To get more information on Automotive Sun Visor Market - Request Free Sample Report

The Automotive Sun Visor Market Size was valued at USD 2.32 billion in 2023 and is expected to reach USD 3.50 billion by 2032 and grow at a CAGR of 4.73% over the forecast period 2024-2032.

The Automotive Sun Visor Market is growing at an encouraging rate as a result of technological developments, innovative designs, and government policies concerning automobile safety and convenience. As a result of this, Japan, China, the USA, France, Germany, and India have been a significant market in 2023 by setting strict safety measures and being supportive of auto technology developments. According to the National Highway Traffic Safety Administration, glare from the sun is involved in about 9,000 accidents each year. The National Library of Medicine states that there is a 16% greater chance of an accident being fatal if the accident occurs with bright sunshine rather than under normal conditions. Therefore governments are heavily investing in policies to promote the usage of safer vehicle parts, including advanced sun visors that help in solar protection. Technological innovation is an essential market driver, with firms releasing 2023 and 2024 sun visor technologies, such as electrochromic sun visors, that change with conditions of light to enhance comfort and safety for users. For instance, on Ford Global Technologies has filed with the U.S. Patent and Trademark Office for a patent for an automatic window tinting system with occupant light exposure detection. This system uses advanced image analysis to adjust light exposure via electrochromic glass, window tinting, and smart sun visors for improved comfort.

Moreover, industry participants are investing heavily in smart solutions, including anti-glare coatings and adjustable sun visor designs. Recent technological advancements, such as integrated sensors and automated systems, are set to redefine vehicle interiors and safety protocols. For instance, leading automotive nations are focusing on eco-friendly production methods and solar protection materials, aligning with the global environmental movement. Moreover, Asia-Pacific has opportunities in the region due to the growing trend of urbanization and increased automobile production. Also, advanced government initiatives to promote automotive safety and technological advancement open up a strong and innovative market environment. Industry majors are exploiting strategic partnerships and innovation hubs for opportunities in this new landscape of the market.

Key Drivers:

Consumer Demand For High-End Safety And Comfort Features Is On The Rise.

The increasing awareness of consumers regarding the role of advanced sun visors in reducing UV exposure and glare is boosting demand. Sun visors with smart technologies such as automatic dimming are being preferred due to their convenience and safety advantages. Government initiatives to reduce the number of accidents caused by visibility issues also support this trend. For example, Research indicates that between 2023 and 2024, the consumer interest in safety technology increased by 20%.

The Smart And Electrochromic Sun Visor Technology Is Improved Through Technological Innovation.

Recently, electrochromic sun visors, along with other smart features, are revamping the market to challenge driver visibility and UV protection. Electrochromic solutions, like the self-tinting visor based on sunlight intensity, is quickly gaining the attraction of car manufacturers. It brings about better glare reduction and efficiency with energy. Governments in the advanced economies of Germany and USA are coming up with funding strategies to speed up the process of technological development. Due to this, demand growth rates are expected to go up by 15%.

Restrain:

High Cost Of Developed Technologies Of Advanced Sun Visor Prevents Its Large-Scale Acceptance.

The high cost in terms of advanced technological integrations, such as electrochromic and sensor-based sun visors, is the significant restraint in the automotive sun visor market. Even though these innovations provide increased safety and comfort for the end-user, their production process involves advanced materials and technologies with a high price tag. For example, smart integration often increases the manufacturing cost that makes it less accessible for price-sensitive consumers or markets with budget constraints. Governments in countries such as India and China have emphasized price cuts, but achieving an affordable mass market is still quite a challenge.

Therefore, manufacturers are under financial squeeze when they introduce these innovations while not compromising on profit margins. According to recent research, 30% of demand remains constrained by affordability. In addition, economic disruptions such as supply chain shortages and inflation further exacerbate these cost issues. Therefore, addressing this financial barrier through research into cost-effective materials and alternative production methods becomes imperative for market players.

By Material Type

Vinyl segment dominated the Automotive Sun Visor Market in 2023 with 62% of market share. It is driven by durability, cost-effectiveness, and ease of maintenance. The flexibility of vinyl allows customization, and it is considered the preferred choice among automotive manufacturers due to its ability to withstand extreme conditions.

In addition, the vinyl segment is expected to grow with the fastest CAGR of 4.84% during the forecast period from 2024 to 2032. The growth is driven by technological innovation, such as the inclusion of advanced UV protection and anti-glare coatings in vinyl sun visors.

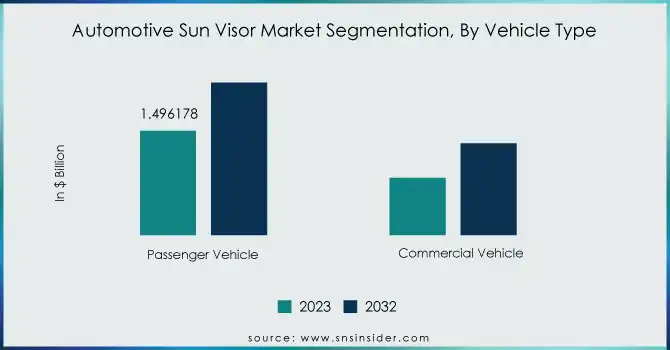

By Vehicle Type

Passenger cars segment dominated the Automotive Sun Visor Market with 64% of market share in 2023. The reason for this is because of the increasing number of passenger vehicles worldwide and the increased demand for advanced safety and comfort features in personal vehicles. Furthermore, consumers place a lot of importance on sun visor solutions when commuting daily as it improves visibility and aesthetics.

Commercial cars are expected to be in growth with the highest CAGR of 5.42% during the 2024-2032 forecast period. This growth mirrors the upsurge demand for commercial transportation and also an enhancement in sun visor technology that would allow improving drivers' visibility and safety along a long-haul route. Other improvements associated with commercial cars include solar protection and electronic sun visor systems, meaning the cars are less liable to contribute to driver fatigue.

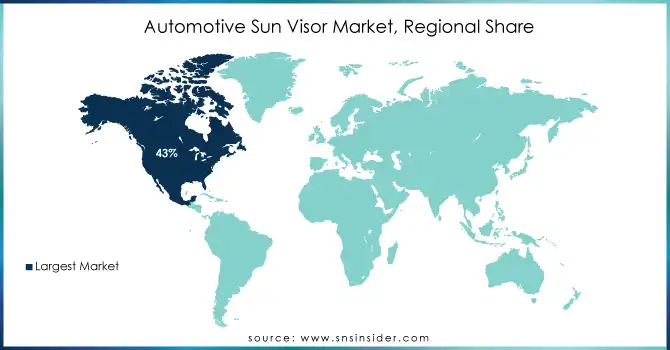

Automotive Sun Visor Market Regional Overview

North America led the Automotive Sun Visor Market in 2023, accounting for 43% of market share, driven by technological advancements, government support for automotive safety, and consumer demand for smart solutions. The USA has put in place a number of policies to promote the adoption of smart sun visors while ensuring innovation and consumer safety.

Asia-Pacific will, however, grow at the fastest CAGR of 5.66% from 2024 to 2032 in the forecast period. The growth is contributed to the increase in the number of automobile production lines, increased urbanization, and rise in consumer disposable incomes. Most of these can be observed in China and India. This region's government as well as the automobile makers will have to focus on advanced manufacturing facilities as well as technological innovations for high demand for smart sun visor solutions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the major players in the Automotive Sun Visor Market are

Ford Global Technologies (Conventional Sun Visor, LCD Sun Visor)

General Motors (LCD Sun Visor, Advanced Sunshade Systems)

Toyota Boshoku Corporation (Fabric Sun Visor, Vinyl Sun Visor)

Visteon Corporation (Smart Sun Visor, Adaptive Sunshade Solutions)

Kasai Kogyo (Advanced Fabric Sun Visor, Custom Vinyl Sun Visor)

Atlas Holdings (Folding Sun Visor, Modular Sunshade Components)

ZF Friedrichshafen AG (Adjustable Sun Visor, Sun Visor with Lighting Integration)

Magna International (Retractable Sun Visor, Anti-Glare Systems)

Honda Motor Co., Ltd. (Standard Sun Visor, Luxury Sunshade Systems)

Hyundai Mobis (Electrochromic Sun Visor, UV Protection Visors)

Nippon Seiki Co., Ltd. (Digital Display Sun Visor, Heads-Up Display Sun Visor)

Faurecia SE (Customized Sun Visor, Premium Upholstered Visors)

Denso Corporation (Integrated Climate Control Visor, High-Durability Visors)

Yanfeng Automotive Interiors (Stylish Sun Visor, Sustainable Sunshade Solutions)

Johnson Controls (Eco-Friendly Sun Visor, Advanced Modular Visors)

Mitsubishi Electric (Electrochromic Glass Visor, Anti-Glare Systems)

Renault Group (Compact Car Visor, Long-Haul Vehicle Sun Visors)

Volvo Group (Heavy-Duty Vehicle Visor, Enhanced Safety Visors)

Tata Motors (Budget Sun Visor, Multi-Purpose Visors)

Fiat Chrysler Automobiles (Stellantis) (Advanced Leather Sun Visor, Integrated Technology Visors)

MAJOR SUPPLIERS (Components, Technologies)

3M Company (Reflective Films, UV Coatings)

BASF SE (Polyurethane, Vinyl Resins)

DuPont (Advanced Polymers, Adhesive Solutions)

Toray Industries (Synthetic Fabrics, Composite Materials)

Saint-Gobain (Glass Components, Electrochromic Materials)

Covestro AG (Thermoplastic Polyurethanes, Polycarbonate Sheets)

Asahi Kasei (High-Performance Plastics, Coated Fabrics)

Solvay SA (Specialty Polymers, Adhesive Materials)

Eastman Chemical Company (Plasticizers, Specialty Films)

SABIC (Engineering Thermoplastics, Advanced Composites)

3M Company

BASF SE

DuPont

Toray Industries

Saint-Gobain

Covestro AG

Asahi Kasei

Solvay SA

Eastman Chemical Company

SABIC

October 2024 - The U.S. private investment firm, Atlas Holdings, has signed an agreement with the German-based REHAU Group to acquire REHAU Automotive. Atlas is involved in various sectors such as manufacturing and distribution and is keenly focused on the automobile sector. The deal will be closed by the end of first quarter of 2025 pending customary closing conditions and any regulatory approvals.

November 2024: Nissan Motor Co., Ltd. announced that it has completed the investment in Kasai Kogyo Co., Ltd. whose investment was announced on May 9, and obtained newly issued Class A preferred shares of Kasai Kogyo. Procedures to accomplish the investment included Kasai Kogyo's ordinary general shareholders meeting and obtaining regulatory approvals required.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.32 Billion |

| Market Size by 2032 | US$ 3.50 Billion |

| CAGR | CAGR of 4.73% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component Type (Conventional Sun Visor, LCD Sun Visor), • By Material Type (Fabric, Vinyl, Others), • By Vehicle Type (Passenger Cars, Commercial cars), • By Propulsion (ICE and Electric Vehicle), • By Sales Channel (OEM and Aftermarket) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Ford Global Technologies, General Motors, Toyota Boshoku Corporation, Visteon Corporation, Kasai Kogyo, Atlas Holdings, ZF Friedrichshafen AG, Magna International, Honda Motor Co., Ltd., Hyundai Mobis, Nippon Seiki Co., Ltd., Faurecia SE, Denso Corporation, Yanfeng Automotive Interiors, Johnson Controls, Mitsubishi Electric, Renault Group, Volvo Group, Tata Motors, and Fiat Chrysler Automobiles |

| Key Drivers | • Consumer Demand For High-End Safety And Comfort Features Is On The Rise. • The Smart And Electrochromic Sun Visor Technology Is Improved Through Technological Innovation. |

| Restraints | • High Cost Of Developed Technologies Of Advanced Sun Visor Prevents Its Large-Scale Acceptance. |

Ans:- The market forecast period is 2024-2032 according to the study report.

Ans:- The vinyl material segment is anticipated to show the highest growth in demand.

Ans:- Increase in the manufacturing of electric vehicles and an increase in demand for passenger safety are the primary market drivers for Car Accessories Market.

Ans:- Yes.

Ans:- The study includes a comprehensive analysis of market trends, as well as present and future market forecasts. DROC analysis, as well as impact analysis for the projected period. Porter’s five forces analysis aids in the study of buyer and supplier potential as well as the competitive landscape etc.

Table Of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Vehicle Production and Sales Volumes, 2020-2032, by Region

5.2 Emission Standards Compliance, by Region

5.3 Vehicle Technology Adoption, by Region

5.4 Consumer Preferences, by Region

5.5 Aftermarket Trends (Data on vehicle maintenance, parts, and services)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Automotive Sun Visor Market Segmentation, By Component Type

7.1 Chapter Overview

7.2 Conventional Sun Visor

7.2.1 Conventional Sun Visor Market Trends Analysis (2020-2032)

7.2.2 Conventional Sun Visor Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 LCD Sun Visor

7.3.1 LCD Sun Visor Market Trends Analysis (2020-2032)

7.3.2 LCD Sun Visor Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Automotive Sun Visor Market Segmentation, By Material Type

8.1 Chapter Overview

8.2 Fabric

8.2.1 Fabric Market Trends Analysis (2020-2032)

8.2.2 Fabric Market Size Estimates And Forecasts To 2032 (USD Billion)

8.3 Vinyl

8.3.1 Vinyl Market Trends Analysis (2020-2032)

8.3.2 Vinyl Market Size Estimates And Forecasts To 2032 (USD Billion)

8.4 Others

8.4.1 Others Market Trends Analysis (2020-2032)

8.4.2 Others Market Size Estimates And Forecasts To 2032 (USD Billion)

9. Automotive Sun Visor Market Segmentation, By Vehicle Type

9.1 Chapter Overview

9.2 Passenger Cars

9.2.1 Passenger Cars Market Trends Analysis (2020-2032)

9.2.2 Passenger Cars Market Size Estimates And Forecasts To 2032 (USD Billion)

9.3 Commercial Cars

9.3.1 Commercial Cars Market Trends Analysis (2020-2032)

9.3.2 Commercial Cars Market Size Estimates And Forecasts To 2032 (USD Billion)

10. Automotive Sun Visor Market Segmentation, By Sales Channel

10.1 Chapter Overview

10.2 OEM

10.2.1 OEM Market Trends Analysis (2020-2032)

10.2.2 OEM Market Size Estimates And Forecasts To 2032 (USD Billion)

10.3 Aftermarket

10.3.1 Aftermarket Market Trends Analysis (2020-2032)

10.3.2 Aftermarket Market Size Estimates And Forecasts To 2032 (USD Billion)

11. Automotive Sun Visor Market Segmentation, By Propulsion

11.1 Chapter Overview

11.2 ICE

11.2.1 ICE Market Trends Analysis (2020-2032)

11.2.2 ICE Market Size Estimates And Forecasts To 2032 (USD Billion)

11.3 Electric Vehicle

11.3.1 Electric Vehicle Market Trends Analysis (2020-2032)

11.3.2 Electric Vehicle Market Size Estimates And Forecasts To 2032 (USD Billion)

12. Regional Analysis

12.1 Chapter Overview

12.2 North America

12.2.1 Trends Analysis

12.2.2 North America Automotive Sun Visor Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.2.3 North America Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.2.4 North America Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.2.5 North America Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.2.6 North America Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.2.7 North America Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.2.8 USA

12.2.8.1 USA Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.2.8.2 USA Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.2.8.3 USA Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.2.8.4 USA Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.2.8.5 USA Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.2.9 Canada

12.2.9.1 Canada Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.2.9.2 Canada Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.2.9.3 Canada Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.2.9.4 Canada Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.2.9.5 Canada Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.2.10 Mexico

12.2.10.1 Mexico Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.2.10.2 Mexico Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.2.10.3 Mexico Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.2.10.4 Mexico Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.2.10.5 Mexico Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.3 Europe

12.3.1 Eastern Europe

12.3.1.1 Trends Analysis

12.3.1.2 Eastern Europe Automotive Sun Visor Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.3.1.3 Eastern Europe Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.3.1.4 Eastern Europe Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.3.1.5 Eastern Europe Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.6 Eastern Europe Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.3.1.7 Eastern Europe Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.3.1.8 Poland

12.3.1.8.1 Poland Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.3.1.8.2 Poland Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.3.1.8.3 Poland Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.8.4 Poland Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.3.1.8.5 Poland Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.3.1.9 Romania

12.3.1.9.1 Romania Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.3.1.9.2 Romania Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.3.1.9.3 Romania Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.9.4 Romania Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.3.1.9.5 Romania Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.3.1.10 Hungary

12.3.1.10.1 Hungary Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.3.1.10.2 Hungary Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.3.1.10.3 Hungary Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.10.4 Hungary Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.3.1.10.5 Hungary Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.3.1.11 Turkey

12.3.1.11.1 Turkey Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.3.1.11.2 Turkey Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.3.1.11.3 Turkey Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.11.4 Turkey Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.3.1.11.5 Turkey Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.3.1.12 Rest Of Eastern Europe

12.3.1.12.1 Rest Of Eastern Europe Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.3.1.12.2 Rest Of Eastern Europe Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.3.1.12.3 Rest Of Eastern Europe Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.12.4 Rest Of Eastern Europe Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.3.1.12.5 Rest Of Eastern Europe Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.3.2 Western Europe

12.3.2.1 Trends Analysis

12.3.2.2 Western Europe Automotive Sun Visor Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.3.2.3 Western Europe Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.3.2.4 Western Europe Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.3.2.5 Western Europe Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.6 Western Europe Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.3.2.7 Western Europe Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.3.2.8 Germany

12.3.2.8.1 Germany Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.3.2.8.2 Germany Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.3.2.8.3 Germany Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.8.4 Germany Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.3.2.8.5 Germany Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.3.2.9 France

12.3.2.9.1 France Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.3.2.9.2 France Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.3.2.9.3 France Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.9.4 France Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.3.2.9.5 France Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.3.2.10 UK

12.3.2.10.1 UK Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.3.2.10.2 UK Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.3.2.10.3 UK Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.10.4 UK Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.3.2.10.5 UK Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.3.2.11 Italy

12.3.2.11.1 Italy Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.3.2.11.2 Italy Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.3.2.11.3 Italy Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.11.4 Italy Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.3.2.11.5 Italy Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.3.2.12 Spain

12.3.2.12.1 Spain Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.3.2.12.2 Spain Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.3.2.12.3 Spain Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.12.4 Spain Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.3.2.12.5 Spain Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.3.2.13 Netherlands

12.3.2.13.1 Netherlands Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.3.2.13.2 Netherlands Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.3.2.13.3 Netherlands Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.13.4 Netherlands Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.3.2.13.5 Netherlands Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.3.2.14 Switzerland

12.3.2.14.1 Switzerland Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.3.2.14.2 Switzerland Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.3.2.14.3 Switzerland Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.14.4 Switzerland Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.3.2.12.5 Switzerland Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.3.2.15 Austria

12.3.2.15.1 Austria Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.3.2.15.2 Austria Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.3.2.15.3 Austria Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.15.4 Austria Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.3.2.15.5 Austria Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.3.2.16 Rest Of Western Europe

12.3.2.16.1 Rest Of Western Europe Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.3.2.16.2 Rest Of Western Europe Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.3.2.16.3 Rest Of Western Europe Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.16.4 Rest Of Western Europe Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.3.2.16.5 Rest Of Western Europe Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.4 Asia Pacific

12.4.1 Trends Analysis

12.4.2 Asia Pacific Automotive Sun Visor Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.4.3 Asia Pacific Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.4.4 Asia Pacific Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.4.5 Asia Pacific Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.6 Asia Pacific Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.4.7 Asia Pacific Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.4.8 China

12.4.8.1 China Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.4.8.2 China Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.4.8.3 China Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.8.4 China Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.4.8.5 China Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.4.9 India

12.4.9.1 India Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.4.9.2 India Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.4.9.3 India Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.9.4 India Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.4.9.5 India Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.4.10 Japan

12.4.10.1 Japan Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.4.10.2 Japan Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.4.10.3 Japan Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.10.4 Japan Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.4.10.5 Japan Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.4.11 South Korea

12.4.11.1 South Korea Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.4.11.2 South Korea Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.4.11.3 South Korea Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.11.4 South Korea Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.4.11.5 South Korea Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.4.12 Vietnam

12.4.12.1 Vietnam Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.4.12.2 Vietnam Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.4.12.3 Vietnam Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.12.4 Vietnam Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.4.12.5 Vietnam Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.4.13 Singapore

12.4.13.1 Singapore Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.4.13.2 Singapore Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.4.13.3 Singapore Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.13.4 Singapore Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.4.13.5 Singapore Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.4.14 Australia

12.4.14.1 Australia Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.4.14.2 Australia Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.4.14.3 Australia Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.14.4 Australia Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.4.14.5 Australia Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.4.15 Rest Of Asia Pacific

12.4.15.1 Rest Of Asia Pacific Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.4.15.2 Rest Of Asia Pacific Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.4.15.3 Rest Of Asia Pacific Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.15.4 Rest Of Asia Pacific Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.4.15.5 Rest Of Asia Pacific Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.5 Middle East And Africa

12.5.1 Middle East

12.5.1.1 Trends Analysis

12.5.1.2 Middle East Automotive Sun Visor Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.5.1.3 Middle East Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.5.1.4 Middle East Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.5.1.5 Middle East Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.6 Middle East Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.5.1.7 Middle East Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.5.1.8 UAE

12.5.1.8.1 UAE Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.5.1.8.2 UAE Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.5.1.8.3 UAE Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.8.4 UAE Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.5.1.8.5 UAE Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.5.1.9 Egypt

12.5.1.9.1 Egypt Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.5.1.9.2 Egypt Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.5.1.9.3 Egypt Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.9.4 Egypt Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.5.1.9.5 Egypt Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.5.1.10 Saudi Arabia

12.5.1.10.1 Saudi Arabia Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.5.1.10.2 Saudi Arabia Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.5.1.10.3 Saudi Arabia Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.10.4 Saudi Arabia Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.5.1.10.5 Saudi Arabia Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.5.1.11 Qatar

12.5.1.11.1 Qatar Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.5.1.11.2 Qatar Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.5.1.11.3 Qatar Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.11.4 Qatar Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.5.1.11.5 Qatar Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.5.1.12 Rest Of Middle East

12.5.1.12.1 Rest Of Middle East Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.5.1.12.2 Rest Of Middle East Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.5.1.12.3 Rest Of Middle East Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.12.4 Rest Of Middle East Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.5.1.12.5 Rest Of Middle East Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.5.2 Africa

12.5.2.1 Trends Analysis

12.5.2.2 Africa Automotive Sun Visor Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.5.2.3 Africa Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.5.2.4 Africa Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.5.2.5 Africa Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.2.6 Africa Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.5.2.7 Africa Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.5.2.8 South Africa

12.5.2.8.1 South Africa Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.5.2.8.2 South Africa Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.5.2.8.3 South Africa Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.2.8.4 South Africa Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.5.2.8.5 South Africa Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.5.2.9 Nigeria

12.5.2.9.1 Nigeria Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.5.2.9.2 Nigeria Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.5.2.9.3 Nigeria Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.2.9.4 Nigeria Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.5.2.9.5 Nigeria Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.5.2.10 Rest Of Africa

12.5.2.10.1 Rest Of Africa Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.5.2.10.2 Rest Of Africa Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.5.2.10.3 Rest Of Africa Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.2.10.4 Rest Of Africa Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.5.2.10.5 Rest Of Africa Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.6 Latin America

12.6.1 Trends Analysis

12.6.2 Latin America Automotive Sun Visor Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.6.3 Latin America Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.6.4 Latin America Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.6.5 Latin America Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.6.6 Latin America Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.6.7 Latin America Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.6.8 Brazil

12.6.8.1 Brazil Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.6.8.2 Brazil Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.6.8.3 Brazil Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.6.8.4 Brazil Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.6.8.5 Brazil Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.6.9 Argentina

12.6.9.1 Argentina Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.6.9.2 Argentina Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.6.9.3 Argentina Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.6.9.4 Argentina Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.6.9.5 Argentina Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.6.10 Colombia

12.6.10.1 Colombia Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.6.10.2 Colombia Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.6.10.3 Colombia Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.6.10.4 Colombia Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.6.10.5 Colombia Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.6.11 Rest Of Latin America

12.6.11.1 Rest Of Latin America Automotive Sun Visor Market Estimates And Forecasts, By Component Type (2020-2032) (USD Billion)

12.6.11.2 Rest Of Latin America Automotive Sun Visor Market Estimates And Forecasts, By Material Type (2020-2032) (USD Billion)

12.6.11.3 Rest Of Latin America Automotive Sun Visor Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.6.11.4 Rest Of Latin America Automotive Sun Visor Market Estimates And Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.6.11.5 Rest Of Latin America Automotive Sun Visor Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

13. Company Profiles

13.1 Ford Global Technologies

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services Offered

13.1.4 SWOT Analysis

13.2 General Motors

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services Offered

13.2.4 SWOT Analysis

13.3 Toyota Boshoku Corporation

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Products/ Services Offered

13.3.4 SWOT Analysis

13.4 Visteon Corporation

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Products/ Services Offered

13.4.4 SWOT Analysis

13.5 Kasai Kogyo

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Products/ Services Offered

13.5.4 SWOT Analysis

13.6 Atlas Holdings

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Products/ Services Offered

13.6.4 SWOT Analysis

13.7 Magna International

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Products/ Services Offered

13.7.4 SWOT Analysis

13.8 Honda Motor Co., Ltd

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Products/ Services Offered

13.8.4 SWOT Analysis

13.9 Hyundai Mobis

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Products/ Services Offered

13.9.4 SWOT Analysis

13.10 Nippon Seiki Co., Ltd

13.10.1 Company Overview

13.10.2 Financial

13.10.3 Products/ Services Offered

13.10.4 SWOT Analysis

14. Use Cases and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Component Type

Conventional Sun Visor

LCD Sun Visor

By Material Type

Fabric

Vinyl

Others

By Vehicle Type

Passenger Cars

Commercial Cars

By Propulsion

ICE

Electric Vehicle

By Sales Channel

OEM

Aftermarket

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Tractor Implements Market

Automotive ECU Market Size was valued at USD 100.03 Billion in 2023 & is expected to reach USD 168.36 Bn by 2032 & grow at a CAGR of 5.92% by 2024-2032.

The Automotive Seats Market size was valued at USD 53.45 Billion in 2023 and is expected to reach USD 60.21 Billion by 2031. And grow at a CAGR of 1.5% over the forecast period of 2024-2031.

The Euro 7 Regulations Compliant Market was USD 2.60 billion in 2023 and is expected to reach $11.05 Bn by 2032, growing at a CAGR of 17.48% by 2024-2032.

Automotive Airbag Market Size was valued at USD 19.84 Billion in 2023 and is expected to reach USD 36.66 Billion by 2032 and grow at a CAGR of 7.09% over the forecast period 2024-2032.

The Battery Separator Market Size was valued at USD 5.80 Billion in 2023 and is expected to reach USD 19.53 Billion by 2032 and grow at a CAGR of 14.47% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone