Get More Information on Automotive Grille Market - Request Sample Report

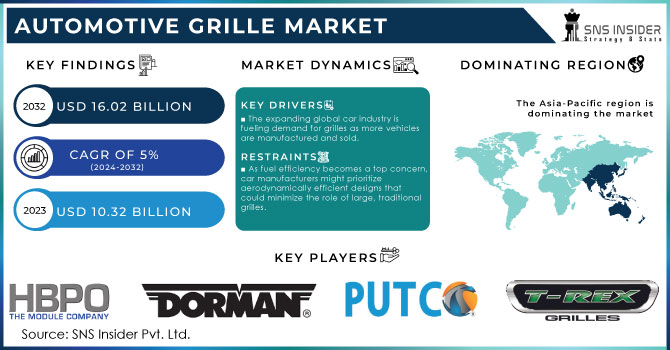

The Automotive Grille Market Size was $10.32 billion in 2023 and is expected to reach USD 16.02 billion by 2032 and grow at a CAGR of 5% by 2024-2032.

The automotive grille market is experiencing a positive outlook due to several converging factors. The global expansion of the automotive industry is the main component, as more vehicles are produced and being sold worldwide. The rising disposable income and increasing urbanization are leading consumers to prioritize aesthetics alongside functionality when purchasing cars. This translates to a growing demand for stylish and attractive grilles that enhance the overall vehicle design. The technological advancements are playing the role in market growth. The introduction of lightweight materials like carbon fibre and aluminium offers car manufacturers benefits such as improved fuel efficiency and reduced CO2 emissions, making these materials increasingly popular choices for grille construction. The rise of electric vehicles presents exciting opportunities for grille manufacturers as electric vehicles require efficient cooling systems to manage battery and electric motor temperatures, creating a demand for specialized grilles designed to meet these unique needs. The growing trend of autonomous vehicles is expected to drive the demand for grille-integrated sensors and other advanced features.

KEY DRIVERS:

The expanding global car industry is fueling demand for grilles as more vehicles are manufactured and sold.

Rising disposable income and urbanization are leading consumers to prioritize stylish grilles that enhance car design.

The rise in disposable income, coupled with increasing urbanization, is significantly impacting consumer preferences in the automotive grille market. As people have more money to spend and drifted towards city living, aesthetics are becoming increasingly important alongside functionality when purchasing a car. This shift in priorities translates to a growing demand for stylish and visually appealing grilles. These grilles elevate the overall design of the vehicle, creating a sense of individuality and reflecting the owner's taste.

RESTRAINTS:

As fuel efficiency becomes a top concern, car manufacturers might prioritize aerodynamically efficient designs that could minimize the role of large, traditional grilles.

The Fuel efficiency is becoming a concern for car manufacturers, leading them to prioritize aerodynamically efficient designs. This focus on well-organized airflow could potentially minimize the role of large, traditional grilles. As air resistance is a major contributor to fuel consumption, car designs might evolve to reduce the size or even close off grilles altogether. This shift could pose a challenge for the traditional automotive grille market, potentially leading to a demand for smaller grilles or even entirely new grille functionalities that prioritize both aesthetics and aerodynamics.

The high cost of advanced materials like carbon fibre could limit their widespread adoption in grille construction.

OPPORTUNITIES:

Growing consumer preference for stylish vehicles opens doors for innovative and visually appealing grille designs.

Technological advancements with lightweight materials like carbon fibre offer a chance to create more fuel-efficient grilles.

CHALLENGES:

Balancing safety regulations that require impact-absorbing grilles with the need for maximum airflow for engine cooling presents a design hurdle.

The growing emphasis on aerodynamics in EVs, potentially leading to smaller or closed grilles, could disrupt traditional grille manufacturers.

The war in Russia-Ukraine has disrupted the previously optimistic outlook of the automotive grille market. Ukraine was a source of certain auto parts, and the conflict has stopped their production and export. This has caused delays in vehicle production worldwide, with estimates suggesting a shortfall of 400,000 units. This has affected the rise in the prices of car, both new and used, due to limited supply. Sanctions imposed on Russia have significantly impacted the market. Several automakers like Toyota, Ford, and BMW, have ceased exports to Russia which is leading to a decline in demand. Russia itself houses 34 auto manufacturing facilities that have suspended operations due to parts shortages and sanctions. This translates to a significant drop in grille production within Russia, further impacting the global supply chain. The immediate disruptions, of the war, have also exacerbated the ongoing chip shortage that has plagued the auto industry. Russia is a major supplier of key minerals necessary for semiconductor manufacturing and the war has disrupted the export of these materials, potentially leading to further delays in vehicle production and impacting the demand for grilles.

During the economic downturn, consumer spending typically contracts, impacting various industries, including automotive. This can directly affect the grille market in several ways. The decline in car sales translates to a decrease in demand for new grilles as past recessions have shown a drop in car sales by as much as 20%. This translates to a similar or slightly lower decrease in demand for grilles, as some replacement parts might still be needed. The economic hardship can make consumers more cautious about discretionary spending. Grilles, while often contributing to a car's aesthetics, are primarily functional. In such a scenario, consumers might prioritize essential car maintenance over grille upgrades or customizations, potentially leading to a further 5-10% decline in demand for non-essential grilles. The sales of high-end, customized grilles might be hit harder, the demand for replacement grilles for essential repairs could remain relatively stable. Thus, an economic slowdown can lead to a combined decline of 25-30% in the automotive grille market, with a potential for faster recovery as economic conditions improve.

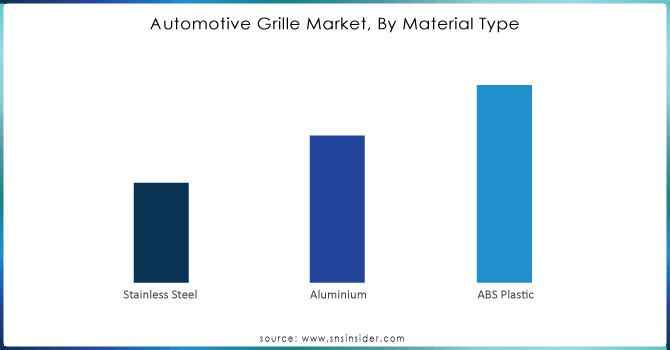

By Material Type:

Stainless Steel

Aluminium

ABS Plastic

The ABS Plastic is the dominating sub-segment in the Automotive Grille Market by material type holding around 60% of the market share. The ABS plastic offers a compelling balance of affordability, lightweight properties and design flexibility. It is simple to shape into a variety of shapes and styles, which makes it fit for many car models. ABS plastic is a cost-effective option compared to metals like aluminium and stainless steel.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Product:

CNC Automotive Grille

Billet Automotive Grille

Mesh Automotive Grille

The Mesh Automotive Grille is the dominating sub-segment in the Automotive Grille Market by product type holding around 45% of market share. Mesh grilles provide a good balance between airflow and protection for the radiator. They are also popular for their sporty and stylish appearance, catering to a large segment of car buyers. Additionally, mesh grilles are generally lighter than other options, contributing to fuel efficiency.

By Vehicle Type:

Passenger cars

LCV

HCV

Passenger Cars is the dominating sub-segment in the Automotive Grille Market by vehicle type holding around 70% of market share. The passenger car segment is the fastest-growing segment as it naturally translates to a higher demand for grilles for passenger cars compared to light commercial vehicles and heavy commercial vehicles.

By Sales Channel:

OEM

Aftermarket

The Original Equipment Manufacturer is the dominating sub-segment in the Automotive Grille Market by sales channel holding around 80% of market share. OEM grilles are factory-installed grilles that come standard with the vehicle. As car manufacturers produce the high volume of vehicles, the demand for OEM grilles significantly increases than the aftermarket segment.

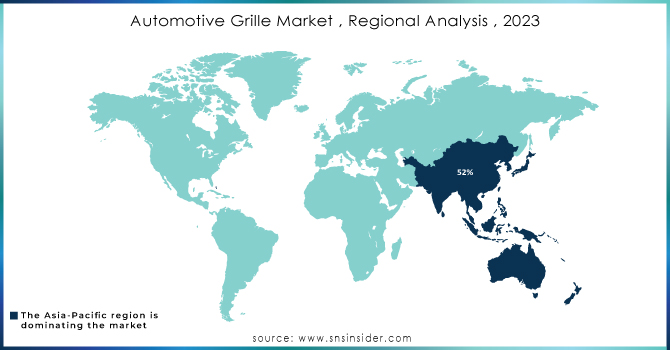

The Asia Pacific is the dominating region in the automotive grille market holding around 52% market share. This dominance is fueled by China's growing car manufacturing industry and a rising middle class with more disposable income to spend on personal vehicles, including grilles. Europe is the second highest region in this market with an estimated 20-25% of market share, leveraging its long-established automotive industry and focus on premium vehicles that often sport intricate and expensive grilles. The North America is experiencing the rapid growth of 4-5%. This can be attributed by the ongoing demand for replacing the vehicles, the popularity of the larger vehicles like pickup-trucks and SUVs and the emerging trend of electric vehicles, which could create the new opportunities for grille manufacturers.

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

The major key players are T-REX Grille (US), Putco (US), Dorman Products (US), HBPO GmbH (Germany), SRG Global (US), Magna International (Canada), Roush Performance (US), Westin Automotive Products (US), Toyoda Gosei Co, Ltd. (Japan), Kirin Auto Parts Co, Ltd (China). and other key players.

In March 2023 - Dorman Products, Inc. announced the release of 200 new motor vehicle parts, including 80 exclusive options and components specifically designed for popular electric vehicles. This expansion reinforces their commitment to offering repair solutions for all vehicle types, from gas-powered to electric.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 10.32 Billion |

| Market Size by 2032 | US$ 16.02 Billion |

| CAGR | CAGR of 5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Material Type (Aluminum, Stainless Steel, ABS Plastic) • by Product (Mesh Automotive Grille, CNC Automotive Grille, Billet Automotive Grille) • by Vehicle Type (Passenger cars, LCV, HCV) |

| Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America |

| Company Profiles | T-REX Grille (US), Putco (US), Dorman Products (US), HBPO GmbH (Germany), SRG Global (US), Magna International (Canada), Roush Performance (US), Westin Automotive Products (US), Toyoda Gosei Co, Ltd. (Japan), and Kirin Auto Parts Co, Ltd (China). |

| Key Drivers | •Improved performance is becoming more widely recognized. •The importance of aerodynamics in fuel efficiency has shifted, and it has proven to be a critical driver. |

| RESTRAINTS | •Due to the current slump in the automotive industry, the automotive grille can expect a downturn. •Premium manufacturers' production rates are being slashed on a regular basis. |

Ans:- The Automotive Grille Market was valued at USD 10.32 billion in 2023.

Ans:- The stainless-steel segment is expected to see the most significant growth.

Ans:- Asia pacific region is anticipated to be the primary driver of the market.

Ans:- Yes.

Ans:- Raw material vendors, Distributors/traders/wholesalers/suppliers, Regulatory authorities, government agencies and NGOs, Trade/Industrial associations, and End-use industries are the stakeholder of this report.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Impact Analysis

5.1 Impact of Russia-Ukraine Crisis

5.2 Impact of Economic Slowdown on Major Countries

5.2.1 Introduction

5.2.2 United States

5.2.3 Canada

5.2.4 Germany

5.2.5 France

5.2.6 UK

5.2.7 China

5.2.8 Japan

5.2.9 South Korea

5.2.10 India

6. Value Chain Analysis

7. Porter’s 5 Forces Model

8. Pest Analysis

9. Automotive Grille Market Segmentation, By Material Type

9.1 Introduction

9.2 Trend Analysis

9.3 Stainless Steel

9.4 Aluminium

9.5 ABS Plastic

10. Automotive Grille Market Segmentation, By Product

10.1 Introduction

10.2 Trend Analysis

10.3 CNC Automotive Grille

10.4 Billet Automotive Grille

10.5 Mesh Automotive Grille

11. Automotive Grille Market Segmentation, By Vehicle Type

11.1 Introduction

11.2 Trend Analysis

11.3 Passenger cars

11.4 LCV

11.5 HCV

12. Automotive Grille Market Segmentation, By Sales Channel

12.1 Introduction

12.2 Trend Analysis

12.3 OEM

12.4 Aftermarket

13. Regional Analysis

13.1 Introduction

13.2 North America

13.2.1 Trend Analysis

13.2.2 North America Automotive Grille Market Segmentation, By Country

13.2.3 North America Automotive Grille Market Segmentation, By Material Type

13.2.4 North America Automotive Grille Market Segmentation, By Product

13.2.5 North America Automotive Grille Market Segmentation, By Vehicle Type

13.2.6 North America Automotive Grille Market Segmentation, By Sales Channel

13.2.7 USA

13.2.7.1 USA Automotive Grille Market Segmentation, By Material Type

13.2.7.2 USA Automotive Grille Market Segmentation, By Product

13.2.7.3 USA Automotive Grille Market Segmentation, By Vehicle Type

13.2.7.4 USA Automotive Grille Market Segmentation, By Sales Channel

13.2.8 Canada

13.2.8.1 Canada Automotive Grille Market Segmentation, By Material Type

13.2.8.2 Canada Automotive Grille Market Segmentation, By Product

13.2.8.3 Canada Automotive Grille Market Segmentation, By Vehicle Type

13.2.8.4 Canada Automotive Grille Market Segmentation, By Sales Channel

13.2.9 Mexico

13.2.9.1 Mexico Automotive Grille Market Segmentation, By Material Type

13.2.9.2 Mexico Automotive Grille Market Segmentation, By Product

13.2.9.3 Mexico Automotive Grille Market Segmentation, By Vehicle Type

13.2.9.4 Mexico Automotive Grille Market Segmentation, By Sales Channel

13.3 Europe

13.3.1 Trend Analysis

13.3.2 Eastern Europe

13.3.2.1 Eastern Europe Automotive Grille Market Segmentation, by Country

13.3.2.2 Eastern Europe Automotive Grille Market Segmentation, By Material Type

13.3.2.3 Eastern Europe Automotive Grille Market Segmentation, By Product

13.3.2.4 Eastern Europe Automotive Grille Market Segmentation, By Vehicle Type

13.3.2.5 Eastern Europe Automotive Grille Market Segmentation, By Sales Channel

13.3.2.6 Poland

13.3.2.6.1 Poland Automotive Grille Market Segmentation, By Material Type

13.3.2.6.2 Poland Automotive Grille Market Segmentation, By Product

13.3.2.6.3 Poland Automotive Grille Market Segmentation, By Vehicle Type

13.3.2.6.4 Poland Automotive Grille Market Segmentation, By Sales Channel

13.3.2.7 Romania

13.3.2.7.1 Romania Automotive Grille Market Segmentation, By Material Type

13.3.2.7.2 Romania Automotive Grille Market Segmentation, By Product

13.3.2.7.3 Romania Automotive Grille Market Segmentation, By Vehicle Type

13.3.2.7.4 Romania Automotive Grille Market Segmentation, By Sales Channel

13.3.2.8 Hungary

13.3.2.8.1 Hungary Automotive Grille Market Segmentation, By Material Type

13.3.2.8.2 Hungary Automotive Grille Market Segmentation, By Product

13.3.2.8.3 Hungary Automotive Grille Market Segmentation, By Vehicle Type

13.3.2.8.4 Hungary Automotive Grille Market Segmentation, By Sales Channel

13.3.2.9 Turkey

13.3.2.9.1 Turkey Automotive Grille Market Segmentation, By Material Type

13.3.2.9.2 Turkey Automotive Grille Market Segmentation, By Product

13.3.2.9.3 Turkey Automotive Grille Market Segmentation, By Vehicle Type

13.3.2.9.4 Turkey Automotive Grille Market Segmentation, By Sales Channel

13.3.2.10 Rest of Eastern Europe

13.3.2.10.1 Rest of Eastern Europe Automotive Grille Market Segmentation, By Material Type

13.3.2.10.2 Rest of Eastern Europe Automotive Grille Market Segmentation, By Product

13.3.2.10.3 Rest of Eastern Europe Automotive Grille Market Segmentation, By Vehicle Type

13.3.2.10.4 Rest of Eastern Europe Automotive Grille Market Segmentation, By Sales Channel

13.3.3 Western Europe

13.3.3.1 Western Europe Automotive Grille Market Segmentation, by Country

13.3.3.2 Western Europe Automotive Grille Market Segmentation, By Material Type

13.3.3.3 Western Europe Automotive Grille Market Segmentation, By Product

13.3.3.4 Western Europe Automotive Grille Market Segmentation, By Vehicle Type

13.3.3.5 Western Europe Automotive Grille Market Segmentation, By Sales Channel

13.3.3.6 Germany

13.3.3.6.1 Germany Automotive Grille Market Segmentation, By Material Type

13.3.3.6.2 Germany Automotive Grille Market Segmentation, By Product

13.3.3.6.3 Germany Automotive Grille Market Segmentation, By Vehicle Type

13.3.3.6.4 Germany Automotive Grille Market Segmentation, By Sales Channel

13.3.3.7 France

13.3.3.7.1 France Automotive Grille Market Segmentation, By Material Type

13.3.3.7.2 France Automotive Grille Market Segmentation, By Product

13.3.3.7.3 France Automotive Grille Market Segmentation, By Vehicle Type

13.3.3.7.4 France Automotive Grille Market Segmentation, By Sales Channel

13.3.3.8 UK

13.3.3.8.1 UK Automotive Grille Market Segmentation, By Material Type

13.3.3.8.2 UK Automotive Grille Market Segmentation, By Product

13.3.3.8.3 UK Automotive Grille Market Segmentation, By Vehicle Type

13.3.3.8.4 UK Automotive Grille Market Segmentation, By Sales Channel

13.3.3.9 Italy

13.3.3.9.1 Italy Automotive Grille Market Segmentation, By Material Type

13.3.3.9.2 Italy Automotive Grille Market Segmentation, By Product

13.3.3.9.3 Italy Automotive Grille Market Segmentation, By Vehicle Type

13.3.3.9.4 Italy Automotive Grille Market Segmentation, By Sales Channel

13.3.3.10 Spain

13.3.3.10.1 Spain Automotive Grille Market Segmentation, By Material Type

13.3.3.10.2 Spain Automotive Grille Market Segmentation, By Product

13.3.3.10.3 Spain Automotive Grille Market Segmentation, By Vehicle Type

13.3.3.10.4 Spain Automotive Grille Market Segmentation, By Sales Channel

13.3.3.11 Netherlands

13.3.3.11.1 Netherlands Automotive Grille Market Segmentation, By Material Type

13.3.3.11.2 Netherlands Automotive Grille Market Segmentation, By Product

13.3.3.11.3 Netherlands Automotive Grille Market Segmentation, By Vehicle Type

13.3.3.11.4 Netherlands Automotive Grille Market Segmentation, By Sales Channel

13.3.3.12 Switzerland

13.3.3.12.1 Switzerland Automotive Grille Market Segmentation, By Material Type

13.3.3.12.2 Switzerland Automotive Grille Market Segmentation, By Product

13.3.3.12.3 Switzerland Automotive Grille Market Segmentation, By Vehicle Type

13.3.3.12.4 Switzerland Automotive Grille Market Segmentation, By Sales Channel

13.3.3.13 Austria

13.3.3.13.1 Austria Automotive Grille Market Segmentation, By Material Type

13.3.3.13.2 Austria Automotive Grille Market Segmentation, By Product

13.3.3.13.3 Austria Automotive Grille Market Segmentation, By Vehicle Type

13.3.3.13.4 Austria Automotive Grille Market Segmentation, By Sales Channel

13.3.3.14 Rest of Western Europe

13.3.3.14.1 Rest of Western Europe Automotive Grille Market Segmentation, By Material Type

13.3.3.14.2 Rest of Western Europe Automotive Grille Market Segmentation, By Product

13.3.3.14.3 Rest of Western Europe Automotive Grille Market Segmentation, By Vehicle Type

13.3.3.14.4 Rest of Western Europe Automotive Grille Market Segmentation, By Sales Channel

13.4 Asia-Pacific

13.4.1 Trend Analysis

13.4.2 Asia-Pacific Automotive Grille Market Segmentation, by Country

13.4.3 Asia-Pacific Automotive Grille Market Segmentation, By Material Type

13.4.4 Asia-Pacific Automotive Grille Market Segmentation, By Product

13.4.5 Asia-Pacific Automotive Grille Market Segmentation, By Vehicle Type

13.4.6 Asia-Pacific Automotive Grille Market Segmentation, By Sales Channel

13.4.7 China

13.4.7.1 China Automotive Grille Market Segmentation, By Material Type

13.4.7.2 China Automotive Grille Market Segmentation, By Product

13.4.7.3 China Automotive Grille Market Segmentation, By Vehicle Type

13.4.7.4 China Automotive Grille Market Segmentation, By Sales Channel

13.4.8 India

13.4.8.1 India Automotive Grille Market Segmentation, By Material Type

13.4.8.2 India Automotive Grille Market Segmentation, By Product

13.4.8.3 India Automotive Grille Market Segmentation, By Vehicle Type

13.4.8.4 India Automotive Grille Market Segmentation, By Sales Channel

13.4.9 Japan

13.4.9.1 Japan Automotive Grille Market Segmentation, By Material Type

13.4.9.2 Japan Automotive Grille Market Segmentation, By Product

13.4.9.3 Japan Automotive Grille Market Segmentation, By Vehicle Type

13.4.9.4 Japan Automotive Grille Market Segmentation, By Sales Channel

13.4.10 South Korea

13.4.10.1 South Korea Automotive Grille Market Segmentation, By Material Type

13.4.10.2 South Korea Automotive Grille Market Segmentation, By Product

13.4.10.3 South Korea Automotive Grille Market Segmentation, By Vehicle Type

13.4.10.4 South Korea Automotive Grille Market Segmentation, By Sales Channel

13.4.11 Vietnam

13.4.11.1 Vietnam Automotive Grille Market Segmentation, By Material Type

13.4.11.2 Vietnam Automotive Grille Market Segmentation, By Product

13.4.11.3 Vietnam Automotive Grille Market Segmentation, By Vehicle Type

13.4.11.4 Vietnam Automotive Grille Market Segmentation, By Sales Channel

13.4.12 Singapore

13.4.12.1 Singapore Automotive Grille Market Segmentation, By Material Type

13.4.12.2 Singapore Automotive Grille Market Segmentation, By Product

13.4.12.3 Singapore Automotive Grille Market Segmentation, By Vehicle Type

13.4.12.4 Singapore Automotive Grille Market Segmentation, By Sales Channel

13.4.13 Australia

13.4.13.1 Australia Automotive Grille Market Segmentation, By Material Type

13.4.13.2 Australia Automotive Grille Market Segmentation, By Product

13.4.13.3 Australia Automotive Grille Market Segmentation, By Vehicle Type

13.4.13.4 Australia Automotive Grille Market Segmentation, By Sales Channel

13.4.14 Rest of Asia-Pacific

13.4.14.1 Rest of Asia-Pacific Automotive Grille Market Segmentation, By Material Type

13.4.14.2 Rest of Asia-Pacific Automotive Grille Market Segmentation, By Product

13.4.14.3 Rest of Asia-Pacific Automotive Grille Market Segmentation, By Vehicle Type

13.4.14.4 Rest of Asia-Pacific Automotive Grille Market Segmentation, By Sales Channel

13.5 Middle East & Africa

13.5.1 Trend Analysis

13.5.2 Middle East

13.5.2.1 Middle East Automotive Grille Market Segmentation, by Country

13.5.2.2 Middle East Automotive Grille Market Segmentation, By Material Type

13.5.2.3 Middle East Automotive Grille Market Segmentation, By Product

13.5.2.4 Middle East Automotive Grille Market Segmentation, By Vehicle Type

13.5.2.5 Middle East Automotive Grille Market Segmentation, By Sales Channel

13.5.2.6 UAE

13.5.2.6.1 UAE Automotive Grille Market Segmentation, By Material Type

13.5.2.6.2 UAE Automotive Grille Market Segmentation, By Product

13.5.2.6.3 UAE Automotive Grille Market Segmentation, By Vehicle Type

13.5.2.6.4 UAE Automotive Grille Market Segmentation, By Sales Channel

13.5.2.7 Egypt

13.5.2.7.1 Egypt Automotive Grille Market Segmentation, By Material Type

13.5.2.7.2 Egypt Automotive Grille Market Segmentation, By Product

13.5.2.7.3 Egypt Automotive Grille Market Segmentation, By Vehicle Type

13.5.2.7.4 Egypt Automotive Grille Market Segmentation, By Sales Channel

13.5.2.8 Saudi Arabia

13.5.2.8.1 Saudi Arabia Automotive Grille Market Segmentation, By Material Type

13.5.2.8.2 Saudi Arabia Automotive Grille Market Segmentation, By Product

13.5.2.8.3 Saudi Arabia Automotive Grille Market Segmentation, By Vehicle Type

13.5.2.8.4 Saudi Arabia Automotive Grille Market Segmentation, By Sales Channel

13.5.2.9 Qatar

13.5.2.9.1 Qatar Automotive Grille Market Segmentation, By Material Type

13.5.2.9.2 Qatar Automotive Grille Market Segmentation, By Product

13.5.2.9.3 Qatar Automotive Grille Market Segmentation, By Vehicle Type

13.5.2.9.4 Qatar Automotive Grille Market Segmentation, By Sales Channel

13.5.2.10 Rest of Middle East

13.5.2.10.1 Rest of Middle East Automotive Grille Market Segmentation, By Material Type

13.5.2.10.2 Rest of Middle East Automotive Grille Market Segmentation, By Product

13.5.2.10.3 Rest of Middle East Automotive Grille Market Segmentation, By Vehicle Type

13.5.2.10.4 Rest of Middle East Automotive Grille Market Segmentation, By Sales Channel

13.5.3 Africa

13.5.3.1 Africa Automotive Grille Market Segmentation, by Country

13.5.3.2 Africa Automotive Grille Market Segmentation, By Material Type

13.5.3.3 Africa Automotive Grille Market Segmentation, By Product

13.5.3.4 Africa Automotive Grille Market Segmentation, By Vehicle Type

13.5.3.5 Africa Automotive Grille Market Segmentation, By Sales Channel

13.5.3.6 Nigeria

13.5.3.6.1 Nigeria Automotive Grille Market Segmentation, By Material Type

13.5.3.6.2 Nigeria Automotive Grille Market Segmentation, By Product

13.5.3.6.3 Nigeria Automotive Grille Market Segmentation, By Vehicle Type

13.5.3.6.4 Nigeria Automotive Grille Market Segmentation, By Sales Channel

13.5.3.7 South Africa

13.5.3.7.1 South Africa Automotive Grille Market Segmentation, By Material Type

13.5.3.7.2 South Africa Automotive Grille Market Segmentation, By Product

13.5.3.7.3 South Africa Automotive Grille Market Segmentation, By Vehicle Type

13.5.3.7.4 South Africa Automotive Grille Market Segmentation, By Sales Channel

13.5.3.8 Rest of Africa

13.5.3.8.1 Rest of Africa Automotive Grille Market Segmentation, By Material Type

13.5.3.8.2 Rest of Africa Automotive Grille Market Segmentation, By Product

13.5.3.8.3 Rest of Africa Automotive Grille Market Segmentation, By Vehicle Type

13.5.3.8.4 Rest of Africa Automotive Grille Market Segmentation, By Sales Channel

13.6 Latin America

13.6.1 Trend Analysis

13.6.2 Latin America Automotive Grille Market Segmentation, by country

13.6.3 Latin America Automotive Grille Market Segmentation, By Material Type

13.6.4 Latin America Automotive Grille Market Segmentation, By Product

13.6.5 Latin America Automotive Grille Market Segmentation, By Vehicle Type

13.6.6 Latin America Automotive Grille Market Segmentation, By Sales Channel

13.6.7 Brazil

13.6.7.1 Brazil Automotive Grille Market Segmentation, By Material Type

13.6.7.2 Brazil Automotive Grille Market Segmentation, By Product

13.6.7.3 Brazil Automotive Grille Market Segmentation, By Vehicle Type

13.6.7.4 Brazil Automotive Grille Market Segmentation, By Sales Channel

13.6.8 Argentina

13.6.8.1 Argentina Automotive Grille Market Segmentation, By Material Type

13.6.8.2 Argentina Automotive Grille Market Segmentation, By Product

13.6.8.3 Argentina Automotive Grille Market Segmentation, By Vehicle Type

13.6.8.4 Argentina Automotive Grille Market Segmentation, By Sales Channel

13.6.9 Colombia

13.6.9.1 Colombia Automotive Grille Market Segmentation, By Material Type

13.6.9.2 Colombia Automotive Grille Market Segmentation, By Product

13.6.9.3 Colombia Automotive Grille Market Segmentation, By Vehicle Type

13.6.9.4 Colombia Automotive Grille Market Segmentation, By Sales Channel

13.6.10 Rest of Latin America

13.6.10.1 Rest of Latin America Automotive Grille Market Segmentation, By Material Type

13.6.10.2 Rest of Latin America Automotive Grille Market Segmentation, By Product

13.6.10.3 Rest of Latin America Automotive Grille Market Segmentation, By Vehicle Type

13.6.10.4 Rest of Latin America Automotive Grille Market Segmentation, By Sales Channel

14. Company Profiles

14.1 T-REX Grille (US)

14.1.1 Company Overview

14.1.2 Financial

14.1.3 Products/ Services Offered

14.1.4 SWOT Analysis

14.1.5 The SNS View

14.2 Putco (US)

14.2.1 Company Overview

14.2.2 Financial

14.2.3 Products/ Services Offered

14.2.4 SWOT Analysis

14.2.5 The SNS View

14.3 Dorman Products (US)

14.3.1 Company Overview

14.3.2 Financial

14.3.3 Products/ Services Offered

14.3.4 SWOT Analysis

14.3.5 The SNS View

14.4 HBPO GmbH (Germany)

14.4.1 Company Overview

14.4.2 Financial

14.4.3 Products/ Services Offered

14.4.4 SWOT Analysis

14.4.5 The SNS View

14.5 SRG Global (US)

14.5.1 Company Overview

14.5.2 Financial

14.5.3 Products/ Services Offered

14.5.4 SWOT Analysis

14.5.5 The SNS View

14.6 Magna International (Canada)

14.6.1 Company Overview

14.6.2 Financial

14.6.3 Products/ Services Offered

14.6.4 SWOT Analysis

14.6.5 The SNS View

14.7 Roush Performance (US)

14.7.1 Company Overview

14.7.2 Financial

14.7.3 Products/ Services Offered

14.7.4 SWOT Analysis

14.7.5 The SNS View

14.8 Westin Automotive Products (US)

14.8.1 Company Overview

14.8.2 Financial

14.8.3 Products/ Services Offered

14.8.4 SWOT Analysis

14.8.5 The SNS View

14.9 Toyoda Gosei Co, Ltd. (Japan)

14.9.1 Company Overview

14.9.2 Financial

14.9.3 Products/ Services Offered

14.9.4 SWOT Analysis

14.9.5 The SNS View

14.10 Kirin Auto Parts Co, Ltd (China)

14.10.1 Company Overview

14.10.2 Financial

14.10.3 Products/ Services Offered

14.10.4 SWOT Analysis

14.10.5 The SNS View

15. Competitive Landscape

15.1 Competitive Benchmarking

15.2 Market Share Analysis

15.3 Recent Developments

15.3.1 Industry News

15.3.2 Company News

15.3.3 Mergers & Acquisitions

16. Use Case and Best Practices

17. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Automotive Electronics Sensor Aftermarket Market size was valued at USD 7680 million in 2023 and is expected to reach USD 12999.6 million by 2031 and grow at a CAGR of 6.8% over the forecast period 2024-2031.

The Industrial Vehicles Market Size was valued at USD 41.5 billion in 2023 and is expected to reach USD 61.67 billion by 2032 and grow at a CAGR of 4.5% over the forecast period 2024-2032.

The EV Composites Market size is projected to reach USD 6.45 billion by 2032, was valued at USD 1.8 billion in 2023 and will grow at a CAGR of 17.3% over the forecast period.

The Off-Road Vehicles Market Size was valued at USD 22.9 billion in 2023 and will reach to USD 37.07 billion by 2032 and grow at a CAGR of 5.5% by 2024-2032

The Automotive Electronic Expansion Valve Market size was $0.79 billion in 2023 and will reach $1.18 billion by 2031 and grow at a CAGR of 5.14% by 2031.

Automotive Pump Market was valued at USD 15.5 Billion in 2023 and is expected to reach USD 23.9 Billion by 2032, growing at a CAGR of 4.92% from 2024-2032.

Hi! Click one of our member below to chat on Phone