Get more Information on Automotive Engineering Service Provider Market - Request Sample Report

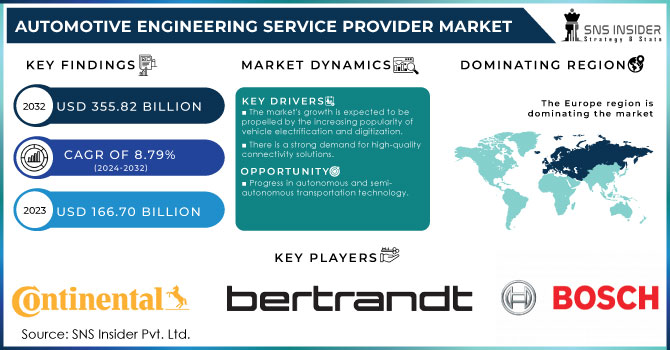

The Automotive Engineering Service Provider Market size was valued at USD 166.70 billion in 2023 and is expected to reach USD 355.82 billion by 2032 and grow at a CAGR of 8.79% over the forecast period 2024-2032.

The Automotive Engineering Service Provider (ESP) market is experiencing major changes due to various important trends. Increasing interest in electric vehicles (EVs) is creating chances for ESPs who specialize in battery technology, powertrain design, and lightweight material integration. Efforts by the government, such as China's significant funding for EV charging infrastructure and the US's backing of domestic battery manufacturing, are helping to speed up this transition even more. An example of this is the U.S. announcing a USD 3.1 billion investment plan for domestic battery production. Stricter global emission regulations are leading to a rising need for ESPs who are skilled in enhancing internal combustion engines (ICE) and creating cleaner technologies such as hybrids.

Additionally, the rise of the autonomous vehicle (AV) industry is leading to a demand for ESPs who specialize in sensor fusion, LiDAR integration, and path planning. This offers a profitable opportunity for ESPs with these skills. In order to succeed in this changing environment, ESPs need to consistently improve their abilities and dedicate substantial resources to research and development (R&D). Being able to adapt and innovate in the rapidly changing automotive industry is essential for taking advantage of the opportunities available in this fast-paced market.

The market's growth is expected to be propelled by the increasing popularity of vehicle electrification and digitization.

There is a strong demand for high-quality connectivity solutions.

Automotive innovation is accelerating with the progression of technology.

Enhancing power density and reducing power consumption.

Effective lightweight material design and aerodynamic optimization are becoming more and more important in reducing a vehicle's energy use. Government incentives like India's FAME II program offer subsidies for energy-efficient electric two-wheelers, encouraging the market to move in that direction. Automotive engineering service providers will have a crucial role in shaping a future where electric vehicles have increased range and exceptional efficiency by considering both aspects of the equation.

Progress in autonomous and semi-autonomous transportation technology.

There is plenty of space for this market to expand with the economy getting better.

The possibility for this business is great with the implementation of standardized safety features.

The future of the AESP market is closely tied to the increasing use of standardized safety features in the automotive sector. As governments around the world focus on road safety, the adoption of rules requiring advanced safety technologies like Automatic Emergency Braking (AEB) and Electronic Stability Control (ESC) is becoming more widespread. The General Safety Regulation of the European Union is a clear example of this pattern, with estimates suggesting that more than 25,000 lives could be saved by 2038.

Major security challenges are confronted by system manufacturers, OEMs, and engineering service providers.

Limitations on IP addresses hinder service providers from using technology on a regular basis.

The future prospects of the automotive engineering service provider market depend on adopting a segmented strategy that caters to distinct stages of development. The Concept/Research segment, though currently smaller in scale, is anticipated to experience significant expansion with a projected investment surge of 20% by 2025. This growth is driven by heightened innovation priorities among automakers, particularly in areas such as electric vehicles and autonomous driving technologies.

Meanwhile, Design services, which presently command the largest market share at 35%, are forecasted to sustain consistent growth. This is fueled by the ongoing demand for vehicles that are both lightweight and visually appealing. Prototyping services, essential for validating designs, are expected to see a 15% increase in investments, propelled by the increasing accessibility of technologies such as 3D printing and rapid prototyping. System integration, which ensures smooth interaction among components, is anticipated to maintain a stable 20% market share. Similarly, the Testing segment, encompassing virtual simulations and real-world trials, is projected to witness a 10% upsurge, driven by the escalating focus on safety and performance standards. This targeted approach to services will be critical for engineering firms to leverage the evolving automotive landscape and capitalize on emerging opportunities in the market.

By Application:

The path of the Automotive Engineering Service Provider Market relies heavily on the intricate dynamics across various application segments. The foremost contender, Advanced Driver-Assistance Systems (ADAS) and Safety, is poised to dominate, primarily fueled by stringent regulatory measures and the intensifying pursuit of autonomous driving technologies. Industry projections indicate that ADAS & Safety will command a significant share, exceeding 25% of the market by 2032, as per SNS Insider analysis.

Conversely, the advent of Electric Vehicles (EVs) is reshaping the landscape, propelling segments such as Battery Development & Management and Charger Testing into a notable growth trajectory. These segments are anticipated to collectively amass a considerable share, potentially reaching 15% by 2032. In contrast, traditional segments like Powertrain & Exhaust are expected to witness a decline, while Chassis and Connectivity Services are slated for consistent growth owing to their enduring relevance across diverse vehicle categories. Amidst this evolution, there emerge compelling prospects for engineering service providers adept at adapting their competencies to meet the evolving demands of the automotive industry. Seizing upon these opportunities necessitates agility and innovation, positioning firms to capitalize on the shifting preferences and priorities within the automotive sector

By Location:

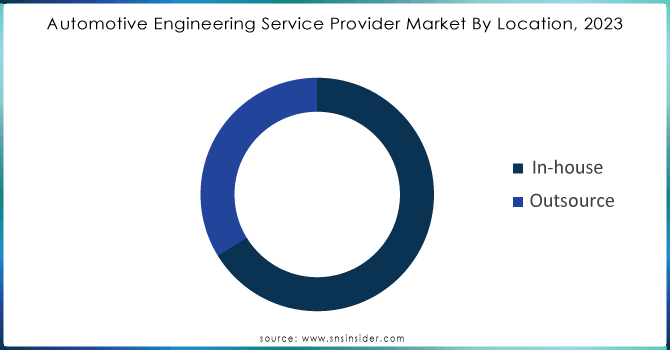

The automotive engineering service provider market is bifurcated into two primary segments based on service location: in-house and outsourced. As of 2023, the in-house segment boasted a commanding market share of approximately 67%. This predominance can be attributed to the clustering of service providers around original equipment manufacturers (OEMs) in developed nations, fostering tight-knit collaboration for design, prototyping, and specialized tasks. Nonetheless, projections suggest a forthcoming power shift in the industry landscape.

The outsourced segment, currently holding a 33% market share, is witnessing rapid expansion propelled by several key factors. The escalating intricacy of vehicles, propelled by advancements in electric, autonomous, and connected car technologies, demands specialized expertise often beyond in-house capabilities. This trend underscores the growing significance of outsourced automotive engineering services in meeting the evolving demands of the market.

Get Customized Report as per your Business Requirement - Ask For Customized Report

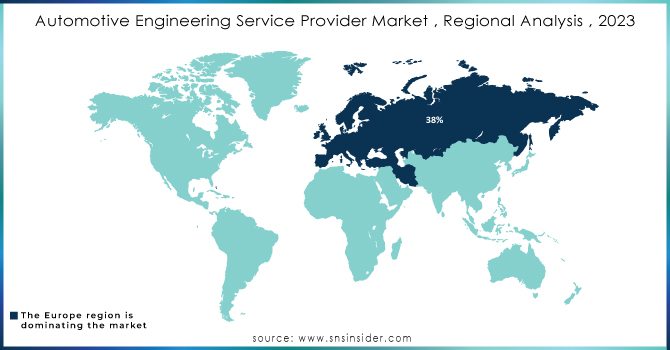

The landscape of the Automotive Engineering Service Provider Market is undergoing a significant transformation, marked by the emergence of regional leaders alongside established industry giants. Presently, Europe commands the largest market share at approximately 38%, leveraging its strong automotive manufacturing heritage and emphasis on cutting-edge technologies. However, the Asia Pacific region is poised for remarkable growth, projected to capture a commanding 48% share by 2032. This growth trajectory is driven by factors such as China's swift adoption of electric vehicles and governmental backing for eco-friendly technologies. Despite being a mature market, North America is expected to maintain a steady 20% share, propelled by ongoing advancements in autonomous driving and connected vehicle solutions. This shift towards regional diversification presents lucrative opportunities for service providers. Companies possessing a global footprint and specialized expertise in meeting diverse market demands will be strategically positioned to capitalize on these emerging trends and thrive in the foreseeable future.

Some of the major players in the Automotive Engineering Service Provider Market are Robert Bosch GmbH (Germany), Continental AG (Germany), HARMAN International (USA), AVL LIST GmbH (Germany), Bertrandt (Germany), EDAG Engineering GmbH (Germany), Imaginative Automotive Engineering Services (India), IAV Automotive Engineering, Inc. (Germany), Magna International Inc (Canada), and Contechs (UK) and other players.

Bosch Engineering: Bosch Engineering, a subsidiary of Robert Bosch GmbH, has been involved in various automotive engineering projects. They have focused on developing advanced driver assistance systems (ADAS), automotive electronics, and software solutions for vehicle control systems.

Magna International: Magna International is a global automotive supplier known for its expertise in engineering services. They have been active in developing lightweight vehicle structures, electric vehicle components, and advanced manufacturing processes aimed at improving efficiency and sustainability in the automotive industry.

EDAG Engineering: EDAG Engineering is a leading provider of engineering services for the automotive industry. They have worked on innovative vehicle concepts, including electric and autonomous vehicles, and have expertise in vehicle integration, prototyping, and testing.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 166.70 Billion |

| Market Size by 2032 | US$ 355.82 Billion |

| CAGR | CAGR of 8.79% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Service Type (Concept/Research, Designing, Prototyping, System Integration, Testing) • by Application (ADAS and Safety, Electrical, Electronics, and Body Controls, Chassis, Connectivity Services, Interior, Exterior, and Body Engineering, Powertrain and Exhaust, Simulation, Battery Development & Management, Charger Testing, Motor Control, Others) • by Location (In-house, Outsourced) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Robert Bosch GmbH (Germany), Continental AG (Germany), HARMAN International (USA), AVL LIST GmbH (Germany), Bertrandt (Germany), EDAG Engineering GmbH (Germany), Imaginative Automotive Engineering Services (India), IAV Automotive Engineering, Inc. (Germany), Magna International Inc (Canada), and Contechs (UK) |

| Key Drivers | •Vehicle electrification and digitization, which are on the rise, are projected to drive the market's growth. •Advanced connectivity solutions are in high demand. |

| RESTRAINTS | •Standard guidelines for engineering service providers are lacking. •The increased level of design complexity has an impact on the final price of the vehicle. |

Ans:- 8.79% is the CAGR of the Automotive Engineering Service Provider Market during the forecast period.

Ans:- Service Type, Application, and Location are the different segments of the market.

Ans:- Standard guidelines for engineering service and increased level of design complexity are the primary market restraints for Automotive Engineering Service Provider Market.

Ans:- Yes.

Ans:- Raw material vendors, Distributors/traders/wholesalers/suppliers, Regulatory authorities, government agencies and NGOs, Commercial research & development (R&D) institutions, Importers and exporters, and End-use industries are the stakeholder of this report.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Feature Analysis, 2023

5.2 User Demographics, 2023

5.3 Integration Capabilities, by Software, 2023

5.4 Impact on Decision-making

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Automotive Engineering Service Provider Market Segmentation, by Service Type

7.1 Chapter Overview

7.2 Concept/Research

7.2.1 Concept/Research Market Trends Analysis (2020-2032)

7.2.2 Concept/Research Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3 Designing

7.2.3.1 Designing Market Trends Analysis (2020-2032)

7.2.3.2 Designing Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.4 Prototyping

7.2.4.1 Prototyping Market Trends Analysis (2020-2032)

7.2.4.2 Prototyping Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.5 System Integration

7.2.5.1 System Integration Market Trends Analysis (2020-2032)

7.2.5.2 System Integration Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.6 Testing

7.2.6.1 Testing Market Trends Analysis (2020-2032)

7.2.6.2 Testing Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Automotive Engineering Service Provider Market Segmentation, by Application

8.1 Chapter Overview

8.2 ADAS and Safety

8.2.1 ADAS and Safety Trends Analysis (2020-2032)

8.2.2 ADAS and Safety Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Electrical, Electronics, and Body Controls

8.3.1 Electrical, Electronics, and Body Controls Market Trends Analysis (2020-2032)

8.3.2 Electrical, Electronics, and Body Controls Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Chassis

8.4.1 Chassis Market Trends Analysis (2020-2032)

8.4.2 Chassis Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Connectivity Services

8.5.1 Connectivity Services Market Trends Analysis (2020-2032)

8.5.2 Connectivity Services Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Interior, Exterior, and Body Engineering

8.6.1 Interior, Exterior, and Body Engineering Market Trends Analysis (2020-2032)

8.6.2 Interior, Exterior, and Body Engineering Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Powertrain and Exhaust

8.7.1 Powertrain and Exhaust Market Trends Analysis (2020-2032)

8.7.2 Powertrain and Exhaust Market Size Estimates and Forecasts to 2032 (USD Billion)

8.8 Simulation

8.8.1 Simulation Market Trends Analysis (2020-2032)

8.8.2 Simulation Market Size Estimates and Forecasts to 2032 (USD Billion)

8.9 Battery Development & Management

8.9.1 Battery Development & Management Market Trends Analysis (2020-2032)

8.9.2 Battery Development & Management Market Size Estimates and Forecasts to 2032 (USD Billion)

8.10 Charger Testing

8.10.1 Charger Testing Market Trends Analysis (2020-2032)

8.10.2 Charger Testing Market Size Estimates and Forecasts to 2032 (USD Billion)

8.11 Motor Control

8.11.1 Motor Control Market Trends Analysis (2020-2032)

8.11.2 Motor Control Market Size Estimates and Forecasts to 2032 (USD Billion)

8.12 Others

8.12.1 Others Market Trends Analysis (2020-2032)

8.12.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Automotive Engineering Service Provider Market Segmentation, by Location

9.1 Chapter Overview

9.2 In-House

9.2.1 In-House Market Trends Analysis (2020-2032)

9.2.2 In-House Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Outsource

9.3.1 Outsource Market Trends Analysis (2020-2032)

9.3.2 Outsource Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Automotive Engineering Service Provider Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.2.4 North America Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.5 North America Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.2.6.2 USA Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.6.3 USA Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.2.7.2 Canada Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.7.3 Canada Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.2.8.2 Mexico Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.8.3 Mexico Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Automotive Engineering Service Provider Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.6.3 Poland Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.7.3 Romania Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Automotive Engineering Service Provider Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.5 Western Europe Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.6.3 Germany Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.2.7.2 France Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.7.3 France Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.2.8.2 UK Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.8.3 UK Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.9.3 Italy Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.10.3 Spain Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.13.3 Austria Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Automotive Engineering Service Provider Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.4.4 Asia Pacific Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.5 Asia Pacific Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.4.6.2 China Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.6.3 China Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.4.7.2 India Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.7.3 India Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.4.8.2 Japan Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.8.3 Japan Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.4.9.2 South Korea Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.9.3 South Korea Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.10.3 Vietnam Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.4.11.2 Singapore Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.11.3 Singapore Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.4.12.2 Australia Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.12.3 Australia Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Automotive Engineering Service Provider Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.5.1.4 Middle East Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.5 Middle East Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.6.3 UAE Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Automotive Engineering Service Provider Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.5.2.4 Africa Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.5 Africa Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Automotive Engineering Service Provider Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.6.4 Latin America Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.5 Latin America Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.6.6.2 Brazil Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.6.3 Brazil Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.6.7.2 Argentina Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.7.3 Argentina Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.6.8.2 Colombia Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.8.3 Colombia Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Automotive Engineering Service Provider Market Estimates and Forecasts, by Service Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Automotive Engineering Service Provider Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Automotive Engineering Service Provider Market Estimates and Forecasts, by Location (2020-2032) (USD Billion)

11. Company Profiles

11.1 Ashok Leyland

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 The SNS View

11.2 Hyundai Motor Company

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products / Services Offered

11.2.4 The SNS View

11.3 Ford Motor Company

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products / Services Offered

11.3.4 The SNS View

11.4 Isuzu Motors

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products / Services Offered

11.4.4 The SNS View

11.5 Gaz Group

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products / Services Offered

11.5.4 The SNS View

11.6 General Motors

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products / Services Offered

11.6.4 The SNS View

11.7 Honda Motor Company

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products / Services Offered

11.7.4 The SNS View

11.8 Renault Group

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products / Services Offered

11.8.4 The SNS View

11.9 Tata Motors

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products / Services Offered

11.9.4 The SNS View

11.10 Others

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products / Services Offered

11.10.4 The SNS View

12. Competitive Landscape

12.1 Competitive Benchmarking

12.2 Market Share Analysis

12.3 Recent Developments

12.3.1 Industry News

12.3.2 Company News

12.3.3 Mergers & Acquisitions

13. Use Case and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Service Type:

Concept/Research

Designing

Prototyping

System Integration

Testing

By Application:

ADAS and Safety

Electrical, Electronics, and Body Controls

Chassis

Connectivity Services

Interior, Exterior, and Body Engineering

Powertrain and Exhaust

Simulation

Battery Development & Management

Charger Testing

Motor Control

Others

By Location:

In-house

Outsource

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Electric Cargo Bikes Market Size was valued at USD 2.12 billion in 2023 and is expected to reach USD 4.95 billion by 2031 and grow at a CAGR of 11.2% over the forecast period 2024-2031.

The Automotive Active Health Monitoring System Market size was valued at USD 3.5 billion in 2023 and is expected to reach USD 18.57 billion by 2031 and grow at a CAGR of 23.2% over the forecast period 2024-2031.

The Automotive Brake Shims Market size was valued at USD 3.10 billion in 2023 and is expected to reach USD 4.49 Billion by 2032, growing at a CAGR of 4.23% over the forecast period of 2024-2032.

The Automotive Night Vision System Market Size was valued at USD 3.65 Billion in 2023 and is expected to reach USD 10.56 Billion by 2032 and grow at a CAGR of 12.58% over the forecast period 2024-2032.

The Automotive Over-The-Air Updates Market Size was valued at USD 4.35 billion in 2023 and is expected to reach USD 19.29 billion by 2032 and grow at a CAGR of 18 % over the forecast period 2024-2032.

The All-Wheel Drive Market Size grow at a CAGR of 8.70% over the forecast period 2024-2031.

Hi! Click one of our member below to chat on Phone