Automotive Simulation Market Report Scope & Overview:

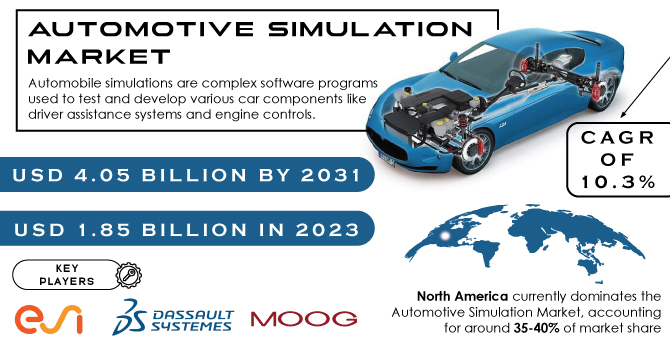

The Automotive Simulation Market Size was valued at USD 1.85 billion in 2023 and is expected to reach USD 4.05 billion by 2031 and grow at a CAGR of 10.3% over the forecast period 2024-2031.

Automobile simulations are complex software programs used to test and develop various car components like driver assistance systems and engine controls. These simulations are crucial for the automotive industry as they allow for safe and controlled testing, leading to better product quality and reduced development time. Originally used for training purposes, automotive simulations have evolved to play a vital role in research, development, and even production. In the production phase, simulations can identify defects in components before they are installed in the car, saving time and money. Simulations can be used to train users on new technologies, promoting smoother adoption. Overall, automotive simulation serves as a powerful tool for ensuring a car's functionality and facilitating the development and implementation of new technologies within the automotive industry.

Get more information on Automotive Simulation Market - Request Free Sample Report

MARKET DYNAMICS:

KEY DRIVERS:

-

Advanced Simulation Techniques Enhance Dependability of Virtual Testing in Automotive Applications

Advancements in simulation tools like CFD, FEA, and real-time simulation are boosting the accuracy and realism of virtual testing in the automotive industry. This translates to more reliable simulations, allowing for better assessment of car components and functionalities before physical prototypes are built.

-

Electric Vehicle Modelling Drives Innovation in Battery Performance, Range, and Charging Infrastructure

RESTRAINTS:

- High Initial Investment Limits Advanced Simulation Adoption for Smaller Automakers

- Complex Software Slows Down Integration of Simulation Tools in Car Design

Advanced simulation software offers immense benefits for car design, but its complexity can be a hurdle. The software often requires specialized training, and engineers may need significant time to become proficient. This learning curve can slow down the integration of simulation tools into the overall car development process.

OPPORTUNITIES:

-

Electric vehicle simulation helps optimize efficiency and predict range.

-

Automotive simulation can help new automakers in emerging markets design affordable cars.

CHALLENGES:

-

Shifting Production & Global Competition Threatens Automotive Simulation Market Growth

IMPACT OF RUSSIA-UKRAINE WAR

The Russia-Ukraine war has disrupted the automotive simulation market, impacting it by an estimated 5-10% in the short term. Disruptions to the global supply chain, particularly for key components like semiconductors, have caused delays and production slowdowns for simulation hardware. Additionally, sanctions on Russia, a significant consumer of automotive technology, have limited market access for some simulation software providers. The war has also exacerbated existing chip shortages, further hindering the development and deployment of new simulation tools. While the long-term impact remains to be seen, the current situation presents challenges for the automotive simulation market, requiring adaptation and innovation to overcome these hurdles.

IMPACT OF ECONOMIC SLOWDOWN

An economic slowdown is expected to dampen the Automotive Simulation Market by an estimated 3-10%. Reduced investments in research and development (R&D) are a primary factor. Automakers tighten their budgets during economic downturns, leading to less spending on advanced technologies like simulation software. Additionally, lower demand for new vehicles translates to a decreased need for rigorous testing and development, further impacting the simulation market. However, some simulation vendors might see increased interest in cost-effective design solutions as automakers look to optimize spending. The overall impact depends on the severity of the slowdown, but it presents both challenges and potential opportunities for the automotive simulation market.

KEY MARKET SEGMENTS:

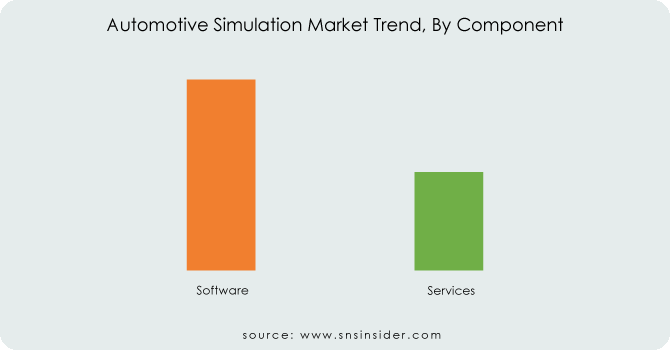

By Component:

-

Software

-

Services

Software is the dominating sub-segment in the Automotive Simulation Market by component, accounting for around 60% of market share. The dominance of software is fueled by the increasing complexity of vehicles and the need for sophisticated virtual testing tools. Software allows for a wider range of simulations at a lower cost compared to physical prototypes.

Need any customization research on Automotive Simulation Market - Enquiry Now

By Application:

-

Prototyping

-

Testing

Testing is the dominating sub-segment in the Automotive Simulation Market by application holding about 50% of market share. The dominance of testing can be attributed to the critical role simulation plays in ensuring vehicle safety, performance, and compliance with regulations. Simulations allow for testing various driving scenarios and environmental conditions without real-world risks.

By End-User:

-

OEMs

-

Automotive Component Manufacturers

-

Regulatory Bodies

OEMs (Original Equipment Manufacturers) is the dominating sub-segment in the Automotive Simulation Market holding above 50% of market share. OEMs rely on simulation for various stages of car development, from initial design concepts to final testing and validation.

REGIONAL ANALYSES

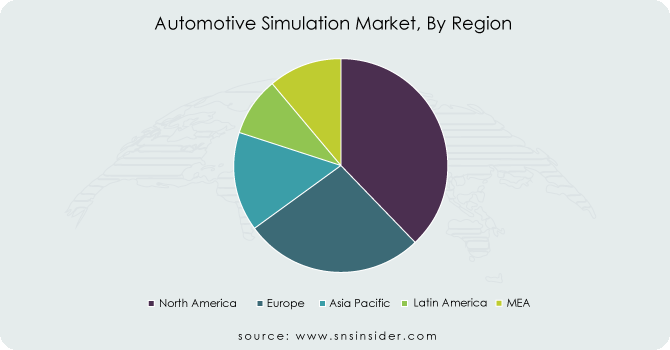

North America currently dominates the Automotive Simulation Market, accounting for around 35-40% of market share This dominance is driven by the presence of major automotive manufacturers and a strong focus on investigate and improvement in the region. Europe is the second highest region in this market holding 30-35% of the share, boasting a well-established automotive industry and stringent security controls that require advanced simulation tools. The Asia Pacific region is expected to witness the fastest growth with an estimated growth rate of approximately 12-15%. This quick rise is fueled by variables like developing automotive industry, expanding government investments in R&D, and a growing demand for electric vehicles.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are ESI Group (Germany), PG Automotive GmbH (Germany), dSPACE GmbH (Germany), ANSYS, Inc. (US), MOOG INC. (US), Dassault Systèmes (France), TESIS GmbH (Germany), Siemens PLM (US) and other key players.

Dassault Systèmes (France)-Company Financial Analysis

RECENT DEVELOPMENTS:

-

In June 2022 - NI acquired monoDrive, a leader in ADAS simulation software, to boost its presence in the autonomous driving sector. This will help carmakers streamline development, testing, and deployment of safer self-driving systems by bridging the gap between simulation and real-world testing, currently hampered by fragmented tools and inefficient processes.

| Report Attributes | Details |

| Market Size in 2023 | US$ 1.85 Billion |

| Market Size by 2031 | US$ 4.05 Billion |

| CAGR | CAGR of 10.3% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Component (Software, Services) • by Application (Prototyping, Testing) • by End-User (OEMs, Automotive Component Manufacturers, Regulatory Bodies) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ESI Group (Germany), PG Automotive GmbH (Germany), dSPACE GmbH (Germany), ANSYS, Inc. (US), MOOG INC. (US), AImotive, Dassault Systèmes (France), TESIS GmbH (Germany), Siemens PLM (US) |

| Key Drivers | • Advanced Simulation Techniques Enhance Dependability of Virtual Testing in Automotive Applications |

| RESTRAINTS |

• High Initial Investment Limits Advanced Simulation Adoption for Smaller Automakers • Complex Software Slows Down Integration of Simulation Tools in Car Design |