Get More Information on Automotive HUD Market - Request Sample Report

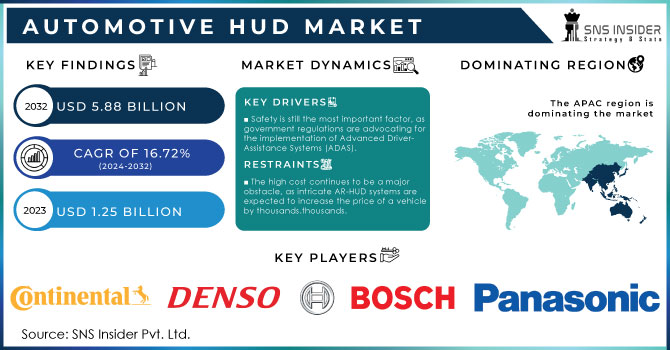

The Automotive HUD Market size was valued at USD 1.25 billion in 2023 and is expected to reach USD 5.88 billion by 2032, the estimated CAGR for the forecast period of 2024-2032 is 16.72%.

The Automotive HUD Market is experiencing a rapid growth in terms of overall demand and acceptance. According to the National Highway Traffic Safety Administration (NHTSA), 94% of crashes are caused by driver error. HUDs improve on this by keeping important information such as speed, navigation and blind spot warnings right in the driver's line of sight, reducing the need to take their eyes off the road. In addition, 72% of US consumers consider advanced driver assistance systems (ADAS) a top priority when purchasing a car. AR HUDs, the next frontier in this technology, seamlessly combine real elements with projected information. These features include tech demographics, with millennials representing more than 60% of people interested in AR HUDs.

One of the most important trends is the growth of HUDs with Augmented Reality (AR), which is projected to grow by a significant rate of 25% by 2031. Another trend is the growing demand for elegant and discreet HUD designs. More than 60% of consumers now prioritize aesthetics and prefer HUDs that integrate seamlessly with modern cars. This change reflects the desire for technology that completes the driving experience, not diminishes it. Finally, HUD innovation is driven by the growth of electric vehicles (EV). Almost half of the electric vehicles manufacturers are actively developing HUD systems specially adapted to the needs of electric cars. These HUDs can display battery range, charging stations and energy efficiency metrics, providing an evolving landscape of environmentally conscious driving.

How is the demand curve shifting amidst high external volatility?

Despite the possibility of a decline in overall auto sales owing to economic uncertainties, there are several reasons to believe that demand for automobiles acquired through HUD will rise. First, in-car technology is a top priority for Millennials and Gen Z, and HUDs immediately address this demand by making driving safer and more comfortable. Manufacturers are being forced to incorporate technologies that raise driver awareness due to the increased focus on fuel efficiency; HUDs, in particular, notably speed up response times and reduce fuel use. A perspective shift in the market is imminent with the introduction of augmented reality (AR) head-up displays. Just picture crucial navigational data or safety alerts displayed directly above the driver's line of sight. Even with the unpredictability of the external market, this fascinating technology is likely to considerably increase demand.

Drivers:

Safety is still the most important factor, as government regulations are advocating for the implementation of Advanced Driver-Assistance Systems (ADAS).

Government efforts to encourage connected car technologies such as intelligent transport systems (ITS) offer a chance for HUDs.

The luxury car category, accounting for 20% of worldwide car sales, plays a crucial role.

The rising luxury cars sales globally is the driving force behind the HUD market. This is because luxury car manufacturers are at the forefront of introducing new technologies and positioning HUDs as premium features that enhance the driving experience. This focus on innovation will spread to the wider market as HUD technology matures and becomes more affordable. Moreover, different sub-segments in the Automotive HUD market provide to different preferences. Windshield HUDs, which project information directly onto the windshield, have the largest share at 60%.

Restrains:

The high cost continues to be a major obstacle, as intricate AR-HUD systems are expected to increase the price of a vehicle by thousands.

Automakers face packaging challenges when integrating large HUD hardware into sleek, modern dashboards.

Maintaining clear and accurate information display is challenging due to various windshield angles and lighting conditions.

Future threats which need to be monitored by the players operating in Automotive HUD Market.

The complexity of the technology is a significant challenge due to the integration of various components such as micro displays, projectors, and combiners from different suppliers. A 2023 study shows a 42% vulnerability in meeting on-time deliveries. Moreover, the quick progress in AR HUDs also brings about more challenges.

Manufacturers face a limited talent pool due to the need for knowledge in micro-optics and software development to work on advanced displays. A recently conducted survey in Q1 2024 indicates that a skill gap may hamper the widespread adoption of AR HUD by 38% during the forecasted period. At last, the sector contends with geopolitical tensions and trade conflicts, which have the potential to interrupt the supply of essential raw materials and finished parts.

By Technology:

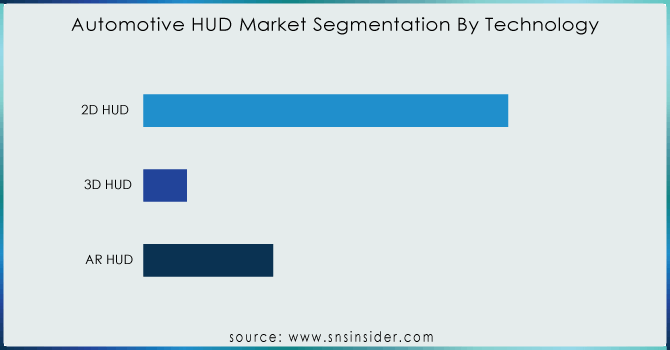

2D HUDs dominate the market with approximately 70% market share by projecting information onto the windshield. Manufacturers often choose them due to their simplicity and affordability. 3D HUDs, accounting for about 5% of the market share, provide a more visually engaging experience through a layered information display that includes depth perception. As costs for this technology decrease and consumer desire for a high-quality in-car experience increases, it is projected to become more popular. AR HUDs, despite being at the forefront, still make up a small portion of the market at roughly 25%.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Vehicle Type:

Passenger cars are expected to maintain the majority market share at approximately 70% and are taking the lead. Several factors are responsible for this dominance. Passenger cars have a greater production volume than commercial vehicles. Secondly, passenger car consumers typically show a greater interest in advanced technological features and a focus on improving driving experiences. This results in a greater readiness to shell out money for features such as HUDs. On the other hand, the commercial vehicle sector, including both Light Commercial Vehicles (LCVs) and Heavy Commercial Vehicles (HCVs), makes up the remaining 30%.

By Propulsion Type:

While Internal Combustion Engine (ICE) vehicles currently hold the larger market share holding 65%, Electric Vehicles (EVs) are guaranteed for significant growth. This can be attributed to several factors. Firstly, premium features like HUDs are often bundled with advanced driver-assistance systems (ADAS) that are becoming increasingly common in EVs due to a focus on safety and automation. Secondly, the focus on creating a more futuristic driving experience aligns well with the innovative image of EVs. As EV adoption accelerates, SNS Insider analysts predict the EV segment to capture a larger share of the HUD market, potentially reaching 40% by 2032.

The Automotive HUD market in APAC has the highest market share at 39%. Several factors are responsible for this dominance. To begin with, a thriving car industry, especially in Japan, drives a high need for state-of-the-art technology in cars. Also, an expanding middle class with increasing disposable income drives the demand for high-end features such as HUDs. Demographics also have an impact, as a youthful, technology obsessed population eagerly adopts new in-vehicle experiences. This younger age group can be found mostly in China, India, and South Korea, where they are actively working on advancing autonomous driving technologies. The emphasis on ADAS enhances the market growth by synergizing with HUDs. The supply chain in APAC is strong, as leading OEMs such as Toyota, Honda, and Hyundai collaborate with established HUD manufacturers such as Continental and Denso. In addition, there are also new local players in China that provide affordable HUD solutions, making them appealing to a wider variety of car markets.

Well-known companies like Nippon Seiki in Japan and Continental in Germany operate alongside strong regional companies like Foryou in China. These large companies control the OEM market by providing HUDs directly to automotive manufacturers. With their solid technical skills and existing partnerships in the automotive industry, they collectively control more than 60% of the market share. Nevertheless, the area experiences a lively secondary market segment too. In this region, companies such as Waylabs in China and Hudway in Taiwan are successful, providing creative and budget-friendly HUD systems for cars already on the road. This part addresses the increasing need for cost-effective options, specifically in emerging markets in APAC, and represents about 40% of the market.

The major Automotive HUD Market key players are as follows:

Continental AG (Combiner HUD, Windshield HUD)

Denso Corporation (AR HUD, Standard HUD)

Nippon Seiki Co., Ltd. (LCD HUD, OLED HUD)

Bosch (3D HUD, AR HUD)

Panasonic Corporation (Transparent Display HUD, Interactive HUD)

Valeo (Laser-based HUD, Digital HUD)

Harman International (Full-Windshield HUD, Augmented Reality HUD)

Garmin Ltd. (Portable HUD, Navigation HUD)

Visteon Corporation (AR Combiner HUD, Dual-Mode HUD)

Yazaki Corporation (Compact HUD, Free-form Optics HUD)

Hudway LLC (Hudway Cast, Hudway Glass)

WayRay (Holographic AR HUD, 3D Navigation HUD)

Pioneer Corporation (Full Color HUD, NaviGate HUD)

Harman (Digital Cockpit HUD, Interactive HUD)

JVCKENWOOD Corporation (Smart HUD, Heads-Up Navigation Display)

LG Electronics (Transparent OLED HUD, Dual Display HUD)

Koito Manufacturing Co., Ltd. (Combiner HUD, Laser HUD)

Hyundai Mobis (Curved HUD, AR Navigation HUD)

Texas Instruments (DLP HUD, High-Resolution HUD)

Robertshaw Controls Company (Micro Display HUD, Projection HUD)

Panasonic Holdings Corporation and Mazda Motor Corporation partnered to develop a full-display meter system for the Mazda CX-70 model. This system incorporates a large display that functions similarly to a HUD, projecting vehicle information directly in the driver's line of sight.

Nippon Seiki Co., Ltd., a supplier of automotive displays and components, partnered with FPT Software to develop next-generation HUD platforms and applications for cars and motorcycles.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.25 Billion |

| Market Size by 2032 | US$ 5.88 Billion |

| CAGR | CAGR of 16.72% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology • By HUD Type • By Vehicle Class • By Vehicle Type • By Propulsion Type • By Level Of Autonomy • By Offering |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Continental AG, Denso Corporation, Nippon Seiki Co., Ltd., Bosch, Panasonic Corporation, Valeo, Harman International, Garmin Ltd., Visteon Corporation, Yazaki Corporation, Hudway LLC, WayRay and others. |

| Key Drivers | • Safety is still the most important factor, as government regulations are advocating for the implementation of Advanced Driver-Assistance Systems (ADAS). • Government efforts to encourage connected car technologies such as intelligent transport systems (ITS) offer a chance for HUDs. • The luxury car category, accounting for 20% of worldwide car sales, plays a crucial role. |

| Restraints | • The high cost continues to be a major obstacle, as intricate AR-HUD systems are expected to increase the price of a vehicle by thousands. • Automakers face packaging challenges when integrating large HUD hardware into sleek, modern dashboards. • Maintaining clear and accurate information display is challenging due to various windshield angles and lighting conditions. |

Ans: The Automotive HUD Market size was valued at USD 1.25 billion in 2023 and is expected to reach USD 5.88 billion by 2032

Ans: The estimated CAGR for the forecast period of 2024-2032 is 16.72%.

Ans: The high cost continues to be a major obstacle, as intricate AR-HUD systems are expected to increase the price of a vehicle by thousands.

Ans: Government efforts to encourage connected car technologies such as intelligent transport systems (ITS) offer a chance for HUDs.

Ans: APAC region holds the highest market share and will be dominating the market over the forecast period.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Vehicle Production and Sales Volumes, 2020-2032, by Region

5.2 Emission Standards Compliance, by Region

5.3 Vehicle Technology Adoption, by Region

5.4 Consumer Preferences, by Region

5.5 Aftermarket Trends (Data on vehicle maintenance, parts, and services)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Automotive HUD Market Segmentation, by Technology

7.1 Chapter Overview

7.2 AR HUD

7.2.1 AR HUD Market Trends Analysis (2020-2032)

7.2.2 AR HUD Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 3D HUD

7.3.1 3D HUD Market Trends Analysis (2020-2032)

7.3.2 3D HUD Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 2D HUD

7.4.1 2D HUD Market Trends Analysis (2020-2032)

7.4.2 2D HUD Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Automotive HUD Market Segmentation, By HUD Type

8.1 Chapter Overview

8.2 Combined HUD

8.2.1 Combined HUD Market Trends Analysis (2020-2032)

8.2.2 Combined HUD Market Size Estimates And Forecasts To 2032 (USD Billion)

8.3 Windshield HUD

8.3.1 Windshield HUD Market Trends Analysis (2020-2032)

8.3.2 Windshield HUD Market Size Estimates And Forecasts To 2032 (USD Billion)

9. Automotive HUD Market Segmentation, By Vehicle Class

9.1 Chapter Overview

9.2 Economy Car

9.2.1 Economy Car Market Trends Analysis (2020-2032)

9.2.2 Economy Car Market Size Estimates And Forecasts To 2032 (USD Billion)

9.3 Mid-Segment Car

9.3.1 Mid-Segment Car Market Trends Analysis (2020-2032)

9.3.2 Mid-Segment Car Market Size Estimates And Forecasts To 2032 (USD Billion)

9.4 Luxury Car

9.4.1 Luxury Car Market Trends Analysis (2020-2032)

9.4.2 Luxury Car Market Size Estimates And Forecasts To 2032 (USD Billion)

10. Automotive HUD Market Segmentation, By Vehicle Type

10.1 Chapter Overview

10.2 Passenger Cars

10.2.1 Passenger Cars Market Trends Analysis (2020-2032)

10.2.2 Passenger Cars Market Size Estimates And Forecasts To 2032 (USD Billion)

10.3 Commercial Vehicles

10.3.1 Commercial Vehicles Market Trends Analysis (2020-2032)

10.3.2 Commercial Vehicles Market Size Estimates And Forecasts To 2032 (USD Billion)

11. Automotive HUD Market Segmentation, By Propulsion Type

11.1 Chapter Overview

11.2 ICE

11.2.1 ICE Market Trends Analysis (2020-2032)

11.2.2 ICE Market Size Estimates And Forecasts To 2032 (USD Billion)

11.3 Electric Vehicles

11.3.1 Electric Vehicles Market Trends Analysis (2020-2032)

11.3.2 Electric Vehicles Market Size Estimates And Forecasts To 2032 (USD Billion)

12. Automotive HUD Market Segmentation, By Level of Autonomy

12.1 Chapter Overview

12.2 Non-Autonomous Cars

12.2.1 Non-Autonomous Cars Market Trends Analysis (2020-2032)

12.2.2 Non-Autonomous Cars Market Size Estimates And Forecasts To 2032 (USD Billion)

12.3 Semi-Autonomous Cars

12.3.1 Semi-Autonomous Cars Market Trends Analysis (2020-2032)

12.3.2 Semi-Autonomous Cars Market Size Estimates And Forecasts To 2032 (USD Billion)

12.4 Autonomous Cars

12.4.1 Autonomous Cars Market Trends Analysis (2020-2032)

12.4.2 Autonomous Cars Market Size Estimates And Forecasts To 2032 (USD Billion)

13. Automotive HUD Market Segmentation, By Offering

13.1 Chapter Overview

13.2 Software

13.2.1 Software Market Trends Analysis (2020-2032)

13.2.2 Software Market Size Estimates And Forecasts To 2032 (USD Billion)

13.3 Hardware

13.3.1 Hardware Market Trends Analysis (2020-2032)

13.3.2 Hardware Market Size Estimates And Forecasts To 2032 (USD Billion)

12. Regional Analysis

12.1 Chapter Overview

12.2 North America

12.2.1 Trends Analysis

12.2.2 North America Automotive HUD Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.2.3 North America Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.2.4 North America Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.2.5 North America Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.2.6 North America Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.2.7 North America Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.2.6 North America Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.2.7 North America Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.2.8 USA

12.2.8.1 USA Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.2.8.2 USA Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.2.8.3 USA Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.2.8.4 USA Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.2.8.5 USA Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.2.8.6 USA Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.2.8.7 USA Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.2.9 Canada

12.2.9.1 Canada Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.2.9.2 Canada Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.2.9.3 Canada Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.2.9.4 Canada Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.2.9.5 Canada Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.2.9.6 Canada Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.2.9.7 Canada Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.2.10 Mexico

12.2.10.1 Mexico Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.2.10.2 Mexico Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.2.10.3 Mexico Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.2.10.4 Mexico Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.2.10.5 Mexico Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.2.10.6 Mexico Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.2.10.7 Mexico Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.3 Europe

12.3.1 Eastern Europe

12.3.1.1 Trends Analysis

12.3.1.2 Eastern Europe Automotive HUD Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.3.1.3 Eastern Europe Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.3.1.4 Eastern Europe Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.3.1.5 Eastern Europe Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.3.1.6 Eastern Europe Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.7 Eastern Europe Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.3.1.8 Eastern Europe Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.3.1.9 Eastern Europe Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.3.1.8 Poland

12.3.1.8.1 Poland Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.3.1.8.2 Poland Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.3.1.8.3 Poland Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.3.1.8.4 Poland Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.8.5 Poland Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.3.1.8.6 Poland Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.3.1.8.7 Poland Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.3.1.9 Romania

12.3.1.9.1 Romania Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.3.1.9.2 Romania Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.3.1.9.3 Romania Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.3.1.9.4 Romania Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.9.5 Romania Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.3.1.9.6 Romania Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.3.1.9.7 Romania Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.3.1.10 Hungary

12.3.1.10.1 Hungary Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.3.1.10.2 Hungary Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.3.1.10.3 Hungary Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.3.1.10.4 Hungary Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.10.5 Hungary Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.3.1.10.6 Hungary Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.3.1.910.7 Hungary Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.3.1.11 Turkey

12.3.1.11.1 Turkey Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.3.1.11.2 Turkey Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.3.1.11.3 Turkey Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.3.1.11.4 Turkey Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.11.5 Turkey Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.3.1.11.6 Turkey Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.3.1.11.7 Turkey Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.3.1.12 Rest Of Eastern Europe

12.3.1.12.1 Rest Of Eastern Europe Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.3.1.12.2 Rest Of Eastern Europe Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.3.1.12.3 Rest Of Eastern Europe Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.3.1.12.4 Rest Of Eastern Europe Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.12.5 Rest Of Eastern Europe Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.3.1.12.6 Rest of EE Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.3.1.12.7 Rest of EE Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.3.2 Western Europe

12.3.2.1 Trends Analysis

12.3.2.2 Western Europe Automotive HUD Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.3.2.3 Western Europe Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.3.2.4 Western Europe Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.3.2.5 Western Europe Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.3.2.6 Western Europe Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.7 Western Europe Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.3.2.8 Western Europe Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.3.2.9 Western Europe Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.3.2.8 Germany

12.3.2.8.1 Germany Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.3.2.8.2 Germany Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.3.2.8.3 Germany Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.3.2.8.4 Germany Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.8.5 Germany Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.3.2.8.6 Germany Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.3.2.8.7 Germany Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.3.2.9 France

12.3.2.9.1 France Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.3.2.9.2 France Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.3.2.9.3 France Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.3.2.9.4 France Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.9.5 France Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.3.2.9.6 France Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.3.2.9.7 France Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.3.2.10 UK

12.3.2.10.1 UK Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.3.2.10.2 UK Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.3.2.10.3 UK Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.3.2.10.4 UK Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.10.5 UK Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.3.2.10.6 UK Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.3.2.10.7 UK Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.3.2.11 Italy

12.3.2.11.1 Italy Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.3.2.11.2 Italy Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.3.2.11.3 Italy Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.3.2.11.4 Italy Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.11.5 Italy Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.3.2.11.6 Italy Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.3.2.11.7 Italy Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.3.2.12 Spain

12.3.2.12.1 Spain Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.3.2.12.2 Spain Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.3.2.12.3 Spain Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.3.2.12.4 Spain Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.12.5 Spain Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.3.2.12.6 Spain Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.3.2.12.7 Spain Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.3.2.13 Netherlands

12.3.2.13.1 Netherlands Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.3.2.13.2 Netherlands Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.3.2.13.3 Netherlands Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.3.2.13.4 Netherlands Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.13.5 Netherlands Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.3.2.13.6 Netherlands Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.3.2.13.7 Netherlands Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.3.2.14 Switzerland

12.3.2.14.1 Switzerland Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.3.2.14.2 Switzerland Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.3.2.14.3 Switzerland Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.3.2.14.4 Switzerland Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.12.5 Switzerland Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.3.2.12.6 Switzerland Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.3.2.12.7 Switzerland Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.3.2.15 Austria

12.3.2.15.1 Austria Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.3.2.15.2 Austria Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.3.2.15.3 Austria Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.3.2.15.4 Austria Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.15.5 Austria Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.3.2.15.6 Austria Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.3.2.16.7 Austria Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.3.2.16 Rest Of Western Europe

12.3.2.16.1 Rest Of Western Europe Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.3.2.16.2 Rest Of Western Europe Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.3.2.16.3 Rest Of Western Europe Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.3.2.16.4 Rest Of Western Europe Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.16.5 Rest Of Western Europe Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.3.2.16.6 Rest of Western Europe Data Generation Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.3.2.16.7 Rest of Western Europe Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.4 Asia Pacific

12.4.1 Trends Analysis

12.4.2 Asia Pacific Automotive HUD Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.4.3 Asia Pacific Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.4.4 Asia Pacific Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.4.5 Asia Pacific Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.4.6 Asia Pacific Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.7 Asia Pacific Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.4.8 Asia Pacific Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.4.9 Asia Pacific Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.4.8 China

12.4.8.1 China Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.4.8.2 China Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.4.8.3 China Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.4.8.4 China Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.8.5 China Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.4.8.6 China Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.4.8.7 China Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.4.9 India

12.4.9.1 India Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.4.9.2 India Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.4.9.3 India Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.4.9.4 India Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.9.5 India Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.4.9.6 India Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.4.9.7 India Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.4.10 Japan

12.4.10.1 Japan Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.4.10.2 Japan Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.4.10.3 Japan Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.4.10.4 Japan Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.10.5 Japan Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.4.10.6 Japan Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.4.10.7 Japan Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.4.11 South Korea

12.4.11.1 South Korea Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.4.11.2 South Korea Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.4.11.3 South Korea Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.4.11.4 South Korea Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.11.5 South Korea Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.4.11.6 South Korea Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.4.11.7 South Korea Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.4.12 Vietnam

12.4.12.1 Vietnam Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.4.12.2 Vietnam Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.4.12.3 Vietnam Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.4.12.4 Vietnam Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.12.5 Vietnam Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.4.12.6 Vietnam Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.4.12.7 Vietnam Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.4.13 Singapore

12.4.13.1 Singapore Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.4.13.2 Singapore Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.4.13.3 Singapore Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.4.13.4 Singapore Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.13.5 Singapore Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.4.13.6 Singapore Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.4.13.7 Singapore Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.4.14 Australia

12.4.14.1 Australia Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.4.14.2 Australia Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.4.14.3 Australia Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.4.14.4 Australia Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.14.5 Australia Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.4.14.6 Australia Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.4.14.7 Australia Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.4.15 Rest Of Asia Pacific

12.4.15.1 Rest Of Asia Pacific Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.4.15.2 Rest Of Asia Pacific Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.4.15.3 Rest Of Asia Pacific Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.4.15.4 Rest Of Asia Pacific Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.15.5 Rest Of Asia Pacific Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.4.15.6 Rest of Asia Pacific Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.4.15.7 Rest of Asia Pacific Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.5 Middle East And Africa

12.5.1 Middle East

12.5.1.1 Trends Analysis

12.5.1.2 Middle East Automotive HUD Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.5.1.3 Middle East Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.5.1.4 Middle East Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.5.1.5 Middle East Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.5.1.6 Middle East Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.7 Middle East Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.5.1.8 Middle East Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.5.1.9 Middle East Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.5.1.8 UAE

12.5.1.8.1 UAE Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.5.1.8.2 UAE Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.5.1.8.3 UAE Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.5.1.8.4 UAE Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.8.5 UAE Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.5.1.8.6 UAE Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.5.1.8.7 UAE East Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.5.1.9 Egypt

12.5.1.9.1 Egypt Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.5.1.9.2 Egypt Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.5.1.9.3 Egypt Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.5.1.9.4 Egypt Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.9.5 Egypt Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.5.1.9.6 Egypt Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.5.1.9.7 Egypt Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.5.1.10 Saudi Arabia

12.5.1.10.1 Saudi Arabia Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.5.1.10.2 Saudi Arabia Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.5.1.10.3 Saudi Arabia Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.5.1.10.4 Saudi Arabia Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.10.5 Saudi Arabia Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.5.1.10.6 Saudi Arabia Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.5.1.10.7 Saudi Arabia Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.5.1.11 Qatar

12.5.1.11.1 Qatar Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.5.1.11.2 Qatar Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.5.1.11.3 Qatar Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.5.1.11.4 Qatar Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.11.5 Qatar Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.5.1.11.6 Qatar Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.5.1.11.7 Qatar Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.5.1.12 Rest Of Middle East

12.5.1.12.1 Rest Of Middle East Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.5.1.12.2 Rest Of Middle East Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.5.1.12.3 Rest Of Middle East Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.5.1.12.4 Rest Of Middle East Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.12.5 Rest Of Middle East Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.5.1.12.6 Rest Of Middle East Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.5.1.12.7 Rest Of Middle East Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.5.2 Africa

12.5.2.1 Trends Analysis

12.5.2.2 Africa Automotive HUD Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.5.2.3 Africa Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.5.2.4 Africa Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.5.2.5 Africa Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.5.2.6 Africa Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.2.7 Africa Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.5.2.8 Africa Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.5.2.9 Africa Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.5.2.8 South Africa

12.5.2.8.1 South Africa Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.5.2.8.2 South Africa Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.5.2.8.3 South Africa Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.5.2.8.4 South Africa Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.2.8.5 South Africa Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.5.2.8.6 South Africa Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.5.2.8.7 South Africa Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.5.2.9 Nigeria

12.5.2.9.1 Nigeria Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.5.2.9.2 Nigeria Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.5.2.9.3 Nigeria Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.5.2.9.4 Nigeria Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.2.9.5 Nigeria Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.5.2.9.6 Nigeria Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.5.2.9.7 Nigeria Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.5.2.10 Rest Of Africa

12.5.2.10.1 Rest Of Africa Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.5.2.10.2 Rest Of Africa Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.5.2.10.3 Rest Of Africa Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.5.2.10.4 Rest Of Africa Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.2.10.5 Rest Of Africa Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.5.2.10.6 Rest Of Africa Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.5.2.10.7 Rest Of Africa Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.6 Latin America

12.6.1 Trends Analysis

12.6.2 Latin America Automotive HUD Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.6.3 Latin America Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.6.4 Latin America Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.6.5 Latin America Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.6.6 Latin America Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.6.7 Latin America Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.6.8 Latin America Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.6.9 Latin America Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.6.8 Brazil

12.6.8.1 Brazil Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.6.8.2 Brazil Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.6.8.3 Brazil Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.6.8.4 Brazil Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.6.8.5 Brazil Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.6.8.4 Brazil Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.6.8.5 Brazil Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.6.9 Argentina

12.6.9.1 Argentina Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.6.9.2 Argentina Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.6.9.3 Argentina Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.6.9.4 Argentina Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.6.9.5 Argentina Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.6.9.6 Argentina Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.6.9.7 Argentina Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.6.10 Colombia

12.6.10.1 Colombia Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.6.10.2 Colombia Automotive HUD Market Estimates And Forecasts, By HUD Type (2020-2032) (USD Billion)

12.6.10.3 Colombia Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.6.10.4 Colombia Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.6.10.5 Colombia Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.6.10.6 Colombia Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.6.10.7 Colombia Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

12.6.11 Rest Of Latin America

12.6.11.1 Rest Of Latin America Automotive HUD Market Estimates And Forecasts, By Technology (2020-2032) (USD Billion)

12.6.11.2 Rest Of Latin America Automotive HUD Market Estimates And Forecasts, HUD Type (2020-2032) (USD Billion)

12.6.11.3 Rest Of Latin America Automotive HUD Market Estimates And Forecasts, By Vehicle Class (2020-2032) (USD Billion)

12.6.11.4 Rest Of Latin America Automotive HUD Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.6.11.5 Rest Of Latin America Automotive HUD Market Estimates And Forecasts, By Propulsion (2020-2032) (USD Billion)

12.6.11.6 Rest Of Latin America Automotive HUD Market Estimates And Forecasts, By Level of Autonomy (2020-2032) (USD Billion)

12.6.11.7 Rest Of Latin America Automotive HUD Market Estimates And Forecasts, By Offering (2020-2032) (USD Billion)

13. Company Profiles

13.1 Continental AG

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services Offered

13.1.4 SWOT Analysis

13.2 Denso Corporation

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services Offered

13.2.4 SWOT Analysis

13.3 Nippon Seiki Co., Ltd.

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Products/ Services Offered

13.3.4 SWOT Analysis

13.4 Bosch

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Products/ Services Offered

13.4.4 SWOT Analysis

13.5 Panasonic Corporation

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Products/ Services Offered

13.5.4 SWOT Analysis

13.6 Valeo

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Products/ Services Offered

13.6.4 SWOT Analysis

13.7 Harman International

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Products/ Services Offered

13.7.4 SWOT Analysis

13.8 Garmin Ltd.

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Products/ Services Offered

13.8.4 SWOT Analysis

13.9 Yazaki Corp

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Products/ Services Offered

13.9.4 SWOT Analysis

13.10 Others

13.10.1 Company Overview

13.10.2 Financial

13.10.3 Products/ Services Offered

13.10.4 SWOT Analysis

14. Use Cases and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Technology

AR HUD

3D HUD

2D HUD

By HUD Type

Combined HUD

Windshield HUD

By Vehicle Class

Economy Car

Mid-Segment Car

Luxury Car

By Vehicle Type

Passegnger Cars

Commercial vehicles

By Propulsion Type

ICE Vehicles

Electric Vehicles

By Level of Autonomy

Non-Autonomous Cars

Semi-Autonomous Cars

Autonomous Cars

By Offering

Software

Hardware

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

Regional Coverage

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Automotive Seats Market size was valued at USD 53.45 Billion in 2023 and is expected to reach USD 60.21 Billion by 2031. And grow at a CAGR of 1.5% over the forecast period of 2024-2031.

The Automotive Wiring Harness Market size is projected to reach USD 72.03 billion by 2032 and was valued at USD 51.05 billion in 2023. The estimated CAGR for 2024-2032 is 3.9%.

The Electric Power Steering Market size was valued at USD 24.1 billion in 2023 and will reach USD 39.50 Bn by 2032 and grow at a CAGR of 4.57% by 2024-2032.

Automotive Engineering Services Outsourcing Market Report Scope & Overview:

The Tourist Bus Market size was estimated at USD 35.89 billion in 2023 and is expected to reach USD 69.79 billion by 2032, with a growing CAGR of 7.70% over the forecast period 2024-2032.

The Automotive Sunroof Market Size was valued at USD 7.45 billion in 2023 and is expected to reach USD 19.36 billion by 2032 and grow at a CAGR of 11.2% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone