Automotive Fender Market Report Scope & Overview:

Get More Information on Automotive Fender Market - Request Sample Report

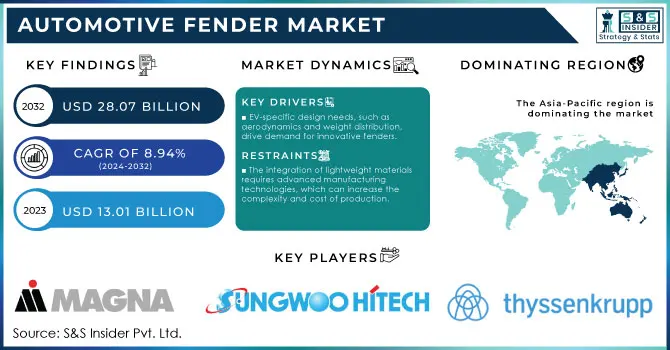

The Automotive Fender Market Size was valued at USD 13.01 billion in 2023 and is expected to reach USD 28.07 Billion by 2032, growing at a CAGR of 8.94% from 2024-2032.

The automotive fender market is set for significant growth, driven by increasing global vehicle production, technological advancements in automotive design, and a rising demand for durable, lightweight materials. Modern fenders play a crucial role in protecting vehicle components and reducing debris impact. Today, fenders are being produced using advanced materials like aluminum and thermoplastics, which not only lower vehicle weight-thereby improving fuel efficiency-but also offer high corrosion resistance, which extends vehicle lifespan. Additionally, the shift towards electric vehicles (EVs) and heightened fuel efficiency standards, influenced by strict environmental regulations, further fuel this market growth.

This trend towards lighter, more sustainable materials has gained substantial traction. In 2023, various U.S. and European automotive manufacturers started adopting high-performance thermoplastic fenders, reducing vehicle weight by as much as 15% and enhancing fuel economy. This shift aligns with a 3% rise in global vehicle production reported by the International Organization of Motor Vehicle Manufacturers (OICA) in 2023, which underscores the robust demand for automotive fender components.

The rapid growth of the EV sector also plays a significant role in fender market expansion. Global EV sales surged by nearly 60% in 2023, intensifying demand for fenders designed to meet EV-specific requirements such as enhanced aerodynamics and efficient weight distribution. Companies like Tesla are pioneering fender designs that reduce drag, a key factor in extending EV battery life, indicating the evolving role of fenders as automakers increasingly embrace electric models.

In summary, the automotive fender market is poised for ongoing growth, spurred by rising EV adoption, material innovations, and global increases in vehicle production. The need for fuel-efficient, lightweight fenders will continue to shape manufacturing trends, setting the stage for the market’s future expansion.

Automotive Fender Market Dynamics

Drivers

-

EV-specific design needs, such as aerodynamics and weight distribution, drive demand for innovative fenders.

-

Emphasis on fuel-efficient designs due to regulatory pressures increases demand for lighter, eco-friendly materials.

-

Use of aluminum and thermoplastics reduces vehicle weight, enhancing fuel efficiency.

The increasing adoption of lightweight materials-aluminium and thermoplastics, in particular-offers solutions for achieving changing requirements on fuel efficiency, durability and environmental requirements will create significant transformation opportunities through the traditional automotive fender industry. Aluminium is around 30 per cent lighter than conventional steel in terms of strength-to-weight ratio, and contributes to overall lightening, thereby improving fuel economy and reduces emission. The weight savings are critical for carmakers who are forced to comply with regulations from organizations such as the U.S. Environmental Protection Agency (EPA), and its European counterparts have carbon dioxide targets for 2025. For instance, Ford F-150 is an aluminum-intensive vehicle that shows how weight reduction can save fuel and also reduce carbon emissions.

More manufacturers are also coming to prefer the use of some thermoplastics like polypropylene and polycarbonate for fenders, since they tend to have great impact resistance, strong durability against corrosion, and interesting design versatility. Such materials are less expensive than metals and offer other advantages like low maintenance cost. In addition to the reduction of costs through production technology, fenders are now affordable for manufacturers due to the availability of high-quality thermoplastic materials. Lightweight materials provide some of their most significant benefits to electric vehicle (EV) market segments such that reduced weight not only translates into enhanced battery range but also improved vehicle performance and efficiency. As global EV sales have risen almost 60% in 2023, there is a growing need for lightweight solutions to improve the performance and efficiency of fenders.

Together, these innovations in advanced materials science are driving the automotive fender market forward and ensuring that traditional combustion-powered vehicles and electric vehicles alike can abide by rigorous environmental regulations without sacrificing widely sought after commercial values such as efficiency, sustainability and performance.

|

Advantage |

Impact on Fender Manufacturing |

|---|---|

|

Fuel Efficiency |

Lowers vehicle weight, leading to better mileage. |

|

Corrosion Resistance |

Extends fender and vehicle lifespan, lowering maintenance. |

|

Increased EV Range |

Reduces energy consumption, extending battery life in EVs. |

|

Enhanced Design Flexibility |

Allows for complex shapes without added weight. |

Restraints

-

The integration of lightweight materials requires advanced manufacturing technologies, which can increase the complexity and cost of production.

-

Whilght materials offer benefits, some, particularly certain thermoplastics, may not offer the same long-term durability as traditional metals.

Thermoplastics have made a mark in automotive fender market by manufacturing lightweight components that help in reducing the vehicle weight, thereby improving overall fuel efficiency. Of course, there are durability concerns with some kind of thermoplastics over traditional metals like steel and aluminum. Thermoplastics provide a number of advantages, including design flexibility, corrosion resistance, and low cost; however, they may experience deterioration over time due to environmental factors such as UV radiation (which are commonly used in all regions), high temperatures and chemical exposure. This degradation causes cracking, discoloration or wear and tear which can mean the need for more frequent repairs or replacements than will ever be needed for metals.

However, with their superior strength and impact resistance, metals like aluminum and steel can be heavier. These characteristics are what makes them more suitable for automotive components that have to last longer than they experience higher stress levels. Fenders are an example-it helps to have metals where they make contact with road debris, weather extremes, and unintentional damage. Hence why automakers are reluctant to go all-in on thermoplastics over metals, particularly in applications where performance and durability is a must.

Though asphalt technology has evolved to yield more durable thermoplastics, the automotive fender industry is a tough nut to break in regard to finding weight-allied yet long-lasting reliability. All in all, thermoplastics are a clear win when it comes to saving weight and building savings, but their finite endurance under realistic conditions continues to be the limiting factor for mass application-especially for fenders on vehicles needing high long-term durability.

Automotive Fender Market Segmentation Overview

By Vehicle Type

Passenger car segment leads the automotive fender market due to strong consumer technology demand for balance of safety and performance as well as fuel efficiency. This sector is a big deal for new lightweight designs that centre around high-mileage, low-polluting vehicles. Furthermore, increasing penetration of electric and hybrid cars which demand for lighter-weight components including aluminium as well as thermoplastics for fender applications. With ever more stringent global environmental regulations that make green components a requirement in the automotive space, advanced materials usage continues as automakers work to hit emissions standards while simultaneously shedding vehicle weight. This trend has proven to be long-lasting, as passenger cars will continue to play a vital role in the market development with consumers focusing more on sustainable and cost-efficient choices.

The commercial vehicle segment is expected to grow at the highest CAGR in the automotive fender market. This demand is fuelled by an upsurge in the requirement of transportation as well as a growing logistics sector which requires more trucks & buses. With the industry intent on improving fuel economy and reducing weight, lightweight materials such as aluminum and composites are becoming increasingly important fender components for commercial vehicles. These materials not only become home to better fuel economy but also help reduce wear and tear during the vehicle lifecycle, thus extending it. Heavy-duty vehicle electrification is also driving demand for lightweight materials to maximize vehicle performance. The commercial vehicle segment is projected to continue making gains with the global growth of infrastructure development and e-commerce.

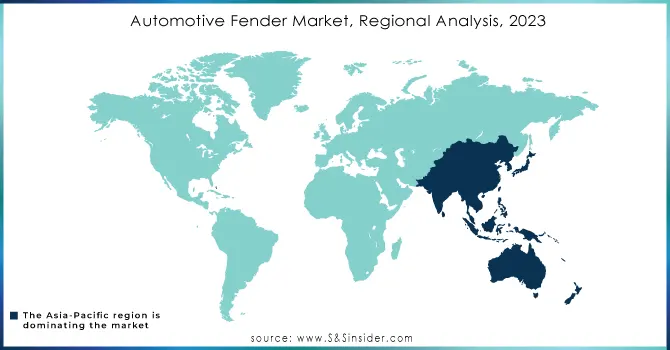

Automotive Fender Market Regional Analysis

The Asia-Pacific dominated the market and represented significant revenue share in 2023, driven primarily by its hub position in terms of vehicle manufacturing and high demand for passenger as well as commercial vehicles. Market growth in this region is driven by rapid industrialization, urbanization, and growing demand for affordable conventional vehicles. Fender production is increasingly using materials such as aluminum and thermoplastics, as demand for electric and hybrid vehicles continues to grow. As a result, broader auto fender installations will continue to grow within Asia — with particular advances in China, Japan and India as nations spend billions on costly systems that satisfy environmental limit necessities and quality control under very tough guidelines. For instance, In 2023, China’s automotive market saw a 5% rise in vehicle sales, boosting demand for high-quality, cost-effective fenders suitable for mass production. Meanwhile, European manufacturers are prioritizing sustainable, lightweight materials, further driving fender demand across the region.

The North America can experience highest CAGR for automotive fender where demand is being driven by high-performance vehicle (trucks and utility vehicles). Innovation in fender technology is being fuelled by stricter safety regulations. This market is driven by increasing demand for lightweight materials like aluminum and composites, which help enhance fuel economy while also complying with environmental regulations. In addition, the revival of innovations and expansion of automotive fender market in North America can be attributed to intelligent technology implementation in vehicles.

Need Any Customization Research On Automotive Fender Market - Inquiry Now

Key Players in Automotive Fender Market

The major key players are

-

Magna International – Light-Weight Plastic Fender

-

Sungwoo Hitech – Plastic Fender for Electric Vehicles (EVs)

-

Thyssenkrupp – Steel Fender Components

-

Continental AG – Plastic Fender for Automotive Applications

-

Faurecia – Lightweight Aluminum Fender

-

Lear Corporation – Composite Fender for EVs

-

Tata AutoComp Systems – Polypropylene Fender

-

Gestamp – Aluminum Automotive Fender

-

Seoyon E-Hwa – Injection Molded Plastic Fender

-

Mitsubishi Electric – Hybrid Plastic Fender for Commercial Vehicles

-

BASF – High-performance Composite Fender

-

Plastic Omnium – Thermoplastic Fender for Hybrid Vehicles

-

Aisin Seiki – Aluminum Fender for Lightweight Vehicles

-

Valeo – Polycarbonate Fender for EVs

-

Kautex Textron – Polymer Fender

-

Jinzhou Halla Electrical Equipment – Electric Vehicle Fender Components

-

Magna Steyr – Lightweight Composite Fender for EVs

-

Sodecar – Plastic Fender for Heavy-Duty Vehicles

-

Kurt Manufacturing – High-Durability Steel Fender

-

Dana Incorporated – Aluminum Fender with Improved Corrosion Resistance

Recent Developments

Magna International announced a major development in March 2024 with the launch of a new series of high-performance fenders designed using advanced lightweight composites. This innovation aims to meet the increasing demand for fuel-efficient, environmentally friendly vehicles.

Sungwoo Hitech, in April 2024, unveiled an advanced plastic fender solution designed for electric vehicles (EVs). This product is tailored to offer enhanced durability and reduced weight, addressing the growing need for sustainable materials in the automotive sector.

Thyssenkrupp continued to advance its efforts in March 2024 by introducing new fender components for commercial vehicles, focusing on materials that provide better corrosion resistance and improved safety features. Their latest product line aligns with stricter environmental and safety regulations.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 13.01 Billion |

| Market Size by 2032 | USD 28.07 Billion |

| CAGR | CAGR of 8.94% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vehicle Type (Passenger Car, Commercial Vehicle) • By Product Type (Metallic, Non-Metallic) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Magna International, Sungwoo Hitech, Thyssenkrupp, Continental AG, Faurecia, Lear Corporation, Tata AutoComp Systems, Gestamp, Seoyon E-Hwa, Mitsubishi Electric, BASF, Plastic Omnium, Aisin Seiki, Valeo |

| Key Drivers | • EV-specific design needs, such as aerodynamics and weight distribution, drive demand for innovative fenders. • Emphasis on fuel-efficient designs due to regulatory pressures increases demand for lighter, eco-friendly materials. |

| RESTRAINTS | • The integration of lightweight materials requires advanced manufacturing technologies, which can increase the complexity and cost of production. • Whilght materials offer benefits, some, particularly certain thermoplastics, may not offer the same long-term durability as traditional metals. |