Get More Information on Automotive E-axle Market - Request Sample Report

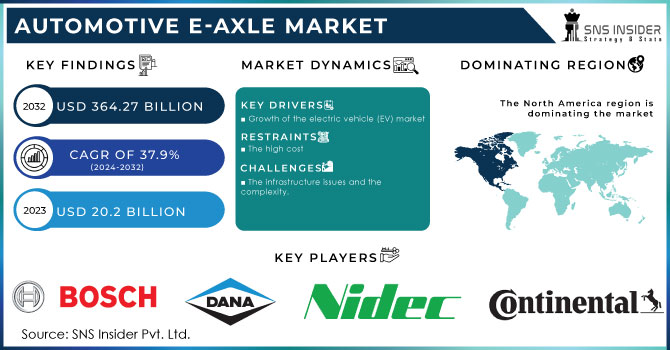

The Automotive E-axle Market is expected to reach USD 364.27 Bn by 2032, the base value of the market was recorded USD 20.2 Bn in 2023, the CAGR is expected to be 37.9% over the forecast period of 2024-2032.

E-axles are small, multi-component modules that save room in the vehicle's chassis. This makes it possible to create more adaptable vehicle designs and packaging, as well as to make room for batteries. By combining the motor and transmission, they are able to minimise the number of moving parts in the powertrain system. This may result in greater dependability and less need for maintenance. E-axles can increase powertrain efficiency by lowering the energy losses connected to conventional powertrains. Internal combustion engines are less efficient at delivering power across a larger RPM range than electric motors. Regenerative braking systems, which can be included into E-axles, absorb and transform kinetic energy into electricity during braking, improving overall energy efficiency. E-axles can improve a vehicle's performance by delivering rapid torque and smooth power distribution, which helps the car accelerate quickly and handle well. E-axles in fully electric cars contribute zero to the reduction of greenhouse gas emissions and the fight against climate change.

E-axles are versatile and can be made to match a variety of vehicle platforms and power needs, making them suited for a variety of vehicle types, from compact cars to SUVs. E-axles can be used to power both the front and back axles of a car, enabling all-wheel drive (AWD) without the need for a separate mechanical connection. Advanced e-axle systems can offer torque vectoring, which distributes torque to individual wheels as efficiently as possible, increasing vehicle stability.

Driver

E-axle development is mostly fuelled by the rising demand for electric vehicles, which is fuelled by environmental concerns, governmental laws, and customer interest in clean and efficient transportation. An essential part of EV powertrains are e-axles. Automakers are being pushed to electrify their fleets of vehicles as a result of strict fuel economy and pollution regulations in several areas. E-axles increase powertrain efficiency and save emissions, which help to satisfy these regulations. E-axles contribute to extending the driving range of electric cars. They contribute to extending the range that electric vehicles can travel on a single charge by optimising power delivery and raising energy efficiency, which is a major concern for consumers.

Restrain

Opportunity

Due to considerations including cheaper operating costs, a less environmental impact, and improved charging infrastructure, consumer interest in electric vehicles is rising. To meet this demand, automakers release more e-axle-equipped electric car models. The shift towards electrification in the car sector is motivated by worries about air quality and climate change. E-axles aid in lowering air pollution and greenhouse gas emissions. The creation of more effective and compact e-axles is made possible by ongoing developments in material science, electric motor, and power electronics technology.

Challenge

Due to considerations including cheaper operating costs, a less environmental impact, and improved charging infrastructure, consumer interest in electric vehicles is rising. To meet this demand, automakers release more e-axle-equipped electric car models. The shift towards electrification in the car sector is motivated by worries about air quality and climate change. E-axles aid in lowering air pollution and greenhouse gas emissions. The creation of more effective and compact e-axles is made possible by ongoing developments in material science, electric motor, and power electronics technology.

Impact of Russia Ukraine

Economic instability brought on by geopolitical conflicts can make it more difficult for companies that build e-axles to get funding for R&D and manufacturing growth. Unfavourable news about global events may affect the attitudes of consumers and investors. Consumers may be hesitant to purchase electric vehicles, and investors may be more cautious about investing in electric vehicle technologies.

To reduce the risks to the supply chain, several automakers may think about moving production and component sourcing out of conflict-ridden areas. This may have an effect on current e-axle production processes. Due to supply chain disruptions and economic uncertainties brought on by geopolitical crises, smaller electric vehicle startups may be especially vulnerable. They may have difficulties in creating electric vehicles with e-axles.

By Electric Vehicle Type

BEV

PHEV

By Vehicle Type

Passenger Cars

Commercial vehicles

By Drive Type

All Wheel Drive

Front Wheel Type

Rear Wheel Drive

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Regional Analysis

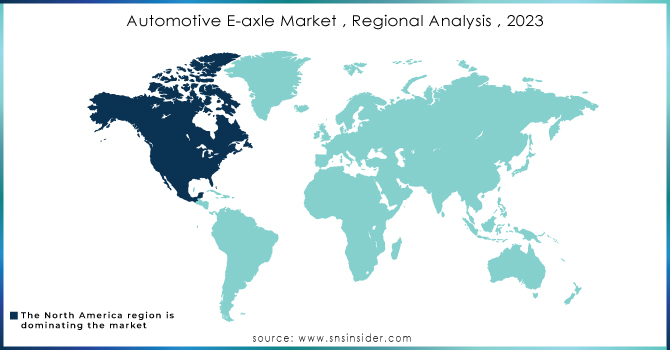

The adoption of electric vehicles has significantly increased in North America, especially in the United States, thanks to customer demand, environmental concerns, and government incentives. As manufacturers engage in electrified vehicle models, e-axle technology is becoming more and more important in the area. Mexico and Canada both have expanding markets for electric vehicles. Particularly in Canada, there has been a growth in demand for electric vehicles, and Mexico is a significant centre for the production of automotive parts, particularly e-axles.

APAC is the region which will be dominating the region because the world's largest and fastest-growing market for electric vehicles is China. The region's e-axles have been developed and produced as a result of the Chinese government's promotion of EV adoption and incentives for automakers.

To meet domestic and global demand, Japanese automakers are investing in electric and hybrid vehicle technology, including e-axles. Home to significant automakers with an emphasis on electrification, South Korea is a crucial market for e-axle technology. As more automakers release electrified models, the Indian market for electric vehicles is rapidly expanding, and e-axles are becoming increasingly significant. A number of Southeast Asian nations are only beginning to adopt electric vehicles, and e-axle technology is expected to contribute to the region's expanding electric vehicle market.

Need any customization research on Automotive E-axle Market - Enquiry Now

The major key players are Dana Limited, Robert Bosch, Nidec Corporation, Continental AG, ZF Friedrichshafen AG, GKN Automotive Limited, Schaeffler AG, AxleTech, Linamar Corporation, Magna International and others.

Recent Development

Dana Limited: The company has launched e-Axles for class 7 & 8 vehicles, the objective behind the product development is to expand commercially available heavy duty powertrain offerings.

Nidec Corporation: Nidec and Renesas has strategically collaborated to increase the production of semiconductor solution for the next generation E-axle.

| Report Attributes | Details |

| Market Size in 2023 | US$ 20.2 Bn |

| Market Size by 2032 | US$ 364.27 Bn |

| CAGR | CAGR of 37.9% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Electric Vehicle Type (BEV, PHEV), • By Vehicle Type (Passenger Cars, Commercial vehicles), • By Drive Type (All Wheel Drive, Front Wheel Type, Rear Wheel Drive), |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Dana Limited, Robert Bosch, Nidec Corporation, Continental AG, ZF Friedrichshafen AG, GKN Automotive Limited, Schaeffler AG, AxleTech, Linamar Corporation, Magna International |

| Key Drivers | • Growth of the electric vehicle (EV) market |

| Market Restraints | • The infrastructure issues and the complexity. |

Ans: The Automotive E-Axle Market is expected to grow at a CAGR of 31.2 %.

Ans: The Automotive E-Axle Market is expected to reach USD 364.27 Bn by 2032, the base value of the market was recorded USD 20.2 Bn in 2023, the CAGR is expected to be 31.2% over the forecast period of 2024-2032.

Ans: Growth of the electric vehicle (EV) market

Ans: The infrastructure issues and the complexity.

Ans: APAC overtook other regional markets as the largest market for Automotive E-Axle, with the highest revenue share.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 Impact of Russia-Ukraine war

4.2 Impact of Ongoing Recession

4.2.1 Introduction

4.2.2 Impact on major economies

4.2.2.1 US

4.2.2.2 Canada

4.2.2.3 Germany

4.2.2.4 France

4.2.2.5 United Kingdom

4.2.2.6 China

4.2.2.7 Japan

4.2.2.8 South Korea

4.2.2.9 Rest of the World

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Automotive E-Axle Market, By Electric Vehicle Type

8.1 BEV

8.2 PHEV

9. Automotive E-Axle Market, By Vehicle Type

9.1 Passenger Cars

9.2 Commercial Cars

10. Automotive E-Axle Market, By Drive Type

10.1 All-Wheel Drive

10.2 Front Wheel Drive

10.3 Rear Wheel Drive

11. Regional Analysis

11.1 Introduction

11.2 North America

11.2.1 North America Automotive E-Axle Market by Country

11.2.2North America Automotive E-Axle Market by Electric Vehicle Type

11.2.3 North America Automotive E-Axle Market by Vehicle Type

11.2.4 North America Automotive E-Axle Market by Drive Type

11.2.5 USA

11.2.5.1 USA Automotive E-Axle Market by Electric Vehicle Type

11.2.5.2 USA Automotive E-Axle Market by Vehicle Type

11.2.5.3 USA Automotive E-Axle Market by Drive Type

11.2.6 Canada

11.2.6.1 Canada Automotive E-Axle Market by Electric Vehicle Type

11.2.6.2 Canada Automotive E-Axle Market by Vehicle Type

11.2.6.3 Canada Automotive E-Axle Market by Drive Type

11.2.7 Mexico

11.2.7.1 Mexico Automotive E-Axle Market by Electric Vehicle Type

11.2.7.2 Mexico Automotive E-Axle Market by Vehicle Type

11.2.7.3 Mexico Automotive E-Axle Market by Drive Type

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Eastern Europe Automotive E-Axle Market by country

11.3.1.2 Eastern Europe Automotive E-Axle Market by Electric Vehicle Type

11.3.1.3 Eastern Europe Automotive E-Axle Market by Vehicle Type

11.3.1.4 Eastern Europe Automotive E-Axle Market by Drive Type

11.3.1.5 Poland

11.3.1.5.1 Poland Automotive E-Axle Market by Electric Vehicle Type

11.3.1.5.2 Poland Automotive E-Axle Market by Vehicle Type

11.3.1.5.3 Poland Automotive E-Axle Market by Drive Type

11.3.1.6 Romania

11.3.1.6.1 Romania Automotive E-Axle Market by Electric Vehicle Type

11.3.1.6.2 Romania Automotive E-Axle Market by Vehicle Type

11.3.1.6.4 Romania Automotive E-Axle Market by Drive Type

11.3.1.7 Turkey

11.3.1.7.1 Turkey Automotive E-Axle Market by Electric Vehicle Type

11.3.1.7.2 Turkey Automotive E-Axle Market by Vehicle Type

11.3.1.7.3 Turkey Automotive E-Axle Market by Drive Type

11.3.1.8 Rest of Eastern Europe

11.3.1.8.1 Rest of Eastern Europe Automotive E-Axle Market by Electric Vehicle Type

11.3.1.8.2 Rest of Eastern Europe Automotive E-Axle Market by Vehicle Type

11.3.1.8.3 Rest of Eastern Europe Automotive E-Axle Market by Drive Type

11.3.2 Western Europe

11.3.2.1 Western Europe Automotive E-Axle Market by Country

11.3.2.2 Western Europe Automotive E-Axle Market by Electric Vehicle Type

11.3.2.3 Western Europe Automotive E-Axle Market by Vehicle Type

11.3.2.4 Western Europe Automotive E-Axle Market by Drive Type

11.3.2.5 Germany

11.3.2.5.1 Germany Automotive E-Axle Market by Electric Vehicle Type

11.3.2.5.2 Germany Automotive E-Axle Market by Vehicle Type

11.3.2.5.3 Germany Automotive E-Axle Market by Drive Type

11.3.2.6 France

11.3.2.6.1 France Automotive E-Axle Market by Electric Vehicle Type

11.3.2.6.2 France Automotive E-Axle Market by Vehicle Type

11.3.2.6.3 France Automotive E-Axle Market by Drive Type

11.3.2.7 UK

11.3.2.7.1 UK Automotive E-Axle Market by Electric Vehicle Type

11.3.2.7.2 UK Automotive E-Axle Market by Vehicle Type

11.3.2.7.3 UK Automotive E-Axle Market by Drive Type

11.3.2.8 Italy

11.3.2.8.1 Italy Automotive E-Axle Market by Electric Vehicle Type

11.3.2.8.2 Italy Automotive E-Axle Market by Vehicle Type

11.3.2.8.3 Italy Automotive E-Axle Market by Drive Type

11.3.2.9 Spain

11.3.2.9.1 Spain Automotive E-Axle Market by Electric Vehicle Type

11.3.2.9.2 Spain Automotive E-Axle Market by Vehicle Type

11.3.2.9.3 Spain Automotive E-Axle Market by Drive Type

11.3.2.10 Netherlands

11.3.2.10.1 Netherlands Automotive E-Axle Market by Electric Vehicle Type

11.3.2.10.2 Netherlands Automotive E-Axle Market by Vehicle Type

11.3.2.10.3 Netherlands Automotive E-Axle Market by Test Type

11.3.2.11 Switzerland

11.3.2.11.1 Switzerland Automotive E-Axle Market by Electric Vehicle Type

11.3.2.11.2 Switzerland Automotive E-Axle Market by Vehicle Type

11.3.2.11.3 Switzerland Automotive E-Axle Market by Drive Type

11.3.2.1.12 Austria

11.3.2.12.1 Austria Automotive E-Axle Market by Electric Vehicle Type

11.3.2.12.2 Austria Automotive E-Axle Market by Vehicle Type

11.3.2.12.3 Austria Automotive E-Axle Market by Drive Type

11.3.2.13 Rest of Western Europe

11.3.2.13.1 Rest of Western Europe Automotive E-Axle Market by Electric Vehicle Type

11.3.2.13.2 Rest of Western Europe Automotive E-Axle Market by Vehicle Type

11.3.2.13.3 Rest of Western Europe Automotive E-Axle Market by Drive Type

11.4 Asia-Pacific

11.4.1 Asia-Pacific Automotive E-Axle Market by country

11.4.2 Asia-Pacific Automotive E-Axle Market by Electric Vehicle Type

11.4.3 Asia-Pacific Automotive E-Axle Market by Vehicle Type

11.4.4 Asia-Pacific Automotive E-Axle Market by Drive Type

11.4.5 China

11.4.5.1 China Automotive E-Axle Market by Electric Vehicle Type

11.4.5.2 China Automotive E-Axle Market by Drive Type

11.4.5.3 China Automotive E-Axle Market by Vehicle Type

11.4.6 India

11.4.6.1 India Automotive E-Axle Market by Electric Vehicle Type

11.4.6.2 India Automotive E-Axle Market by Vehicle Type

11.4.6.3 India Automotive E-Axle Market by Drive Type

11.4.7 Japan

11.4.7.1 Japan Automotive E-Axle Market by Electric Vehicle Type

11.4.7.2 Japan Automotive E-Axle Market by Vehicle Type

11.4.7.3 Japan Automotive E-Axle Market by Drive Type

11.4.8 South Korea

11.4.8.1 South Korea Automotive E-Axle Market by Electric Vehicle Type

11.4.8.2 South Korea Automotive E-Axle Market by Vehicle Type

11.4.8.3 South Korea Automotive E-Axle Market by Drive Type

11.4.9 Vietnam

11.4.9.1 Vietnam Automotive E-Axle Market by Electric Vehicle Type

11.4.9.2 Vietnam Automotive E-Axle Market by Vehicle Type

11.4.9.3 Vietnam Automotive E-Axle Market by Drive Type

11.4.10 Singapore

11.4.10.1 Singapore Automotive E-Axle Market by Electric Vehicle Type

11.4.10.2 Singapore Automotive E-Axle Market by Vehicle Type

11.4.10.3 Singapore Automotive E-Axle Market by Drive Type

11.4.11 Australia

11.4.11.1 Australia Automotive E-Axle Market by Electric Vehicle Type

11.4.11.2 Australia Automotive E-Axle Market by Vehicle Type

11.4.11.3 Australia Automotive E-Axle Market by Drive Type

11.4.12 Rest of Asia-Pacific

11.4.12.1 Rest of Asia-Pacific Automotive E-Axle Market by Electric Vehicle Type

11.4.12.2 Rest of Asia-Pacific Automotive E-Axle Market by Vehicle Type

11.4.12.3 Rest of Asia-Pacific Automotive E-Axle Market by Test Type

11.5 Middle East & Africa

11.5.1 Middle East

11.5.1.1 Middle East Automotive E-Axle Market by country

11.5.1.2 Middle East Automotive E-Axle Market by Electric Vehicle Type

11.5.1.3 Middle East Automotive E-Axle Market by Vehicle Type

11.5.1.4 Middle East Automotive E-Axle Market by Drive Type

11.5.1.5 UAE

11.5.1.5.1 UAE Automotive E-Axle Market by Electric Vehicle Type

11.5.1.5.2 UAE Automotive E-Axle Market by Vehicle Type

11.5.1.5.3 UAE Automotive E-Axle Market by Drive Type

11.5.1.6 Egypt

11.5.1.6.1 Egypt Automotive E-Axle Market by Electric Vehicle Type

11.5.1.6.2 Egypt Automotive E-Axle Market by Vehicle Type

11.5.1.6.3 Egypt Automotive E-Axle Market by Drive Type

11.5.1.7 Saudi Arabia

11.5.1.7.1 Saudi Arabia Automotive E-Axle Market by Electric Vehicle Type

11.5.1.7.2 Saudi Arabia Automotive E-Axle Market by Vehicle Type

11.5.1.7.3 Saudi Arabia Automotive E-Axle Market by Drive Type

11.5.1.8 Qatar

11.5.1.8.1 Qatar Automotive E-Axle Market by Electric Vehicle Type

11.5.1.8.2 Qatar Automotive E-Axle Market by Vehicle Type

11.5.1.8.3 Qatar Automotive E-Axle Market by Drive Type

11.5.1.9 Rest of Middle East

11.5.1.9.1 Rest of Middle East Automotive E-Axle Market by Electric Vehicle Type

11.5.1.9.2 Rest of Middle East Automotive E-Axle Market by Vehicle Type

11.5.1.9.3 Rest of Middle East Automotive E-Axle Market by Drive Type

11.5.2 Africa

11.5.2.1 Africa Transfusion Diagnostics Market by country

11.5.2.2 Africa Automotive E-Axle Market by Electric Vehicle Type

11.5.2.3 Africa Automotive E-Axle Market by Vehicle Type

11.5.2.4 Africa Automotive E-Axle Market by Drive Type

11.5.2.5 Nigeria

11.5.2.5.1 Nigeria Automotive E-Axle Market by Electric Vehicle Type

11.5.2.5.2 Nigeria Automotive E-Axle Market by Vehicle Type

11.5.2.5.3 Nigeria Automotive E-Axle Market by Drive Type

11.5.2.6 South Africa

11.5.2.6.1 South Africa Automotive E-Axle Market by Electric Vehicle Type

11.5.2.6.2 South Africa Automotive E-Axle Market by Vehicle Type

11.5.2.6.3 South Africa Automotive E-Axle Market by Drive Type

11.5.2.7 Rest of Africa

11.5.2.7.1 Rest of Africa Automotive E-Axle Market by Electric Vehicle Type

11.5.2.7.2 Rest of Africa Automotive E-Axle Market by Vehicle Type

11.5.2.7.3 Rest of Africa Automotive E-Axle Market by Test type

11.6 Latin America

11.6.1 Latin America Automotive E-Axle Market by country

11.6.2 Latin America Automotive E-Axle Market by Electric Vehicle Type

11.6.3 Latin America Automotive E-Axle Market by Technique

11.6.4 Latin America Automotive E-Axle Market by Drive Type

11.6.5 Brazil

11.6.5.1 Brazil America Automotive E-Axle by Electric Vehicle Type

11.6.5.2 Brazil America Automotive E-Axle by Technique

11.6.5.3 Brazil America Automotive E-Axle by Drive Type

11.6.6 Argentina

11.6.6.1 Argentina America Automotive E-Axle by Electric Vehicle Type

11.6.6.2 Argentina America Automotive E-Axle by Technique

11.6.6.3 Argentina America Automotive E-Axle by Drive Type

11.6.7 Colombia

11.6.7.1 Colombia America Automotive E-Axle by Electric Vehicle Type

11.6.7.2 Colombia America Automotive E-Axle by Technique

11.6.7.3 Colombia America Automotive E-Axle by Drive Type

11.6.8 Rest of Latin America

11.6.8.1 Rest of Latin America Automotive E-Axle by Electric Vehicle Type

11.6.8.2 Rest of Latin America Automotive E-Axle by Technique

11.6.8.3 Rest of Latin America Automotive E-Axle by Drive Type

12 Company profile

12.1 Dana Limited

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.1.5 The SNS View

12.2 Robert Bosch

12.2.1 Company Overview

12.2.2 Financials

12.2.3 Product/Services Offered

12.2.4 SWOT Analysis

12.2.5 The SNS View

12.3 Nidec Corporation

12.3.1 Company Overview

12.3.2 Financials

12.3.3 Product/Services Offered

12.3.4 SWOT Analysis

12.3.5 The SNS View

12.4 Continental AG

12.4.1 Company Overview

12.4.2 Financials

12.4.3 Product/Services Offered

12.4.4 SWOT Analysis

12.4.5 The SNS View

12.5 ZF Friedrichshafen

12.5.1 Company Overview

12.5.2 Financials

12.5.3 Product/Services Offered

12.5.4 SWOT Analysis

12.5.5 The SNS View

12.6 GKN Automotive Limited

12.6.1 Company Overview

12.6.2 Financials

12.6.3 Product/Services Offered

12.6.4 SWOT Analysis

12.6.5 The SNS View

12.7 Schaeffler AG

12.7.1 Company Overview

12.7.2 Financials

12.7.3 Product/Services Offered

12.7.4 SWOT Analysis

12.7.5 The SNS View

12.8 AxleTech

12.8.1 Company Overview

12.8.2 Financials

12.8.3 Product/Services Offered

12.8.4 SWOT Analysis

12.8.5 The SNS View

12.9 Linamar Corporation

12.9.1 Company Overview

12.9.2 Financials

12.9.3 Product/Services Offered

12.9.4 SWOT Analysis

12.9.5 The SNS View

12.10 Magna International

12.10.1 Company Overview

12.10.2 Financials

12.10.3 Product/Services Offered

12.10.4 SWOT Analysis

12.10.5 The SNS View

13. Competitive Landscape

13.1 Competitive Bench marking

13.2 Market Share Analysis

13.3 Recent Developments

13.3.1 Industry News

13.3.2 Company News

13.3.3 Mergers & Acquisitions

14. Use Case and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Electric Bus Market size was valued at USD 34.2 billion in 2023 & is expected to reach USD 147.05 billion by 2031 and grow at a CAGR of 20% by 2024-2031

The Swappable Electric Vehicle Battery Market size will reach USD 3892.37 Mn by 2032 & was $561.59 Mn in 2023 and grow at a CAGR at 24% by 2024-2032.

The Automotive Operating System Market Size was valued at USD 8.88 Billion in 2023 and is expected to reach USD 21.09 Billion by 2032 and grow at a CAGR of 10.1% over the forecast period 2024-2032.

The Automotive Data Logger Market size was valued at USD 3.94 billion in 2023 and is expected to reach USD 7.80 billion by 2032 and grow at a CAGR of 7.89% over the forecast period 2024-2032.

The Automotive Camera Cleaning System Market Size was valued at USD 1243.30 Million in 2023 and is expected to reach USD 6861.32 Million by 2032 and grow at a CAGR of 21.01% over the forecast period 2024-2032.

The Automotive Seat Belts Market Size was valued at USD 17.02 Billion in 2023 and is expected to reach USD 27.59 Billion by 2032 and grow at a CAGR of 5.56% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone