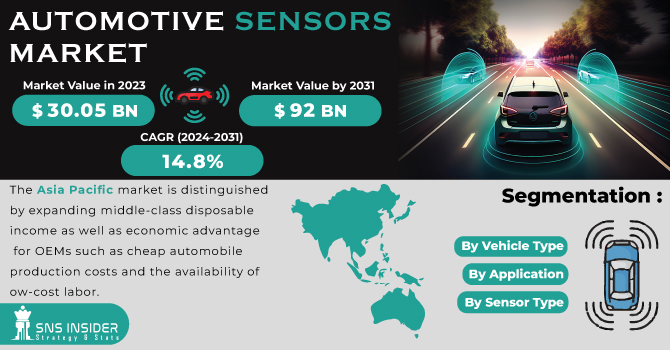

The Automotive Sensors Market was valued at USD 27.09 billion in 2023 and is expected to reach USD 76.57 billion by 2032, growing at a CAGR of 12.27% over the forecast period 2024-2032.

Get More Information on Automotive Sensors Market - Request Sample Report

The automotive sensors market is witnessing growth due to the rising interest in technology that improves safety, efficiency, and driving experience. With changes in consumer preferences in favor of smart and connected vehicles, the deployment of sensors in powertrain systems, safety systems, and telematics is accelerating. Increasing adoption of Advanced Driver-Assistance Systems (ADAS), autonomous driving technologies, and emission regulations have led to the demand for position, pressure, and NOx sensors. These sensors are vital for optimal vehicle performance, increased fuel economy, and compliance with increasingly stringent emissions standards. Moreover, the increasing adoption of electric vehicles (EVs) and hybrid vehicles also drives up the demand for battery management sensors, energy efficient sensors, and regenerative braking sensors, thus creating a better market opportunity for sensors. ADAS technologies used in over 85% of new vehicles in developed markets by 2024, while 50 million EVs are predicted to hit the road by 2025. Battery management sensors will reach 4.2 billion units, and 90% of new vehicles in the EU and U.S. worldwide will be using sensors for emission compliance.

Moreover, device and software penetration into vehicles with the rapid expansion of the Internet of Things (IoT) will drive demand for connected vehicle technologies and telematics systems, thus boosting market growth. With the Wide adoption of vehicles integrated with smart infrastructure and smart communication/interaction networks, the need for sensors in automotive, especially in the department of vehicle body electronics and telematics, is needed. Investment in sensor technologies, driven by the automotive industry's needs for an increasingly secure driving and traveling experience for drivers and their passengers whilst also reducing environmental impact and improving the overall driving experience, is likely to see the automotive sensors market continue to expand in the coming years. Sensor-based safety technologies like collision Avoidance, Parking Assist, and Adaptive Cruise Control will be available in 60% of new Vehicles by 2024. The transition to electric and hybrid cars, along with the emanation of IoT and sensor boosting, will lower the emissions from vehicles by 30% below ICE vehicles by 2025. For navigation and safety, autonomous vehicles will have 20-30 sensors. Also, 40% of vehicles will use telematics for processing real-time data for navigation, traffic management, and emergencies.

Key Drivers:

Predictive Maintenance and Real-Time Monitoring Driving Growth of Automotive Sensors in Smart Fleets

The growing attention towards predictive maintenance and real-time monitoring in vehicles is one of the major factors driving the growth of the automotive sensors market. As sensor technology improves, car manufacturers are installing smart sensors in vehicles that track wear and tear on important parts like brakes, tires, and engines. The use of these sensors delivers data in real-time used for assessing the potential failure which can be prevented through timely maintenance thereby minimizing downtime or expensive repairs. This trend is especially powerful in the commercial vehicles segment, where predictive maintenance can maximize efficiency and minimize downtime. With fleet operators increasingly embracing connected tech for optimized logistics, the need for scalable durable automotive sensors is seen to grow. In 2024, 70% of fleet operators will be using GPS tracking solutions, while 95% of fleet managers recognize how much they benefit from connected technologies for more efficient fleets. Smart Fleets technology can reduce maintenance costs by up to 25% and unplanned downtime by up to 70% for commercial vehicles, through predictive maintenance technologies. Further, by 2025, more than 50% of commercial vehicles are projected to be equipped with predictive maintenance sensors covering critical components such as brakes, tires, and engines for real-time data collection.

Smart Cities and V2X Communication Driving Automotive Sensor Growth and Enhancing Traffic Safety Worldwide

The rapid growth of smart cities and V2X (Vehicle-to-Everything) communication is among the more significant market drivers. As governments and city planners promote smart infrastructure, vehicles are being built to interact with their environment, including traffic lights, pedestrian crossings, and other vehicles. This trend is powered by advanced sensors including radar, lidar, and camera sensors which enable the vehicle to sense and respond to its surroundings almost instantly. V2X communication not only facilitates improved traffic management with reduced congestion but it also increases safety by avoiding crashes and enabling optimised navigation. With the proliferation of these sensors that are quickly starting to act as enabling elements for smart city projects around the globe, their adoption is expected to be a key enabler for the automotive sensors market over the upcoming years. Arizona, Texas, and Utah will receive a combined USD 60 million from the U.S. Department of Transportation to spur V2X deployment. More than 60% of vehicles will include V2X technologies, and radar, LiDAR, and camera sensors are expected to expand 10 to 15% annually. V2X communication is expected to help reduce 30% of traffic accidents, increasing safety while also optimizing navigation.

Restrain:

Challenges in Integrating Diverse Automotive Sensors and Ensuring Secure Data Transmission in Modern Vehicles

The complexity involved in the integration of diverse sensor types into a single system is one of the key restraints in the automotive sensors market. Modern vehicles include many different types of sensors (image, position, inertial sensors, etc.) that must operate consistently to ensure maximum performance. The largest automakers have gone to get two or three sensor technologies, software, and vehicle platforms, to be compatible with each other which is hard. This results in slow product development and higher technical barriers to achieving stability of the system. As modern cars are increasingly connected, telematics proliferate, and the sharing of vehicular data is the norm, they risk more than the exfiltration of these swathes of data. For manufacturers, the collection of generated data by their sensors comes at a cost because now they have to ensure that this data is transmitted and stored securely. Although regulatory compliance and the creation of layered cybersecurity are necessary, it complicates sensor design and deployment.

By Sensor Type

In 2023, position sensors accounted for the largest market share of 28.7% owing to their wide application in powertrain, chassis, and safety systems in automotive. They are critical for the accurate control and monitoring of vehicle subsystems such as throttle position and steering angle, pedal positions, concerning gear shifts. The use of more sophisticated advanced driver-assistance systems (ADAS) and the demand for high vehicle performance are leading to the integration of position sensors which are now constituting a key component for the seamless operation of ADAS, fuel efficiency, and others for safety purposes. In addition, they have become ubiquitous in every segment of the market, from traditional internal combustion engine (ICE) vehicles to electric vehicles (EVs).

The pressure sensors category is anticipated to develop at the highest CAGR from 2024 to 2032, as it has a growing number of applications on contemporary automobiles. They are essential for monitoring tire pressure, fuel systems, braking systems, and HVAC systems that aid in vehicle safety, efficiency, and performance. The increasing adoption of electric and hybrid cars has also boosted the need for pressure sensors, which are essential for the battery management system (BMS) and thermal management system (TMS). Moreover, the growing requirement for stringent emission regulation across the globe is preparing pressure sensors to be used in exhaust and fuel systems to be considered a high-growth segment shortly.

By Application

In 2023, the automotive sensors market was dominated by powertrain systems, accounting for a 29.7% share, as these systems are critical to vehicle performance, efficiency, and emissions. Powertrain systems contain sensors such as position, temperature, and pressure sensors to monitor and optimize engine performance, fuel injection, and transmission systems. These sensors promote optimal combustion, reduced emissions, and fuel efficiency, factors that make them suitable for the automotive industry to meet stringent environmental regulations. Apart from that, they are dominating since these are widely used in both conventional ICE vehicles and EVs as other than ICE cars, EVs also utilize various sensors to help in controlling the Motor, Battery Management, and Thermal Regulation.

The safety and control systems segment are likely to expand at the highest CAGR during the period from 2024 to 2032 due to the increasing penetration of Advanced Driver Assistance Systems (ADAS) and autonomous driving technologies. These systems are dependent on numerous sensors like radar, lidar, image sensors inertial sensors, etc. necessary to support automotive abilities such as collision avoidance, lane-keeping assist, adaptive cruise control, etc. As governments and regulatory authorities enforce advanced safety features in vehicles and consumers push for even higher safety standards, it has become important for automotive manufacturers to integrate sensors inside safety and control systems. In addition, the roll-out of autonomous vehicles is likely to propel further growth as the complexity of sensor networks, and the need for real-time decision-making and increased situational awareness, are set to rise significantly.

By Vehicle Type

In 2023, passenger cars occupied the majority share of 70.8% of the automotive sensors market owing to large volumes of vehicle production along with the widespread adoption of advanced technologies. Passenger vehicles have been generally leading the charge in developing sensor technology and are expected to use the full suite of sensor types to increase safety, comfort, and performance. Growing adoption of Advanced Driver Assistance Systems (ADAS), Infotainment systems, and Environmental monitoring in passenger cars is driving demand for position, pressure, and image sensors. Also, the increasing demand for electric and hybrid passenger vehicles that need sensors for battery management, motor control, and thermal systems has increased the demand for them in the market. Passenger cars also command most of the market, thanks, in part, to government-imposed safety features such as airbags, lane departure warnings, and tire pressure monitoring systems.

Light Commercial Vehicles (LCVs) have been growing at the fastest CAGR during 2024 and 2032, supported by the widening spectrum of applications in last-mile delivery along with logistics Strong growth of e-commerce and urbanization is pushing for higher demand for LCVs that need advanced sensor technologies for better driver safety, load handling, and for an improved fuel efficiency Moreover, the shift towards electric LCVs is also driving sensors for battery systems, regenerative braking, and telematics for fleet monitoring. Increasing focus on emissions reduction and operational optimization in commercial fleets is accelerating the adoption of advanced safety systems such as ADAS and V2X with heavy reliance on sensors. Altogether, these components have set the anatomy LCV marketplace segment among the fastest developing segments in the automotive sensors marketplace.

Regional Analysis

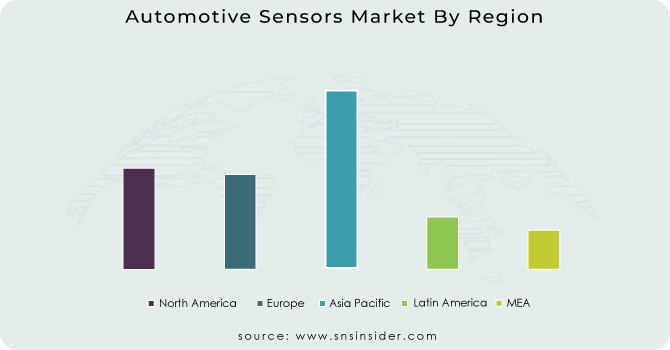

The automotive sensors market in Asia Pacific accounted for a 38.6% share in 2023 and is anticipated to witness the fastest CAGR from 2024 to 2032. Such dominance is due to the enormous vehicle production in the region led by China, Japan, South Korea, and India, which is the global base for automobile production. In particular, these countries are making significant investments in electric vehicle (EV) production and advanced driver-assistance systems (ADAS), which drives a fairly strong demand for sensors. To illustrate China, the global biggest automotive market, is heading EV production with companies such as BYD and NIO taking advantage of the most innovative sensor solutions for battery management and safety systems. Likewise, Toyota of Japan and Hyundai from South Korea seem to be investing significantly in ADAS and other sensor-based systems to adapt to the new era of safety and efficiency. This in turn boosts the demand for sensors across the region, owing to the swift adoption of government initiatives and policies to promote EVs and mitigate emissions levels. Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME), for example, encourages automakers such as Tata Motors and Mahindra & Mahindra to upgrade their vehicles with sensors that allow them to be electrified and help them meet emissions compliance more effectively.

Get Customized Report as per your Business Requirement - Request For Customized Report

Some of the major players in the Automotive Sensors Market are:

Aeva (Aeries II, Atlas)

Kistler Group (High-temperature Pressure Sensors, Ballistic Pressure Sensors)

Luminar Technologies (Hydra, Iris+)

Denso Corporation (Engine Control Modules, Fuel Pumps)

Bosch (MEMS Accelerometers, Oxygen Sensors)

Continental AG (Radar Sensors, Lidar Sensors)

Delphi Technologies (Fuel Injection Systems, Engine Control Units)

Infineon Technologies AG (Magnetic Sensors, Pressure Sensors)

NXP Semiconductors (Inertial Measurement Units, Tire Pressure Monitoring Sensors)

Sensata Technologies (Speed Sensors, Position Sensors)

TE Connectivity (Temperature Sensors, Humidity Sensors)

Valeo (Ultrasonic Parking Sensors, Rain-Light Sensors)

ZF Friedrichshafen AG (Airbag Sensors, Steering Angle Sensors)

Aptiv PLC (Occupant Detection Sensors, Active Safety Sensors)

Analog Devices (Gyroscope Sensors, Accelerometers)

Honeywell International Inc. (Mass Airflow Sensors, Knock Sensors)

Mitsubishi Electric Corporation (Automotive Cameras, Millimeter-Wave Radars)

OmniVision Technologies (Image Sensors, Camera Modules)

ON Semiconductor (Image Sensors, Proximity Sensors)

Texas Instruments (LiDAR Sensors, Ultrasonic Sensors)

Some of the Raw Material Suppliers for companies:

TDK Corporation

CoorsTek

Amphenol Advanced Sensors

Goodfellow

Ceradex

Hitachi High-Tech Corporation

Novonix

ON Semiconductor

Infineon Technologies

NXP Semiconductors

In December 2024, Aeva unveiled its new 4D LiDAR sensor, Atlas Ultra, and showcased partnerships with Torc Robotics and Wideye by AGC at CES 2025, highlighting innovations for autonomous driving and seamless in-cabin integration.

In December 2024, DENSO and Onsemi strengthened their long-term collaboration to enhance autonomous driving and ADAS technologies, with DENSO acquiring Onsemi shares to deepen their partnership.

In July 2024, Infineon and Swoboda partnered to develop high-performance current sensor modules for electromobility, enhancing electric vehicle traction inverters and battery management systems.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 27.09 Billion |

| Market Size by 2032 | USD 76.57 Billion |

| CAGR | CAGR of 12.27% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Sensor Type (Temperature Sensors, Pressure Sensors, Oxygen Sensors, NOx Sensors, Position Sensors, Speed Sensors, Inertial Sensors, Image Sensors, Others) • By Application (Powertrain Systems, Chassis, Exhaust Systems, Safety & Control Systems, Vehicle Body Electronics, Telematics Systems, Others) • By Vehicle Type (Passenger cars, LCV, HCV) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Aeva, Kistler Group, Luminar Technologies, Denso Corporation, Bosch, Continental AG, Delphi Technologies, Infineon Technologies, NXP Semiconductors, Sensata Technologies, TE Connectivity, Valeo, ZF Friedrichshafen AG, Aptiv PLC, Analog Devices, Honeywell International Inc., Mitsubishi Electric Corporation, OmniVision Technologies, ON Semiconductor, Texas Instruments. |

| Key Drivers | • Predictive Maintenance and Real-Time Monitoring Driving Growth of Automotive Sensors in Smart Fleets • Smart Cities and V2X Communication Driving Automotive Sensor Growth and Enhancing Traffic Safety Worldwide |

| RESTRAINTS | • Challenges in Integrating Diverse Automotive Sensors and Ensuring Secure Data Transmission in Modern Vehicles |

Ans: The Automotive Sensors Market is expected to grow at a CAGR of 12.27% during 2024-2032.

Ans: Automotive Sensors Market size was USD 27.09 billion in 2023 and is expected to Reach USD 76.57 billion by 2032.

Ans: The major growth factor of the automotive sensors market is the increasing demand for advanced driver-assistance systems (ADAS) and autonomous driving technologies.

Ans: The Passenger cars segment dominated the Automotive Sensors Market in 2023.

Ans: Asia Pacific dominated the Automotive Sensors Market in 2023.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Automotive Sensors Cost per Sensor Unit (2023)

5.2 Automotive Sensors Sensor Reliability and Failure Rates (2023)

5.3 Automotive Sensors Sensor Integration Trends

5.4 Automotive Sensors Supply Chain and Production Metrics

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Automotive Sensors Market Segmentation, By Sensor Type

7.1 Chapter Overview

7.2 Temperature Sensors

7.2.1 Temperature Sensors Market Trends Analysis (2020-2032)

7.2.2 Temperature Sensors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Pressure Sensors

7.3.1 Pressure Sensors Market Trends Analysis (2020-2032)

7.3.2 Pressure Sensors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Oxygen Sensors

7.4.1 Oxygen Sensors Market Trends Analysis (2020-2032)

7.4.2 Oxygen Sensors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 NOx Sensors

7.5.1 NOx Sensors Market Trends Analysis (2020-2032)

7.5.2 NOx Sensors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Position Sensors

7.6.1 Position Sensors Market Trends Analysis (2020-2032)

7.6.2 Position Sensors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 Speed Sensors

7.7.1 Speed Sensors Market Trends Analysis (2020-2032)

7.7.2 Speed Sensors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.8 Inertial Sensors

7.8.1 Inertial Sensors Market Trends Analysis (2020-2032)

7.8.2 Inertial Sensors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.9 Image Sensors

7.9.1 Image Sensors Market Trends Analysis (2020-2032)

7.9.2 Image Sensors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.10 Others

7.10.1 Others Market Trends Analysis (2020-2032)

7.10.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Automotive Sensors Market Segmentation, By Application

8.1 Chapter Overview

8.2 Powertrain Systems

8.2.1 Powertrain Systems Market Trends Analysis (2020-2032)

8.2.2 Powertrain Systems Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Chassis

8.3.1 Chassis Market Trends Analysis (2020-2032)

8.3.2 Chassis Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Exhaust Systems

8.4.1 Exhaust Systems Market Trends Analysis (2020-2032)

8.4.2 Exhaust Systems Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Safety & Control Systems

8.5.1 Safety & Control Systems Market Trends Analysis (2020-2032)

8.5.2 Safety & Control Systems Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Vehicle Body Electronics

8.6.1 Vehicle Body Electronics Market Trends Analysis (2020-2032)

8.6.2 Vehicle Body Electronics Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Telematics Systems

8.7.1 Telematics Systems Market Trends Analysis (2020-2032)

8.7.2 Telematics Systems Market Size Estimates and Forecasts to 2032 (USD Billion)

8.8 Others

8.8.1 Others Market Trends Analysis (2020-2032)

8.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Automotive Sensors Market Segmentation, By Vehicle Type

9.1 Chapter Overview

9.2 Passenger cars

9.2.1 Passenger Cars Market Trends Analysis (2020-2032)

9.2.2 Passenger Cars Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 LCV

9.3.1 LCV Market Trends Analysis (2020-2032)

9.3.2 LCV Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 HCV

9.4.1 HCV Market Trends Analysis (2020-2032)

9.4.2 HCV Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Automotive Sensors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.2.4 North America Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.5 North America Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.2.6.2 USA Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.6.3 USA Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.2.7.2 Canada Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.7.3 Canada Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.2.8.2 Mexico Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.8.3 Mexico Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Automotive Sensors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.6.3 Poland Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.7.3 Romania Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Automotive Sensors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.5 Western Europe Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.6.3 Germany Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.3.2.7.2 France Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.7.3 France Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.3.2.8.2 UK Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.8.3 UK Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.9.3 Italy Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.10.3 Spain Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.13.3 Austria Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Automotive Sensors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.4.4 Asia Pacific Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.5 Asia Pacific Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.4.6.2 China Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.6.3 China Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.4.7.2 India Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.7.3 India Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.4.8.2 Japan Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.8.3 Japan Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.4.9.2 South Korea Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.9.3 South Korea Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.10.3 Vietnam Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.4.11.2 Singapore Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.11.3 Singapore Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.4.12.2 Australia Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.12.3 Australia Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Automotive Sensors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.5.1.4 Middle East Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.5 Middle East Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.6.3 UAE Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Automotive Sensors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.5.2.4 Africa Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.5 Africa Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Automotive Sensors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.6.4 Latin America Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.5 Latin America Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.6.6.2 Brazil Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.6.3 Brazil Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.6.7.2 Argentina Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.7.3 Argentina Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.6.8.2 Colombia Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.8.3 Colombia Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Automotive Sensors Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Automotive Sensors Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Automotive Sensors Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11. Company Profiles

11.1 Aeva

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Kistler Group

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Luminar Technologies

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Denso Corporation

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Bosch

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Continental AG

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Delphi Technologies

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Infineon Technologies

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 NXP Semiconductors

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Sensata Technologies

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Sensor Type

Temperature Sensors

Pressure Sensors

Oxygen Sensors

NOx Sensors

Position Sensors

Speed Sensors

Inertial Sensors

Image Sensors

Others

By Application

Powertrain Systems

Chassis

Exhaust Systems

Safety & Control Systems

Vehicle Body Electronics

Telematics Systems

Others

By Vehicle Type

Passenger cars

LCV

HCV

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Automotive Actuators Market Size was USD 20.3 Billion in 2023 and is expected to reach USD 32.4 Bn by 2032, growing at a CAGR of 5.34% by 2024-2032.

The Bicycle Accessories Market Size was valued at USD 16.63 Billion in 2023 and will reach USD 30.44 Billion by 2032 and grow at a CAGR of 6.97% by 2024-2032.

Weigh-In-Motion System Market was USD 1.11 billion in 2023 and is expected to reach USD 2.79 Billion by 2032, growing at a CAGR of 10.77% by 2024-2032.

The Automotive Metal Stamping Market Size was valued at USD 108.41 Bn in 2023 and will reach USD 163.90 Bn by 2032 and grow at a CAGR of 4.7% by 2024-2032

Electric Commercial Vehicle Market Size was valued at USD 71.51 billion in 2023 and is expected to reach USD 521.92 billion by 2032 and grow at a CAGR of 24.74% over the forecast period 2024-2032.

The Automotive Sunroof Market Size was valued at USD 7.45 billion in 2023 and is expected to reach USD 19.36 billion by 2032 and grow at a CAGR of 11.2% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone