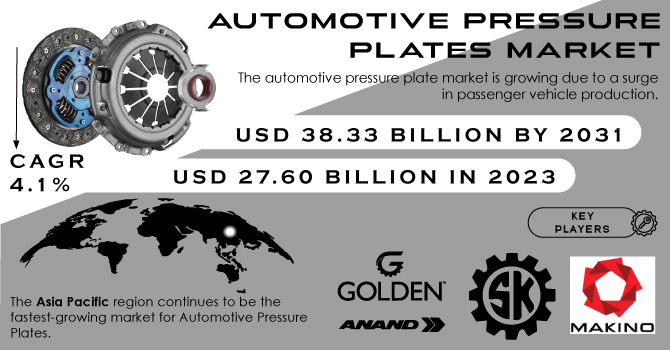

The Automotive Pressure Plates Market Size was valued at USD 27.60 billion in 2023 and is expected to reach USD 38.33 billion by 2031 and grow at a CAGR of 4.1% over the forecast period 2024-2031.

The automotive pressure plate market is growing due to a surge in passenger vehicle production. Since every manual transmission car needs a pressure plate, rising vehicle output directly translates to market growth. Furthermore, advancements in car manufacturing, driven by consumer demand for comfort and performance, are expected to positively impact the market. The development of innovative clutch systems like the Dual Clutch Transmission (DCT), fueled by the need for fuel-efficient vehicles, presents another optimistic factor. However, the pre-existing global car fleet is a significant source of future pressure plate sales. Routine maintenance and breakdowns will necessitate replacements, driving up demand throughout the forecast period. The affordability of manual clutches compared to automatics is expected to further drive the automotive pressure plate market in the coming years.

Get More Information on Automotive Pressure Plates Market - Request Sample Report

KEY DRIVERS:

Rising car production and innovative technology are driving demand for new vehicles.

The surge in car sales creates a direct need for more automotive parts, including pressure plates. This trend is amplified by the growing demand for high-performance vehicles with strong acceleration and traction. As a result, the pressure plate market is expected to move by the overall rise in car demand.

Widening landscape of the automobile market

RESTRAINTS:

Automatic transmissions and electric vehicles may dampen demand for pressure plates.

The growing popularity of automatic transmissions and electric vehicles threatens to decrease demand for pressure plates. Traditional transmissions rely on pressure plates to function, but automatics often utilize different mechanisms. Electric vehicles, on the other hand, forgo transmissions entirely due to their distinct electric motors. This shift in automotive technology could lead to a decline in the need for pressure plates.

OPPORTUNITIES:

Rising vehicle production and manual transmission affordability are fueling the market.

Growth in high-performance car demand creates opportunities for innovative pressure plate designs.

CHALLENGES:

The popularity of electric vehicles with different drivetrains could limit future sales.

The Russia-Ukraine war disrupts the automotive pressure plate market. Disrupted supply chains due to the conflict could make it harder to obtain raw materials and components, potentially hindering production and inflating costs. A weaker global economy might also lead to fewer people buying new cars, reducing demand for new pressure plates. The aftermarket segment, focused on repairs and replacements for existing vehicles, might see some resilience. As older cars require maintenance, pressure plate replacements could maintain steady demand despite the economic slowdown.

An economic slowdown can disrupt the automotive pressure plate market. Weaker consumer spending might lead to fewer new car purchases, directly reducing demand for pressure plates needed in original equipment (OEM) manufacturing. This could lead to production slowdowns or even temporary shutdowns for pressure plate manufacturers. However, the impact might not be uniform across the market. The aftermarket segment, which caters to repairs and replacements for existing vehicles, could show some resilience. Even during an economic downturn, car owners are likely to prioritize maintaining their existing vehicles.

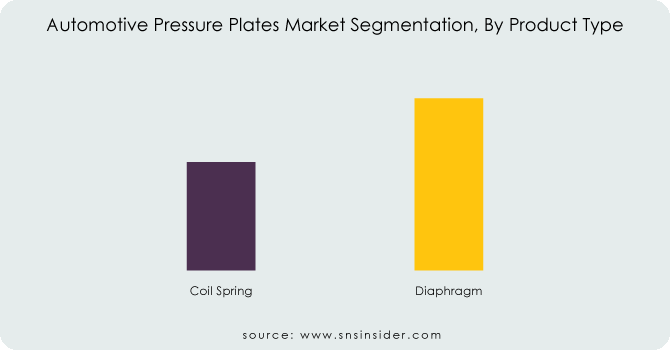

By Product Type:

Coil Spring

Diaphragm

Diaphragm dominates the Automotive Pressure Plates Market by product with 75% of market share. Diaphragm pressure plates are lighter, offer smoother gear changes, and have a higher clamping force compared to coil spring types. These features make them ideal for modern vehicles, particularly passenger cars with manual transmissions.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Vehicle Type:

Passenger cars

LCV

HCV

Passenger Cars dominates the Automotive Pressure Plates Market by vehicle type, with 60% of market share due to the higher volume of passenger car production globally compared to light commercial vehicles (LCVs) and heavy commercial vehicles (HCVs). The widespread use of manual transmissions in passenger cars further contributes to this dominance.

By Clutch Type:

Single plate friction

Multiple frictions

Cone clutch

Single Plate Friction dominates the Automotive Pressure Plates Market by clutch type with 80% of market share as this is the most common type of clutch used in passenger cars and light commercial vehicles. It utilizes a single pressure plate to clamp the clutch disc against the flywheel. This simplicity and affordability make single plate friction clutches dominant in these vehicle segments.

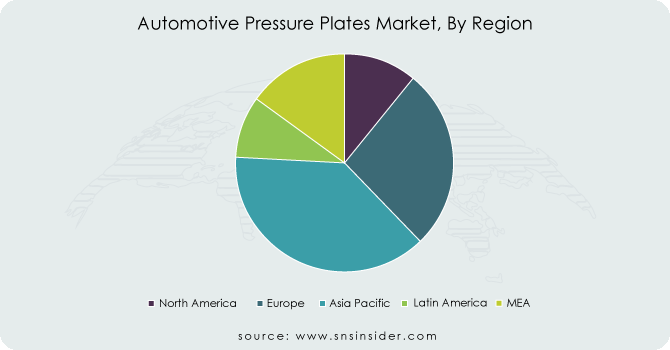

The Asia Pacific is the dominating region in the Automotive Pressure Plate Market. This dominance is likely due to the significant growth in the automotive sector in this region, particularly in countries like China and India.

Europe is the second highest region in the Automotive Pressure Plate Market. The presence of established automotive manufacturers and a focus on technological advancements contribute to this region's strong market position.

The Asia Pacific region continues to be the fastest-growing market for Automotive Pressure Plates. This is primarily driven by the factors mentioned earlier, like the growing automotive industry and rising car ownership in developing countries.

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

The major key players are California Custom Clutch Corporation (US), GOLDEN Precision Products Private Limited (India), S. K. Auto Industries (India), Makino Auto Industries Private Limited (India), Raicam Clutch Ltd (Italy), SASSONE SRL (Italy), ANAND Group (India), MACAS Automotive (India), Apls Automotive Industries Private Limited (India), Hebei Tengda Auto Parts Co., Ltd. (China), Setco Automotive Ltd (India), and RSM Autokast Ltd. (India) are other key players.

In Dec. 2023 - Machine tool giant Makino India further solidified its commitment to India with a new "Turnkey and Engineering Factory" in Coimbatore. This expansion signifies their focus on bringing advanced manufacturing solutions and strengthening their presence in the Indian market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 27.60 Billion |

| Market Size by 2031 | US$ 38.33 Billion |

| CAGR | CAGR of 4.1 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Product Type (Coil Spring, Diaphragm) • by Vehicle Type (Passenger cars, LCV, HCV) • by Clutch Type (Single plate friction, Multiple frictions, Cone clutch) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | California Custom Clutch Corporation (US), GOLDEN Precision Products Private Limited (India), S. K. Auto Industries (India), Makino Auto Industries Private Limited (India), Raicam Clutch Ltd (Italy), SASSONE SRL (Italy), ANAND Group (India), MACAS Automotive (India), Apls Automotive Industries Private Limited (India), Hebei Tengda Auto Parts Co., Ltd. (China), Setco Automotive Ltd (India), and RSM Autokast Ltd. (India) |

| Key Drivers | • Rising car production and innovative technology are driving demand for new vehicles. • Widening landscape of the automobile market |

| RESTRAINTS | • Automatic transmissions and electric vehicles may dampen demand for pressure plates. |

Ans: The expected CAGR of the global Automotive Pressure Plates Market during the forecast period is 4.1%.

Ans:The Automotive Pressure Plates Market was valued at USD 27.60 billion in 2023.

Ans: The Asia Pacific region is the dominating region in the Automotive Pressure Plates Market.

Ans: Diaphragm dominates the Automotive Pressure Plates Market by product type.

Ans: Passenger cars dominate the Automotive Pressure Plates Market By Vehicle Type.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Impact Analysis

5.1 Impact of Russia-Ukraine Crisis

5.2 Impact of Economic Slowdown on Major Countries

5.2.1 Introduction

5.2.2 United States

5.2.3 Canada

5.2.4 Germany

5.2.5 France

5.2.6 UK

5.2.7 China

5.2.8 Japan

5.2.9 South Korea

5.2.10 India

6. Value Chain Analysis

7. Porter’s 5 Forces Model

8. Pest Analysis

9. Automotive Pressure Plates Market Segmentation, By Product Type

9.1 Introduction

9.2 Trend Analysis

9.3 Coil Spring

9.4 Diaphragm

10. Automotive Pressure Plates Market Segmentation, By Vehicle Type

10.1 Introduction

10.2 Trend Analysis

10.3 Passenger cars

10.4 LCV

10.5 HCV

11. Automotive Pressure Plates Market Segmentation, By Clutch Type

11.1 Introduction

11.2 Trend Analysis

11.3 Single plate friction

11.4 Multiple frictions

11.5 Cone clutch

12. Regional Analysis

12.1 Introduction

12.2 North America

12.2.1 Trend Analysis

12.2.2 North America Automotive Pressure Plates Market Segmentation, By Country

12.2.3 North America Automotive Pressure Plates Market Segmentation, By Product Type

12.2.4 North America Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.2.5 North America Automotive Pressure Plates Market Segmentation, By Clutch Type

12.2.6 USA

12.2.6.1 USA Automotive Pressure Plates Market Segmentation, By Product Type

12.2.6.2 USA Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.2.6.3 USA Automotive Pressure Plates Market Segmentation, By Clutch Type

12.2.7 Canada

12.2.7.1 Canada Automotive Pressure Plates Market Segmentation, By Product Type

12.2.7.2 Canada Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.2.7.3 Canada Automotive Pressure Plates Market Segmentation, By Clutch Type

12.2.8 Mexico

12.2.8.1 Mexico Automotive Pressure Plates Market Segmentation, By Product Type

12.2.8.2 Mexico Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.2.8.3 Mexico Automotive Pressure Plates Market Segmentation, By Clutch Type

12.3 Europe

12.3.1 Trend Analysis

12.3.2 Eastern Europe

12.3.2.1 Eastern Europe Automotive Pressure Plates Market Segmentation, by Country

12.3.2.2 Eastern Europe Automotive Pressure Plates Market Segmentation, By Product Type

12.3.2.3 Eastern Europe Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.3.2.4 Eastern Europe Automotive Pressure Plates Market Segmentation, By Clutch Type

12.3.2.5 Poland

12.3.2.5.1 Poland Automotive Pressure Plates Market Segmentation, By Product Type

12.3.2.5.2 Poland Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.3.2.5.3 Poland Automotive Pressure Plates Market Segmentation, By Clutch Type

12.3.2.6 Romania

12.3.2.6.1 Romania Automotive Pressure Plates Market Segmentation, By Product Type

12.3.2.6.2 Romania Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.3.2.6.4 Romania Automotive Pressure Plates Market Segmentation, By Clutch Type

12.3.2.7 Hungary

12.3.2.7.1 Hungary Automotive Pressure Plates Market Segmentation, By Product Type

12.3.2.7.2 Hungary Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.3.2.7.3 Hungary Automotive Pressure Plates Market Segmentation, By Clutch Type

12.3.2.8 Turkey

12.3.2.8.1 Turkey Automotive Pressure Plates Market Segmentation, By Product Type

12.3.2.8.2 Turkey Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.3.2.8.3 Turkey Automotive Pressure Plates Market Segmentation, By Clutch Type

12.3.2.9 Rest of Eastern Europe

12.3.2.9.1 Rest of Eastern Europe Automotive Pressure Plates Market Segmentation, By Product Type

12.3.2.9.2 Rest of Eastern Europe Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.3.2.9.3 Rest of Eastern Europe Automotive Pressure Plates Market Segmentation, By Clutch Type

12.3.3 Western Europe

12.3.3.1 Western Europe Automotive Pressure Plates Market Segmentation, by Country

12.3.3.2 Western Europe Automotive Pressure Plates Market Segmentation, By Product Type

12.3.3.3 Western Europe Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.3.3.4 Western Europe Automotive Pressure Plates Market Segmentation, By Clutch Type

12.3.3.5 Germany

12.3.3.5.1 Germany Automotive Pressure Plates Market Segmentation, By Product Type

12.3.3.5.2 Germany Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.3.3.5.3 Germany Automotive Pressure Plates Market Segmentation, By Clutch Type

12.3.3.6 France

12.3.3.6.1 France Automotive Pressure Plates Market Segmentation, By Product Type

12.3.3.6.2 France Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.3.3.6.3 France Automotive Pressure Plates Market Segmentation, By Clutch Type

12.3.3.7 UK

12.3.3.7.1 UK Automotive Pressure Plates Market Segmentation, By Product Type

12.3.3.7.2 UK Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.3.3.7.3 UK Automotive Pressure Plates Market Segmentation, By Clutch Type

12.3.3.8 Italy

12.3.3.8.1 Italy Automotive Pressure Plates Market Segmentation, By Product Type

12.3.3.8.2 Italy Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.3.3.8.3 Italy Automotive Pressure Plates Market Segmentation, By Clutch Type

12.3.3.9 Spain

12.3.3.9.1 Spain Automotive Pressure Plates Market Segmentation, By Product Type

12.3.3.9.2 Spain Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.3.3.9.3 Spain Automotive Pressure Plates Market Segmentation, By Clutch Type

12.3.3.10 Netherlands

12.3.3.10.1 Netherlands Automotive Pressure Plates Market Segmentation, By Product Type

12.3.3.10.2 Netherlands Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.3.3.10.3 Netherlands Automotive Pressure Plates Market Segmentation, By Clutch Type

12.3.3.11 Switzerland

12.3.3.11.1 Switzerland Automotive Pressure Plates Market Segmentation, By Product Type

12.3.3.11.2 Switzerland Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.3.3.11.3 Switzerland Automotive Pressure Plates Market Segmentation, By Clutch Type

12.3.3.1.12 Austria

12.3.3.12.1 Austria Automotive Pressure Plates Market Segmentation, By Product Type

12.3.3.12.2 Austria Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.3.3.12.3 Austria Automotive Pressure Plates Market Segmentation, By Clutch Type

12.3.3.13 Rest of Western Europe

12.3.3.13.1 Rest of Western Europe Automotive Pressure Plates Market Segmentation, By Product Type

12.3.3.13.2 Rest of Western Europe Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.3.3.13.3 Rest of Western Europe Automotive Pressure Plates Market Segmentation, By Clutch Type

12.4 Asia-Pacific

12.4.1 Trend Analysis

12.4.2 Asia-Pacific Automotive Pressure Plates Market Segmentation, by Country

12.4.3 Asia-Pacific Automotive Pressure Plates Market Segmentation, By Product Type

12.4.4 Asia-Pacific Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.4.5 Asia-Pacific Automotive Pressure Plates Market Segmentation, By Clutch Type

12.4.6 China

12.4.6.1 China Automotive Pressure Plates Market Segmentation, By Product Type

12.4.6.2 China Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.4.6.3 China Automotive Pressure Plates Market Segmentation, By Clutch Type

12.4.7 India

12.4.7.1 India Automotive Pressure Plates Market Segmentation, By Product Type

12.4.7.2 India Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.4.7.3 India Automotive Pressure Plates Market Segmentation, By Clutch Type

12.4.8 Japan

12.4.8.1 Japan Automotive Pressure Plates Market Segmentation, By Product Type

12.4.8.2 Japan Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.4.8.3 Japan Automotive Pressure Plates Market Segmentation, By Clutch Type

12.4.9 South Korea

12.4.9.1 South Korea Automotive Pressure Plates Market Segmentation, By Product Type

12.4.9.2 South Korea Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.4.9.3 South Korea Automotive Pressure Plates Market Segmentation, By Clutch Type

12.4.10 Vietnam

12.4.10.1 Vietnam Automotive Pressure Plates Market Segmentation, By Product Type

12.4.10.2 Vietnam Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.4.10.3 Vietnam Automotive Pressure Plates Market Segmentation, By Clutch Type

12.4.11 Singapore

12.4.11.1 Singapore Automotive Pressure Plates Market Segmentation, By Product Type

12.4.11.2 Singapore Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.4.11.3 Singapore Automotive Pressure Plates Market Segmentation, By Clutch Type

12.4.12 Australia

12.4.12.1 Australia Automotive Pressure Plates Market Segmentation, By Product Type

12.4.12.2 Australia Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.4.12.3 Australia Automotive Pressure Plates Market Segmentation, By Clutch Type

12.4.13 Rest of Asia-Pacific

12.4.13.1 Rest of Asia-Pacific Automotive Pressure Plates Market Segmentation, By Product Type

12.4.13.2 Rest of Asia-Pacific Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.4.13.3 Rest of Asia-Pacific Automotive Pressure Plates Market Segmentation, By Clutch Type

12.5 Middle East & Africa

12.5.1 Trend Analysis

12.5.2 Middle East

12.5.2.1 Middle East Automotive Pressure Plates Market Segmentation, by Country

12.5.2.2 Middle East Automotive Pressure Plates Market Segmentation, By Product Type

12.5.2.3 Middle East Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.5.2.4 Middle East Automotive Pressure Plates Market Segmentation, By Clutch Type

12.5.2.5 UAE

12.5.2.5.1 UAE Automotive Pressure Plates Market Segmentation, By Product Type

12.5.2.5.2 UAE Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.5.2.5.3 UAE Automotive Pressure Plates Market Segmentation, By Clutch Type

12.5.2.6 Egypt

12.5.2.6.1 Egypt Automotive Pressure Plates Market Segmentation, By Product Type

12.5.2.6.2 Egypt Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.5.2.6.3 Egypt Automotive Pressure Plates Market Segmentation, By Clutch Type

12.5.2.7 Saudi Arabia

12.5.2.7.1 Saudi Arabia Automotive Pressure Plates Market Segmentation, By Product Type

12.5.2.7.2 Saudi Arabia Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.5.2.7.3 Saudi Arabia Automotive Pressure Plates Market Segmentation, By Clutch Type

12.5.2.8 Qatar

12.5.2.8.1 Qatar Automotive Pressure Plates Market Segmentation, By Product Type

12.5.2.8.2 Qatar Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.5.2.8.3 Qatar Automotive Pressure Plates Market Segmentation, By Clutch Type

12.5.2.9 Rest of Middle East

12.5.2.9.1 Rest of Middle East Automotive Pressure Plates Market Segmentation, By Product Type

12.5.2.9.2 Rest of Middle East Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.5.2.9.3 Rest of Middle East Automotive Pressure Plates Market Segmentation, By Clutch Type

12.5.3 Africa

12.5.3.1 Africa Automotive Pressure Plates Market Segmentation, by Country

12.5.3.2 Africa Automotive Pressure Plates Market Segmentation, By Product Type

12.5.3.3 Africa Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.5.3.4 Africa Automotive Pressure Plates Market Segmentation, By Clutch Type

12.5.3.5 Nigeria

12.5.3.5.1 Nigeria Automotive Pressure Plates Market Segmentation, By Product Type

12.5.3.5.2 Nigeria Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.5.3.5.3 Nigeria Automotive Pressure Plates Market Segmentation, By Clutch Type

12.5.3.6 South Africa

12.5.3.6.1 South Africa Automotive Pressure Plates Market Segmentation, By Product Type

12.5.3.6.2 South Africa Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.5.3.6.3 South Africa Automotive Pressure Plates Market Segmentation, By Clutch Type

12.5.3.7 Rest of Africa

12.5.3.7.1 Rest of Africa Automotive Pressure Plates Market Segmentation, By Product Type

12.5.3.7.2 Rest of Africa Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.5.3.7.3 Rest of Africa Automotive Pressure Plates Market Segmentation, By Clutch Type

12.6 Latin America

12.6.1 Trend Analysis

12.6.2 Latin America Automotive Pressure Plates Market Segmentation, by country

12.6.3 Latin America Automotive Pressure Plates Market Segmentation, By Product Type

12.6.4 Latin America Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.6.5 Latin America Automotive Pressure Plates Market Segmentation, By Clutch Type

12.6.6 Brazil

12.6.6.1 Brazil Automotive Pressure Plates Market Segmentation, By Product Type

12.6.6.2 Brazil Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.6.6.3 Brazil Automotive Pressure Plates Market Segmentation, By Clutch Type

12.6.7 Argentina

12.6.7.1 Argentina Automotive Pressure Plates Market Segmentation, By Product Type

12.6.7.2 Argentina Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.6.7.3 Argentina Automotive Pressure Plates Market Segmentation, By Clutch Type

12.6.8 Colombia

12.6.8.1 Colombia Automotive Pressure Plates Market Segmentation, By Product Type

12.6.8.2 Colombia Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.6.8.3 Colombia Automotive Pressure Plates Market Segmentation, By Clutch Type

12.6.9 Rest of Latin America

12.6.9.1 Rest of Latin America Automotive Pressure Plates Market Segmentation, By Product Type

12.6.9.2 Rest of Latin America Automotive Pressure Plates Market Segmentation, By Vehicle Type

12.6.9.3 Rest of Latin America Automotive Pressure Plates Market Segmentation, By Clutch Type

13. Company Profiles

13.1 California Custom Clutch Corporation (US)

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services Offered

13.1.4 SWOT Analysis

13.1.5 The SNS View

13.2 GOLDEN Precision Products Private Limited (India)

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services Offered

13.2.4 SWOT Analysis

13.2.5 The SNS View

13.3 S. K. Auto Industries (India)

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Products/ Services Offered

13.3.4 SWOT Analysis

13.3.5 The SNS View

13.4 Makino Auto Industries Private Limited (India)

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Products/ Services Offered

13.4.4 SWOT Analysis

13.4.5 The SNS View

13.5 Raicam Clutch Ltd (Italy)

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Products/ Services Offered

13.5.4 SWOT Analysis

13.5.5 The SNS View

13.6 SASSONE SRL (Italy)

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Products/ Services Offered

13.6.4 SWOT Analysis

13.6.5 The SNS View

13.7 ANAND Group (India)

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Products/ Services Offered

13.7.4 SWOT Analysis

13.7.5 The SNS View

13.8 MACAS Automotive (India)

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Products/ Services Offered

13.8.4 SWOT Analysis

13.8.5 The SNS View

13.9 Apls Automotive Industries Private Limited (India)

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Products/ Services Offered

13.9.4 SWOT Analysis

13.9.5 The SNS View

13.10 Hebei Tengda Auto Parts Co., Ltd. (China)

13.10.1 Company Overview

13.10.2 Financial

13.10.3 Products/ Services Offered

13.10.4 SWOT Analysis

13.10.5 The SNS View

13.11 Setco Automotive Ltd (India)

13.11.1 Company Overview

13.11.2 Financial

13.11.3 Products/ Services Offered

13.11.4 SWOT Analysis

13.11.5 The SNS View

13.12 RSM Autokast Ltd. (India)

13.12.1 Company Overview

13.12.2 Financial

13.12.3 Products/ Services Offered

13.12.4 SWOT Analysis

13.12.5 The SNS View

14. Competitive Landscape

14.1 Competitive Benchmarking

14.2 Market Share Analysis

14.3 Recent Developments

14.3.1 Industry News

14.3.2 Company News

14.3.3 Mergers & Acquisitions

15. Use Case and Best Practices

16. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Electric Mobility Market Size was USD 298.25 Billion in 2023 and is expected to reach USD 1395.17 Bn by 2032 and grow at a CAGR of 18.75% by 2024-2032.

Automatic Number Plate Recognition (ANPR) System Market Size was valued at USD 3.17 Billion in 2023 and is expected to reach USD 6.96 Billion by 2032 and grow at a CAGR of 9.15% over the forecast period 2024-2032.

The V2X Cybersecurity Market Size was valued at USD 2.6 billion in 2023 and is expected to reach USD 12.0 billion by 2032, growing at a CAGR of 18.5% over the forecast period 2024-2032.

Automotive ECU Market Size was valued at USD 100.03 Billion in 2023 & is expected to reach USD 168.36 Bn by 2032 & grow at a CAGR of 5.92% by 2024-2032.

The Automated Guided Vehicle (AGV) Market Size was valued at USD 3.61 billion in 2023 and is expected to reach USD 7.83 billion by 2032 and grow at a CAGR of 8.98% over the forecast period 2024-2032.

The Automotive Conformal Coatings Market was valued USD 2.69 billion by 2032, and will reach USD 1.35 Bn by 2023, and Growing at a CAGR 7.23% by 2024-2032

Hi! Click one of our member below to chat on Phone