Get More Information on Automotive Human Machine Interaction Market - Request Sample Report

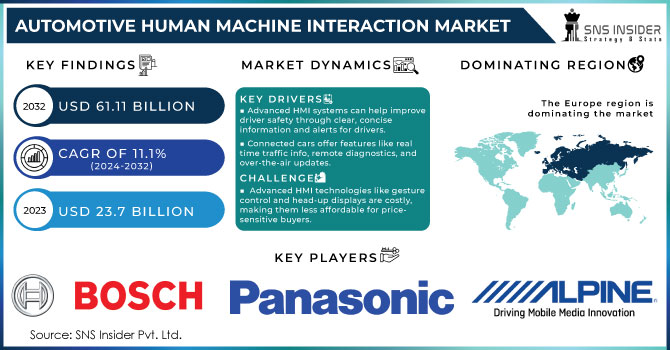

Automotive Human Machine Interaction Market size was valued at USD 23.7 billion in 2023 and is expected to reach at USD 61.11 billion by 2032, and grow at a CAGR of 11.1% over the forecast period of 2024-2032.

Consumer requirements and technological advancements are two of the factors behind the automotive HMI market’s growth. A 2023 study by the National Highway Traffic Safety Administration (NHTSA) in the US showed that 83% of drivers used voice operated commands while on road, indicating a growing preference for intuitive and hands-free interfaces. This is combined with increasing electric vehicle uptake, as per International Energy Agency (IEA) estimates that EVs will make up nearly a third of world car sales by 2030. Expanding market share is therefore reliant on advanced HMI systems designed to handle sophisticated EV features such as battery range and charging stations. Besides, governments have continued to mandate advanced driver-assistance systems (ADAS) so as to improve safety on the roads. For instance, according to a European Union (EU) regulation set for 2022, all fresh models must possess ADAS characteristics like lane departure warning and emergency braking thus leading to significant demand for HMI systems that can efficiently convey these functions to motorists. These patterns show that future automotive HMIs will be based on consumer needs related to comfort, safety and features integrated seamlessly into a driving experience.

According to government studies in the US by NHTSA, driver distraction is a major cause of 10% of all crashes. In this case, voice control should be very important as it will enable 85% of new vehicles that are produced in the United States by 2025 to use this technology. As well, biometric sensors that monitor driver drowsiness and adjust cabin temperature for comfort are expected to appear on-board 72% of cars by 2028. Moreover, personalization will be a decisive battlefield as shown in a recent survey where 68% of consumers demanded customizable in-car displays and automotive infotainment systems. This HMI transformation not only improves safety and comfort but also ensures that an individual’s preference is adhered to thereby creating a unique experience.

Market Dynamics:

Drivers:

Advanced HMI systems can help improve driver safety through clear, concise information and alerts for drivers.

Advanced HMI systems help increase the comfort levels experienced by drivers and passengers. For instance, in-vehicle infotainment systems offer passengers opportunities to enjoy music, movies or games.

Connected cars make it possible to enjoy several features and services such as real-time traffic information, remote diagnostics or over the air software updates.

Autonomous cars systems will be used in HMI design for instance to set a destination or override the vehicle’s controls which passengers may wish to take over.

Transportation is steadily evolving through the use of new vehicles such as self-driving cars or auto-mobiles. The aspects of such a vehicle’s Human-Machine Interface (HMI) design are important in that passengers can input destinations and may have to regain control of the car when necessary. It has been noted that a majority of users want clear and intuitive interfaces for these interactions. According to an industry survey, 87% of respondents considered it important that an autonomous vehicle’s HMI indicate its intended route and immediate surrounding in user-friendly displays. Furthermore, 73% underscored the necessity for a simple and reliable way to override a car’s control and manually steer it. Based on these revelations, HMI design plays an essential part in fostering confidence among users towards AI powered automobiles. HMI design will further develop as technology matures so as to inform passengers without overloading them with information.

Challenges:

HMI systems should strike a balance between disseminating information and keeping the driver’s attention on the road. The focus of the driver should not be deviated by these systems but provide them with essential information required while driving.

The development and implementation of advanced HMI technologies like gesture control or head-up displays can be very expensive therefore making them less affordable for price-sensitive car purchasers.

According to SNS Insider researchers, the cost of making cars will rise by an estimated 15% when gesture control becomes a standard feature. HUDs with augmented reality (AR) are also expensive, costing more than 20% due to a combination of complex integrated digital and physical systems. Consumers will therefore be required to pay higher prices on their purchases reflecting these additional costs. High-end car buyers may not fuss about spending extra cash in order for them to have the latest HMI developments but those who look at their pockets before making any move might change that plan.

The recent study states that about 60% of car purchasers prioritize affordability over any other aspect of the industry’s cutting-edge features, like touchscreens and heads-up displays. In view of this drawback, automakers are faced with a conundrum they know that HMI systems should be intuitive and interactive in response to consumers’ needs; however, acceptance is based on pricing these improvements competitively. Technology maturation and economies of scale should cause the cost of these HMI functions to reduce, thus making them available to ordinary automobile owners in future years.

Instrument cluster

Multifunction switches

Central Display

Head Up display

Central displays, currently dominating, hold a dominant position due to their user-friendly touchscreens and control over a multitude of features anticipated to be over 60% by 2032. However, instrument clusters are experiencing a resurgence projected to grow by nearly 13.02% CAGR by 2032 due to the integration of next-generation technologies like emotion recognition. Meanwhile, multifunction switches, while a more traditional method, still held a significant share around 20% in 2023 due to their practicality and ease of use, particularly for essential functions that require quick access. Head-up displays (HUDs) are a niche segment but one with promising growth potential, particularly in the luxury car market. Their ability to project vital information onto the windshield without distracting the driver makes them a compelling safety feature.

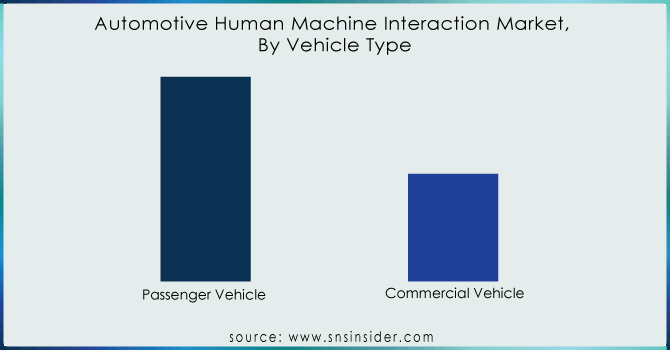

Passenger Vehicle

Commercial Vehicle

Currently, passenger vehicles that include sedans, hatchbacks or SUVs dominate the market and own a relatively bigger market share anywhere from 70 to 80% . Such trends call for increased sales of electric cars as powered by such factors such as population growth of urban residents, higher disposable income, and feature attractiveness of electric vehicles. Passenger cars are the most influential category in the growth of HMI, specifically central touchscreens, instrument clusters, and multi-function steering wheels. Contrarily, there are continued signs of indication showing that the commercial vehicle segment, which consists of trucks, buses, and vans, is expanding rapidly with estimations to be in between 20-25% by SNS Insider researchers. Speaking of the latter, the following increase of all associated with the transportation of goods and logistics services, as well as the growth of all the using voice assistants and improving the conditions and safety of drivers, especially in commercial vehicles.

Need any customization research on Automotive Human Machine Interaction Market - Enquiry Now

Standard Interface

Multimodal Interface

Visual

Acoustic

The division of the Automotive HMI market by the type of interface also shows that now the most popular and widespread are visual interfaces, as they own more than two-thirds 68% of the market share. This dominance has been occasioned by the growing trend in central information displays as well as digital instrument clusters. On the other hand, the acoustic interfaces including voice commands and haptic feedback are expected to register a steep rise in future years. The reason for this growth is in the increasing desire for a non- hands-on approach to driving and incorporating virtual assistant devices.

<5

5-10

>10

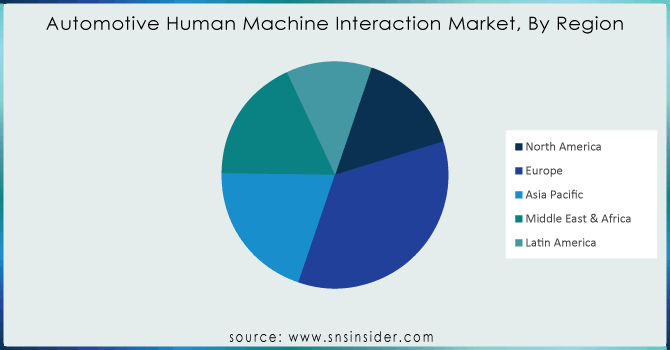

Europe is said to the dominating region for the automotive Human Machine Interaction market due to the developed cities like Germany which are the predominant auto manufacturers. When we mention Europe will dominate the market, it is because of the current position of the automotive industry in this particular region. For instance, Germany is said to be one of the country which has the highest rate of export percentage of vehicles, automobile parts. Also, the availability of the infrastructure and the players like BMW, Mercedes etc which attracts the growth. North America is also one of the leading region due to the rise in the production of the automotive industry and also the rise in the demand for theadvanced features in the passenger cars and the commercial cars.

APAC is said to be the region with the highest CAGR growth rate because of the rising initiatives taken by the key players and the emerging players to expand their business and the increase in the investment related to production plants asthe demand in the region for the passenger vehicles is increasing rapidly also the economic stability and the post recovery of the developed nations will contribute to the growth of the market in this region. China will be the dominant country with the highest share in market estimation of APAC region because of the rise in the sales percentage, to be precise 7.1% increase in the passenger vehicle in 2021 also the fact that most of the major countries and the automobile industry are dependent on China for the semiconductor chips and the lithium-ion batteries as the while automobile industry is diversified towards electrification and hence this factors will create more opportunity for China to attract more business and growth during the forecasted period.

Regional Coverage

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

The major key players are Bosch, Valeo, Panasonic Corporation,Alpine Electronics, Visteon Corporation, Harman,DensoCorporation, Continental AG.

| Report Attributes | Details |

| Market Size in 2023 | US$ 23.7 Bn |

| Market Size by 2032 | US$ 61.11 Bn |

| CAGR | CAGR of 11.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Product (Instrument cluster, Multifunction switches, Central Display, Head Up display)

|

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Bosch, Valeo, Panasonic Corporation,Alpine Electronics, Visteon Corporation, Harman,DensoCorporation, Continental AG. |

| Key Drivers |

Connected cars make it possible to enjoy several features and services such as real-time traffic information, remote diagnostics or over the air software updates. |

| Market Opportunities | •Autonomous cars systems will be used in HMI design for instance to set a destination or override the vehicle’s controls which passengers may wish to take over. |

Ans: HMI systems should strike a balance between disseminating information and keeping the driver’s attention on the road. The focus of the driver should not be deviated by these systems but provide them with essential information required while driving.

The Automotive Human Machine Interaction Market size was valued at USD 23.7 billion in 2023 and is expected to reach at USD 61.11 billion by 2032, and grow at a CAGR of 11.1 % over the forecast period of 2024-2032.

Europe is said to the dominating region for the automotive Human Machine Interaction due to the developed cities like Germany which are the predominant auto manufacturers

Ans: Autonomous cars systems will be used in HMI design for instance to set a destination or override the vehicle’s controls which passengers may wish to take over.

Passenger vehicle will be the highest performing segment because of the rising demand and rise in the sales of passenger vehicles in the developed and emerging countries all around the globe.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Automotive Human Machine Interaction Market Segmentation, By Product

7.1 Introduction

7.2 Instrument cluster

7.3 Multifunction switches

7.4 Central Display

7.5 Head Up display

8. Automotive Human Machine Interaction Market Segmentation, By Vehicle Type

8.1 Introduction

8.2 Passenger Vehicle

8.3 Commercial Vehicle

9. Automotive Human Machine Interaction Market Segmentation, By Access Type

9.1 Introduction

9.2 Standard Interface

9.3 Multimodal Interface

10. Automotive Human Machine Interaction Market Segmentation, By Interface Type

10.1 Introduction

10.2 Visual

10.3 Acoustic

11. Automotive Human Machine Interaction Market Segmentation, By Display Size

11.1 Introduction

11.2 <5

11.3 5-10

11.4 >10

12. Regional Analysis

12.1 Introduction

12.2 North America

12.2.1 Trend Analysis

12.2.2 North America Automotive Human Machine Interaction Market By Country

12.2.3 North America Automotive Human Machine Interaction Market By Product

12.2.4 North America Automotive Human Machine Interaction Market By Vehicle Type

12.2.5 North America Automotive Human Machine Interaction Market By Access Type

12.2.6 North America Automotive Human Machine Interaction Market, By Interface Type

12.2.7 North America Automotive Human Machine Interaction Market, By Display Size

12.2.8 USA

12.2.8.1 USA Automotive Human Machine Interaction Market By Product

12.2.8.2 USA Automotive Human Machine Interaction Market By Vehicle Type

12.2.8.3 USA Automotive Human Machine Interaction Market By Access Type

12.2.8.4 USA Automotive Human Machine Interaction Market, By Interface Type

12.2.8.5 USA Automotive Human Machine Interaction Market, By Display Size

12.2.9 Canada

12.2.9.1 Canada Automotive Human Machine Interaction Market By Product

12.2.9.2 Canada Automotive Human Machine Interaction Market By Vehicle Type

12.2.9.3 Canada Automotive Human Machine Interaction Market By Access Type

12.2.9.4 Canada Automotive Human Machine Interaction Market, By Interface Type

12.2.9.5 Canada Automotive Human Machine Interaction Market, By Display Size

12.2.10 Mexico

12.2.10.1 Mexico Automotive Human Machine Interaction Market By Product

12.2.10.2 Mexico Automotive Human Machine Interaction Market By Vehicle Type

12.2.10.3 Mexico Automotive Human Machine Interaction Market By Access Type

12.2.10.4 Mexico Automotive Human Machine Interaction Market, By Interface Type

12.2.10.5 Mexico Automotive Human Machine Interaction Market, By Display Size

12.3 Europe

12.3.1 Trend Analysis

12.3.2 Eastern Europe

12.3.2.1 Eastern Europe Automotive Human Machine Interaction Market By Country

12.3.2.2 Eastern Europe Automotive Human Machine Interaction Market By Product

12.3.2.3 Eastern Europe Automotive Human Machine Interaction Market By Vehicle Type

12.3.2.4 Eastern Europe Automotive Human Machine Interaction Market By Access Type

12.3.2.5 Eastern Europe Automotive Human Machine Interaction Market By Interface Type

12.3.2.6 Eastern Europe Automotive Human Machine Interaction Market, By Display Size

12.3.2.7 Poland

12.3.2.7.1 Poland Automotive Human Machine Interaction Market By Product

12.3.2.7.2 Poland Automotive Human Machine Interaction Market By Vehicle Type

12.3.2.7.3 Poland Automotive Human Machine Interaction Market By Access Type

12.3.2.7.4 Poland Automotive Human Machine Interaction Market By Interface Type

12.3.2.7.5 Poland Automotive Human Machine Interaction Market, By Display Size

12.3.2.8 Romania

12.3.2.8.1 Romania Automotive Human Machine Interaction Market By Product

12.3.2.8.2 Romania Automotive Human Machine Interaction Market By Vehicle Type

12.3.2.8.3 Romania Automotive Human Machine Interaction Market By Access Type

12.3.2.8.4 Romania Automotive Human Machine Interaction Market By Interface Type

12.3.2.8.5 Romania Automotive Human Machine Interaction Market, By Display Size

12.3.2.9 Hungary

12.3.2.9.1 Hungary Automotive Human Machine Interaction Market By Product

12.3.2.9.2 Hungary Automotive Human Machine Interaction Market By Vehicle Type

12.3.2.9.3 Hungary Automotive Human Machine Interaction Market By Access Type

12.3.2.9.4 Hungary Automotive Human Machine Interaction Market By Interface Type

12.3.2.9.5 Hungary Automotive Human Machine Interaction Market, By Display Size

12.3.2.10 Turkey

12.3.2.10.1 Turkey Automotive Human Machine Interaction Market By Product

12.3.2.10.2 Turkey Automotive Human Machine Interaction Market By Vehicle Type

12.3.2.10.3 Turkey Automotive Human Machine Interaction Market By Access Type

12.3.2.10.4 Turkey Automotive Human Machine Interaction Market By Interface Type

12.3.2.10.5 Turkey Automotive Human Machine Interaction Market, By Display Size

12.3.2.11 Rest of Eastern Europe

12.3.2.11.1 Rest of Eastern Europe Automotive Human Machine Interaction Market By Product

12.3.2.11.2 Rest of Eastern Europe Automotive Human Machine Interaction Market By Vehicle Type

12.3.2.11.3 Rest of Eastern Europe Automotive Human Machine Interaction Market By Access Type

12.3.2.11.4 Rest of Eastern Europe Automotive Human Machine Interaction Market By Interface Type

12.3.2.11.5 Rest of Eastern Europe Automotive Human Machine Interaction Market, By Display Size

12.3.3 Western Europe

12.3.3.1 Western Europe Automotive Human Machine Interaction Market By Country

12.3.3.2 Western Europe Automotive Human Machine Interaction Market By Product

12.3.3.3 Western Europe Automotive Human Machine Interaction Market By Vehicle Type

12.3.3.4 Western Europe Automotive Human Machine Interaction Market By Access Type

12.3.3.5 Western Europe Automotive Human Machine Interaction Market By Interface Type

12.3.3.6 Western Europe Automotive Human Machine Interaction Market, By Display Size

12.3.3.7 Germany

12.3.3.7.1 Germany Automotive Human Machine Interaction Market By Product

12.3.3.7.2 Germany Automotive Human Machine Interaction Market By Vehicle Type

12.3.3.7.3 Germany Automotive Human Machine Interaction Market By Access Type

12.3.3.7.4 Germany Automotive Human Machine Interaction Market By Interface Type

12.3.3.7.5 Germany Automotive Human Machine Interaction Market, By Display Size

12.3.3.8 France

12.3.3.8.1 France Automotive Human Machine Interaction Market By Product

12.3.3.8.2 France Automotive Human Machine Interaction Market By Vehicle Type

12.3.3.8.3 France Automotive Human Machine Interaction Market By Access Type

12.3.3.8.4 France Automotive Human Machine Interaction Market By Interface Type

12.3.3.8.5 France Automotive Human Machine Interaction Market, By Display Size

12.3.3.9 UK

12.3.3.9.1 UK Automotive Human Machine Interaction Market By Product

12.3.3.9.2 UK Automotive Human Machine Interaction Market By Vehicle Type

12.3.3.9.3 UK Automotive Human Machine Interaction Market By Access Type

12.3.3.9.4 UK Automotive Human Machine Interaction Market By Interface Type

12.3.3.9.5 UK Automotive Human Machine Interaction Market, By Display Size

12.3.3.10 Italy

12.3.3.10.1 Italy Automotive Human Machine Interaction Market By Product

12.3.3.10.2 Italy Automotive Human Machine Interaction Market By Vehicle Type

12.3.3.10.3 Italy Automotive Human Machine Interaction Market By Access Type

12.3.3.10.4 Italy Automotive Human Machine Interaction Market By Interface Type

12.3.3.10.5 Italy Automotive Human Machine Interaction Market, By Display Size

12.3.3.11 Spain

12.3.3.11.1 Spain Automotive Human Machine Interaction Market By Product

12.3.3.11.2 Spain Automotive Human Machine Interaction Market By Vehicle Type

12.3.3.11.3 Spain Automotive Human Machine Interaction Market By Access Type

12.3.3.11.4 Spain Automotive Human Machine Interaction Market By Interface Type

12.3.3.11.5 Spain Automotive Human Machine Interaction Market, By Display Size

12.3.3.12 Netherlands

12.3.3.12.1 Netherlands Automotive Human Machine Interaction Market By Product

12.3.3.12.2 Netherlands Automotive Human Machine Interaction Market By Vehicle Type

12.3.3.12.3 Netherlands Automotive Human Machine Interaction Market By Access Type

12.3.3.12.4 Netherlands Automotive Human Machine Interaction Market By Interface Type

12.3.3.12.5 Netherlands Automotive Human Machine Interaction Market, By Display Size

12.3.3.13 Switzerland

12.3.3.13.1 Switzerland Automotive Human Machine Interaction Market By Product

12.3.3.13.2 Switzerland Automotive Human Machine Interaction Market By Vehicle Type

12.3.3.13.3 Switzerland Automotive Human Machine Interaction Market By Access Type

12.3.3.13.4 Switzerland Automotive Human Machine Interaction Market By Interface Type

12.3.3.13.5 Switzerland Automotive Human Machine Interaction Market, By Display Size

12.3.3.14 Austria

12.3.3.14.1 Austria Automotive Human Machine Interaction Market By Product

12.3.3.14.2 Austria Automotive Human Machine Interaction Market By Vehicle Type

12.3.3.14.3 Austria Automotive Human Machine Interaction Market By Access Type

12.3.3.14.4 Austria Automotive Human Machine Interaction Market By Interface Type

12.3.3.14.5 Austria Automotive Human Machine Interaction Market, By Display Size

12.3.3.15 Rest of Western Europe

12.3.3.15.1 Rest of Western Europe Automotive Human Machine Interaction Market By Product

12.3.3.15.2 Rest of Western Europe Automotive Human Machine Interaction Market By Vehicle Type

12.3.3.15.3 Rest of Western Europe Automotive Human Machine Interaction Market By Access Type

12.3.3.15.4 Rest of Western Europe Automotive Human Machine Interaction Market By Interface Type

12.3.3.15.5 Rest of Western Europe Automotive Human Machine Interaction Market, By Display Size

12.4 Asia-Pacific

12.4.1 Trend Analysis

12.4.2 Asia-Pacific Automotive Human Machine Interaction Market By Country

12.4.3 Asia-Pacific Automotive Human Machine Interaction Market By Product

12.4.4 Asia-Pacific Automotive Human Machine Interaction Market By Vehicle Type

12.4.5 Asia-Pacific Automotive Human Machine Interaction Market By Access Type

12.4.6 Asia-Pacific Automotive Human Machine Interaction Market By Interface Type

12.4.7 Asia-Pacific Automotive Human Machine Interaction Market, By Display Size

12.4.8 China

12.4.8.1 China Automotive Human Machine Interaction Market By Product

12.4.8.2 China Automotive Human Machine Interaction Market By Vehicle Type

12.4.8.3 China Automotive Human Machine Interaction Market By Access Type

12.4.8.4 China Automotive Human Machine Interaction Market By Interface Type

12.4.8.5 China Automotive Human Machine Interaction Market, By Display Size

12.4.9 India

12.4.9.1 India Automotive Human Machine Interaction Market By Product

12.4.9.2 India Automotive Human Machine Interaction Market By Vehicle Type

12.4.9.3 India Automotive Human Machine Interaction Market By Access Type

12.4.9.4 India Automotive Human Machine Interaction Market By Interface Type

12.4.9.5 India Automotive Human Machine Interaction Market, By Display Size

12.4.10 Japan

12.4.10.1 Japan Automotive Human Machine Interaction Market By Product

12.4.10.2 Japan Automotive Human Machine Interaction Market By Vehicle Type

12.4.10.3 Japan Automotive Human Machine Interaction Market By Access Type

12.4.10.4 Japan Automotive Human Machine Interaction Market By Interface Type

12.4.10.5 Japan Automotive Human Machine Interaction Market, By Display Size

12.4.11 South Korea

12.4.11.1 South Korea Automotive Human Machine Interaction Market By Product

12.4.11.2 South Korea Automotive Human Machine Interaction Market By Vehicle Type

12.4.11.3 South Korea Automotive Human Machine Interaction Market By Access Type

12.4.11.4 South Korea Automotive Human Machine Interaction Market By Interface Type

12.4.11.5 South Korea Automotive Human Machine Interaction Market, By Display Size

12.4.12 Vietnam

12.4.12.1 Vietnam Automotive Human Machine Interaction Market By Product

12.4.12.2 Vietnam Automotive Human Machine Interaction Market By Vehicle Type

12.4.12.3 Vietnam Automotive Human Machine Interaction Market By Access Type

12.4.12.4 Vietnam Automotive Human Machine Interaction Market By Interface Type

12.4.12.5 Vietnam Automotive Human Machine Interaction Market, By Display Size

12.4.13 Singapore

12.4.13.1 Singapore Automotive Human Machine Interaction Market By Product

12.4.13.2 Singapore Automotive Human Machine Interaction Market By Vehicle Type

12.4.13.3 Singapore Automotive Human Machine Interaction Market By Access Type

12.4.13.4 Singapore Automotive Human Machine Interaction Market By Interface Type

12.4.13.5 Singapore Automotive Human Machine Interaction Market, By Display Size

12.4.14 Australia

12.4.14.1 Australia Automotive Human Machine Interaction Market By Product

12.4.14.2 Australia Automotive Human Machine Interaction Market By Vehicle Type

12.4.14.3 Australia Automotive Human Machine Interaction Market By Access Type

12.4.14.4 Australia Automotive Human Machine Interaction Market By Interface Type

12.4.14.5 Australia Automotive Human Machine Interaction Market, By Display Size

12.4.15 Rest of Asia-Pacific

12.4.15.1 Rest of Asia-Pacific Automotive Human Machine Interaction Market By Product

12.4.15.2 Rest of Asia-Pacific Automotive Human Machine Interaction Market By Vehicle Type

12.4.15.3 Rest of Asia-Pacific Automotive Human Machine Interaction Market By Access Type

12.4.15.4 Rest of Asia-Pacific Automotive Human Machine Interaction Market By Interface Type

12.4.15.5 Rest of Asia-Pacific Automotive Human Machine Interaction Market, By Display Size

12.5 Middle East & Africa

12.5.1 Trend Analysis

12.5.2 Middle East

12.5.2.1 Middle East Automotive Human Machine Interaction Market By Country

12.5.2.2 Middle East Automotive Human Machine Interaction Market By Product

12.5.2.3 Middle East Automotive Human Machine Interaction Market By Vehicle Type

12.5.2.4 Middle East Automotive Human Machine Interaction Market By Access Type

12.5.2.5 Middle East Automotive Human Machine Interaction Market By Interface Type

12.5.2.6 Middle East Automotive Human Machine Interaction Market, By Display Size

12.5.2.7 UAE

12.5.2.7.1 UAE Automotive Human Machine Interaction Market By Product

12.5.2.7.2 UAE Automotive Human Machine Interaction Market By Vehicle Type

12.5.2.7.3 UAE Automotive Human Machine Interaction Market By Access Type

12.5.2.7.4 UAE Automotive Human Machine Interaction Market By Interface Type

12.5.2.7.5 UAE Automotive Human Machine Interaction Market, By Display Size

12.5.2.8 Egypt

12.5.2.8.1 Egypt Automotive Human Machine Interaction Market By Product

12.5.2.8.2 Egypt Automotive Human Machine Interaction Market By Vehicle Type

12.5.2.8.3 Egypt Automotive Human Machine Interaction Market By Access Type

12.5.2.8.4 Egypt Automotive Human Machine Interaction Market By Interface Type

12.5.2.8.5 Egypt Automotive Human Machine Interaction Market, By Display Size

12.5.2.9 Saudi Arabia

12.5.2.9.1 Saudi Arabia Automotive Human Machine Interaction Market By Product

12.5.2.9.2 Saudi Arabia Automotive Human Machine Interaction Market By Vehicle Type

12.5.2.9.3 Saudi Arabia Automotive Human Machine Interaction Market By Access Type

12.5.2.9.4 Saudi Arabia Automotive Human Machine Interaction Market By Interface Type

12.5.2.9.5 Saudi Arabia Automotive Human Machine Interaction Market, By Display Size

12.5.2.10 Qatar

12.5.2.10.1 Qatar Automotive Human Machine Interaction Market By Product

12.5.2.10.2 Qatar Automotive Human Machine Interaction Market By Vehicle Type

12.5.2.10.3 Qatar Automotive Human Machine Interaction Market By Access Type

12.5.2.10.4 Qatar Automotive Human Machine Interaction Market By Interface Type

12.5.2.10.5 Qatar Automotive Human Machine Interaction Market, By Display Size

12.5.2.11 Rest of Middle East

12.5.2.11.1 Rest of Middle East Automotive Human Machine Interaction Market By Product

12.5.2.11.2 Rest of Middle East Automotive Human Machine Interaction Market By Vehicle Type

12.5.2.11.3 Rest of Middle East Automotive Human Machine Interaction Market By Access Type

12.5.2.11.4 Rest of Middle East Automotive Human Machine Interaction Market By Interface Type

12.5.2.11.5 Rest of Middle East Automotive Human Machine Interaction Market, By Display Size

12.5.3 Africa

12.5.3.1 Africa Automotive Human Machine Interaction Market By Country

12.5.3.2 Africa Automotive Human Machine Interaction Market By Product

12.5.3.3 Africa Automotive Human Machine Interaction Market By Vehicle Type

12.5.3.4 Africa Automotive Human Machine Interaction Market By Access Type

12.5.3.5 Africa Automotive Human Machine Interaction Market By Interface Type

12.5.3.6 Africa Automotive Human Machine Interaction Market, By Display Size

12.5.3.7 Nigeria

12.5.3.7.1 Nigeria Automotive Human Machine Interaction Market By Product

12.5.3.7.2 Nigeria Automotive Human Machine Interaction Market By Vehicle Type

12.5.3.7.3 Nigeria Automotive Human Machine Interaction Market By Access Type

12.5.3.7.4 Nigeria Automotive Human Machine Interaction Market By Interface Type

12.5.3.7.5 Nigeria Automotive Human Machine Interaction Market, By Display Size

12.5.3.8 South Africa

12.5.3.8.1 South Africa Automotive Human Machine Interaction Market By Product

12.5.3.8.2 South Africa Automotive Human Machine Interaction Market By Vehicle Type

12.5.3.8.3 South Africa Automotive Human Machine Interaction Market By Access Type

12.5.3.8.4 South Africa Automotive Human Machine Interaction Market By Interface Type

12.5.3.8.5 South Africa Automotive Human Machine Interaction Market, By Display Size

12.5.3.9 Rest of Africa

12.5.3.9.1 Rest of Africa Automotive Human Machine Interaction Market By Product

12.5.3.9.2 Rest of Africa Automotive Human Machine Interaction Market By Vehicle Type

12.5.3.9.3 Rest of Africa Automotive Human Machine Interaction Market By Access Type

12.5.3.9.4 Rest of Africa Automotive Human Machine Interaction Market By Interface Type

12.5.3.9.5 Rest of Africa Automotive Human Machine Interaction Market, By Display Size

12.6 Latin America

12.6.1 Trend Analysis

12.6.2 Latin America Automotive Human Machine Interaction Market By country

12.6.3 Latin America Automotive Human Machine Interaction Market By Product

12.6.4 Latin America Automotive Human Machine Interaction Market By Vehicle Type

12.6.5 Latin America Automotive Human Machine Interaction Market By Access Type

12.6.6 Latin America Automotive Human Machine Interaction Market By Interface Type

12.6.7 Latin America Automotive Human Machine Interaction Market, By Display Size

12.6.8 Brazil

12.6.8.1 Brazil Automotive Human Machine Interaction Market By Product

12.6.8.2 Brazil Automotive Human Machine Interaction Market By Vehicle Type

12.6.8.3 Brazil Automotive Human Machine Interaction Market By Access Type

12.6.8.4 Brazil Automotive Human Machine Interaction Market By Interface Type

12.6.8.5 Brazil Automotive Human Machine Interaction Market, By Display Size

12.6.9 Argentina

12.6.9.1 Argentina Automotive Human Machine Interaction Market By Product

12.6.9.2 Argentina Automotive Human Machine Interaction Market By Vehicle Type

12.6.9.3 Argentina Automotive Human Machine Interaction Market By Access Type

12.6.9.4 Argentina Automotive Human Machine Interaction Market By Interface Type

12.6.9.5 Argentina Automotive Human Machine Interaction Market, By Display Size

12.6.10 Colombia

12.6.10.1 Colombia Automotive Human Machine Interaction Market By Product

12.6.10.2 Colombia Automotive Human Machine Interaction Market By Vehicle Type

12.6.10.3 Colombia Automotive Human Machine Interaction Market By Access Type

12.6.10.4 Colombia Automotive Human Machine Interaction Market By Interface Type

12.6.10.5 Colombia Automotive Human Machine Interaction Market, By Display Size

12.6.11 Rest of Latin America

12.6.11.1 Rest of Latin America Automotive Human Machine Interaction Market By Product

12.6.11.2 Rest of Latin America Automotive Human Machine Interaction Market By Vehicle Type

12.6.11.3 Rest of Latin America Automotive Human Machine Interaction Market By Access Type

12.6.11.4 Rest of Latin America Automotive Human Machine Interaction Market By Interface Type

12.6.11.5 Rest of Latin America Automotive Human Machine Interaction Market, By Display Size

13. Company Profiles

13.1 Bosch

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services Offered

13.1.4 The SNS View

13.2 Valeo

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services Offered

13.2.4 The SNS View

13.3 Panasonic Corporation

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Products/ Services Offered

13.3.4 The SNS View

13.4 Alpine Electronics

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Products/ Services Offered

13.4.4 The SNS View

13.5 Visteon Corporation

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Products/ Services Offered

13.5.4 The SNS View

13.6 Harman

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Products/ Services Offered

13.6.4 The SNS View

13.7 Continental AG.

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Products/ Services Offered

13.7.4 The SNS View

13.8 Denso Corp.

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Products/ Services Offered

13.8.4 The SNS View

13.9 Others

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Products/ Services Offered

13.9.4 The SNS View

14. Competitive Landscape

14.1 Competitive Benchmarking

14.2 Market Share Analysis

14.3 Recent Developments

14.3.1 Industry News

14.3.2 Company News

14.3.3 Mergers & Acquisitions

15. Use Case and Best Practices

16. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The EV Composites Market size is projected to reach USD 6.45 billion by 2032, was valued at USD 1.8 billion in 2023 and will grow at a CAGR of 17.3% over the forecast period.

The Smart Railways Market size was valued at $30.89 billion in 2023 & is expected to reach USD 58.89 billion by 2031 & grow at a CAGR of 8.4% by 2024-2031

The Automotive Radiator Fan Market Size was valued at USD 8.3 billion in 2023 and is expected to reach USD 12.72 billion by 2031 and grow at a CAGR of 5.48% over the forecast period 2024-2031.

The Power Sport Vehicle Tire Market Size was valued at USD 4.80 billion in 2023 and is expected to reach USD 7.24 billion by 2032, and grow at a CAGR of 4.67% over the forecast period 2024-2032.

The Automotive Battery Market Size was USD 59.4 Billion in 2023 & is expected to reach USD 101.62 Billion by 2032, growing at a CAGR of 6.15% by 2024-2032.

The Electric Vehicle Connector Market Size was recorded at USD 2.08 billion in 2023 and is expected to reach USD 17.8 billion by 2032, growing at a CAGR of 27% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone