental AG (Camera-Monitoring System, Smart Mirror)

Robert Bosch GmbH (Bosch Virtual Mirror, Rearview Camera Systems)

Murakami Corporation (Digital Mirror System, Camera Monitors)

Honda Motor Co., Ltd. (Honda E with Digital Mirrors, Side Camera Mirror System)

Toyota Motor Corporation (Toyota Digital Exterior Mirrors, Lexus Virtual Mirrors)

LG Electronics (LG Camera-Based Mirror System, OLED Displays)

Denso Corporation (Camera-Based Mirror Systems, Electronic Mirrors)

Aptiv PLC (Aptiv Advanced Driver Assistance Systems, Adaptive Exterior Mirrors)

BMW AG (BMW iX with Virtual Mirrors, BMW Digital Mirror System)

Audi AG (Audi e-tron Virtual Mirrors, Audi Camera-Based Mirror System)

Nissan Motor Co., Ltd. (Nissan Leaf Virtual Mirrors, Nissan Intelligent Mirror System)

ZF Friedrichshafen AG (ZF Digital Mirror System, ZF Rearview Camera System)

Valeo S.A. (Valeo Camera System, Smart Rearview Mirror)

Furukawa Electric Co., Ltd. (Furukawa Camera Monitors, Virtual Mirror Systems)

Kyocera Corporation (Kyocera Camera Mirror System, Digital Monitor for Vehicles)

3M

LG Chem

BASF

Sumitomo Chemical

SABIC

Dow Chemical

Mitsubishi Chemical Corporation

DuPont

Covestro AG

Honeywell International

In July 2024, the 2024 Audi A6 e-tron12 features second-generation virtual exterior mirrors, improving aerodynamics and vehicle efficiency. These mirrors offer automatic adjustment, electric folding, and heated cameras for better visibility.

In June 2024, the Audi Q8 e-tron will feature virtual exterior mirrors with cameras that send high-resolution images to OLED screens inside, enhancing safety and visibility. Currently available in Europe, the system adjusts automatically for different driving conditions.

| Report Attributes | Details |

| Market Size in 2023 | USD 228.46 Million |

| Market Size by 2032 | USD 929.64 Million |

| CAGR | CAGR of 16.92% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services) • By Deployment Mode (On-Premises, Cloud) • By Installation Type (Fixed, Free Style) • By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Duty Trucks, Buses and Coaches, Others) • By Distribution Channel (OEM, Aftermarket, IAM (Independent Aftermarket Manufacturer)) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Gentex Corporation, Samsung Electronics, Magna International, Ficosa International, Valeo SA, Continental AG, Robert Bosch GmbH, Murakami Corporation, Honda Motor Co., Ltd., Toyota Motor Corporation, LG Electronics, Denso Corporation, Aptiv PLC, BMW AG, Audi AG, Nissan Motor Co., Ltd., ZF Friedrichshafen AG, Valeo S.A., Furukawa Electric Co., Ltd., Kyocera Corporation. |

| Key Drivers | • Sustainability Drive and Strict Regulations Accelerate Adoption of Virtual Exterior Mirrors for Better Efficiency • Government Support and Technological Advancements Drive Growing Demand for Virtual Exterior Mirrors in Vehicles |

| RESTRAINTS | • Technological Reliability and Consumer Resistance Challenge Widespread Adoption of Virtual Exterior Mirrors |

Ans: The Automotive virtual exterior mirror Market is expected to grow at a CAGR of 16.92% during 2024-2032.

Ans: Automotive virtual exterior mirror Market size was USD 228.46 million in 2023 and is expected to Reach USD 929.64 million by 2032.

Ans: The major growth factor of the automotive virtual exterior mirror market is the increasing demand for enhanced vehicle safety, improved aerodynamics, and the integration of advanced driver assistance systems (ADAS) in modern vehicles.

Ans: The Passenger Cars segment dominated the Automotive virtual exterior mirror Market in 2023.

Ans: North America dominated the Automotive virtual exterior mirror Market in 2023.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Automotive Virtual Exterior Mirror Performance Metrics of Virtual Mirrors (2023)

5.2 Automotive Virtual Exterior Mirror Technology Adoption Rate (2023)

5.3 Automotive Virtual Exterior Mirror Consumer Preference and Sentiment

5.4 Automotive Virtual Exterior Mirror Average Product Lifespan and Reliability

5.5 Automotive Virtual Exterior Mirror Growth in Electric and Autonomous Vehicle Segments

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Automotive virtual exterior mirror Market Segmentation, By Component

7.1 Chapter Overview

7.2 Hardware

7.2.1 Hardware Market Trends Analysis (2020-2032)

7.2.2 Hardware Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Software

7.3.1 Software Market Trends Analysis (2020-2032)

7.3.2 Software Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Services

7.4.1 Services Market Trends Analysis (2020-2032)

7.4.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Automotive virtual exterior mirror Market Segmentation, By Deployment Mode

8.1 Chapter Overview

8.2 On-Premises

8.2.1 On-Premises Market Trends Analysis (2020-2032)

8.2.2 On-Premises Market Size Estimates and Forecasts To 2032 (USD Billion)

8.3 Cloud

8.3.1 Cloud Market Trends Analysis (2020-2032)

8.3.2 Cloud Market Size Estimates and Forecasts To 2032 (USD Billion)

9. Automotive virtual exterior mirror Market Segmentation, By Installation Type

9.1 Chapter Overview

9.2 Fixed

9.2.1 Fixed Market Trends Analysis (2020-2032)

9.2.2 Fixed Market Size Estimates and Forecasts To 2032 (USD Billion)

9.3 Free Style

9.3.1 Free Style Market Trends Analysis (2020-2032)

9.3.2 Free Style Market Size Estimates and Forecasts To 2032 (USD Billion)

10. Automotive virtual exterior mirror Market Segmentation, By Vehicle Type

10.1 Chapter Overview

10.2 Passenger Cars

10.2.1 Passenger Cars Market Trends Analysis (2020-2032)

10.2.2 Passenger Cars Market Size Estimates and Forecasts To 2032 (USD Billion)

10.3 Light Commercial Vehicles

10.3.1 Light Commercial Vehicles Market Trends Analysis (2020-2032)

10.3.2 Light Commercial Vehicles Market Size Estimates and Forecasts To 2032 (USD Billion)

10.4 Heavy Duty Trucks

10.4.1 Heavy Duty Trucks Market Trends Analysis (2020-2032)

10.4.2 Heavy Duty Trucks Market Size Estimates and Forecasts To 2032 (USD Billion)

10.5 Buses and Coaches

10.5.1 Buses and Coaches Market Trends Analysis (2020-2032)

10.5.2 Buses and Coaches Market Size Estimates and Forecasts To 2032 (USD Billion)

10.6 Others

10.6.1 Others Market Trends Analysis (2020-2032)

10.6.2 Others Market Size Estimates and Forecasts To 2032 (USD Billion)

11. Automotive virtual exterior mirror Market Segmentation, By Distribution Channel

11.1 Chapter Overview

11.2 OEM

11.2.1 OEM Market Trends Analysis (2020-2032)

11.2.2 OEM Market Size Estimates and Forecasts To 2032 (USD Billion)

11.3 Aftermarket

11.3.1 Aftermarket Market Trends Analysis (2020-2032)

11.3.2 Aftermarket Market Size Estimates and Forecasts To 2032 (USD Billion)

11.4 IAM (Independent Aftermarket Manufacturer)

11.4.1 IAM (Independent Aftermarket Manufacturer) Market Trends Analysis (2020-2032)

11.4.2 IAM (Independent Aftermarket Manufacturer) Market Size Estimates and Forecasts To 2032 (USD Billion)

12. Regional Analysis

12.1 Chapter Overview

12.2 North America

12.2.1 Trends Analysis

12.2.2 North America Automotive Virtual Exterior Mirror Market Estimates and Forecasts, By Country (2020-2032) (USD Billion)

12.2.3 North America Automotive Virtual Exterior Mirror Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.2.4 North America Automotive Virtual Exterior Mirror Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.2.5 North America Automotive Virtual Exterior Mirror Market Estimates and Forecasts, By Installation Type (2020-2032) (USD Billion)

12.2.6 North America Automotive Virtual Exterior Mirror Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.2.7 North America Automotive Virtual Exterior Mirror Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.2.8 USA

12.2.8.1 USA Automotive Virtual Exterior Mirror Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.2.8.2 USA Automotive Virtual Exterior Mirror Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.2.8.3 USA Automotive Virtual Exterior Mirror Market Estimates and Forecasts, By Installation Type (2020-2032) (USD Billion)

12.2.8.4 USA Automotive Virtual Exterior Mirror Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.2.8.5 USA Automotive Virtual Exterior Mirror Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.2.9 Canada

12.2.9.1 Canada Automotive Virtual Exterior Mirror Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.2.9.2 Canada Automotive Virtual Exterior Mirror Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.2.9.3 Canada Automotive Virtual Exterior Mirror Market Estimates and Forecasts, By Installation Type (2020-2032) (USD Billion)

12.2.9.4 Canada Automotive Virtual Exterior Mirror Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.2.9.5 Canada Automotive Virtual Exterior Mirror Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.2.10 Mexico

12.2.10.1 Mexico Automotive Virtual Exterior Mirror Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.2.10.2 Mexico Automotive Virtual Exterior Mirror Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.2.10.3 Mexico Automotive Virtual Exterior Mirror Market Estimates and Forecasts, By Installation Type (2020-2032) (USD Billion)

12.2.10.4 Mexico Automotive Virtual Exterior Mirror Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.2.10.5 Mexico Automotive Virtual Exterior Mirror Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.3 Europe

12.3.1 Eastern Europe

12.3.1.1 Trends Analysis

12.3.1.2 Eastern Europe Automotive Virtual Exterior Mirror Market Estimates and Forecasts, By Country (2020-2032) (USD Billion)

12.3.1.3 Eastern Europe Automotive Virtual Exterior Mirror Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.4 Eastern Europe Automotive Virtual Exterior Mirror Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.1.5 Eastern Europe Automotive Virtual Exterior Mirror Market Estimates and Forecasts, By Installation Type (2020-2032) (USD Billion)

12.3.1.6 Eastern Europe Automotive Virtual Exterior Mirror Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.7 Eastern Europe Automotive Virtual Exterior Mirror Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.3.1.8 Poland

12.3.1.8.1 Poland Automotive Virtual Exterior Mirror Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.8.2 Poland Automotive Virtual Exterior Mirror Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.1.8.3 Poland Automotive Virtual Exterior Mirror Market Estimates and Forecasts, By Installation Type (2020-2032) (USD Billion)

12.3.1.8.4 Poland Automotive Virtual Exterior Mirror Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.8.5 Poland Automotive Virtual Exterior Mirror Market Estimates and Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.3.1.9 Romania

12.3.1.9.1 Romania Automotive Virtual Exterior Mirror Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.9.2 Romania Automotive Virtual Exterior Mirror Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.1.9.3 Romania Automotive Virtual Exterior Mirror Market Estimates and Forecasts, By Installation Type (2020-2032) (USD Billion)

12.3.1.9.4 Romania Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.9.5 Romania Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.3.1.10 Hungary

12.3.1.10.1 Hungary Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.10.2 Hungary Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.1.10.3 Hungary Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Installation Type (2020-2032) (USD Billion)

12.3.1.10.4 Hungary Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.10.5 Hungary Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.3.1.11 Turkey

12.3.1.11.1 Turkey Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.11.2 Turkey Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.1.11.3 Turkey Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Installation Type (2020-2032) (USD Billion)

12.3.1.11.4 Turkey Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.11.5 Turkey Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.3.1.12 Rest Of Eastern Europe

12.3.1.12.1 Rest Of Eastern Europe Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.12.2 Rest Of Eastern Europe Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.1.12.3 Rest Of Eastern Europe Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Installation Type (2020-2032) (USD Billion)

12.3.1.12.4 Rest Of Eastern Europe Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.12.5 Rest Of Eastern Europe Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.3.2 Western Europe

12.3.2.1 Trends Analysis

12.3.2.2 Western Europe Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.3.2.3 Western Europe Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.4 Western Europe Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.2.5 Western Europe Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Installation Type (2020-2032) (USD Billion)

12.3.2.6 Western Europe Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.7 Western Europe Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.3.2.8 Germany

12.3.2.8.1 Germany Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.8.2 Germany Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.2.8.3 Germany Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Material Vehicle Type (2020-2032) (USD Billion)

12.3.2.8.4 Germany Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.8.5 Germany Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.3.2.9 France

12.3.2.9.1 France Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.9.2 France Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.2.9.3 France Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Installation Type (2020-2032) (USD Billion)

12.3.2.9.4 France Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.9.5 France Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.3.2.10 UK

12.3.2.10.1 UK Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.10.2 UK Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.2.10.3 UK Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Installation Type (2020-2032) (USD Billion)

12.3.2.10.4 UK Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.10.5 UK Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.3.2.11 Italy

12.3.2.11.1 Italy Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.11.2 Italy Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.2.11.3 Italy Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Installation Type (2020-2032) (USD Billion)

12.3.2.11.4 Italy Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.11.5 Italy Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.3.2.12 Spain

12.3.2.12.1 Spain Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.12.2 Spain Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.2.12.3 Spain Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Installation Type (2020-2032) (USD Billion)

12.3.2.12.4 Spain Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.12.5 Spain Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.3.2.13 Netherlands

12.3.2.13.1 Netherlands Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.13.2 Netherlands Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.2.13.3 Netherlands Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Installation Type (2020-2032) (USD Billion)

12.3.2.13.4 Netherlands Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.13.5 Netherlands Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.3.2.14 Switzerland

12.3.2.14.1 Switzerland Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.14.2 Switzerland Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.2.14.3 Switzerland Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Installation Type (2020-2032) (USD Billion)

12.3.2.14.4 Switzerland Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.12.5 Switzerland Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.3.2.15 Austria

12.3.2.15.1 Austria Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.15.2 Austria Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.2.15.3 Austria Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Installation Type (2020-2032) (USD Billion)

12.3.2.15.4 Austria Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.15.5 Austria Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.3.2.16 Rest Of Western Europe

12.3.2.16.1 Rest Of Western Europe Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.16.2 Rest Of Western Europe Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.2.16.3 Rest Of Western Europe Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Installation Type (2020-2032) (USD Billion)

12.3.2.16.4 Rest Of Western Europe Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.16.5 Rest Of Western Europe Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.4 Asia Pacific

12.4.1 Trends Analysis

12.4.2 Asia Pacific Automotive virtual exterior mirror Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.4.3 Asia Pacific Automotive virtual exterior mirror Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.4 Asia Pacific Automotive virtual exterior mirror Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.4.5 Asia Pacific Automotive virtual exterior mirror Market Estimates And Forecasts, By Installation Type (2020-2032) (USD Billion)

12.4.6 Asia Pacific Automotive virtual exterior mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.7 Asia Pacific Automotive virtual exterior mirror Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.4.8 China

12.4.8.1 China Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.8.2 China Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.4.8.3 China Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Installation Type (2020-2032) (USD Billion)

12.4.8.4 China Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.8.5 China Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.4.9 India

12.4.9.1 India Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.9.2 India Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.4.9.3 India Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Installation Type (2020-2032) (USD Billion)

12.4.9.4 India Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.9.5 India Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.4.10 Japan

12.4.10.1 Japan Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.10.2 Japan Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.4.10.3 Japan Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Installation Type (2020-2032) (USD Billion)

12.4.10.4 Japan Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.10.5 Japan Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.4.11 South Korea

12.4.11.1 South Korea Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.11.2 South Korea Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.4.11.3 South Korea Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Installation Type (2020-2032) (USD Billion)

12.4.11.4 South Korea Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.11.5 South Korea Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.4.12 Vietnam

12.4.12.1 Vietnam Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.12.2 Vietnam Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.4.12.3 Vietnam Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Installation Type (2020-2032) (USD Billion)

12.4.12.4 Vietnam Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.12.5 Vietnam Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.4.13 Singapore

12.4.13.1 Singapore Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.13.2 Singapore Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.4.13.3 Singapore Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Installation Type (2020-2032) (USD Billion)

12.4.13.4 Singapore Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.13.5 Singapore Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.4.14 Australia

12.4.14.1 Australia Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.14.2 Australia Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.4.14.3 Australia Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Installation Type (2020-2032) (USD Billion)

12.4.14.4 Australia Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.14.5 Australia Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.4.15 Rest Of Asia Pacific

12.4.15.1 Rest Of Asia Pacific Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.4.15.2 Rest Of Asia Pacific Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.4.15.3 Rest Of Asia Pacific Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Installation Type (2020-2032) (USD Billion)

12.4.15.4 Rest Of Asia Pacific Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.15.5 Rest Of Asia Pacific Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.5 Middle East And Africa

12.5.1 Middle East

12.5.1.1 Trends Analysis

12.5.1.2 Middle East Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.5.1.3 Middle East Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.4 Middle East Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.5 Middle East Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Installation Type (2020-2032) (USD Billion)

12.5.1.6 Middle East Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.7 Middle East Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.5.1.8 UAE

12.5.1.8.1 UAE Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.8.2 UAE Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.8.3 UAE Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Installation Type (2020-2032) (USD Billion)

12.5.1.8.4 UAE Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.8.5 UAE Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.5.1.9 Egypt

12.5.1.9.1 Egypt Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.9.2 Egypt Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.5.1.9.3 Egypt Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Installation Type (2020-2032) (USD Billion)

12.5.1.9.4 Egypt Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.9.5 Egypt Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.5.1.10 Saudi Arabia

12.5.1.10.1 Saudi Arabia Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.10.2 Saudi Arabia Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.5.1.10.3 Saudi Arabia Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Installation Type (2020-2032) (USD Billion)

12.5.1.10.4 Saudi Arabia Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.10.5 Saudi Arabia Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.5.1.11 Qatar

12.5.1.11.1 Qatar Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.11.2 Qatar Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.5.1.11.3 Qatar Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Installation Type (2020-2032) (USD Billion)

12.5.1.11.4 Qatar Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.11.5 Qatar Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.5.1.12 Rest Of Middle East

12.5.1.12.1 Rest Of Middle East Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.12.2 Rest Of Middle East Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.5.1.12.3 Rest Of Middle East Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Installation Type (2020-2032) (USD Billion)

12.5.1.12.4 Rest Of Middle East Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.12.5 Rest Of Middle East Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.5.2 Africa

12.5.2.1 Trends Analysis

12.5.2.2 Africa Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.5.2.3 Africa Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.2.4 Africa Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.5.2.5 Africa Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Installation Type (2020-2032) (USD Billion)

12.5.2.6 Africa Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.2.7 Africa Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.5.2.8 South Africa

12.5.2.8.1 South Africa Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.2.8.2 South Africa Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.5.2.8.3 South Africa Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Installation Type (2020-2032) (USD Billion)

12.5.2.8.4 South Africa Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.2.8.5 South Africa Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.5.2.9 Nigeria

12.5.2.9.1 Nigeria Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.2.9.2 Nigeria Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.5.2.9.3 Nigeria Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Installation Type (2020-2032) (USD Billion)

12.5.2.9.4 Nigeria Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.2.9.5 Nigeria Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.5.2.10 Rest Of Africa

12.5.2.10.1 Rest Of Africa Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.5.2.10.2 Rest Of Africa Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.5.2.10.3 Rest Of Africa Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Installation Type (2020-2032) (USD Billion)

12.5.2.10.4 Rest Of Africa Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.2.10.5 Rest Of Africa Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.6 Latin America

12.6.1 Trends Analysis

12.6.2 Latin America Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.6.3 Latin America Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.6.4 Latin America Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.6.5 Latin America Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Installation Type (2020-2032) (USD Billion)

12.6.6 Latin America Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.6.7 Latin America Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.6.8 Brazil

12.6.8.1 Brazil Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.6.8.2 Brazil Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.6.8.3 Brazil Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Installation Type (2020-2032) (USD Billion)

12.6.8.4 Brazil Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.6.8.5 Brazil Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.6.9 Argentina

12.6.9.1 Argentina Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.6.9.2 Argentina Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.6.9.3 Argentina Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Installation Type (2020-2032) (USD Billion)

12.6.9.4 Argentina Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.6.9.5 Argentina Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.6.10 Colombia

12.6.10.1 Colombia Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.6.10.2 Colombia Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.6.10.3 Colombia Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Installation Type (2020-2032) (USD Billion)

12.6.10.4 Colombia Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.6.10.5 Colombia Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

12.6.11 Rest Of Latin America

12.6.11.1 Rest Of Latin America Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Component (2020-2032) (USD Billion)

12.6.11.2 Rest Of Latin America Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.6.11.3 Rest Of Latin America Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Installation Type (2020-2032) (USD Billion)

12.6.11.4 Rest Of Latin America Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.6.11.5 Rest Of Latin America Automotive Virtual Exterior Mirror Market Estimates And Forecasts, By Distribution Channel (2020-2032) (USD Billion)

13. Company Profiles

13.1 Gentex Corporation

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services Offered

13.1.4 SWOT Analysis

13.2 Samsung Electronics

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services Offered

13.2.4 SWOT Analysis

13.3 Magna International

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Products/ Services Offered

13.3.4 SWOT Analysis

13.4 Ficosa International

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Products/ Services Offered

13.4.4 SWOT Analysis

13.5 Valeo SA

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Products/ Services Offered

13.5.4 SWOT Analysis

13.6 Continental AG

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Products/ Services Offered

13.6.4 SWOT Analysis

13.7 Robert Bosch GmbH

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Products/ Services Offered

13.7.4 SWOT Analysis

13.8 Murakami Corporation

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Products/ Services Offered

13.8.4 SWOT Analysis

13.9 Honda Motor Co., Ltd.

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Products/ Services Offered

13.9.4 SWOT Analysis

13.10 Toyota Motor Corporation

13.12.1 Company Overview

13.12.2 Financial

13.12.3 Products/ Services Offered

13.12.4 SWOT Analysis

14. Use Cases and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Component

Hardware

Software

Services

By Deployment Mode

On-Premises

Cloud

By Installation Type

Fixed

Free Style

By Vehicle Type

Passenger Cars

Light Commercial Vehicles

Heavy Duty Trucks

Buses And Coaches

Others

By Distribution Channel

OEM

Aftermarket

IAM (Independent Aftermarket Manufacturer)

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Automotive Powertrain Market size was valued at USD 908.14 Bn in 2023 and is expected to reach USD 2455.30 Bn by 2032, growing at a CAGR of 11.8% over the forecast period 2024-2032.

The Car Accessories Market size was valued at USD 9.2 billion in 2023 and is expected to reach USD 13.11 Bn by 2032 and grow at a CAGR of 4% by 2024-2032.

The Automotive Horn Systems Market Size was valued at USD 923.17 million in 2023 and is expected to reach USD 1812.64 million by 2031 and grow at a CAGR of 8.8% over the forecast period 2024-2031.

The Armored Vehicle Market size will reach USD 68.04 Bn by 2032, the market was valued at USD 49.92 Bn in 2023 and will grow at a CAGR of 3.5% by 2024-2032.

The Automotive Engine Market Size was valued at USD 99.81 Billion in 2023 and is expected to reach USD 127.96 Billion by 2032 and grow at a CAGR of 2.82% over the forecast period 2024-2032.

The Route Optimization Software Market Size was valued at USD 7.01 Billion in 2023 & will reach USD 23.50 Bn by 2032 & grow at a CAGR of 14.41% by 2024-2032

Hi! Click one of our member below to chat on Phone