Get E-PDF Sample Report on Automotive Smart Key Market - Request Sample Report

The Automotive Smart Key Market Size was valued at USD 10.0 Billion in 2023 and is expected to reach USD 21.7 Billion by 2032, growing at a CAGR of 9.03% from 2024-2032.

The Automotive Smart Key Market is rapidly expanding, driven by the growing demand for advanced vehicle security systems and the widespread adoption of keyless entry technology. Smart keys enhance convenience, safety, and automation by allowing drivers to unlock and start their vehicles without the need to physically insert a key. This shift toward smart key technology is fueled by the automotive industry's focus on improving user experience and vehicle protection. Beyond basic functionality, smart keys are increasingly integrated with features like remote start, personalized settings, and tracking, further boosting market growth. A key driver of this growth is the rising consumer preference for convenience and the seamless integration of digital technologies in vehicles. The global automotive smart key market is projected to experience significant growth, with technological advancements enabling the addition of more features to smart key systems. Bluetooth and Near Field Communication (NFC) technologies, for instance, are enhancing the security and convenience of smart keys.

The growing concern over vehicle security, especially regarding theft, is also contributing to the increased adoption of smart keys. By utilizing encrypted signals and unique identification codes, these keys prevent unauthorized access and key duplication. The recent research study revealed that nearly 60% of new vehicles sold in 2023 were equipped with keyless entry systems, underscoring the shift toward more secure vehicle access solutions. Technological innovations, such as biometric integration, voice recognition, and advanced encryption technologies, are shaping the future of the automotive smart key market. Some automakers are even developing smart keys with fingerprint and facial recognition capabilities, enhancing security. This trend aligns with the broader move toward smart, connected vehicles that prioritize both convenience and safety.

Additionally, the rising popularity of electric vehicles (EVs) is positively influencing the market, as these vehicles require advanced digital systems for enhanced security. Smart key technologies align seamlessly with the trend toward more connected, digitalized vehicles. The growth in premium vehicle sales, which commonly feature advanced keyless entry systems, is also contributing to market expansion. The automotive smart key market is set for continued growth, driven by increasing consumer demand for convenience, security, and technological advancements. As smart key systems evolve with additional features, the market is expected to see substantial progress, positioning it as a critical element in the future of automotive innovation.

Drivers

Increasing concerns about vehicle theft and unauthorized access are driving the adoption of smart keys with encrypted communication and unique identification features.

The automotive industry's shift toward connected and autonomous vehicles is contributing to the rise in demand for smart keys with advanced functionalities.

High-end vehicles and electric cars, which often feature sophisticated keyless entry systems, are increasing in demand, driving market growth.

High-end and electric vehicles have gained immense popularity in recent years, which is contributing significantly to the growth of automotive smart keys. Advancements in automotive technology have made keyless entry systems a standard feature in many premium and electric vehicles. These systems, which enhance convenience and security, are now commonplace, especially in higher-end models. These systems not only make it more convenient for users but also increase the security of vehicles as well as provide a hassle-free driving experience that aligns with consumers moving toward automation. Many luxury car manufacturers have recently begun packaging advanced smart key systems not only with keyless entry, but also remote start, personal setting configurations, and advanced leveling and measurement features, and some even use Bluetooth, NFC, and biometric technology to secure these high-end experiences. Increases in market share for electric vehicles (EVs) are also changing the impetus for smart key technologies. Because electric vehicles (EVs) heavily rely on digital technologies such as for battery management and connectivity many are equipped with advanced keyless entry systems, which complement their tech-centric design. With the adoption of EVs, the demand for integrated smart key systems that enable a holistic, keyless experience combined with a growing focus on lifestyle factor-based automotive solutions further complements the automotive industry's drive towards smarter, connected, experiences.

The automotive smart key market is anticipated to grow significantly, due to the high demand for luxury and electric vehicles, which need smart key systems, among other sophisticated technological solutions. With the development of high-tech digital features in vehicles, smart key technology will be the key to promoting the development of more mature and application fields in the automotive market.

Restraints

The production of advanced smart key systems requires expensive technology and components, increasing the overall cost of vehicles and limiting affordability for some consumers.

Smart key systems can experience technical failures, such as battery depletion or malfunctioning sensors, which may affect the user experience and consumer trust in the technology.

The integration of smart key systems across various vehicle models and manufacturers can be challenging, potentially limiting the widespread adoption of the technology.

This uniqueness of smart key systems across different vehicle models and manufacturers is a huge challenge in the automotive smart key market. The transition to seamless compatibility between vehicle security systems and smart keys is complicated since different automakers use proprietary technologies, protocols, and other system requirements. This absence of standardization impedes the creation of a single smart key solution working across all brands and models of vehicles. Different manufacturers can apply their specific technologies like Bluetooth NFC or any biometric authentication method, and end up building non-interoperable systems. This makes it difficult for consumers to use the same smart key across multiple vehicles, or when changing brands. As a result, automobile manufacturers focus on proprietary technologies, exacerbating the compatibility issues and increasing market fragmentation. The wide variety of vehicle models, ranging from basic cars to luxury premium models, creates a complex and fragmented landscape for smart key systems. This variation makes it challenging to implement a universal system that can seamlessly work across different brands and vehicle types. Top-end vehicles incorporate smarter keyless entry features including remote start, encrypted security, and personalized settings, while entry-level vehicles often include simpler keyless entry systems, restricting the universality of smart keys between market segments.

These issues, combined with the necessity of fulfilling varying preferences of consumers with different vehicle types, restrict the higher-level adoption of automotive smart keys. Fragmentation might hamper the growth of this market in slow motion, as manufacturers will have to make huge investments in designing systems compatible with the new technology, or else it may become unattractive to certain consumer segments. Thus, the automotive smart key market can continue to grow only after tackling these integration barriers.

By Application

The multi-function segment dominated the market and represented a significant revenue share of 68.28%, owing to the growing need among consumers for enhanced, integrated features in automotive smart keys. These smart keys come with a host of functions, such as advanced keyless entry, remote start function, personal settings, smartphone-to-vehicle integration, location tracking, and advanced vehicle security features. The incorporation of more aspects of the car experience into car keys has set multi-function smart keys as one of the standard features for premium vehicles over the years, especially in EVs and high-end luxury vehicles with all the bells and whistles of car technology. This trend is being driven by an increase in preference for convenience, safety, and connectivity in modern vehicles.

The single-function segment is anticipated to experience the highest CAGR during the forecast period. This growth can be attributed to the adoption of simple but effective smart key technology among mid-range and economy vehicles. As automakers strive to offer consumers additional features without significantly increasing costs, simpler, single-function smart keys focused solely on keyless entry are gaining popularity. These keys provide a cost-effective solution that meets basic consumer demands for convenience while keeping production expenses low. The growth of this segment is also driven by increasing demand for low-cost cars with good in-car technologies. Higher penetration of smart key systems in entry-level vehicles would further propel growth, and this segment is likely to grow steadily, particularly in emerging markets, where affordability and the most basic functionality of this feature are of primary consideration. Single-function smart keys are likely to become more affordable as the cost of solutions becomes available in the market.

By Installation

The Original Equipment Manufacturer (OEM) segment dominated the market and represented a revenue share of more than 78.0% in 2023, as the rising number of automakers offering smart key systems in vehicle models as standard features. Automakers have become increasingly active in boosting the security, convenience, and, hence, consumption of OEM-installed smart keys. The increasing demand for advanced features - including reminders, remote start, and personalization-makes automakers use smart key technology to distinguish their vehicles in a marketplace where buyers have many options. According to the report, more than 70% of new vehicles sold in the last few years come with OEM-installed keyless entry systems. This segment is predicted to remain steadfast on the top owing to the ongoing development in vehicle security features and consumer inclination towards innovative systems.

The aftermarket segment of the automotive smart key market is gaining traction with the highest compound annual growth rate (CAGR) since most consumers are looking to upgrade their vehicles with advanced smart key systems. The increasing customization of vehicles and the need for more comfort is holding back a major share of this segment. This is why an increasing number of consumers opt for aftermarket smart key solutions that are affordable and easy to use. This trend is particularly prevalent in the market for older vehicle models, where supplying new OEM smart keys may not be commercially viable, or replacing them at dealerships could be prohibitively expensive. The aftermarket category is growing continuously, however, due to owners of cars opting more for added security and comfort features. This segment is expected to see further growth, with the increasing penetration of keyless entry systems across vehicles.

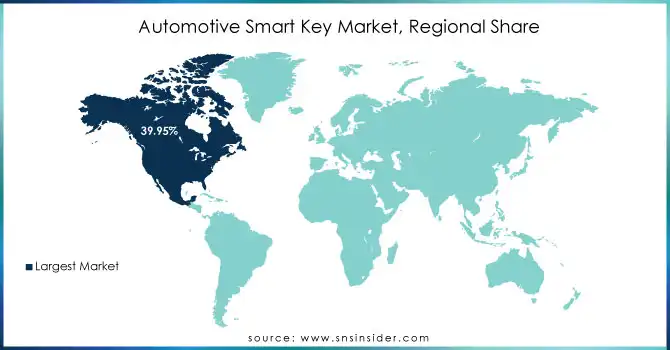

North America dominated the automotive smart key market and accounted for a revenue share of more than 39.95% in 2023, due to the highest demand for advanced automotive technologies such as keyless entry systems. The demand for premium vehicles and increased emphasis on vehicle security and convenience are helping drive growth for a significant part of this market. The region's strong automotive infrastructure, plus the presence of major smart key industry players, bolsters its top position. It says North America will remain on top, fueled by the continued demand for luxury and electric vehicles. In addition to this, the implementation of the use of the latest technologies like biometric recognition and improved security is also expected to boost the growth

Asia-Pacific region is projected to show the highest CAGR over the forecast years due to the increasing automotive industry in countries like China, Japan, and South Korea. One major factor in this growth is the rising demand for electric vehicles, which requires advanced technologies such as smart keys. In addition, the world's largest automotive manufacturers are based in the Asia-Pacific region, which is closing the gap in the adoption of keyless entry systems.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

The major key players along with their product

Continental AG

Valeo

Bosch

Denso Corporation

Hella GmbH & Co. KGaA

Delphi Technologies

Lear Corporation

Kiekert AG

Smartrac N.V.

Hyundai Mobis

Aisin Seiki Co., Ltd.

Harman International

Ficosa International

Visteon Corporation

Aptiv PLC

Kostal Group

Valeo Sylvania

January 2024: Continental enhanced its smart key technology by incorporating more robust encryption to prevent unauthorized access, reinforcing security in premium and mid-range vehicles

February 2024: Denso introduced a new line of smart keys compatible with hybrid and electric vehicles, featuring improved compatibility with digital connectivity platforms

March 2024: The Hyundai Mobis Company launched a mobile-app-based keyless entry system, which uses NFC and biometric technology to enhance user convenience and vehicle security.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 15.5 Billion |

| Market Size by 2032 | USD 23.9 Billion |

| CAGR | CAGR of 4.92% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Single Function, Multi-function) • By Technology (Remote Keyless Entry, Passive Keyless Entry) • By Installation (OEM, Aftermarket) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Continental AG, Valeo, Bosch, ZF Friedrichshafen AG, Denso Corporation, Hella GmbH & Co. KGaA, Delphi Technologies, Lear Corporation, Magna International, Kiekert AG, Smartrac N.V., Hyundai Mobis, Aisin Seiki Co., Ltd., Harman International. |

| Key Drivers | • Increasing concerns about vehicle theft and unauthorized access are driving the adoption of smart keys with encrypted communication and unique identification features. • The automotive industry's shift toward connected and autonomous vehicles is contributing to the rise in demand for smart keys with advanced functionalities. |

| RESTRAINTS | • The production of advanced smart key systems requires expensive technology and components, increasing the overall cost of vehicles and limiting affordability for some consumers. • Smart key systems can experience technical failures, such as battery depletion or malfunctioning sensors, which may affect the user experience and consumer trust in the technology. |

Ans- Challenges in the Automotive Smart Key Market are

Ans- one main growth factor for the Automotive Smart Key Market is

Ans- the North America dominated the market and represented a significant revenue share in 2023

Ans- the CAGR of the Automotive Smart Key Market during the forecast period is 9.03% from 2024-2032.

Ans: Automotive Smart Key Market was valued at USD 10.0 Billion in 2023 and is expected to reach USD 21.7 Billion by 2032, growing at a CAGR of 9.03% from 2024-2032.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Vehicle Production and Sales Volumes, 2020-2032, by Region

5.2 Emission Standards Compliance, by Region

5.3 Vehicle Technology Adoption, by Region

5.4 Consumer Preferences, by Region

5.5 Aftermarket Trends (Data on vehicle maintenance, parts, and services)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Automotive Smart Key Market Segmentation, By Application

7.1 Chapter Overview

7.2 Single Function

7.2.1 Single Function Market Trends Analysis (2020-2032)

7.2.2 Single Function Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Multi-function

7.3.1 Multi-function Market Trends Analysis (2020-2032)

7.3.2 Multi-function Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Automotive Smart Key Market Segmentation, by Technology

8.1 Chapter Overview

8.2 Remote Keyless Entry

8.2.1 Remote Keyless Entry Market Trends Analysis (2020-2032)

8.2.2 Remote Keyless Entry Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Passive Keyless Entry

8.3.1 Passive Keyless Entry Market Trends Analysis (2020-2032)

8.3.2 Passive Keyless Entry Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Automotive Smart Key Market Segmentation, by Installation

9.1 Chapter Overview

9.2 OEM

9.2.1 OEM Market Trends Analysis (2020-2032)

9.2.2 OEM Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3Aftermarket

9.3.1Aftermarket Market Trends Analysis (2020-2032)

9.3.2Aftermarket Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Automotive Smart Key Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.4 North America Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.5 North America Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.6.2 USA Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.6.3 USA Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.7.2 Canada Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.7.3 Canada Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.8.2 Mexico Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.8.3 Mexico Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Automotive Smart Key Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.6.2 Poland Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.6.3 Poland Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.7.2 Romania Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.7.3 Romania Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Automotive Smart Key Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.4 Western Europe Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.5 Western Europe Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.6.2 Germany Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.6.3 Germany Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.7.2 France Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.7.3 France Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.8.2 UK Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.8.3 UK Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.9.2 Italy Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.9.3 Italy Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.10.2 Spain Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.10.3 Spain Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.13.2 Austria Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.13.3 Austria Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Automotive Smart Key Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.4 Asia Pacific Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.5 Asia Pacific Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.6.2 China Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.6.3 China Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.7.2 India Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.7.3 India Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.8.2 Japan Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.8.3 Japan Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.9.2 South Korea Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.9.3 South Korea Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.10.2 Vietnam Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.10.3 Vietnam Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.11.2 Singapore Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.11.3 Singapore Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.12.2 Australia Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.12.3 Australia Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Automotive Smart Key Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.4 Middle East Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.5 Middle East Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.6.2 UAE Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.6.3 UAE Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Automotive Smart Key Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.4 Africa Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.5 Africa Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Automotive Smart Key Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.4 Latin America Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.5 Latin America Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.6.2 Brazil Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.6.3 Brazil Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.7.2 Argentina Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.7.3 Argentina Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.8.2 Colombia Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.8.3 Colombia Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Automotive Smart Key Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Automotive Smart Key Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Automotive Smart Key Market Estimates and Forecasts, by Installation (2020-2032) (USD Billion)

11. Company Profiles

11.1 Continental AG

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Valeo

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Bosch

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 ZF Friedrichshafen AG

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Denso Corporation

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Hella GmbH & Co. KGaA

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Delphi Technologies

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Lear Corporation

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Magna International

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Kiekert AG

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusio

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Application

By Technology

By Installation

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

Europe

Asia Pacific

Middle East & Africa

Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

The Automotive Turbocharger Market size was valued at USD 14.21 billion in 2023 & will reach USD 26.12 billion by 2032 and grow at a CAGR of 7% by 2024-2032

The Automatic High Beam Control Market Size was valued at USD 10.68 billion in 2023 and is expected to reach USD 18.82 billion by 2032 and grow at a CAGR of 6.5% over the forecast period 2024-2032.

The Rail Infrastructure Market Size was valued at USD 53.93 Billion in 2023 and is expected to reach USD 73.95 Billion by 2032 and grow at a CAGR of 3.61% over the forecast period 2024-2032.

The Automotive Electronics Sensor Aftermarket Market size was valued at USD 7680 million in 2023 and is expected to reach USD 12999.6 million by 2031 and grow at a CAGR of 6.8% over the forecast period 2024-2031.

The locomotive Market size was valued at USD 20.05 billion in 2023 and is expected to reach at USD 47.65 billion by 2032 and grow at a CAGR of 9.10% over the forecast period of 2024-2032.

The Automotive Cybersecurity Market Size was USD 3.37 Billion in 2023 and will reach USD 16.24 Billion by 2032 and grow at a CAGR of 19.11% by 2024-2032.

Hi! Click one of our member below to chat on Phone