Get More Information on Automotive Repair and Maintenance Services Market - Request Sample Report

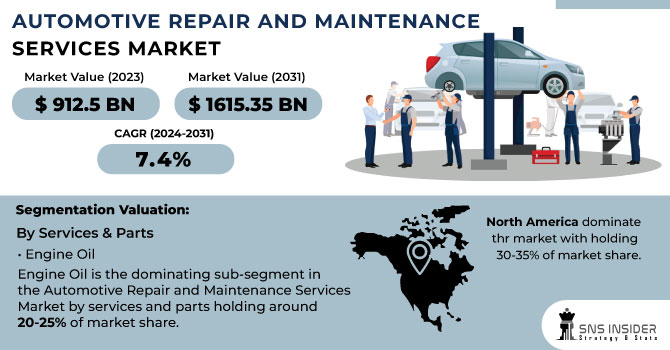

The Automotive Repair and Maintenance Services Market Size was valued at USD 912.5 billion in 2023 and is expected to reach USD 1615.35 billion by 2031 and grow at a CAGR of 7.4% over the forecast period 2024-2031.

The automotive repair and service industry keeps our cars running smoothly by offering maintenance and replacements for parts that wear down over time. This includes everything from oil filters and wiper blades to batteries and collision bodywork. The market itself is quite fragmented, with many independent repair shops and local suppliers competing for your business. This can be a good thing for consumers, as it often leads to competitive pricing and flexible service options. The industry caters to a wide range of vehicles, from passenger cars and SUVs to commercial trucks and motorcycles.

It's no surprise then that the market has seen significant growth in recent years, and this trend is expected to continue. As the number of vehicles on the road keeps rising, so will the demand for regular maintenance and repairs. People are also becoming more aware of the importance of keeping their cars in good condition, both for safety reasons and to extend the vehicle's lifespan.

KEY DRIVERS:

Increasing vehicle age due to advancements in materials and technology is leading to more repair needs.

Rising car sales and the expansion of after-sales services are creating more business for repair shops.

The automotive repair industry is experiencing a rise due the increasing number of cars being sold translates directly to a larger pool of vehicles requiring maintenance and repairs. As more people own cars, there's a natural rise in demand for services to keep them running smoothly. The after-sales service sector is expanding. This means car manufacturers and dealerships are offering more comprehensive maintenance plans and extending the range of services available.

RESTRAINTS:

The increasing complexity of modern vehicles with advanced technology can make repairs expensive and require specialized skills.

Modern cars, packed with advanced technology and intricate parts offers improved performance and safety but their complexity can significantly hike repair costs. Fixing these high-tech components requires specialized skills and knowledge that not all mechanics possess. This can lead to a scenario where repairs become expensive due to the limited pool of qualified technicians and the specialized tools and software needed for diagnostics and fixes.

Consumers may choose to delay repairs due to high service costs, opting for temporary fixes or extending service intervals.

OPPORTUNITIES:

The rise of electric vehicles creates a need for specialized repair services and technician training.

Repair shops can leverage technology like online booking systems and remote diagnostics to improve customer convenience.

CHALLENGES:

Increasing complexity of vehicles with advanced tech makes repairs expensive and requires specialized skills.

High service costs may lead customers to delay repairs or seek cheaper, temporary fixes.

The war in Russia-Ukraine has disrupted the automotive repair and maintenance market, impacting it in several ways. The supply chain disruptions are a major hurdle. Ukraine supplied key components like wiring looms and neon gas for semiconductors, crucial for modern vehicles. The conflict caused shortages and price hikes for these parts, potentially inflating repair costs by around 5-10% of share. The sanctions on Russia limited access to raw materials, potentially delaying repairs by 2-5% due to part shortages. The war-driven surge in oil and gas prices increased the cost of essential lubricants and fluids by an estimated 3-7%, potentially leading some consumers to delay non-critical repairs. While the exact market size impact is unclear, some analysts predict a global production decline of 1 million vehicles, meaning a smaller pool of new cars needing maintenance in the short term.

Economic slowdowns can disrupt the automotive repair and maintenance market. Limiting budgets lead consumers to delay non-essential repairs, potentially declining the market by 5-10%. This means people might prioritize urgent fixes while postponing routine maintenance or seeking cheaper options like used parts. The cost-conscious consumers during downturns might opt for do-it-yourself (DIY) repairs with the help of online resources, potentially reducing demand for professional services by 2-3%. Repair shops will have to face problems with lower customer traffic leading to decreased revenue. This can force them to cut costs by reducing staff or operating hours, and in extreme cases, some shops may even be forced to close their doors. Economic downturns can also lead people to hold onto their cars for longer, ultimately increasing the demand for maintenance and repairs as these vehicles age.

By Services & Parts

Engine Oil

Gear Oil

Brake Oil

Grease

Tires

Batteries

Wear & Tear Parts

Air Filter

Cabin Filter

Oil Filter

Wiper Blades

Others

Engine Oil is the dominating sub-segment in the Automotive Repair and Maintenance Services Market by services and parts holding around 20-25% of market share. It's a critical component requiring regular replacement to maintain engine health and performance. Regardless of vehicle type or service provider, engine oil changes are a fundamental part of car maintenance.

By Service Providers

Automobile Dealerships

Franchise General Repairs

Specialty Shops

Locally Owned Repair Shops

Tire Shops

Others

Locally Owned Repair Shops is the dominating sub-segment in the Automotive Repair and Maintenance Services Market by service providers holding around 40-45% of market share. These shops hold the largest market share due to several factors. They often offer competitive pricing compared to dealerships and franchises. Additionally, they build long-term relationships with customers, fostering trust and loyalty. Their local presence allows for convenient service and flexibility in repairs.

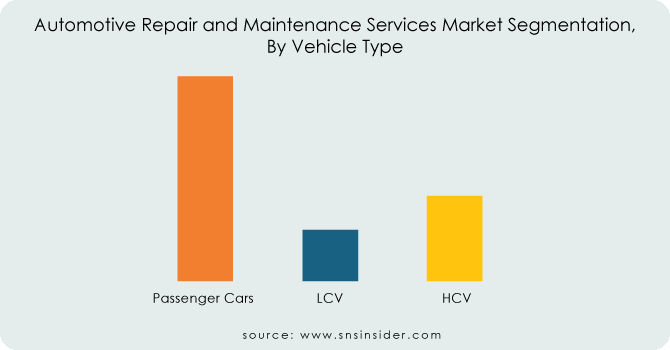

By Vehicle Type

Passenger Cars

LCV

HCV

Passenger Cars is the dominating sub-segment in the Automotive Repair and Maintenance Services Market by vehicle type holding around 60-65% of market share due to the sheer number of passenger cars on the road compared to other vehicle types. The widespread ownership and frequent use of passenger cars lead to a consistent demand for maintenance services. Rising disposable income and increasing urbanization further contribute to the dominance of this segment.

Get Customized Report as per your Business Requirement - Request For Customized Report

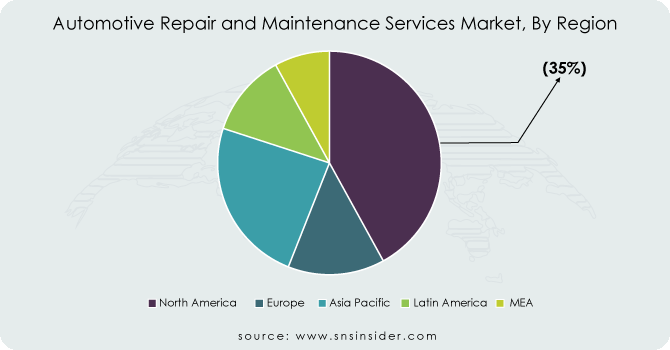

The North America is the dominating region in the Automotive Repair and Maintenance Services Market holding around 30-35% of market share due to its long-established automotive industry, high car ownership, and ingrained car maintenance culture. Strict emission regulations further drive demand for frequent check-ups and repairs.

The Asia Pacific is fastest-growing region holding the CAGR of 10%. Rapid economic development, urbanization, and a growing middle class with more disposable income to spend on car maintenance are fueling this growth. Government initiatives promoting vehicle safety and emission control further propel the market forward.

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

The major key players are Arnold Clark Automobiles Limited, Asbury Car Group, Inc., Ashland Automotive, Inc., Belron International Ltd., LKQ Corporation, Mobivia Groupe, Inter Cars, Mekonomen Group, Hance's European, EUROPART Holding GmbH, USA Automotive, CarParts.com, Inc., myTVS, M & M Auto Repair, Bosch Car Service, Halfords Group Plc, Wrench, Inc., Sun Auto Service. Carmax Autocare Center, Firestone Complete Auto Care, Inc., Goodyear Tire & Rubber Company., Jiffy Lube International, Inc. and other key players.

In July 2023: KwikFix Automotive Repairs in India has launched a user-friendly mobile app. This app streamlines car maintenance and accessory purchases, allowing users to manage everything from their smartphones. It even personalizes repair recommendations based on driving habits and vehicle type.

In Oct. 2023: In collaboration with Amazon, Ford offers a new in-vehicle service in the US. Ford owners can now use Alexa voice commands to schedule, track, and pay for car repairs and maintenance, simplifying the service experience. This program is expected to expand to other regions in the future.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 912.5 Billion |

| Market Size by 2031 | US$ 1615.35 Billion |

| CAGR | CAGR of 7.4% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Services & Parts (Engine Oil, Gear Oil, Brake Oil, Grease, Tires, Batteries, Wear & Tear Parts, Air Filter, Cabin Filter, Oil Filter, Wiper Blades, Others) • By Service Providers (Automobile Dealerships, Franchise General Repairs, Specialty Shops, Locally Owned Repair Shops, Tire Shops, Others) • By Vehicle Type (Passenger Cars, LCV, HCV) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Arnold Clark Automobiles Limited, Asbury Car Group, Inc., Ashland Automotive, Inc., Belron International Ltd., LKQ Corporation, Mobivia Groupe, Inter Cars, Mekonomen Group, Hance's European, EUROPART Holding GmbH, USA Automotive, CarParts.com, Inc., myTVS, M & M Auto Repair, Bosch Car Service, Halfords Group Plc, Wrench, Inc., Sun Auto Service. Carmax Autocare Center, Firestone Complete Auto Care, Inc., Goodyear Tire & Rubber Company., Jiffy Lube International, Inc. |

| Key Drivers | • Increasing vehicle age due to advancements in materials and technology is leading to more repair needs. • Rising car sales and the expansion of after-sales services are creating more business for repair shops. |

| Restraints | • The increasing complexity of modern vehicles with advanced technology can make repairs expensive and require specialized skills. • Consumers may choose to delay repairs due to high service costs, opting for temporary fixes or extending service intervals. |

Ans: The expected CAGR of the global Automotive Repair and Maintenance Services Market during the forecast period is 7.4%.

Ans: The Automotive Repair and Maintenance Services Market was valued at USD 912.5 billion in 2023.

Ans: Increasing vehicle age, rising car sales, and expanding after-sales services.

Ans: Increasing repair complexity and high service costs.

Ans: Ford offering in-vehicle service scheduling via Alexa.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Impact Analysis

5.1 Impact of Russia-Ukraine Crisis

5.2 Impact of Economic Slowdown on Major Countries

5.2.1 Introduction

5.2.2 United States

5.2.3 Canada

5.2.4 Germany

5.2.5 France

5.2.6 UK

5.2.7 China

5.2.8 Japan

5.2.9 South Korea

5.2.10 India

6. Value Chain Analysis

7. Porter’s 5 Forces Model

8. Pest Analysis

9. Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

9.1 Introduction

9.2 Trend Analysis

9.3 Engine Oil

9.4 Gear Oil

9.5 Brake Oil

9.6 Grease

9.7 Tires

9.8 Batteries

9.9 Wear & Tear Parts

9.10 Air Filter

9.11 Cabin Filter

9.12 Oil Filter

9.13 Wiper Blades

9.14 Others

10. Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

10.1 Introduction

10.2 Trend Analysis

10.3 Automobile Dealerships

10.4 Franchise General Repairs

10.5 Specialty Shops

10.6 Locally Owned Repair Shops

10.7 Tire Shops

10.8 Others

11. Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

11.1 Introduction

11.2 Trend Analysis

11.3 Passenger Cars

11.4 LCV

11.5 HCV

12. Regional Analysis

12.1 Introduction

12.2 North America

12.2.1 Trend Analysis

12.2.2 North America Automotive Repair and Maintenance Services Market, By Country

12.2.3 North America Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.2.4 North America Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.2.5 North America Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.2.6 USA

12.2.6.1 USA Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.2.6.2 USA Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.2.6.3 USA Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.2.7 Canada

12.2.7.1 Canada Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.2.7.2 Canada Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.2.7.3 Canada Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.2.8 Mexico

12.2.8.1 Mexico Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.2.8.2 Mexico Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.2.8.3 Mexico Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.3 Europe

12.3.1 Trend Analysis

12.3.2 Eastern Europe

12.3.2.1 Eastern Europe Automotive Repair and Maintenance Services Market, By Country

12.3.2.2 Eastern Europe Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.3.2.3 Eastern Europe Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.3.2.4 Eastern Europe Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.3.2.5 Poland

12.3.2.5.1 Poland Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.3.2.5.2 Poland Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.3.2.5.3 Poland Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.3.2.6 Romania

12.3.2.6.1 Romania Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.3.2.6.2 Romania Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.3.2.6.4 Romania Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.3.2.7 Hungary

12.3.2.7.1 Hungary Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.3.2.7.2 Hungary Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.3.2.7.3 Hungary Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.3.2.8 Turkey

12.3.2.8.1 Turkey Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.3.2.8.2 Turkey Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.3.2.8.3 Turkey Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.3.2.9 Rest of Eastern Europe

12.3.2.9.1 Rest of Eastern Europe Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.3.2.9.2 Rest of Eastern Europe Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.3.2.9.3 Rest of Eastern Europe Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.3.3 Western Europe

12.3.3.1 Western Europe Automotive Repair and Maintenance Services Market, By Country

12.3.3.2 Western Europe Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.3.3.3 Western Europe Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.3.3.4 Western Europe Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.3.3.5 Germany

12.3.3.5.1 Germany Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.3.3.5.2 Germany Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.3.3.5.3 Germany Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.3.3.6 France

12.3.3.6.1 France Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.3.3.6.2 France Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.3.3.6.3 France Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.3.3.7 UK

12.3.3.7.1 UK Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.3.3.7.2 UK Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.3.3.7.3 UK Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.3.3.8 Italy

12.3.3.8.1 Italy Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.3.3.8.2 Italy Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.3.3.8.3 Italy Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.3.3.9 Spain

12.3.3.9.1 Spain Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.3.3.9.2 Spain Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.3.3.9.3 Spain Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.3.3.10 Netherlands

12.3.3.10.1 Netherlands Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.3.3.10.2 Netherlands Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.3.3.10.3 Netherlands Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.3.3.11 Switzerland

12.3.3.11.1 Switzerland Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.3.3.11.2 Switzerland Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.3.3.11.3 Switzerland Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.3.3.1.12 Austria

12.3.3.12.1 Austria Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.3.3.12.2 Austria Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.3.3.12.3 Austria Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.3.3.13 Rest of Western Europe

12.3.3.13.1 Rest of Western Europe Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.3.3.13.2 Rest of Western Europe Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.3.3.13.3 Rest of Western Europe Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.4 Asia-Pacific

12.4.1 Trend Analysis

12.4.2 Asia-Pacific Automotive Repair and Maintenance Services Market, By Country

12.4.3 Asia-Pacific Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.4.4 Asia-Pacific Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.4.5 Asia-Pacific Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.4.6 China

12.4.6.1 China Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.4.6.2 China Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.4.6.3 China Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.4.7 India

12.4.7.1 India Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.4.7.2 India Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.4.7.3 India Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.4.8 Japan

12.4.8.1 Japan Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.4.8.2 Japan Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.4.8.3 Japan Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.4.9 South Korea

12.4.9.1 South Korea Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.4.9.2 South Korea Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.4.9.3 South Korea Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.4.10 Vietnam

12.4.10.1 Vietnam Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.4.10.2 Vietnam Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.4.10.3 Vietnam Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.4.11 Singapore

12.4.11.1 Singapore Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.4.11.2 Singapore Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.4.11.3 Singapore Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.4.12 Australia

12.4.12.1 Australia Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.4.12.2 Australia Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.4.12.3 Australia Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.4.13 Rest of Asia-Pacific

12.4.13.1 Rest of Asia-Pacific Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.4.13.2 Rest of Asia-Pacific Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.4.13.3 Rest of Asia-Pacific Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.5 Middle East & Africa

12.5.1 Trend Analysis

12.5.2 Middle East

12.5.2.1 Middle East Automotive Repair and Maintenance Services Market, By Country

12.5.2.2 Middle East Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.5.2.3 Middle East Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.5.2.4 Middle East Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.5.2.5 UAE

12.5.2.5.1 UAE Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.5.2.5.2 UAE Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.5.2.5.3 UAE Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.5.2.6 Egypt

12.5.2.6.1 Egypt Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.5.2.6.2 Egypt Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.5.2.6.3 Egypt Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.5.2.7 Saudi Arabia

12.5.2.7.1 Saudi Arabia Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.5.2.7.2 Saudi Arabia Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.5.2.7.3 Saudi Arabia Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.5.2.8 Qatar

12.5.2.8.1 Qatar Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.5.2.8.2 Qatar Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.5.2.8.3 Qatar Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.5.2.9 Rest of Middle East

12.5.2.9.1 Rest of Middle East Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.5.2.9.2 Rest of Middle East Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.5.2.9.3 Rest of Middle East Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.5.3 Africa

12.5.3.1 Africa Automotive Repair and Maintenance Services Market, By Country

12.5.3.2 Africa Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.5.3.3 Africa Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.5.3.4 Africa Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.5.3.5 Nigeria

12.5.3.5.1 Nigeria Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.5.3.5.2 Nigeria Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.5.3.5.3 Nigeria Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.5.3.6 South Africa

12.5.3.6.1 South Africa Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.5.3.6.2 South Africa Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.5.3.6.3 South Africa Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.5.3.7 Rest of Africa

12.5.3.7.1 Rest of Africa Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.5.3.7.2 Rest of Africa Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.5.3.7.3 Rest of Africa Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.6 Latin America

12.6.1 Trend Analysis

12.6.2 Latin America Automotive Repair and Maintenance Services Market, By Country

12.6.3 Latin America Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.6.4 Latin America Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.6.5 Latin America Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.6.6 Brazil

12.6.6.1 Brazil Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.6.6.2 Brazil Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.6.6.3 Brazil Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.6.7 Argentina

12.6.7.1 Argentina Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.6.7.2 Argentina Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.6.7.3 Argentina Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.6.8 Colombia

12.6.8.1 Colombia Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.6.8.2 Colombia Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.6.8.3 Colombia Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

12.6.9 Rest of Latin America

12.6.9.1 Rest of Latin America Automotive Repair and Maintenance Services Market Segmentation, By Services & Parts

12.6.9.2 Rest of Latin America Automotive Repair and Maintenance Services Market Segmentation, By Service Providers

12.6.9.3 Rest of Latin America Automotive Repair and Maintenance Services Market Segmentation, By Vehicle Type

13. Company Profiles

13.1 Arnold Clark Automobiles Limited

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services Offered

13.1.4 SWOT Analysis

13.1.5 The SNS View

13.2 Asbury Car Group, Inc.

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services Offered

13.2.4 SWOT Analysis

13.2.5 The SNS View

13.3 Ashland Automotive, Inc.

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Products/ Services Offered

13.3.4 SWOT Analysis

13.3.5 The SNS View

13.4 Belron International Ltd.

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Products/ Services Offered

13.4.4 SWOT Analysis

13.4.5 The SNS View

13.5 LKQ Corporation

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Products/ Services Offered

13.5.4 SWOT Analysis

13.5.5 The SNS View

13.6 Mobivia Groupe

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Products/ Services Offered

13.6.4 SWOT Analysis

13.6.5 The SNS View

13.7 Inter Cars

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Products/ Services Offered

13.7.4 SWOT Analysis

13.7.5 The SNS View

13.8 Mekonomen Group

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Products/ Services Offered

13.8.4 SWOT Analysis

13.8.5 The SNS View

13.9 Hance's European

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Products/ Services Offered

13.9.4 SWOT Analysis

13.9.5 The SNS View

13.10 EUROPART Holding GmbH

13.10.1 Company Overview

13.10.2 Financial

13.10.3 Products/ Services Offered

13.10.4 SWOT Analysis

13.10.5 The SNS View

13.11 USA Automotive

13.11.1 Company Overview

13.11.2 Financial

13.11.3 Products/ Services Offered

13.11.4 SWOT Analysis

13.11.5 The SNS View

13.12 CarParts.com, Inc.

13.12.1 Company Overview

13.12.2 Financial

13.12.3 Products/ Services Offered

13.12.4 SWOT Analysis

13.12.5 The SNS View

13.13 myTVS

13.13.1 Company Overview

13.13.2 Financial

13.13.3 Products/ Services Offered

13.13.4 SWOT Analysis

13.13.5 The SNS View

13.14 M & M Auto Repair

13.14.1 Company Overview

13.14.2 Financial

13.14.3 Products/ Services Offered

13.14.4 SWOT Analysis

13.14.5 The SNS View

13.15 Bosch Car Service

13.15.1 Company Overview

13.15.2 Financial

13.15.3 Products/ Services Offered

13.15.4 SWOT Analysis

13.15.5 The SNS View

13.16 Halfords Group Plc

13.16.1 Company Overview

13.16.2 Financial

13.16.3 Products/ Services Offered

13.16.4 SWOT Analysis

13.16.5 The SNS View

13.17 Wrench, Inc.

13.17.1 Company Overview

13.17.2 Financial

13.17.3 Products/ Services Offered

13.17.4 SWOT Analysis

13.17.5 The SNS View

13.18 Sun Auto Service.

13.18.1 Company Overview

13.18.2 Financial

13.18.3 Products/ Services Offered

13.18.4 SWOT Analysis

13.18.5 The SNS View

13.19 Carmax Autocare Center

13.19.1 Company Overview

13.19.2 Financial

13.19.3 Products/ Services Offered

13.19.4 SWOT Analysis

13.19.5 The SNS View

13.20 Firestone Complete Auto Care, Inc.

13.20.1 Company Overview

13.20.2 Financial

13.20.3 Products/ Services Offered

13.20.4 SWOT Analysis

13.20.5 The SNS View

13.21 Goodyear Tire & Rubber Company.

13.21.1 Company Overview

13.21.2 Financial

13.21.3 Products/ Services Offered

13.21.4 SWOT Analysis

13.21.5 The SNS View

13.22 Jiffy Lube International, Inc.

13.22.1 Company Overview

13.22.2 Financial

13.22.3 Products/ Services Offered

13.22.4 SWOT Analysis

13.22.5 The SNS View

14. Competitive Landscape

14.1 Competitive Benchmarking

14.2 Market Share Analysis

14.3 Recent Developments

14.3.1 Industry News

14.3.2 Company News

14.3.3 Mergers & Acquisitions

15. Use Case and Best Practices

16. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The locomotive Market size was valued at USD 20.05 billion in 2023 and is expected to reach at USD 47.65 billion by 2032 and grow at a CAGR of 9.10% over the forecast period of 2024-2032.

The Bus Seat Market Size was valued at USD 13.5 billion in 2023 and is expected to reach USD 21.67 billion by 2032 and grow at a CAGR of 5.4% by 2024-2032.

The Motorcycles Market Size was valued at USD 118.25 billion in 2023 and is expected to reach USD 226.71 billion by 2032 and grow at a CAGR of 7.5% over the forecast period 2024-2032.

The Automotive Wheel Rims Market Size was USD 42.36 billion in 2023 and is expected to hit USD 87.55 billion by 2031 and grow at a CAGR of 9.5% by 2024-2031

The Motorcycle Lead Acid Battery Market Size was valued at USD 5.21 Billion in 2023 and is expected to reach USD 8.52 Billion by 2032 and grow at a CAGR of 5.63% over the forecast period 2024-2032.

The Tubeless Tire Market size is expected to reach USD 282.90 Bn by 2031, the market was valued at USD 175.5 Bn in 2023 and will grow at a CAGR of 6.15% over the forecast period of 2024-2031.

Hi! Click one of our member below to chat on Phone