Get more information on Automotive Adhesives Market - Request Sample Report

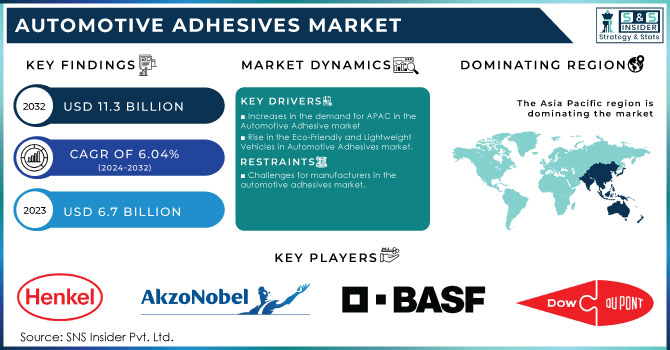

The Automotive Adhesives Market Size was valued at USD 6.7 Billion in 2023. It is expected to grow to USD 11.3 Billion by 2032 and grow at a CAGR of 6.04% over the forecast period of 2024-2032.

The growing use of multi-material bonding in today's vehicles is indicative of the trend within the automotive sector toward stronger, lighter, and more efficient designs. In their quest for greater fuel efficiency and reduced emissions, automakers increasingly look to a combination of steel, aluminum, and composites. For instance, in the case of glass-to-metal joints, adhesives offer a flexible, durable, and reliable method for bonding these dissimilar materials with different thermal expansion behavior and mechanical properties to enable successful integration. Adhesives facilitate the bonding of multipurpose materials that help maintain structural stability in vehicles while also having potential implications for crash safety, vehicle weight reduction, and overall performance. This trend is key to satisfying changing regulations and consumer expectations for more environmentally friendly vehicles.

According to the U.S. Department of Energy, the use of lightweight materials such as aluminum and composites in vehicles can reduce vehicle weight by 10-50%, improving fuel efficiency by 6-8% for every 10% reduction in weight. This directly supports the shift towards multi-material bonding in the automotive industry.

The use of adhesives in the automated manufacturing process is changing how vehicles are built, especially in high-volume automotive assembly plants. Vehicle designs are becoming increasingly complex, and new technological advancements are enabling the use of more advanced materials that demand precision production. One of the key technologies in this transformation is adhesive dispensing robots and automated systems. Using exact precision these systems apply the adhesives that optimize the inter-bonding processes for each steel, aluminum, and composites. This can not only increase accuracy in material usage but can also eliminate wastage and lessen the time taken for production, allowing manufacturers to ramp up operations seamlessly.

According to the U.S. Bureau of Labor Statistics (BLS), the use of robots in manufacturing industries, including automotive, increased significantly. By 2021, nearly 30% of U.S. manufacturers used robots in their production processes, with the automotive industry leading this trend. Automation technologies, such as adhesive dispensing systems, are integral to improving precision and efficiency in vehicle production.

Drivers

Increases in the demand for APAC in the Automotive Adhesive market

Rise in the Eco-Friendly and Lightweight Vehicles in Automotive Adhesives market.

The Automotive adhesives market is driven by the growth of eco-friendly and lightweight vehicles. Nowadays, the government has taken stringent rules regarding the environmental concern for the global footprint and provides various advantages tax benefits to the companies. So, car companies have no choice but to aim lower than ever when it comes to carbon footprints. This has caused a transition between regular heavy materials such as steel, and aluminum composites to lighter and high-strength plastic. Adhesives enable this transformation, providing the means to bond these lightweight materials that cannot be joined effectively using standard mechanical fasteners such as bolts or welds. Moreover, they also work to reduce weight by removing the requirement for heavy joining hardware. With the increasing popularity of electric vehicles (EVs), automakers are now more than ever, forced to build lighter and more energy-efficient vehicles that make the most out of EV batteries. Eco-friendly adhesives further support the industry's sustainability objectives due to their low or zero volatile organic compound (VOC) nature and the absence of harmful chemicals. This new wave of increasing demand for sustainable lightweight vehicle production is further escalating the demand for advanced automotive adhesives.

The European Union's Green Deal targets a 55% reduction in CO2 emissions from cars by 2030, compared to 2021 levels. This legislation is propelling the automotive industry toward eco-friendly and lightweight vehicles, and adhesives play a key role in ensuring these vehicles meet the required emissions targets by reducing overall vehicle weight.

Restraint

Challenges for manufacturers in the automotive adhesives market.

High-Performance Adhesives and Cost Considerations in the Adhesive Industry.

The high prices of raw materials greatly influence the cost price of automotive adhesives and have become a main challenge faced by manufacturing entities. Changes in prices of key raw materials like petrochemicals, resins, or polymers affect the production costs of adhesives. From there, manufacturers must decide if they can absorb those extra costs without squeezing their margins too tightly or hand that cost increase to carmakers. This, in turn, could raise vehicle production costs and ultimate prices to consumers. Additionally, it has proven to be a recipe for sometimes scarceness of adhesive vital parts because of the unrestrained raw material industry. These shortages can halt production schedules, slowing down the supply chain and leading to delayed deliveries of adhesives to automotive manufacturers. This presents additional complications because carmakers need to have a steady supply of adhesives to keep their production on track, which in turn impacts automotive production as a whole.

Opportunity

Customization Fuels the Automotive Adhesives Market.

Growing electric vehicle (EV) market in the adhesives industry.

enhanced strength and heat resistance can open doors for new applications.

As the demand for vehicles that can be modified to different needs and desires continues to rise, automotive adhesives market figures also witness significant transformations in the global automotive market. With consumers increasingly looking for customized features and designs, the automakers are opting for a multitude of materials to satisfy these demands. Traditional joining technologies such as welding have limitations due to the incompatibility of materials combined with the need for rigid joints. On the other hand, adhesives provide much more versatility to flawlessly bond a variety of modern body materials, including high-strength steel regular decay metals composites adjuncts and plastics. This flexibility enables a range of innovative, customized vehicle designs with consistent structural integrity and crash safety performance. Beyond weight reduction and fuel efficiency, they provide additional solutions for the ongoing transition to personalized lightweight vehicles. While automakers look for new vehicle customization possibilities, adhesives are also playing a larger role in achieving functional and aesthetic goals.

By Resin Type

The Polyurethane segment held the largest market share around 31% in 2023. polyurethanes are the go-to choice for structural bonding of various automotive components. From body panels and glass installation to interior assembly, PUs offers exceptional adhesive strength, flexibility to accommodate movement, and impressive resistance to both impact and temperature fluctuations. This versatility makes them a popular choice for a wide range of automotive applications. In the automotive industry, polyurethane adhesives are commonly used in structural bonding, windshield installation, and interior assembly, where strong yet flexible bonding is crucial for both safety and performance. Additionally, polyurethane adhesives contribute to vehicle weight reduction, which is a key factor in improving fuel efficiency and meeting stringent emissions regulations. As automakers continue to prioritize lightweight materials and durable bonding solutions, the demand for polyurethane adhesives remains high, solidifying their dominance in the market.

By Technology

Water-based adhesives held the largest market share around 34% in 2023. Water based adhesives are formulated using water as a solvent, therefore they have much lower volatile organic compounds (VOCs) than the solvent-based types. This fits with the trend in the sector towards sustainability and increasingly strict environmental regulations. Water-based adhesives also have great adhesion capabilities on a range of substrates including metals, plastics, and composites, which is key in modern automotive manufacturing. These components are easy to apply and clean, with a fast-drying time that supports production efficiency on an assembly line. In addition to this, the growing awareness among consumers and the increasing regulatory pressure over environmental impacts is likely to drive further demand for water-based adhesives which will continue to dominate automotive adhesives technology.

By Application

Body-in-White (BIW) segment held the largest market share in the automotive adhesives market around 40% in 2023. It is because of its importance on vehicle structure and safety. The term used in automotive nomenclature is the build stage between the frame and body shell of the vehicle, before painting and component installation; hence the acronym BIW. The adhesives used in this stage are critical for joining different substrates like high-strength steel, aluminum, and composites that are increasingly being used to increase vehicle strength and reduce weight. Adhesives are used additionally as they allow the incorporation of these materials into BIW applications which also improves overall vehicle rigidity and crash performance. Also, a rise in the interest toward lightweight planning of vehicles for gathering fuel effectiveness and discharge standards is additionally driving interest for pitches in BIW fragments.

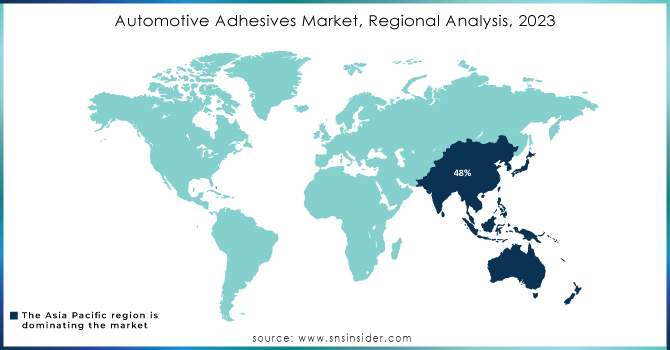

The Asia Pacific region held the largest market share around 48% in 2023. Factors such as robust growth in automotive and general industries are contributing towards the higher market share of the Asia-Pacific region in the automotive adhesives market. It includes top automotive manufacturing countries such as China, Japan, South Korea, and India which are characterized by the provisions of high automotive vehicle production. The automotive industry is one of the major consumers of adhesives, large domestic and foreign brands are continuously increasing production to meet consumer demand in China as it has already become the world's largest automotive market. Moreover, the rise in electric vehicles (EV) and weight reduction materials in this area has created a demand for advanced adhesives capable of bonding various substrates like aluminum & composites. In addition, government initiatives for environmental sustainability along with stringent emission regulations are compelling the manufacturers to utilize innovative bonding solutions which in turn propel the global industrial adhesives market growth. Asia Pacific region possesses a lot of development potential, With the increasing wealth across these countries, more and more people will have cars, thus propelling greater demand for automotive adhesives as well.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players in Automotive Adhesives Market

Key Manufacturers

Henkel & Co. KGaA (Loctite 498)

Akzo Nobel N.V. (Dinitrol)

BASF SE (BASF SikaBond)

Illinois Tool Works Inc. (ITW Plexus)

DowDuPont (Betamate)

Bostik (Bostik 646)

H.B. Fuller Company (Titebond III)

Sika AG (SikaForce)

PPG Industries (Pitt-Tech)

Solvay S.A (Avery Dennison Adhesives)

Jowat AG (Jowat-Toptherm 851.20)

3M Company (3M Scotch-Weld)

Momentive Performance Materials Inc. (Silicone Adhesive)

Lord Corporation (Lord 754)

MasterBond Inc. (EP21LV)

Permabond LLC (Permabond 105)

Gorilla Glue Company (Gorilla Super Glue)

Tremco Incorporated (Tremco TREMCO Sealants)

Weicon GmbH & Co. KG (Weicon Easy-Mix)

Soudal Group (Soudal Automotive Adhesive)

Toyota Motor Corporation

Ford Motor Company

General Motors (GM)

Volkswagen AG

Honda Motor Co., Ltd.

Delphi Technologies

Valeo S.A.

Magna International Inc.

Bosch Automotive

Denso Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 6.7 Billion |

| Market Size by 2032 | US$ 11.3 Billion |

| CAGR | CAGR of 6.04% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Resin Type (Polyurethane, Epoxy, Acrylics, Siliconek, SMP, MMA, Others (polysulfide, rubber, polyamide, and others)) • By Application (Body in white, Paint Shop, Assembly, Power Train ) • By Vehicle Type (Passenger cars, LCVs, Trucks, Buses, Aftermarket) • By Technology (Hot melt, Solvent Based, Water based, Pressure Sensitive, Others (Reactive and Thermosetting)) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Henkel & Co. KGaA, Akzo Nobel N.V., BASF SE, Illinois Tool Works Inc., DowDuPont, Bostik, H.B. Fuller Company, Sika AG, PPG Industries, Solvay S.A, Jowat AG |

| DRIVERS | • Increases in the demand of APAC in Automotive Adhesive market • Rise in the Eco-Friendly and Lightweight Vehicles in Automotive Adhesives market. |

| Restraints | • Challenges for manufacturers in the automotive adhesives market. • High-Performance Adhesives and Cost Considerations in adhesive industry |

Ans. The Compound Annual Growth rate for the Automotive Adhesive Market over the forecast period is 6.04%.

Ans. The projected market size for the Automotive Adhesive Market is USD 11.3 Billion by 2032.

Ans. The passage mentions manufacturers are strategically increasing production capacity to meet the rising demand for automotive adhesives. This allows them to expand their reach and become more prominent players in the region.

Ans. Automotive adhesives are lighter weight than welding materials and can improve a car's body stiffness, leading to better handling.

Ans. Because they are exceptionally durable even under harsh environmental conditions, allowing them to withstand challenges that other adhesives cannot.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Resin Type

3.2 Bottom-up Resin Type

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Type, 2023

5.2 Feedstock Prices, by Country, by Type, 2023

5.3 Regulatory Impact, by l Country, by Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, by Type, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Type Benchmarking

6.3.1 Type specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new Age Cohort launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Automotive Adhesives Market Segmentation, By Resin Type

7.1 Chapter Overview

7.2 Polyurethane

7.2.1 Polyurethane Market Trends Analysis (2020-2032)

7.2.2 Polyurethane Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Epoxy

7.3.1 Epoxy Market Trends Analysis (2020-2032)

7.3.2 Epoxy Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Acrylics

7.4.1 Acrylics Market Trends Analysis (2020-2032)

7.4.2 Acrylics Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Silicone

7.5.1 Silicone Market Trends Analysis (2020-2032)

7.5.2 Silicone Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 SMP

7.6.1 SMP Market Trends Analysis (2020-2032)

7.6.2 SMP Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 MMA

7.7.1 MMA Market Trends Analysis (2020-2032)

7.7.2 MMA Market Size Estimates and Forecasts to 2032 (USD Billion)

7.8 Others

7.8.1 Others Market Trends Analysis (2020-2032)

7.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Automotive Adhesives Market Segmentation, By Vehicle Type

8.1 Chapter Overview

8.2 Passenger cars

8.2.1 Passenger cars Market Trends Analysis (2020-2032)

8.2.2 Passenger cars Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 LCVs

8.3.1 LCVs Market Trends Analysis (2020-2032)

8.3.2 LCVs Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Trucks

8.4.1 Trucks Market Trends Analysis (2020-2032)

8.4.2 Trucks Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Buses

8.5.1 Buses Market Trends Analysis (2020-2032)

8.5.2 Buses Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Aftermarket

8.6.1 Aftermarket Market Trends Analysis (2020-2032)

8.6.2 Aftermarket Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Automotive Adhesives Market Segmentation, By Technology

9.1 Chapter Overview

9.2 Hot melt

9.2.1 Hot melt Market Trends Analysis (2020-2032)

9.2.2 Hot melt Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Solvent Based

9.3.1 Solvent Based Market Trends Analysis (2020-2032)

9.3.2 Solvent Based Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Water based

9.4.1 Water based Market Trends Analysis (2020-2032)

9.4.2 Water based Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Pressure Sensitive

9.5.1 Pressure Sensitive Market Trends Analysis (2020-2032)

9.5.2 Pressure Sensitive Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Others

9.6.1 Others Market Trends Analysis (2020-2032)

9.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Automotive Adhesives Market Segmentation, By Application

10.1 Chapter Overview

10.2 Body in white

10.2.1 Body in white Market Trends Analysis (2020-2032)

10.2.2 Body in white Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Paint Shop

10.3.1 Paint Shop Market Trends Analysis (2020-2032)

10.3.2 Paint Shop Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Assembly

10.4.1 Assembly Market Trends Analysis (2020-2032)

10.4.2 Assembly Market Size Estimates and Forecasts to 2032 (USD Billion)

10.5 Power Train

10.5.1 Power Train Market Trends Analysis (2020-2032)

10.5.2 Power Train Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Automotive Adhesives Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.2.4 North America Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.2.5 North America Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.2.6 North America Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.2.7.2 USA Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.2.7.3 USA Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.2.7.4 USA Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.2.8.2 Canada Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.2.8.3 Canada Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.2.8.4 Canada Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.2.9.2 Mexico Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.2.9.3 Mexico Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.2.9.4 Mexico Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Automotive Adhesives Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.3.1.7.2 Poland Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.1.7.3 Poland Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.1.7.4 Poland Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.3.1.8.2 Romania Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.1.8.3 Romania Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.1.8.4 Romania Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turke Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Automotive Adhesives Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.3.2.4 Western Europe Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.2.5 Western Europe Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.6 Western Europe Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.3.2.7.2 Germany Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.2.7.3 Germany Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.7.4 Germany Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.3.2.8.2 France Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.2.8.3 France Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.8.4 France Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.3.2.9.2 UK Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.2.9.3 UK Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.9.4 UK Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.3.2.10.2 Italy Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.2.10.3 Italy Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.10.4 Italy Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.3.2.11.2 Spain Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.2.11.3 Spain Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.11.4 Spain Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.3.2.14.2 Austria Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.2.14.3 Austria Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.14.4 Austria Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Automotive Adhesives Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.4.4 Asia Pacific Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.4.5 Asia Pacific Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.6 Asia Pacific Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.4.7.2 China Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.4.7.3 China Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.7.4 China Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.4.8.2 India Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.4.8.3 India Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.8.4 India Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.4.9.2 Japan Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.4.9.3 Japan Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.9.4 Japan Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.4.10.2 South Korea Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.4.10.3 South Korea Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.10.4 South Korea Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.4.11.2 Vietnam Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.4.11.3 Vietnam Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.11.4 Vietnam Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.4.12.2 Singapore Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.4.12.3 Singapore Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.12.4 Singapore Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.4.13.2 Australia Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.4.13.3 Australia Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.13.4 Australia Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Automotive Adhesives Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.5.1.4 Middle East Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.5.1.5 Middle East Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.1.6 Middle East Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.5.1.7.2 UAE Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.5.1.7.3 UAE Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.1.7.4 UAE Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Automotive Adhesives Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.5.2.4 Africa Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.5.2.5 Africa Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.2.6 Africa Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Afric Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Automotive Adhesives Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.6.4 Latin America Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.6.5 Latin America Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.6.6 Latin America Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.6.7.2 Brazil Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.6.7.3 Brazil Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.6.7.4 Brazil Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.6.8.2 Argentina Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.6.8.3 Argentina Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.6.8.4 Argentina Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.6.9.2 Colombia Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.6.9.3 Colombia Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.6.9.4 Colombia Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Automotive Adhesives Market Estimates and Forecasts, By Resin Type (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Automotive Adhesives Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Automotive Adhesives Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Automotive Adhesives Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12. Company Profiles

12.1 Henkel & Co. KGaA

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Product / Services Offered

12.1.4 SWOT Analysis

12.2 Akzo Nobel N.V.

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Product / Services Offered

12.2.4 SWOT Analysis

12.3 BASF SE

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Product / Services Offered

12.3.4 SWOT Analysis

12.4 Illinois Tool Works Inc.

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Product / Services Offered

12.4.4 SWOT Analysis

12.5 DowDuPont

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Product / Services Offered

12.5.4 SWOT Analysis

12.6 Bostik

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Product / Services Offered

12.6.4 SWOT Analysis

12.7 H.B. Fuller Company

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Product / Services Offered

12.7.4 SWOT Analysis

12.8 Sika AG

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Product / Services Offered

12.8.4 SWOT Analysis

12.9 PPG Industries

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Product / Services Offered

12.9.4 SWOT Analysis

12.10 Solvay S.A

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Product/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Resin Type

Epoxy

Acrylics

Silicone

SMP

MMA

Others

By Vehicle Type

Passenger cars

LCVs

Trucks

Buses

Aftermarket

By Technology

Hot melt

Solvent Based

Water based

Pressure Sensitive

Others

By Application

Body in white

Paint Shop

Assembly

Power Train

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Optical Coating Market Size was valued at USD 15.63 Billion in 2023 and is expected to reach USD 26.90 Billion by 2032, growing at a CAGR of 6.22% over the forecast period of 2024-2032.

The Medical Textile Industry Market Size was valued at USD 33.2 billion in 2023 and is expected to reach USD 48.49 billion by 2032 and grow at a CAGR of 4.30% over the forecast period 2024-2032.

Nanofiltration Membranes Market size was valued at USD 1.1 billion in 2023 and is expected to reach USD 2.6 billion by 2032, at a CAGR of 10.1% from 2024-2032.

The Flexible Foam Market was valued at USD 45.52 Billion in 2023 and is expected to reach USD 71.75 Billion by 2032, growing at a CAGR of 5.19% from 2024-2032.

Collagen Peptides Market size was USD 683.9 Million in 2023 and is expected to reach USD 1118.20 Million by 2032, growing at a CAGR of 5.6% from 2024-2032.

The Naphthalene Market size was USD 4.42 Billion in 2023 and is expected to reach USD 6.04 Billion by 2032, growing at a CAGR of 3.53 % from 2024 to 2032.

Hi! Click one of our member below to chat on Phone