Automotive Aftermarket Industry Size & Overview:

Get More Information on Automotive Aftermarket Industry - Request Sample Report

The Automotive Aftermarket Industry Size was valued at USD 425.25 billion in 2023 and is expected to reach USD 575.52 billion by 2031 and grow at a CAGR of 3.92% over the forecast period 2024-2031.

-

Analysis of Present and Future demand landscape:

The aftermarket industry is experiencing several driving forces. As the global vehicle fleet ages, there's a heightened need for frequent part replacements. The exapnding car ownership in developing nations such as China and India is boosting demand for parts. The enduring popularity of performance enhancements and customization fuels the aftermarket accessories market. Moreover, the increasing complexity of modern vehicles, characterized by advanced features requiring specialized parts, opens up a niche market for aftermarket players. However, the emergence of electric vehicles (EVs) presents a long-term challenge due to their extended service intervals and potentially reduced need for traditional wear-and-tear parts. To adapt, aftermarket businesses are shifting focus towards EV-specific components like charging equipment and battery maintenance systems, ensuring their relevance in the ever-evolving automotive landscape. Notably the change in the YoY was observed around 4 - 5% and is projected to reach 10% during the forecasted peirod.

It has been changing as a result of changing consumer preferences and product advancements. The transition from a duopolistic to a fiercely competitive commercial vehicle market has allowed the automotive aftermarket to grow in the two-wheeler space, as well as experience qualitative changes in terms of improved performance, improved fuel efficiency, and increased safety and comfort, technology adaptation, and improved activities to streamline connectivity. Despite these changes, the aftermarket has maintained its momentum, with companies launching innovative solutions with a greater network reach, digital solutions, and a variety of other activities.

MARKET DYNAMICS:

KEY DRIVERS:

-

Automobile sales are rapidly expanding, and demand for international brands is increasing.

-

Increasing technological advancements, as well as increased internet adoption and digitalization.

The increasing complexity of modern vehicles, characterized by advanced features such as autonomous driving systems and electric drivetrains, is driving a growing need for a technologically adept aftermarket. This demand surge necessitates specialized parts, diagnostic tools, and technicians proficient in these cutting-edge technologies. Concurrently, the pervasive influence of the internet and digitalization is reshaping the customer journey. Online parts sales are experiencing a year-over-year growth rate exceeding 15%, facilitated by platforms offering convenient access to extensive component selections and promoting price transparency. Moreover, repair shops are integrating digital tools for tasks like appointment scheduling, online diagnostics, and remote monitoring, resulting in a more streamlined service experience for consumers.

RESTRAINTS:

-

Increased government subsidies have resulted in a decrease in sales.

-

The sharp reduction in the no. of older workers needed by the aftermarket services.

-

Vehicle maintenance has increased as a result of more strict pollution control and safe transportation laws.

OPPORTUNITIES:

-

The government's increased emission standards ensure the emergence of growth prospects for this market.

-

The demand is set to benefit from a shift in the trend of vehicle customization to attain maximum performance.

-

As people put off buying a new car due to economic concerns, the average vehicle age is anticipated to rise.

As economic concerns lead to tighter budgets and deferred new car purchases, the automotive aftermarket sector is positioned for significant growth. Anticipated increases in the average age of vehicles indicate a rising demand for replacement parts, accessories, and repair services. Already, year-over-year (YOY) growth in the aftermarket industry is evident, with projections indicating a surge of 4% to 4.8% compared to previous years.

CHALLENGES:

-

High R&D costs are a concern.

-

Vehicle safety technology adoption and electric vehicle sales are on the rise.

IMPACT OF RUSSIA-UKRAINE WAR:

The conflict has worsened existing vulnerabilities in supply chains, which were already strained by the COVID-19 pandemic and semiconductor shortages. This has resulted in shortages of components and halts in production not only within Russia and Ukraine but also impacting automotive factories across Europe and beyond. Notably, plants like Eurocar in Ukraine and others such as Hyundai and Toyota in Russia have experienced production suspensions due to component shortages. Sanctions imposed on Russia have compelled automakers to seek alternative sources for components like engines, gearboxes, and powertrains. This shift requires significant adjustments in supply chain strategies, potentially involving divestment from Russia and Ukraine and reinvestment in other European countries to ensure business continuity. In order to mitigate similar risks in the future, automotive companies are contemplating diversifying their sourcing of inventory across different regions and suppliers. This strategic move may entail a departure from lean, just-in-time inventory models to maintaining larger inventories, necessitating significant changes in how the automotive aftermarket functions.

The crisis has led to escalating costs, which in turn affects consumer demand within the automotive sector. As companies grapple with these heightened expenses and supply chain disruptions, there may be downstream effects on the availability and pricing of aftermarket parts and services.

In essence, the Russia-Ukraine crisis presents substantial challenges for the automotive industry, prompting strategic shifts in supply chain management, sourcing practices, and inventory strategies to navigate the uncertain landscape.

IMPACT OF ECONOMIC SLOWDOWN:

The current worldwide economic downturn is significantly impacting the Automotive Aftermarket Industry, characterized by evolving trends and consumer habits. With an estimated value of $800 billion, the industry is projected to experience a yearly growth rate of 3%, reaching about $1.2 trillion by 2030. However, this growth trajectory is influenced by transformative technologies and market dynamics, leading to disruptions across the value chain, alterations in consumer access, and changes in profit distribution. Notably, the emergence of electric vehicles, connected cars, and the increasing prominence of e-commerce could potentially result in a shift of 30% to 40% of aftermarket profits.

The Automotive Aftermarket Industry is compelled to adjust to changing consumer demands, technological progressions, and broader economic trends. Industry participants should contemplate expanding their product range, improving digital infrastructure, and innovating new business strategies to stay competitive and seize emerging prospects.

Overview of Market Segmentation Analysis:

The automotive aftermarket thrives by meeting the diverse needs of vehicle owners, with replacement parts being its dominant sector, holding a substantial 60% share. This category addresses the wear and tear inherent in daily driving, covering vital elements such as brake pads (with a lifespan of approximately 25,000-70,000 miles), filters (typically replaced every 3,000-15,000 miles depending on type), and tires (renewed every 30,000-70,000 miles). The demand for these parts is buoyed by the aging global vehicle fleet, where older automobiles require more frequent replacements. Additionally, the popularity of extended warranties and the DIY maintenance trend contribute significantly to this segment. Extended warranties often necessitate the use of specific aftermarket parts for repairs, while DIY enthusiasts seek a broad range of replacement components at competitive prices. Nonetheless, challenges persist. Counterfeit parts pose risks to safety and performance, and the growing complexity of modern vehicles may lead to more repairs being conducted by specialized dealerships with advanced tools and expertise. Nevertheless, the fundamental need to replace worn-out parts ensures that this segment will remain the cornerstone of the automotive aftermarket for the foreseeable future.

Market, By Replacement Parts

The global market is divided into tires, Brake Parts, Body parts, Lighting & Electronic Components, Filters, Exhaust components, batteries, Wheels, Turbochargers, and Others based on the replacement parts segment. In terms of replacement parts, the tire category would be the largest and is expected to dominate the market in terms of size. Because tires have a shorter replacement cycle than their component counterparts, it is projected to remain the leading segment.

Market, By Distribution Channels:

According to the distribution channels segment, the global market is divided into Retailers, Wholesaler & Distributor. In terms of size, the retail segment is expected to dominate the market. In terms of revenue, the wholesale and distribution industry is expected to increase at a rapid pace. Original Equipment Manufacturers (OEMs), Original Equipment Suppliers (OES), wholesalers, and workshop owners are all responding to the expanding online aftermarket trend.

Market, By Service Channels:

To Get Customized Report as per your Business Requirement - Request For Customized Report

Based on the service channels, the global market has been divided into DIY (Do it yourself), DIFM (Do it for Me), and OE (Delegating to OEMs). In terms of scale, the OEM segment is expected to dominate the aftermarket. In terms of revenue, the DIY market is expected to increase at a rapid pace. Customers of DIFM purchase parts online but have them installed by a professional workshop.

MARKET SEGMENTATION:

By Replacement Parts:

-

Tire

-

Brake Parts

-

Body parts

-

Lighting & Electronic Components

-

Filters

-

Exhaust components

-

Battery

-

Wheels

-

Turbochargers

-

Others

By Distribution Channel:

-

Retailers

-

Wholesaler & Distributor

By Service Channel:

-

DIY (Do it yourself)

-

DIFM (Do it for Me)

-

OE (Delegating to OEMs)

REGIONAL ANALYSIS:

The APAC region is emerging as a dominant force in the global automotive aftermarket sector, with a projected Compound Annual Growth Rate (CAGR) surpassing 4.1% from 2024 to 2031. By 2028-2031, the market size is expected to exceed USD 170 billion, driven by several key factors. The market share of APAC region for this market is estimated around 20%-28%. The rising middle class in APAC is leading to an increase in the number of vehicles, especially older ones requiring frequent maintenance. Secondly, economic growth is resulting in higher disposable incomes, enabling car owners to prioritize vehicle maintenance. Lastly, the proliferation of e-commerce platforms is making replacement parts more accessible, disrupting traditional distribution channels and fostering a more competitive environment. While China leads the region with the largest automotive aftermarket, countries like India and those in Southeast Asia are witnessing significant year-on-year demand growth, making APAC an attractive market for both established companies and new entrants in the automotive aftermarket industry.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS:

Continental AG (Germany), Aisin Seiki Co. Ltd. (Japan), Robert Bosch GmbH (Germany), 3M (U.S.), Valeo (France), Denso Corporation (Japan), Magneti Marelli S.p.A. (Italy), Cooper Tire & Rubber Company (U.S.), Sumitomo Electric Industries Ltd. (Japan), Federal-Mogul Corporation (U.S.), Aptiv PLC (U.K.), Delphi Automotive PLC, HELLA KGaA Hueck & Co., Valeo Group, ZF Friedrichshafen AG are some of the affluent competitors with significant market share in the Automotive Aftermarket Industry.

Recent Developments:

-

Bosch have unveiled groundbreaking advancements in electric vehicle (EV) components, pushing the boundaries of efficiency and sustainability.

-

3M's introduction of advanced materials for automotive maintenance has redefined durability standards, enhancing vehicle longevity.

-

Bridgestone's tire technology has seen significant upgrades, prioritizing safety and performance in all road conditions.

-

AutoZone's strategic expansion into digital platforms has revolutionized the customer experience, providing seamless access to a wide array of aftermarket products and services. These developments signify a concerted effort among industry giants to not only meet evolving consumer demands but also to pioneer transformative solutions shaping the future of automotive maintenance and repair.

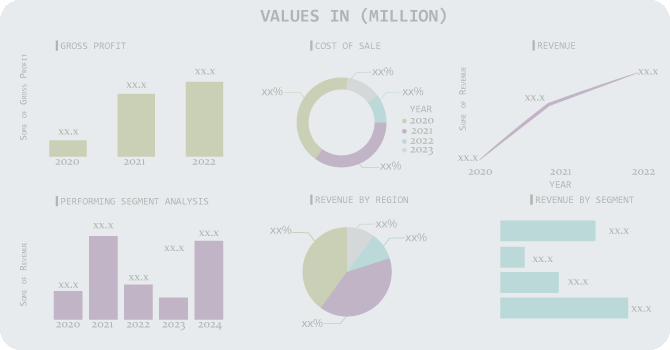

Denso Corporation (Japan)-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 425.25 Billion |

| Market Size by 2031 | US$ 575.52 Billion |

| CAGR | CAGR of 3.92% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Replacement Parts (Tire, Brake Parts, Body parts, Lighting & Electronic Components, Filters, Exhaust components, Battery, Wheels, Turbochargers, Others) • by Distribution Channel (Retailers, Wholesaler & Distributor) • by Service Channel (DIY (Do it yourself), DIFM (Do it for Me), OE (Delegating to OEMs)) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Continental AG (Germany), Aisin Seiki Co. Ltd. (Japan), Robert Bosch GmbH (Germany), 3M (U.S.), Valeo (France), Denso Corporation (Japan), Magneti Marelli S.p.A. (Italy), Cooper Tire & Rubber Company (U.S.), Sumitomo Electric Industries Ltd. (Japan), Federal-Mogul Corporation (U.S.), Aptiv PLC (U.K.), Delphi Automotive PLC, HELLA KGaA Hueck & Co., Valeo Group, ZF Friedrichshafen AG |

| Key Drivers | •Automobile sales are rapidly expanding, and demand for international brands is increasing. •Increasing technological advancements, as well as increased internet adoption and digitalization. |

| RESTRAINTS | •Increased government subsidies have resulted in a decrease in sales. •The sharp reduction in the no. of older workers needed by the aftermarket services. |