To Get More Information on Automotive Engineering Services Market - Request Sample Report

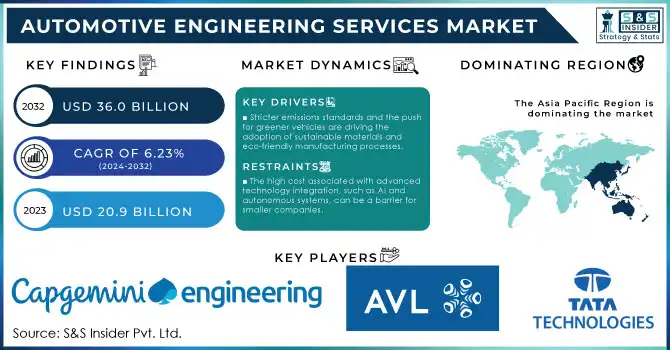

The Automotive Engineering Services Market size was valued at USD 20.9 billion in 2023 and is expected to reach USD 36.0 Billion by 2032, with a growing CAGR of 6.23% from 2024-2032.

The automotive engineering services market has been growing with robust speed and is catalyzed by the demand for innovative, and sustainable automotive solutions over the years. The main factors driving it are electric vehicle (EV) emergence, autonomous driving tech and connected car systems, which are increasingly making their way into our lives. In this respect, the EV market is driving demand for engineering services such as battery development, lightweight materials and energy-efficient systems. With a growing number of companies investing heavily in EV platforms, flush with advancements that involve state-of-the-art technology—like AI, machine learning, and 5G connectivity—that engineering demand increases exponentially. More than 14 million EVs were sold across the globe in 2023, indicative of the fast-paced growth of electric mobility and engineering services enabling the effective design and manufacturing of such vehicles.

Apart from electrification, the automotive engineering services market will be propelled by surging demand for autonomous vehicles. Corporations have directed their attention towards improved vehicle performance and safety via innovative driver-assistance systems (ADAS). The shift towards emission reduction and compliance with stringent environmental legislations is driving the innovation into lightweight materials and sustainable product processes, which are likely to present new opportunities for growth in areas like material science, crash safety testing and emission control.

Therefore, the combination of vehicle connectivity, smart manufacturing, and digital engineering tools like simulation, prototyping, and virtual testing is essential. All these developments facilitate designing, engineering, manufacturing, and testing of the vehicle, empowering companies to deliver on changing consumer demands. In addition, the shift toward further digitization in the automotive sector, along with regulatory mandates to produce cleaner, safer and more efficient vehicles, continues to drive demand for engineering services.

Coupled with investments by companies in smart manufacturing and next-gen technologies, this will keep the automotive engineering services market on a positive growth trajectory. Consequently, the market will remain robust, as other opportunities will emerge in developing technologies, such as 5G integration of cars, smart infrastructure, and next-generation autonomous driving systems.

Drivers

Stricter emissions standards and the push for greener vehicles are driving the adoption of sustainable materials and eco-friendly manufacturing processes.

The rise of connected vehicles is boosting demand for digital engineering services, such as simulation, prototyping, and software integration.

The rise of connected vehicles is boosting demand for digital engineering services, such as simulation, prototyping, and software integration.

Digital Engineering services, among others, are witnessing a rapid surge in demand in the automotive engineering sector owing to advances in technologies such as 5G, IoT, and AI finding their way into vehicles. When vehicles become more connected than ever, ensuring that functionality, safety, and communication across software stacks is seamless requires engineering specialization. The connected vehicle trend has increased the demand for services like simulation, prototyping, and software integration to optimize the development of connected vehicles. Simulation technologies are also an important part of development, allowing manufacturers to test and develop how individual functions should work without having to run physical prototypes, which helps avoid expensive production mistakes.

The process is also supported through prototyping which can create prototypes of vehicle physical components for more accurate validation, prove beneficial in refining designs, reduce costs and accelerate time to market for new models. Given the growing complexity of in-vehicle systems, in particular due to the nature of some autonomous driving features and over-the-air software updates, software integration is also important to ensure that systems are able to work together seamlessly. Also, with the amount of data generated by connected vehicles on the rise as well, this increased need for cybersecurity and data analytics will further increase demand for engineers to help manage and protect that data as well. Automatic vehicle engineering services market is growing rapidly to connected vehicle is plays an important factor for the growth of the market. Digital engineering services can be vital for designing and optimizing these complex systems to enable connected, autonomous, and data-driven vehicles to be developed more effectively and safely.

Restraints

The high cost associated with advanced technology integration, such as AI and autonomous systems, can be a barrier for smaller companies.

There is a growing need for engineers with expertise in advanced technologies, but the shortage of skilled professionals limits the market's potential.

There is a growing need for engineers with expertise in advanced technologies, but the shortage of skilled professionals limits the market's potential.

A major challenge for this market is the lack of skilled personnel, particularly those skilled in advanced technologies like artificial intelligence (AI) and machine learning (ML), and autonomous systems. About EV requirements as the automotive industry transforms to support electric vehicles (EVs), connected cars, and autonomous driving technologies, the need for engineers with specialized skills has skyrocketed. Even so, industry transformation has outpaced the growth of talent pools and talent — which, if unaddressed, risks stalling the sector’s growth potential.

There is an acute shortage in the domain of things such as autonomous vehicle systems, battery development for EVs, and software integration, all of which require engineers with specialized skill sets and knowledge that sits across various disciplines. As indicated in the latest industry reports, engineers working in software development, data analytics, and cybersecurity and system integration are increasingly in demand. But there just aren't enough people with the right skills to meet the needs of increasingly ambitious automotive companies that are scrambling to innovate and get new technologies ready for sale.

The OEMs will then have a multi-layered R&D division, unlocking billions worth of value but creating a risk where the shortage of engineers can create a bottleneck in product development. This is particularly impacting engineering service providers where the lack of attraction and retention of talent, can lead to delays, cost escalations and inefficiencies. In addition, as the complexity of vehicle systems grows, the automotive engineering services market needs people with advanced software and data science skills, as well as integration capabilities with AI.

This, in turn, has led to many companies either training and upskilling existing engineers or working with educational institutions to address the skills gap. Nevertheless, this gap will continue to be a major impediment to the automotive engineering services market, as shortage of qualified workforce will provide near-term restraints to the growth of automotive engineering services market.

By Type

The mechanical segment dominated the automotive engineering services market and represented significant revenue share in 2023. The automotive industry is increasingly competitive and requires prototyping in mechanical manufacturing so as to achieve accurate manufacturing results and turnaround times that save on costs in the end. The mechanical segment has been continually growing as an increasing propensity of customers to avail of convenience will lead OEMs to continue to focus on innovation by investing in the methods of production.

The software segment is growing rapidly at the highest CAGR in the market. The bulk of this demand is attributed to the increasing common usage of software applications in vehicles. The changing landscape of the automotive industry, specifically, the rise of connected car services, has also greatly increased the need for a software engineering workforce. Moreover, the embedded systems segment has seen massive growth as modern vehicles demand more features, which leads to increased complexity and connectivity.

By Location

In 2023, the in-house segment accounted for the largest share of automotive engineering service provider overall market, as most of the complex automotive engineering services such as powertrain design and engine and transmission systems are preferred to be like to be developed inside the hub of major Original Equipment Manufacturer (OEMs), as these designs and optimizations are log-in-dependent and require various methods and specialization that can be carried out within the hub for optimum results. It can also maintain the secrecy of design specifications. This also includes data security for technological advancements and automotive designs, which also makes market dominance.

Due to increasing focus from the leading companies to outsource its designs and commercial projects to reduce the overall costing, the outsource segment is expected to grow at the highest growth rate. Moreover a company with minimum capital investment will tend to opt for outsourcing with the immediate delivery of solution and products without such high capital investment.

Asia Pacific hold the largest and fastest growing global automotive engineering services market share in 2023 and throughout the forecast period. Some leading automotive OEMs find availability of labor in the Asian region (India & China) and outsource production and other operations there. Thus, automotive ESO service providers are channelling their focus. India provides a cost advantage of 15-26%. India has opened up a highly competitive market to global OEMs, serving a plethora of global segments. Stringent emission regulations globally have seen Auto OEMs like Kia, BYD, MG entering the Indian market. Initiatives like FAME, Make in India, and NATRIP provide further impetus to manufacturing plants, infrastructure projects, and acceptance of EVs in the region. The manufacturing is also encouraged through the number incentives and subsidies given by Central and State governments. Asia pacific market is expected to have a steady CAGR growth and is expected to dominate the market share led by China, Japan, India, and South Korea.

Europe is expected to become the second fastest-growing region during the forecast period. However, the automotive comfort market may experience slower growth due to the high costs associated with driver comfort features and the increasing demand for autonomous vehicles. On the other hand, North America and the Rest of the World (RoW), including the Middle East, are expected to see growth driven by the rise in new electric vehicle (EV) sales in these regions.

Do You Need any Customization Research on Automotive Engineering Services Market - Inquire Now

The major key players are

Tata Technologies – ProConnect Automotive Suite

AVL List GmbH – AVL Powertrain Engineering Solutions

Capgemini Engineering – Autonomous Driving Solutions

Altran (Capgemini) – ADAS and Electric Vehicle Development Solutions

Continental AG – ContiSense Tire Pressure Monitoring System

Magna International – Magna e-Drive Systems

BASF – BASF Lightweight Materials

Ficosa International – Ficosa Rear-View Camera System

Bentley Systems – OpenRoads for Vehicle Infrastructure Design

Roush Enterprises – Roush Mustang Performance Packages

Ricardo plc – Ricardo E4C Electric Powertrain

Daimler AG – Mercedes-Benz EQ Electric Vehicles

Harman International (Samsung Electronics) – Harman Kardon Automotive Audio Systems

Bosch Engineering GmbH – Bosch Vehicle Control Systems

Hella GmbH & Co. KGaA – Hella Adaptive Headlights

ZF Friedrichshafen AG – ZF Electric Drive Axle

Honda R&D Co. Ltd. – Honda e Electric Car

Mitsubishi Electric – Mitsubishi Electric Automotive Controllers

Siemens Digital Industries Software – Simcenter 3D for Automotive Design

EDAG Engineering GmbH – EDAG CityBot Electric Vehicle Concept

March 2024 - Bosch showcased new safety and driver assistance systems, leveraging artificial intelligence (AI) and machine learning for enhanced vehicle autonomy

February 2024 - Magna introduced advancements in electric vehicle (EV) powertrain systems, focusing on efficiency improvements and integration with autonomous driving technologies.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 20.9 Billion |

| Market Size by 2032 | USD 36.0 Billion |

| CAGR | CAGR of 6.23% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Body Engineering, Chassis Engineering, Powertrain Engineering, Safety Systems, Infotainment Systems, Others) • By Type (Mechanical, Embedded, Software • By Location (In-house, Outsource) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Tata Technologies, AVL List GmbH, Capgemini Engineering, Altran (Capgemini), Continental AG, Magna International, BASF, Ficosa International, Bentley Systems, Roush Enterprises, Ricardo plc, Daimler AG, Harman International (Samsung Electronics) |

| Key Drivers | • Stricter emissions standards and the push for greener vehicles are driving the adoption of sustainable materials and eco-friendly manufacturing processes. • The rise of connected vehicles is boosting demand for digital engineering services, such as simulation, prototyping, and software integration. |

| Restraints | • The high cost associated with advanced technology integration, such as AI and autonomous systems, can be a barrier for smaller companies. • There is a growing need for engineers with expertise in advanced technologies, but the shortage of skilled professionals limits the market's potential. |

Ans- On-board Connectivity Market was valued at USD 10.01 billion in 2023 and is expected to reach USD 27.67 Billion by 2032, growing at a CAGR of 11.97% from 2024-2032.

Ans- the CAGR of Automotive Engineering Services Market during the forecast period is of 11.97% from 2024-2032.

Ans- The North America dominated the market and represented significant revenue share in 2023

Ans- one main growth factor for the On-board Connectivity Market is

Ans- Challenges in Automotive Engineering Services Market are

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Vehicle Production and Sales Volumes, 2020-2032, by Region

5.2 Emission Standards Compliance, by Region

5.3 Vehicle Technology Adoption, by Region

5.4 Consumer Preferences, by Region

5.6 Aftermarket Trends (Data on vehicle maintenance, parts, and services)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Automotive Engineering Services Market Segmentation, By Application

7.1 Chapter Overview

7.2 Body Engineering

7.2.1 Body Engineering Market Trends Analysis (2020-2032)

7.2.2 Body Engineering Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Chassis Engineering

7.3.1 Chassis Engineering Market Trends Analysis (2020-2032)

7.3.2 Chassis Engineering Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Powertrain Engineering

7.4.1 Powertrain Engineering Market Trends Analysis (2020-2032)

7.4.2 Powertrain Engineering Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Safety Systems

7.5.1 Safety Systems Market Trends Analysis (2020-2032)

7.5.2 Safety Systems Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Infotainment Systems

7.6.1 Infotainment Systems Market Trends Analysis (2020-2032)

7.6.2 Infotainment Systems Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 Others

7.7.1 OthersMarket Trends Analysis (2020-2032)

7.7.2 OthersMarket Size Estimates and Forecasts to 2032 (USD Billion)

8. Automotive Engineering Services Market Segmentation, by Type

8.1 Chapter Overview

8.2 Mechanical

8.2.1 Mechanical Market Trends Analysis (2020-2032)

8.2.2 Mechanical Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Embedded

8.3.1 Embedded Market Trends Analysis (2020-2032)

8.3.2 Embedded Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Software

8.4.1 Software Market Trends Analysis (2020-2032)

8.4.2 Software Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Automotive Engineering Services Market Segmentation, by Location

9.1 Chapter Overview

9.2 In-house

9.2.1 In-house Market Trends Analysis (2020-2032)

9.2.2 In-house Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Outsource

9.3.1 Outsource Market Trends Analysis (2020-2032)

9.3.2 Outsource Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Automotive Engineering Services Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.2.4 North America Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.5 North America Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.2.6.2 USA Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.6.3 USA Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.2.7.2 Canada Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.7.3 Canada Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.2.8.2 Mexico Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.8.3 Mexico Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Automotive Engineering Services Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.3.1.6.2 Poland Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.6.3 Poland Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.3.1.7.2 Romania Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.7.3 Romania Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Automotive Engineering Services Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.3.2.4 Western Europe Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.5 Western Europe Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.3.2.6.2 Germany Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.6.3 Germany Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.3.2.7.2 France Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.7.3 France Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.3.2.8.2 UK Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.8.3 UK Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.3.2.9.2 Italy Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.9.3 Italy Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.3.2.10.2 Spain Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.10.3 Spain Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.3.2.13.2 Austria Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.13.3 Austria Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Automotive Engineering Services Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.4.4 Asia Pacific Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.5 Asia Pacific Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.4.6.2 China Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.6.3 China Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.4.7.2 India Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.7.3 India Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.4.8.2 Japan Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.8.3 Japan Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.4.9.2 South Korea Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.9.3 South Korea Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.4.10.2 Vietnam Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.10.3 Vietnam Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.4.11.2 Singapore Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.11.3 Singapore Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.4.12.2 Australia Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.12.3 Australia Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Automotive Engineering Services Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.5.1.4 Middle East Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.5 Middle East Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.5.1.6.2 UAE Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.6.3 UAE Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Automotive Engineering Services Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.5.2.4 Africa Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.5 Africa Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Automotive Engineering Services Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.6.4 Latin America Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.5 Latin America Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.6.6.2 Brazil Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.6.3 Brazil Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.6.7.2 Argentina Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.7.3 Argentina Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.6.8.2 Colombia Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.8.3 Colombia Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Automotive Engineering Services Market Estimates and Forecasts, Application (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Automotive Engineering Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Automotive Engineering Services Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

11. Company Profiles

11.1 Tata Technologies

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 AVL List GmbH

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Capgemini Engineering

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Altran (Capgemini)

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Continental AG

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Magna International

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 BASF

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Ficosa International

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Bentley Systems

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Roush Enterprises

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Application

Body Engineering

Chassis Engineering

Powertrain Engineering

Safety Systems

Infotainment Systems

Others

By Type

Mechanical

Embedded

Software

By Location

In-house

Outsource

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Automotive Wiring Harness Market size is projected to reach USD 72.03 billion by 2032 and was valued at USD 51.05 billion in 2023. The estimated CAGR for 2024-2032 is 3.9%.

All-Terrain Vehicle (ATV) Engines Market Size was valued at USD 4.46 billion in 2023 and is expected to reach USD 5.87 billion by 2032 and grow at a CAGR of 3.1% over the forecast period 2024-2032.

The Automotive Electronic Expansion Valve Market size was $0.79 billion in 2023 and will reach $1.18 billion by 2031 and grow at a CAGR of 5.14% by 2031.

The Automotive Electronics Market was size was recorded at USD 260.25 Billion in 2023 and has been estimated to reach USD 503.53 Billion by 2032. The expected CAGR is 8.6% over the forecast period of 2024-2032.

The Automotive Center Stack Market is expected to grow at a CAGR of 6.8% over the forecast period of 2023-2030.

The Connected Car Market size was valued at USD 10.80 billion in 2023 and will reach USD 32.87 billion by 2032, growing at a CAGR of 11.74% by of 2024-2032

Hi! Click one of our member below to chat on Phone