AUTOMOTIVE LIGHTWEIGHT MATERIAL MARKET SIZE:

To get more information on Automotive Lightweight Material Market - Request Free Sample Report

The Automotive Lightweight Material Market Size was valued at USD 82.68 Billion in 2023 and is expected to reach USD 128.02 Billion by 2032 and grow at a CAGR of 5.0% over the forecast period 2024-2032.

The Automotive Lightweight Materials Market is a rapidly evolving sector, driven by the growing need for fuel efficiency, sustainability, and compliance with stringent government regulations aimed at reducing emissions. Lightweight materials such as aluminum, high-strength steel, magnesium, plastics, and composites are pivotal in reducing vehicle weight, enhancing performance, and supporting environmental goals. The adoption of lightweight materials is particularly crucial in electric vehicles (EVs), where reduced weight translates to improved battery efficiency and longer driving ranges. Innovations in material technology, such as advanced composites and aluminum alloys that are 10-15% lighter than traditional materials, are shaping the market dynamics.

Europe is at the forefront of research and development in this field, contributing significantly to global R&D investments, which reached USD 1.35 trillion in 2023. This focus aligns with the automotive industry’s commitment to clean and green transportation technologies, highlighting the essential role of lightweight materials in achieving a sustainable future.

MARKET DYNAMICS

KEY DRIVERS:

Stricter Emissions Regulations Propel Adoption of Lightweight Materials in Automotive Manufacturing

Governments across the world are enforcing strict emission rules, which, in turn, compels manufacturers to use lightweight materials. These materials enable lighter vehicles, thereby increasing the fuel efficiency of the vehicles and reducing the carbon emissions as expected to meet standards like that of the EU's CO2 regulation.

Involving increased usage of stricter emissions regulations for the adoption of lightweight materials in the automobile industry is a response to an increase in the number of government mandates involving a reduction in carbon footprints. Setting very ambitious goals, the European Union (EU) has fixed the average emissions limit for new cars to 95 grams of CO2 per KM from 2023. This would entail reducing greenhouse gas emissions by about 55% by 2030 compared with their 2021 level. To achieve such a goal, in the United States, the EPA has set very ambitious goals by the year 2030 for the reduction of emissions from the light-duty vehicle segment by 40%. So far in this respect, these regulatory requirements incite manufacturers to plan more efficient vehicles for which lightweight materials are being considered as an alternative. For instance, it can be demonstrated through statistics that reducing the weight of a vehicle by 10% results in an improvement of 6-8% in the fuel efficiency of the vehicle. This will also target the objectives established by regulatory bodies.

Rising Consumer Demand for Fuel Efficiency Sparks Innovations in Lightweight Materials

The modern consumer is concerned first and foremost with gas efficiency in a new vehicle. It allows manufacturers to improve performance without ever diminishing fuel efficiency. Demand is accelerating and will attract investment in aluminium and advanced composites, among other materials.

The automotive lightweight materials market is growing remarkably due to the rising awareness of consumers about sustainability and fuel efficiency. According to the data of 2023, 70% of consumers believed that fuel economy was an important factor in the buying decision for a vehicle. In general, this shift towards more fuel-efficient vehicles will be extensively experienced among the younger generations, of whom 62% of the respondents from Gen Z said that sustainability would decide their choices. This demand is encouraging investors in the automobile sector to look into lightweight materials that will ensure better fuel efficiency with no compromise on performance. Because any weight loss has the potential to enhance fuel economy by as much as 6-8%, a lighter automobile with even a 10% weight reduction is becoming increasingly more attractive for aluminum and other advanced composites.

RESTRAIN:

High Production Costs Impede Adoption of Lightweight Automotive Materials

Light-weight solutions in the automotive material market have high production costs with carbon fiber and some composites. These materials are characterized by rather complicated technology, which results in the use of exclusive techniques and technologies, thereby pushing up the cost level. Manufacturers may therefore discourage the implementation of light solutions because they will count more toward cost issues than all those about other factors such as performance and durability. The high initial investment for material could limit the mass take-up of such materials in the industry.

The data also illustrates the involvement of several economic factors besides the largest expense of manufacturing lightweight automotive materials. Advanced materials like carbon fiber can cost between USD 20 and USD 40 per kilogram, whereas normal materials like steel can cost around USD 0.75 to USD 2 per kilogram in terms of average costs. The production facilities also require an investment that runs over a magnitude of USD 100 million; this is an added cost burden by such automotive manufacturers as they look forward to utilizing lightweight solutions. Such high costs will be a major turn-off to widespread adoption even with the environmental benefits thus the need for new manufacturing processes that reduce the cost burden.

KEY MARKET SEGMENTS

BY END USE

In 2023, The Passenger Cars segment represented a significant 68% of the automotive lightweight material market, this trend is mainly influenced by the fuel efficiency and environmental friendliness preferred by consumers. Studies show that a reduction in vehicle weight can boost fuel economy by 6-8% for every 10% reduction in weight. Answering this trend with innovative design solutions, the leading automotive companies have started to roll out new designs.

For instance, Ford launched its F-150 boasting high-strength aluminum alloys and BMW rolled out iSeries models made of carbon fiber composites. Such innovation is also crucial at a time when the industry is shifting towards lighter, more fuel-efficient vehicles.

The Light Commercial Vehicles segment is projected to grow at the fastest CAGR of 6.39% during the forecast period, driven by the acute need for fuel-efficient solutions. LCVs account for around 23% of the CO2 generated through road transport worldwide; thus, the lighter, the better becomes imperative to achieve the desired environmental relief. Lightweight materials such as advanced composites and aluminum can increase up to 15% in terms of fuel efficiency with substantial emission reductions.

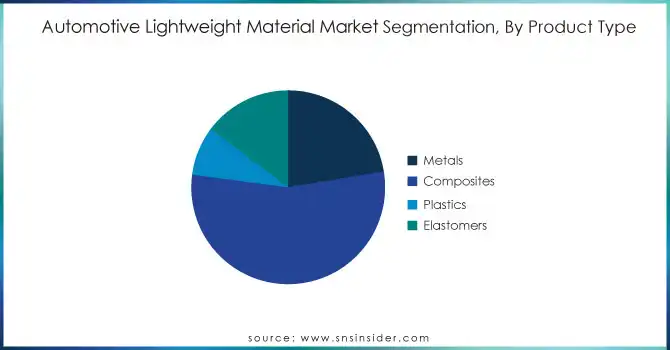

BY PRODUCT TYPE

The Composites segment dominated the automotive lightweight materials market in 2023, however, with a market share of 54%. Increasing demand for durable, yet lightweight solutions that boost fuel efficiency and performance have been driving growth so far. High-profile manufacturers like Boeing and Toray Industries are leading advances in composite technologies, which is expanding its capacity for carbon fiber to match the rising car orders, while Boeing is considering utilizing advanced composites for vehicle design applications. The use of composites also incurs a reduction in weight as high as 20 to 30%, with a direct consequence on fuel efficiency and as high as 15% reduction in CO2 emissions along the lifetime of the vehicle.

The Elastomers segment in this market is expected to witness the fastest CAGR of 7.36% in the forecast period through which the automobile sector, particularly faces the need for more elastic, easy-to-use materials that reduce the weight of a vehicle. BASF has developed the most recent elastomer products related to the increasing demand for car performance with less weight, such as new tire compounds providing better fuel efficiency. Continental puts all its efforts into finding new applications for elastomers in seals and gaskets and focusing on durability and efficiency.

REGIONAL ANALYSIS

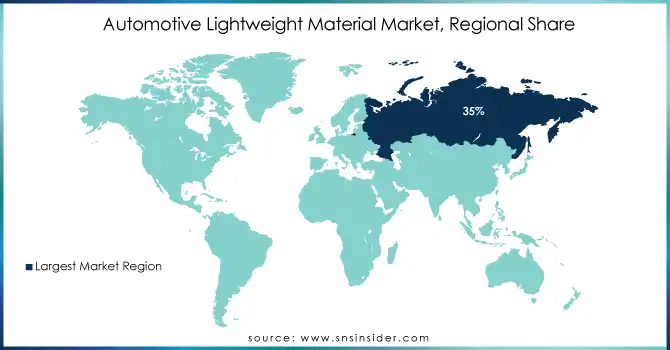

In 2023, the European automotive lightweight materials market captured a substantial market share of approximately 35%, Strict emissions regulations have been the main cause for this dominance as the commitment to such regulations forces heavy investment by manufacturers in lightweight technologies that aim at optimizing fuel efficiency and minimizing CO2 levels.

For instance, European Union's aim to reduce greenhouse gas emissions by 55% by 2030, increasing the adoption of lightweight materials, which, as projected, would reduce the overall weight of the vehicle by almost 30% using advanced materials, such as aluminum and carbon fiber. In addition, through lightweight solutions, the European automotive industry will bring about a combined reduction of approximately 220 million metric tons by 2030.

In 2023, North America emerged as the fastest-growing region in the automotive lightweight materials market, with a projected CAGR of 6.86% from 2024 to 2032. This is being spurred by increasing demand for fuel-efficient vehicles, improvements in manufacturing technologies, and positive initiatives from governments to reduce carbon emissions.

For example, the U.S. Department of Energy has also invested in development research into lightweight materials that not only drove innovation but also transformed the car industry. These companies, like General Motors and Ford, are actively introducing new models that utilize lightweight materials to improve the efficiency and performance of their vehicles.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players

Some of the major players in the Automotive Lightweight Material Market are:

ThyssenKrupp AG (High-Strength Steel Alloys, Advanced High-Strength Steel (AHSS))

Novelis, Inc. (Aluminum Sheet and Plate, Aluminum Extruded Shapes)

Alcoa Corporation (Aluminum Sheet and Plate, Aluminum Extruded Shapes)

Owens Corning (Glass Fiber Composites, Carbon Fiber Reinforced Composites)

Toray Industries, Inc. (Carbon Fiber Reinforced Composites, High-Performance Resins)

ArcelorMittal (Advanced High-Strength Steel (AHSS), High-Strength Steel Alloys)

BASF SE (Polyurethane Foam, Polyamide Composites)

Covestro AG (Polycarbonate Composites, Polyurethane Foam)

Magna International (Magnesium Alloy Components, Aluminum Alloy Components)

3M Company (Structural Adhesives, Sealing Tapes)

Arconic Inc. (Aluminum Sheet and Plate, Aluminum Extruded Shapes)

DuPont de Nemours, Inc. (Kevlar Aramid Fiber Composites, Nomex Nomex Fiber Composites)

General Motors Company (Carbon Fiber Reinforced Plastic (CFRP) Components, Magnesium Alloy Components)

Nippon Steel Corporation (High-Strength Steel Alloys, Advanced High-Strength Steel (AHSS))

Sumitomo Chemical Co., Ltd. (Engineering Plastics, Polyurethane Foam)

LyondellBasell Industries Holdings B.V. (Polypropylene Composites, Polyethylene Composites)

Stratasys Ltd. (3D Printed Polymer Composites, 3D Printed Metal Composites)

Tata Steel (High-Strength Steel Alloys, Advanced High-Strength Steel (AHSS))

POSCO (High-Strength Steel Alloys, Advanced High-Strength Steel (AHSS))

PPG Industries (PPG Automotive Coatings, PPG Automotive Glass)

RECENT TRENDS

In October 2024, Gestamp unveiled the most recent innovations in lightweight at the 12th International Suppliers Fair (IZB) in Wolfsburg, Germany. The company there presented its Multipath Platform Concept chassis, which is also adaptable for different powertrains, and can avoid up to 50% of investments in tooling. Gestamp also revealed GES-MULTISTEP 2.0 hot stamping technology that allows the company to add strength to its product through ultra-high-strength steel.

In April 2024, Hyundai Motor Group signed a strategic partnership deal with Toray Group, aiming to develop future mobility solutions by using innovative materials such as carbon fiber. Both companies sought to mutually set the production of carbon fiber-reinforced plastics to enhance vehicle performance and safety. By doing so, both firms promised to actively integrate these advanced materials into new mobility products over the next period. The signing ceremony, held at the headquarters of Hyundai, was another monumental step toward increasing efficiency and even durability in mobility applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 82.68 Billion |

| Market Size by 2032 | US$ 128.02 Billion |

| CAGR | CAGR of 5.0 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Metals, Composites, Plastics, Elastomers) • By End-use (Passenger Cars, Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV)) • By Application Type (Body in White, Chassis and Suspension, Powertrain, Closures, Interiors, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ThyssenKrupp AG, Novelis, Inc., Alcoa Corporation, Owens Corning, Toray Industries, Inc., ArcelorMittal, BASF SE, Covestro AG, Magna International, 3M Company, Arconic Inc., DuPont de Nemours, Inc., General Motors Company, Nippon Steel Corporation, Sumitomo Chemical Co., Ltd., LyondellBasell Industries Holdings B.V., Stratasys Ltd., Tata Steel, POSCO, Covestro AG |

| Key Drivers | • Stricter Emissions Regulations Propel Adoption of Lightweight Materials in Automotive Manufacturing • Rising Consumer Demand for Fuel Efficiency Sparks Innovations in Lightweight Materials |

| Restraints | • High Production Costs Impede Adoption of Lightweight Automotive Materials |

Ans: The Automotive Lightweight Material Market is expected to grow at a CAGR of 5.0% during 2024-2032.

Ans: The Automotive Lightweight Material Market size was USD 82.68 billion in 2023 and is expected to Reach USD 128.02 billion by 2032.

Ans: The major growth factor of the Automotive Lightweight Material Market is the increasing demand for fuel-efficient and lightweight vehicles to meet stringent emissions regulations and improve fuel economy.

Ans: Composites dominated the Automotive Lightweight Material Market.

Ans: Europe dominated the Automotive Lightweight Material Market in 2023.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Vehicle Production and Sales Volumes, 2020-2032, by Region

5.2 Emission Standards Compliance, by Region

5.3 Vehicle Technology Adoption, by Region

5.4 Consumer Preferences, by Region

5.5 Aftermarket Trends (Data on vehicle maintenance, parts, and services)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Automotive Lightweight Material Market Segmentation, By End-use

7.1 Chapter Overview

7.2 Passenger Cars

7.2.1 Passenger Cars Market Trends Analysis (2020-2032)

7.2.2 Passenger Cars Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Light Commercial Vehicles (LCV)

7.3.1 Light Commercial Vehicles (LCV) Market Trends Analysis (2020-2032)

7.3.2 Light Commercial Vehicles (LCV) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Heavy Commercial Vehicles (HCV)

7.4.1 Heavy Commercial Vehicles (HCV) Market Trends Analysis (2020-2032)

7.4.2 Heavy Commercial Vehicles (HCV) Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Automotive Lightweight Material Market Segmentation, By Application Type

8.1 Chapter Overview

8.2 Body in White

8.2.1 Body in White Market Trends Analysis (2020-2032)

8.2.2 Body in White Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Chassis and Suspension

8.3.1 Chassis and Suspension Market Trends Analysis (2020-2032)

8.3.2 Chassis and Suspension Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Powertrain

8.4.1 Powertrain Market Trends Analysis (2020-2032)

8.4.2 Powertrain Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Closures

8.5.1 Closures Market Trends Analysis (2020-2032)

8.5.2 Closures Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Interiors

8.6.1 Interiors Market Trends Analysis (2020-2032)

8.6.2 Interiors Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Others

8.7.1 Others Market Trends Analysis (2020-2032)

8.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Automotive Lightweight Material Market Segmentation, By Product Type

9.1 Chapter Overview

9.2 Metals

9.2.1 Metals Market Trends Analysis (2020-2032)

9.2.2 Metals Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Composites

9.3.1 Composites Market Trends Analysis (2020-2032)

9.3.2 Composites Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Plastics

9.4.1 Plastics Market Trends Analysis (2020-2032)

9.4.2 Plastics Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Elastomers

9.5.1 Elastomers Market Trends Analysis (2020-2032)

9.5.2 Elastomers Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Automotive Lightweight Material Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.2.4 North America Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.2.5 North America Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.2.6.2 USA Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.2.6.3 USA Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.2.7.2 Canada Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.2.7.3 Canada Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.2.8.2 Mexico Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.2.8.3 Mexico Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Automotive Lightweight Material Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.1.6.3 Poland Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.1.7.3 Romania Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Automotive Lightweight Material Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.5 Western Europe Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.6.3 Germany Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.2.7.2 France Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.7.3 France Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.2.8.2 UK Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.8.3 UK Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.9.3 Italy Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.10.3 Spain Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.13.3 Austria Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Automotive Lightweight Material Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.4.4 Asia Pacific Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.5 Asia Pacific Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.4.6.2 China Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.6.3 China Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.4.7.2 India Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.7.3 India Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.4.8.2 Japan Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.8.3 Japan Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.4.9.2 South Korea Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.9.3 South Korea Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.10.3 Vietnam Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.4.11.2 Singapore Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.11.3 Singapore Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.4.12.2 Australia Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.12.3 Australia Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Automotive Lightweight Material Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.5.1.4 Middle East Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.1.5 Middle East Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.1.6.3 UAE Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Automotive Lightweight Material Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.5.2.4 Africa Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.2.5 Africa Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Automotive Lightweight Material Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.6.4 Latin America Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.6.5 Latin America Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.6.6.2 Brazil Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.6.6.3 Brazil Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.6.7.2 Argentina Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.6.7.3 Argentina Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.6.8.2 Colombia Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.6.8.3 Colombia Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Automotive Lightweight Material Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Automotive Lightweight Material Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Automotive Lightweight Material Market Estimates and Forecasts, By Application Type(2020-2032) (USD Billion)

11. Company Profiles

11.1 ThyssenKrupp AG

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Novelis, Inc.

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Alcoa Corporation

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Owens Corning

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Toray Industries, Inc.

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 ArcelorMittal

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 BASF SE

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Covestro AG

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Magna International

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 3M Company

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

MARKET SEGMENTATION

By Product Type

Metals

Composites

Plastics

Elastomers

By End-use

Passenger Cars

Light Commercial Vehicles (LCV)

Heavy Commercial Vehicles (HCV)

By Application Type

Body in White

Chassis and Suspension

Powertrain

Closures

Interiors

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Mobility as a Service Market Size was USD 402.46 billion in 2023 and will reach to USD 2613.7 bn by 2032 with a CAGR of 23.12 % by 2024-2032.

The Automotive Data Logger Market size was valued at USD 3.94 billion in 2023 and is expected to reach USD 7.80 billion by 2032 and grow at a CAGR of 7.89% over the forecast period 2024-2032.

The Connected Motorcycle Market Size was USD 160.28 Million in 2023 and will reach USD 3953.17 Million by 2032 and grow at a CAGR of 42.83% by 2024-2032.

The Automotive Software Market Size was valued at USD 19.52 billion in 2023 and is expected to reach USD 38.05 billion by 2032 and grow at a CAGR of 7.7% over the forecast period 2024-2032.

The Electric Vehicle Charging Infrastructure Market Size was $25.8 billion in 2023 & will reach $199.25 bn by 2032 & grow at a CAGR of 25.5% by 2024-2032

The Vehicle Analytics Market Size was valued at USD 4.20 billion in 2023, and expected to reach USD 25.87 billion by 2031, and grow at a CAGR of 25.5% over the forecast period 2024-2031.

Hi! Click one of our member below to chat on Phone