Get More Information on Automotive Metal Stamping Market - Request Sample Report

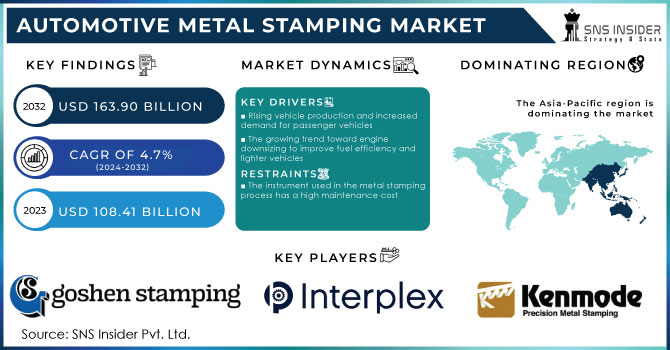

The Automotive Metal Stamping Market Size was valued at USD 108.41 Bn in 2023 and will reach USD 163.90 Bn by 2032 and grow at a CAGR of 4.7% by 2024-2032

Metal stamping for automobiles is a method of processing sheet metals and transforming them into various shapes and sizes according to individual requirements and use. Blanking, embossing, bending, coining, and flanging are among the five basic techniques used in sheet metal stamping. A piece of sheet metal is sliced into a blank or a number of blanks during the blanking process. Embossing is the process of stretching materials into shallow depressions to add different decorative patterns. Metal stamping is used in different stages of manufacturing in the automotive industry, including panels, brackets, bonnets, roofs, hangers, and other components, resulting in steady demand in the automotive metal stamping market.

Alloys like titanium, cast aluminum, cast iron, and forged steel are still used extensively in vehicle engines. Furthermore, technological improvements such as the usage of hybrid electromagnetically assisted sheet metal stamping machines, which reduce failures by managing strain distribution during stamping, are likely to boost industry growth.

Rising vehicle production and increased demand for passenger vehicles

The growing trend toward engine downsizing to improve fuel efficiency and lighter vehicles

The automotive metal stamping market is expected to be fueled by technological advancements.

The automotive metal stamping industry is poised for a surge driven by innovations that enhance efficiency and precision. Advancements in automation like robotic feeding systems and sensor-controlled presses will streamline production and reduce waste. Additionally, the integration of 3D printing for tooling will allow for faster prototyping and customization of stamped parts. These technological leaps, coupled with the development of powerful simulation software to optimize stamping processes, will translate to significant cost reductions and lighter vehicle components. This confluence of factors will propel the automotive metal stamping market forward, solidifying its role in the future of car manufacturing.

The fast expansion of manufacturing industries

The instrument used in the metal stamping process has a high maintenance cost

Stamping's growth is anticipated to be hampered by limited pricing flexibility

The rapidly expanding automobile industry

Demand for smart cars is rapidly increasing.

The desire for automobiles that think for themselves is surging. Consumers are increasingly drawn to "smart cars" loaded with technology that enhances every aspect of driving. This fascination stems from a confluence of factors. Safety features like automatic emergency braking and lane departure warnings provide peace of mind, while built-in navigation and internet connectivity transform commutes into connected experiences. For many, the future of driving is no longer just about getting from point A to B, but about a personalized and intelligent transportation pod. This growing demand is pushing automakers to constantly innovate, making the roads of tomorrow look a whole lot smarter.

Technological advancements and investments in R&D

The increasing usage of plastics/composites as metal substitutes is posing a new challenge

The complexity of operations of newly imported equipment is a major challenge

The war in Ukraine has sent shockwaves through the automotive metal stamping market. Disruptions began with critical parts shortages. Ukraine was a major supplier of wire harnesses, essential for a car's electrical system. This stalled production lines, especially in Europe. Beyond immediate parts, Russia's role as a key metal exporter is causing tremors. Sanctions and rising energy costs are pushing up prices of steel, aluminum, and nickel, all crucial for stamped auto parts. This cost inflation squeezes margins for metal stampers and car manufacturers alike. The long-term impact remains unclear, but the industry is scrambling to find alternative suppliers and cope with a new era of higher material costs.

An economic slowdown can trigger a domino effect within the automotive industry, negatively impacting the automotive metal stamping market. Reduced consumer spending power leads to declining car sales, forcing manufacturers to scale back production. This translates to a lower demand for metal stamped components like body panels, chassis parts, and brackets. Furthermore, economic uncertainty can cause automotive companies to delay investments in new vehicle models, further dampening demand for metal stamping services. Metal stamping companies may resort to layoffs or production cuts to manage costs during an economic downturn.

Market, By Technology:

The automotive metal stamping market can be dissected based on the specific technologies used to manipulate the sheet metal. Blanking, the process of cutting out precise shapes, and bending, which forms angles and curves, are anticipated to remain dominant due to their prevalence in creating body panels and structural components. Embossing creates raised designs, while coining refines details and imparts higher strength. Flanging forms folded edges for rigidity and attachment points. Finally, "Other" technologies encompass niche processes like shearing and perforating used for specialized applications. Understanding the role of each technology within the market allows for informed decisions about production techniques, material selection, and overall cost optimization.

Market, By Application:

The automotive metal stamping market is driven by its application in various vehicle types. Passenger cars hold the largest share due to high production volumes and consistent demand for components like doors, hoods, and trunks. Commercial vehicles, including trucks and buses, are experiencing significant growth due to rising infrastructure projects and increasing freight movement. Recreational vehicles, popular in North America, utilize metal stamping for their robust chassis and body parts, but their market share is concentrated geographically. As the global automotive industry expands and diversifies, all three segments are expected to witness a rise in demand for metal stamped parts, influencing the overall market growth.

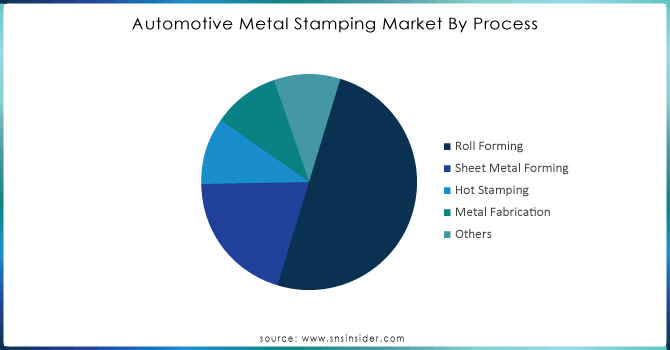

Market, By Process:

By process, the automotive metal stamping market can be segmented into distinct categories. Roll forming excels in creating long, continuous pieces like roof rails and door beams. Sheet metal forming, a broader category, encompasses various techniques like bending and flanging to create complex shapes for hoods and fenders. Hot stamping utilizes heat to shape high-strength steel for crucial safety components like pillars. Metal fabrication involves a wider range of techniques like welding and cutting, often used alongside other processes for intricate parts. Finally, the "Others" segment includes specialized techniques like hydroforming for complex, hollow structures. Understanding the strengths and applications of each process is crucial for optimizing production efficiency and component quality in the automotive metal stamping industry.

By Technology:

Blanking

Coining

Bending

Embossing

Flanging

Others

By Application:

Passenger cars

Commercial vehicles

Recreational vehicles

By Process:

Roll Forming

Sheet Metal Forming

Hot Stamping

Metal Fabrication

Others

Get Customized Report as per your Business Requirement - Request For Customized Report

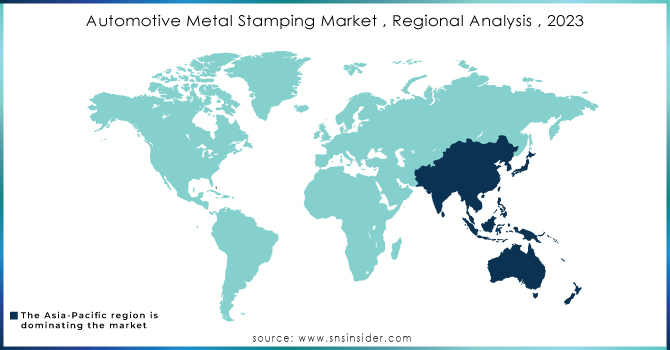

In terms of revenue, Asia Pacific leads the way, followed by Europe, North America, Latin America, and the Middle East and Africa (MEA). China is the world's largest automobile metal stamping market, and the Asia Pacific region is the world's dominating automotive metal stamping market. This is because China is the world's greatest supplier of metals including aluminum, steel, and iron, which are utilized extensively in the car industry for metal stamping. Because of the presence of major vehicle manufacturers in Germany, it is the most important market and the largest contributor to the automotive metal stamping industry in Europe.

Because of the low consumption and manufacturing of automobiles in Latin America, the Middle East, and Africa, the growth rate of the automotive metal stamping industry is modest. The market for automotive metal stamping is predicted to expand in the future years, thanks to expansion in the automotive sector and investments in Latin American and Middle Eastern, and African vehicle businesses.

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Aro Metal Stamping, Alcoa Inc., Kenmode Precision Metal Stamping, Interplex Industries, Martinrea International, Goshen Stamping Company, Shiloh Industries, Inc., Acro Metal Stamping, Lindy Manufacturing, Manor Tool & Manufacturing Company, Tempco Manufacturing, American Industrial Company, Wisconsin Metal Parts, Inc., and Clow Stamping Co. are some of the major players in the industry.

Aro Metal Stamping, known for its focus on diverse industries, has hinted at expanding its production capacity to cater to the growing demand for lightweight, high-strength metal components in electric vehicles.

Alcoa, a leader in aluminum production, is likely leveraging its material expertise to develop lighter yet robust aluminum alloys specifically for automotive stamping.

Kenmode Precision Metal Stamping, a strong contender in the custom metal stamping segment, might be looking to solidify its position by investing in advanced automation technologies. This could involve implementing robotic feeding systems and intelligent press controls to optimize production speed and precision for complex automotive parts. Interplex Industries, on the other hand, could be exploring strategic acquisitions or partnerships to broaden its automotive stamping portfolio.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 108.41 Billion |

| Market Size by 2032 | US$ 163.90 Billion |

| CAGR | CAGR of 4.9% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Technology (Blanking, Coining, Bending, Embossing, Flanging, Others) • by Application (Passenger cars, Commercial vehicles, Recreational vehicles) • by Process (Roll Forming, Sheet Metal Forming, Hot Stamping, Metal Fabrication, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Aro Metal Stamping, Alcoa Inc., Kenmode Precision Metal Stamping, Interplex Industries, Martinrea International, Goshen Stamping Company, Shiloh Industries, Inc., Acro Metal Stamping, Lindy Manufacturing, Manor Tool & Manufacturing Company, Tempco Manufacturing, American Industrial Company, Wisconsin Metal Parts, Inc., and Clow Stamping Co. |

| Key Drivers | •Rising vehicle production and increased demand for passenger vehicles. •The growing trend toward engine downsizing to improve fuel efficiency and lighter vehicles. |

| RESTRAINTS | •The instrument used in the metal stamping process has a high maintenance cost. •Stamping's growth is anticipated to be hampered by limited pricing flexibility. |

Automotive Metal Stamping Market Size was valued at USD 103.53 billion in 2022.

The major players in the market are Aro Metal Stamping, Alcoa Inc., Kenmode Precision Metal Stamping, Interplex Industries, Martinrea International, Goshen Stamping Company, Shiloh Industries, Inc., Acro Metal Stamping, Lindy Manufacturing, Manor Tool & Manufacturing Company, Tempco Manufacturing, and others in the final report.

The Automotive Metal Stamping Market is segmented into three segments, By Technology, By Application, and By Process.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Impact Analysis

5.1 Impact of Russia-Ukraine Crisis

5.2 Impact of Economic Slowdown on Major Countries

5.2.1 Introduction

5.2.2 United States

5.2.3 Canada

5.2.4 Germany

5.2.5 France

5.2.6 UK

5.2.7 China

5.2.8 Japan

5.2.9 South Korea

5.2.10 India

6. Value Chain Analysis

7. Porter’s 5 Forces Model

8. Pest Analysis

9. Global Automotive Metal Stamping Market Segmentation, by Technology

9.1 Introduction

9.2 Trend Analysis

9.3 Blanking

9.4 Coining

9.5 Bending

9.6 Embossing

9.7 Flanging

9.8 Others

10. Global Automotive Metal Stamping Market Segmentation, by Application

10.1 Introduction

10.2 Trend Analysis

10.3 Passenger cars

10.4 Commercial vehicles

10.5 Recreational vehicles

11. Global Automotive Metal Stamping Market Segmentation, by Process

11.1 Introduction

11.2 Trend Analysis

11.3 Roll Forming

11.4 Sheet Metal Forming

11.5 Hot Stamping

11.6 Metal Fabrication

11.7 Others

12. Regional Analysis

12.1 Introduction

12.2 North America

12.2.1 USA

12.2.2 Canada

12.2.3 Mexico

12.3 Europe

12.3.1 Eastern Europe

12.3.1.1 Poland

12.3.1.2 Romania

12.3.1.3 Hungary

12.3.1.4 Turkey

12.3.1.5 Rest of Eastern Europe

12.3.2 Western Europe

12.3.2.1 Germany

12.3.2.2 France

12.3.2.3 UK

12.3.2.4 Italy

12.3.2.5 Spain

12.3.2.6 Netherlands

12.3.2.7 Switzerland

12.3.2.8 Austria

12.3.2.9 Rest of Western Europe

12.4 Asia-Pacific

12.4.1 China

12.4.2 India

12.4.3 Japan

12.4.4 South Korea

12.4.5 Vietnam

12.4.6 Singapore

12.4.7 Australia

12.4.8 Rest of Asia Pacific

12.5 The Middle East & Africa

12.5.1 Middle East

12.5.1.1 UAE

12.5.1.2 Egypt

12.5.1.3 Saudi Arabia

12.5.1.4 Qatar

12.5.1.5 Rest of the Middle East

11.5.2 Africa

12.5.2.1 Nigeria

12.5.2.2 South Africa

12.5.2.3 Rest of Africa

12.6 Latin America

12.6.1 Brazil

12.6.2 Argentina

12.6.3 Colombia

12.6.4 Rest of Latin America

13. Company Profiles

13.1 Interplex Industries,

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services Offered

13.1.4 SWOT Analysis

13.1.5 The SNS View

13.2 Aro Metal Stamping, Alcoa Inc

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services Offered

13.2.4 SWOT Analysis

13.2.5 The SNS View

13.3 Kenmode Precision Metal Stamping

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Products/ Services Offered

13.3.4 SWOT Analysis

13.3.5 The SNS View

13.4 Martinrea International

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Products/ Services Offered

13.4.4 SWOT Analysis

13.4.5 The SNS View

13.5 Goshen Stamping Company

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Products/ Services Offered

13.5.4 SWOT Analysis

13.5.5 The SNS View

13.6 Shiloh Industries, Inc.

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Products/ Services Offered

13.6.4 SWOT Analysis

13.6.5 The SNS View

13.7 Acro Metal Stamping

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Products/ Services Offered

13.7.4 SWOT Analysis

13.7.5 The SNS View

13.8 Lindy Manufacturing

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Products/ Services Offered

13.8.4 SWOT Analysis

13.8.5 The SNS View

13.9 Manor Tool & Manufacturing Company

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Products/ Services Offered

13.9.4 SWOT Analysis

13.9.5 The SNS View

13.10 Others

13.10.1 Company Overview

13.10.2 Financial

13.10.3 Products/ Services Offered

13.10.4 SWOT Analysis

13.10.5 The SNS View

14. Competitive Landscape

14.1 Competitive Benchmarking

14.2 Market Share Analysis

14.3 Recent Developments

14.3.1 Industry News

14.3.2 Company News

14.3.3 Mergers & Acquisitions

15. Use Case and Best Practices

16. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Automotive Over-The-Air Updates Market Size was valued at USD 4.35 billion in 2023 and is expected to reach USD 19.29 billion by 2032 and grow at a CAGR of 18 % over the forecast period 2024-2032.

The Electric Vehicle Battery Charger Market Size was USD 11.9 billion in 2023 and will reach USD 73 billion by 2032 and grow at a CAGR of 22.4% by 2024-2032.

The Intelligent All-Wheel Drive System Market was valued at USD 3.9 billion in 2023 and is expected to reach USD 9.49 billion by 2032, growing at a CAGR of 10.42% over the forecast period 2024-2032.

The Automotive Battery Management System Market Size was valued at USD 5.27 Billion in 2023 and is expected to reach USD 21.24 Billion by 2032 growing at a CAGR of 16.78% over the forecast period 2024-2032.

The Automotive Operating System Market Size was valued at USD 8.88 Billion in 2023 and is expected to reach USD 21.09 Billion by 2032 and grow at a CAGR of 10.1% over the forecast period 2024-2032.

The Pontoon Market Size was valued at USD 8.68 Billion in 2023 and is expected to reach USD 17.27 Billion by 2032 and grow at a CAGR of 8.0% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone