Automotive Battery Market Size & Overview:

Get More Information on Automotive Battery Market - Request Sample Report

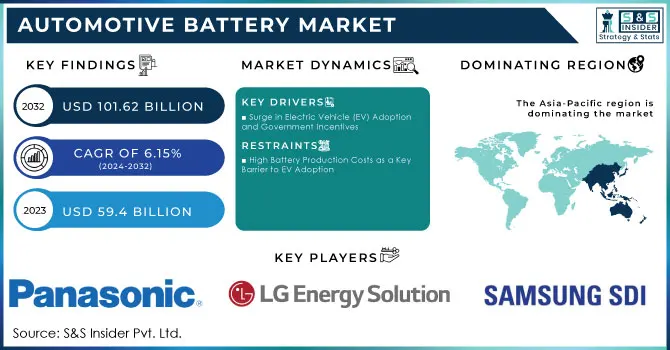

The Automotive Battery Market Size was valued at USD 59.4 Billion in 2023 and is expected to reach USD 101.62 Billion by 2032, growing at a CAGR of 6.15% over the forecast period 2024-2032.

The automotive battery market is experiencing rapid growth, driven by the global shift to electric vehicles (EVs) and the rising demand for sustainable energy solutions. Governments worldwide are pushing for cleaner energy, with many setting deadlines to phase out internal combustion engine (ICE) vehicles in favor of EVs. Global EV sales are projected to account for nearly 50% of all vehicle sales by 2030, with Europe leading the way and EV sales surpassing 10 million units annually. Fueled by federal tax incentives and the Biden-Harris administration's policies, including the USD 45 million allocated by the U.S. Department of Energy for advancing battery manufacturing and recycling technologies.

Innovations in battery technology are key to this transition. Solid-state batteries are also emerging, with IM Motors set to launch the first production vehicle with this technology, featuring a 130-kWh battery pack capable of delivering 622 miles on China’s cycle. Companies like QuantumScape, Solid Power, and Toyota are also advancing solid-state battery production.

EV battery recycling projects to lower costs and support the clean energy transition. The demand for lithium batteries is projected to increase five to tenfold by the decade’s end, driven by the rising popularity of EVs and stationary storage. This growth will be complemented by an increase in battery raw material demand, with the Biden-Harris administration aiming for EVs to represent half of all U.S. vehicle sales by 2030. This strategic investment in battery innovation and recycling will foster a more resilient and sustainable domestic supply chain, benefiting both the environment and the economy.

Automotive Battery Market Dynamics

Drivers

-

Surge in Electric Vehicle (EV) Adoption and Government Incentives

The rapid rise in electric vehicle (EV) adoption is a key driver for the automotive battery market. In 2023, global passenger EV sales reached 10.5 million, a significant increase from 6.5 million in 2021. Europe has seen a particularly notable surge in EV sales, with a 62% growth over the 12 months leading up to July 2023. In Germany, for example, EVs accounted for 20% of the market share in 2023, driven by popular models such as the Volkswagen ID.4, Fiat 500e, and Tesla Model Y. This growth is part of a larger trend in the European Union, where EV adoption has steadily increased since 2018. In the U.S., battery electric vehicle (BEV) sales surpassed those in the European Union for the first time in Q3 2024, reflecting strong demand. Government initiatives, like the Inflation Reduction Act (IRA), have played a crucial role in this growth, offering tax credits and subsidies that reduce EV costs and encourage manufacturers to increase production.Despite challenges like EV infrastructure, ongoing investments are expected to support continued growth and drive the transition to zero-emission vehicles. As global EV sales continue to rise, there is an escalating demand for advanced automotive batteries that can support longer driving ranges, faster charging, and enhanced safety standards. Technological advancements in battery energy density, charging efficiency, and cost reduction are accelerating EV adoption. The increasing popularity of EVs, along with government incentives and the push for decarbonization, is a major catalyst for the automotive battery market, presenting significant opportunities for manufacturers, recyclers, and raw material suppliers as the industry moves toward a sustainable, zero-emission transportation future.

Restraints

-

High Battery Production Costs as a Key Barrier to EV Adoption

One of the most significant challenges in the automotive battery market is the high cost of battery production, which directly affects the affordability and widespread adoption of electric vehicles (EVs). Despite significant technological advancements in battery chemistry and manufacturing, EV battery costs remain relatively high. According to recent reports, the cost of EV battery packs has dropped by 90% from 2008 to 2023, yet they still represent a substantial portion of an EV's total cost. For example, the average cost of an EV battery pack in 2023 is approximately USD 137 per kilowatt-hour (kWh), However, this cost reduction is not yet enough to make EVs affordable for all consumers, particularly in price-sensitive markets. As a result, automakers often face challenges in pricing their vehicles competitively while maintaining profit margins. This high battery cost continues to be a barrier to EV adoption, especially in the entry-level vehicle segment, where affordability is crucial. Furthermore, the cost of raw materials, such as lithium, cobalt, and nickel, remains volatile, contributing to the overall cost of batteries. Recent reports highlight that while metal prices have decreased by up to 60%, demand for these metals is still on the rise, causing potential price fluctuations. Additionally, battery-recycling technologies though under development, are costly and not yet widely adopted, further adding to the overall financial burden. As automakers and consumers continue to face the challenge of high battery costs, market growth could be constrained unless more cost-effective production methods, raw material supply chains, and recycling processes are developed.

Automotive Battery Market Segment Overview

By Battery Type

In 2023, lead-acid batteries held a dominant 51% share of the automotive battery market. Despite the growth of electric vehicles (EVs) and the rise of lithium-ion batteries, lead-acid batteries remain essential for internal combustion engine (ICE) vehicles, providing reliable power for starting engines and powering electrical systems. Their cost-effectiveness, long history of use, and affordability make them a preferred option, especially for budget models. Furthermore, lead-acid batteries are 95% recyclable, supporting sustainability efforts. Their widespread use in commercial vehicles, such as trucks and buses, reinforces their strong market position, even as the industry shifts towards electric mobility.

By Vehicle Type

In 2023, passenger cars captured around 73% of the automotive battery market's revenue, solidifying their position as the largest segment. This is largely due to the high demand for both traditional internal combustion engine (ICE) vehicles and electric vehicles (EVs). Passenger cars, including sedans, hatchbacks, and SUVs, are the most produced and sold vehicle types globally. For ICE vehicles, lead-acid batteries remain the primary choice for powering functions like starting and lighting. However, the rapid shift toward electric and hybrid vehicles has increased demand for lithium-ion batteries, which power battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). As consumers increasingly opt for EVs, spurred by environmental concerns, government incentives, and technological improvements, passenger cars are expected to drive continued growth in the automotive battery market.

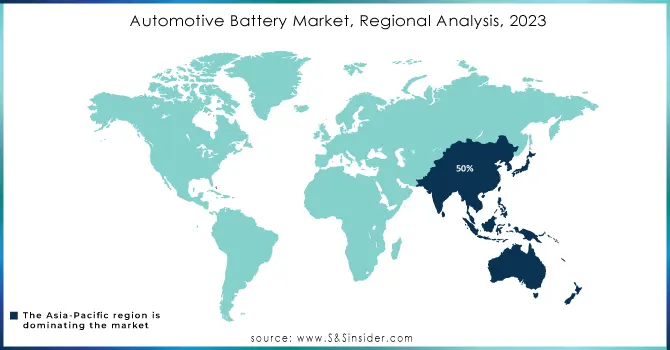

Automotive Battery Market Regional Analysis

In 2023, the Asia-Pacific region accounted for around 50% of the global automotive battery market, driven by the rapid adoption of electric vehicles (EVs) and a robust automotive industry in China, Japan, South Korea, and India. China remains the largest market, fueled by government incentives, subsidies, and stringent emissions regulations, with major battery manufacturers like CATL and BYD. Japan and South Korea are also witnessing significant growth, with automakers such as Toyota, Honda, and Hyundai ramping up EV production, increasing demand for advanced battery technologies. India is emerging as a key market, supported by a growing middle class and government initiatives to reduce pollution. The region’s dominance is expected to persist due to strong policies, rising EV adoption, and key industry investments.

In 2023, North America became the fastest-growing region in the automotive battery market, driven by rising electric vehicle (EV) demand and substantial investments in EV infrastructure. The U.S. and Canada have advanced electric mobility through government incentives like the Inflation Reduction Act (IRA), offering tax credits for manufacturers and consumers. Domestically, automakers and battery producers are focusing on local production of advanced battery technologies. Tesla’s “4680” battery cells, GM’s Ultium battery technology, and Ford’s all-electric F-150 Lightning highlight major product innovations. Additionally, companies like Panasonic and Northvolt are setting up production plants in the region. These factors, combined with strong policies and industry advancements, are propelling North America’s automotive battery market growth and its role in the global transition to electric mobility

Need Any Customization Research On Automotive Battery Market - Inquiry Now

Key Players in Automotive Battery Market

Some of the Major Players in Automotive Battery Market with product:

-

Panasonic (Lithium-Ion batteries, EV batteries for Tesla)

-

LG Energy Solution (Lithium-Ion EV batteries, pouch and cylindrical cells)

-

CATL (Lithium-Ion batteries, LFP and NCM batteries)

-

BYD (Blade Battery, Lithium-Iron Phosphate or LFP)

-

Samsung SDI (Lithium-Ion batteries, prismatic and cylindrical cells)

-

SK Innovation (Lithium-Ion batteries, pouch-type EV batteries)

-

A123 Systems (Lithium-Ion phosphate batteries for EVs)

-

Johnson Controls (Lead Acid, Absorbent Glass Mat (AGM) batteries)

-

GS Yuasa (Lead Acid, Lithium-Ion batteries for hybrid vehicles)

-

Exide Industries (Lead Acid batteries, Enhanced Flooded Batteries (EFB))

-

Toshiba (SCiB rechargeable batteries, Lithium-Titanate)

-

EnerSys (Lead Acid batteries, AGM batteries)

-

Amara Raja (Lead Acid batteries, VRLA batteries)

-

VARTA AG (Lead Acid batteries, AGM and EFB batteries)

-

Hitachi Chemical (Lithium-Ion batteries for hybrid vehicle applications)

-

Leoch International (Lead Acid batteries, Gel and AGM batteries)

-

Banner Batteries (Lead Acid batteries, AGM and EFB batteries)

-

Saft Group (Lithium-Ion batteries for specialty applications)

-

Clarios (Lead Acid batteries, AGM and EFB batteries)

-

Northvolt (Lithium-Ion batteries, prismatic cells for EVs)

List of companies that supply raw materials for automotive battery cells, which are crucial for manufacturing Lithium-Ion and Lead Acid batteries:

-

Albemarle Corporation

-

Livent Corporation

-

Ganfeng Lithium

-

Glencore

-

Vale S.A.

-

BASF

-

Umicore

-

POSCO Chemical

-

Sumitomo Metal Mining Co., Ltd.

-

Shaanxi Nonferrous Tiancheng Lithium Co.

-

China Northern Rare Earth Group High-Tech Co.

-

Mitsubishi Corporation RtM Japan Ltd.

-

Zhejiang Huayou Cobalt Co., Ltd.

-

Tianqi Lithium

-

Koch Industries

-

Xiamen Tungsten Co., Ltd.

-

Shaanxi J&R Optimum Energy Co.

-

Ningbo Shanshan Co., Ltd.

-

Piedmont Lithium

-

Sichuan Yunnan Tin Company

Recent News

-

March 2024: Morocco announced the establishment of its first industrial zone dedicated to electric vehicle (EV) battery production, with initial investments total USD 2.3 billion. The 283-hectare industrial zone is expected to attract investments from companies like CNGR (China) and Al Mada (Moroccan-based African private investment fund).

-

February 2024: JSW Group plans to invest USD 4.82 billion to establish electric vehicle and battery manufacturing projects in Odisha, India. JSW formed a joint venture with SAIC Motor (China) in November 2023, aiming to compete with both domestic and international players in India's expanding EV market

Recent Development

-

March 2024: Exide Technologies acquired BE-Power GmbH, marking a significant milestone.The acquisition allows both companies to combine their strengths and increase investments in the advanced lithium-ion battery business.

-

May 2024: EnerSys signed an agreement to acquire Bren-Tronic, Inc., a leading manufacturer of lithium batteries and charging solutions.The acquisition strengthens EnerSys’s position in the Specialty Aerospace and Defense business, enhancing its offerings for military and defense applications with improved engineering and product development competencies.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 59.4 Billion |

| Market Size by 2032 | USD 101.62 Billion |

| CAGR | CAGR of 6.15% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Battery Type (Lead Acid, Lithium-Ion, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Panasonic, LG Energy Solution, CATL, BYD, Samsung SDI, SK Innovation, A123 Systems, Johnson Controls, GS Yuasa, Exide Industries, Toshiba, EnerSys, Amara Raja, VARTA AG, Hitachi Chemical, Leoch International, Banner Batteries, Saft Group, Clarios, and Northvolt. |

| Key Drivers |

• Surge in Electric Vehicle (EV) Adoption and Government Incentives |

| RESTRAINTS |

• High Battery Production Costs as a Key Barrier to EV Adoption |