Get More Information on Automotive Glass Market - Request Sample Report

The Automotive Glass Market size was USD 18.12 billion in 2023 and is expected to Reach USD 43.38 billion by 2032 and grow at a CAGR of 10.20% over the forecast period of 2024-2032.

The Automotive Glass Market is undergoing a transformation driven by technological advancements and changing consumer demands for safety and aesthetics. Notably, the market has seen an increase in the adoption of laminated and tempered glass, which enhances safety by reducing shattering risks while improving thermal insulation and UV protection. In terms of vehicle safety, approximately 90% of new vehicles are equipped with advanced driver-assistance systems (ADAS), which require high-quality automotive glass to function effectively. Key features, such as heads-up displays (HUD) and integrated sensors for lane departure warnings, have led to a 25% increase in demand for specialized glass that meets stringent safety standards. This trend emphasizes the importance of high-performance glass products in modern vehicles.

|

Types of Automotive Glass |

Description |

Commercial Products |

|---|---|---|

|

Laminated Glass |

A safety glass made by sandwiching a layer of polyvinyl butyral (PVB) between two layers of glass, commonly used in windshields. |

AGC Automotive, Saint-Gobain |

|

Tempered Glass |

Glass that has been heat-treated to increase strength and shatter resistance, often used in side and rear windows. |

Pilkington, Guardian Industries |

|

Composite Glass |

A combination of materials designed to enhance strength, insulation, and impact resistance, used in various automotive applications. |

Corning Gorilla Glass, XPEL |

|

Smart Glass |

Glass with integrated technologies for variable opacity or transparency, often used in advanced driver-assistance systems (ADAS). |

Research Frontiers, AGC Automotive |

|

Coated Glass |

Glass treated with special coatings to reduce glare, improve visibility, or enhance aesthetics, used in various vehicle applications. |

Sika Corporation, Eastman Chemical Company |

|

UV-Blocking Glass |

Glass specifically designed to block harmful ultraviolet (UV) rays, protecting passengers and interior materials. |

Solera Holdings, NSG Group |

|

Acoustic Glass |

Glass engineered to reduce noise levels inside the vehicle, improving passenger comfort. |

Saint-Gobain, Pilkington |

|

Solar Control Glass |

Glass that minimizes solar heat gain and glare, improving energy efficiency in vehicles. |

Guardian Industries, SunGuard |

Additionally, automakers are focusing on reducing vehicle weight to improve fuel efficiency, with lightweight glass solutions becoming increasingly popular. Lighter glass can contribute to a reduction in vehicle weight by up to 10%, leading to fuel economy improvements of 2-5%. This shift is crucial as manufacturers face regulations aimed at reducing carbon emissions. Smart glass technologies are also on the rise, allowing glass to adjust its transparency based on external conditions. By reducing the reliance on air conditioning, these innovations can lead to energy savings of up to 20% in vehicles. As electric and hybrid vehicles continue to gain popularity, the demand for high-quality, durable glass is growing.

DRIVERS

The surge in global vehicle production, fueled by heightened consumer demand for personal and commercial vehicles, is significantly increasing the demand for automotive glass.

The increased production of vehicles worldwide is significantly influencing the demand for automotive glass, reflecting a broader trend in the automotive industry. In recent years, there has been a noticeable surge in vehicle manufacturing, with global production reaching approximately 77 million units in 2022, according to the International Organization of Motor Vehicle Manufacturers (OICA). This growth can be attributed to several factors, including an expanding middle class, urbanization, and a shift towards personal mobility solutions, which have all heightened consumer demand for both personal and commercial vehicles.

Additionally, the rise of electric vehicles (EVs) and advanced driver-assistance systems (ADAS) is further propelling the automotive glass market. EVs, which often feature larger windshields and panoramic roofs for enhanced aesthetics and functionality, require specialized glass products that contribute to improved energy efficiency and driving experience. Moreover, as vehicles become increasingly equipped with safety and connectivity features, the need for high-performance glass that supports these technologies grows. In essence, as automobile production ramps up to meet consumer needs, the corresponding demand for automotive glass continues to rise. In 2021, it was estimated that approximately 90% of new vehicles were fitted with laminated windshields, underscoring the critical role automotive glass plays in modern vehicle design and safety. This trend is expected to persist as manufacturers adapt to changing consumer preferences and technological advancements, further solidifying the link between vehicle production and the automotive glass market.

Technological advancements in automotive glass, including lightweight and shatterproof materials, improved thermal insulation, and smart glass with integrated sensors, significantly enhance vehicle safety and performance.

Technological advancements in automotive glass are revolutionizing vehicle design and safety features. Innovations like lightweight glass not only reduce the overall weight of vehicles but also contribute to improved fuel efficiency. Switching from traditional glass to lightweight alternatives can decrease vehicle weight by up to 10%, which significantly enhances fuel economy. Shatterproof glass is another critical development, designed to resist impact and prevent shattering, thereby enhancing passenger safety during collisions. In addition, these types of glass often employ laminated structures, which can absorb energy during an impact, further protecting occupants.

Another notable advancement is the introduction of smart glass, equipped with integrated sensors that can automatically adjust tint based on external light conditions. This technology not only enhances driving comfort but also plays a role in regulating cabin temperature, contributing to energy savings by reducing the reliance on air conditioning. Additionally, smart glass can provide heads-up displays that project vital information onto the windshield, allowing drivers to access navigation and safety data without diverting their attention from the road. Furthermore, improved thermal insulation properties of modern automotive glass help maintain optimal interior temperatures, enhancing passenger comfort and reducing energy consumption. For example, advanced coatings can reflect infrared rays while allowing visible light to enter, improving both aesthetics and energy efficiency.

RESTRAIN

The rise of alternative materials like plastics and composites in vehicle manufacturing may restrict the automotive glass market's growth by offering lighter, more durable, and cost-effective options for various applications.

The availability of alternative materials, particularly plastics and composites, poses a significant challenge to the automotive glass market. These materials are increasingly being utilized in vehicle manufacturing due to their lightweight properties, durability, and cost-effectiveness. Composites can offer similar structural integrity to glass while being lighter and less prone to shattering, which enhances vehicle performance and fuel efficiency. According to the research, the use of composites in the automotive sector has seen an annual growth rate of approximately 15%, driven by the push for more fuel-efficient and environmentally friendly vehicles.

Furthermore, advancements in plastic technologies have led to the development of high-performance polymers that can withstand varying temperatures and mechanical stresses, making them suitable replacements for traditional glass components. For example, polycarbonate is becoming a popular choice for windows and windshields due to its impact resistance and lightweight nature. This shift toward alternative materials is also supported by the automotive industry’s increasing focus on sustainability, as many manufacturers aim to reduce their carbon footprint by using recyclable or bio-based materials. As a result, the automotive glass market may face constraints in demand, especially in applications where weight reduction and cost are critical factors. While glass continues to hold advantages in certain areas, the growing trend toward alternative materials could hinder its market growth and necessitate innovation to remain competitive in an evolving automotive landscape.

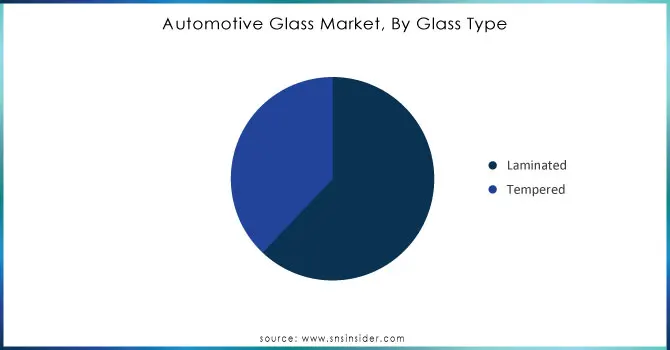

By Glass Type

In 2023, Tempered glass segment dominated the market share over 62.08%. Its popularity is attributed to several advantageous properties, including cost-effectiveness, high strength, and exceptional durability. This makes tempered glass an optimal choice for various automotive applications, particularly in windows and backlites. Its strength is a significant factor, as tempered glass is 4-5 times stronger than standard float glass, thereby enhancing vehicle safety and structural integrity. Additionally, the use of tempered glass contributes to lower manufacturing costs compared to laminated glass, allowing manufacturers to optimize production processes without compromising quality. These factors collectively underscore the growing preference for tempered glass in the automotive sector, driving innovation and development in vehicle design and safety standards.

Need Any Customization Research On Automotive Glass Market - Inquiry Now

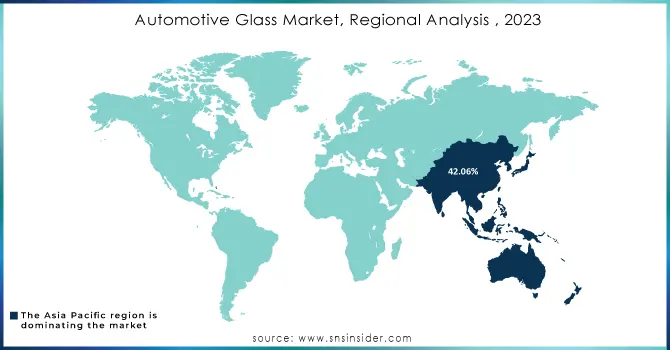

The Asia Pacific region dominated the market share by over 42.06% in 2023, driven primarily by key players like China and India. The rapid economic development in these countries has led to significant improvements in living standards and increased disposable incomes, which in turn boosts vehicle ownership. The rising preference for SUVs and premium vehicles, which require more glass due to their larger size, further propels the demand for automotive glass. In China, the government’s support for the automotive industry and investments in infrastructure have facilitated robust vehicle production, while India’s growing automotive sector is also contributing to increased glass usage.

North America is poised to be the fastest-growing region in the Automotive Glass Market, thanks to technological advancements and a focus on innovation. The early adoption of advanced glass glazing techniques by companies such as Magna International and Guardian Glass is setting a benchmark for quality and performance. These innovations not only improve vehicle aesthetics but also enhance safety and energy efficiency, making vehicles more appealing to consumers. Additionally, the region is witnessing a surge in electric vehicle production, which often incorporates advanced glass solutions for enhanced functionality and design.

Some of the major key players of Automotive Glass Market

Saint Gobain Sekurit (Automotive Laminated Glass, Tempered Glass)

Fuyao Glass Industry Group Co. Ltd (Automotive Windshields, Side and Rear Windows)

AGC Inc. (Safety Glass, Coated Glass)

Xinyi Glass Holdings Limited (Automotive Float Glass, Laminated Glass)

Nippon Sheet Glass Co. Ltd (Windscreens, Side Windows)

Magna International Inc. (Automotive Exterior Glass, Glass Encapsulation)

Guardian Glass LLC (Laminated and Tempered Glass, Glass for Electric Vehicles)

Webasto Group (Sunroofs, Roof Systems)

Corning Incorporated (Lightweight Glass, Advanced Glass Solutions)

Schott AG (Specialty Glass for Automotive Applications)

Plymouth Glass (Custom Glass Fabrication, Windows)

Sika AG (Adhesives and Sealants for Automotive Glass)

Toyota Boshoku Corporation (Automotive Interior Glass Solutions)

Toyo Glass Co. Ltd (Automotive Glass Manufacturing)

Trinseo (Polycarbonate Glass Solutions)

Aisin Seiki Co. Ltd (Automotive Door Glass and Mirrors)

Hengfeng Group (Automotive Glass and Accessories)

Hexion Inc. (Resins and Adhesives for Bonding Glass)

Koei Glass Co. Ltd (Automotive Windshields and Windows)

NSG Group (Automotive Glass Solutions, Laminated Glass)

Suppliers for manufacturing high-quality glass to developing adhesives and coatings, their contributions are essential to the automotive industry's evolution towards more sustainable and technologically advanced solutions of Automotive Glass Market:

Saint-Gobain Sekurit

AGC Inc.

Pilkington (NSG Group)

Guardian Industries

Mitsubishi Glass

Xinyi Glass Holdings Limited

Covestro AG

Sika AG

Trinseo S.A.

Fuyuan Glass

In 2024: Asahi India Glass Ltd. (AIS) is targeting a 75% market share in the passenger vehicle (PV) glass segment by FY2025, driven by the increasing demand for premium cars. The company has been expanding its production capacity and upgrading technology to meet the growing needs of luxury automakers in India.

In August 2023: Sisecam joined the ZEvRA initiative to produce low-carbon automotive glass for electric vehicles, backed by USD 0.27 million from the EU’s Horizon Europe program. Coordinated by the Fraunhofer Institute, the project supports the EU’s 2035 zero-emission target, involving 28 partners, including Skoda, Citroen, Peugeot, Toyota, and Volkswagen.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 18.12 billion |

| Market Size by 2032 | USD 43.38 billion |

| CAGR | CAGR of 10.20% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Glass Type (Laminated, Tempered) • By Application (Windshield, Sidelite, Backlite, Sunroof) • By Vehicle Type (Passenger Car, Light Commercial Vehicles, Heavy Commercial Vehicles, Electric Vehicles) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Saint Gobain Sekurit, Fuyao Glass Industry Group Co. Ltd, AGC Inc., Xinyi Glass Holdings Limited, Nippon Sheet Glass Co. Ltd, Magna International Inc., Guardian Glass LLC, Webasto Group, Corning Incorporated, Schott AG, Plymouth Glass, Sika AG, Toyota Boshoku Corporation, Toyo Glass Co. Ltd, Trinseo, Aisin Seiki Co. Ltd, Hengfeng Group, Hexion Inc., Koei Glass Co. Ltd, NSG Group. |

| Key Drivers | • The surge in global vehicle production, fueled by heightened consumer demand for personal and commercial vehicles, is significantly increasing the demand for automotive glass. • Technological advancements in automotive glass, including lightweight and shatterproof materials, improved thermal insulation, and smart glass with integrated sensors, significantly enhance vehicle safety and performance. |

| RESTRAINTS | • The rise of alternative materials like plastics and composites in vehicle manufacturing may restrict the automotive glass market's growth by offering lighter, more durable, and cost-effective options for various applications. |

Ans: The Automotive Glass Market is expected to grow at a CAGR of 10.20% during 2024-2032.

Ans: The Automotive Glass Market was USD 18.12 billion in 2023 and is expected to Reach USD 43.38 billion by 2032.

Ans: The surge in global vehicle production, fueled by heightened consumer demand for personal and commercial vehicles, is significantly increasing the demand for automotive glass.

Ans: The “Tempered glass” segment dominated the Automotive Glass Market.

Ans: Asia-Pacific dominated the Automotive Glass Market in 2023.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics

4.1 Market Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Vehicle Production and Sales Volumes, 2020-2032, by Region

5.2 Emission Standards Compliance, by region

5.3 Vehicle Technology Adoption, by region

5.4 Consumer Preferences, by region

5.5 Aftermarket Trends (Data on vehicle maintenance, parts, and services)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Automotive Glass Market Segmentation, By Glass Type

7.1 Chapter Overview

7.2 Laminated

7.2.1 Laminated Market Trends Analysis (2020-2032)

7.2.2 Laminated Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Tempered

7.3.1 Tempered Market Trends Analysis (2020-2032)

7.3.2 Tempered Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Automotive Glass Market Segmentation, By Application

8.1 Chapter Overview

8.2 Windshield

8.2.1 Windshield Market Trends Analysis (2020-2032)

8.2.2 Windshield Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Sidelite

8.3.1 Sidelite Market Trends Analysis (2020-2032)

8.3.2 Sidelite Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Backlite

8.4.1 Backlite Market Trends Analysis (2020-2032)

8.4.2 Backlite Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Sunroof

8.5.1 Sunroof Market Trends Analysis (2020-2032)

8.5.2 Sunroof Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Automotive Glass Market Segmentation, By Vehicle Type

9.1 Chapter Overview

9.2 Passenger Car

9.2.1 Passenger Car Market Trends Analysis (2020-2032)

9.2.2 Passenger Car Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Light Commercial Vehicles

9.3.1 Light Commercial Vehicles Market Trends Analysis (2020-2032)

9.3.2 Light Commercial Vehicles Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Heavy Commercial Vehicles

9.4.1 Heavy Commercial Vehicles Market Trends Analysis (2020-2032)

9.4.2 Heavy Commercial Vehicles Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Electric Vehicles

9.5.1 Electric Vehicles Market Trends Analysis (2020-2032)

9.5.2 Electric Vehicles Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Automotive Glass Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.2.4 North America Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.5 North America Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.2.6.2 USA Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.6.3 USA Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.2.7.2 Canada Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.7.3 Canada Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.2.8.2 Mexico Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.8.3 Mexico Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Automotive Glass Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.6.3 Poland Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.7.3 Romania Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Automotive Glass Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.5 Western Europe Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.6.3 Germany Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.3.2.7.2 France Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.7.3 France Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.3.2.8.2 UK Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.8.3 UK Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.9.3 Italy Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.10.3 Spain Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.13.3 Austria Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.4 Asia-Pacific

10.4.1 Trends Analysis

10.4.2 Asia-Pacific Automotive Glass Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia-Pacific Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.4.4 Asia-Pacific Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.5 Asia-Pacific Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.4.6.2 China Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.6.3 China Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.4.7.2 India Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.7.3 India Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.4.8.2 Japan Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.8.3 Japan Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.4.9.2 South Korea Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.9.3 South Korea Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.10.3 Vietnam Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.4.11.2 Singapore Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.11.3 Singapore Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.4.12.2 Australia Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.12.3 Australia Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia-Pacific Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia-Pacific Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Automotive Glass Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.5.1.4 Middle East Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.5 Middle East Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.6.3 UAE Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Automotive Glass Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.5.2.4 Africa Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.5 Africa Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Automotive Glass Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.6.4 Latin America Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.5 Latin America Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.6.6.2 Brazil Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.6.3 Brazil Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.6.7.2 Argentina Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.7.3 Argentina Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.6.8.2 Colombia Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.8.3 Colombia Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Automotive Glass Market Estimates and Forecasts, By Glass Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Automotive Glass Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Automotive Glass Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11. Company Profiles

11.1 Webasto Group

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Corning Incorporated

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Xinyi Glass Holdings Limited

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Schott AG

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Guardian Glass LLC

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Nippon Sheet Glass Co. Ltd

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Magna International Inc.

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 AGC Inc.

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Saint Gobain Sekurit

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Fuyao Glass Industry Group Co. Ltd

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Glass Type

Laminated

Tempered

By Application

Windshield

Sidelite

Backlite

Sunroof

By Vehicle Type

Passenger Car

Light Commercial Vehicles

Heavy Commercial Vehicles

Electric Vehicles

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Electric Vehicle Connector Market Size was recorded at USD 2.08 billion in 2023 and is expected to reach USD 17.8 billion by 2032, growing at a CAGR of 27% over the forecast period 2024-2032.

The Automotive Battery Management System Market Size was valued at USD 5.27 Billion in 2023 and is expected to reach USD 21.24 Billion by 2032 growing at a CAGR of 16.78% over the forecast period 2024-2032.

The Automotive Electronic Expansion Valve Market size was $0.79 billion in 2023 and will reach $1.18 billion by 2031 and grow at a CAGR of 5.14% by 2031.

The Ventilated Seats Market Size was valued at USD 9 billion in 2023 and is expected to reach USD 14.57 billion by 2032 and grow at a CAGR of 5.5% over the forecast period 2024-2032.

The Truck Rental Market Size was valued at $125.50 billion in 2023 and is expected to reach $218.87 billion by 2031 and grow at a CAGR of 7.2% by 2024-2031

The Automotive Brake Valve Market size was valued at USD 12.59 billion in 2023 and is expected to reach USD 20.07 billion by 2031 and grow at a CAGR of 6% over the forecast period 2024-2031.

Hi! Click one of our member below to chat on Phone