Get More Information on Automotive Collision Avoidance System Market - Request Sample Report

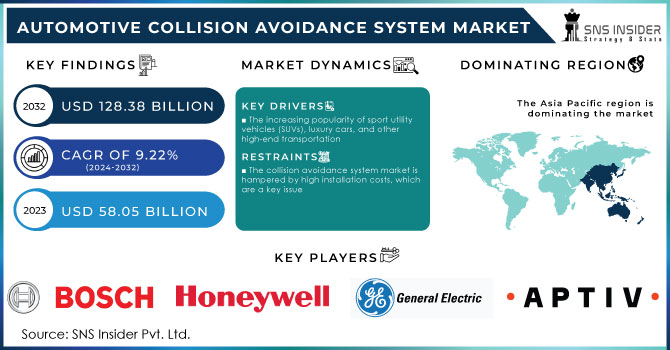

The Automotive Collision Avoidance System Market size was valued at USD 58.05 billion in 2023 and is expected to reach USD 128.38 billion by 2032 and grow at a CAGR of 9.22% over the forecast period 2024-2032.

Government regulations are pushing for the integration of advanced safety features in vehicles. For instance, the European Union has mandated the inclusion of Emergency Lane Keeping Assist (ELKA) and Autonomous Emergency Braking (AEB) systems in all new vehicles by 2022, as per UNECE regulations. Similar mandates are anticipated in other regions. Concurrently, increasing consumer awareness about safety, along with rising disposable incomes, is fueling demand for advanced driver-assistance systems (ADAS) like Collision Avoidance Systems (CAS). Furthermore, technological advancements in sensors, cameras, and LiDAR (Light Detection and Ranging) are driving down costs and enhancing efficiency in CAS development. This has led to substantial investments in the sector, exemplified by Mobileye securing $840 million in 2020 for the advancement of autonomous driving technologies. With mounting government regulations, heightened consumer demand, and ongoing technological innovation, the CAS market is positioned for a resilient and prosperous future.

KEY DRIVERS:

The increasing popularity of sport utility vehicles (SUVs), luxury cars, and other high-end transportation

A rise in interest in self-driving cars

Growth in the demand for vehicles with automated driving systems

Visibility and safety enhancements like blind-spot collision prevention aid increase market growth

The course of the Automotive Collision Avoidance System (CAS) market is poised to be heavily influenced by advancements in features aimed at bolstering driver visibility and safety. A prime example is the burgeoning technology of blind-spot collision prevention, which employs radar or camera sensors to detect vehicles in a driver's blind spot. It issues audible or visual warnings to avert potential collisions, marking a swiftly evolving facet of automotive safety systems.

RESTRAINTS:

The collision avoidance system market is hampered by high installation costs, which are a key issue

Due to automobile sales and production being cyclical, market growth is stifled

OPPORTUNITIES:

An increase in the minimum safety standards for motor vehicles

Integration of electronic components in an automobile

Advanced driver assistance systems in passenger cars should boost the collision avoidance business

The emergence of Advanced Driver-Assistance Systems (ADAS) in the realm of passenger vehicles is poised to revolutionize the Automotive Collision Avoidance System (CAS) market. ADAS functionalities, such as automatic emergency braking and lane departure warnings, serve as catalysts for collision avoidance technology. By swiftly identifying potential hazards and prompting corrective actions, ADAS is paving the path towards a future with significantly fewer accidents. This momentum is further fueled by governmental mandates like the European Union's directive requiring AEB systems in all new vehicles by 2022. In the United States, the National Highway Traffic Safety Administration (NHTSA) estimates that the adoption of AEB alone could potentially prevent up to 40% of all police-reported crashes. Acknowledging this immense potential, automotive manufacturers are channeling substantial investments into advancing ADAS capabilities.

CHALLENGES:

Rigid barriers are less effective because more of the impact energy is passed to the car occupants, causing more injuries

Low-cost automobile makers avoid adding these systems, which could slow market growth

The recent conflict in Ukraine has introduced challenges to the Automotive Collision Avoidance System (CAS) market, which previously showed a promising trajectory with a projected 10.4% Compound Annual Growth Rate (CAGR). Immediate repercussions of the war present a mixed scenario. Supply chain disruptions, particularly concerning essential components such as semiconductors often procured from Eastern Europe, are leading to production delays. Concurrently, escalating material costs due to sanctions and global energy price hikes are anticipated to inflate CAS prices. Nevertheless, amidst these challenges, there is a glimmer of hope.

Governments are redirecting their attention towards safety regulations, evident in the US government's injection of an additional $1 billion into the research and development of Advanced Driver-Assistance Systems (ADAS), a category encompassing CAS. Similar endeavors are underway in Europe and China. This renewed governmental commitment to safety, combined with increasing consumer demand for advanced driver assistance features, is poised to drive long-term market growth. While the current conflict poses immediate obstacles, it may inadvertently expedite the advancement and adoption of CAS technologies, ultimately fortifying the market in the years ahead.

An economic downturn could cast uncertainty over the automotive collision avoidance system (CAS) market, though its effects may vary. While decreased consumer spending might lead to fewer overall car purchases and potentially diminish demand for high-end CAS features in new vehicles research indicates a 10% reduction in car sales during such downturns there could be a counterbalancing increase in retrofitting existing cars with CAS features. As consumers prioritize cost-effective safety upgrades for their current vehicles over investing in new cars with advanced CAS pre-installed.

Moreover, government mandates in certain regions are driving CAS adoption. For instance, the European Union's mandate for Emergency Lane Keeping Assist (ELKA) systems in all new cars since 2022 ensures a steady demand, with similar regulations emerging elsewhere. This regulatory momentum, alongside substantial investments in CAS development reaching approximately USD 17.8 billion globally in 2023 implies that the CAS market may experience slower growth rather than a complete halt during an economic slowdown.

Get Customized Report as per Your Business Requirement - Request For Customized Report

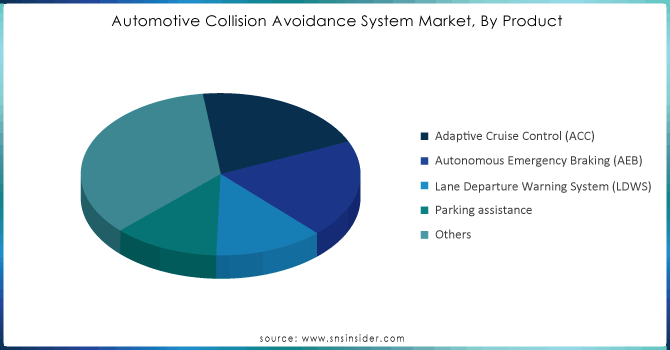

The global market has been divided into Adaptive Cruise Control (ACC), Autonomous Emergency Braking (AEB), Lane Departure Warning System (LDWS), Parking assistance, and Others Based on the product segment. Blind-spot detection and lane departure warning systems that use cameras and radar have become more popular because their prices have gone down.

The rising need for urban parking solutions is expected to bolster the demand for parking assistance systems, while advanced features such as blind spot detection and night vision are anticipated to see increased adoption. Government mandates, like the EU's requirement for AEB implementation in new vehicles by 2022, will notably impact the distribution of market segments. According to our research, ACC currently holds a 35% market share, closely followed by AEB at 30%. LDWS and parking assistance systems are forecasted to secure approximately 20% and 15% of the market share respectively, with the remaining 10% attributed to emerging technologies.

Government mandates, such as the US NHTSA's requirement for automatic emergency braking implementation in new vehicles by 2023, are poised to accelerate the adoption of Collision Avoidance Systems (CAS). Although precise market share projections may vary, analysts indicate that camera systems presently dominate, trailed by RADAR and LiDAR, while ultrasonic and other technologies occupy a more specialized niche. This dynamic landscape is expected to undergo continuous evolution as technology advances and regulatory standards become more stringent.

The global market has been divided into Rail, Automotive, Aerospace and Defense, and Marine based on the application segment. The automotive industry was the most significant user of this technology, followed by the smart railway and the construction and mining industries.

The future trajectory of the Automotive Collision Avoidance System (CAS) market will be significantly influenced by its diversified applications across various sectors. Within the automotive industry, which dominates with an estimated 60% market share as of 2023, market expansion will be propelled by stringent regulations and the escalating demand for Advanced Driver-Assistance Systems (ADAS). Notably, initiatives such as the European Union's mandate requiring ADAS functionalities like Automatic Emergency Braking (AEB) in new vehicles by 2035 will notably stimulate market growth.

Simultaneously, the Rail sector, projected to hold a 10% market share by 2031, is poised to experience substantial investments directed towards the implementation of positive train control systems aimed at collision prevention. Likewise, the Aerospace and Defense segment, comprising approximately 15% of the market share, is anticipated to witness a surge in CAS adoption across military vehicles and autonomous drones, driven by the imperative for heightened safety measures.

By Product:

Adaptive Cruise Control (ACC)

Autonomous Emergency Braking (AEB)

Lane Departure Warning System (LDWS)

Parking assistance

Others

By Technology:

LiDAR

RADAR

Ultrasonic

Camera

Others

By Application:

Rail

Automotive

Aerospace and Defense

Marine

REGIONAL ANALYSIS:

The future of the Automotive Collision Avoidance System (CAS) market in APAC and NA is on a fast track, fueled by government regulations and a safety-conscious consumer base. In the Asia Pacific (APAC) region, stricter NCAP (New Car Assessment Program) mandates, like those recently implemented in China, are expected to significantly boost CAS adoption. This, coupled with a rapidly growing middle class prioritizing car safety, will push the APAC market to a projected CAGR of over 9.95% by 2031.

North America (NA), a mature market, will likely see a shift towards advanced CAS features like automatic emergency braking. Government initiatives like the US Department of Transportation's target for all light vehicles to have forward collision warning by 2025 will play a key role. This focus on advanced functionalities, alongside rising demand for luxury vehicles with top-tier safety features, is expected to propel the NA CAS market to a steady CAGR of around 8.77% in the coming years.

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Robert Bosch GmbH (Germany), General Electric Company (US), Aptiv Plc (Republic of Ireland), Honeywell International, Inc. (the US), Denso Corporation (Japan), Siemens AG (Germany), Alstom SA (France), Rockwell Collins, Inc. (the US), and Hexagon AB (Sweden) are some of the affluent competitors with significant market share in the Automotive Collision Avoidance System Market.

Companies such as Bosch, Continental, and Mobileye have been at the forefront, introducing cutting-edge advancements aimed at enhancing vehicle safety and reducing accidents.

Bosch, for instance, has been focusing on refining its radar and camera-based systems to provide more accurate detection of obstacles and pedestrians, thus enabling quicker responses from vehicles.

Continental has been pushing boundaries with its advanced sensor fusion technology, seamlessly integrating data from multiple sensors to create a comprehensive view of the vehicle's surroundings.

Mobileye has been pioneering the integration of artificial intelligence and machine learning algorithms into its collision avoidance systems, enabling vehicles to anticipate and avoid potential collisions with unparalleled precision.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 58.05 Billion |

| Market Size by 2032 | US$ 128.38 Billion |

| CAGR | CAGR of 9.22% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Product (Adaptive Cruise Control (ACC), Autonomous Emergency Braking (AEB), Lane Departure Warning System (LDWS), Parking assistance, Others) • by Technology (LiDAR, RADAR, Ultrasonic, Camera, Others) • by Application (Rail, Automotive, Aerospace and Defense, Marine) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Robert Bosch GmbH (Germany), General Electric Company (US), Aptiv Plc (Republic of Ireland), Honeywell International, Inc. (the US), Denso Corporation (Japan), Siemens AG (Germany), Alstom SA (France), Rockwell Collins, Inc. (the US), and Hexagon AB (Sweden) |

| Key Drivers | •The increasing popularity of sport utility vehicles (SUVs), luxury cars, and other high-end transportation. •A rise in interest in self-driving cars. |

| RESTRAINTS | •The collision avoidance system market is hampered by high installation costs, which are a key issue. •Due to automobile sales and production being cyclical, market growth is stifled. |

The Automotive Collision Avoidance System Market size was valued at USD 58.05 billion in 2023 and is expected to reach USD 115.67 billion by 2031 and grow at a CAGR of 9.22% over the forecast period 2024-2031.

The CAGR of Automotive Collision Avoidance System market is 9.22%.

North America and Europe region are dominating the Automotive Collision Avoidance System market.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Impact Analysis

5.1 Impact of Russia-Ukraine Crisis

5.2 Impact of Economic Slowdown on Major Countries

5.2.1 Introduction

5.2.2 United States

5.2.3 Canada

5.2.4 Germany

5.2.5 France

5.2.6 UK

5.2.7 China

5.2.8 Japan

5.2.9 South Korea

5.2.10 India

6. Value Chain Analysis

7. Porter’s 5 Forces Model

8. Pest Analysis

9. Global Automotive Collision Avoidance System Market Segmentation, By Product

9.1 Introduction

9.2 Trend Analysis

9.3 Adaptive Cruise Control (ACC)

9.4 Autonomous Emergency Braking (AEB)

9.5 Lane Departure Warning System (LDWS)

9.6 Parking assistance

9.7 Others

10. Global Automotive Collision Avoidance System Market Segmentation, By Technology

10.1 Introduction

10.2 Trend Analysis

9.1 LiDAR

9.2 RADAR

9.3 Ultrasonic

9.4 Camera

9.5 Others

11. Global Automotive Collision Avoidance System Market Segmentation, By Application

11.1 Introduction

11.2 Trend Analysis

10.1 Rail

10.2 Automotive

10.3 Aerospace and Defense

10.4 Marine

12. Regional Analysis

12.1 Introduction

12.2 North America

12.2.1 USA

12.2.2 Canada

12.2.3 Mexico

12.3 Europe

12.3.1 Eastern Europe

12.3.1.1 Poland

12.3.1.2 Romania

12.3.1.3 Hungary

12.3.1.4 Turkey

12.3.1.5 Rest of Eastern Europe

12.3.2 Western Europe

12.3.2.1 Germany

12.3.2.2 France

12.3.2.3 UK

12.3.2.4 Italy

12.3.2.5 Spain

12.3.2.6 Netherlands

12.3.2.7 Switzerland

12.3.2.8 Austria

12.3.2.9 Rest of Western Europe

12.4 Asia-Pacific

12.4.1 China

12.4.2 India

12.4.3 Japan

12.4.4 South Korea

12.4.5 Vietnam

12.4.6 Singapore

12.4.7 Australia

12.4.8 Rest of Asia Pacific

12.5 The Middle East & Africa

12.5.1 Middle East

12.5.1.1 UAE

12.5.1.2 Egypt

12.5.1.3 Saudi Arabia

12.5.1.4 Qatar

12.5.1.5 Rest of the Middle East

11.5.2 Africa

12.5.2.1 Nigeria

12.5.2.2 South Africa

12.5.2.3 Rest of Africa

12.6 Latin America

12.6.1 Brazil

12.6.2 Argentina

12.6.3 Colombia

12.6.4 Rest of Latin America

13. Company Profiles

13.1 Robert Bosch GmbH

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services Offered

13.1.4 SWOT Analysis

13.1.5 The SNS View

13.2 General Electric Company

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services Offered

13.2.4 SWOT Analysis

13.2.5 The SNS View

13.3 Aptiv Plc

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Products/ Services Offered

13.3.4 SWOT Analysis

13.3.5 The SNS View

13.4 Honeywell International, Inc.

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Products/ Services Offered

13.4.4 SWOT Analysis

13.4.5 The SNS View

13.5 Denso Corporation

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Products/ Services Offered

13.5.4 SWOT Analysis

13.5.5 The SNS View

13.6 Siemens AG

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Products/ Services Offered

13.6.4 SWOT Analysis

13.6.5 The SNS View

13.7 Alstom SA

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Products/ Services Offered

13.7.4 SWOT Analysis

13.7.5 The SNS View

13.8 Rockwell Collins, Inc.

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Products/ Services Offered

13.8.4 SWOT Analysis

13.8.5 The SNS View

13.9 Hexagon AB

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Products/ Services Offered

13.9.4 SWOT Analysis

13.9.5 The SNS View

13.10 Others

13.10.1 Company Overview

13.10.2 Financial

13.10.3 Products/ Services Offered

13.10.4 SWOT Analysis

13.10.5 The SNS View

14. Competitive Landscape

14.1 Competitive Benchmarking

14.2 Market Share Analysis

14.3 Recent Developments

14.3.1 Industry News

14.3.2 Company News

14.3.3 Mergers & Acquisitions

15. Use Case and Best Practices

16. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Automotive Smart Antenna Market Size was valued at USD 2.8 billion in 2023 and is expected to reach USD 6.36 billion by 2031 and grow at a CAGR of 10.8% over the forecast period 2024-2031.

The Industrial Vehicles Market Size was valued at USD 41.5 billion in 2023 and is expected to reach USD 61.67 billion by 2032 and grow at a CAGR of 4.5% over the forecast period 2024-2032.

The Automotive Navigation Systems Market Size is expected to reach USD 60.18 billion by 2031 and grow at a CAGR of 7.4% over the forecast period 2024-2031.

The OTR Tires Market size was valued at USD 10.72 billion in 2023, and is expected to reach USD 18.11 Bn by 2032, and grow at a CAGR of 5.48% by 2024-2032

The Rubber Track for Defense & Security Market Size was USD 132.95 Mn in 2023, and will reach USD 228.20 Mn by 2032, and grow at a CAGR of 6.19% by 2024-2032

The Automotive Insurance Market size was valued at USD 680.06 billion in 2023 and is expected to reach USD 935.03 billion by 2031 and grow at a CAGR of 4.05% over the forecast period 2024-2031.

Hi! Click one of our member below to chat on Phone