Automotive Intelligence Battery Sensor Market Report Scope & Overview

Get More Information on Automotive Intelligence Battery Sensor Market - Request Sample Report

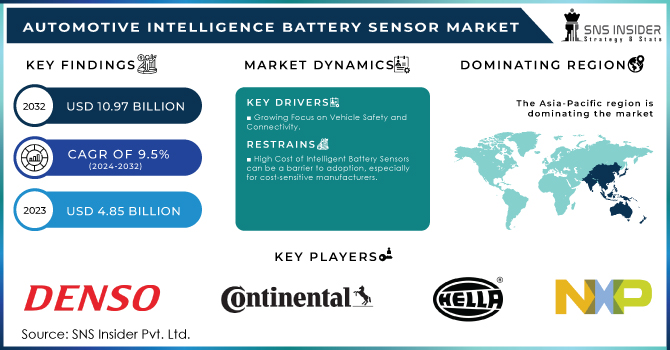

The Automotive Intelligence Battery Sensor Market Size was valued at USD 4.85 billion in 2023 and is expected to reach USD 10.97 billion by 2032 and grow at a CAGR of 9.5% over the forecast period 2024-2032.

The rising demand for EVs and HEVs necessitates accurate battery health monitoring, which intelligent sensors can provide. Stringent government regulations to combat climate change are pushing for cleaner transportation. Intelligent battery sensors contribute to this goal by optimizing battery usage and extending the range of EVs and HEVs. Advancements in battery technology, like high-capacity lithium-ion batteries, require more sophisticated sensor systems for optimal performance and safety, a need that intelligent battery sensors address. However, there are challenges to overcome. Intelligent sensors are more complex and expensive than traditional ones, potentially hindering adoption. Integrating them with existing vehicle electronics can be challenging and require technical expertise, leading to higher development costs.

MARKET DYNAMICS:

KEY DRIVERS:

-

Advancements in Battery Technology

-

Growing Focus on Vehicle Safety and Connectivity

The automotive industry is prioritizing advanced driver-assistance systems (ADAS) and autonomous vehicles. Intelligent battery sensors provide real-time data on battery health, which is critical for ensuring safe vehicle operation and uninterrupted power supply for these technologies.

RESTRAINTS:

-

High Cost of Intelligent Battery Sensors can be a barrier to adoption, especially for cost-sensitive manufacturers.

-

Technical Complexity of Integration

Integrating intelligent battery sensors with existing vehicle electronics can be challenging, requiring technical expertise and potentially leading to higher development costs.

OPPORTUNITIES:

-

Data Analytics and Cloud Integration in the Automotive Intelligent Battery Sensor Market.

-

Cloud integration allows for real-time analysis of this sensor data. Advanced algorithms can identify subtle changes that might go unnoticed with manual checks, enabling early detection of potential battery issues. This pose significant opportunity for predictive maintenance and improved battery management strategies also by analyzing historical battery data and real-time sensor readings, cloud-based analytics can predict potential battery degradation or failures before they occur. this enables proactive maintenance schedules, where batteries can be serviced or replaced before they become critical issues. Predictive maintenance reduces downtime, extends battery life, and minimizes repair costs.

CHALLENGES:

-

Durability and Reliability in Harsh Environments

-

Limited Availability of Skilled Workforce can be a barrier

The integration and maintenance of intelligent battery sensors require a skilled workforce with expertise in sensor technology and automotive electronics. Addressing this potential skill gap is essential.

KEY MARKET SEGMENTS ANALYSIS:

By Vehicle Type:

Currently, passenger cars hold the dominant share of the market, The global production volume of passenger cars significantly outpaces that of commercial vehicles. This translates to a larger market base for intelligent battery sensors used in passenger cars. Consumer preference for hybrid and electric vehicles is on the rise, driven by factors like environmental awareness and increasing fuel efficiency regulations. These vehicles require more sophisticated battery management systems, leading to a higher demand for intelligent battery sensors in passenger cars. commercial vehicles are expected to be the fastest-growing segment There's a growing trend of companies electrifying their commercial fleets, particularly for short-haul deliveries and inner-city transportation. This shift towards electric commercial vehicles will significantly increase the demand for intelligent battery sensors in this segment.

By Technology:

Based on Technology, MCU holds the dominant market share, because MCUs are essentially miniaturized computers that can process data, perform calculations, and make decisions. This allows them to handle complex battery management tasks beyond simple data transmission, offering greater functionality compared to LIN and CAN. While MCUs might have a slightly higher initial cost compared to LIN or CAN, their increased functionality and potential for integration can lead to cost savings in the long run.

CAN is expected to be the fastest-growing segment due to its scalability and standardization advantages. CAN is a well-established industry standard, making it easier for car manufacturers to integrate different sensor systems from various suppliers. This fosters wider adoption and faster growth.

REGIONAL ANALYSES

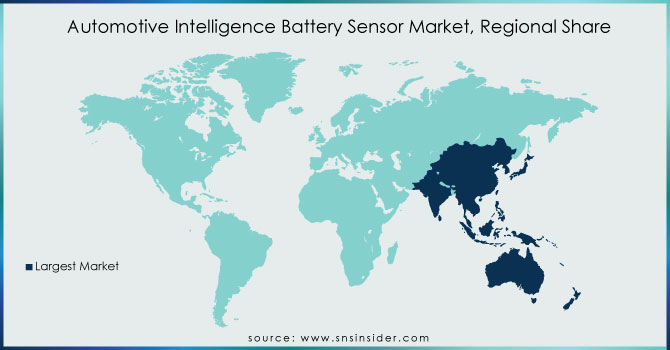

The Asia-Pacific region is anticipated to dominate the growth of the automotive intelligent battery sensor market. This dominance can be attributed to a series of sequential factors. Firstly, the automotive sector in key countries like China and India is experiencing exponential growth. Government policies in these nations heavily incentivize electric vehicle (EV) production and adoption, leading to a massive demand for batteries and the intelligent sensor systems that optimize their performance. Furthermore, China is a major producer of both passenger cars and commercial vehicles, many of which are increasingly incorporating advanced battery management systems that necessitate intelligent battery sensors. Secondly, a strong focus on fuel efficiency is propelling the market forward. Stringent government regulations like China VI and India VI are pushing carmakers to develop vehicles with improved fuel efficiency. Intelligent battery sensors play a crucial role here by providing real-time data on battery health and performance. This data allows car manufacturers to optimize engine performance and extend battery life, resulting in better fuel economy and reduced emissions. Finally, the surging demand for both passenger cars and commercial vehicles in China and India is a significant contributor. This growth is fueled by factors like increasing urbanization, rising disposable income, and improved infrastructure.

North America is home to major automotive manufacturers and technology companies heavily invested in electric vehicle development. These companies are constantly pushing the boundaries of battery technology, and intelligent battery sensors are a crucial element in optimizing battery performance and range. Similar to Asia, North America is implementing stricter emission regulations to combat climate change. This pushes carmakers to adopt technologies that improve fuel efficiency and reduce emissions. Intelligent battery sensors play a vital role here by providing data for optimizing engine performance and maximizing battery life, ultimately leading to cleaner vehicles. Consumer demand for EVs is rising steadily in North America, driven by factors like increasing environmental awareness, government incentives, and the development of more affordable and feature-rich EVs. This surge in EV adoption translates to a greater need for intelligent battery sensors to ensure optimal battery health and performance.

Get Customized Report as per Your Business Requirement - Request For Customized Report

KEY PLAYERS

The major key players are DENSO CORPORATION (Japan), Continental AG (Germany), HELLA GmbH and Co. KGaA (Germany),Vishay Intertechnology Inc. (U.S.), Inomatic GmbH (Germany) and NXP Semiconductors (Netherlands), ams AG (Austria), Robert Bosch GmbH (Germany), Furukawa electric co., ltd. (Japan), MTA S.p.A. (Italy), and other key players.

RECENT DEVELOPMENT

In May 2024, Continental AG introduced new sensors designed specifically for electric vehicles. These include the high-voltage Current Sensor Module (CSM), which measures both current and temperature to ensure battery safety and longevity, and the Battery Impact Detection (BID) system, which provides lightweight underfloor protection for batteries.

In July 24, 2023, Stellantis has made strides with its Intelligent Battery Integrated System (IBIS), which integrates inverter and charger functions into a single unit. This development is part of Stellantis's broader strategy to advance battery technology and establish new gigafactories in the U.S., reflecting the industry's push towards more efficient and integrated battery management systems.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 4.85 Billion |

| Market Size by 2032 | US$ 10.97 Billion |

| CAGR | CAGR of 9.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Voltage (12 Volt, 14 Volt, 24 Volt, 48 Volt) • by Technology (LIN, CAN, MCU) • by Vehicle Type (Passenger cars, Commercial vehicles) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Continental AG (Germany), NXP Semiconductors (Netherlands), Robert Bosch GmbH (Germany), HELLA GmbH, and Co. KGaA (Germany), DENSO CORPORATION (Japan), Inomatic GmbH (Germany), AMS AG (Austria), Furukawa electric co., ltd. (Japan), Vishay Intertechnology Inc. (U.S.), and MTA S.p.A. (Italy) |

| Key Drivers | •People all throughout the world are worried about rising fuel usage and CO2 emissions. •The global automotive intelligence battery sensor market is being fueled by a booming automotive sector. |

| RESTRAINTS | •The high cost of the automotive intelligence battery sensor will limit the expansion of the market. •Concern for the environment is on the rise. |