Automotive Actuator Market Report Scope & Overview

Get PDF Sample Copy of Automotive Actuator Market - Request Sample Report

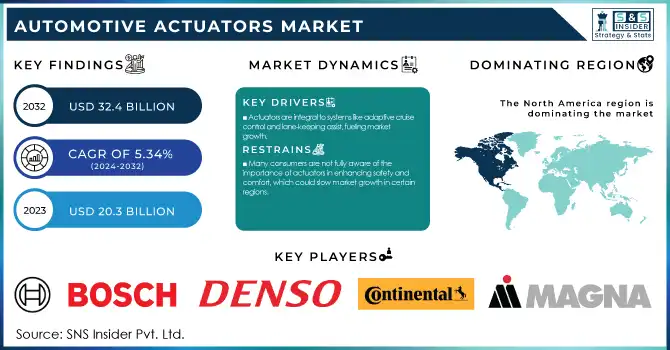

The Automotive Actuators Market Size was valued at USD 20.3 Billion in 2023 and is expected to reach USD 32.4 Billion by 2032, growing at a CAGR of 5.34% from 2024-2032.

The Automotive Actuators Market is experiencing significant growth, driven by advancements in vehicle automation, electrification, and heightened consumer expectations for safety and comfort. Actuators, essential for converting energy into mechanical motion, serve critical functions across automotive systems, including engine management, HVAC, braking, and seat adjustment systems. The increasing adoption of electric and hybrid vehicles has notably fueled the demand for electric actuators, valued for their precision and essential role in their control systems.

A key growth driver is the expanding adoption of Advanced Driver Assistance Systems (ADAS) and autonomous driving technologies. Actuators are central to ADAS features such as adaptive cruise control, lane-keeping assist, and automated parking, which are increasingly becoming standard in mid-range and premium vehicles. By 2030, over 50% of new cars will incorporate ADAS features, underscoring their growing prominence. Sustainability goals and stringent emission regulations are accelerating the electrification of automotive systems. Electric actuators, known for their energy efficiency and accuracy, are replacing traditional hydraulic and pneumatic options in many applications. Additionally, the industry’s focus on reducing vehicle weight to enhance fuel efficiency has increased the demand for compact and lightweight actuator designs.

The growing emphasis on luxury and comfort in vehicles is another significant driver

Advanced actuators enable features like automated climate control, adjustable seating, and active aerodynamics. For instance, seat actuators with personalized adjustment capabilities and memory functions are becoming standard in high-end models. Emerging economies, particularly in Asia-Pacific, are contributing robustly to market growth. The rapid expansion of vehicle production in countries like China and India, coupled with substantial investments in electric vehicle infrastructure and government incentives, is driving demand for advanced actuators. Moreover, technological advancements, including the integration of IoT and AI in actuators, are enhancing their functionality and reliability. Smart actuators with real-time monitoring and predictive maintenance capabilities are increasingly used in connected vehicles, offering improved performance and operational efficiency.

Automotive Actuators Market Dynamics

Drivers

-

Actuators are integral to systems like adaptive cruise control and lane-keeping assist, fueling market growth.

Actuators are crucial for systems such as adaptive cruise control (ACC) and lane-keeping assist (LKA) — the basic building blocks of Advanced Driver Assistance Systems (ADAS). These technologies add to overall vehicle safety, as well as make it easier to drive, which has been becoming widespread across models, especially in the mid-range and higher luxury segments. ACC adjusts the speed of the vehicle autonomously once a preceding vehicle is reached by managing throttle and braking to ensure a safe gap distance. Likewise, LKA actuators operate in conjunction with the steering apparatus to ensure the vehicle continues in its lane through minor adjustments. Rising demand amongst consumers for vehicles with advanced safety features, and stringent global safety regulations are driving the adoption of ADAS. Emerging standards, including the European Union Vision Zero and U.S. NHTSA standards, will make safety technologies (ACC, LKA, etc.) mandatory, further driving the need for efficient actuators. These regulations have spurred the adoption of high-performance actuator solutions in vehicles across the globe.

Actuators must therefore deliver precision, reliability, and speed in any driving environment for the best performance in ADAS. Recent technological developments and innovations including integration with smart sensors to provide real-time monitoring, have improved the effectiveness and performance of actuators which may have made them essential in automotive safety systems of the current days. With the transition from assisted driving to autonomous driving technologies, actuators will increasingly play a supporting role for more complex functions (for example: adaptive lane positioning, and predictive braking). It is driving actuator design in the direction of smaller, lighter-weight & more energy-efficient solutions.

-

The transition to electric and hybrid vehicles is increasing demand for electric actuators due to their precision and energy efficiency.

-

Features like automated climate control and adjustable seating rely on advanced actuators, particularly in luxury vehicles.

Restraints

-

Many consumers are not fully aware of the importance of actuators in enhancing safety and comfort, which could slow market growth in certain regions.

The biggest restraint in the Automotive Actuators Market is the lack of customer awareness regarding the importance of actuators in improving the safety, comfort, and performance of the vehicles. Adaptive cruise control, lane-keeping assist, seat adjustments, and climate control are essential components of various advanced systems that enhance the driving experience, all of which depend on actuators to function effectively. Nonetheless, few consumers understand how these technologies operate in their vehicles, which may restrict demand for actuator-utilizing elements.

Consumers Science has found that the gap in relevant knowledge is wider in countries where fewer people have adopted the latest driver assistance systems (ADAS) and other new automotive technologies, to which consumers who do not actively seek out the latest safety and comfort features may not pay much attention. However, when buyers are unaware of the role actuators play in safety, comfort, and vehicle performance, the benefits of advanced features such as adaptive cruise control and automated seat adjustments may not be fully appreciated. Due to this unawareness, adoption of these equipped vehicles can get delayed which will, in turn, restrain the actuator market growth.

Secondly, this unawareness by consumers will directly influence their purchase decision because consumers are unaware that actuators are important for the better functionality of their compact vehicles. With some exceptions, consumers are just demotivated by talk of actuators so automakers need to get a lot more active in educating buyers that actuators matter when it comes to safer, more comfortable driving. To overcome this challenge and ensure growing penetration, it will be essential to communicate transparently how actuators impact the entire driving experience.

The lower consumer knowledge may also affect the aftermarket, as customers may refrain from replacing or upgrading actuators if they do not recognize a strong value proposition. Therefore, consumer knowledge about actuator technologies might take time, and thus, the growth of the automotive actuators market can, therefore, be slower in some regions.

-

The production of advanced actuators, particularly electric ones, requires high precision and specialized materials, leading to increased costs for manufacturers.

-

Integrating actuators into existing vehicle platforms, especially in legacy systems, can be complex and costly, limiting adoption in some markets.

Automotive Actuators Market Segment Analysis

By Type

The electric actuators segment dominated the Automotive Actuators Market and accounted for a revenue share of more than 40% in 2023, Owing to their energy-efficient and accurate performance as well as the growing electrification of vehicles. Electric actuators are used in systems like Adaptive Cruise Control, lane-keeping assist, and seat adjustments, which are becoming commonplace in vehicles today, especially electric and hybrid vehicles. We see the demand for electric actuators being propelled further with growing consumer adoption of electric vehicles and more integration with more advanced driver assistance systems. They have high performance, low energy consumption, and a small form factor making them ideal for automotive applications. In addition, the increasing shift towards autonomous driving, which offers a heavy dependency on accurate actuators, is additionally aiding in the maintenance of the electric actuators market in the forefront.

The hydraulic actuators segment is expected to grow at the fastest CAGR during the forecast period. Such growth takes place owing to their indispensable deployment in heavy-duty vehicles such as trucks and buses requiring high power and force for system operation including steering, brake, etc. Hydraulic actuators are preferred due to their capability to work well in tough situations and are best suited for situations that require lifting considerable amounts of heavyweight all in a compact form. With the rapid increase in demand for commercial vehicles, particularly in developing countries, the use of hydraulic actuators has become increasingly important to ensure efficient performance and reliability for these larger vehicles. Moreover, the rising need for heavy machinery and infrastructure projects bolsters the market for straddle carriers, assisted by the booming construction and transportation industry across the world.

By Application

The engine segment dominated the market and represented a revenue share of more than 38% in 2023, owing to the rise in demand for various engine efficiency and engine performance products. Actuators are very important in engine management systems, and they are used to control the throttle valve, exhaust gas recirculation, and variable valve timing among other components. Growth in the precision actuators market for automotive applications can be attributed to the increasing need for better fuel efficiency, lower emissions, and overall engine performance. As hybrid and electric vehicle adoption increases and these vehicles need more sophisticated powertrain management, the engine application segment is expected to grow throughout the forecast period. Additionally, an increasing shift towards stringent emissions guidelines is motivating manufacturers to further develop actuator technologies that enhance engine control and boost performance.

The HVAC system segment is expected to witness the fastest growth over the forecast period, owing to rising consumer demand for sophisticated climate control systems within the vehicle. Air circulation, temperature control, and ventilation are among the most important aspects of passenger comfort, making HVAC actuators key components. With the increasing automation of climate control in mid-range and premium vehicles, these actuators are gaining traction in this segment. This aspect is further expected to increase demand for this segment, owing to the growing trend towards energy-efficient and eco-friendly HVAC systems, particularly in electric vehicles. Additionally, air purification, humidity control, and other smart HVAC systems are likely to spur the actuator demand. HVAC is projected to maintain its leadership as a higher focus is placed on vehicle comfort.

By Vehicle Type

The SUV segment dominated the market and accounted for 38% of the market share in 2023. With rising demand for SUVs in the booming SUVs market all over the globe. These vehicles are desired for their large sizes, added safety features, as well as high comfort and performance levels which require multiple actuator-driven systems. Actuators are what allow systems like climate control, seat adjustments, and advanced safety technologies such as adaptive cruise control and lane-keeping assist to work. Due to the increased sales of SUVs across North America and the Asia-Pacific region, automotive actuators are replacing a larger market share of vehicle applications in SUVs. The move to better performance and technology in SUVs ensures that this segment will continue to rule the market.

The hatchback/sedan segment is projected to grow at the fastest CAGR from 2024-2032. This mainly results from the increasing demand for small and fuel-efficient cars mainly in emerging markets. The rising implementation of actuator systems in hatchbacks and sedans is boosting the demand for active and passive safety, comfort, and precision vehicle performance methods. In systems such as automatic climate control, electric windows, power seats, etc. - actuators are employed. Moreover, the increasing adoption of electric vehicles (mostly hatchbacks or sedans) is contributing to the further growth of actuators in this segment. The hatchback/sedan segment is likely to continue on its rapid path in actuators as the movement to electrification of vehicles accelerates the move to EVs.

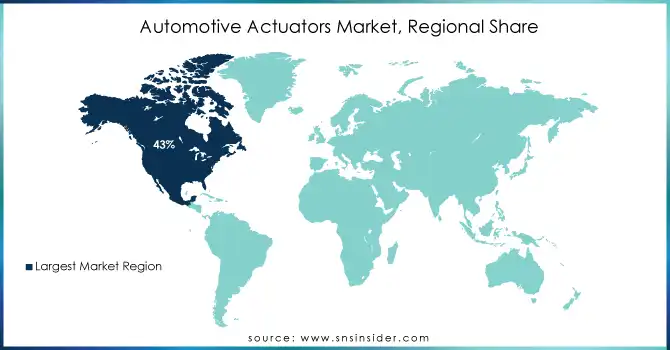

Automotive Actuators Market Regional Overview

In 2023, North America leads the Automotive Actuators Market and holds a revenue share of more than 43%, owing to high-end users' demand for high-end vehicles and advanced technology adoption. The U.S. and Canada are leaders in the adoption of advanced automotive capabilities, especially actuator-based safety and comfort systems. The Asia Pacific region is also projected to exhibit a higher growth rate over the near future owing to the presence of prominent automobile manufacturers and suppliers, in addition to significant investments incurred in the manufacture of electric automobile segment vehicles. The growth is also fuelled by strict safety regulations and an increase in consumer consumption for SUVs and luxury vehicles fitted with actuator-based systems, which bolsters North America in the actuator market. In addition, rising emphasis on autonomous driving and ADAS technologies is also anticipated to drive the regional demand for actuators, supported by the growing consumer inclination toward more safety and convenience features connected within the vehicle.

The Asia Pacific region is expected to register the fastest CAGR during the forecast period. The market growth is largely attributed to the flourishing automotive industry in these developing regions, along with the increasing disposable income of consumers and demand for advanced vehicle functionalities. The trend of transitioning to electric vehicles among these nations generates new demand for actuators fundamental for climate control, seat, and safety features in vehicles. Moreover, the rapid urbanization and the increasing middle class in Asia-Pacific show the need for passenger vehicles that have systems underneath them function which are driven by actuators. The region is likely to maintain the highest CAGR in the market as the automotive landscape transforms and EV adoption rises.

Get Customised Report as per Your Business Requirement - Enquiry Now

Key Players in Automotive Actuators Market

The major key players along with their products are

-

Bosch – Electric Actuators for braking systems

-

Denso Corp – Power Window Actuators

-

Continental – Electric Parking Brake Actuators

-

Magna International – Actuators for Adaptive Seats

-

Aisin Seiki – Electric Seat Adjusters

-

BorgWarner – Turbo Actuators for engine systems

-

ZF Friedrichshafen – Electric Steering Actuators

-

Honeywell – Pneumatic Actuators for exhaust systems

-

Thyssenkrupp – Actuators for Suspension Systems

-

Delphi Technologies – Fuel Injection Actuators

-

Schneider Electric – Actuators for HVAC systems

-

Johnson Electric – Seat Recliner Actuators

-

Valeo – Actuators for Active Grilles

-

Mitsubishi – Electric Steering Actuators

-

JTEKT – Power Steering Actuators

-

Schaeffler – Actuators for Transmission Systems

-

Parker Hannifin – Hydraulic Actuators for Heavy-Duty Vehicles

-

Stanley Electric – Actuators for Lighting Systems

-

Hitachi Automotive Systems – Actuators for Vehicle Safety Features

-

Yaskawa Electric Corporation – Servo Motors and Actuators for Vehicle Robotics

Recent Developments

-

February 2024 – Bosch introduced advanced actuator systems for next-generation autonomous driving. Their new actuators are designed to meet the increasing demand for highly responsive and reliable actuator-driven systems in autonomous vehicles.

-

January 2024– Continental unveiled a new actuator solution specifically aimed at improving seat adjustment and climate control in EVs. This move aligns with the growing demand for enhanced comfort features in electric vehicles.

| Report Attributes | Details |

| Market Size in 2023 | US$ 20.3 Billion |

| Market Size by 2032 | US$ 32.4 Billion |

| CAGR | CAGR of 5.34% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Transmission Actuator, Driveline Actuator, Brake Actuator) • By Vehicle Type (Passenger Car, Light Commercial vehicle, Heavy commercial vehicle) • By Working Type (Pneumatic, Hydraulic, Electromagnetic, Electric) • By Sales Channel (OEM, Aftermarket.) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Denso Corp, Hitachi, Bosch, Nidec, Mitsubishi, ZF Friedrichshafen, Magna, Mahle, Brose, Vitescho, Renesas |

| Key Drivers | • The rise in demand and rising production of passenger and commercial vehicles. |

| Market Restraints | • The rising concern for driver’s safety and also the advancement in automotive industry lately. • Government initiative to support the OEM and suppliers in terms of production and the legal procedures. |