Automotive Aftermarket Glass Market Size & Overview:

Get More Information on Automotive Aftermarket Glass Market - Request Sample Report

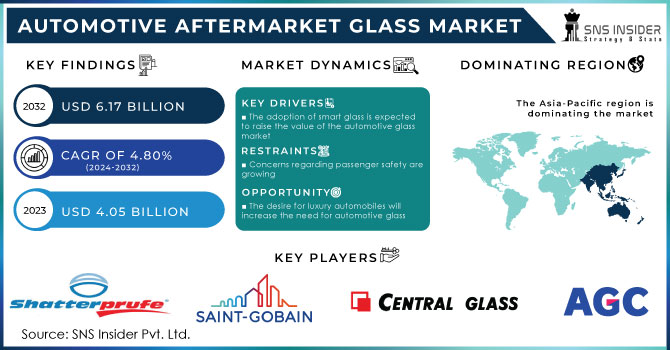

The Automotive Aftermarket Glass Market Size was valued at USD 4.05 billion in 2023 and is expected to reach USD 6.17 billion by 2032 and grow at a CAGR of 4.80% over the forecast period 2024-2032.

The automotive aftermarket glass market is characterized by an ever-growing demand fueled by a myriad of factors. As vehicle ownership continues to rise globally, so does the need for replacement and repair of automotive glass components. Market demand is driven not only by wear and tear but also by accidents and environmental factors, such as extreme weather conditions or road debris. Additionally, advancements in vehicle safety features necessitate specialized glass solutions, further amplifying market demand. Consumer preferences for customization and aesthetics also contribute to the surge in demand, as drivers seek to enhance the appearance and functionality of their vehicles. Moreover, the growing trend towards sustainability and eco-friendliness has spurred demand for energy-efficient and recyclable glass options, reflecting an evolving consumer mindset. In essence, the market demand for automotive aftermarket glass is a dynamic interplay of practical necessity, technological innovation, and evolving consumer preferences, shaping the industry's landscape and driving continual growth and adaptation.

Market Understanding:

Automotive glasses are decorative auto glasses that shield passengers from the elements like rain, wind, and sunlight. Rising vehicle demand and wealth in various countries are expected to boost the worldwide auto glass industry ahead. Increased passenger safety concerns and the development of smart glass technologies to improve sunlight protection, comfort, and visibility are expected to drive the growth of the Auto Glass Market throughout the forecast period. Additionally, rising demand for lightweight automobiles, as well as increasing technological advances and innovation in vehicle design, are expected to boost the Auto Glass Market's growth.

Although the industry is expected to grow steadily in the next years, several issues, such as inventory management and more digitization, may stifle growth to some extent. The availability of several car models around the world makes it difficult for market suppliers to manage inventories according to client needs. Additionally, increased customer awareness of product prices and alternative options as a result of digitalization is anticipated to reduce vendor margins.

MARKET DYNAMICS:

KEY DRIVERS:

-

The adoption of smart glass is expected to raise the value of the automotive glass market

-

Sunroof glass is becoming more popular in high-end vehicles

-

Creation of new glass design iterations

-

Auto industry technological advancements

-

Customers' high level of living

-

Growing industrialization and urbanization

-

Rise in production of Electric vehicle

The automotive aftermarket glass market is experiencing a notable surge in response to the rise in production of electric vehicles (EVs). As the automotive industry continues its pivotal shift towards sustainability and cleaner transportation solutions, EVs have emerged as a driving force behind this transformation. This shift is propelling demand for specialized glass components tailored to the unique design and requirements of electric vehicles. With a focus on enhancing aerodynamics, reducing weight, and optimizing energy efficiency, aftermarket glass manufacturers are innovating at a rapid pace to meet the evolving needs of the automotive sector.

RESTRAINTS:

-

Higher automotive glass manufacturing costs may limit global market share

-

Concerns regarding passenger safety are growing

-

The entire cost of automotive glass is influenced by the material's limited supply

OPPORTUNITIES:

-

The desire for luxury automobiles will increase the need for automotive glass

-

Increased safety standards on automotive glass and rising passenger vehicle sales

With the expanding demand for passenger vehicles globally, the Automotive Aftermarket Glass Market has witnessed a significant surge in sales. This uptick can be attributed not only to the rising number of vehicles on the road but also to the increased emphasis on safety standards regarding automotive glass. Manufacturers and consumers alike are increasingly prioritizing safety features, including advanced glass technologies, to enhance passenger protection and mitigate risks on the road.

CHALLENGES:

-

Industry players may face considerable obstacles due to government limitations on automobile glass certification

-

Acquisition of raw materials for the production of automobile glass

IMPACT OF RUSSIA-UKRAINE WAR:

As geopolitical tensions escalate, key players in the automotive glass market find themselves navigating a landscape fraught with uncertainty. Supply chain disruptions stemming from the conflict have posed challenges in sourcing raw materials essential for manufacturing automotive glass components. This, coupled with economic sanctions and geopolitical instability, has led to price volatility and production delays, impacting the profitability and operations of market players. Additionally, the rising geopolitical tensions have dampened consumer confidence and slowed down passenger vehicle sales in affected regions. Despite these challenges, the automotive aftermarket glass market remains resilient, with manufacturers and distributors exploring alternative supply routes and strategies to mitigate the impact of the conflict. As the situation continues to evolve, adaptation and flexibility will be crucial for sustaining growth and navigating the complexities of the automotive glass market amidst geopolitical turmoil.

IMPACT OF ECONOMIC SLOWDOWN:

When confronted with an economic slowdown, the landscape undergoes a recalibration, impacting key players significantly. In such times, the demand for automotive aftermarket glass faces a delicate balancing act. On one hand, the reduced consumer spending and cautious investment sentiment may dampen the demand for replacement glass, affecting the revenue streams of major players in the industry. Conversely, the aftermarket segment often sees a surge in demand during economic downturns, as consumers opt to repair and maintain their existing vehicles rather than purchasing new ones. This trend is particularly noticeable in the passenger vehicle sector, where individuals seek cost-effective solutions to prolong the lifespan of their vehicles. Consequently, while the overall automotive industry may experience a slowdown, the aftermarket glass market could witness a spike in sales driven by the necessity for affordable repairs. The interplay between economic conditions and consumer behavior underscores the resilience and adaptability of the automotive glass market, as key players navigate through turbulent times, leveraging opportunities within the aftermarket segment to mitigate the impact of economic slowdowns.

MARKET SEGMENTATION:

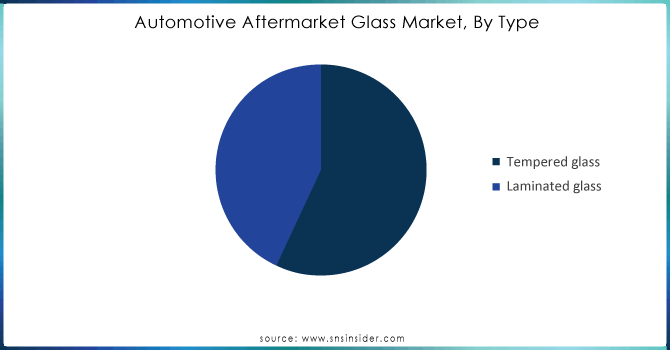

Market, By Type:

In the automotive aftermarket glass sector, two primary varieties stand out: tempered and laminated glass. Tempered glass holds the lion's share, commanding approximately 51.3% of the market as of 2022. This dominance is primarily attributed to its cost-effectiveness and impressive durability, making it a preferred choice for side and rear windows (sidelite and backlite). However, there's a notable uptick anticipated in the demand for laminated glass, with a projected YoY of 6.2%. This surge is fueled by a growing emphasis on safety among consumers, leading to an increased adoption of laminated glass for windshield replacements. This trend towards laminated windshields signals a potential future challenge to the longstanding supremacy of tempered glass in the market.

Get Customized Report as per your Business Requirement - Request For Customized Report

Market, By Vehicle Type:

In 2023, passenger cars maintained their stronghold in the automotive aftermarket glass market, accounting for a significant 66% share. This dominance is primarily driven by the abundant presence of passenger cars on the roads, surpassing other vehicle categories. Nonetheless, the light commercial vehicle (LCV) segment is anticipated to exhibit remarkable growth, boasting a projected YoY that surpasses passenger cars. This surge is attributed to the escalating demand for delivery vans and the expanding realm of e-commerce activities. Although heavy commercial vehicles currently hold a smaller market share, potential advancements in automation and infrastructure enhancements in specific regions could shape their future growth trajectory.

Market, by Application:

Based on the application segment, the global market has been divided into Windscreen, Backlite, Sunroof, and Sidelight. Because of its increased consumption in the car industry, the windscreen segment will lead the market over the projection period.

By Type:

-

Tempered Glass

-

Laminated Glass

By Vehicle Type:

-

Passenger vehicles

-

Heavy Commercial vehicles

By Application:

-

Windscreen

-

Backlite

-

Sidelight

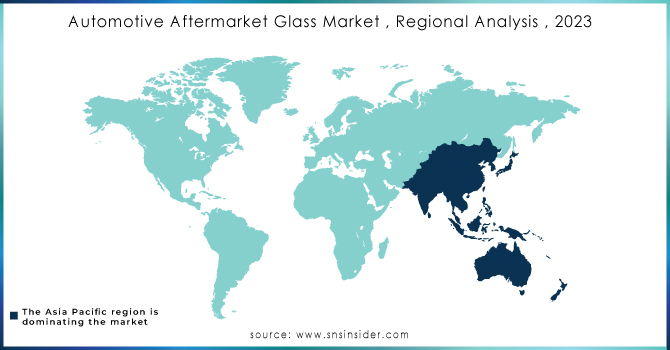

REGIONAL ANALYSIS:

The global market is divided into four regions: Asia Pacific (APAC), Europe, North America, and the Rest of the World. The abundance of economic resources in India and China to assemble and manufacture automotive parts, the presence of established glass manufacturing players, and the presence of several new production plants in China to meet the growing demand for electric cars are all contributing to the region's global market growth. This expanding demand necessitates a parallel expansion in the aftermarket glass sector, crucial for vehicle maintenance and safety. The region's diverse landscape, comprising emerging economies like China, India, and Southeast Asian nations, presents a dynamic market characterized by evolving consumer preferences and regulatory landscapes. Additionally, the increasing adoption of advanced automotive technologies further fuels the demand for high-quality aftermarket glass solutions to meet the stringent safety standards. Against this backdrop, stakeholders in the APAC automotive aftermarket glass market are poised for substantial growth opportunities, propelled by a confluence of factors driving the region's automotive industry forward.

Over the projected period, Europe is expected to hold the second-largest share of the worldwide automotive glass business. The worldwide automotive glass market in North America is expected to increase steadily over the projected period.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS:

Major Company profiles included are Shatterprufe (South Africa), Saint Global S.A. (Paris), Central Glass Co. Ltd (Tokyo), Xinyi Glass Holdings Limited (Hong Kong), Asahi Glass Co., Ltd (Japan), Fuyao Glass Industry Group Co. Ltd (China), Olimpia Auto Glass Inc. (Turkey), Guardian Industries Corp (US), Vitro, Taiwan Glass Ind. Corp, S.A.B. de C.V. (Mexico), and Nippon Sheet Glass Co. Ltd (Japan).

Recent Developments:

-

Gobain, who have been pioneering advancements in glass technology, introducing innovative solutions aimed at enhancing safety, durability, and aesthetics in automotive glass products.

-

AGC Inc. has been actively expanding its global footprint through strategic acquisitions and collaborations, further solidifying its position as a prominent player in the market.

-

Nippon Sheet Glass Co., Ltd. has been focusing on sustainable practices and eco-friendly initiatives, aligning its product offerings with the growing trend towards environmentally conscious solutions. These key players, among others, continue to shape the Automotive Aftermarket Glass Market, driving innovation and setting new benchmarks for excellence in the industry.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 4.05 Billion |

| Market Size by 2032 | US$ 6.17 Billion |

| CAGR | CAGR of 4.80 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Type (Tempered Glass, Laminated Glass) • by Vehicle Type (Passenger Vehicles, Light Commercial Vehicles, Heavy Commercial vehicles) • by Application (Windscreen, Backlite, Sunroof, Sidelight) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Shatterprufe (South Africa), Saint Global S.A. (Paris), Central Glass Co. Ltd (Tokyo), Xinyi Glass Holdings Limited (Hong Kong), Asahi Glass Co., Ltd (Japan), Fuyao Glass Industry Group Co. Ltd (China), Olimpia Auto Glass Inc. (Turkey), Guardian Industries Corp (US), Vitro, Taiwan Glass Ind. Corp, S.A.B. de C.V. (Mexico), and Nippon Sheet Glass Co. Ltd (Japan). |

| Key Drivers | •The adoption of smart glass is expected to raise the value of the automotive glass market. •Sunroof glass is becoming more popular in high-end vehicles. |

| RESTRAINTS | •Higher automotive glass manufacturing costs may limit global market share. •Concerns regarding passenger safety are growing. |