Automotive Retread Tires Market Report Scope & Overview:

The Automotive Retread Tires Market size was valued at USD 7756 million in 2023 and is expected to reach USD 10614.6 million by 2031 and grow at a CAGR of 4% over the forecast period 2024-2031.

The automotive care, retread tires offers a unique approach to extending the usable life of tires. These tires are essentially pre-owned, having their worn-out tread stripped away and replaced with a completely new layer. The global market for retread tires is poised for substantial growth in the years ahead. The main reason behind this growth is the increasing pressure to find cheaper tire solutions. Retreads offer a significantly lower price point compared to brand new tires, making them an attractive option for businesses managing fleets of commercial vehicles and for cost-conscious consumers alike. These tires are well-suited for the demanding applications encountered by heavy-duty trucks, buses, and even aircraft. The commercial vehicle segment itself is experiencing significant growth due to the expansion of the transportation and logistics industries, further amplifying the demand for retread tires. The government regulations and initiatives that promote sustainable practices are expected to play a significant role in driving the growth of the retread tire market. The retreading process offers a more environmentally friendly alternative to traditional tire disposal and manufacturing methods.

Get More Information on Automotive Retread Tires Market - Request Sample Report

MARKET DYNAMICS:

KEY DRIVERS:

-

Retreading reduces environmental impact by reusing casings, minimizing waste and emissions, appealing to eco-conscious consumers.

-

Extensive use in heavy-duty trucks, buses, and aircraft fuels demand due to the growing transportation sector.

The expansion of the transportation and logistics industries is a significant driver for the demand of retreaded tires in heavy-duty vehicles. Trucks, buses, and aircraft rely heavily on these tires to handle demanding workloads. As the transportation sector experiences growth, the need for these vehicles increases proportionally. This translates to a rising demand for their tires, making retreads an attractive option. Since retreads offer a cost-effective alternative to new tires, fleet operators and transportation companies can manage their budgets more efficiently while maintaining their vehicles.

RESTRAINTS:

-

Strict quality control standards and regulations can increase retreading costs and complexity.

-

Concerns about safety and performance compared to new tires can limit consumer adoption.

Consumer perception remains a hurdle for the automotive retread tire market. Many drivers hold concerns about the safety and performance of retreads compared to the brand new tires. These anxieties might stem from misconceptions about the retreading process or a lack of awareness about the rigorous quality checks these tires undergo. This perception gap can limit consumer adoption, especially among drivers who prioritize safety and peak performance for their vehicles.

OPPORTUNITIES:

-

Marketing retreads as an eco-friendly choice can appeal to environmentally conscious consumers.

-

Collaborations with fleet management companies can offer cost-effective retreading solutions to businesses.

CHALLENGES:

-

Consumer concerns about retread safety compared to new tires can hinder market growth.

-

Reliance on specialized equipment and skilled labour for retreading can create operational challenges.

IMPACT OF RUSSIA-UKRAINE WAR

The ongoing war in Russia-Ukraine has impacted the automotive retread tire market, disrupting established supply chains and impacting raw material costs. Russia is a major supplier of palladium, a critical element in catalytic converters, which indirectly affects tire production costs due to its connection to the automotive industry. The war has caused a surge in oil prices by over 10% which translates to increased costs for materials like rubber used in both new and retreaded tires. While the direct impact on the retread market itself might be difficult to quantify, these factors put pressure on overall tire affordability, potentially influencing consumer behaviour. The sanctions on Russia have disrupted trade routes and caused logistical bottlenecks, potentially impacting the import and export of retreaded tires in certain regions.

IMPACT OF ECONOMIC SLOWDOWN

An economic slowdown disrupts the potential growth of the automotive retread tire market . During economic downturns, consumer spending typically limits. This can lead to a decrease in demand for both new and retreaded tires, as consumers delay non-essential car maintenance or opt for used cars which may not require immediate tire replacements. Fleet operators, a major consumer segment for retreads, might also postpone tire replacements or reduce the size of their fleets in response to lower economic activity. This could lead to a decline in retread sales, impacting market growth projections. It can also lead to reduced access to credit, potentially making it harder for retreading facilities to invest in new equipment or upgrades, hindering their ability to improve efficiency and compete effectively. The severity of the impact would depend on the depth and duration of the slowdown. Thus, the cost-effective nature of retreads could also position them favourably.

KEY MARKET SEGMENTS:

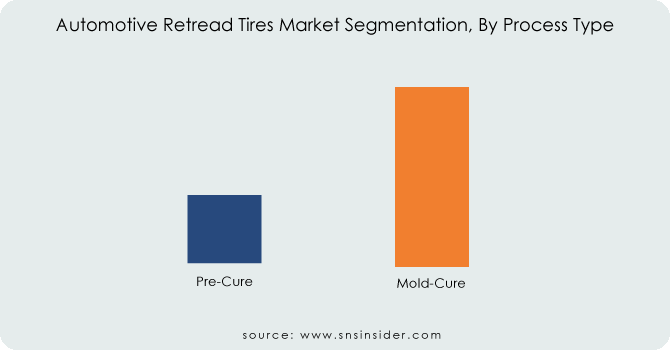

By Process Type

-

Pre-cure

-

Mold-cure

Mold-Cure is the dominating sub-segment in the Automotive Retread Tires Market by process type holding around 70-80% of market share. Mold-cure retreading is the more traditional and widely used process. It involves applying uncured rubber to the buffed casing and then curing it in a mold under high pressure and heat. This process offers established quality control procedures and good overall performance, making it the preferred choice for many retreaders.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Sales Channel

-

OEM

-

Aftermarket

Aftermarket is the dominating sub-segment in the Automotive Retread Tires Market by sales channel holding around 80-90% of the market share. The aftermarket segment caters to existing vehicles that require tire replacements. This segment is significantly larger than the OEM (Original Equipment Manufacturer) segment, which focuses on supplying tires for new vehicles. The wider availability and established network make the aftermarket the dominant sales channel for retreaded tires.

By Vehicle Type

-

Passenger Cars

-

Light Commercial Vehicles

-

Heavy Commercial Vehicles

Light Commercial Vehicles (LCVs) is the dominating sub-segment in the Automotive Retread Tires Market by vehicle type holding around 45-55% of market share. Light commercial vehicles, including vans, pickup trucks, and small buses, are widely used in various industries like transportation, logistics, and construction. These vehicles experience high mileage and require frequent tire replacements. Retreaded tires offer a cost-effective solution for LCV fleets, making this segment the leader in the retread tire market.

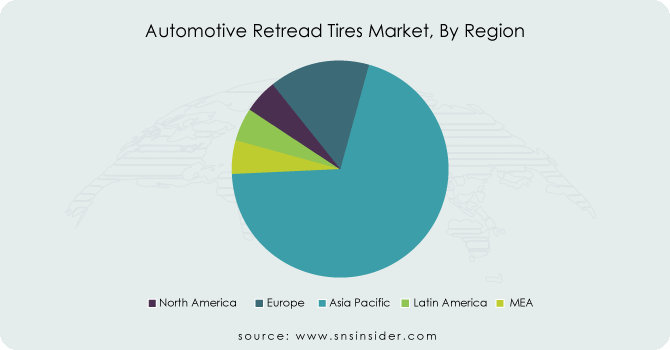

REGIONAL ANALYSES

The Asia Pacific is the dominating region in the Automotive Retread Tires Market holding around 55-60% of market share. This region have a vast and ever-growing vehicle population, creating a high demand for tires. Cost-effectiveness and a growing focus on sustainability make retreads an attractive option.

North America is the second-highest region in this market with well-established retread industry, particularly in the United States. The extensive use of retreads in commercial vehicle fleets, especially in construction and logistics, significantly contributes to this share.

Latin America is experiencing the fastest market growth, with a projected rate of 6-8%. This region's expanding transportation and logistics sectors are driving the demand for cost-effective tire solutions. Government regulations that promote sustainable practices are creating a favourable environment for retreading.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are Continental AG, Bridgestone Corporation (Japan), Nokian Tires plc (Finland). MRF Tires (India), The Goodyear Tire & Rubber Company (US), Michelin (France), Marangoni S.p.A. (Italy), KRAIBURG AUSTRIA GmbH & CO. KG (Austria), Pilipinas Kai Rubber Corporation (Philippines), JK Tires (India), Eastern Treads (India) and other key players.

Continental AG-Company Financial Analysis

RECENT DEVELOPMENT

-

In Sept. 2022: The Goodyear Tire & Rubber Company and Treadco, Inc. have joined forces. This strategic partnership will create the largest network of facilities dedicated to truck tire sales, service, and retreading. This collaboration is poised to reshape the industry landscape and potentially enhance customer service options.

-

In Aug. 2022: Bridgestone has renewed its partnership with Microsoft to improve tire analytics. This collaboration will boost Bridgestone's digital advancements and allow them to develop more sophisticated methods for predicting and managing tire maintenance needs.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 7756 Million |

| Market Size by 2031 | US$ 10614.6 Million |

| CAGR | CAGR of 4% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Process Type (Pre-cure, Mold-cure) • By Sales Channel (OEM, Aftermarket) • By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Continental AG, Bridgestone Corporation (Japan), Nokian Tires plc (Finland). MRF Tires (India), The Goodyear Tire & Rubber Company (US), Michelin (France), Marangoni S.p.A. (Italy), KRAIBURG AUSTRIA GmbH & CO. KG (Austria), Pilipinas Kai Rubber Corporation (Philippines), JK Tires (India), Eastern Treads (India) |

| Key Drivers | • Retreading reduces environmental impact by reusing casings, minimizing waste and emissions, appealing to eco-conscious consumers. • Extensive use in heavy-duty trucks, buses, and aircraft fuels demand due to the growing transportation sector. |

| Restraints | • Strict quality control standards and regulations can increase retreading costs and complexity. • Concerns about safety and performance compared to new tires can limit consumer adoption. |