Automotive Communication Technology Market Report Scope & Overview:

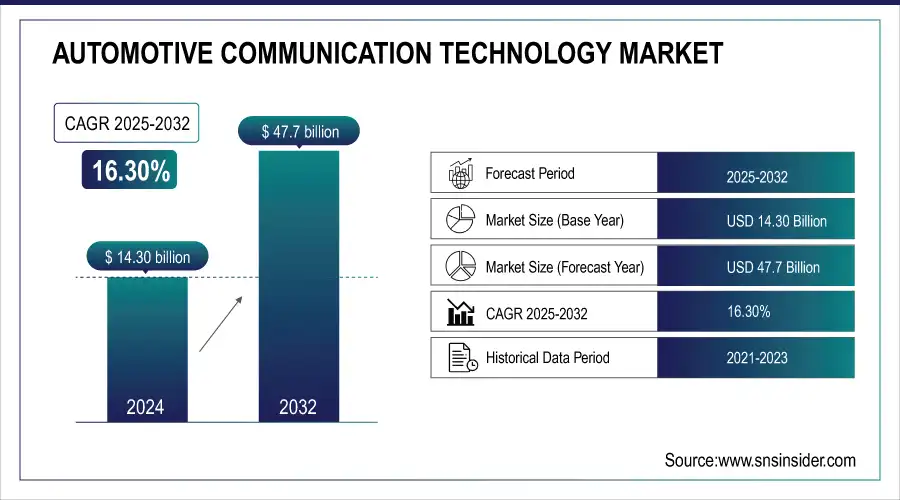

The Automotive Communication Technology Market was valued at USD 14.30 Billion in 2024 and is expected to reach USD 47.7 Billion by 2032, growing at a CAGR of 16.30% from 2025-2032.

Growth in Automotive Communication Technology is attributed to increased vehicle connectivity and the implementation of modern communication protocols to optimize different in-vehicle systems. It provides technologies that can ensure smooth data transfer between ECUs, sensors, and actuators behind critical functionalities including infotainment, advanced driver assistance systems, and autonomous driving. In addition, the increasing demand for electric vehicles and connected car consumption, which needs advanced data systems for optimized functioning, also stimulates the need for stronger communication networks. The growth of this market can be attributed to the growing adoption of ADAS and autonomous driving which require real-time communication between sensors, cameras, and processors. This trend necessitates the increasing use of high-speed and low-latency technologies, such as Controller Area Network, Local Interconnect Network, and Ethernet, to power the systems. Furthermore, the increasing complexity of in-vehicle electronics has also accelerated the deployment of Time-Sensitive Networking to achieve time-synchronized and lossless transmission of in-vehicle communication for real-time applications.

To Get more information on Automotive Communication Technology Market - Request Free Sample Report

The faster growth of the EV market has fueled the demand for communication technology. EVs rely on smart networks to orchestrate battery management, charging protocols, and power flow. Importantly, the count of production EVs exploded by 40%+ in 2023, reflecting the rapid uptake of these vehicles and their technologies. Another important growth driver is the increasing number of connected cars, as they provide internet access and vehicle-to-everything (V2X) communication. With growing connectivity features for navigation, diagnostics, and entertainment, it is estimated that over 75% of new vehicles will have connectivity capabilities by 2024.

Market Size and Forecast:

-

Market Size in 2024 USD 14.30 Billion

-

Market Size by 2032 USD 47.7 Billion

-

CAGR of 16.30% From 2025 to 2032

-

Base Year 2024

-

Forecast Period 2025-2032

-

Historical Data 2021-2023

Automotive Communication Technology Market Trends:

-

Growing integration of Controller Area Network (CAN) and Ethernet protocols in EVs to enable real-time communication between ECUs.

-

Rising importance of communication systems in optimizing battery management, power distribution, and regenerative braking efficiency.

-

Increasing demand for compatibility with fast-charging infrastructure and vehicle-to-grid (V2G) connectivity.

-

Expansion of advanced in-vehicle communication technologies to support connected and autonomous vehicle development.

-

Regulatory mandates and global EV adoption targets accelerating the deployment of robust automotive communication networks.

Automotive Communication Technology Market Growth Drivers:

-

Hybrid and electric vehicles require advanced communication systems to manage complex electrical architectures efficiently.

Automotive communication technologies play a significant role in hybrid and Electric Vehicles (EVs), which require sophisticated communication systems to control their elaborate electrical systems. In contrast to traditional vehicles, EVs consist of complex components such as battery management systems, electric powertrains, and charging interfaces that require seamless data exchange to operate optimally and safely.

Communications technologies like Controller Area Networks and Ethernet are now enabling real-time communication between electronic control units (ECUs), optimal battery task efficiency through monitoring, power distribution, and regenerative braking. This controls the integration of the systems based on these protocols, which allows for optimized energy recuperation and enhanced powertrain performance.

Additionally, strong communication networks are necessary to design EVs that are compatible with fast-charging capability and interconnection with charging infrastructure, as well as advanced features such as vehicle-to-grid (V2G) connectivity. With the rest of the world striving to reach their EV adoption targets as well as new regulatory obligations making these goals mandatory to achieve, the need for these types of communication technologies is growing further and will truly be a key enabler to optimize both the efficiency and functionality of future EVs.

Automotive Communication Technology Market Restraints:

-

The lack of widespread vehicle-to-everything (V2X) infrastructure hinders the full utilization of advanced communication systems.

A significant barrier to unlocking the full potential of advanced communication systems in the automotive environment is the limited availability of V2X infrastructure in the first place. V2X refers to technology that enables vehicles (V2V), infrastructure (V2I), pedestrians (V2P), and networks (V2N) to exchange information freely, to make driving safer, traffic more efficient, and the overall experience better. But V2X systems require a lot of infrastructure like smart traffic signals, connected road signage, and robust wireless networks that are in many areas, still in the development stage. Cars with advanced communication technology will not be able to take full advantage of their capabilities without a strong V2X infrastructure in place. As an example, consider time-critical applications that depend on real-time data sharing for collision prevention, traffic management, and also adaptive navigation are limited by the number of connected elements in the environment. Such limitation makes V2X communication less effective for advanced driver assistance system (ADAS)/autonomous driving solutions, which require V2X communication for both situational awareness. Moreover, the disparity in infrastructural development across different regions results in a piecemeal ecosystem, that acts as a bottleneck to global firming of V2X-enabled technologies. Particularly in developing areas, the challenge is also intensified because building and maintaining V2X infrastructure requires considerable financial resources which are not necessarily available, and where policy priorities differ.

Addressing this need will require coordinated action from governments, automotive manufacturers, and technology providers to accelerate V2X infrastructure deployment. As long as those systems are not readily available, the automotive communication technology space will still be unable to take advantage of all the V2X-based enhancements.

Automotive Communication Technology Market Segment Analysis:

By Vehicle Class

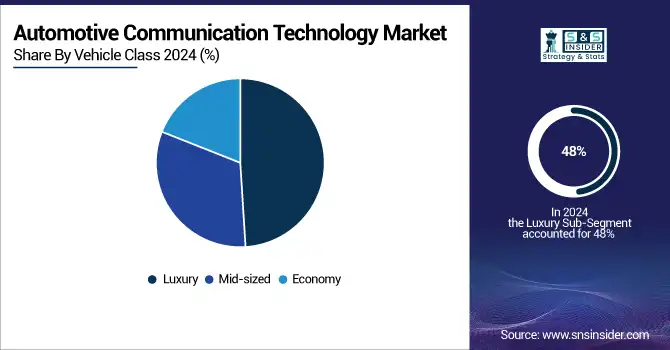

Luxury segments dominated the automotive communication technology market and represented a significant revenue share of 48% in 2024, due to the early adoption of advanced connectivity features along with premium communication systems. Luxury automobiles are furnished with advanced systems like V2X communication, sophisticated driver assistance, and autonomous driving, requiring solid communication networks. The soaring consumer demands for better safety, infotainment, and comfort have encouraged manufacturers to embed smart communication protocols such as Ethernet and TSN. The luxury side will still be the market's leader going forward, with automakers trying new things, such as over-the-air updates and advanced cybersecurity. This is driven by the increasing adoption of electric luxury vehicles, which require some of the most sophisticated new communication systems to enable complex powertrains and social and smart features.

The automotive communication technology market is experiencing the fastest CAGR during the forecast period. Increasing consumer demand for basic ADAS features, infotainment, and smartphone integration in affordable cars propels growth. In this segment, regulatory mandates for safety features like rearview cameras and emergency braking spur the adoption of communication technologies as well. However, the economy segment will get a boost in the years to come through the development of affordable communication protocols such as CAN and LIN. On the other hand, as electric and connected vehicle expansion in emerging markets continues, demand will be accelerated by manufacturers offering relatively low-cost, yet efficient communication systems to price-sensitive consumers.

By Bus Module

The CAN bus module dominated the automotive communication technology market and accounted for a revenue share of more than 39% in 2024, due to its mechanical nature, reliability, low cost, and effectiveness in in-vehicle communication. CAN is a widely adopted vehicle bus standard designed to facilitate communication among electronic control units (ECUs), allowing critical systems like engine control, braking, and infotainment to communicate. That rugged performance in the harsh automotive environment, along with handling moderate data transmission demands, has made it the preferred standard for many vehicle manufacturers. CAN will dominate the field for prevalent vehicle functions, especially for mid-range and economy vehicles due to its low-cost reliable nature in the future. As automotive systems become more complex, higher bandwidth solutions will force more sophisticated technologies to be increasingly co-located next to CAN.

The automotive communication technology market with the Ethernet segment is growing with the fastest CAGR during the forecast period, owing to high data transmission capabilities and increased scalability to support advanced applications in the automotive domain, such as autonomous driving, infotainment, and V2X communication. This larger bandwidth and low latency are ideal for the more massive amounts of data from modern automotive systems like high-definition cameras, sensors, and advanced ADAS features. Ethernet is projected to be the backbone of in-vehicle communication systems, and it will supplement or replace the legacy protocol in high-performance applications in the future. Ethernet will be on the rise as carmakers push toward integrated, high-bandwidth systems in luxury and electric vehicles. Ethernet was the obvious communication network for safety-critical systems and the ongoing evolution of time-sensitive networking will refine that connection even more.

Automotive Communication Technology Market Regional Analysis:

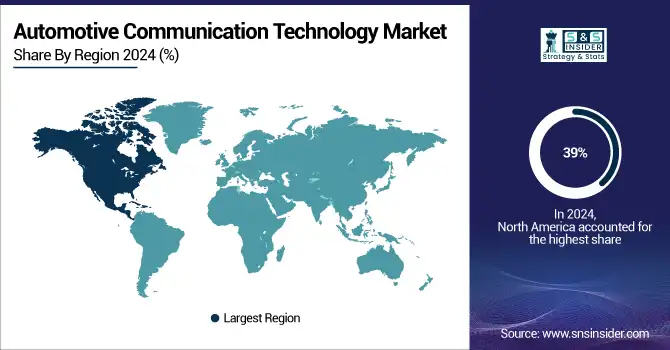

North America Automotive Communication Technology Market Insights

North America dominated the market and accounted for a revenue share of more than 39% in 2024, owing to the tech-savvy nature of the region, high penetration of electric charges (EVs), and rigorous safety regulations. Key growth drivers in the region include rising penetration of ADAS, autonomous driving technologies, and connected car functions. Moreover, the presence of key automotive manufacturers and technology providers, and an increasing demand for high-speed communication solutions, further driven the growth of automotive communication technologies. North America is predicted to continue to grow at a steady pace, especially with the continued 5G rollout, V2X development, and the trend of self-driving and EVs. The region's efforts to improve road safety and minimize carbon emissions are also predicted to drive the rapid growth of connected communication systems.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Automotive Communication Technology Market Insights

The Asia Pacific is expected to register the fastest CAGR during the forecast period, owing to the presence of strong automotive manufacturing in the region, especially in China, Japan, and South Korea. Elaboration of these vehicles and the growth in connected car technologies is likely to drive the demand for advanced communications systems. The market is also growing with the increase in autonomous driving which will be supported by big automotive players in the region. Asia Pacific market is expected to remain attractive with investments in 5G infrastructure, smart city drive, and V2X communication systems in the upcoming years. However, with countries such as China and India demanding cleaner, more efficient vehicles, the need for advanced communication technologies will also grow, which makes the region pivotal in the global automotive communication technology market.

Europe Automotive Communication Technology Market Insights

Europe’s automotive communication technology market is fueled by strong adoption of connected and electric vehicles, alongside strict EU regulations promoting safety and emissions reduction. Advanced in-vehicle networks like CAN, LIN, and Ethernet are increasingly deployed to support autonomous driving, electrification, and V2X communication, reinforcing Europe’s leadership in automotive innovation.

Latin America (LATAM) and Middle East & Africa (MEA) Automotive Communication Technology Market Insights

In LATAM and MEA, the automotive communication technology market is expanding with rising vehicle production, infrastructure development, and adoption of connected solutions. Governments’ focus on smart mobility and electrification, along with increasing consumer demand for safety and infotainment features, is driving growth despite cost sensitivity and slower EV adoption rates.

Automotive Communication Technology Market Key Players:

Some of the Automotive Communication Technology Market Companies are

Bosch

Continental AG

NXP Semiconductors

Denso Corporation

Renesas Electronics

Qualcomm

Delphi Technologies

Harman International

Texas Instruments

Competitive Landscape for Automotive Communication Technology Market:

December 2024: Jaguar and Vodafone: Showcased connected car capabilities at the Wimbledon tennis tournament, demonstrating real-time GPS, high-speed internet access, and data sharing features.

|

Report Attributes |

Details |

| Market Size in 2024 | USD 14.30 Billion |

| Market Size by 2032 | USD 47.7 Billion |

| CAGR | CAGR of 16.30% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Bus Module (Local Interconnect Network,Controller Area Network, FlexRay, Media Oriented Systems Transport, Ethernet) |

|

Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

|

Company Profiles |

Bosch, Continental AG, NXP Semiconductors, Denso Corporation, Renesas Electronics, Qualcomm, Delphi Technologies, Harman International, Texas Instruments |